Nebius Upgraded 2030 Valuation Estimate!

Q3 2025 Insane Capacity and ARR Guidance Upgrades!

About a month ago, I released my Nebius 2030 valuation model, and while I expected the company to give some updates, I didn’t expect them to increase their capacity and ARR targets to such an extent.

Thus, I have decided to update the valuation model to increase the 2030 share price further!

However, the market reacted negatively to the earnings, sending the stock down 7%, largely due to 3 reasons.

I believe the main reason for such a reaction was the revenue miss, with Nebius missing the $156M analyst revenue target by $10M.

The company also plans to issue 25M shares to sell on the market.

Additionally, another development that caused Nebius and other AI infrastructure stocks to fall was CoreWeave lowering its 2025 revenue guidance due to “supply chain issues” and construction delays at one of its colocation data centers.

These are short-term concerns that have no long-term effect on Nebius trajectory!

Let’s take a look at the quarter and the updated 2030 valuation model!

1. Q3 2025

2. Valuation

3. Valuation Model

4. Conclusion

1. Q3 2025

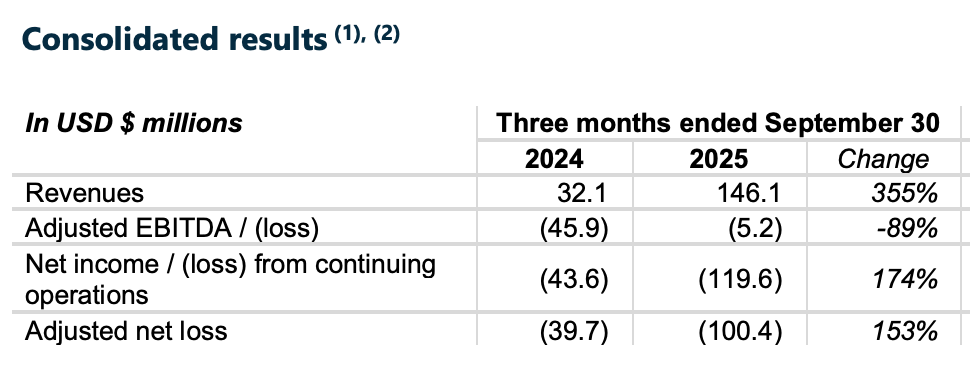

Nebius reported revenues of $146.1M an increase of 355% Y/Y!

As I mentioned in the introduction, this was $10M below the Wall Street analyst target, a miss of 6.4%.

I saw some commentators suggest that this miss is a huge red flag for a company that is supposed to be growing incredibly fast, which shouldn’t be missing revenue estimates so early in the AI boom.

This is a rather poor take in my opinion!

Nebius is heavily capacity-constrained, and they are not missing revenue estimates because of a lack of demand for its services, rather, they are missing it because they are unable to fulfill all the demand that they have.

“Given the progress we’ve made to date, we are confident in our business strategy, operations, and overall market demand. The only real limitation on our revenue growth in 2025 has been the amount of capacity that we have been able to bring online. In the last few months, we have worked very hard to unlock this bottleneck, and we will continue doing so in 2026.” Nebius Q3 2025 Letter to Shareholders

This is completely normal for a company at this stage of its life. Analysts will, from time to time, underestimate or overestimate revenues as they don’t have perfect visibility when which data centers will be activated and how much revenue they will generate.

Focusing on this $10M revenue miss misses the forest for the trees!

Here is why:

Nebius announced a $3B 5-year deal with Meta.

Core AI business reported 19% ADJ EBITDA margin.

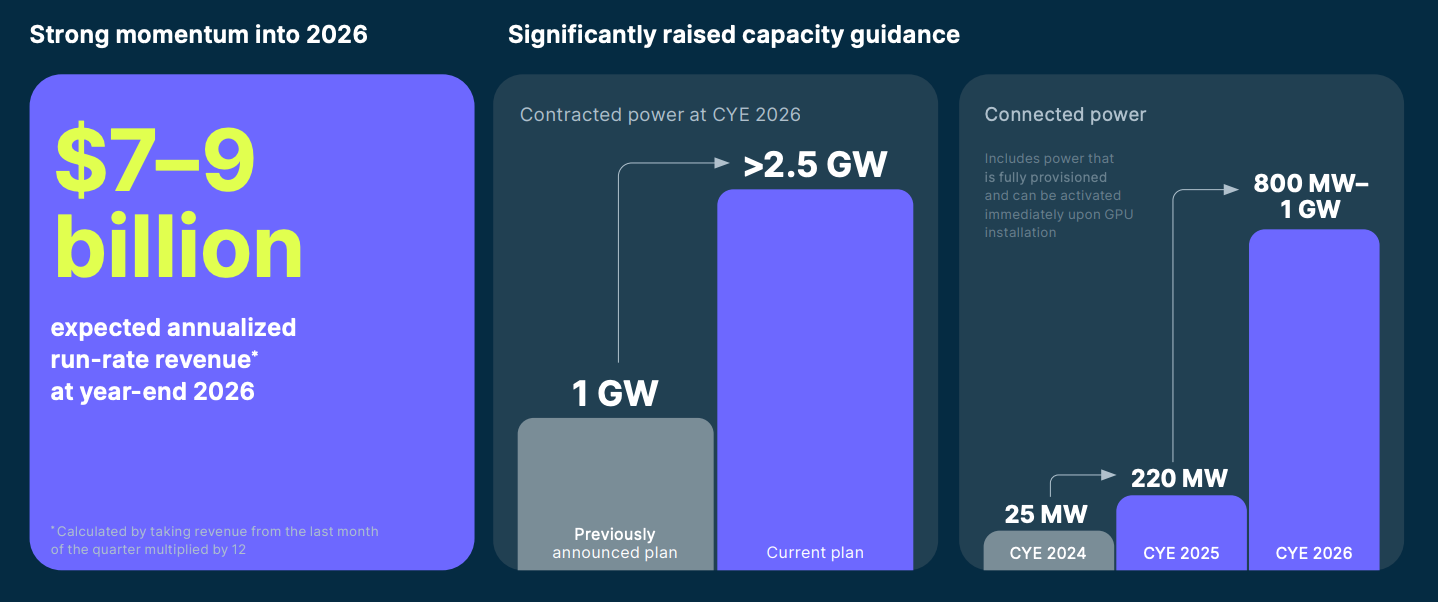

New $7-9B 2026 ARR Target.

Increased 2026 contracted power guidance from 1GW to 2.5GW.

Increased 2026 connected power guidance from 220MW to 0.8-1GW.

Raised 2025 capex guidance from $2B to $5B.

First, Nebius just signed a $3B 5-year deal with Meta. This is yet another Hyperscaler that has picked Nebius services over competitors. However, some analysts and investors were disappointed at the low contract value compared to the $17.4B deal with Microsoft. But there is no cause for concern, as Nebius specifically mentioned in the earnings release that there was plenty of demand, but they simply lacked the capacity to offer Meta.

If they had more capacity, they would have signed a larger contract!

“In fact, demand for this capacity was overwhelming, and the size of the contract was limited to the amount of capacity that we had available.” Nebius Q3 2025 Letter to Shareholders

This positions Nebius well to sign larger deals in the future as they grow the capacity.

Furthermore, Nebius reported a significant improvement in core AI profitability, with ADJ EBITDA rising to 19%.

Last quarter, they simply reported “positive ADJ EBITDA”, so it is great to see them being more specific and deliberate in their disclosures.

The biggest and most important announcement came in the form of a monster 2026 ARR guidance and a massive jump in capacity targets!

The company revealed a $7-9B ARR guidance for 2026. This essentially means that they expect revenues of around $580-$750M in December of 2026. If we assume that there is no meaningful customer churn in 2027, it would mean that they expect 2027 revenues of $7-9B.

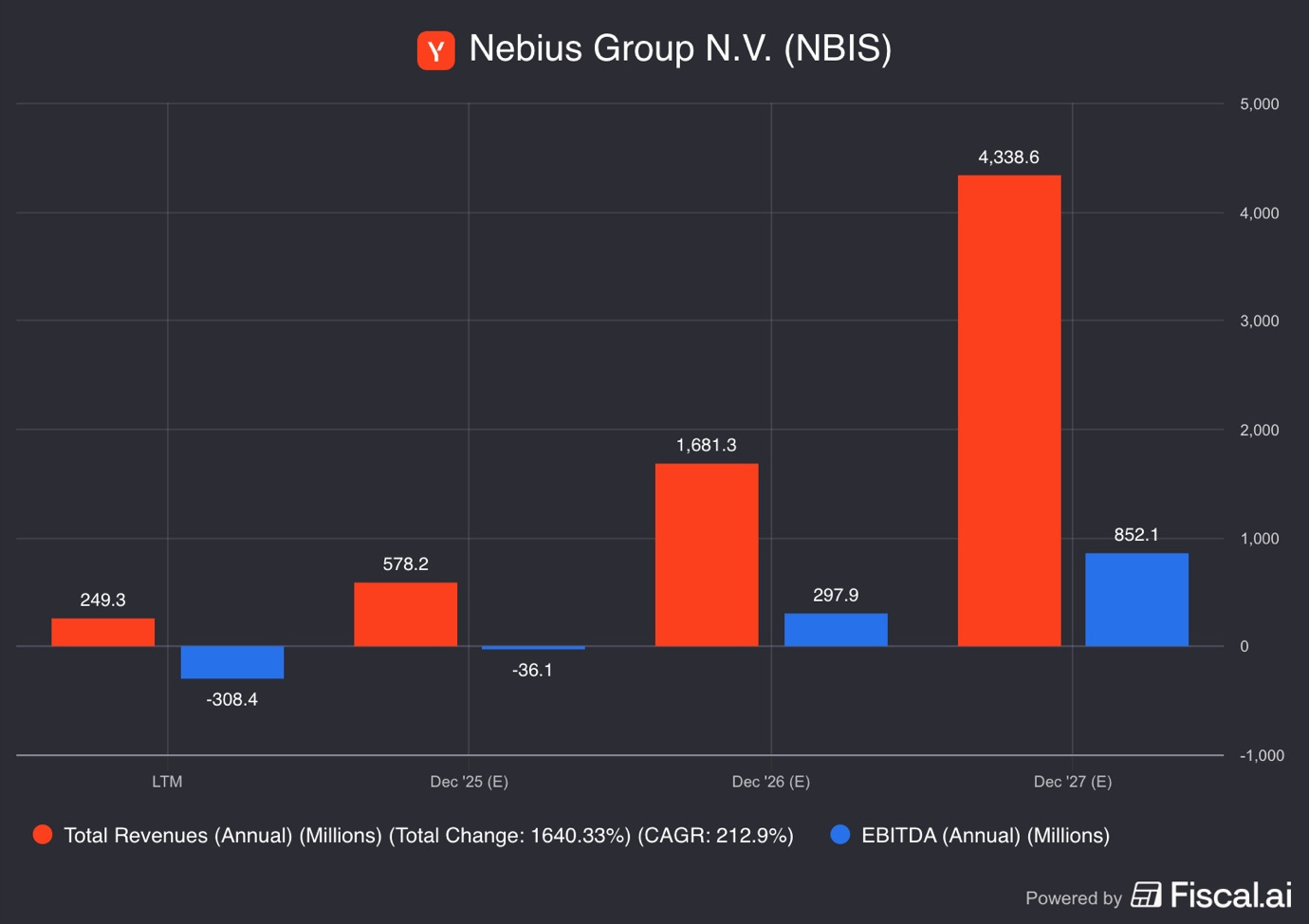

Analysts currently forecast 2027 revenues of $4.3B!

Yes, you read that right, it is highly likely that Nebius 2027 analyst estimates will increase by 100% in the next few months and a year as analysts realize this and update their estimates.

But they are unlikely to simply double their estimates, because Nebius still needs to bring all the capacity online. The market will punish AI infrastructure stocks heavily for any supply chain issues or construction delays. CoreWaeve’s stock fell 16% yesterday as they pushed out some capacity by a quarter due to construction delays.

There is a concern that Nebius data centers could suffer the same fate, especially considering their aggressive expansion targets!

This quarter, Nebius increased its 2026 contract power target from 1GW to 2.5GW!

They expect that about 40% of that will be connected, around 0.8-1GW, and if we assume that the company makes $12M ARR per MW, that means they are expecting to have 580-750MW active.

Let’s remember that contracted power is the energy that the utility has agreed to deliver to Nebius, but a lot of the equipment still needs to be built and installed.

Meanwhile, connected power is what is already connected and ready to draw from the grid.

Active power is the power currently being consumed by Nebius clients for AI workloads, and it generates the company’s revenues.

Notice that Nebius didn’t give an active power guidance, because there is a lot of uncertainty about when exactly the company could have the facility built, GPUs delivered, and energy connected for active data center activities.

It will be a few years before the 2.5GW mentioned will be fully active!

If your head is spinning from this 150% increase in contracted power target, then you are not the only one. This is an absolutely insane target, and very ambitious. Understandably, this means that Nebius will have to invest significantly more to meet this target.

Thus, they increase their 2025 capex guidance from $2B to $5B!

“Regarding CapEx, we are raising our 2025 guidance from approximately $2 billion to circa $5 billion. This acceleration reflects our strong conviction in the demand outlook and our decision to secure critical infrastructure, including hardware, power, land, and key sites. These investments are strategic enablers of future growth and will position us exceptionally well to capture the opportunities ahead.” Nebius Q3 2025 Earnings Call

They have already spent about $2B in capex so far in 2025, meaning they plan to spend $3B I in Q4, about 50% more than in the prior 9 months. Nebius wouldn’t be able to do this if they didn’t secure $4.3B in financing in September. Furthermore, thanks to their stock rising so much this year, they are able to raise billions of dollars from equity sales.

The company plans to sell up to 25M shares at the market to raise funding for this expansion, and at the current share price of $102, they could raise $2.6B. This is about a 10% dilution. While it might seem significant, let’s remember that the company will use these funds to significantly accelerate its expansion plans.

A 10% dilution for a 150% increase in 2026 capacity seems a worthy trade-off!

2. Valuation

A market cap of $25.6B means that Nebius now trades 3-4 times its next year’s ARR. That would be very expensive if they were not growing the businesses 355% Y/Y.

As I mentioned, it is quite likely that analyst 2027 estimates need to go up, but let’s look at them anyway.

2027 estimates of $4.3B for revenue and $852M for EBITDA imply that Nebius trades for a forward 2027 P/S of 6, and P/EBITDA of 31. A reasonable valuation for hypergrowth. However, Nebius guided for $7-9B in ARR in 2026, which would imply 2027 revenues of at least $7-9B.

Using this forward revenue estimate, we get a 2027 P/S of 3-4, half as expensive as analysts would imply!

The more I look at Nebius, the less expensive the company looks.

3. Valuation Model

First, if Nebius could have 2.5GW of contracted power by the end of 2026,