Is Nebius still a Buy?

Updated Nebius Investment Case!

On June 19, I released my Nebius Investment Case in which I analyzed the business. While I identified the potential of this company, I was not particularly bullish.

This is because I didn’t find the unit economics of the GPU rental that particularly attractive and found the company to be a VC-like, very high-risk, very high-reward opportunity.

Since then, it has become glaringly obvious that I was wrong!

As Nebius has jumped over 160% in these 4 months, I thought it could be useful to look back at what happened.

I believe I made the following mistakes in my analysis:

Undervaluing Nebius subsidiaries

Missing the potential of Hyperscaler deals (Microsoft)

Underestimating the unit economics

Underestimating AI demand, thus modeling a lower capacity

Overestimating required dilution

Let’s analyze all 5 of these and see if Nebius is still a buy despite rising over 160% and trading for a $32B market cap.

1. Subsidiaries

2. Microsoft

3. Unit Economics

4. AI Demand

5. Is Nebius a BUY Today?

1. Nebius Subsidiaries

The first mistake is underestimating how much value Nebius could generate from its stakes in other companies.

When Nebius split from Yandex, it kept all its non-Russian subsidiaries. This includes autonomous driving technology company Avride, data labeling company Toloka, open-source database company ClickHouse, and more.

Previously, I estimated that Nebius’ stake in these subsidiaries could be valued between $2-4B, however, it has become apparent that they could be worth 2-3x that.

Nebius’ autonomous driving subsidiary Avride alone could be worth $4-6B!

I underestimated this subsidiary, as it is way behind Waymo, and will require lots of capital to be scaled.

However, it is quickly scaling and cornering a niche in small robot delivery.

Through their partnership with Grubhub, these food delivery robots are delivering around 1,200-1,400 deliveries a day at the Ohio State University campus. While this was already known, recently the company revealed that they have completed over 100,000 deliveries on said campus. The deliveries are made in around 15 min, drastically improving convenience and user experience.

Last month, it was announced that after the smashing success of this pilot, Grubhub is bringing this partnership to the University of Arizona!

If they can deliver 100,000 meals on a single campus, there is a potential for millions of deliveries if this technology is brought to thousands of large universities in the US and Canada.

This might seem trivial, but I think the university food delivery robot business alone is a multi-billion-dollar vertical, and this success demonstrates their ability to expand!

Furthermore, Uber Eats is deploying Avride’s small autonomous delivery robots for food delivery in Dallas and Jersey City, in addition to Austin. This is going well, and companies are planning to enable grocery delivery as well.

Grocery delivery in urban areas using small robots is another multi-billion-dollar vertical!

Additionally, Avride and Uber are doing final testing to begin robotaxi services in Dallas by the end of the year. This would make Avride only the 3rd company doing paid robotaxi miles in the US, next to Tesla and Waymo.

This would be a symbolic milestone that would significantly increase Avride’s valuation in the eyes of investors, enabling them to raise funding at significantly better terms!

Next, I drastically underestimated ClickHouse.

ClickHouse builds a high-performance analytical database designed for extremely fast queries on massive datasets. This service is becoming extremely important in the age of AI, as having well-organized and labeled databases that are easily accessible is a must for LLM models to give fast responses to prompts. Their databases have trillions of rows.

This has made ClickHouse an important vendor for the $183B AI start-up Anthropic!

ClickHouse provides:

Prompt analytics

AI Token usage monitoring

Fine-tuning dataset exploration

Real-time model analytics

Recently, it was reported by media outlets that ClickHouse has hired a series of employees, which would hint at them preparing for an IPO.

The company last raised funding at $6B valuation, but considering the strong demand for their services from some of the hottest AI start-ups such as OpenAI, Anthropic, and Mistral AI, I find it likely that the IPO would set them for $20B+ market cap.

This could mean that Nebius stake of around 28% could be worth around $4-6B!

After reevaluating these two subsidiaries, I have realized that Nebius will be able to extract significantly more value out of them. The company could try to borrow funds using stakes in these companies as collateral.

Also, as Nebius’ risk profile and financial situation have improved significantly in these 4 months (I will expand on that later), they are not in a rush to sell them to raise capital.

This enables them to delay the sale of these stakes, thus getting more for them!

Getting more money out of these subsidiaries de-risks Nebius and lowers the amount of capital that needs to be raised through debt and dilution.

2. Microsoft Deal

The second mistake was that I largely dismissed the possibility of Hyperscalers signing agreements with Nebius.

My thinking was that Nebius is a direct competitor in many areas, and I thought that neither Google, Microsoft, Amazon, nor Oracle wants to support a rival and would rather build their own data center. Their own data centers would offer better unit economics, as any deal with Nebius has a markup that covers Nebius’s margins.

However, this logic was incorrect, as the demand for AI compute is much larger than I thought, leading Microsoft to seek outside capacity.

Last month, Nebius signed a $17.4B-19.4B 5-year deal with Microsoft, which instantly sent its stock price up almost 50% in a single day!

Nebius is building a new state-of-the-art, greenfield data center in New Jersey, with an initial planned gross capacity of 300MW, with the potential to expand it to 400MW. Microsoft will rent access to 100K Nvidia GPUs, which could demand 180-220MW, but we need to add 20% extra for additional IT equipment, resulting in a 216-264MW.

This means that Microsoft could take up around 72-88% of the initial capacity and 54-66% of potential capacity!

At $17.4B for 5 years, that amounts to $3.48B per year, for 100K GPUs.

Revenues of $34.8K per GPU and $3.97 per hour!

This is a very strong anchor tenant that will enable Nebius to basically cover all costs and have a decent margin. The remaining capacity will be used for Nebius’ cloud business, where Nebius will earn truly great margins.

The deal will enable Nebius to cheaply borrow money through a vehicle known as revenue-backed loans.

Essentially, because Microsoft is such a large, profitable, and stable enterprise with a credit rating literally better than the US government, banks and investors are willing to lend money to Nebius at highly attractive terms, because the probability that Microsoft will not honor its contractual obligations is extremely low.

Thus, Nebius will borrow money using the Microsoft deal as collateral!

There are many ways this could be structured. One way would be for Nebius to sell these receivables at a discount of, let’s say, 3-7% to a special vehicle that is funded by a consortium of lenders, and Microsoft would transfer payments directly to that special vehicle.

Nebius CEO Arkady Volozh has indicated that this is just the first of likely many deals with hypescallers!

Personally, I find a deal with Oracle the most likely, as they could need some outside capacity to deliver on the $300B deal they signed with OpenAI.

3. Unit Economics

The third mistake was that I underestimated the unit economics!

The deal with Microsoft very glaringly demonstrated that. Microsoft agreed to 5 years of using 100K Nvidia GPUs for $3.97 an hour.

So, let’s model the economics of a $1B investment in an AI data center again!

Nvidia GPUs are the largest expense category because AI workloads require the most advanced chips. Additionally, as the demand greatly outstrips supply, Nvidia and its foundry, TSMC, demand very high prices.

After GPUs, all supporting equipment must be purchased, including CPUs, memory chips, networking, and cooling equipment. Additionally, land must be acquired, and construction needs to take place.

Hyperscalers sometimes spend 20-30% more on supporting infrastructure than on GPUs, but as AI needs the best chips, this is unlikely.

For simplicity, let’s assume a 60:40 split for GPUs and all other expenses.

This leaves us $600M to spend on Nvidia GPUs!

Nvidia G300 GPUs that Microsoft signed the deal for cost between $51-55K, but Nvidia likely gives a volume discount. So assuming $42K per chip, we can buy around 14.3 thousand GPUs, which Nebius plans to depreciate over 4 years.

Let’s assume that the other $400M gets depreciated over 10 years.

Let’s use the $4 per hour price charged to Microsoft.

If we assume an average 90% utilization rate over these 4 years, Nebius could generate $450M in revenue per year!

That would be just from GPU rental, but Nebius also offers Cloud services, so let’s model an additional 20% on top of that, around $90M per year.

That gives us a total 4-year revenue of $2.16B.

But Nebius must also pay for electricity, maintenance, all the software licenses, and other direct costs. Let’s assume that these expenses will be 20% of revenue, leaving Nebius with an 80% gross margin.

That leaves us with a gross profit of $1.73B!

After accounting for the $600M depreciation of GPUs and $160M for other equipment, we arrive at a project operating profit of around $970M after 4 years. (1.73-600-160)

That is a pre-tax ROI of 24.2% per year!

This is significantly higher than the 8.3% I estimated before.

Key causes for the delta are:

Higher price per hour

Higher utilization

Adding cloud income to the calculation

The $4 per hour price is 33% higher than the $3 estimated I used.

Moreover, the Microsoft deal proves that the demand is much is really strong, and 90% utilization is a more realistic assumption.

Most importantly, if even the mighty Microsoft agreed to sign such a long-term deal, the economics of Nebius’ cloud business are likely much more favorable than I believed. Previously, I excluded the potential for cloud revenues from the unit economics calculation, but now I have more confidence on this being a major business.

24.2% ROI per year is quite attractive unit economics!

4. AI Demand

The fourth mistake is that I underestimated the AI demand!

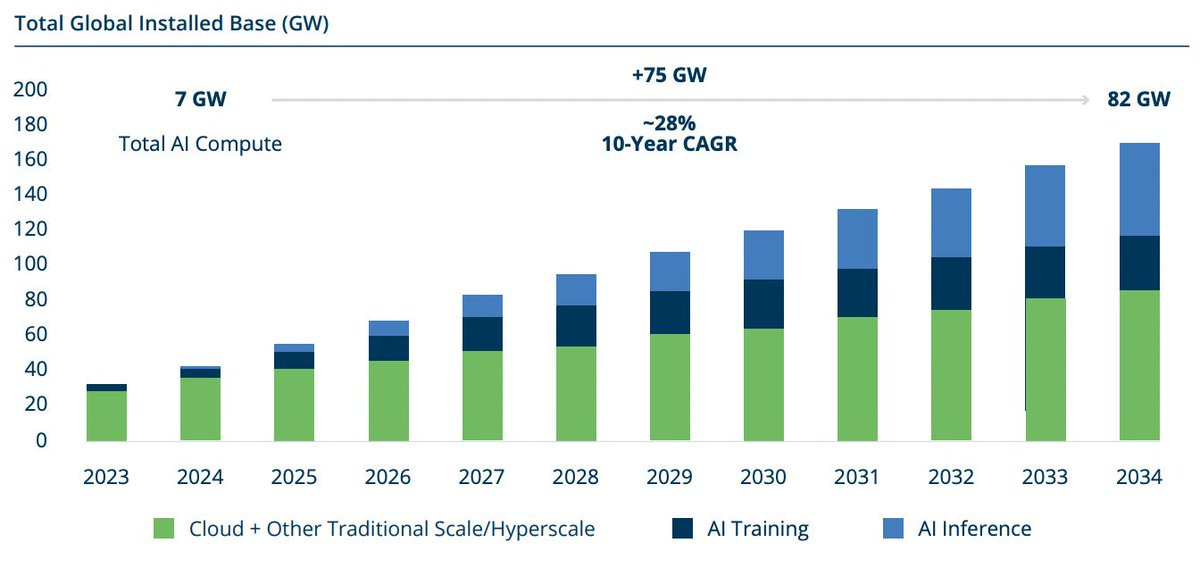

Recently, Brookfield released their data center forecast, estimating that global AI compute will increase with a 28% CAGR to reach 82GW by 2034!

That’s more than 11X growth in just 10 years!

We are standing before a multi-decade generational investment wave that will be looked back on by future generations with awe. The AI is the most revolutionary technology in the history of our species. It will be as revolutionary as electricity, the wheel, the internet, and germ theory.

This will create massive AI winners, and Nebius is uniquely poised to be one of them!

This means that my 2030 capacity estimate for Nebius was way off.

In addition to the New Jersey facility that will be largely used by Microsoft, Nebius has other data centers that will go online in the next few years!

The Kansas City data center is a colocation facility where Nebius rents space from data center company Patmos. Currently operational at 5MW, there are plans to scale it to 40MW.

Through colocation partners, Nebius is also building a business in the UK, which could scale to 54MW.

The Finland site has the capacity for 75MW.

However, the big news is that recently Nebius bought a plot of land in Alabama for $90M with plans to build a new greenfield data center!

The size of the plot, 79 acres/32 hectares, suggests that this is not a small data center. It likely will be of a similar size to the New Jersey data center, with a planned capacity of 400MW.

As per Nebius, they expect to have 1GW of contracted power by year-end 2026. Please note that contracted and connected power are not the same thing. Contracted power just means that Nebius has agreements in place with a local utility to supply 1GW of power, but it will take some time to actually receive and install all the equipment and begin using said power.

This means that as Nebius scales all existing data center agreements, they could realistically have 1GW of capacity by the end of 2027!

This is absolutely unbelievable and stratospheric growth that is not only putting all bears to shame, but also all the skeptics like me four months ago.

The management has done an incredible job building such a strong company in such a relatively short amount of time.

5. Is Nebius a BUY Today?

My answer to this question, together with a new valuation model that takes into account the Microsoft deal, is provided to Global Equity Briefing Premium members!

Here is what my Premium Members can expect:

Top Monthly Picks - Each month, I will select a few stocks that I find likely to outperform.

These picks will focus more on short-term pricing movements and swift through market narratives.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on semi-monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Pricing Structure

I strive to build a long-term relationship with my Premium subscribers, so I have chosen a pricing structure that emphasizes annual subscriptions.

The standard practice is to give 2 months free for annual plans, but I have decided to give 6!

Small note, please go to the website to purchase the subscription, as if you do it on the iOS app, you have to pay the 30% Apple Tax. (The plan cost more there)

Thank you for being a reader. I look forward to seeing you on Global Equity Briefing!

Equity Research Report List

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

I enjoy when people reevaluate their thinking periodically, especially if it means admitting they made a mistake. It’s a sign of credibility.

Great write-up.