Is Tesla a buy?

Tesla Investment Case!

Elon is one of, if not the most visionary business leaders of the last 100 years. He is the key person behind not one, not two, not there, but six large technology companies. Tesla, SpaceX, X Corp (Twitter), The Boring Company, Neuralink and xAI.

With a net worth of $413B, he is by far the richest person in the world! It is quite likely that Elon will become the first Trillionaire!

While Elon has always been a rather controversial figure, in the last 5 years, he has possibly become the second most controversial person in the world. Only behind, the man he helped put back into the office. Calling his behavior erratic feels like an understatement.

Today, I am going to take a look at his biggest and most successful company!

Tesla’s Investment Case is largely driven by Electric Vehicles, Energy Storage, Autonomous Driving, and Optimus.

Let’s dig in!

1. Electric Vehicles

2. Autonomous Driving

3. Energy Segment

4. Optimus

5. Valuation

6. Final Thoughts

1. Electric Vehicles

The world’s transition to electric vehicles (EVs) is inevitable. While it is well known that EVs generate fewer emissions, let’s put aside the CO2 argument for a bit and look at how EVs are fundamentally superior to internal combustion engine (ICE) vehicles.

Higher Energy Efficiency – depending on the EV and driving circumstances, electric motors convert 80-90% of the electric energy from the battery into motion. Whereas ICE engines only convert 20-30% of gasoline energy into motion. Yes, you read that right, 70-80% of the energy that’s generated from burning gasoline is wasted as heat.

Lower Operating Costs – Largely due to this improved energy efficiency, EVs are significantly cheaper per 1 km driven. Depending on various factors, the Tesla Model Y consumes around 0.20 kWh per 1 KM. For instance, in Germany, 1 kWh costs around EUR 0.30 to 0.40. This means that it would cost a German Model Y owner around 7-euro cents to drive 1 KM. Meanwhile, the VW Tiguan consumes 7.5 liters per 100km, and gasoline costs around EUR 1.80 per 1l in Germany, meaning that the Tiguan owner pays around 13.5-euro cents to drive 1 KM. So, in this example, EVs are 48% cheaper per 1KM.

Lower Maintenance Costs – EVs need less regular maintenance than ICE vehicles. There is no oil to change, no spark plugs, no ICE engine, no exhaust system, etc. Fewer visits to the garage save time and money for the owners.

Cheaper to Manufacture – Yes, you read that correctly. EVs are cheaper to manufacture if we exclude the material costs and the factory building costs. I know it’s a big if, but as old ICE factories age, they need to be replaced anyway. Additionally, new manufacturing methods are reducing the need for expensive minerals. EVs are cheaper to manufacture because they require fewer cooling systems and have fewer moving parts, with more modular parts. This enables a more streamlined manufacturing process that enables increased automation, thus requiring fewer employees.

Technological Progress – EV technology is improving at a very fast pace. Electric motors are becoming more efficient. Increased automation is enabling EVs to be manufactured increasingly faster and cheaper. Additionally, batteries are becoming cheaper and denser.

In the chart above from Bloomberg, we clearly see that in the last decade, batteries have become 82% cheaper!

Elon and many other experts have predicted that the prices will fall by another 80% in the next decade!

The truth is that ICE technology largely stopped advancing years ago, and that is unlikely to change. While EVs are already cheaper when taking into account the total lifetime cost of ownership, soon, their price tag will also be lower at the dealership. In the future, people will be able to charge their EVs relatively quickly and drive many times more km than an ICE car can drive with one tank today.

While, of course, EVs are not perfect, all issues are being worked on. Charging stations are becoming more frequent and more reliable. Battery recycling is improving and new manufacturing methods are reducing the need for polluting and expensive minerals.

In the graph above, we see that although Tesla’s vehicle delivery growth has been absolutely explosive, 2024 was the first year that saw deliveries decrease, falling 1%. Elon and the company have named high interest rates, loss of subsidies in certain markets, and a tough macroeconomic environment as the main causes for this decline. Others, however, believe tougher competition, lack of new vehicles, no traditional marketing campaigns, and Elon’s erratic behavior are the key causes.

Overall, the EV market grew 25% in 2024, driven by a strong 40% growth in China. In the US and Canada, EV sales grew by 9%. However, Europe saw a 3% decline. The Chinese government heavily subsidizes both the manufacturers and the consumers. Meanwhile, due to the removal of subsidies in certain European countries and a lack of appealing models from legacy autos, consumers shunned EVs in Europe.

Precedence Research forecasts the global EV market to grow with a 22.7% CAGR to reach $2.45T by 2034!

The transition to EVs will take longer than other technological revolutions. Cars are expensive purchases with long, useful lives, so even under ideal conditions, it would take decades to fully transition the fleet. However, the conditions in many countries are less than ideal. Lack of investment in the charging infrastructure by governments, legacy autos, and energy companies is slowing down the transition.

Legacy autos are slowly moving out of the denial stage into the anger and bargaining stages of grief. They are increasingly attacking government regulations, especially in Europe, that they have known about for many years. These companies must deal with bloated workforces that lack the skills needed for the EV age and powerful unions that don’t want to face mass layoffs. Most critically, they don’t want to accelerate EV investment as that would cause their cash flow to plummet.

Legacy autos simply don’t have what it takes to remain relevant!

This bodes well for Tesla, who are well-positioned to be the leader of the EV age. Tesla doesn’t have unions blackmailing them into unreasonably high wages. Their factories are not only the most advanced in the world, but also are constantly getting improved. Tesla’s fast charging “Supercharger” network is the biggest in the world by a huge margin.

Most importantly, EVs are computers on wheels, unlike ICE vehicles, which are mechanical in nature. Thus, EVs require a completely different workforce to build and design them. Tesla is one of the most desired workplaces for young engineers, enabling them to hire the best talent. Elon’s reputation as a visionary leader helps in this regard.

Sometimes, the media makes a large fuss about a “Tesla recall.” Well, actually calling them recalls is silly, as the vast majority of them are just software updates. If an update is required, Tesla can easily provide it through over-the-air software. Meanwhile, most legacy autos need to be brought to the dealership for simple updates.

Overall, Tesla’s relentless focus on costs, their better battery, power train, and electric motor technologies, in combination with first principles thinking, position them to become one of the largest auto manufacturers in the world!

2. Autonomous Driving

While there are certainly plenty of people who enjoy driving, most see it as a tedious but necessary part of their daily lives. Sitting in traffic is physically and mentally exhausting. According to the 2022 survey of the AAA Foundation for Traffic Safety, the average American spends 1 hour each day behind the wheel.

What if that wouldn’t be necessary?

Tesla is aiming to change that with its Full Self Driving (FSD) system. FSD is a system where, instead of a human, an AI drives the vehicle. Autonomous driving has the potential to save trillions of dollars, thus completely revolutionizing the transportation industry.

AI doesn’t sleep, it never gets hungry, sick, or impatient. AI can make split-second decisions with greater accuracy than the average driver. Apart from the monetary aspect, AI has the potential to drastically reduce the number of car accidents, thus saving millions of lives.

While Elon has been saying that “Level 5 FSD is just 1 year away” for many years, during the Q4 earnings call, he said that Tesla is advancing faster than ever, and they plan to start offering an advanced FSD in Austin, Texas, in June of 2025.

Once Tesla develops a fully operational FSD, the company plans to monetize it in 3 key ways.

1. FSD Subscriptions

2. Licensing FSD

3. Robotaxis

Let’s talk about each.

In some jurisdictions, Tesla currently offers an FSD subscription that is not fully autonomous but provides various advanced driving assist features. For $99 a month, subscribers can autonomously drive on the highway, change lanes, drive on and off ramps, park, and more. Tesla hasn’t released subscriber numbers, but if the rumors are true, the adoption has been lackluster. Many drivers feel that the features are not worth the money and are waiting for FSD to get more advanced. Tesla is actively working with regulators and, as I said earlier, plans to offer more advanced features in Austin this year. It is widely expected that, once it becomes more advanced, Tesla will increase the price of FSD. As of today, Tesla’s fleet is 5 million cars strong and getting larger every year. FSD could potentially have millions of subscribers, generating billions of dollars for the company.

Additionally, Elon and Tesla have mentioned that they have had some discussions with certain automakers about the possibility of licensing FSD in the future. It is quite likely that once FSD is fully operational, the company will license it, creating a new large, high-margin segment.

Autonomous driving has always been a major focus for Tesla and Elon, thus the company has equipped most of its cars with extensive sensors to generate copious amounts of data to be used in AI training. Most other automakers, unfortunately, have not done so, therefore they don’t generate enough data for testing. The development of autonomous driving is very expensive, and Elon has argued that without such data, it is essentially impossible to create an autonomous system.

For this reason, most legacy autos have abandoned their autonomous driving ventures. Rather than investing in the technology themselves, they are waiting for an advanced system they could license. Just recently, General Motors shut down its robotaxi division, Cruise, despite spending an estimated $10B on it.

The final and best idea to monetize FSD is Robotaxis. Tesla plans to launch an Uber-like mobile app that would enable customers to order autonomous taxis. Such a service has the potential to be significantly cheaper than a human-driven alternative.

It is estimated that just by eliminating the driver, one could save upwards of 50-60%. Additionally, Elon believes that taking into account higher car utilization rates, lower insurance, and the potential to manufacture purpose-built robotaxis, the cost per mile could be even 70-90% lower.

Understandably, the demand for such a service would be immense, likely leading to astronomical growth.

Analysts at Precedence Research estimate that the global robotaxi market will grow with a 60% CAGR to reach $188.91B by 2034!

For a slice of this potentially highly lucrative business, Tesla is competing with Google’s Waymo, Amazon’s Zoox, and various Chinese competitors.

3. Energy Segment

Tesla Energy division makes a lot of products, but two of them are extremely successful, the Tesla Power Wall and Tesla Megapack.

Tesla Power Wall is a battery system designed for home energy storage. Depending on the location and government incentives, a fully installed Power Wall 2 costs between $10,000 to $16,000 and stores 13.5kWh of electricity.

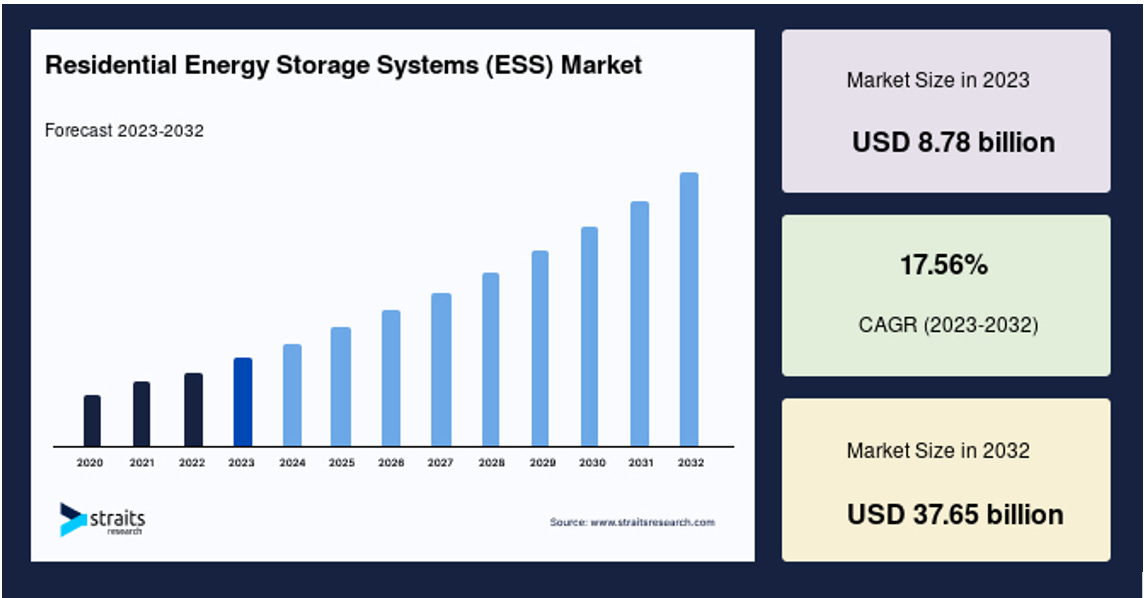

Analysts at Straits Research forecast that the residential energy storage systems market will grow with a 17.56% CAGR to reach $37.65B by 2032!

Let’s take a look at the main use cases for storing energy at home.

When paired with a solar installation, the Power Wall provides storage and enables greater flexibility. In Solar energy, there is a phenomenon known as the duck curve. The majority of solar energy is generated during the day when the sun is shining, however the demand for electricity is the highest in the evening when people return from work and start using various appliances. Power Wall stores the energy generated during the day so it can be used in the evening.

Additionally, the Power Wall provides backup power during grid blackouts. During hurricanes, wildfires, winter storms, or other natural disasters, people sometimes lose power for days. A fully charged Power Wall holds enough electricity for half a day of an average American household’s use. By turning certain devices off and only focusing on the essentials, one could stretch this out for even 3-4 days. So, 2, Power Walls could even be enough for one week.

Another use case is energy arbitrage. Utilities in many jurisdictions price energy based on demand and supply. This means that often electricity is significantly cheaper during the middle of the day when Solar generation is at its highest or during the night when the electricity demand is low. This changes from city to city, depending on the usage and generation patterns. Tesla Power Wall can be programmed to charge during off-peak hours when electricity is the cheapest and discharged during peak hours when electricity is the most expensive, generating savings.

Tesla Megapack is essentially just a much bigger Power Wall. A single Megapack costs over $1M and can store 3.9 MWh of electricity, equivalent to around 300 Power Walls. It is used by organizations such as utilities, renewable energy developers, regional governments, large factories, and more.

For example, The Ventura Energy Storage Project in Ventura County, California, consists of 142 Megapacks, enough to power 80,000 homes for four hours. While not disclosed, it is likely the project cost more than $150M.

The objectives of Megapack are similar to Power Wall, just on a much larger scale!

It can be paired with renewable energy projects such as solar and wind farms to store the energy generated during peak hours to be released during peak demand. Furthermore, A Megapack provides backup power not to a single house but to potentially tens of thousands. Meanwhile, independent power producers and energy traders use Megapacks to benefit from energy arbitrage opportunities.

Overall, Megapack improves the stability of the grid by providing flexible and reliable options to balance supply and demand fluctuations.

Analysts at Grand View Research forecasts that the global grid-scale battery market will grow with a 27% CAGR to reach $44.9B by 2030!

4. Optimus

Tesla is building a humanoid robot called Optimus, which is meant to replace the most dangerous and boring tasks people engage in.

During the Q4 earnings call Elon said that once mass production is fully scaled, they could manufacture millions of these bots, potentially generating “North of $10T” in revenues.

Furthermore, he said they are planning to start mass production sometime in the next few years, and that the company is planning to spend $500B on training costs.

Currently, Tesla is designing a production line capable of manufacturing 1,000 robots a month. The goal is to start production in early or mid-2026. After the first ramp-up phase, the next step would be to increase the production to 10,000 a month and then to 100,000.

The TAM for such a robot would be immense! Optimus could replace millions of factory workers at a fraction of the cost. Moreover, as we discussed in the FSD section, AI doesn’t sleep, eat, or drink, so Optimus would work 24/7.

Optimus has the potential to significantly increase the output of all factories worldwide, leading to a massive increase in the world’s GDP!

However, considering Elon’s history of overly optimistic predictions and proclivity for hyperbole, I don’t believe that Tesla will manufacture a fully operational robot before the 2030s.

Additionally, even if they do release some Optimus bots, I am extremely skeptical that their full potential could be achieved as quickly and as cheaply as Elon claims. People have been working on humanoid robots for decades, spending billions of dollars, and so far, have achieved nothing but a few niche use cases.

I can’t, with any reasonable degree of certainty, estimate how much revenue Optimus could generate in this decade. For this reason, I have chosen to completely ignore it in my Tesla valuation model.

5. Valuation

Tesla closed 2024 with revenues of $97.7B and a net income of $7.1B. These are impressive numbers, but we need to remember that the company has a market cap of $1.27T, resulting in a P/E of 200. Such a high valuation means that Tesla investors expect a lot of growth from the company.

In my valuation model, I try to model the outcomes Tesla needs to achieve to justify this valuation. This is not a forecast!

In the auto business, I model Tesla, growing to 5M vehicles a year by 2030, driven by the release of various cheaper models. The average selling price would drop to $32K as a result, however, gross margins could increase due to lower battery prices and higher manufacturing efficiencies.

This would result in the auto business generating around $161B in sales, and $37B in Gross Profit!

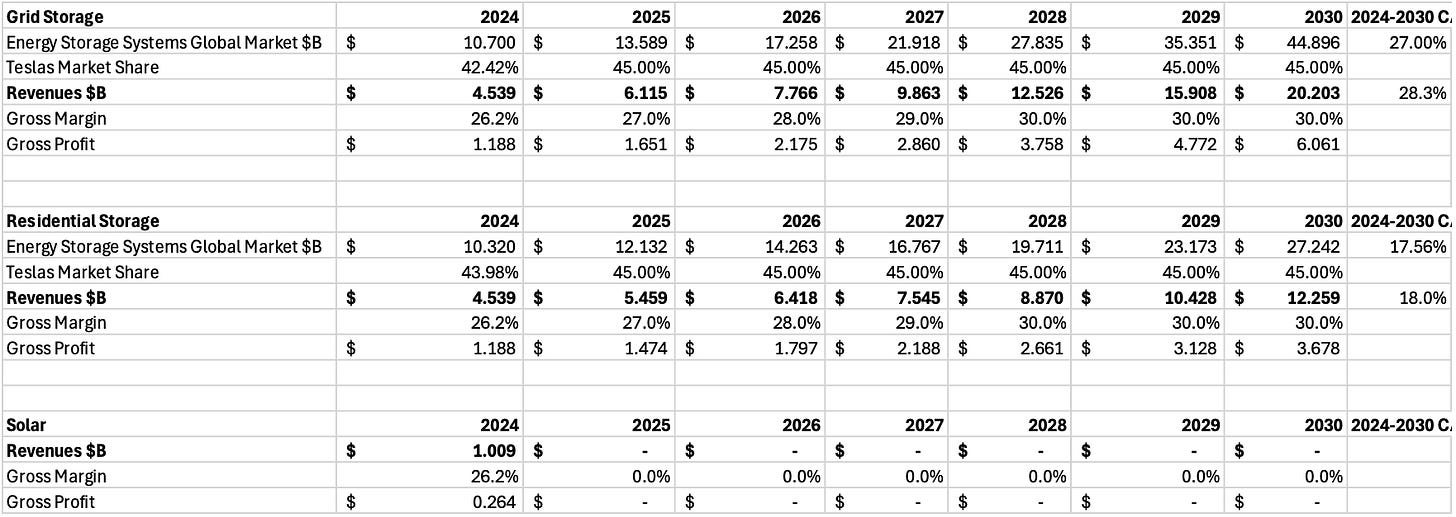

I split the energy segment into three parts, grid storage, residential storage, and solar revenues. Tesla doesn’t disclose the split, but considering the strong growth of the grid segment and the weak performance of the solar, I estimate that the grid generates 50%, residential 40%, and solar 10%.

I used the researcher forecasts mentioned in the energy section of this article for both storage market segments and assumed a slight market share and margin improvement. Additionally, I assumed grid and residential operate with the same gross margins. Concerning the Tesla solar segment, their installations fell 36% in 2023, and in 2024, the company stopped disclosing installations. This business has been underperforming for years, so as I have no reasonable way to estimate it, I assume it goes to 0.

These assumptions result in grid storage generating revenues of $45B and a gross profit of $6.1B, meanwhile, residential storage would generate $27.2B in revenues and $3.7B in gross profit!

Next, to estimate the results of the services segment, I assumed that currently, 98% of the segment is charging, servicing, and others, and the remaining 2% comes from FSD. Tesla doesn’t disclose the split, so it is very hard to estimate. As the company grows the charging network, the revenues generated by it will increase, and economies of scale will enable significantly higher gross margins.

I model Tesla generating $24.2B from charging and servicing, leading to a $3.4B in gross profit!

Regarding the FSD, I model Tesla, having 1.335M subscribers paying $250 a month. This recurring software income would have limited running expenses, enabling 80% gross margins.

Tesla FSD subscriptions could generate $4B in sales and $3.2B in gross profit!

The final segment is robotaxis. I used the Precedence Research global robotaxi market forecast. Then, I assumed that Tesla would have a 30% market share. Precedence’s forecast includes China, and I am highly skeptical that the Chinese government will allow Western companies any access at all. Additionally, I don’t find it likely Tesla will be the only significant player in the West. 30% market share is quite a generous assumption. Lastly, I modeled an 80% gross margin, the same as in the FSD segment.

These assumptions, result in Tesla robotaxis generating $14B in revenues and $11.2B in gross profit!

I model that higher economies of scale will enable Tesla to lower operating expenses as a share of the revenue from 10.6% today to 7%. Additionally, I estimate taxes and other costs to be 25% of the operating income.

The result of all these assumptions is revenues of $236B, and a net income of $36B!

If we assume that yearly dilution doesn’t exceed 1.5% and Tesla trades for P/E 50, its valuation could reach $1.8T, a 27.6% upside from today!

Yes, you read that right! All these aggressive assumptions, and yet there is only a 27.6% upside in 6 years! That is a CAGR of 4.1%.

Let’s improve these assumptions.

In this more optimistic valuation model, I increased vehicle sales from 5M to 7M, grid and home storage market share from 45% to 60%, charging and servicing revenues from $24B to $41B, FSD subscriptions from 1.3M to 3M and price to $300, robotaxi market share from 30% to 60%.

FSD and taxi margins increased to 90%, all others remained the same.

This extremely aggressive valuation model results in a 115 % upside from today, a CAGR of 13.6%!

6. Final Thoughts

Tesla is one of the most innovative technology companies of our modern era.

However, there is no way to sugarcoat it, the valuation is extremely demanding!

Tesla investors are betting that the company will deliver multiple low-probability outcomes.

They are not pricing in steady unit growth, but explosive unit growth!

They are not pricing in a leading energy storage market share, but a dominant one!

They are not pricing in a few million FSD subscribers, but many millions!

They are not pricing in a strong robotaxi market share but a monopolistic one!

They are not pricing in strong software margins but unparalleled ones!

They are not pricing in current products but new, highly speculative ones without 100% certainty they will ever be created!

Additionally, let’s not forget about Elon’s crazy antics in the last few years.

First, he dismissed the seriousness of the Covid-19 pandemic. Then he defied COVID lockdown rules and began spreading “alternative theories” about the virus.

Since he purchased Twitter, he has completely transformed the platform, firing 80% of employees and enabling bots and conspiracy theories to flourish. He removed content moderators and allowed countless previously banned persons, such as Donald Trump, Andrew Tate, and Alex Jones, to return. Elon claims he is restoring free speech, while his critics claim he is doing the opposite, using the platform to silence left-leaning ideas and promote right-wing ideology.

His “war against the woke mob”, the backing of Donald Trump, and the embrace of far-right parties have ruined his reputation with millions of people.

He went from an eccentric tech billionaire to a nazi-saluting right winger!

Whether the above statement is accurate is irrelevant, the fact that millions of people in the world think so matters. In my opinion, it would be completely foolish to believe that Elon’s behavior over the last few years has had no negative effect on Tesla’s sales.

Researchers at a London-based consulting firm, Brand Finance, estimated that the value of the Tesla brand fell 26% in 2024 to $43B!

Additionally, 2024 was the first year that saw Tesla sales volumes decline. Furthermore, Tesla has slowed down factory expansion plans, paused the development of the Mexican factory, and stopped talking about building more factories. Instead, they talk of optimizing current factories, yet both Shanghai and Berlin were supposed to make 2M vehicles a year by now, but they are nowhere close.

My honest opinion is that I am not sure if he is a net positive to Tesla anymore. There is no doubt that without his first principles thinking, obsessive focus, and complete dedication, Tesla would have gone out of business a long time ago. He most certainly was the right man at the right time to push this amazing company into this new electric age.

However, I am not sure he is the right person to lead Tesla through the next stage of its lifecycle.

In 20 years will we look back at Tesla and think what the company could have become with another person at the helm?

Or are my doubts unwarranted, and Elon will prevail in his quest to make Tesla a $100T leader of AI and robotics?

Tell me in the comments!

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed 8k word Deep Dives on Ferrari, Palantir, Robinhood, Celsius, Mercado Libre and Hello Fresh!

Additionally, i have written Investment Cases on Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write 1 article a week!

Subscribe to get all my articles as soon as they are released!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Great post on TSLA, it was interesting to read, thanks for sharing.

Great work Ray! Thanks for sharing. I don’t agree with your assessment of Elon’s personal impact on the business but your assessment of the business itself is rock solid