Briefing: State of the Streaming Wars!

All hail King Netflix!

While all other streamers struggled with losses and flops, 2023 was a good year for Netflix! The worlds top streaming service added 29.5 net new subscribers, reaching 260 million subscribers! The company once again proved its status as the King of streaming!

Let’s look into the state of the Streaming Wars!

Netflix

Netflix lost subscribers for the first time in Q1 and Q2 of 2022, leading many to believe that “Competition is here!”. After a long winter sleep, Disney+, Apple TV+, HBO Max, Peacock, and Paramount had all finally entered the streaming industry. Numerous media experts and Wall Street analysts have been saying for years that once legacy Hollywood studios bring their 100-year-old TV and movie-making skills into the digital age, Netflix will crumble.

For many, 2022 seemed to prove this thesis as the stock fell 75%. Even famous hedge fund manager Bill Ackman sold his Netflix position for an estimated $400M loss. However, the cheers of Netflix bears were short-lived. Netflix said that this subscriber loss was temporary, and the company was quickly proven right! Subscriber growth returned and Netflix finished 2022 with 9 million net new subscribers.

Looking at the paid subscriber graph, we see incredible growth! The small blip at the beginning of 2022 was completely compensated by growth in the latter half of the year!

So, what happened?

Bears believed that Netflix’s business model was structurally weak, however, I think there are quite a few things that bears got wrong!

Covid Growth Pull Forward

Netflix benefited from Covid-induced streaming demand acceleration. People sitting at home needed to entertain themselves somehow. However, once most COVID restrictions were lifted, we saw lots of “revenge” spending. Entertainment and travel companies showed strong results, and demand for airlines went through the roof.

People were just tired of sitting at home, playing Xbox, and watching Netflix, so they looked for other ways of entertaining themselves. This led many customers to cancel their subscriptions. However, this period was clearly transitory, as Netflix’s compelling value proposition convinced many new users to sign up.

Competition

Back then, it seemed that competitors will eat Netflix’s lunch. Legacy movie studios have huge content backlogs, Prime Video and Apple TV+ have seemingly infinite resources. What I believe happened is that all these new streamers spent handsomely on promotions and marketing, convincing many customers to try their service, putting pressure on Netflix’s growth.

However, this was not sustainable. None of them were profitable and sooner or later they would have to cut marketing and content budgets and increase prices. This is exactly what happened in 2023. With higher prices and less content, other streamers value propositions were not as compelling as before, benefiting Netflix.

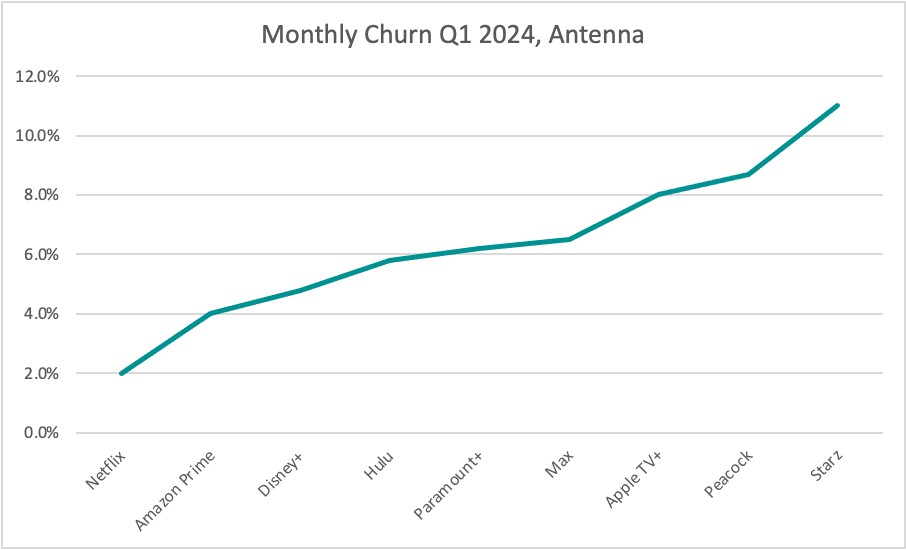

This can be observed in the above monthly churn chart. Not only Netflix’s churn is the lowest in the industry, but the difference is simply astronomic. Prime Video is second best, and their churn of 4% is double that of Netflix’s.

Password Sharing

When Netflix was in its infancy, the company was very lenient towards password sharing. It was commonplace for families and friends to share an account. Reed Hastings wanted people to create habits around watching Netflix. Thus, the company was not so concerned with missing out on earnings in the short term.

Now that the company has reached such a massive scale, it has fully entrenched itself in people’s living rooms. So, Netflix finally cracked down on password sharing. The company was confident that the number of new signups would be larger than the number of angry users canceling the service. Many observers were unsure if people would be willing to pay, and there were a lot of outraged customers online. Understandably, as it’s very difficult to convince people to pay for something that they were getting for free.

However, the password crackdown was successful, with Netflix reaching new subscriber highs. It was quite ingenious of Netflix to save this growth lever for later, if Netflix had done a password crackdown years ago, the company simply wouldn’t have grown as fast and would be a smaller company today.

Netflix Supreme Execution

Netflix is one of the highest spenders in the industry, during the last 5 years the company spent a whopping $72 billion on content! This massive spending created a vast content library, catering to all tastes.

One of the reasons why bears thought that competitors would dethrone Netflix was the lack of strong IP and nostalgia-bait content. Disney has Marvel and Star Wars, HBO Max has Game of Thrones, DC and Harry Potter.

However, the company has proven that it can gain and retain users without legacy IP. Furthermore, Netflix has become quite apt at acquiring and developing lesser-known IP. Wednesday, a 2022 TV show about a character from a little-known IP had more viewers than any Disney+ Star Wars show.

Additionally, Netflix are masters at acquiring legacy content and using its massive scale to give it a new life. In Nielsen’s 2023 streaming-wrapped report, 7 of the top 10 most viewed acquired streaming programs were at Netflix. Suits, a legal drama that ended in 2019 was viewed for 57 billion minutes.

According to Forbes research, more people think Netflix is the best streaming service than any other. I believe this is the result of Netflix’s massive content spend and great user interface!

Other Streamers

Market dynamics have changed, investors are no longer satisfied with subscriber growth, they want to see cash flow. How is this changing the competition dynamic?

Prime Video

There is a big asterisk next to the Prime Video subscriber number, Amazon doesn’t report exact subscriber figures, the only thing they said is that Prime has over 200 million subscribers. At first glance, it might seem that Amazon is competing quite well with Netflix. However, I believe this number is artificially high as it’s linked with various other Amazon Prime benefits, such as free shipping. I imagine there is a large cohort of subscribers who only subscribe for other benefits and never watch Prime Video. However, that doesn’t change the fact that Amazon is clearly second.

Historically the main difference between Netflix and Prime Video has been the different objectives. Netflix’s main objective is to entertain its users and make money, while Prime Video’s main objective is to “sell more shoes on Amazon”. Essentially, it’s a churn reduction tool for Amazon Prime.

However, it seems that this has been changing. Amazon has been increasing prices in the US, Canada, and Europe. Moreover, the company announced that it will start showing ads. Early estimates for 2024 forecast $3B in ad revenue for Amazon Prime. Furthermore, Amazon is increasing content spend on live sports as well.

However, Prime Video has yet to master the ability to create hugely popular series like Netflix has. The most expensive TV series ever, Rings of Power, cost a massive $462M and was a huge flop for Amazon. Nielsen estimated it was nowhere near the top 10 most-viewed streaming shows for 2022. Moreover, Rings of Power was panned by fans, and leaked information suggests only 37% of viewers who started watching the show finished it.

According to the Nielsen 2023 streaming wrapped report, there were 0 Prime Video movies in the movie top 10, and only 1 original TV show in the TV show top 10. Netflix had 7 TV shows and 3 movies in the top 10.

Disney+

With 150.2 million paid subscribers Disney+ is the third most popular streaming service, a must-have for families. Their large library of content from Disney, Marvel, Star Wars, and National Geographic has something for everybody.

Disney’s IP strength is quite visible in Nielsen’s 2023 top 10 streamed movies list, with 6 movies on the list, 4 family-friendly Disney animated movies, 1 Marvel and Avatar: The Way of Water. This underscores the continued demand among audiences for intellectual property-driven films. However, it seems that amongst TV show viewers IP is not as important. Despite releasing 4 Star Wars and 4 Marvel TV shows during 2023, there was only 1 Disney+ TV show in the top 10.

The company also controls Hulu and ESPN+ with both streaming services still growing. Meanwhile, looking at Disney+ subscriber numbers, we notice that in 2023 they lost 400K domestic and 1.3M international subscribers. It is concerning that this early in its growth journey Disney is already losing subscribers. This is somewhat counterintuitive and goes against the broader narrative. A lot of people expected that with its great IP and brand recognition Disney+ will surpass Netflix.

This clearly shows that narratives are often wrong!

Disney’s direct-to-consumer business unit lost over $1B in Q4 2022, unfortunately for Disney Wallstreet can’t stomach these losses anymore, thus in reaction to falling stock price the company has set a course for profitability. During 2023 Disney cut costs and increased prices decreasing losses by 79% to $216M in Q4 2023.

“We continue to expect to reach profitability at our combined streaming businesses in the fourth quarter of fiscal 2024, and are making tremendous progress in this area, with first quarter Entertainment DTC operating losses improving by nearly $300 million versus the prior quarter. We believe this business will ultimately be a key earnings growth driver for the Company.” Disney Q4 2023 Earnings Release

The company expects its streaming business unit to be profitable in Q4 2024. One of the ways Disney plans to achieve that is by cracking down on password sharing. Let’s see if it is as effective for Disney as it was for Netflix.

HBO (MAX)

After the merger of Warner Media and Discovery. The new company decided to merge HBO Max and Discovery+ to form one giant streaming service MAX. The combined subscriber number now stands at 97.7 million.

While impressive the company still has a lot of cost-cutting to do to. Warner Bros Discovery has lost an absolutely mind-boggling $10.5B in 2022-2023. Moreover, the merger saddled the company with over $48B in long-term debt. This has led to an 80% fall in the stock price.

The company is on an aggressive warpath. The goal is to cut costs, increase prices, and pay back debt. In 2023 the company showed good progress towards that goal. Revenue increased by 22%, losses fell by 57% and long-term debt decreased by 14%.

2024 will show us how customers will respond to MAX. So far MAX seems to be a distant 4th in the streaming wars!

Paramount

On the surface it would seem that Paramount should do well in the streaming wars, however, the company is struggling!

Paramount stock has fallen 76% during the last 3 years, with a market cap of just $8.5B. During this period the revenue has been stagnant, approximately $29B, while $4.5B in net income has turned into a $608M loss.

The company added 11.6M subscribers, +20% in 2023, reaching 67.5M. Furthermore, Paramount+ revenue increased by 61% Y/Y, reaching $4.4B. However, its direct-to-consumer business unit still lost $1.7B in adjusted EBITDA.

Paramount’s position is quite precarious. The company’s cash cow, the legacy broadcast TV business is dying at the same time as the company is losing money in streaming. Revenue in its TV media business has decreased by $2b, 11.6% in 2 years! If cord-cutting accelerates and Paramount can’t rein in streaming losses, the company will be forced to take drastic measures. Assets divestments and/or acquisitions could be in the cards for Paramount.

It would appear Paramount realizes this as the rumor is that the company is actively exploring strategic opportunities. Such a proactive approach could be wise. Get a deal before the company’s situation deteriorates, avoiding potentially forced fire sale of its assets.

It seems that Pramount’s merger with Skydance appears as the most likely outcome of these negotiations.

Apple TV+

Apple doesn’t report subscriber numbers for their streaming service, 25 million is the latest available estimate. Similarly to Prime Video, the objective of this streaming service is not to profit on its own. The main objective of Apple TV+ is to reduce churn for its Apple One subscription.

Apple One is Apple’s ultimate subscription bundle consisting of services offering music, video games, iCloud, fitness, news, and of course TV+. Sales of Apple devices have reached their peak, thus the company is aggressively pursuing a growth strategy based on the sale of services to its active client base. With this bundle, Apple wants to create a comprehensive package that provides enough value for lots of families to subscribe. Individually none of these services need to be excellent, they just need to be good enough for customers to not cancel the bundle.

Analyzing Apple TV+ subscriber numbers individually they seem rather disappointing. According to the CordCutting 2023 streaming report, lack of interesting content is the biggest reason why people cancel subscriptions. Apple’s churn of 8% is one of the worst in the industry. To increase subscribers and lower the churn, the company must simply build a larger content library and that is going to take time.

Conclusion

First mover advantage and long-term thinking have allowed Netflix to build the best streaming service. Its user interface has consistently ranked as the easiest to use. Most people say that Netflix is their favorite streaming service. Moreover, their monthly churn is miles better than any competitor.

The capitulation of other streaming services is likely. Warner Bros for years had the position that they would never license HBO content to Netflix. Desperate for cash the company started licensing some shows. I believe other companies are likely to follow suit.

Netflix has won the streaming wars!

However, this doesn’t mean that other streamers are doomed!

Most will eventually figure out the business model and become profitable. I believe Disney+ is the most likely to have a decent streaming business. Their IP’s are just so strong, if Bob Iger fails to make Disney+ profitable, Disney board will hire someone who will. Moreover, Hulu and ESPN also create great content that people will want to watch.

Apple and Amazon will likely achieve the objective of having their streaming service reduce churn for their other more profitable products.

Paramount, WBD, Peacock, AMC and Skydance are the wild cards, at this point I don’t see how they can stay independent. Legacy media are struggling to compete with the new entrants (Apple, Netflix and Amazon), thus I think consolidation is likely.

Thank you for reading, Follow me on:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.