Long Pagaya!

Pagaya Investment Case!

While lending has existed in some form or another for thousands of years, in the last 70 years, the industry has seen rapid changes. First, the computer and then the internet completely changed how lending is done.

It transformed from a manual and slow, paper-driven industry into an automated, fast, and digital industry!

Today, the industry is about to experience another transformation, as AI promises to deliver the next leap in convenience for lenders and borrowers alike.

This is where the business of Pagaya comes into the picture.

Pagaya is a financial services technology company with a unique operating model. They are not a neo-bank, a payment processor, a lender, a trading brokerage, or a crypto platform. In fact, they are not a B2C consumer-facing brand at all. Instead, Pagaya operates a two-sided, B2B credit network.

On one side, it provides AI-driven loan creditworthiness assessment services to 31 US banks and fintechs.

On the other side, it helps 154 institutional credit investors deploy capital using Pagaya’s AI credit platform through the aforementioned 31 lending partners.

Since its founding, Pagaya has evaluated $3.2T in applications, deploying $38B in credit investors’ capital.

As a result of stronger-than-expected financial performance, the stock is up 167% YTD, reaching a market cap of $2B.

In this report, I will explain their business model, look at how they make money, and what services they provide to lenders and credit investors. The report will conclude by analyzing Pagaya’s opportunities for growth and building a 2030 valuation model.

Let’s begin.

1. Business Model

2. The Value Proposition

3. The Opportunity

4. Valuation

5. Valuation Model

6. Conclusion

1. Business Model

The most basic business model of a bank is to collect deposits from clients and then use them as funding for loans to borrowers. A bank is profitable when it earns enough in interest income to cover interest costs and loan defaults.

However, this model is very capital-intensive and is subject to strict government regulations. Essentially, banks can only lend a certain share of their assets, and only to borrowers who pass a creditworthiness assessment.

In practice, this means that 42% of consumer loan applications in the US get declined, leaving money on the table!

This is where Pagaya aims to help.

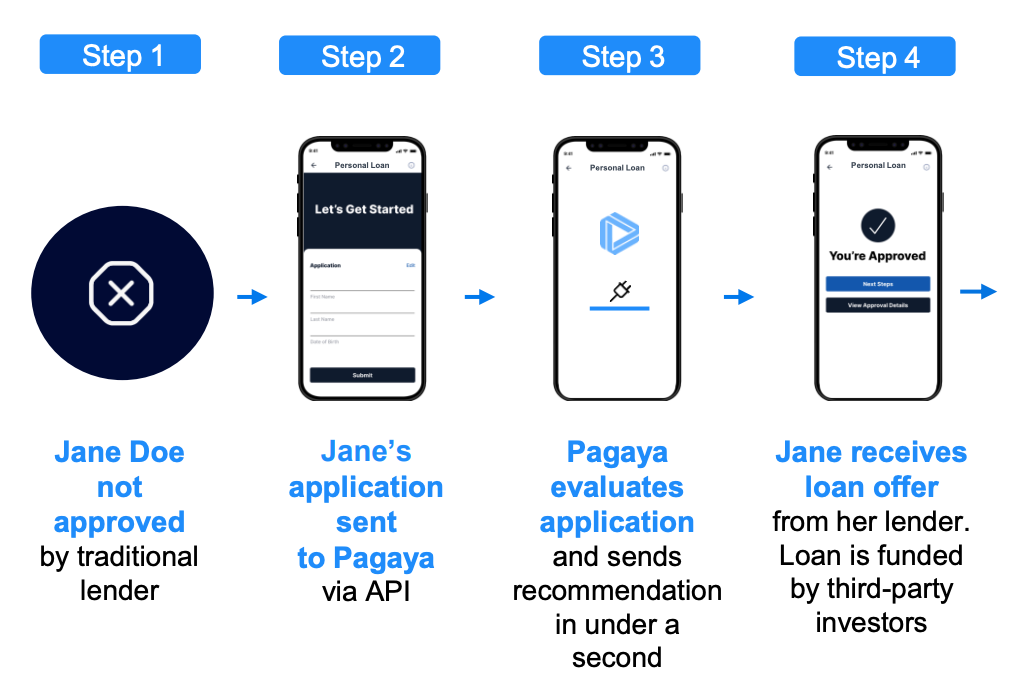

When a person applies for a loan, a bank evaluates whether that loan meets its criteria. Essentially, the bank wants to generate the highest risk-adjusted return from its capital. If a $1,000 loan application doesn’t meet the criteria, it gets rejected.

The bank then passes that application to Pagaya, whose AI model checks if it meets the requirements of their credit investor partners. If AI approves the application, the bank’s client receives a $1,000 loan, which is funded by the credit investor.

All sides benefit from this arrangement.

A customer gets a loan. The bank earns a commission for originating and servicing the loan. Moreover, it retains the customer relationship, as rejected customers often seek loans elsewhere. Credit investors earn interest income from the loan repayments.

Pagaya earns a commission for its AI credit model and for connecting the bank with credit lenders.

Let’s expand on how it works on the lending and funding side.