Stock Battle: Pepsi vs Coca-Cola!

World War Cola!

There are millions of people that at this very moment are drinking a beverage sold by Pepsi and Coca-Cola. For over 100 years these 2 giants have been fighting the soda wars. This is Real Madrid vs FC Barcelona, Lakers vs Celtics, and Yankees vs Red Sox of corporate rivalries!

1. Basics

The Coca-Cola Company has possibly the best-known brand in the world. Founded by one John S. Pemberton in 1892 in the US state of Georgia. The company has become a huge global brand with a presence in basically every country of the world. Its original key ingredient, Cocaine, was unfortunately removed in 1903. The lack of the drug in the beverage hasn’t stopped millions of people from making Coca-Cola a must-have daily drink.

Intrabrand in their “Best Global Brands 2023” report ranked Coca-Cola as the 8th most valuable brand in the world, worth $58B.

With a market cap of $274B as of 1. July 2024, Coca-Cola Company is the world’s largest beverage and food company, slightly above the $267B market cap of Nestle. As you can see in the screenshot above, in the last 40 years KO 0.00%↑ has grown by an impressive 5,204%! Warren Buffet famously invested $1.8B in 1987 and hasn’t sold since. As of Q1 2024, his stake is worth $24.5B.

Founded in North Carolina in 1898 by Caleb D. Brandham, Pepsi might be known as the smaller cousin to Coca-Cola. However, over the years the company has ferociously fought Coca-Cola for the crown, in the process becoming one of the world’s largest food and beverage conglomerates.

In the previously mentioned Intrabrand “Best Global Brands 2023” report, Pepsi was ranked as the 35th strongest brand in the world, valued at $19.8B.

With a $223B market cap, Pepsi is slightly smaller than Coca-Cola. Similarly, it too has had excellent returns, growing by 6,878% since the 1980s.

2. Beverage Business

Pepsi

Apart from its flagship namesake Pepsi brand, the group owns famous brands such as Tropicana, Mountain Dew, Gatorade, Naked, Pure Leaf, and others. Some of you have seen Starbucks ready-to-drink coffee on store shelves, well this is a result of a joint venture partnership with PepsiCo.

LTM domestic sales of PepsiCo beverages were $27.7B. They have been growing at a relatively steady, but slow rate of 3% for a decade!

Coca-Cola

Apart from controlling a plethora of various brands, The Coca-Cola Company is most famous for the trifecta. Coca-Cola, Fanta and Sprite.

The company operates two business lines. Finished Products segment handles all beverages that the Coca-Cola Company itself has manufactured and is distributing. While the Concentrate segment sells syrup to bottling plants.

In the chart above it can be seen how during the last 10 years Coca-Cola has undergone a transition from a Finished Product heavy business, towards one where the majority of the sales is generated by the Concentrate division. In 2014 the revenue split was 62/38 towards Finished Products, in LTM Q1 2024 the split was 42/58. A few reasons are driving this change, but primarily it was driven by a desire for higher margins.

This transition is a bit similar to the one McDonald’s is going through. McDonald’s is selling company-owned restaurants to franchisees because it’s more profitable to just charge a royalty on all sales than to run restaurants themselves.

For Coca-Cola, it’s more profitable to sell syrup to bottling plants than to bottle and distribute beverages themselves!

The company doesn’t need to build expensive bottling plants and pay employees involved in the production and distribution. Because of the power imbalance and Coca-Cola’s negotiating strength, the company can demand quite favorable terms from its bottlers and distributors. Thus, they operate with much smaller margins. HBC AG a Coca-Cola bottle in Europe has an operating margin of 9.4%. The main bottler of Mexico, Femsa, operates with a margin of 13.5%. Coca-Cola Company’s operating margin is 29.4%.

3. Food

Coca-Cola doesn’t have a meaningful food business, which is a stark contrast to Pepsi. Even though Pepsi is the main part of the name of the conglomerate, PepsiCo. 59% of the group’s revenue is actually generated by food!

Through its acquisitions of Frito-Lay and Quaker Foods, PepsiCo group controls famous brands such as Lays, Doritos, Cheetos, Quaker, Ruffles, and many others.

While sales of Quaker Foods have been flat, the Frito-Lay division has grown by 77% since 2013, a CAGR of 5.7%. Frito-Lay North America LTM sales reached $25B in Q1 2024. With an operating income of $6.7B, and a 26.7% margin, snacks are quite a profitable business. 42% of PepsiCo group operating profits are generated by Frito-Lay North America, while another 4% are generated by Quaker Foods North America.

So rather than being a beverage company that sells some food, PepsiCo is a food company that sells beverages!

4. Energy drinks. Monster vs Celsius

Energy drinks are a relatively new and fast-growing beverage segment. Both Pepsi and Coca-Cola were caught by surprise by the incredible success of Monster Energy and Red Bull. RedBull and Monster appeared seemingly out of nowhere and just in the span of a little bit more than a decade became global multi-billion-dollar brands.

Mordor Intelligence expects global energy drinks sales to grow with a 5.83% CAGR reaching $74B by 2030.

For a few years Coca-Cola tried to sell energy drinks on its own, but in 2024 abandoned it and signed a massive $2.15B deal with Monster. As part of the deal, Coca-Cola took a 16% stake in Monster and both companies agreed to swap assets, Monster took over all of Coca-Cola’s energy drink brands and gave all its non-energy brands to Coca-Cola. Coca-Cola is the sole global distributor of Monster energy drinks, whilst Monster is the sole energy drink distributed by Coca-Cola.

This has proven to be a great deal for both companies!

The value of Coca-Cola’s equity stake in Monster has increased by over 400%, while thanks to Coca-Cola’s all-encompassing distribution network Monster’s sales have increased by 200%!

To not get outdone by Coca-Cola, Pepsi did two large deals in this space. In 2020, it acquired Rockstar Energy, a brand with a 3.9% US market share in 2023. Furthermore, seeing the success of Coca-Cola’s deal with Monster, Pepsi signed a similar agreement with Celsius. I wrote a full deep dive on this up-and-coming energy drink brand.

Celsius. The New Disruptor! Deep Dive Part 1/3.

This energy drink company came seemingly out of nowhere and has caught the world by surprise. Massive sales growth has allowed the company to gain a cult following with a plethora of fitness enthusiasts and everyday people alike. Large commercial success has enabled the stock of Celsius to become a darling of capital markets. With a market cap of $21B, …

In short, Celsius is an energy drink company that has quickly gained popularity. With a 2023 market share of 5.9%, it was the 3rd most popular energy drink brand in the US. Celsius differentiates itself by targeting the fitness niche and is especially popular with women. Pepsi took an 8.5% stake in Celsius for $550M, thus becoming its exclusive distributor in Canada and the US.

Pepsi has been able to use its distribution to turbocharge Celsius sales, as Pepsi’s sales of Celsius products grew by 440% in 2023!

5. Finances

Pepsi’s revenues in 2023 were $91.5B, up 5.9% Y/Y, driven by strong growth in its domestic snack (+7%) and Latin American (+19%) segments. However, flat sales in Asia and a decrease of 4.6% in Africa were a drag on the performance.

Net income for the year was $9.1B, up 1.84%, below the revenue growth rate. Likely as customers were less accepting of inflation, Pepsi was forced to return to some discounting, causing lower margins. However, FCF increased by 41% to $7.9B.

2024 has started noticeably slower, with Q1 sales of $18.3B being 2.3% higher than last year, however, profitability improved slightly, with net income creasing by 5.7% to $2B.

In terms of revenues, Coca-Cola is a significantly smaller company, largely due to its different business model that emphasizes syrup concentrate profitability!

Coca-Cola closed 2023 with $45.7B in sales, up 5.9% Y/Y. Concentrate sales increased by 10.3% to $26.5B, while finished products grew only by 1.5% to $19.2B. We can see in the chart above that although Pepsi’s revenues are double Coca-Cola’s, Coca-Cola generates more income and free cash flow. $10.7B and $9.7B respectively.

Coca-Cola’s first quarter of 2024 was as slow as Pepsi’s, revenues increased by 2.9% to $11.3B and net income reached $3.2B, up 2.3%.

In the table above we can see some key ratios of both companies. By most metrics, Coca-Cola is undoubtedly the superior company. While gross margins are relatively similar, Pepsi’s operating and net margins are half of Coca-Cola’s. Its FCF margin of 7.9% is almost 3 times lower than Coca-Cola’s.

Furthermore, Pepsi has significantly higher indebtedness in its business. Its net debt of $37.5B is $10B above Coca-Cola’s. Additionally, 50% of assets are funded by debt, compared to 40% for Coca-Cola. Lastly, the EBIT/Net Interest ratio of 15.4 vs 35.2 tells us that it is more than twice as easy for Coca-Cola to cover its interest payments than it is for Pepsi.

The only metric by which Pepsi is glaringly better is days inventory, as Coca-Cola keeps 96 days of sales on its balance sheet, compared to 48.7 for Pepsi. Looking at the history of this metric, I see that Pepsi has always had significantly lower inventory levels. I suspect that this is partially due to Pepsi’s food business. Food is more perishable than beverages, requiring Pepsi to recycle inventory more often.

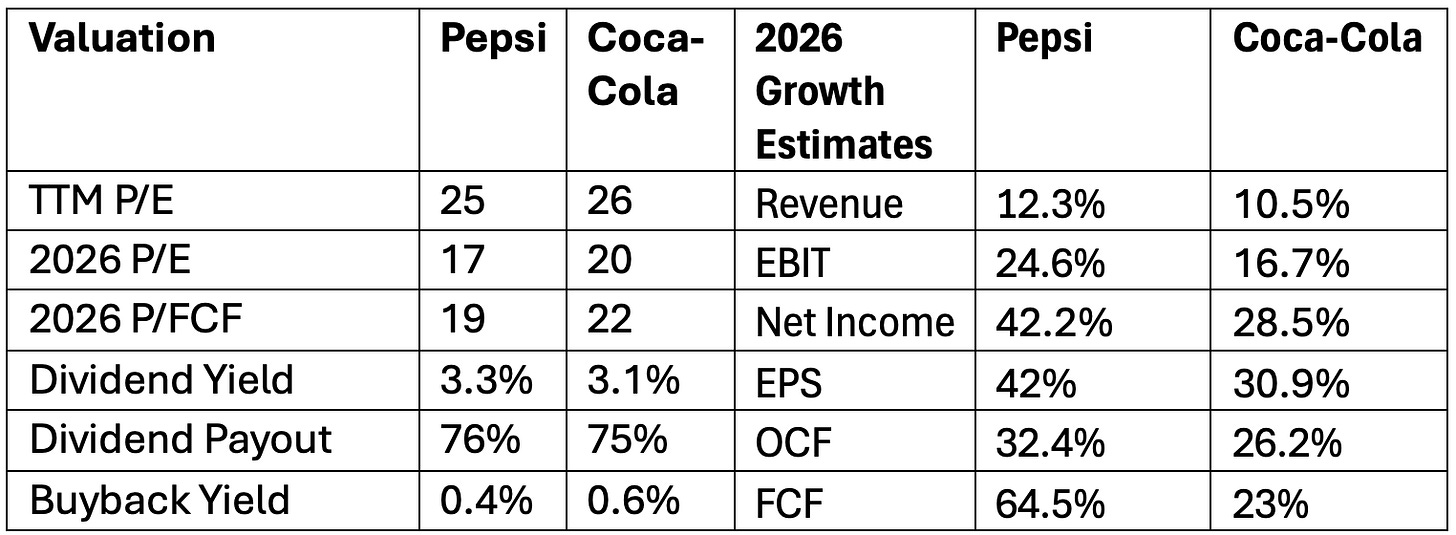

Analyzing valuations, we see that both companies are quite similar, trading for TTM P/E of around 25, and 2026 valuation multiples of around 20, with Coca-Cola being slightly more expensive. Pepsi’s dividend yield of 3.3% is 6% higher than the 3.1% of Coca-Cola, with both companies having a similar dividend payout ratio of 75%.

Looking at Wall Street 2026 estimates, it appears Pepsi’s top line should grow by 12.3%, somewhat faster than 10.5% of Coca-Cola. However, as profitability and cash flows are projected to jump 40%+, substantially above the sales growth, margins are expected to improve. Similarly, the market expects Coca-Cola to improve margins, with both Net Income and FCF forecast to increase by 20%+.

6. Future

Changing Customer Preferences

The food and beverage industry continuously deals with changing trends. People crave new experiences with novelty often being a factor in guiding decisions. Young people are quite keen to differentiate themselves from their parents. When certain habits become associated with previous generations, they often reject them.

This is as valid for fashion as it is for food. Thus, it’s not really a surprise that the popularity of soda is decreasing.

From 2007 to 2015 daily soda consumption among US high school students decreased from 33.8% to 20.5%!

Similar trends can be observed in other countries as well. A more optimistic person would suggest the decline was driven by informed kids making better decisions for their health. However, as mentioned in the energy drink section, the extreme rise of these highly caffeinated beverages makes me conclude otherwise.

Customers are rejecting the simple drinks of the past, and are demanding more flavors. Mordor Research predicts that fruit-flavored beverages will show especially great growth. To capitalize on the trend, Pepsi has released new colas with berry, lime, and mango flavors. Whilst Coca-Cola has released cinnamon cola and cranberry Sprite.

GLP-1 Obesity Drugs

The release of “miracle” obesity drugs has spooked many food and beverage investors. These drugs can fundamentally alter the brains of their users, changing habits and altering food preferences.

In my view, Pepsi is more exposed. 59% of their revenue comes from selling exactly the kind of food obese people consume the most, unhealthy snacks. Furthermore, it seems to me that this industry is dominated by super users. A person who eats 4 packs of chips a week consumes more in a year than most people in their lifetime. These are exactly the people GLP-1 drugs are designed for. The loss of such customers could have an outsized impact on Pepsi.

However, it is still too early to tell what effect GLP-1s will have on the food and beverage industry. It is unlikely that GLP-1 will solve obesity completely. Furthermore, although it is a risk for both Pepsi and Coca-Cola, huge global brands such as them are capable of adapting to changing customer trends. Some analysts predict that as super users decline, companies will be forced to innovate and release healthier alternatives that appeal to more people. Certainly better for society, but could make Pepsi and Coca-Cola less profitable businesses.

Alcohol

As we have reached peak soda both companies have realized that there is significant potential in the alcohol business. Both millennials and Gen Z are moving away from drinking beer and wine towards cocktails and hard liquor.

According to Nielsen 2022 research, the dollar value of ready-to-drink (RTD) hard sodas (soda with alcohol) increased by 163% in the US. Spirit seltzers grew by 73% and RTD cocktails by 61.4%. While 2022 was still influenced by COVID, the trend towards RTD cocktails is likely to persist.

Grand View Research believes that this market will grow with a 13.6% CAGR, reaching $36.6B by 2030. This segment is very competitive and strong brands drive customer decisions, especially for Gen Z and millennials. Luckily for Pepsi and Coca-Cola, they have built incredible brand equity that will undoubtedly help them in attracting customers.

For years the “Jack and Coke” has been a mainstay at house parties and bars alike. I am surprised that it took Coca-Cola this long to finally partner with Jack Daniels to release a RTD version of the legendary combo. I have no doubt that this will be a bestseller. Meanwhile, Pepsi released a hard seltzer version of its Mountain Dew brand. As the growth of their traditional beverages slows down both companies will continue signing alcohol partnerships to chase growth.

7. Conclusion

Both companies are huge global brands that have expanded rapidly over the last 40 years. Their financials are great, balance sheets are sound and both businesses are forecast to grow at a steady rate. Which one to buy would have to depend on one’s preferences. Pepsi is more diversified across different brands and foods and growing slightly quicker. However, Coca-Cola has better margins and less debt. Depending on one’s investing goals both could be great additions to a balanced portfolio.

Dividend investors seek safe dividends that are likely to grow. Pepsi and Coca-Cola are the ultimate dividend aristocrats. The pair pays stable and high dividends of around 3.3%, with a relatively safe payout ratio of 75%. They are safe investments that have continuously grown dividends for decades. Sales of beverages and snacks are rather predictable. While a recession might cause some dents and disruptions, people still want to drink soda and eat chips.

Predictability and safety make them an incredibly attractive investment for patient long-term investors!

However, neither of them are innovative fast-growing companies. Both are 100+ year-old juggernauts that have exhausted all the easy avenues for growth. Literally every single supermarket, convenience store, and gas station in the world already sells their products. Apart from the growing population in the developing world, there are few avenues left for organic growth. Thus, both are likely to look to M&A for help. Neither Pepsi nor Coca-Cola will grow sales by 100% in a relatively short time.

Thus, neither Pepsi nor Coca-Cola is a great investment if one is looking to multiply their money many times over!

Thank you for reading, Follow me on:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.