Presenting The Global Equity Portfolio!

Full portfolio review and analysis.

After writing for Global Equity Briefing for almost 2 years now, I have finally decided to share my portfolio and track it publicly.

I am using Portseido to visualize and track my portfolio. (More on that below)

Honestly, the main reason I waited so long was that I wanted to do more research on companies and become more confident in the portfolio before sharing it with my readers.

Another reason is that I was very overweight at a particular company, and for a long time, I was having trouble deciding what to do with that position. However, late last year, I started selling, and by early this year, I completely sold out of it and was looking at other opportunities.

From now on, my readers will receive full portfolio reviews on a monthly basis. Furthermore, they will be notified of all activity in the portfolio using the Substack chat feature.

Additionally, these portfolio reviews will replace and merge with my top monthly picks segment, in which I look at my watchlist and analyze what is driving their performance.

Let’s look at the Global Equity Portfolio!

1. Performance

2. Holdings

3. Watchlist/Top Monthly Picks

1. Performance

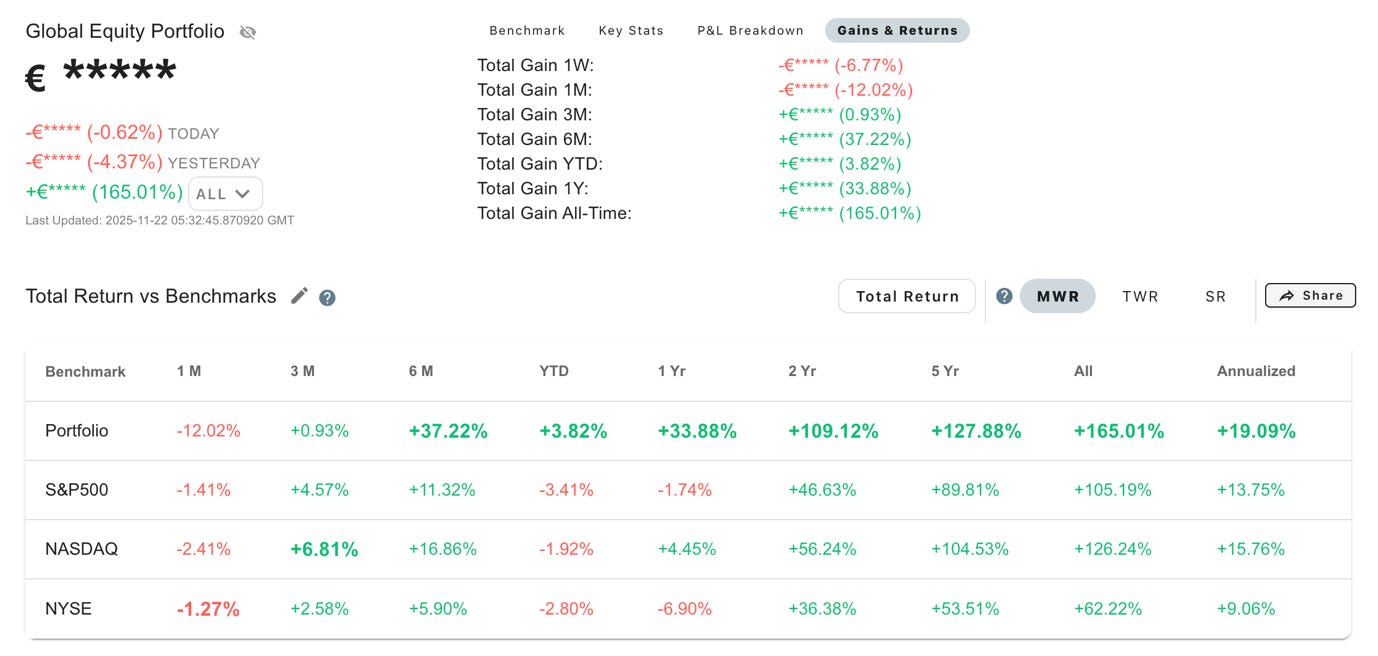

Since its founding, the Global Equity Portfolio has generated a money-weighted return of 165.01%!

That is an annualized return of 19.09% since April 2020, beating the S&P500’s return of 13.75%, Nasdaq’s of 15.76% and NYSE’s of 9.06%!

This means that the Global Equity Portfolio outperformed the S&P500 by 57%!

At this point, I think it would be prudent to discuss what money-weighted return (MWR) means and why I think it ultimately is the best way to measure an individual portfolio return.

MWR measures the return on an investment, including the timing and size of cash flows. Essentially, this method looks at how each invested dollar or euro actually performed.

Let’s say that an investor created a $100K portfolio at the beginning of a year, which grew 16%. During the year, they saw an opportunity and deposited $20K that grew by 20%. The end result is a portfolio worth $140K.

A simple return calculation tells us that the portfolio grew by 16.7%. ($140-$120)/$120

Whilst a MWR calculation will separate the performance of $100K and the $20K.

It will look at the timing of that $20K deposit, and depending on when it happened, it will have a larger or smaller impact on the MWR return. Simply put, MWR rewards gains and punishes losses that happen soon after a person invests.

If we assume that the $20K deposit was made 2 months before the end of the year, the final MWR is 19.6%.

Since the $100K was invested all year and returned 16%, and the $20K was added late and returned 20%, the unified MWR blends these timed cash flows, which works out to about 19.6%. I believe it is a more accurate representation of the actual performance of one’s invested funds.

Thus, the performance of the Global Equity Portfolio will be measured using the MWR method and compared against market benchmarks, such as the S&P500, NYSE, and the Nasdaq!

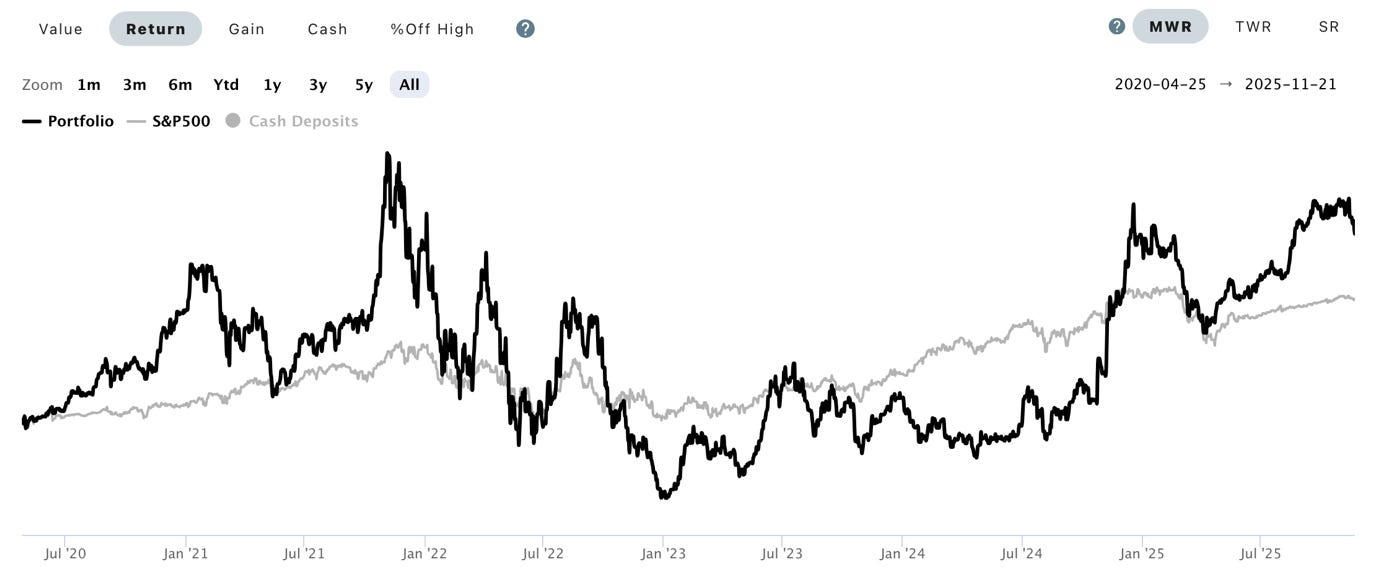

In the above image, we see a graph from Portseido that compares the performance of the Global Equity Portfolio to the S&P500 if invested in the index at the same time as I bought the stocks.

I recently began using Portseido to track the performance of the Global Equity Portfolio. They are an investment performance tracking and visualizations platform that is extremely easy to use. I especially like their smart benchmarking graphs and tables you can see in the pictures above.

This is exactly what I was looking for, and I would recommend them to everyone looking to approach investing seriously and beat the market in the long term.

Use my link below to begin your 2-week trial.

https://www.portseido.com/?fpr=global

2. Holdings

Before we discuss my current holdings, I would like to talk about the past and what drove my returns. The Global Equity Portfolio began in April of 2020, when I sold all my stocks across various brokerages and began from beginning at Trading 212.