EYE-CARE pharma at an inflection point.

Harrow Health Investment Case!

Thanks to modern medicine and science, people are living much longer than they used to. In the early 1900s, the average life expectancy was around 40-50 years, but by the 1950s, it had increased to 65-70 years. Today, life expectancy in most developed countries is around 80 years, and it continues to slowly increase thanks to new advancements.

However, achieving these advancements is getting more expensive and difficult as all the easy pickings have been discovered. Thus, the focus on modern pharmaceuticals is increasingly shifting to improving the quality of life.

One of the most straightforward ways to improve a person’s life is to help them develop or recover any of the 5 key human senses, touch, taste, smell, hearing, or sight.

This is where the business I am analyzing today comes into the picture.

Harrow is a pharmaceutical company that specializes in commercializing treatments for ophthalmic diseases.

Ophthalmic disease refers to any disorder or condition that affects the eyes or the structures surrounding them, such as the eyelids, tear ducts, and optic nerves. This is a crucial area of medicine that is only expected to become more relevant, as longer screen times and aging lead to a higher prevalence of eye diseases in the population.

Harrow is a $1.7B company with a portfolio of promising eye care treatments standing at an inflection point of huge growth.

Total revenue has grown 157% since 2022 to $228M, driven by the release of a new and highly successful patented eye drops tackling the $6B dry eye disease segment. Most importantly, the company has revealed an ambitious goal of having sales of $250M a quarter by 2027.

This would be a 292% increase compared to Q2 2025, in just 2 years!

If this feat is achieved, Harrow’s shareholders will be handsomely rewarded.

In this report, I will tell you how the company plans to achieve this goal and what returns Harrow shareholders could see.

1. Business Model

2. Pipeline

3. The Opportunity

4. M&A Strategy

5. Valuation

6. Conclusion

1. Business Model

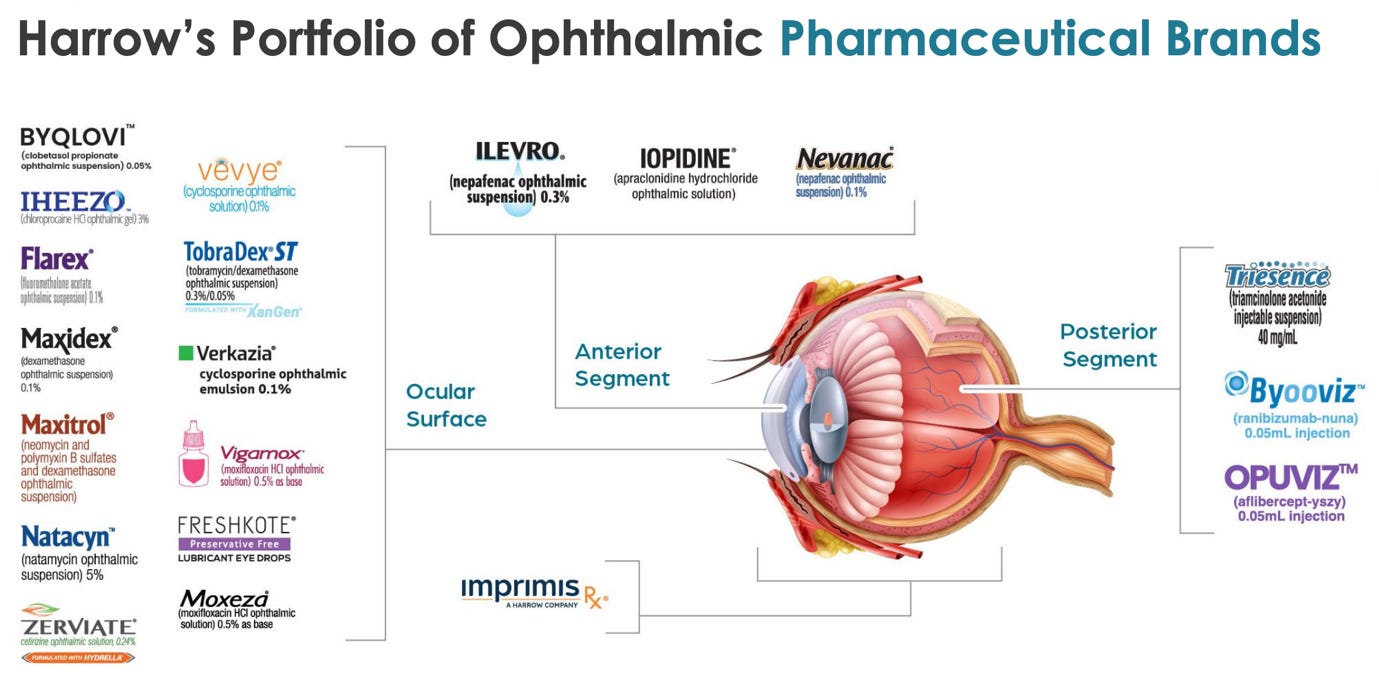

Harrow’s business model covers the entire eye, offering treatments for diseases affecting the outside eye (ocular), inside (anterior), and behind the eye (posterior).

With a market cap of $1.7B and sales of $228M, Harrow is one of the leading core-focus ophthalmic disease companies in North America. While there are pharmaceutical companies with orders of magnitude larger eye care businesses, they are massive conglomerates that are saddled with other, less promising and slower-growing segments. This uniquely positions Harrow to benefit exclusively from this fast-growing and important segment of the healthcare industry.

The company serves the eye disease segment through its 3 core segments:

Compounded Pharmacy

Specialty Prescription

Buy and Bill

Compounded Pharmacy

Before expanding upmarket, Harrow began as a compounded pharmacy specializing in ophthalmic medicines. A compounded pharmacy differs from an ordinary pharmacy by not only selling medicines, but also manufacturing or, more precisely, compounding them.

Instead of mass-producing medications, it creates specialized, customized versions for individual patients, who, due to certain medical conditions, are unable to take a particular mass-produced drug.