Long IREN!

Updated 2030 Valuation Model!

In yesterday’s article, I explored how Iren’s stock reacted so negatively to the earnings, because of:

No Hypersacler Deal

Huge Revenue Miss

Huge Earnings Miss

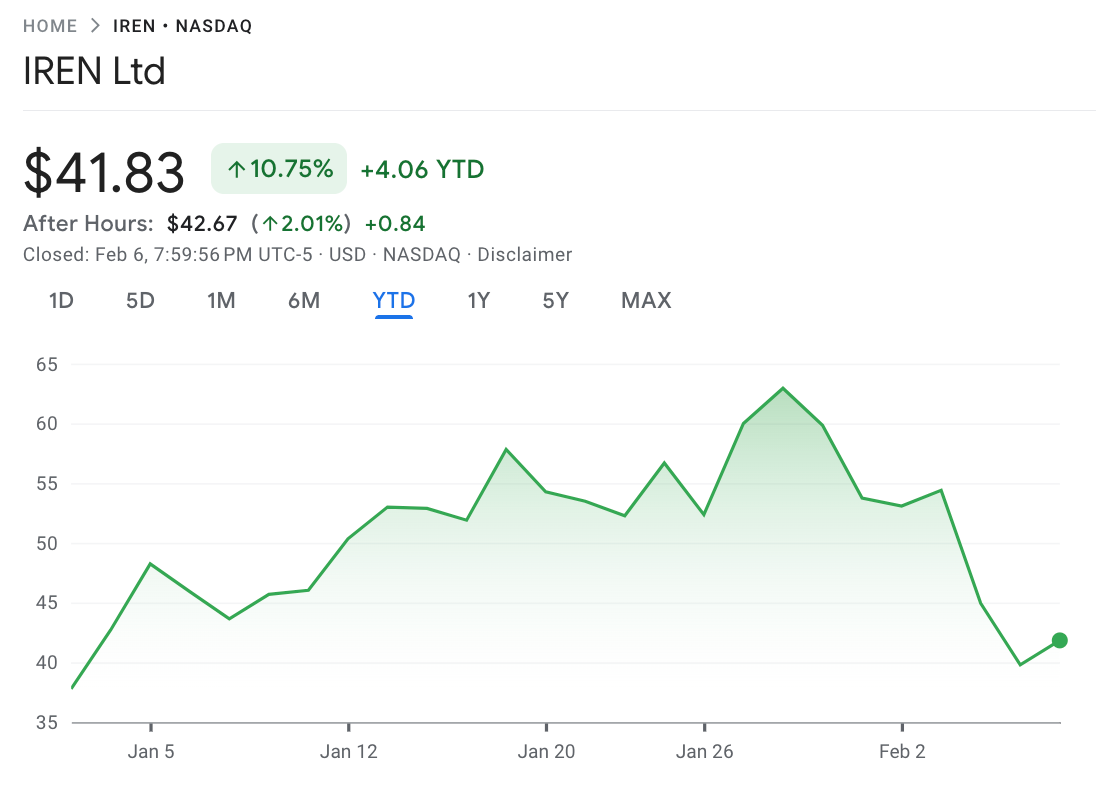

I firmly believe that the over 20% fall was completely unjustified, and thus it is no surprise that the stock has completely recovered. You can read my analysis of the quarter in the article below without a paywall.

In this article, I will present a new IREN 2030 Valuation Model.

After the Iren announced a $3.6B GPU financing at an attractive 6% interest rate, a new 1.6GW data center in Oklahoma, and a strong $3.4B ARR 2026 target, I felt that my previous valuation model had become outdated.

Let’s dig in.

1. Valuation

After an incredibly volatile and rocky start to the year, Iren now trades for $42.67 a share, giving the company a market cap of around $12B.