Is the stock about to recover?

Hello Fresh. Hungry for More! Equity Research! Part 3/3

Hello Readers!

Today I bring the final part of my Hello Fresh Deep Dive!

The pandemic caused a surge in demand for this DtC subscription food company’s products. Such supercharged demand enabled Hello Fresh to increase sales by 107% and achieve record profits. However, the hyper-growth is over, flat sales and unprofitability are here. Is Hello Fresh doomed as its stock price would suggest, or was Mr. Market a bit too pessimistic? That’s the question I am hoping to answer in the final part of this deep dive!

Before jumping to financial analysis and valuation, I suggest you read previous parts of this deep dive, to get the full picture of the company!

1. Opportunities

2. Financial Analysis

3. Valuation

4. Conclusion

1. Opportunities

Hello Fresh carefully analyzes opportunities and regularly expands to new verticals. The RTE expansion is currently reaching massive scale, additionally, its butcher and pet food vertical shows promising growth. Let us look at some opportunities the company could pursue to expand its business.

Ready-to-Eat

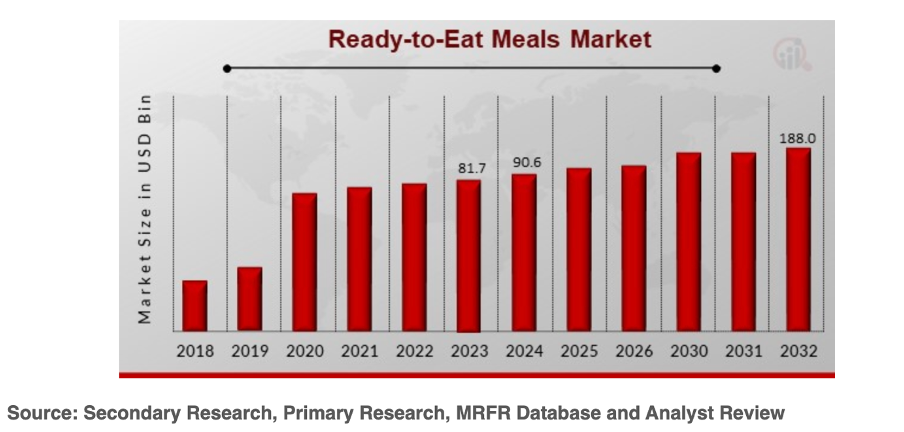

RTE meals market is large and growing. Researchers from Market Research Future estimate that $90.6B worth of meals is sold globally today.

The RTE market is forecast to grow with a CAGR of 10.98% till 2032, reaching $188B!

As we discussed earlier in the report, convenience is increasingly becoming the most important criterion in meal decision-making. However, not everyone is keen on consuming copious amounts of salt and sugar prevalent in quick meals. RTE meals can potentially be the middle ground. They provide convenience for a price similar to a fast-food meal without the guilt and the sugars of it.

The ready-to-eat segment is a growth machine and could potentially be both larger and more profitable than the meal box business!

“We are confident that the RTE product category will not just be a growth story but also one of margin expansion in the coming years. This will be driven in the near-term by the successful scale-up of our Arizona facility ……….. and in the mid- term by the maturing of the customer base……….. Given that per customer unit economics look at least as attractive as meal kits, we expect RTE product category margins to reach at least the level of meal kits. When combined with faster topline growth than meal kits in the coming years, this means our RTE product category should be the largest contributor to absolute profit growth in the mid-term.” Hello Fresh Half-Year Report 2024

As per Hello Fresh disclosure above, the company believes its RTE segment can achieve margins “at least as good” as the meal prep segment. I