In 2018, Canada became one of the first countries in the world to fully legalize recreational cannabis. The legalization caused a boom in the legal cannabis industry, which was previously dominated by illicit growers.

Hundreds of new companies were founded, and hundreds of existing businesses entered the industry with hopes of huge growth and massive profits.

High Tide was one of these companies!

The Nasdaq listed company was founded in 2009 as a cannabis accessory retailer, but as soon as the legalization rolled in, it expanded to service the legal cannabis market

Huge excitement about the future created a massive bubble across the whole cannabis sector. High Tide was not immune, as their stock rose more than 700% to reach a market cap of CA$590M.

Since then, High Tide’s market cap has fallen to CA$301M, and after a series of diluting acquisitions and share issuances to fund expansion, the stock is down 75% from the all-time high.

Today, however, High Tide is straightening out its business and is starting to look like an attractive small-cap investment.

In this High Tide Investment Case article, I will look at their Canadian business, recent deal to enter Germany, potential for other markets, Costco-style loyalty program, and valuation!

Let’s get into the weeds of this small-cap opportunity!

1. Canadian Cannabis Market

2. High Tide Presence

3. Loyalty Program

4. Store Performance

5. International Expansion

6. Financials

7. Valuation

8. Conclusion

1. Canadian Cannabis Market

The 2018 legalization caused a lot of excitement in the industry, creating a massive race to the top. It soon became clear that this race was going to be quite expensive, so High Tide and many other cannabis businesses IPO’ed to raise money and raise money they did.

Tilray Brands raised US$1.1B and at one point reached a valuation of US$10B as speculative investors sent this cannabis stock sky-high (pun intended). Since then, Tilray has crashed more than 90% due to slowing growth and massive losses. There are countless companies with similar stories.

Unfortunately, progress in the Canadian industry has been much slower than originally expected. Here are the main causes:

1. Overestimated demand – A Deloitte 2018 Cannabis Report forecast that by 2019 63% of purchases will shit to the legal market, and sales will reach US$6.13B. Unfortunately, this forecast was way off, and even today, the legal market hasn’t reached the US$6B level. Many cannabis companies overproduced, causing oversupply and falling prices.

2. Regulatory issues – The government wanted to carefully take into account all considerations, so the approval process was extremely slow. Complex regulations created high compliance costs and frustrated many entrepreneurs.

3. High prices – Strict regulations, huge upfront costs, and high taxes made legal cannabis expensive, putting pressure on demand and lowering seller margins.

4. Strong illicit networks – Drug dealers had built strong relationships with their customers and suppliers. These illicit sellers were not burdened with high costs, so their prices were much lower, making them more competitive. Additionally, regular users were used to buying cannabis from their dealers and trusted them. Many “stoners” simply didn’t see the benefit of paying more for legal cannabis.

Today, however, the situation is completely different, with many of the above-mentioned issues starting to be resolved.

Firstly, cannabis has been legal for 7 years already. The industry has developed significantly, causing people to change their habits and many of the illicit networks to break down. In a 2024 survey, 72% of cannabis users said to be using the legal market, a significant improvement from 41% in 2020 and 24% in 2019.

Secondly, the expectations regarding the growth of the industry have been completely reset. No one is forecasting hypergrowth in Canada, and any notion that US federal legalization might be around the corner is dead.

Statista Market Research forecasts that the legal cannabis market will grow with a 2.46% CAGR to reach $6.59B by 2029!

These much lower expectations have lowered excitement in the industry, causing many cannabis businesses to shut down. Fire & Flower had 102 stores in 2021, and after being acquired out of bankruptcy, many are being closed. As of mid-2023, the company had 90 stores. While in the short term, it is causing some pain in the industry, High Tide will benefit from this consolidation.

High Tide’s investment case is largely driven not by the growth of the industry but by market share gains!

On the regulation front, the Ontario provincial government increased the maximum allowed stores per entity from 75 to 150. This created an active debate in other provinces about increasing limits as well. Additionally, Manitoba cancelled a 6% special cannabis “Social Responsibility” tax. Meanwhile, across Canada provinces are easing rules that regulate how and where cannabis can be displayed, increasing flexibility and making certain promotional activities easier.

Easing regulations will support the growth of the industry and the dying of the illicit market!

2. High Tide Presence

When legalization took place, many companies and investors believed that the majority of the economics of a cannabis sale would go to the grower. High Tide believed otherwise, and rather than investing in cultivation, built an impressive retail footprint.

High Tide operates the largest legal recreational cannabis dispensary chain in Canada, Canna Cabana.

Canna Cabana has 8 stores in British Colombia, 84 in Alberta, 12 in Saskatchewan, 11 in Manitoba, and 76 in Ontario, for a total of 191 stores. High Tide’s long-term target is to have 300 stores in Canada.

Historically, they were opening 30-40 stores per year, but the pace of the expansions has slowed down. In 2023, the company made a goal to become FCF-positive, thus, they decided to open only 13 stores. The goal was met, FCF was CA$14.9M. In 2024, the opening pace reaccelerated to 29 new stores, and the goal for 2025 is to open between 20 and 30.

Apart from Quebec and Nova Scotia, High Tide has a significant presence in all of the main provinces, with an 11% market share in the five provinces it operates. Both Quebec and Nova Scotia don’t allow corporate dispensaries, with cannabis there being sold only by provincial monopolies.

With such a large presence, High Tide is gaining leverage over growers, enabling lower prices compared to what small independent retailers can negotiate!

Moreover, to increase margins, High Tide is focusing on building its own in-house store brands.

Similar to Costco with Kirkland Signature, High Tide sells products under the Cabana Cannabis and Queen of Bud brands.

In this way, a customer builds a relationship and loyalty with the retailer, not the manufacturer, giving retailer leverage in negotiations!

And the similarities with Costco don’t end here!

3. Loyalty Program

Cabana Club is the first-of-its-kind recreational cannabis loyalty program. Members have access to special discounts of 10-25% on cannabis and accessories. Standard membership is free, but the Elite level costs CA$35 a year.

Cabana Club has been extremely successful, growing to 1.72M members as of January 2025!

In the graph above, we can see how explosive the growth has been. In 2024, members grew 34% Y/Y.

73K of these members are at the Elite level!

In addition to extra discounts on products and delivery, Elite members get access to exclusive Elite merchandise. In 2024, Elite members grew 161% Y/Y.

The main goal of the Cabana Club is to increase customer loyalty and drive repeat purchases. People love low prices, and stoners are no different, they will flock to the vendor with the best prices.

Frequent cannabis users are responsible for the majority of the spending and are the most likely to keep using the illicit market!

A 2021 survey discovered that 10% of cannabis users are responsible for 66% of all cannabis consumed in Canada!

Instinctively, this makes perfect sense. A daily user might smoke 30-60 joints per month, much more than an occasional smoker who gets stoned once in a while.

An occasional user might not see the financial benefit of using an illicit dealer, as they would only save a few dollars. However, a daily user likely spends a noticeable share of their income on cannabis. For them, an illicit supplier could save hundreds of dollars a month.

As a result of strong discounts, Cabana Club is not only capturing regular users but also reducing the appeal of the black market!

With this strategy, High Tide aims to become the Costco of the Canadian cannabis industry!

Costco has gained a cult-following thanks to its obsessive focus on low prices and large selection. High Tide is working to create a similar concept platform for cannabis, offering the largest selection and affordable prices. In addition, High Tide offers something that drug dealers cannot, convenience and quality control.

People love convenience, look at the success of Amazon, Netflix, and Uber Eats. Canna Cabana has a dedicated e-commerce platform and 191 retail stores offering an unparalleled selection of high-quality products, available quickly and efficiently. Illicit dealers might be cheaper, but they are selling untested, questionable quality products in an inconvenient way.

With Cabana Club, High Tide is aiming to capture a large share of those 10% power users who generate 66% of all sales!

4. Store Performance

High Tides stores earn much more per store than any other competitor!

The average Canna Cabana store operates at a CA$2.6M run rate!

The average competing store earns CA$1.2M, less than 50% of Canna Cabana. In Alberta, Canna Cabana’s per-store sales are 80% higher than competitors, while in Ontario, a fully ramped store makes 230% more per store.

I believe this is the direct result of their real estate strategy and high customer loyalty created by the Cabana Club.

Large selection and low prices are key to driving repeat business. However, location is incredibly important. Canna Cabana’s strategy is to open locations in easily accessible areas next to grocery stores, fast food restaurants, and plazas with high foot traffic.

In the chart above, we see that Canna Cabana’s same-store sales have increased by 130% since 2021. The company achieved this by taking market share, as during the same period, the total industry sales increased only by 31%.

Additionally, High Tide dispensaries have one of the best store-level economics in the industry!

Excluding HQ overhead and costs of other ventures, a Canna Cabana store operates with gross margins of 25% and EBITDA margins of 11%.

This means that High Tide can recoup the estimated CA$260K it costs to build a dispensary in approximately 10 months!

5. International Expansion

In 2017, medicinal Cannabis was legalized in Germany. Meanwhile, in February of 2024, the German parliament legalized the limited possession and cultivation of Cannabis for recreational use! According to the new rules, people are permitted to have 3 cannabis plants and store up to 50 grams at home.

If the Canadian experience is any indication, this is just the start of a long, slow, and tedious process towards full retail legalization!

The Germans are not known to be prudent regulators, so the industry will likely deal with even more issues than in Canada. Experts are already sounding alarms on excessive bureaucracy and slow progress.

Despite all the issues and hurdles, Germany is projected to become a huge market for Cannabis. With 83M people and a GDP of $4.2T, Germany is the 4th largest economy in the world, double the size of Canada.

Thus, it is not a huge surprise that High Tide has decided to expand to this new, highly promising market. Just recently, they announced a €4.8M deal to acquire a 51% stake in Purecan, a German medical cannabis company based in Frankfurt. High Tide holds an option to purchase the remaining 49% in the future.

Purecan is a pharmaceutical wholesaler, and High Tide intends to use its supply chain in Canada to export Cannabis to Germany at attractive prices.

Researchers at Spherical Insights forecast that the legal German cannabis market will grow with a 16.76% CAGR to US$4.85B!

As of today, retail sales of cannabis by dedicated businesses are not yet legal in Germany, and the government will likely take time to build a regulatory framework, especially considering the upcoming parliament elections on 23. February 2025.

High Tide CEO said that they are carefully watching legislative changes and will enter the retail German market with its Canna Cabana brand as soon as the law allows it.

In the same earnings call, he said that they are looking at many other countries for potential expansion. United Kingdom legalized medical cannabis in 2018, while Australia did so in 2016. Additionally, he mentioned that the medicinal cannabis markets in Poland and Denmark are developing nicely and could be attractive!

6. Financials

High Tide closed FY 2024 with revenues of CA$522M, up 7.1% Y/Y, operating income of CA$15.3M, up 667%, net income of -CA$4.3M, up 99%, and FCF of CA$27.3M, up 83%.

Since 2017, High Tide has grown sales by 5,213%, quite impressive. However, growth has slowed down noticeably. Y/Y revenue growth has been decreasing for 5 years in a row, bottoming at 7.1% in 2024.

I find it likely that the growth will reaccelerate in the next few years!

High Tide has been an unprofitable and cash flow burning company for many years, and changing market conditions in 2023 forced it to shift focus from top-line growth to improving margins. Now that the company has improved its business economics, it can shift its focus back to growing sales.

Profitability and Cash Flow

In 2024, High Tide reached operating profitability for the first time in years.

With an operating profit of CA$15.3M, the operating margin increased to 2.9%, up from -62.4% in 2019.

While net income is still negative, the net margin has improved noticeably from -20% just 2 years ago to -0.8%. During the boom years, High Tide made some acquisitions that didn’t generate the desired value. These failed deals are largely responsible for High Tide not reaching profitability today as they are causing impairments of goodwill and write-downs in asset values. The majority of these write-downs should be completed by now.

High Tide adjusts for these impairments and stock-based compensation in its Adjusted EBITDA metric.

ADJ EBITDA reached CA$38.3M in 2024, an increase of 25% from 2023 and 209% from 2021. Indicating a significant improvement in operating economics!

Meanwhile, in the chart above, we can observe significantly improving cash flow dynamics. The FCF margin reached 5.2% in 2024, almost doubling from 3.1% of the prior year. FCF of CA$27.3M is quite impressive considering High Tide burned CA$3.3M just 2 years ago.

There is huge potential for continued FCF growth!

Balance Sheet

High Tide reached a record level of CA$48M in cash in 2024, an increase of 223% from 2021. During the same time, debt grew by 31% to $CA76.6M. This clearly indicates an improving cash position and reduction in relative debt, however, the company still has a net debt position of $CA26.6M.

Net debt to EBITDA ratio of 0.9 means that around 11 months of EBITDA are sufficient to pay off their net debt of $CA26.6M. Meanwhile, the EBITDA to interest expense ratio of 2.3 tells us that High Tide can cover their yearly interest payment of CA$12.8M with around 5 months of EBITDA.

Overall, High Tide has a healthy cash level and enough profits to manage its debts!

In addition to prudent debt management, High Tide has significantly reduced its inventory. As of 2024, they hold CA$29.3M of inventory, enough for 27 days of sales, down from 97 days in 2019 and 54 days in 2020.

Dilution

Historically, High Tide has been a very dilutive company. In 2020, there were 16M shares outstanding, as of FY 2024, there are 81M.

This means that in just 4 years, the share count increased by 406%!

From 2020 to 2022, High Tide increased its store count by 124% and grew revenues by 328%. Let’s remember that during these years, the company was losing money. This means that to fund this expansion, High Tide had to issue new shares.

Such aggressive share issuance was bound to slow down, and it has. In 2023 and 2024, High Tide grew shares outstanding by 6% and 7.3%, respectively, for a cumulative increase of 13.8%.

Now that High Tide has become FCF positive and is on a path to full GAAP profitability, it is likely that in the future, the dilution will be significantly lower!

Wall Street Estimates

High Tide management has made some ambitious promises regarding accelerated revenue growth and improving profitability, and Wall Street analysts seem to believe them.

Analyst consensus estimates see High Tide revenue growth improving to 14.9% per year, up from 7.1% this year. Such growth would lead to 2026 sales of $CA689.7M.

Furthermore, analysts expect margins to improve, enabling High Tide to grow operating income by 52% to CA$35.4M.

FY 2026 should be the first year of GAAP profitability, with net income growing by 423% to CA$13.9M!

This means that Wall Street expects a 2% net income margin in 2026.

Concerning FCF, analysts forecast slower 2-year growth of 27.7%, as High Tide’s goal to open 20 to 30 stores could lead to higher capital expenditures.

Overall, analysts expect that High Tide will deliver strong top-line growth and improving profitability!

7. Valuation

With a market cap of CA$301M, High Tide trades for just P/S of 0.6, P/FCF of 11, and FCF yield of 9.1%.

Taking 2026 Wall Street estimates into account, P/S is 0.4, P/FCF is 8.6 and FCF yield is 11.6%. Additionally, as the company is expected to reach profitability, 2026 P/E is 35.

I find the valuation to be attractive considering High Tide’s potential!

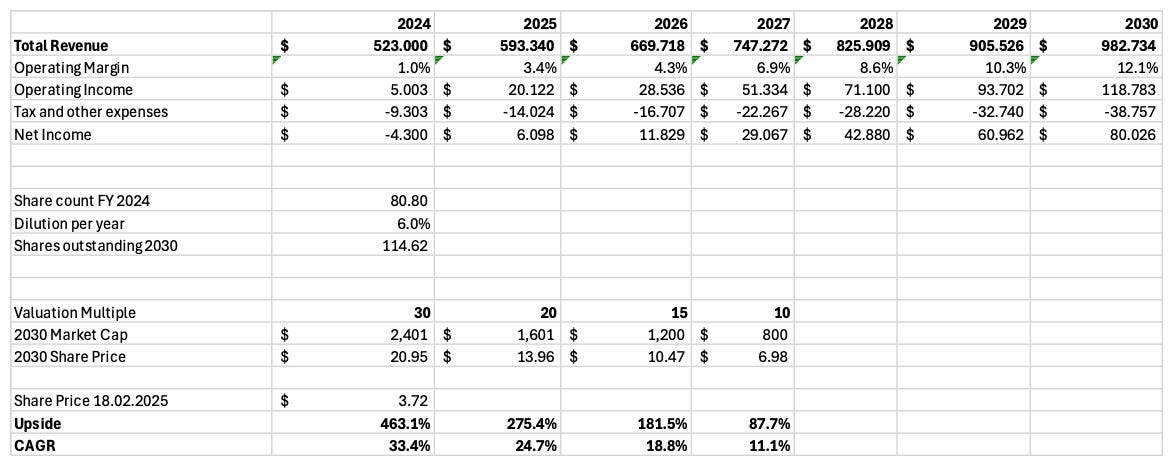

I built 2 valuation models to assess the potential return investors could expect!

Base Case and Bull Case!

All values are in Canadian Dollars!

Base Case

I model High Tide, reaching its goal of 300 stores by 2030. Additionally, I expect them to grow revenue per store at minimum with the same CAGR as the whole Canadian cannabis market, so 3.1%. In terms of profitability, I model a 10% operating margin at maturity.

For the accessories business, it was 7% of the cannabis revenue, which I have left the same. Moreover, I model the unit as having a 10% operating margin.

The last segment is the Data Analytics and Other income. Here, High Tide records the advertising income of their e-commerce websites and subscription income from Cabana Club. Additionally, High Tide sells cannabis data analytics to growers and wholesalers. This segment largely earns software income, so I estimate a 40% operating margin. In 2024, it was 8% of Canada cannabis revenue. I have assumed this won’t change.

The result of these assumptions is total revenue of CA$982.7M in 2030, an increase of 88%!

Additionally, I model operating margin increasing to 12.1%, enabling net income to reach CA$80M.

Assuming a P/E of 30, we get to the market cap of CA$2.4B.

If dilution doesn’t exceed 6% per year, the 2030 share price would reach CA$20.95.

That is a 463% upside to today’s share price of CA$3.72, a CAGR of 33.4%!

Even a P/E of 15 would deliver an 181.5% gain, a CAGR of 18.8%!

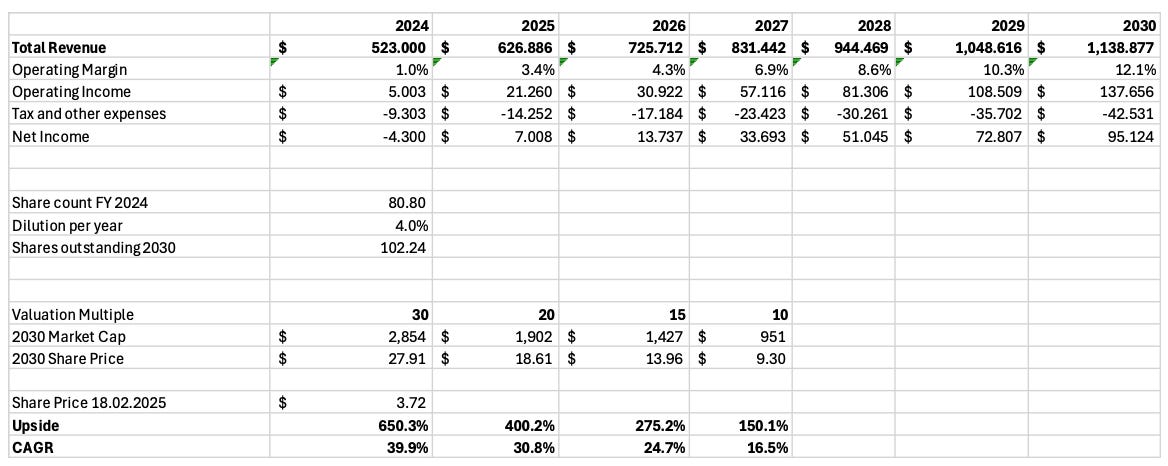

Bull Case

Let’s assume that, rather than 300, High Tide is able to have 330 stores by 2030. Additionally, let’s increase the revenue per store to CA$3M from CA$2.85M.

With these improved assumptions, revenue increases to CA$1.14B, up 117.8% from today, instead of 88% as in the Base Case!

Leaving margins unchanged, net income increases to CA$95.1M.

With a P/E of 30, we get to the market cap of CA$2.85B.

Assuming that High Tide can grow the business with a lower dilution of 4%, we get a 2030 share price of CA$27.91.

That is a 650% upside to today’s share price of CA$3.72, a CAGR of 39.9%!

Even if the market assigns a lower P/E of 15, investors could see a 275% upside!

Germany

As I mentioned earlier, Germany is certainly a massive market.

However, significant operational and regulatory uncertainty makes it impossible to estimate High Tide’s 2030 sales and profits with any certainty!

Spherical Insights forecasts the German market to grow with a 16.76% CAGR to reach an estimated US$2.6B (CA$3.78B) by 2030. The Deloitte 2018 Canada forecast shows us how inaccurate estimates could get, but let’s try to model results anyway.

If High Tide gets a 5% market share and reaches a 4% net margin, they could have sales of around CA$190M and profits of $CA8M. Assigning a multiple of 20, we get a potential increase in market cap of CA$160M.

A 10% market share could lead to sales of $CA378M and profits of CA$15M, delivering an increase in market cap of $CA300M.

A 20% market share could increase the market cap by CA$600M. You get the picture.

Let’s remember that the entire market of the company today is just $CA301M.

What is a reasonable market share and profitability estimate?

I have no idea!

8. Conclusion

High Tide is a reasonably priced company operating in an industry experiencing rapid global changes!

Six years after the legalization of cannabis in Canada, the industry is still struggling to find its footing. However, High Tide seems to be on a path to prosperity.

It is applying concepts proven in other industries to increase sales and customer loyalty. Mirroring Costco’s strategy in cannabis, Cabana Club has the potential to capture the most frequent and highest profitability cannabis users.

High Tide has a clear executable strategy to reach 300 stores by 2030. Additionally, they are set to reach profitability and are poised to remain a significant player in the Canadian cannabis industry.

International expansion could potentially turbocharge their growth, enabling massive profits!

However, as with any small-cap, there are significant risks. The cannabis markets might not develop as the company hopes, and intensifying competition might pressure margins.

Overall, I find High Tide to be an incredibly interesting high-risk, high-reward small-cap opportunity!

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Ferrari, Palantir, Robinhood, Celsius, Mercado Libre and Hello Fresh!

Additionally, i have written Investment Cases on Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write 1 article a week!

Subscribe to get all my articles as soon as they are released!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.