Is Zeta a buy?

Dissecting Zeta’s 2025 Investor Day.

On October 8, 2025, Zeta had its Investor Day, in which the company laid out a clear growth path towards a highly profitable future. Initially, the market responded positively to the announcement, with the stock jumping nearly 8% during the presentation.

Zeta summarized their future in 3 words:

Durable

Predictable

Profitable

However, this optimism quickly faded, and the stock closed the day up not even 1% from the open. This was because investors clearly expected an upgraded 2028 guidance, driven by the previously announced Marigold acquisition, but that didn’t happen.

Even worse, I saw some suggest that the acquisition was done only to meet the guidance.

This is incorrect as Zeta clearly stated that Marigold is incremental to 2028 guidance, and this seems to be a clear misunderstanding of what the company said.

In this article, I will dissect Zeta’s Investor Day, a few weeks ago I wrote full Equity Research report on Zeta.

Let’s roll.

1. Durable, Predictable, and Profitable

2. Marigold Acquisition

3. 2028 Guidance

4. Athena

5. Other AI Announcements

6. Is Zeta a Buy?

7. Conclusion

1. Durable, Predictable, and Profitable

By durable, Zeta means that the company is poised to benefit from structural long-term trends in the market. This is not a cyclical business, but a business experiencing strong tailwinds that will last way into the next decade as enterprises digitize, automate, and enhance their marketing and advertising practices using AI.

By predictable, Zeta emphasizes its incredible visibility into future demand due to long-term, subscription-driven contracts with large enterprises.

By profitable, Zeta highlights its strong and constantly improving EBITDA profitability thanks to a highly scalable technology-driven business model. Margins are poised to improve as scale brings higher operating leverage.

2. Marigold Acquisition

Recently, Zeta announced an $325M acquisition of Marigold’s enterprise software business.

Zeta has 4 strict criteria when conducting M&A.

1. Easy to integrate

2. Accretive from Day 1

3. Clear operational and strategic synergies

4. Enhances Zeta’s growth profile

Marigold looks to meet all 4 of these criteria.

I, and probably most people reading this, had never heard of Marigold before, so let’s look at what they do and how they complement Zeta’s offering.

Marigold is a marketing automation platform that has many of the same capabilities Zeta has. Customer messaging over email, SMS, app pop-ups, and other channels. Various analytics, customer personalization, campaign manager, and other activation tools.

So, there are 3 real things that Zeta is buying, new customers, consumer data, and loyalty software.

The deal significantly expands ZETA’s footprint within the high-value enterprise segment!

Marigold serves more than 100 global enterprise brands, including 20 of the world’s top 100 advertisers and over 40 Fortune 500 companies. Many of these customers are from EMEA and APAC, regions in which Zeta has essentially no presence.

Prior to the acquisition, ZETA reported a base of 567 scaled customers. While there likely is some overlap, the addition of 100+ established enterprise clients represents a 17% increase in high-value client relationships.

This substantial increase in enterprise penetration is strategically critical. Acquiring these established relationships allows ZETA to bypass the traditionally long and expensive organic sales cycles required to secure a Fortune 500 contract.

Zeta will focus heavily on cross-selling its existing product suite to these new large-scale customers.

Furthermore, these additional customers will generate even more data to feed Zeta’s AI models, supporting improved targeting, leading to a higher ROI on advertising and marketing budgets.

Furthermore, Marigold has a highly developed loyalty business, which is very synergistic to Zeta’s data and marketing automation services. Marigold offers a cloud-based loyalty program engine that tracks member behavior, rewards, tiers, and loyalty points. The platform integrates with point of sales and e-commerce systems in real time, essentially a completely new capability that Zeta didn’t have before.

The combination of Zeta’s consumer identity, marketing, and advertising AI models, with Marigold’s valuable activity signals from loyalty, will create an even more powerful customer retention and acquisition engine!

While the headline acquisition number is $325M, it is not a simple cash transaction. There is an upfront payment of $200M, comprised of $100M in cash and $100M equity. This implies a dilution of around 2.2-2.5%. The remaining $125M, is structured as a seller note payable within three months post-closing, and subject to certain working capital deductions.

The acquired Marigold business is expected to contribute $190M in revenues in 2026, has a gross margin of more than 70% and a “mid-to-high teens” ADJ EBITDA margin.

This means that Marigold was acquired for less than 2x FWD P/S and 10-12x ADJ EBITDA!

This is a very reasonable acquisition price, especially during a bull market.

Overall, I rate this acquisition as a 7.5!

This price is reasonable, but there are some overlapping capabilities. Zeta will probably 1) move to integrate the features that they don’t have into their platform, 2) slowly move customer contracts over to Zeta’s contracts, and 3) close overlapping products and fire the teams working on them.

3. 2028 Guidance

The company reaffirmed its previously issued 2028 guidance and specifically mentioned that the Marigold acquisition is incremental.

Revenue of $2.1B, implying a 20% revenue CAGR from 2024.

ADJ EBITDA of $525M, implying a 25% margin and 28.4% CAGR.

FCF of $340M, implying a 65% cash conversion ratio, 16% margin, and a 38.7% CAGR.

As I said in the introduction, I believe many investors were hoping that Zeta would integrate the Marigold acquisition and increase the guidance. If that had happened, I think the stock would have increased significantly, as a lot of investors and algorithm funds only trade on increased guidance.

Management clearly knew it and decided not to increase the guidance anyway, which I think is a good, long-term, focused strategy!

They clearly said that Marigold is incremental to this guidance, and rushing to update the guidance before full closing is risky, as they could make errors.

Underpromise and overdeliver is the strategy here!

As long-term investors, we should be happy that they did so, giving us an opportunity to purchase this company at the low price they are trading at today.

During the M&A announcement conference call, the CEO said they need to spend more time analyzing Marigold to assess what synergies could be achieved. New guidance for Q4 2025 and FY 2026 will be provided upon closing in Q4 2025, probably during the Q3 2025 earnings call.

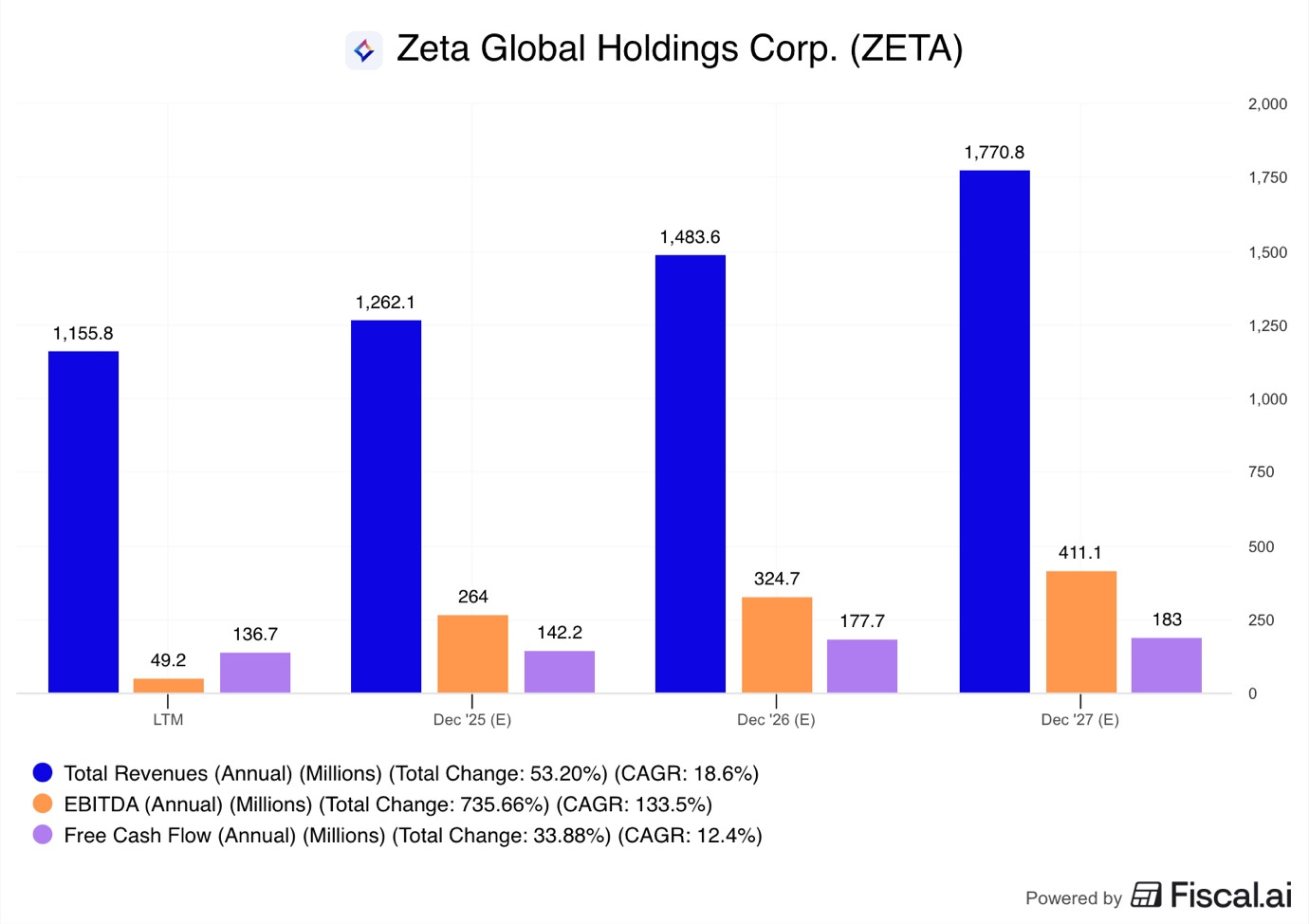

I don’t have access to 2028 analysts’ estimates, but let’s look at 2027 estimates to see what analysts are thinking.

The 2027 revenue estimate is $1.77B, implying that Zeta would have to grow by 18.6% in 2028 to meet that guidance. So, analysts do believe that Zeta’s revenue guidance.

EBITDA estimate is $411M, assuming SBC of $100M, ADJ EBITDA is estimated at around $511M, implying that Zeta needs to grow by 2.7% in 2028 to meet the guidance, completely doable.

FCF of $183M, implying Zeta would need to grow 86% in 2028 to meet that guidance.

Overall, it seems that EBITDA and revenue estimates are in line with the guidance, but FCF is not!

This means that analyst estimates need to go up to meet the Zeta’s 2028 FCF guidance and incorporate the Marigold acquisition.

This could be a major boost to the stock as these estimates go up in the next few months!

4. Athena

Before the event, the CEO teased that they would reveal “the newest and most transformative product to date”.

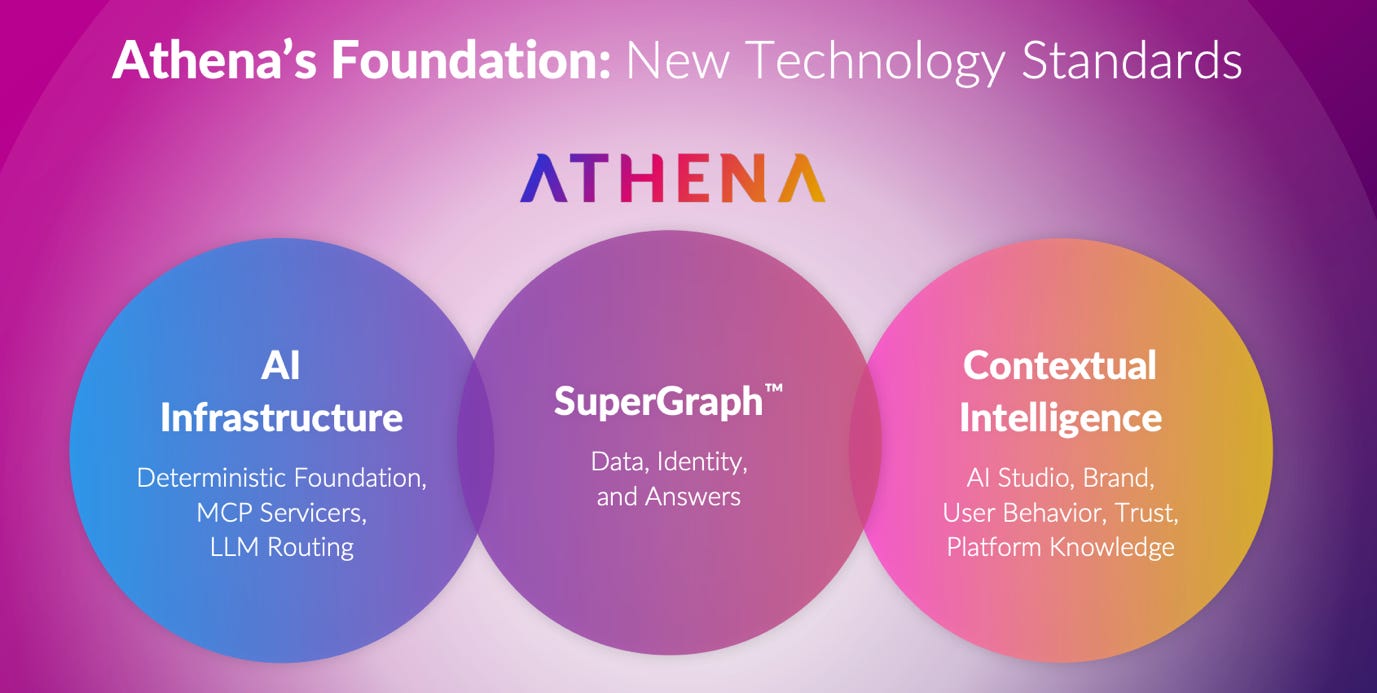

Thus, they revealed Athena, an innovative conversational AI chat solution.

Athena is described as a “Conversational, Superintelligent Agent that Transforms Questions Into Actionable Answers”.

This development represents a significant architectural shift in marketing automation. Athena is designed to transform the creation and execution of complex marketing campaigns from tedious graphical user interface configuration to simplified, natural language input, potentially including voice-powered intelligence straight into marketing workflows.

This agentic AI system is built to drastically reduce the complexity and time-to-campaign for marketers. By automating complicated tasks, such as segmentation, campaign optimization, and activation, based on conversational prompts, Athena could enable marketing teams to operate much simpler and faster.

Instead of thinking which checkbox to select, one would just tell Athena what outcome they want, and Athena will suggest campaign parameters.

The functionality of Athena is turbocharged by ZETA’s proprietary data foundation!

Other companies that might provide similar conversational LLM solutions don’t have access to ZETA’s platform, which is powered by data on hundreds of millions of people and billions of marketing activity signals.

This deep, first-party data set, cultivated over several years, that constantly gets larger, allows the platform to predict consumer intent with higher accuracy.

Athena reminds me of Palantir’s AIP platform, which lets companies build internal LLM chatbots in a highly secure way. Palantir has seen demand explode for this product in various industries, with great success in defense, manufacturing, and healthcare.

Zeta’s Athena could achieve something similar in marketing and advertising!

Palantir AIP, Mistal AI, ChatGPT, and other AI companies could provide API’s or software to build internal LLM models, but they don’t have the data to power these models, Zeta does. All these companies would create a blank slate, whilst Zeta would create an already trained intelligent assistant.

The ability to deploy generative AI functionality that directly generates revenue-driving action based on deep proprietary data is a structural advantage over competitors!

5. Other AI Announcements

In addition to Athena, there were many other AI products that were announced and presented. If I were to list them all, this report would be 100 pages, so I will just mention the few that I think are the most important.

Generative Engine Optimization

When Google transformed internet search, the company birthed a new vertical of marketing, search engine optimization (SEO). Marketing specialists realized that by optimizing a company’s website and content, they would rank higher in search results, directly increasing revenues.

Generative Engine Optimization (GEO) is a new field in marketing that focuses on optimizing a company’s website and content to make it AI LLM readable to increase a brand’s visibility in LLM answers, leading to higher revenues. It is bringing the same idea of SEO to the LLM age.

Zeta released a comprehensive set of tools that will help brands analyze responses to standard questions in ChatGPT, Gemini, Perplexity, Meta, and other popular LLM chatbots to identify a brand’s visibility and suggest methods of improving it.

AI Visibility Leaderboard

Correction of AI Hallucinations

Optimization Strategy

Competitive Benchmarking

This is a crucial tool that will help brands respond to changing industry dynamics as SEO increasingly becomes less relevant.

AI Customer Onboarding

A critical problem for all enterprise platforms is minimizing the time a new client spends on implementation before generating revenues. Time is money, and the faster they begin using your services, the more money you will make.

Traditional client onboarding involves extensive, costly manual labor for data configuration, consumer identity analysis, and validation across various company databases.

By leveraging AI agents, Zeta aims to automate this entire sequence!

This drastic reduction in manual effort and duration shortens the implementation cycle. A faster implementation cycle improves customer satisfaction and reduces the risk associated with delayed revenue and high labor costs during the initial implementation phase.

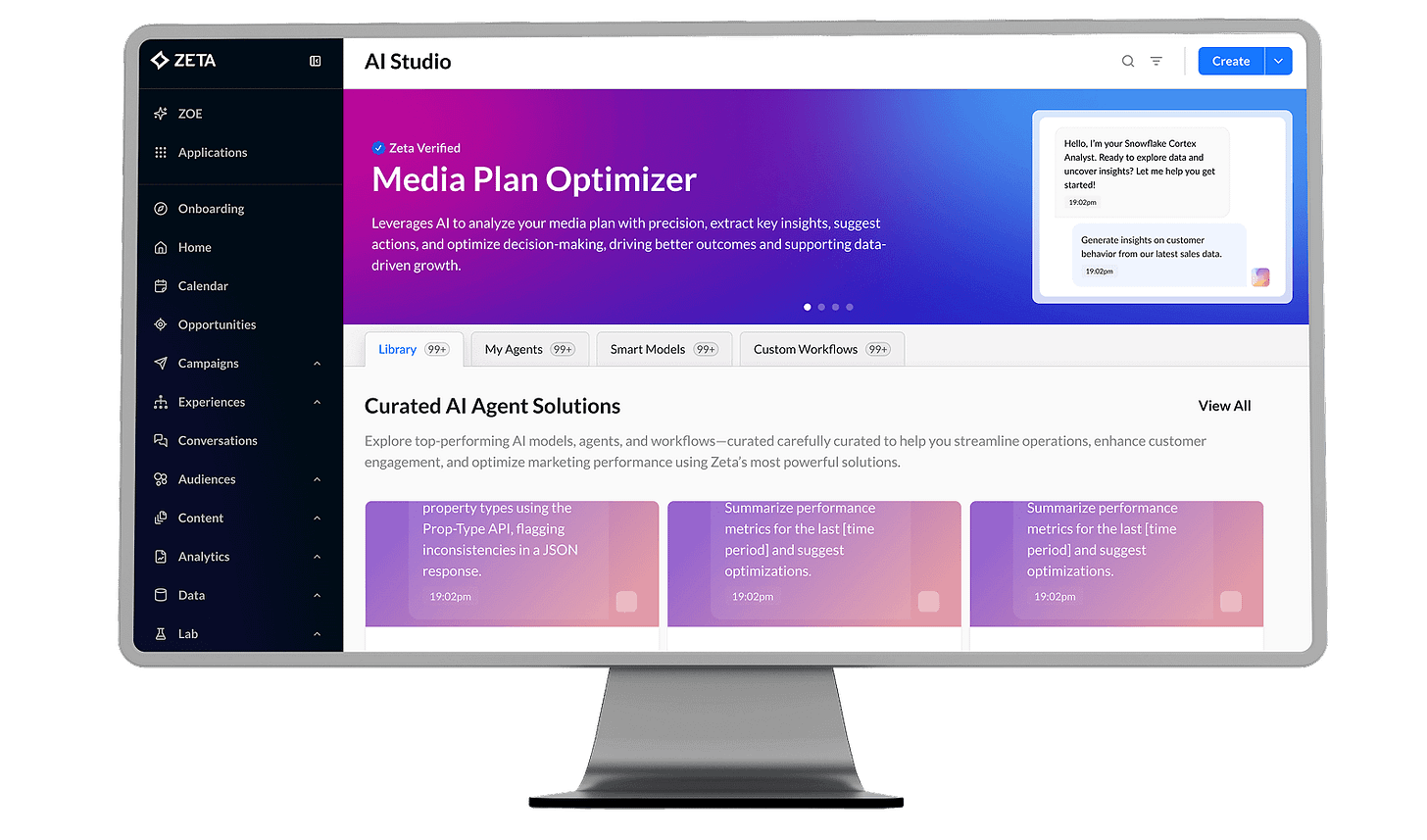

AI Agent Studio

Zeta’s AI Agent Studio is a suite of AI tools that allows users to select and activate prebuilt AI agents, create custom agents, and link them together to execute complex marketing workflows rather than simple, linear tasks.

An AI agent is essentially a virtual employee that performs a set of preprogrammed tasks!

An Agent is not just an AI chatbot that answers your questions, it can execute campaigns, do analytics, and prepare reports.

This platform enables users to automate and create interconnected AI agents, which are customizable AI-driven workflows for automating tasks like audience segmentation, media planning, campaign creation, customer journey optimization, A/B testing, and data onboarding.

Marketing executives will love this feature as it promises to reduce marketing overhead by increasing productivity, enabling more to be achieved with less, leaving higher budget allocations for advertising spending.

The Agentic App Suite

Zeta delivers its AI power through the Agentic App Suite, a collection of specialized applications that leverage the Zeta Marketing Platform’s identity and data foundation to perform complex, multi-step tasks.

The Advisor app translates high-level business goals such as revenue growth, cost savings, or higher engagement into measurable, AI-driven plans. It provides clear recommendations and links these objectives directly to automated workflows and real-time KPI optimization. This feature essentially automates the strategic planning stage, ensuring objectives are programmatically translated into tasks needed to achieve those objectives.

The Workflows app enables marketing department employees to create detailed, multi-step tasks by combining specialized AI agents. This app automates complex sequences, accelerating campaign creation by drastically reducing manual work.

As the name implies, the Simulator app simulates campaign results. Users can forecast, test, and refine complex cross-channel strategies and budget allocations based on desired attribution models before any financial resources are spent. This feature enables smarter, data-validated decision-making, significantly increasing the ROI and reducing wasted marketing dollars.

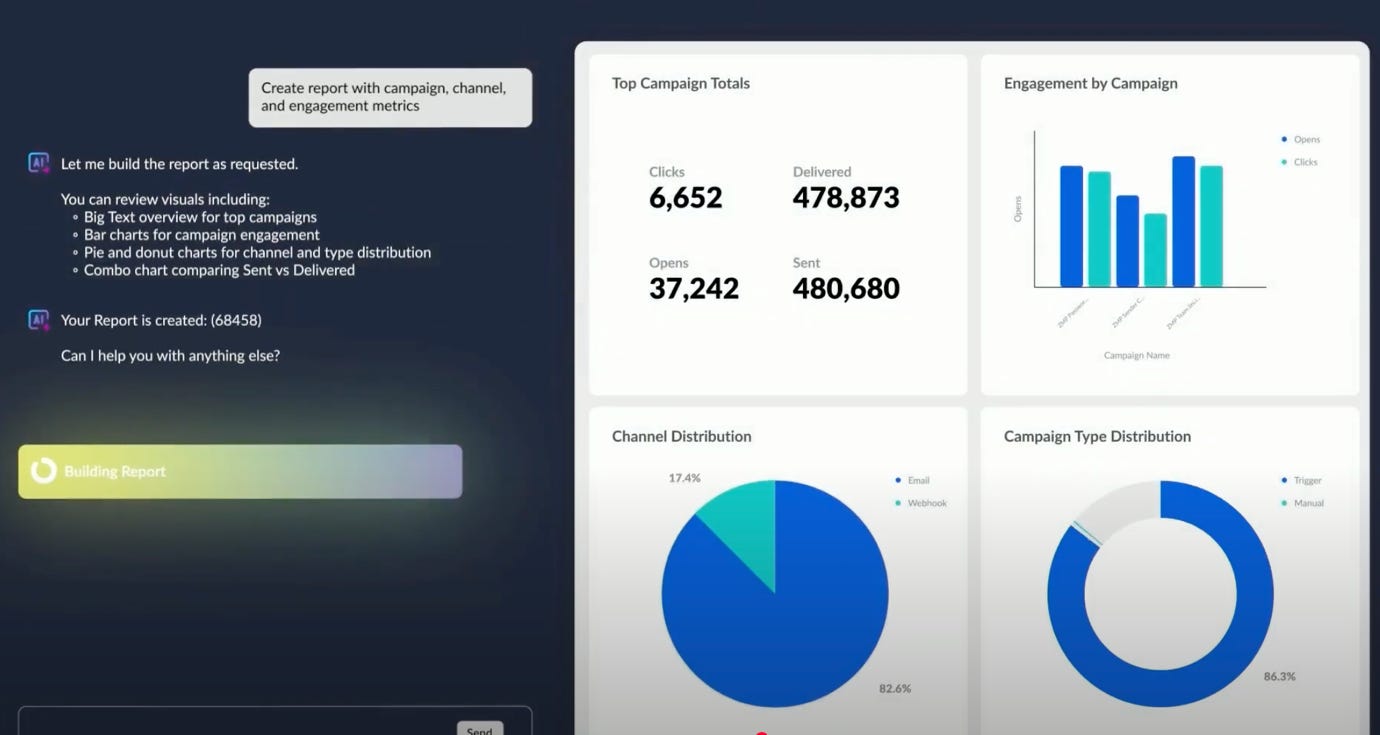

The Insights app provides analytics in an easy-to-read way. Marketers can use written queries to instantly generate trends, identify audience opportunities, discover new pockets of growth, and create management-ready dashboards. This transforms raw data into immediate, actionable answers quickly and effortlessly.

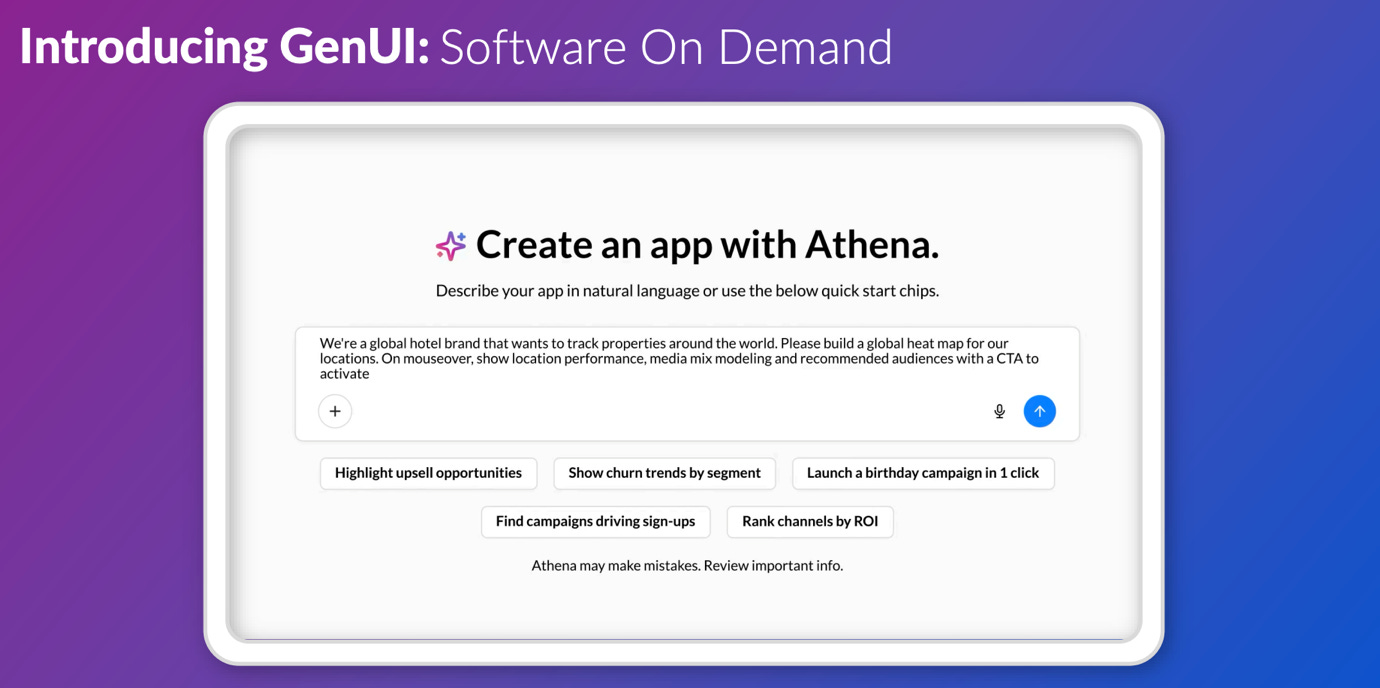

GenUI

GenUI stands for generative user interface and refers to AI-driven interfaces that are dynamic, personalized, and evolve in real-time based on the user’s context and needs.

Instead of static apps and dashboards, Zeta enables users to use AI to build their own!

GenUI creates “UI on demand,” assembling reports, controls, simulations, creative tools, and activation flows automatically in response to a marketer’s needs.

It is deeply integrated with Athena and AI Studio. Meaning GenUI doesn’t just display data, it generates fully operational environments, such as planning workspaces, media optimizers, or creative studios, instantly. Designed for flexibility across industries, it adapts to the role of the user.

So the interactive dashboard will look different whether it is used by an analyst, creative designer, marketing planner, or executive, and delivers personalized interfaces for each use case without manual configuration.

In essence, GenUI transforms Zeta from a platform you learn to use into an interface that learns what you need!

6. Is Zeta a Buy?

The answer to this question and an updated valuation model that includes the marigold acquisition will be available tomorrow for Global Equity Briefing Premium Members.

7. Post Scriptum

After I finished this report, Trump decided to restart his Trade War with China. This caused a huge sell-off in the market, with Zeta falling close to 10%.

Zeta provides digital software services, and while it is not exposed to China, some of its clients are.

However, this is an overreaction, and Zeta’s long-term prospects have not changed one bit!

Here is what my Premium Members can expect:

Top Monthly Picks - Each month, I will select a few stocks that I find likely to outperform.

These picks will focus more on short-term pricing movements and swift through market narratives.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on a monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Pricing Structure

I strive to build a long-term relationship with my Premium subscribers, so I have chosen a pricing structure that emphasizes annual subscriptions.

The standard practice is to give 2 months free for annual plans, but I have decided to give 6!

Small note, please go to the website to purchase the subscription, as if you do it on the iOS app, you have to pay the 30% Apple Tax. (The plan cost more there)

Thank you for being a reader. I look forward to seeing you on Global Equity Briefing!

Join the Global Equity Briefing Premium Service.

Equity Research Report List

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.