Introducing: The Dutch Investors!

Guest Post. Dino Polska vs Match Group

Hello Readers!

Today, I bring a guest post from my friends at The Dutch Investors!

Enjoy!

Dino Polska vs Match Group

Shopping vs Dating

Dear friends of Global Equity Briefing,

Today, we’re diving deeper into Match Group and Dino Polska. One of them we’ll swipe right on, the other we’ll swipe left. It’s a bear case vs. a bull case.

One match that did work out? The partnership between Global Equity Briefing and The Dutch Investors. This article wasn’t written by Ray, but by Luuk from The Dutch Investors. We both share a passion for in-depth research in the quest to find the best companies worldwide.

Honestly, detailed research focused on long-term investing is rare these days. That’s why, if you enjoy Ray’s content, we’re confident you’ll find value in The Dutch Investors too. They bring particular expertise in Dutch and European companies like ASML, Adyen, Basic-Fit, Booking.com, and Dino Polska.

Not sure yet? Read the Bear vs Bull case below and find if the Dutch Investors content could be valuable for you.

Bull case - Dino Polska

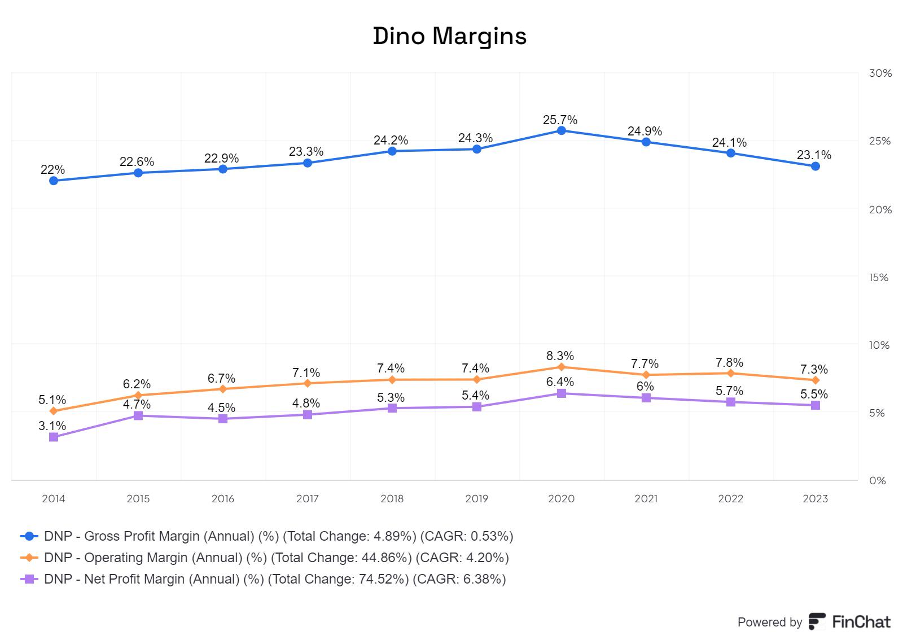

Dino Polska is a Polish supermarket chain with impressive net margins of 5.5%. This is exceptional compared to competitors, who typically operate with margins between 1% and 2.5%. In this bull case, we’ll uncover the secrets behind Dino’s remarkable 5.5% margins.

We even visited three Dino Polska stores ourselves to ensure the accuracy of what we’re about to share.

A little bit of background

First, it’s important to understand that Poland is a young democracy, having gained independence from the Soviet Union in 1989. Just ten years later, Dino Polska’s founder, Tomasz Biernacki, opened the first Dino supermarket in western Poland, where the majority of their stores are still located today. Now, Dino Polska operates 2,504 stores.

Currently, Poland is the sixth-largest economy in Europe and boasts one of the fastest-growing GDPs in the EU. With a population of 40 million steadily moving toward the upper-middle class, Poland presents a compelling investment opportunity.

The secret behind margins twice as high as competitors

Retail is a tough business. A 5.5% margin, compared to Jeronimo Martins (Biedronka) at 2.5%, means Dino’s profits are twice as high. The 5.5% margin in 2023 was no coincidence, Dino is consistently doing a lot of things differently. This is why their business model and competitive moat are so closely linked.

Locations

One major difference is Dino’s choice of store locations. While competitors like Lidl, Biedronka, Zabka, and Tesco are often located nearby or in the city centers, Dino chooses to build only in rural areas. This not only reduces land costs but also enables Dino Polska to design each store exactly the same way.

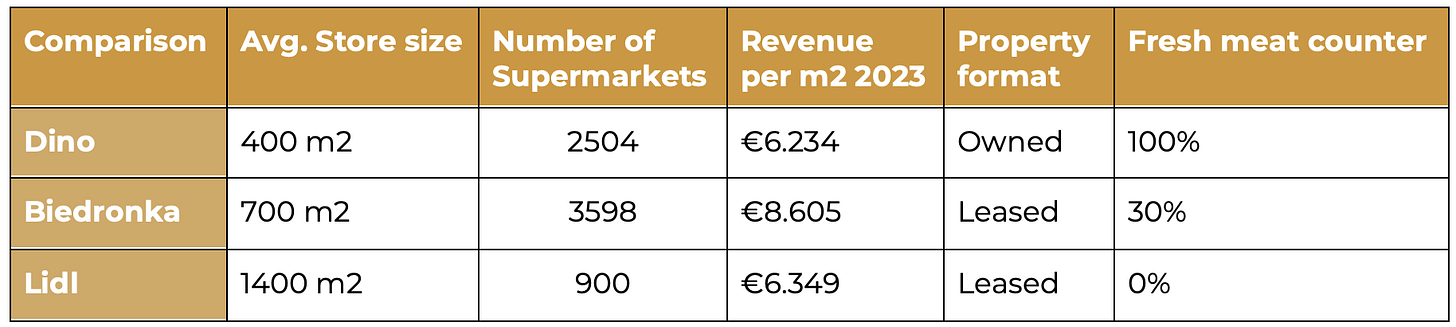

Comparison Dino Polska vs competitors

Below you see the difference in store sized, owned vs leased and the focus on fresh meat. Based on this, it is fair to say that Dino Polska tends to be more of a convenience store in rural areas.

Vertically integrated

When every store is built exactly the same, and you’re opening a store a day (as Dino did in 2022) why not own the construction company yourself? That’s exactly what founder Tomasz Biernacki decided to do. By acquiring his own construction company, Dino Polska saves on materials, architects, and in-house design, while also speeding up new store openings. After all, as they say: time is money.

But there’s more… Dino has further vertically integrated its business model by owning its own meat processing company, Agro-Rydzyne. This may sound minor, but meat holds a significant place in Polish culture, making this move strategically important.

Benefits of standardization

In addition to cost savings on construction, standardization offers Dino further advantages that contribute to its high net margins. When every store is identical, both inside and out, logistics become highly efficient. Each truck can carry the exact same stock, every store operates with the same efficiency, and new initiatives (like adding solar panels) can be implemented on a large scale with ease.

Store openings

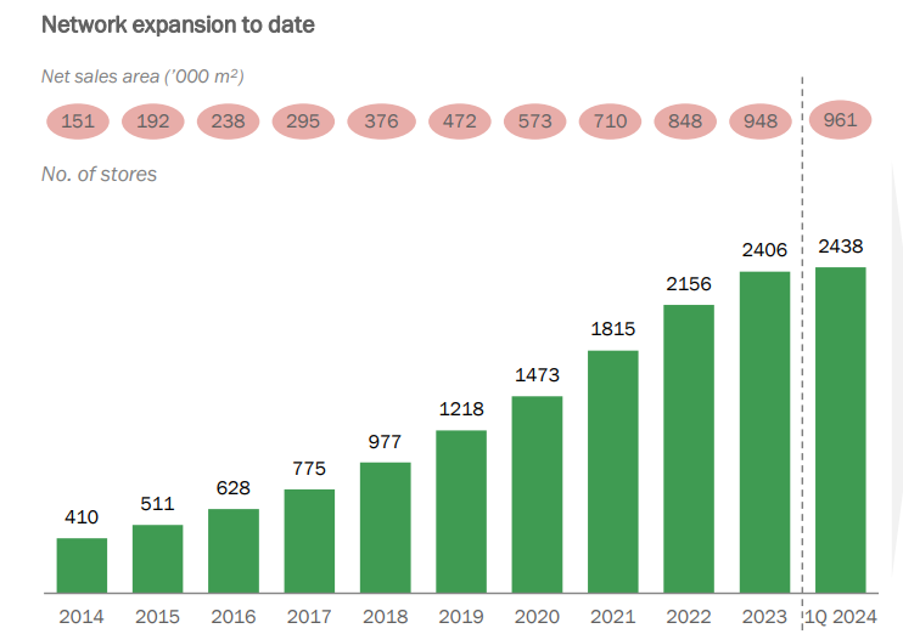

In 2021 and 2022, Dino opened nearly one new supermarket every day. These are impressive growth figures, to be sure. However, a slowdown became evident in the first half of 2023. In a recent press release, Dino announced plans to rely less on debt to fuel growth due to rising interest rates.

Great story, do the numbers add up?

A strong business model with a deep moat must be reflected in the numbers; otherwise, it’s meaningless.

Like for Like sales: The first question to ask is: does Dino manage to outpace inflation with its growth? The answer is yes

Roic: Dino’s return on invested capital (ROIC) has increased almost every year since its IPO in 2014, now standing at a solid 25.9%. This is impressive, especially considering that Dino reinvests its entire operating cash flow each year to open new supermarkets. As a result, free cash flow remains low, effectively allowing Dino to break even. Given the high returns from new locations, this capital allocation strategy seems entirely rational.

Margins: Some graphs speak for themselves:

Financially healthy?

Dino’s debt level is well-managed. The total debt on which Dino pays interest is around 750 million Zloty, an amount that could likely be repaid within a year, given their annual operating cash flow of nearly 2 billion Zloty. Unlike many supermarket chains that lease land or buildings, Dino owns almost all its supermarkets and land. This approach minimizes lease obligations and is generally more cost-effective in the long run.

Of course there are risks

A unique business model doesn’t automatically ensure happy customers: What really attracts customers are low prices, quality products, friendly service, and strong branding. If competitors consistently outperform Dino Polska on these fronts, customers may start to leave, impacting Dino's growth and profitability.

Price wars: There is currently a price war going on in Poland between Biedronka and Lidl in particular.Both retailers are heavily advertising on TV and radio, each claiming to offer the lowest prices to attract consumers. Naturally, this affects other supermarkets like Dino; if price differences become too high, customers will leave. To still guarantee customers the lowest price on their 500 best-selling products, Dino might need to lower prices, which would inevitably impact their margins.

Biedronka copying Dino Polska: I see Biedronka gravitate toward Dino’s supermarket format, even opening locations in small villages near existing Dino stores. This doesn’t seem like a smart move to me, as Dino is more profitable, can offer lower prices, and is likely to come out ahead in the long run. However, if Biedronka continues down this path, it could pose a (temporary or longer-term) hit to Dino’s profitability.

Polish population decline: Poland is projected to see a significant population decline, with an expected decrease of around 10% by 2050. While this isn’t a direct risk for Dino specifically, it could impact many companies reliant on the Polish market. Hopefully, the Polish government will take effective measures to address this challenge.

🎁 Exclusive access: Audio analysis Dino Polska

TDI Premium members receive an extensive research report and an audio-analysis of an interesting company every Friday. Since you’re already so invested in Dino Polska by reading this article, we would like to give you free access to our premium Dino Polska analysis:

>> Get free access to Dino Polska analysis

Conclusion

Dino Polska appears well-positioned to continue compounding over the next decade. If they succeed, their current valuation at 23 times earnings looks very attractive. With an exceptional business model and strong margins, I believe they can withstand competitive pressures and come out on top. The key will be to keep an eye on whether like-for-like (LFL) sales maintain healthy growth.

Bear case - Match Group

After swiping right on Dino Polska, let’s now swipe left on a company that seems promising at first glance but doesn’t quite make the cut: Match Group. This bear case is worth a deeper dive because, at first, Match Group seems to check a lot of boxes we usually look for:

● People will always keep dating.

● Online dating is more popular than ever.

● Match Group is the industry leader with Tinder.

● Match Group has a strong moat thanks to network effects.

● Match Group has high profit margins.

● Match Group is buying back shares.

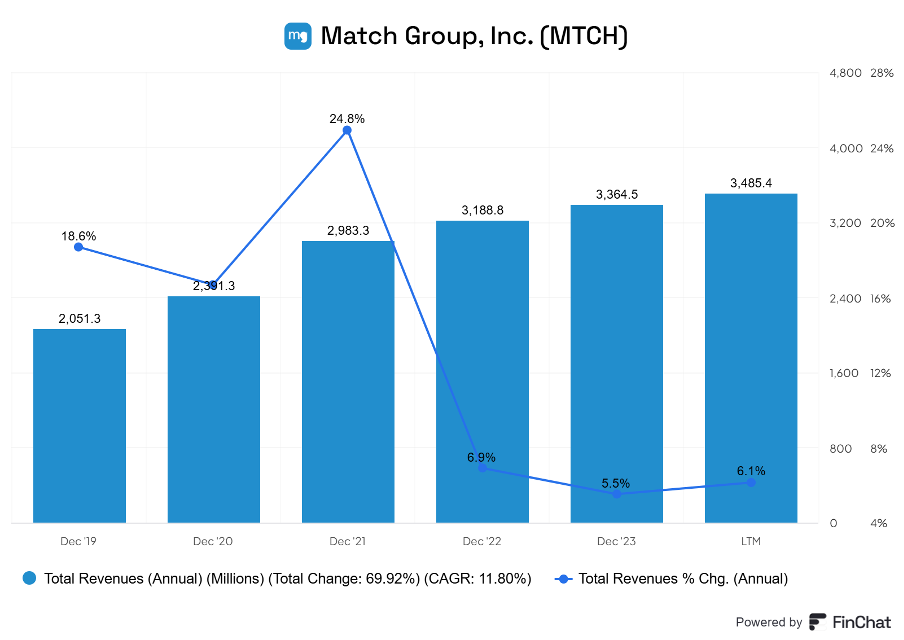

To top it off, look at this impressive chart:

At face value, there’s a lot to like about Match Group. But as we dig deeper, we start to uncover some fundamental issues that make this a more complex investment. To understand these challenges, let’s take a closer look at Match Group’s business model.

Match Group Business model

Match Group is the company behind some of the biggest names in online dating. Currently, Tinder is by far the largest of the bunch accounting for 60% of revenue and for 80% of the profits. Other platforms in Match Group’s portfolio are: Hinge, Match, Meetic, OkCpid, Pairs, Plenty Of Fish, Hakuna. You’d almost think these are the names students use to define different types of hookups ;)

At first glance, Match Group’s valuation might look appealing, and you could certainly argue a strong bull case. However, in my view, there are some fundamental risks that make it a tricky investment.

Fundamental problems

Limited brand loyalty

Unlike traditional social media platforms, dating apps struggle to build brand loyalty. Without lasting friend or interest networks, users often switch between apps like Tinder, Bumble, and Hinge, frequently exploring newer options. This lack of “stickiness” makes user retention challenging for Match.

Why is there no brand loyalty?

Dating apps are a commodity

Dating apps have become commoditized, with similar features across platforms like video and voice messaging. Because of this, users feel little attachment to any one app and are quick to switch, leading to market instability and fluctuations in Match’s market share.

The result: slowing revenue growth

Unable to expand

In the past Match Group had the ambition to transform its dating app business into a more “social discovery” and entertainment ecosystem. This is why they bought Cyperconnect for $1.7 billion in 2021. They were following the metaverse hype which quickly faded. Match paid over eight times the revenue, which was way too much. Considering net profits of Match were only $277 million in 2021, this acquisition is even more remarkable.

Because Match Group would like to expand into another network effect business, I don’t think Match Group will ever succeed in expanding their offerings beyond dating. For every new platform you need users to make it entertaining (the network effect), I don’t see why Match Group would succeed instead of another company with more expertise and focus.

Challenges in monetization

First of all, retaining paying users in online dating is a challenge. Many people sign up for a subscription, only to find after a month or two that the paid features aren’t making much of a difference for them. As a result, they quickly drop off.

Then there’s the issue of saturation among users willing to pay for premium. Match Group’s strategy has focused heavily on increasing revenue per paying user (RPP) rather than expanding the base of paying users. This approach may look profitable on the surface but signals a plateau in terms of reaching new paying customers.

Next up: advertising on dating apps isn’t exactly attractive for brands. On a platform like Instagram, for example, sponsored posts blend smoothly with organic content, and advertisers can create their own profiles to build a following and establish an online presence. Dating apps just don’t offer that flexibility. While there is no data on this, I’d bet the average user swipes past an ad in under two seconds.

To finish off this list, dating apps lack a “community” that would give premium features social value. In gaming, buying a special skin or accessory is a way to stand out among friends or other players. But in online dating, premium features don’t impress anyone. If anything, they might be seen as a bit silly rather than prestigious.

My biggest fear (conclusion)

Network effects can be incredibly strong (just look at Meta) but they can also reverse just as powerful. As soon as users start to leave a dating platform, the value for remaining users drops quickly. The fact that dating apps are a commodity, users are not loyal and there are difficulties monetizing the platform, opens the door for competition. It is widely known that dating is a huge market with huge potential rewards. Once a new technology will pop up that enables a better user experience, the news will spread like wildfire on social media and users will start running right away.

Of course, this is speculative, but as a long-term investor, looking at a five-year horizon or more, I can’t rest easy with even a small chance of this scenario unfolding.

There’s definitely a compelling value case for Match Group, but here’s a reminder of some timeless advice:

Rule #1: Don’t lose money.

Rule #2: Don’t forget rule #1.

All investments carry risk, but with Match Group, I can imagine a real scenario

where the company might not exist in 20 years. With thousands of stocks to choose from, I’d rather invest my money elsewhere.

—------------------------------------------------------------------

First of all I would like to thank Ray for giving me the opportunity to write this for

you. And of course a thank you to you for reading this bear vs bull case.

If you are a serious investor who loves discovering new (Dutch) quality stocks,

make sure to follow The Dutch Investors.

They cover companies like:

● ASML: Monopolist in lithography systems

● Adyen: One of the biggest payments providers in the world

● Teqnion: A small Swedish serial acquirer 🧱

● EssilorLuxottica: Monopolist in the eyewear market 👓

Have a wonderful day and happy investing.

The Dutch Investors & Global Equity Briefing

I hope you liked this guest post. Go ahead and subscribe to The Dutch Investors, not all investing newsletters have such high-quality research as they do!

Additionally, I wrote a guest post on their Substack!

You can find the article on their Substack right now! I explain why I am Bearish Volkswagen and Bullish Amazon!

Thank you for reading, Follow me on:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.