Hello Readers!

Today I bring the final part of my Hello Fresh Deep Dive!

The pandemic caused a surge in demand for this DtC subscription food company’s products. Such supercharged demand enabled Hello Fresh to increase sales by 107% and achieve record profits. However, the hyper-growth is over, flat sales and unprofitability are here. Is Hello Fresh doomed as its stock price would suggest, or was Mr. Market a bit too pessimistic? That’s the question I am hoping to answer in the final part of this deep dive!

Before jumping to financial analysis and valuation, I suggest you read previous parts of this deep dive, to get the full picture of the company!

1. Opportunities

2. Financial Analysis

3. Valuation

4. Conclusion

1. Opportunities

Hello Fresh carefully analyzes opportunities and regularly expands to new verticals. The RTE expansion is currently reaching massive scale, additionally, its butcher and pet food vertical shows promising growth. Let us look at some opportunities the company could pursue to expand its business.

Ready-to-Eat

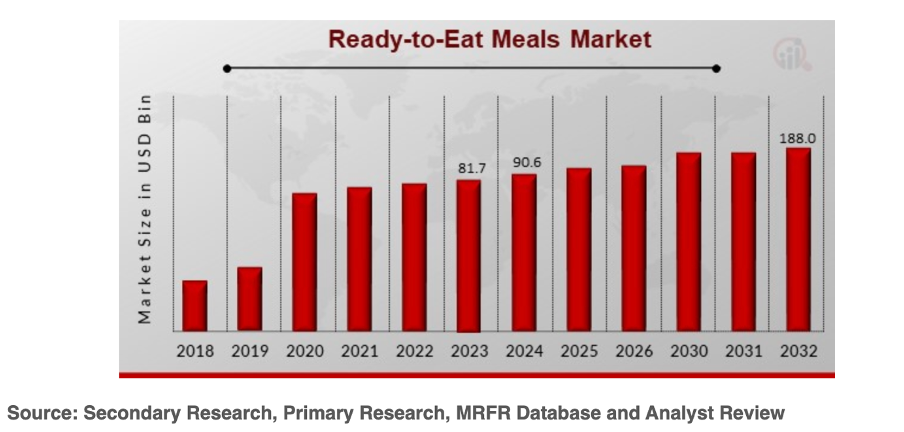

RTE meals market is large and growing. Researchers from Market Research Future estimate that $90.6B worth of meals is sold globally today.

The RTE market is forecast to grow with a CAGR of 10.98% till 2032, reaching $188B!

As we discussed earlier in the report, convenience is increasingly becoming the most important criterion in meal decision-making. However, not everyone is keen on consuming copious amounts of salt and sugar prevalent in quick meals. RTE meals can potentially be the middle ground. They provide convenience for a price similar to a fast-food meal without the guilt and the sugars of it.

The ready-to-eat segment is a growth machine and could potentially be both larger and more profitable than the meal box business!

“We are confident that the RTE product category will not just be a growth story but also one of margin expansion in the coming years. This will be driven in the near-term by the successful scale-up of our Arizona facility ……….. and in the mid- term by the maturing of the customer base……….. Given that per customer unit economics look at least as attractive as meal kits, we expect RTE product category margins to reach at least the level of meal kits. When combined with faster topline growth than meal kits in the coming years, this means our RTE product category should be the largest contributor to absolute profit growth in the mid-term.” Hello Fresh Half-Year Report 2024

As per Hello Fresh disclosure above, the company believes its RTE segment can achieve margins “at least as good” as the meal prep segment. I agree and find it likely that margins will ultimately be higher than meal prep.

On the price side, we see that an RTE meal costs $3 more than a meal kit meal. There are a few reasons why I find it likely that these $3 are more than enough to enable better unit economics than the meal kit business.

Scaled production – RTE meals are prepared in large-scale commercial kitchens from ingredients purchased and packed in bulk. This is in stark contrast to meal-prep kits that contain lots of small packaging. There is potential for high economies of scale of RTE to deliver great unit economics.

Less packaging – Meal kits require a lot of packaging to ensure that individual ingredients remain fresh and are portioned correctly. RTE meals have less packaging complexity, which delivers cost savings.

Delivery – A box with 6 RTE meals takes less space than a similar meal-prep kit and costs more money. This means that not only does it cost less to deliver these meals, but they also have a higher dollar value.

Longer Shelf life – Cooked RTE meals have longer shelf life than fresh ingredients, enabling better inventory management, lowering food waste, and reducing losses from spoilage.

Fitness and Health

Active people are as busy if not more busy, than the average person. Thus, a clear trend is emerging, the demand is increasing for healthy, tasty, and convenient solutions that meet all the nutritional requirements of an active person. Sales of high-protein yogurts, cookies, brownies, and drinks are growing. The consumption of protein shakes in office and university lunchrooms has turned from a niche health trend into a regular occurrence.

These trends can be easily observed in the sports nutrition sales statistics. Sports nutrition is a large and growing segment of the fast-moving consumer goods industry.

In 2022, global sports nutrition sales reached $27.7B. This market is forecast to reach $37.1B by 2027, an increase of 25% over 5 years. I have no doubt that Hello Fresh will begin more actively targeting this growing segment as its RTE and meat delivery segment scales.

There is potential for the company to become the go-to RTE meal provider for fitness enthusiasts!

By creating plans tailored to the needs of fitness enthusiasts, Hello Fresh can not only increase sales but also increase margins. People who train at the gym tend to consume more protein in their diets. Protein is expensive, so higher protein content is a strong justifier for higher prices. Factor already offers “Protein+” meals, but I believe there is potential to expand on this offering. Adding protein yogurts, shakes, snacks, pre-workouts, and potentially even fitness supplements. Getting customers through the door with RTE fitness meals and then upselling them other fitness-adjacent products is a great way to increase sales and reduce churn.

Geographic Expansion

While meal kits are suffering from a structural slowdown caused by the pandemic growth demand pull forward, there is still potential for this segment to grow.

Statista Market insights predict that the global meal kit industry will reach $16.6B by 2029, an increase of 25% from 2024.

While some of the growth will come from existing mature markets such as North America and Western Europe, it is expected that Asia will experience strong growth. The rising middle class will increasingly seek to increase life comforts, and saving time on cooking will be one of those. The market of meal kits is forecast to grow with a CAGR of 13.2% till 2030. Apart from Australia, Hello Fresh has no meaningful presence in Asia Pacific.

Additionally, Factor has only recently expanded to Canada and Europe. It is likely that Factor can match meal-kit revenues in these regions.

Thus, presenting a multi-billion EUR opportunity for the company!

Margin Improvements

Hello Fresh sales declined exactly at the moment when high input cost inflation caused their expenses to rise. Falling sales and rising costs are a potent recipe for a margin collapse.

The gross margin has fallen to 62.7% from 65.9%, mainly due to rising input costs. Operating margin dove to -0.9%, from 6.3%, as marketing spending grew despite lower sales. Net income margin fell to -1.5%, while FCF halved to 1.6% from 3.7%. Improving these margins is a must for Hello Fresh to remain in business. I believe the road to margin improvements is clear.

Maturity of meal kits – In some regions, this business is over 10 years old and has clearly reached maturity faster than the company hoped. Hello Fresh is in the process of transforming their operations to match the maturity of this business. Lower marketing spending and higher prices will reduce volumes but will increase the monetization of its existing customers. Further margin improvements will come from the closure of underperforming plants, the exit of some smaller unprofitable markets, and capex focused on margin improvements rather than growth. I could see this segment operating at around 7%-12% EBIT margins once full maturity is reached in all regions.

Churn reduction – Shifting from growth marketing to maintenance marketing should reduce churn. By offering free desserts, sauces, and condiments, Hello Fresh is changing its marketing focus from discounts to consumption. Lower churn would increase LTV, reduce marketing expenses, and increase contribution margin. An increase from 30% to 40% in long-term revenue retention would be very accretive to the bottom line.

Scaling RTE – As Factor is yet to reach full scale, it’s operating with depressed margins. Hello Fresh is incurring high marketing expenses building the Factor brand and spending capex on infrastructure for future demand. In the next few years, the need for capex and marketing will reduce, increasing margins. I expect the RTE segment to eventually reach 7%-12% EBIT margins.

Up sale funnel – The addition of new offerings such as Good Chop and Pets Table is great to get more money out of existing customers. Good Chop has a Trustpilot rating of 4.4, while Pets Table’s rating is 4.6. Such overwhelmingly positive reviews indicate Hello Fresh has identified what resonates well with its customer base, encouraging loyalty and repeat purchases. By expanding into complementary markets, HelloFresh can increase average order values at attractive conversion costs and deepen customer engagement. The addition of premium add-ons, such as higher protein options, desserts, condiments, and supplements, could support further average order value increases.

2. Financial Analysis

9M 2024 Hello Fresh sales reached €7.7B, an increase of 1.3% Y/Y while operating income decreased 162% to - €70.7M. Net income of -€119.1M is 714% lower. Falling revenues of the meal kit segment led to a collapse in its profits, while the RTE segment hasn’t reached profitability yet.

Sales Growth

In 2016, Hello Fresh sold €597M worth of meal kits.

Since then, the company has grown with a 39% CAGR, over 1,191% to reach €7.7B in sales!

The graph above clearly shows that the company has plateaued, with very limited growth since 2022. It is unlikely the company will grow sales as quickly as before. The meal kit segment is reaching maturity earlier than the management hoped, and while the RTE segment is promising, it is still small and will take some years to reach a similar level.

73% of revenue comes from the mature and declining meal-kit segment. 26% is generated by the RTE segment, which is growing by 50% Y/Y. I find it likely that the RTE segment will surpass meal kits somewhere between 2028 and 2030.

The Other segment is a wild card. Although it currently generates just 1% of the group’s revenue, it is growing 130% Y/Y.

Profitability

Contribution margin is one of the key metrics Hello Fresh uses to assess the financial viability of their business. The company defines contribution margin as revenue minus procurement, cooking, and fulfillment expenses.

In LTM as of Q3 2024, the contribution margin was €1.94B, 25.1% of revenue!

Contribution margin shows how much is left for marketing, general administrative expenses, and taxes after their two biggest expense categories.

Scale and pricing are the most important drivers of contribution margin. Scale enables Hello Fresh to have lower per-unit input costs while customer loyalty and brand familiarity allow higher prices. In the chart above we see how the company gained 11.7% percentage points in contribution margin from 2016 to 2019. However, since 2020 the contribution margin has stagnated and is actually at a 7-year low.

As the RTE segment grows and meal kits are optimized, the contribution margin could stabilize at around 28% to 32%!

The results so far in 2024 have not been great. EBIT went to negative €70.7M, -0.9% margin, while the company lost €119M with a -1.5% margin. Hello Fresh runs a high fixed and high variable costs business. To sell its products, the company must build and maintain large and complex operational facilities such as warehouses, processing plants, and logistics centers. Additionally, they pay for marketing to generate sales and raw materials to service customers.

Fundamentally, this business model is not conducive to high margins!

Additionally, low margins with high fixed costs mean that profits can quickly turn into losses, as we are observing right now. However, high variable costs also allow to reduce costs quickly, putting a stop level for losses. When Hello Fresh saw sales slowing down, it fired thousands of employees, closed some manufacturing plants, and reduced meal kit marketing spending. Wall Street analysts expect that these changes will enable Hello Fresh to make a €155M net profit in 2025.

The 2020 EBIT and net income margins of 11.3% and 9.8% were outlier results caused by massive pandemic demand. I find it unlikely the company can ever return to such margins.

In my opinion, in the long-term Hello Fresh is likely to reach EBIT margins of around 6% to 8%, and net margins of 4% to 5%!

FCF and Balance Sheet

As of LTM of Q3 2024, Hello Fresh operating cash flow is €265M, capital expenditures of €145M lead to an FCF of €120M.

While FCF has improved significantly since the negative €59M FCF of 2022, it is 77% below the pandemic peak of 2020, and 46% below 2021. I believe it will take a few years before Hello Fresh can reach similar FCF levels.

Additionally, in the chart above we clearly see the capex explosion. The pandemic surge in demand caused the first capex increase wave in 2020 and 2021. While the ramp-up of RTE has kept the capex elevated in 2022 and 2023. The company overinvested in infrastructure expecting continued fast growth. This means that Hello Fresh has more capacity than it currently needs. While bad in the short term, it might be beneficial in the long term if Hello Fresh manages to grow into their capacity.

Seeing these developments, Hello Fresh has reduced capex by 42%, saving €105M!

Lower capex needs mean that FCF is likely to grow significantly in the next years as RTE scales and meal-kit margins improve.

Additionally, a - €404M 9M 2024 operating working capital indicates that Hello Fresh runs a negative working capital business!

This is highly beneficial to the company! As it receives payments from customers between 7 to 30 days before orders are delivered, while it pays its suppliers between 30 to 60 days after receiving the supplies. So, depending on the situation, the company holds cash for 30 to 90 days before paying it out. During this time, the funds can be used for operational purposes, reducing the need for credit lines or they can be invested to generate interest. Since 2020 interest income has grown 11X from €1M to €11.7M.

The company currently has €356M of cash on its balance sheet and a debt of €744M, leading to a net debt of €388M. It would take around 3 years of FCF to pay off all of its net debt.

A debt ratio of 0.3 means that only 30% of Hello Fresh’s assets are financed by debt. While net debt/EBITDA of 3.6 and EBITDA/interest expense of 2.9 indicate that its profitability is perfectly sufficient to cover its liabilities.

Considering the negative working capital dynamic and its debt indicators, I find Hello Fresh’s balance sheet to be stable and healthy!

Dilution

Hello Fresh management has stated that, as shareholders of the company, they are disappointed in its recent performance. While the management focuses on turning around Hello Fresh operations, they saw an opportunity to repurchase shares at a reduced valuation. The company announced a €150M share repurchase plan for 2023 through 2024.

Hello Fresh will use these funds not only to repurchase shares on an open market but also to buy back convertible bonds that were issued in 2020. Considering Hello Fresh’s depressed market cap of around €1.5B, this would significantly reduce the shares outstanding.

Since implementing the program, the company has reduced the weighted average diluted shares outstanding by 6.11%!

Considering Hello Fresh’s FCF generation, and the relative healthiness of its balance sheet, I find it likely that the company will continue repurchasing shares, especially if the valuation remains depressed. These share repurchases should help grow earnings per share.

3. Valuation

As mentioned in the introduction of this report, Hello Fresh stock has taken a serious beating. Today, the company is worth just around €1.5B, down 90% from its peak of €16B.

We discussed in the financial analysis section how the business dynamics changed not to the company's advantage.

First, Hello Fresh became a slow-growing company with decreasing margins, then a company with declining revenues and increasing losses!

Under such circumstances, investor pessimism was understandable. Recoveries are hard and rare, whilst falling knives get caught every day. However, sometimes Mr. Market gets too pessimistic, causing companies to fall to unreasonably low valuations. This, however, creates an opportunity for investors with a different view of the business.

In the above table, I have placed Hello Fresh’s valuation metrics. The trailing twelve-month column shows us that the company is trading rather affordably, 13.6 times its free cash flow with an FCF Yield of 7%. In the previous chapters, I explained why I find it likely Hello Fresh is not a falling knife. The company is seriously focused on stabilizing margins in its mature meal-kit business whilst its RTE business is exploding.

This can be observed in the forward valuation metrics, Wall Street analysts project that the company will return to profitability next year, resulting in a 15.7 FWD P/E. Furthermore, WS predicts that earnings and cash flow will increase significantly in 2026. P/E based on 2026 earnings is 10, whilst FCF yield is 11.6%.

This depressed valuation gives Hello Fresh stock an easy road to significant growth if the company meets Wall Street expectations!

Additionally, if Hello Fresh outperforms these expectations, there is potential for an explosion in the value of its stock.

I have built a Base Case and a Bull Case valuation model in which I try to see what financial performance is required for investors to generate positive returns. These models are not meant to be viewed as a forecast but rather as an intellectual exercise.

In both cases, I ignore the Other segment of Hello Fresh and focus on meal-kits and RTE. Good Chop and Pet’s Table are interesting and fast-growing however, their potential is uncertain. It is still too early to tell how big these segments could become and what their economics would be like. Thus, I decided to ignore them, so if they become large and profitable, it would provide an additional boost to the stock. On the other hand, if losses accelerate it could cause some downward pressure.

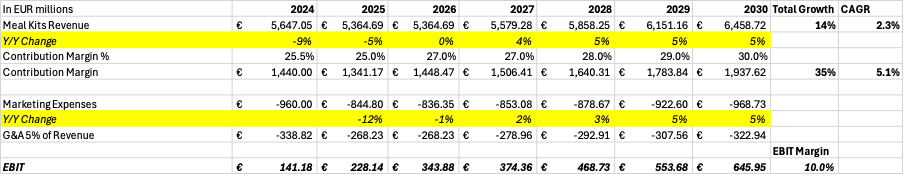

Base Case

The legacy meal kit segment will continue to decline next year and in 2026. Additionally, the contribution margin will bottom at around 25% in 2026.

However, I model a return to modest, low, single-digit growth starting in 2027. As I mentioned in the opportunities section, the segment as a whole is expected to grow 25% by 2029. I find it likely that by that time Hello Fresh’s operational strategy and marketing shifts would have put the company back on a growth path.

Additionally, I model gradual improvements to a 29% contribution margin in 2030. Driven by improved utilization of the currently existing infrastructure, increased automation, higher procurement efficiencies, and synergies with the RTE business.

Furthermore, Hello Fresh has stated their intention to lower marketing expenses and focus on higher-value customers. The meal-kit segment is already mature, so a transition from growth to maintenance marketing level makes sense. Such assumptions result in €6.032B in sales for the meal-kit segment, a growth of 7% from 2024 levels, 1.1% CAGR. Improving margins would lead to a 21% increase in contribution margin.

This leads to a meal-kit EBIT of €496M, an 8.2% margin!

The RTE segment is driving the Hello Fresh growth story. Factor has a massive growth runaway, so I model sales increase of 204% by 2030, a CAGR of 20.4%. Driven by increased penetration in North America and expansion in Europe and Australia.

While I believe the contribution margin today is lower than for meal-kits, I model that it will surpass the meal-kit segment in 2026 and will gradually increase to 32% by 2030. Higher automation and increased scale will lower costs. Moreover, as the segment matures increased customer loyalty should allow for higher prices.

Currently, marketing costs are elevated as Factor is in its hyper-growth phase. I model a gradual reduction in marketing expenses as a % of revenue starting in 2027 and stabilisation of around 22% in 2030.

RTE sales surpass meal kits in 2030, reaching €6.2B, while contribution margin grows by 342%, 28.1% CAGR.

The RTE EBIT could reach €291M, a 4.7% margin!

Combining both segments, we get to 2030 revenue of €12.25B, an increase of 59% from 2024, 8.1% CAGR. Blended contribution margin of 30.5%, an increase of 5.9% percentage points from the 24.6% level of 2024. Marketing expenses as a share of revenue increase till 2027, then start falling as the RTE segment matures to reach 19.1% in 2030.

Total EBIT would reach €787M, a 6.4% margin!

I model taxes, interest, and other expenses to be 40% of EBIT, leading to Net Income of €472M, a 3.9% margin.

In regards to dilution, I currently model a 10% reduction in total shares outstanding by 2030. As mentioned in the dilution section, the company is aggressively repurchasing its shares.

The Base model shows that even with a modest P/E of 10, the stock could potentially return over 220%, a CAGR of 18.1%!

Considering Hello Fresh’s growth potential, I find it likely the company could trade at a higher multiple.

With a P/E of 20, Hello Fresh stock could return over 540% in just 6 years!

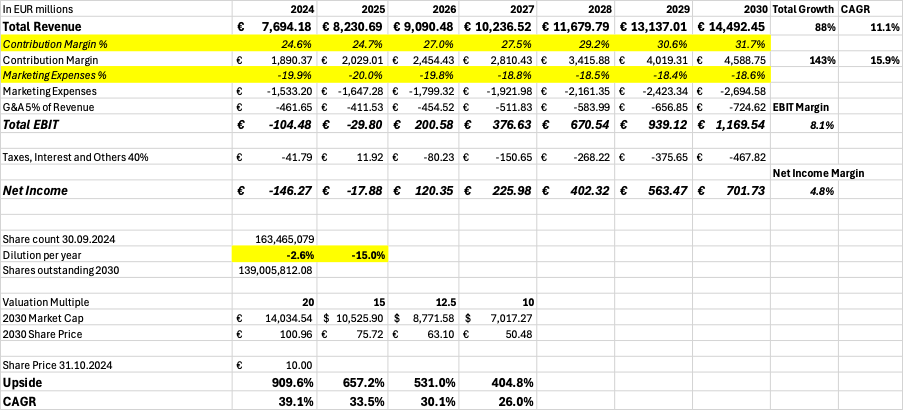

Bull Case

In the Bull Case model, I have used slightly better assumptions for the company.

The meal-kit segment reaches the bottom and returns to growth one year faster in 2026, with sales reaching €6.46B. Total growth for the period would be 14%, above 7% of the base case. Additionally, the contribution margin improves faster and reaches a 30% level in 2030, a 1% point higher than in the base case.

This leads to a meal-kit EBIT of €646, a 10% margin!

In the bull case, the RTE segment revenue would reach €8B, a growth of 292%, €1.7B higher than in the base case. Additionally, the contribution margin reaches 33%, whilst marketing expenses are 21% of revenue, rather than 22% in the base case. The RTE segment becomes EBIT positive in 2027, a year earlier.

RTE EBIT would reach €523M, a 6.5% margin.

Key factors driving improvements over the base case on the cost side would be more efficient manufacturing and greater operational and marketing synergies between RTE and meal kit segments. On the revenue side, higher marketing conversions and additional successful geographic expansions would increase sales, while improved customer loyalty could lead to lower churn.

The combined revenue of the bull case scenario would be €14.49B, an increase of 88% from 2024, CAGR of 11.1%. Blended contribution margin of 31.7% and an EBIT of €1.17B, margin of 8.1%.

Total Net Income would reach €702M, a 4.8% Margin!

In regards to dilution, I selected a 15% reduction in total shares outstanding by 2030 as higher income allows the company to repurchase more shares, a notable improvement over the base case.

The Bull case model shows that even with a modest P/E of 10, the stock could potentially have huge returns of over 404%, a CAGR of 26%!

If the company indeed reaches these more bullish estimates, there is a significant likelihood that the market will reward it with a higher multiple.

With a P/E of 20, Hello Fresh stock could 10X in a mere 6 years!

4. Conclusion

Hello Fresh is not a perfect business!

The company sells a commoditized product with lots of competition and no switching costs. Low customer loyalty and a desire for novelty make the churn very high. Their business model demands substantial and constant marketing to get new customers and to reacquire churned ones.

However, it doesn’t need to be a perfect business to be a large profitable enterprise! €1 of profit is the same whether it comes from a 5% or 25% margin.

HelloFresh has built a leading meal-kit service business by effectively addressing the needs of modern consumers seeking convenience, quality, and culinary variety. While currently underperforming, thanks to Hello Fresh’s realigned strategy focused on margins and high-value customers over growing sales, meal kits could become a cash cow.

Furthermore, its RTE segment could grow significantly and become a multi-billion EUR business rivaling meal kits in size and profitability!

While the company is currently unprofitable, with over €356M in cash and a debt ratio of 0.3%, the company is in sound financial condition. This financial strength enables the company to weather short-term challenges. Moreover, an FCF of 120M coupled with its depressed valuation of just around €1.5B allows the company to significantly reduce the number of shares outstanding.

The Base Case valuation model shows that even with modest assumptions, this company could become a multi-bagger, while the Bull Case indicates a 10X potential!

The company has a clear and executable path that could allow it to up-sell various higher-margin add-ons, reduce customer churn, and increase margins.

If successful, Hello Fresh could become one of the best turnaround stories of recent years!

Thank you for reading, Follow me on:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

I enjoyed reading your article. It gives a 360 degree perspective of not only the business itself but also the market under which it operates in. I also agree with your take on the current asymmetric upside. I tend to think that german equities in general are currently depressed, which offers exciting opportunities in terms of mispriced valuations.