Is Celsius redemption here?

Inventory issues are over and Alani Nu acquisition is going spectacularly!

While 2024 was a tough year for Celsius, 2025 is shaping up to be a redemption year.

Many investors and analysts were skeptical of the Alani Nu acquisition, but as I said in my last Celsius article, I believe it was the right decision, and this quarter demonstrated that.

Celsius released a stellar Q2 2025 earnings report, sending the stock up 23%!

The Alani Nu retail sales grew an incredible 129% Y/Y and 39% Q/Q.

I have never seen an acquisition so quickly prove the thesis behind it.

Meanwhile, Celsius brand sales grew by 9% Y/Y, ending the downtrend.

Now the combined Celsius portfolio holds a strong 17.3% US energy drink market share!

Growing faster than most competitors, Celsius seems positioned to go back to gaining market share.

Is Celsius set to go back to its all-time highs?

Let’s explore.

1. Pepsi Inventory Issues

2. Alani Nu

3. International

4. Q2 2025 Results

5. Valuation

6. Conclusion

1. Pepsi Inventory Issues

On 1. In August of 2022, Pepsi invested $550M in Celsius and became its exclusive distribution partner in the USA and Canada. (Read my analysis of the partnership in my Deep Dive)

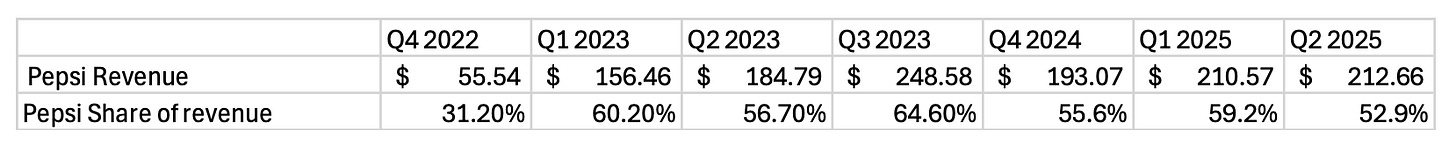

Pepsi channel quarterly revenue grew by 348% from Q4 2024 to Q3 2023, and Pepsi’s share of overall Celsius revenue grew from 31.2% to 64.6%.

The deal was working perfectly, until it wasn’t!