Ferrari. Equity Research!

Exclusivity, Success in a bottle (car), and True Luxury!

The Sexiest Company in the World, that’s quite a bold statement. One can argue there are more “sexier” companies, or how can an 80-year-old car manufacturer be “sexy”? I promise that this moniker will seem appropriate by the time you will have read this report.

Table of contents

1. The Story of Ferrari

From humble beginnings in Modena, Italy Ferrari has become one of the world's most famous global brands, known for its fast cars, slick designs, and luxury. The Ferrari logo is as iconic as the company itself and is one of the most recognizable logos in the world.

“The Prancing Horse symbolises exclusivity, performance and quality all over the world.Our prestige is built upon decades of sporting success and the inimitable style of our cars, which are unique in their innovation, technology and driving pleasure.We craft exclusive, authentic and memorable experiences for our clients in everything we do.” - Ferrari About us

What is the business of Ferrari? And no, this is not a dumb question. Yes, at first glance, it might seem obvious, they sell automobiles. However, if one looks under the hood, it becomes apparent that the automobile is a delivery mechanism with whom the true product is sold. Ferrari sells Exclusivity, Success in a bottle (car), and True Luxury. It’s an absolutely beautiful delivery mechanism.

Exclusivity

The company is notoriously secretive about the exact sales numbers of particular models, what we do know is that in 2023 they sold 13.663 new cars. Globally there were around 68 million cars sold in 2022. With a minuscule market share, Ferrari volumes are a rounding error for the global market. However, Ferrari the company is anything but a rounding error.

Ferrari are masters at understanding the concept of artificial scarcity. Ferrari “812 Competizione” starts at 600.000 EUR. Well, I am not being exactly honest, you see there were only 999 cars built and they are all sold out. So even if one was so inclined to part ways with 600.000 EUR, unfortunately, they need to look elsewhere.

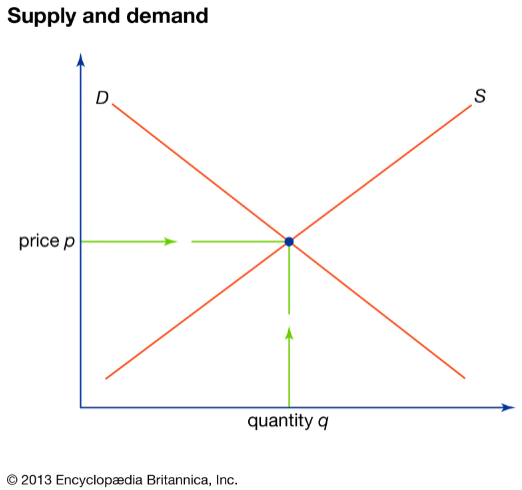

One of the most well-known and understood principles in economics is the relationship between supply, demand, and price. As the classic picture below illustrates, the price of a good is determined by the supply and demand of said good.

High demand and low supply leads to high prices. Low demand and high supply lead to low prices. Low prices increase the demand, whilst high prices reduce the demand. Price always shifts to create equilibrium between supply and demand under which all supply is sold. The equilibrium point is always moving as high prices incentivize higher supply, higher supply results in a price reduction, and reduced price leads to less supply and the cycle continues.

The demand and supply curve only works if neither demand, supply, nor price is artificially limited. Price controls lead to good shortages, as without higher prices, suppliers are not incentivized to increase supply to meet the demand. Another example is OPEC, recently this cartel of certain oil-producing nations agreed to cut oil production, with the hope that lower supply will create oil scarcity, thus increasing prices.

Ferrari is using this relationship between supply and demand to their advantage, by artificially limiting supply Ferrari is keeping the prices high, whilst maintaining high demand for their luxury cars. This is artificial scarcity at play.

The Cambridge Dictionary defines scarcity as “a situation in which something is not easy to find or get”. The goal of artificial scarcity is to keep the supply low, essentially creating a state of scarcity. There is no “real” reason why only 999 “812 Competizione” were made. Ferrari has the technical capability and capital to manufacture 10.000, 50.000, or even 100.000 models. With higher volumes economies of scale would allow Ferrari to cut costs significantly. This is the common manufacturing way.

Yet that is not the approach Ferrari has chosen. The reason why Ferrari is not ramping up production ASAP is precisely because Ferrari is not a common automobile manufacturer. If 50.000 812 Competizione came off the production line not only the price would decrease, but Ferrari would also lose what makes them so special, what really drives people to pay hundreds of thousands, Ferrari would lose their Exclusivity.

Success in a bottle (car)

Enzo Ferrari was famously a race car driver. In 1929 he founded a racing team “Scuderia Ferrari” to participate in various races. At first, the team used cars manufactured by other companies, but after various disputes, Enzo decided to go on his own. To raise funds for his team, Enzo had the great idea to sell cars to the public, thus in 1947 he began selling Ferrari-branded cars.