Is Mercado Libre a Buy?

2030 Valuation Model!

Welcome to Global Equity Briefing, my twice-weekly investing newsletter.

I am Ray, a passionate investor and equity analyst. Today, I am returning to one of the highest-quality companies in the world.

In my opinion, Mercado Libre is one of the best long-term opportunities, because analysts perpetually underestimate its TAM!

Many investors mistakenly believe that because the economies of Latin America are weaker than those in the US, e-commerce will have a tougher time there.

In the last 5 years:

GMV has grown by 185%

Payment Volumes by 408%

Revenues by 559%

Operating profit by 2,347%

Yet, despite that, the stock has increased only 19%!

Furthermore, the stock has fallen by 23% since its July peak, largely due to margin concerns. This year, Mercado Libre implemented some measures aimed at strengthening market share at the cost of margins. They lowered the threshold for free shipping from R79 to R19 ($12.6 to $3.4), largely to better compete with Amazon.

Amazon, of course, is the world’s largest and most famous e-commerce giant. As the e-commerce markets of the US, Canada, and Western Europe are maturing and growth is slowing, Amazon is looking at new markets for growth, such as Brazil and Mexico, Mercado Libre’s core regions.

For many years, analysts pontificated that Amazon poses a huge threat to Mercado Libre’s business, yet that hasn’t materialized, and now they are panicking again.

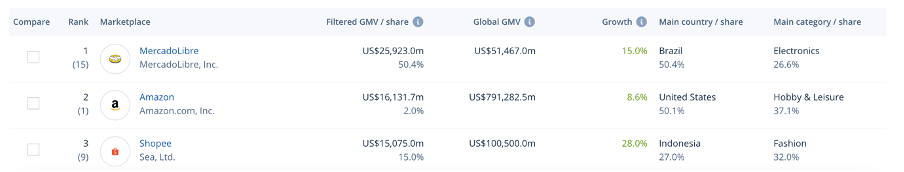

In the picture above, we see the 2024 leading Brazilian e-commerce players by GMV from the research firm ECDB. Here we see that Amazon is struggling to catch up, its GMV of $16B is 38% below $26B of Mercado Libre and growing at half the rate, 8.6% vs 15%.

Amazon, of course, is not satisfied with this result, so they fired the Amazon Brazil country manager, Daniel Mazini, and hired a new one, Juliana Sztrajtman.

The new leadership’s plan to revitalize growth by 1) reducing fees for logistics, 2) implementing new seller incentives, and 3) lowering take rates.

Essentially, Amazon is luring away sellers from Mercado Libre with promises of lower costs and higher marketing budgets to attract new customers. In my opinion, this more aggressive push will hurt smaller e-commerce players rather than Mercado Libre.

Firstly, it is too late, and secondly, Mercado Pago.

Mercado Libre has already built a comprehensive and automated logistics network that is larger and more developed. Just some discounts won’t be enough to lure sellers away, especially considering how developed Mercado Libre’s cross-border commerce is.

Furthermore, Amazon doesn’t have an in-house financial services arm like Meli has with Mercado Pago. Through Pago, Mercado Libre funds both the sellers and the buyers. By providing loans to both sides, it creates a synergetic loop, where loans to sellers increase the supply of the goods on the marketplace, whilst loans to buyers increase the demand for these goods.

The reaction to Mercado Libre’s measures, in my opinion, has been extreme and unwarranted. This presents investors with an attractive entry point.

Read my full Mercado Libre Deep Dive from last year to learn more about the company.

In today’s report, I will give you:

3 key reasons why Mercado Libre is one of the best long-term opportunities on the market.

Analysis of current valuation and analyst estimates.

And conclude with a 2030 valuation model.

Let’s begin.