Stock Battle: Eli Lilly vs Novo Nordisk!

The explosion of GLP1s!

Thanks to riding the GLP-1 wave, Eli Lilly and Novo Nordisk are two of the hottest pharmaceutical stocks of the last 5 years.

GLP-1 stands for glucagon-like peptide-1, a hormone in the gut that regulates sugar and insulin levels in the blood. Originally, early medicines were developed to treat diabetes. However, researchers observed that many patients lost weight and reported a loss of appetite and a strange apathy towards food. Both companies thought that if redirected towards treating obesity, these drugs could be extremely effective. They were right on the money!

GLP-1s could potentially become the highest-earning medicines in history!

But Eli and Novo are not just GLP-1s, both are serious pharmaceutical organizations that have been treating patients for more than a hundred years.

Let’s compare their businesses!

1. Basics

Eli Lilly and Company was founded in 1876 by one Eli Lilly in Indianapolis, Indiana, USA. The company started by selling various medicines to treat malaria but later expanded. During WW1 and WW2, Lilly was a key supplier to the US military, selling such medicines as painkillers, penicillin, antiseptics, and more.

From humble beginnings, Lilly has grown into a global conglomerate with over 40 thousand employees worldwide. Today, Eli Lilly is the world’s largest pharmaceutical company, with a market cap of over $708B and sales of $40B. Lilly’s stock is up 559% in the last 5 years!

Novo Nordisk is a 100-year-old pharmaceutical company founded in Denmark. Its original focus was the manufacture and distribution of insulin in Denmark. Since then, Novo has grown into a massive conglomerate with over 64 thousand employees in dozens of countries.

Today, with over $37B in sales and a market cap of $348B, Novo Nordisk is the biggest company in Europe and the world’s second-largest pharmaceutical company. Its stock is up 255% in the last 5 years!

2. Diabetes and GLP1s

Eli Lilly and Novo Nordisk are market-leading insulin producers. Insulin is a hormone produced by the pancreas that regulates blood glucose levels. In the late 1800s, the true role of the pancreas was discovered, while the first effective insulin injections were developed in the 1920s. Lily was one of the pioneers who, in the 1920s, mass-produced the medicine. Today, Novo’s yearly sales of insulin are above $7B, while Lilly has many insulin drugs with sales of over $3B a year.

As mentioned in the introduction, GLP-1s are extremely effective medicines that are primarily used to treat diabetes and obesity. Since launch, they have earned both companies tens of billions of dollars.

When the news spread of massive weight loss experienced by GLP-1 patients, people without diabetes demanded to be prescribed GLP-1s. Intense media attention and impressive results of various celebrities created an environment of extreme demand. Celebrities such as Oprah, Elon Musk, Kim Kardiash, and Adele appeared in public noticeably slimmer, further fueling the frenzy. Sales of Lilly’s Trulicity grew from $4.8B in 2020 to $7.1B by 2023, while Novo’s Ozempic sales grew from $2.6B to $14B.

Trulicity is Lilly’s massively successful diabetes treatment medicine, released in 2014. It works by stimulating the pancreas to release insulin while helping the liver release less glucose in the blood. 2023 sales decreased 4% Y/Y to $7.1B, likely due to some patients who took it to treat obesity switching to Mounjaro.

Lilly’s blockbuster GLP1 obesity drug is Mounjaro. Administered once a week by injection, the drug helps patients lose 15% to 20% of their body weight.

In 2023, its sales were $5.1B, a 10X increase from the prior year!

Ozempic is the most famous GLP-1 drug. Novo started its development in 2008, after the success of its earlier GLP-1 drug, Victoza. The goal was to improve the efficacy and create a longer-lasting effect, enabling patients to inject it once a week rather than daily. At its peak in 2017, Victoza generated $3.7B in sales. As of 2023, the sales had fallen to $1.3B due to the explosion in Ozempic sales. In 2018 Novo earned $276M from Ozempic, by today, sales have grown to $16.2B, increasing 58 times.

Ozempic sales have grown with a completely bonkers 109.7% CAGR!

Roots Analysis researchers believe that the global GLP1 drug market will grow with an 11.1% CAGR to reach $157B!

If we look at the yellow graph in the chart above we see how the use of GLP1s as a treatment for obesity will be the main driver of this growth.

Data Horizon Research believes that the global weight loss drug market will grow with a 45.7% CAGR to reach $82.8B.

Just for context, weight loss drug sales were only $1.4B in 2021. This means that the market is projected to increase 80 times in a decade. The TAM is so massive and growing so quickly that both Lilly and Novo stand to earn over $100B in the next decade.

In total, Eli Lilly and Novo Nordisk stand to earn hundreds of billions of dollars during the lifecycle of GLP1s!

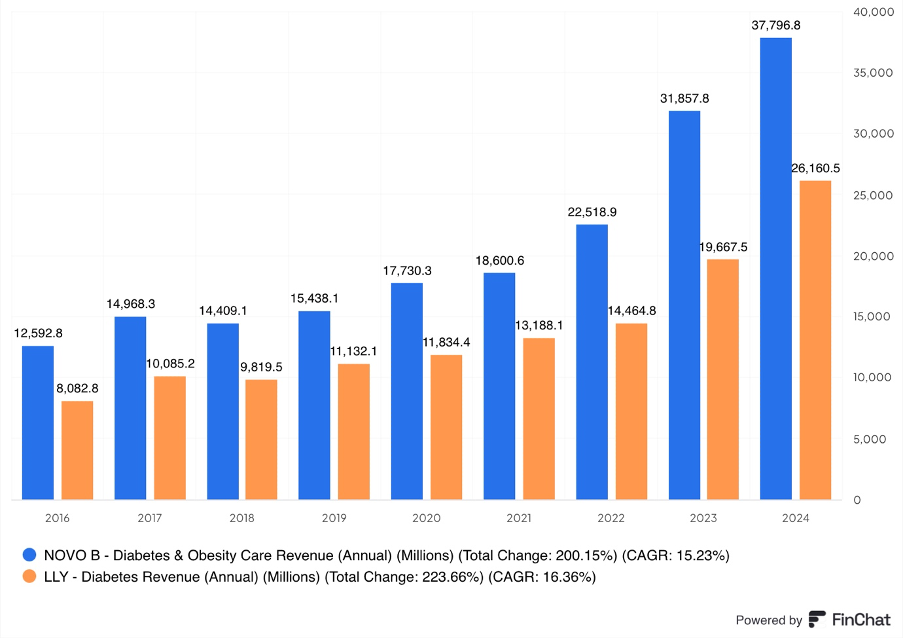

In the graph above, we see that both companies were able to grow their Diabetes and Obesity sales extremely quickly. In 2016, Lilly’s diabetes revenues were $8.1B, since then, sales have grown over 223% to $26.2B. Meanwhile, Novo’s diabetes sales were $37.8B this year, growing by 200% from 2016, slightly slower than Lilly but from a larger base of $12.6B.

3. Other Medicines

Eli Lilly

Oncology – refers to the treatment of cancer. In 2022, the WHO estimated there are 20 million new cancer patients every year, and almost 10 million deaths. Lilly’s oncology drugs earned $6B in revenue in the last twelve months, growing with a 6.2% CAGR since 2016. Verzenio is a very successful breast cancer drug that had sales of $3.9B in 2023.

Immunology – Lilly’s drugs target autoimmune and inflammatory conditions. If we look at the blue column in the graph above, we see that this is a relatively new and exploding category for Lilly. Taltz, the best-selling drug in this segment, had sales of $2.8B in 2023.

Neuroscience – Emgality is Lilly’s migraine treatment drug that made $678M in sales during 2023. Other drugs in this segment are used to treat Alzheimer’s, depression, schizophrenia, and other conditions. Looking at the orange column in the graph above we can see that this segment has been quite volatile for Lilly. The company earned $5.1B from it, up 89% from 2016.

Novo Nordisk

With only 7% of their sales generated from treating rare diseases, Novo Nordisk is not as diversified as Lilly. In fact, Novo’s revenues from this segment have fallen 19% from 2012 and currently stand at $2.5B. However, the company is motivated to reignite this segment and has a pipeline of promising drugs.

“Despite the challenges encountered this year, we remain confident that our rich pipeline in rare disease can bring growth back on track. The line-up of new therapies includes significant advances in both rare blood and endocrine disorders.” Novo Nordisk 2023 Annual Report

4. Finances

Sales Growth

Both companies are very similar in size. Novo Nordisk’s last 12-month sales as of Q3 2024 were $40.4B, while Lilly’s sales were $40.9B.

Since 2016, Novo’s revenue has grown by 155%, a 12.85% CAGR!

The 624% explosion in GLP1 sales primarily drove growth, as insulin and rare disease sales decreased by 17% and 24%, respectively.

Whilst Lilly’s revenue increased by 93%, a CAGR of 8.8%!

Apart from a 224% strong growth in its Diabetes division, as mentioned in the previous chapter, other segments performed well. The immunology division grew sales by 2.225%.

Margins

Both companies have an 80%+ Gross Margin. The cost to manufacture and distribute medicines is usually very low compared to the price of it.

Discovering the drug is the hard part, manufacturing and distributing it is the easy part!

In 2009 the operating margins of both companies were literally the same, 29.2%. However, from that point onwards there was a huge divergence, as Lilly’s margins collapsed as some of its more profitable drugs reached the patent cliff. We will discuss patents in more detail in the next chapter of this article.

In stark contrast, Novo’s operating margins exploded as the company started releasing its highly profitable GLP1s. Operating margin peaked at 44.8% in 2023.

Today, Lilly has recovered from the 2014 bottom and is quickly reaching similar operating margins.

Looking at the net profit margin, we see a similar view, after 2009, Lilly struggled while Novo reached new highs. Today, Lilly has fully recovered and has a net margin of 20.5%, up from -1% in 2017. Novo’s net profit margin of 35% has been relatively stable since 2016, fluctuating in the 30s.

Profitability and Cash Flow

As outlined in the previous section, both companies have healthy margins. However, it is their huge scale that makes them remarkably profitable!

Novo Nordisk’s net income is $14.1, since 2016 the company has grown its profitability by 163%, a CAGR of 13.3%!

Meanwhile, Eli Lilly’s net income reached $8.4B, up 206%, CAGR of 15.5%!

Looking at the FCF graph above, we notice a huge dip in Lilly’s FCF in 2023!

This was primarily caused by a $3.8B acquisition of “in-processes R&D” and a $3.4B investment in property and equipment.

Novo Nordisk’s FCF was $11.6B up 99% from 2016!

Novo’s FCF is also artificially depressed, as the company is investing in capex to increase the production of its drugs. LTM Capex of $5.7B was 6 times larger than in 2021.

Key Ratios

In the below table, I have placed some of the key ratios for both companies.

Analyzing their indebtedness ratios, we notice that Lilly is a significantly more leveraged company!

Their net debt of $27.1B stands in stark contrast to the -$2.5B position of Novo. 40% of Lilly’s assets are financed by debt, while only 10% of Novo’s are. However, a net debt/EBITDA of 1.6 and EBIT/Interest of 21.5 tells us that Lilly’s profitability is sufficient to manage such leverage levels.

Both companies have generally low capex requirements, with low-teens as a percentage of revenue. While capital return ratios tell us that Novo generates more profits from its invested capital, assets, and shareholder equity.

Valuation

We established that Novo is the more profitable company with higher margins and less debt. To compare, which company is the better buy, I have placed some valuation metrics below.

The valuation metrics show that Novo is a cheaper company by all metrics!

Novo’s TTM and forward ratios are all lower than Lilly’s. Additionally, not only Novo’s dividend yield of 1.3% is almost double Lilly’s 0.7% dividend, but also its payout ratio is lower.

So, looking at these metrics, it might seem that Novo’s is clearly the better buy, however, Lilly is growing faster!

Analyzing the projected growth according to 2026 Wall Street analyst estimates, we notice that Lilly is projected to grow revenue with a 26.9% CAGR, compared to Novo’s 19.2%. Furthermore, Lilly is projected to significantly improve its margins, with EPS and FCF growing with 66.6% and 213.2% CAGRs. Compared to the 23% and 21% EPS and FCF CAGRs of Novo Nordisk.

5. Patent Expirations

Capitalism is great at incentivizing companies to make more profit, but often, it is criticized for ignoring questions of morality and public good. If a pharmaceutical company develops a life-saving drug, it is entitled to billions in profits. However, the more expensive the drug, the fewer people can get it. Millions die every year from diseases that have been “cured”, because they can’t afford the cure.

Governments could force companies to sell drugs for cheap, but the development of new drugs would stop. The society needs pharmaceutical companies to keep innovating and releasing new, more effective medicines. So, a system has developed, to incentivize new drug development companies get patent protections for a certain number of years. After patents expire other companies are free to recreate the drug and sell it for cheap. This ensures pharmaceutical companies are rewarded for their efforts, and low-income patients get cheaper access to most drugs.

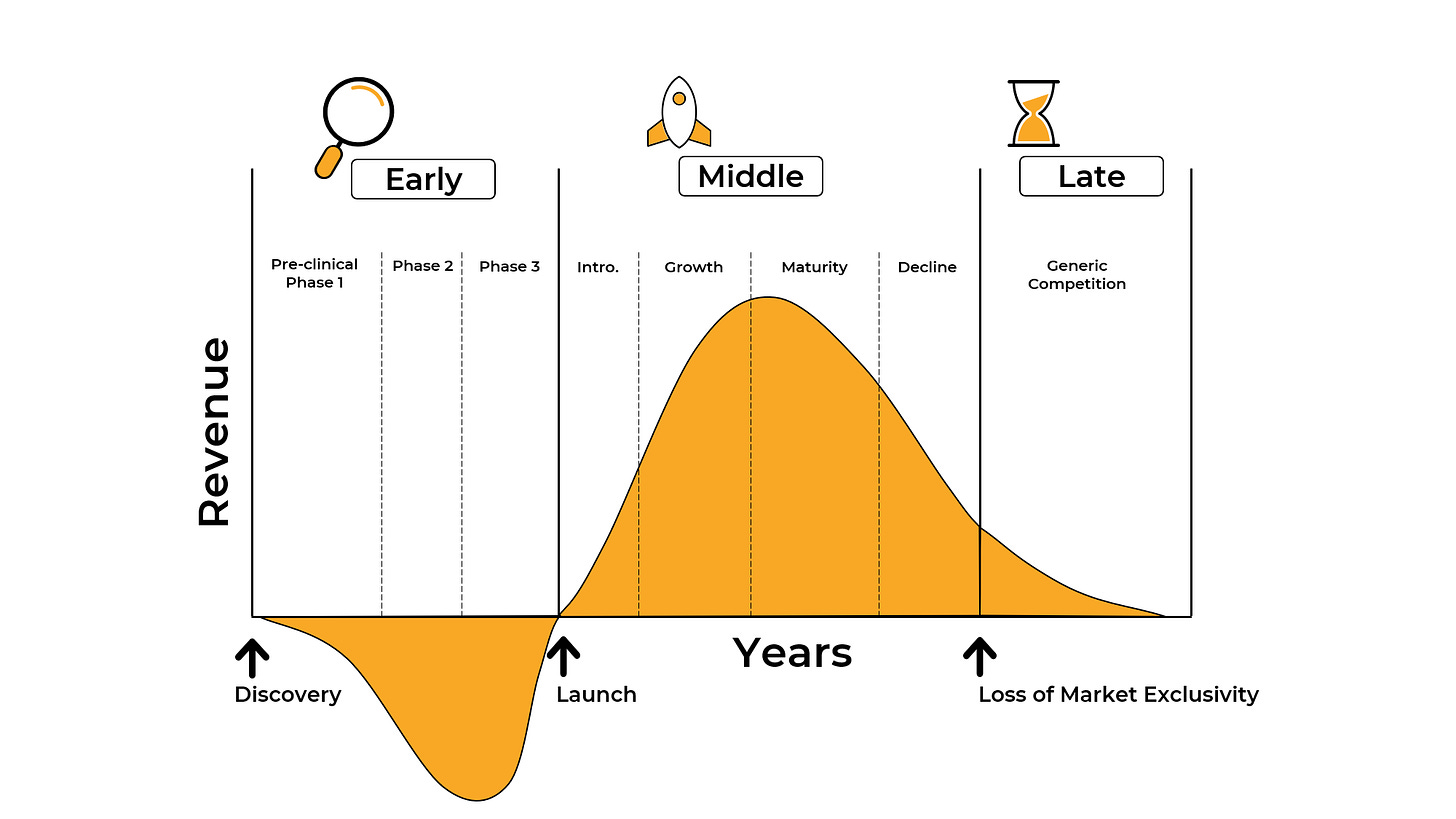

In the picture above, we see a drug’s life cycle. It takes many years from discovery to beginning of sales and a few more years to recover the development costs. During the middle stage of a drugs life, the company must earn enough profits to pay for the development of a drug that will replace the current one once the patent expires.

Lilly’s Trulicity patent will be the first to expire in 2027 in the US and 2029 in Europe, while Mounjaro’s patent expires in 2036. Lilly has managed to replace Trulicity with Mounjaro before its patent expires, an ideal scenario. Mounjaro could possibly earn Lilly over $100B before it expires. Lilly’s 3rd highest revenue drug, Verzenio, loses patent protection in 2031. Meanwhile, Taltz goes generic in 2030.

6. Acquisitions

As both companies earn billions in profits from their GLP-1s, they will undoubtedly deploy them to acquire other pharma companies. Acquiring already-developed drugs is much quicker than developing one yourself and both have historically done plenty of M&A.

In 2019, Lilly paid $7.2B to acquire Loxo Oncology to strengthen its cancer treatment offerings. The company has completed dozens of small acquisitions over the years to expand its pipeline, diversify its portfolio, and participate in high-growth therapeutic areas. Just last year, Lilly paid $1.4B for POINT Biopharma to advance its radiopharmaceutical discovery, development, and manufacturing efforts for the treatment of cancer.

Novo’s acquisition strategy is more conservative, they have done fewer acquisitions and for smaller prices. The company spent $3.3B in 2022 on Dicerna Pharmaceuticals to strengthen its Rare Diseases division with cutting-edge RNA biotechnology tools. Additionally, a few months ago, in March of 2024, Novo acquired Cardior Pharmaceuticals for $1.1B. Cardior specializes in cardiovascular disease treatments.

Acquiring new companies is easy, integrating them and bringing their pipeline of drugs to the market is hard!

There are hundreds of relatively young and small pharmaceutical companies globally that have unique and interesting ideas but need funding. As GLP1 profits continue rolling in, both companies will be bombarded with offers and inquiries. Finding good companies for reasonable prices is difficult and might even get more difficult!

7. Conclusion

In conclusion, both companies have built large, innovative, and fast-growing companies that deliver incredibly important products. GLP1s are very effective medicines that are set to improve the lives of millions of people.

As a result, both companies are set to earn $100s of billions in the next decade!

Their financials are perfectly sound. On one side of the coin, the margins and debt levels are better at Novo Nordisk. On the other, Lilly is a more diversified company.

93% of Novo’s sales come from Diabetes and Obesity products, while only 64% of Lilly’s. Additionally, Novo’s Rare Disease segment is struggling, while Lilly’s Immunology and Neuroscience segments are doing well.

Novo Nordisk trades for a cheaper valuation, however, Lilly is growing quicker and is set to become a larger and more profitable company than Novo.

Investors need to choose between premium valuation, higher growth, and more diversification of Eli Lilly and a more concentrated GLP1 business with less debt, higher dividends, and buybacks, trading at a more reasonable valuation.

Thank you for reading, Follow me on:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

is NVO stock dip due to work force reduction posing an oppurtunity to buy some shares?Or, existing out? Please advise.

Great work - thanks a lot !! What I would be interested in: when do Novo's patents expire??