How Grab got 42M Users to spend $17B on its platform?

Grab. The Makings of a SuperApp! Equity Research! Part 1/3

People have always loved convenience, so even since ancient times, there have been businesses willing to service these needs. However, in the last 2 decades, businesses expressly designed to deliver unparalleled convenience have exploded in popularity.

One of the fastest-growing and most popular such businesses in South East Asia is Grab!

Dubbed “the Uber of Southeast Asia”. Grab is the most popular mobility service in the region, whose 42M monthly users spend over $17B on the platform.

In the 2010s, as the world experienced a digital revolution, new technologies converged to create businesses that were previously unimaginable.

Smartphones became mainstream as billions of people purchased devices with new and revolutionary capabilities.

Mobile internet access exploded as carriers invested over $1T to roll out 3G, 4G, and 5G technologies.

Google created the most accurate and widely available digital Maps in human history, enabling previously unimaginable travel convenience.

Easy to use, reliable, secure, and fast digital payments facilitated by Visa, Mastercard, and Apple Pay supercharged the growth of the digital economy.

Cloud infrastructure providers such as AWS powered the backends for many of these new digital age companies.

Most importantly, the innovations in the semiconductor industry made by ASML, Intel, Nvidia, and TSMC enabled all this through cost-effective and powerful computer chips.

The convergence of these technologies created an environment in which Grab was able to flourish!

In Part 1 of this Deep Dive, we look at how Grab conquered the region and its business model.

1. The Story of Grab

2. Business Model

3. Mobility and Delivery

4. Financial Services

5. Customer Acquisition

6. Parts 2 and 3

1. The Story of Grab

Grab was founded in 2011 in Kuala Lumpur, Malaysia, by Anthony Tan, who remains the CEO today. Originally called MyTeksi, through various expansions, mergers, and reorganizations, the company became Grab in 2016. Since then, they have expanded their operations to Singapore, Indonesia, Thailand, Vietnam, Philippines, Myanmar and Cambodia.

Grab’s offering

Grab’s mobile app allows people to choose from a selection of vehicles to drive them to their desired destination. Depending on the location, customers can pick motorbikes, taxis, ride-hailing cars, luxury vehicles, and even boats.

In 2023, there were 20.4M monthly transacting customers using Grab mobility services, up 79% from COVID lows but still 17% below the pre-COVID high of 24.7M.

As of the last 12 months of Q3 2024, Grab generated $1B from its mobility activities, 37.3% of total revenue.

Next, in 2015, the company began offering delivery services, starting with GrabExpress, a package delivery service. Through the years, Grab has significantly expanded its delivery offering, adding groceries and restaurant meals. Additionally, to further assist local businesses in the use of the platform, GrabMerchant was released. A solution that helps merchants manage their operations on Grab, tracking orders, deliveries, and sales.

In 2023, there were 19.1M monthly transacting people using the service, up 78.5% from 2019 but down 1.6% from 2022. The COVID pandemic caused a pull forward in demand for food delivery in 2021 and 2022. So, when the pandemic ended and cities lifted all restrictions, people decided to have fewer meals delivered.

As of the last 12 months of Q3 2024, Grab generated $1.45B from the delivery segment, 54% of total revenue.

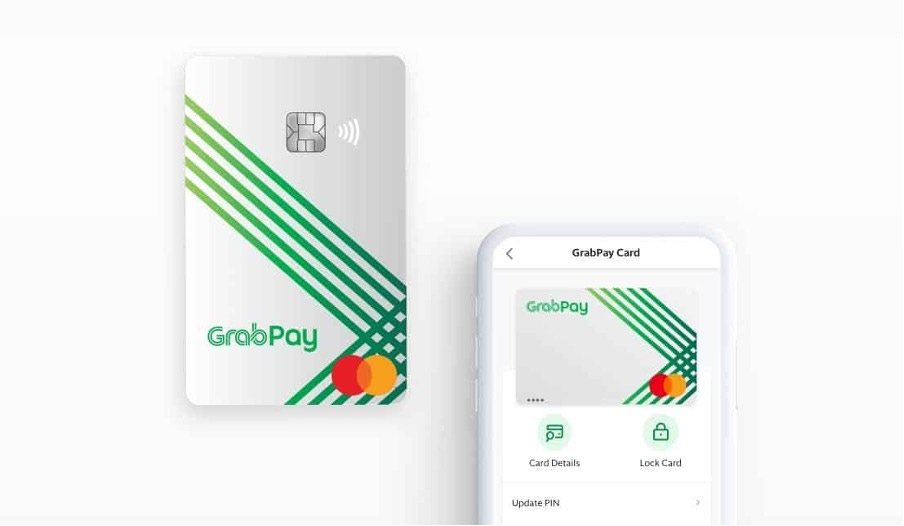

Lastly, when ease of transacting becomes a bottleneck to growth, one might be forced to take matters in its own hands. So, in 2017, Grab launched GrabPay, a digital wallet and mobile payment platform that allows users to make payments for various services. Originally only meant to be used within the Grab ecosystem, it has since expanded outside it as well.

In 2023, 23.3M people were