Is Root a buy?

Root Investment Case!

Financial services is one of the world’s largest industries, generating yearly revenues of over $30T, yet it is one of the least disrupted. Countless of the world’s largest financial services companies are over 100 years old, and while some use modern technologies, most of them still rely on the same slow, outdated, and customer-unfriendly business practices.

One of the biggest subsets of financial services is the $7.8T insurance industry, and it could be even less disrupted and less customer-friendly. This is largely because the industry is very capital-intensive, cyclical, has high product complexity, and relies on an intricate patchwork of old tech systems.

Root is a $1.5B fish in this trillion-dollar ocean, hoping to challenge the sharks with a fast, modern, and customer-friendly business model.

This approach has enabled them to accumulate a policy portfolio that is nearing 500,000, an increase of 308% from 2018.

With its mobile-first platform, growing collection of real-world data, AI underwriting models, and strong distribution network, Root is working to disrupt the personal insurance industry, starting with autos.

Their long-term goal is to “be the largest and most profitable personal lines insurance provider in the US”. This is an extremely ambitious long-term goal that puts Root against the biggest players in the industry.

If successful, Root could drastically reduce costs for customers, whilst increasing satisfaction and user experience, all while delivering supreme returns for its shareholders.

In this Root Investment Case, I will analyze how the company plans to do it and what returns shareholders could be looking at.

1. Business Model

2. The Opportunity

3. Valuation

4. Conclusion

1. Business Model

Root is an insurance company specializing in personal car insurance.

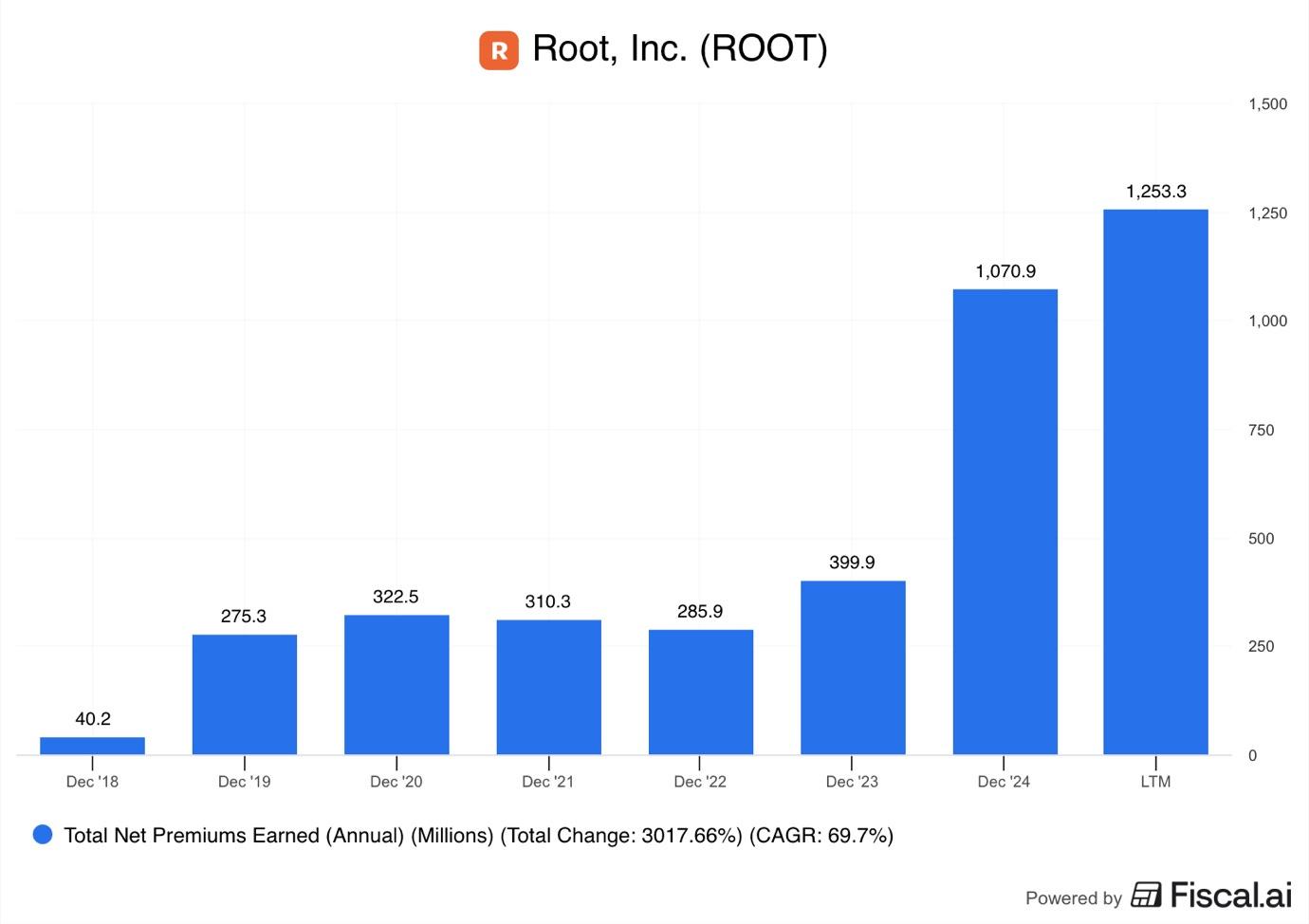

Since 2018, the company has rapidly expanded, growing its net premiums earned by 31x, to $1.25B!

Fundamentally, the business model of the insurance industry is very simple.

Insurance companies collect a relatively small payment from each policyholder who wants to be compensated in case of a certain event. It then pools these policy premiums from a large number of policyholders into a sizable fund. If a certain event occurs, the insurance policy gets activated, and the insurance company uses that sizable fund to pay a single policyholder a relatively large sum of money.

In insurance, this sizable fund is called float. While the insurer waits for an event that triggers a payout, it invests that float in income-generating assets, such as bonds, treasuries, investment funds, equities, etc.

Simply put, collected insurance premiums must be higher than claims paid!

However, this is where the simplicity ends, and the complicated nature of the insurance industry reveals itself. How does an insurance company determine the price of a policy?

It calculates the probability of a policy triggering event.

Then, it estimates the size of the potential claim.

Considers loss adjustment expenses (costs of processing claims once triggered).

Takes into account overall administrative expenses.

Adds the desired insurance underwriting profit margin.

But this is easier said than done. How can they estimate operating expenses and insurance claims many years out with any degree of certainty?

This is where the insurance companies make their cake and earn their edge.

Underwriting Strategy

Traditionally, insurance companies resorted to using historical data, risk groups, emerging trends, and complicated statistical models. This step is critical because the likelihood of loss is the starting point for everything else in pricing.

For vehicle insurance, that meant analyzing historical accident patterns in a city/county/state and adjusting pricing for vehicle type and risk category. While this model works great in aggregate for an insurance company, this methodology causes frustration for drivers.

Because pricing is determined by factors outside a driver’s control!

When asked in questionnaires, more than 80% of drivers usually respond that they are better than the average driver. While these responses are wrong mathematically, many of them are right in spirit, as research consistently says that a small minority of drivers are responsible for the majority of the accidents. With 5-10% of drivers likely responsible for 40-50% of accidents.