Grid Investment Supercycle Opportunity!

Arteche Investment Case!

All of our modern existence depends on electricity!

While it all seems easy and simple for us, the end users, the reality is that behind each watt, there is a comprehensive set of systems that make it all possible.

And today, we will be looking at Arteche, a €1B market cap company from Spain, whose stock has risen an incredible 139% so far in 2025.

What drove this rise?

The company manufactures critical equipment needed to modernize electrical grids.

Arteche is uniquely positioned to benefit from the ongoing grid modernization Supercycle!

You see, for decades, governments, utilities, and grid operators have underinvested in the grid infrastructure due to strained budgets, inefficient regulation, and a lack of urgency. This makes current grids ill-equipped to handle increased demand for electricity coming from the growth of electric vehicles, the rise of wind and solar, and the AI-driven data center explosion.

We saw this vividly on 28 April 2025 when the Spanish and Portuguese grid completely collapsed for 10 hours in one of the world’s worst outages ever, causing billions in damages. After the blackout, the Portuguese government announced a €400M grid modernization package, whilst Spain changed regulations requiring additional grid upgrades.

This was a wake-up call not only for the EU, but also for the entire world, and especially renewable energy-heavy countries!

Analysts at Bloomberg estimate that the global yearly grid capex will expand by 61% from an estimated $300B currently to $483B by 2030!

In this report, I will look at Arteche’s business and how the company stands to gain from this strong, durable, long-term demand expansion.

Let’s begin.

1. Business Model

2. Financials

3. The Opportunity

4. The Bull Case

5. Valuation

6. Conclusion

1. Business Model

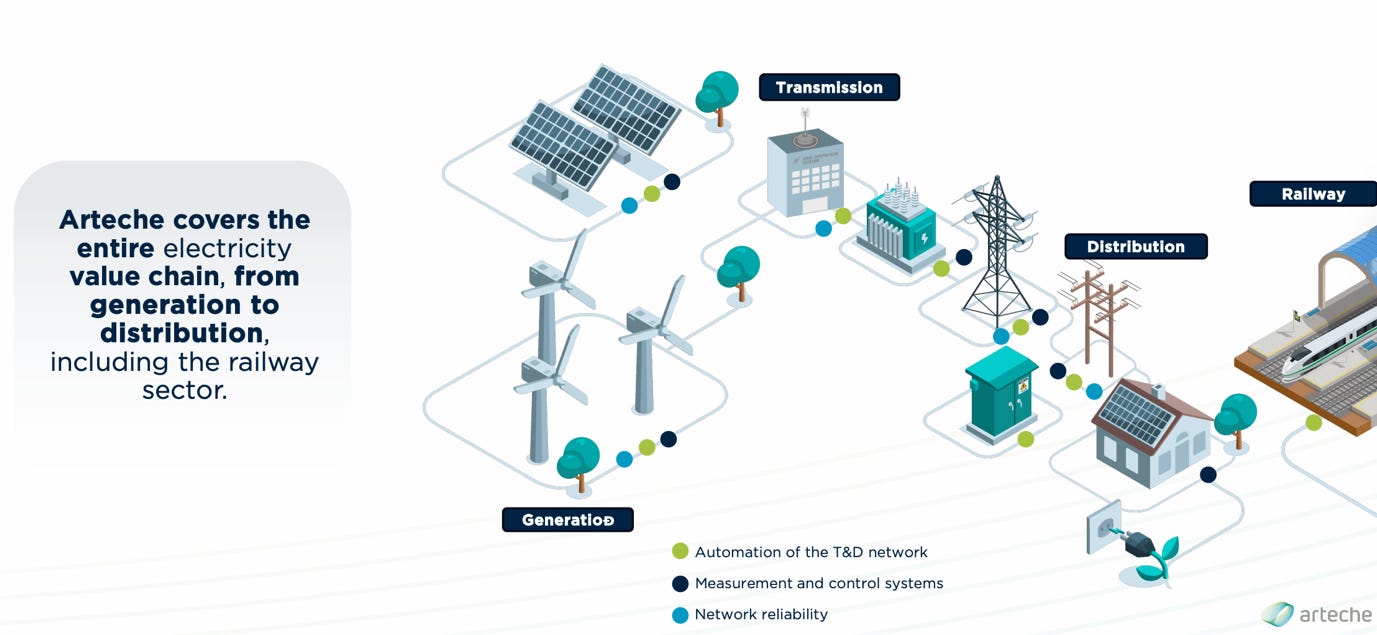

Arteche is a Spanish manufacturer of electrical equipment and components for the global trillion-euro energy generation, transmission, and digitalization industries.

In industrial manufacturing, companies are often classified by their position in the segment value chain in tiers between 1 and 3.

Tier 3 companies generate the least value, as they mostly sell basic, easy-to-manufacture parts and components. They have the smallest margins, but benefit from low capex and R&D requirements. These companies tend not to have a direct relationship with the end user and sell their products to Tier 2s and Tier 1s.

Tier 2 companies generate more value and have higher margins than Tier 3, as they manufacture critical components, parts, and complete pieces of equipment. In addition to selling equipment to Tier 1s, they also have some direct relationships with end users.

Tier 1 companies generate the most value and have the highest margins, as they operate as systems integrators. These businesses design and sell sophisticated multi-million euro systems directly to utilities and grid operators. As Tier 1s manage the final customer relationship with the end users, they can decide which Tier 2 and Tier 3 components will go into the system, giving them strong negotiating leverage.

Arteche has a unique value proposition, being in the middle between Tier 1 and Tier 2!

While the company sells equipment to Tier 1s such as Scheiner Electric, ABB, and Siemens, who incorporate it into their systems, it also has direct relationships with utilities such as Iberdrola in Spain, Enel in Italy, and Eletrobras in Brazil.

Essentially, Arteche is a Tier 1.5 business that covers the entire electricity value chain, from generation to distribution.

They don’t operate in the commoditized Tier 3 space, offer more services than a typical Tier 2 supplier would, but also lack the scale and ambition to become a Tier 1 player (it would require years and billions of euros).

Arteche services its customers through 3 core segments:

Measurement and Monitoring

Transmission, Distribution, and Grid Automation

Network Reliability

Simply put, the Measurement and Monitoring division measures energy flows, and Grid Automation controls them, then Network Reliability stabilizes and optimizes them.

Let’s look at each in more detail.