10 Biggest Mistakes Investors Make

Investing Basics. #4

Compound interest is the most powerful force in the universe, the 8th wonder of the world.

Often attributed to Albert Einstein, although there is no evidence he ever said it. Regardless of who said that first, this quote is one of life’s absolute truths.

People who understand it and invest their money in assets that generate compound interest create generational wealth!

Thanks to the proliferation of the internet and new investing platforms, it has never been easier to invest.

However, it has also never been easier to make massive investing mistakes!

So, I decided to take a look at some of the biggest mistakes that investors make and how to avoid them.

Let’s discuss them.

1. Investing More Than You Can Afford

2. Investing Less Than You Can Afford

3. Buying Hype Stocks

4. Selling Early

5. Not Doing Enough Research

6. Being a Trader, Not an Investor

7. Having Unrealistic Goals

8. Lack of Consistency

9. Diworsification

10. Timing the Market

11. Conclusion

1. Investing More Than You Can Afford

This mistake is especially common with new investors.

It is understandable, you just made an account on a brokerage, made some early investments, and maybe even scored some wins.

You just got the taste for the gains, and everything seems much simpler than it actually is!

So, you start depositing more money than maybe you should, or your income allows you to.

This is a huge mistake.

Let me tell you a story from when I was 21.

I had started investing a few years prior and quickly got a taste for it. At that time, I was studying at the university, so I had very little income from my part-time job and whatever money my parents gave me.

I invested all my money, and had literally EUR 0 in my savings account!

This came back to bite me when, during the spring break of 2017, a few friends of mine invited me to go to Prague. Anyone who has been to Prague will tell you that it is the best place for a spring break in Europe for a bunch of 21-year-olds.

As I wanted to go, but had no money, I either had to sell my stocks or ask my parents for money.

I ended up doing both.

The trip was great.

But it was an important lesson, don’t invest more than you can afford.

Build a savings account that has enough funds for a few months of living expenses and a random trip to Prague.

At the time, I was sitting on some gains, so it wasn’t the worst situation, however, forced selling can be especially painful during market downturns. Many people in 2008 were forced to sell stocks at 20%, 30%, 50% and even 70% losses to cover their living expenses when they lost their jobs.

Be smarter than that.

2. Investing Less Than You Can Afford

This is the other side of that coin.

If you are not investing enough, you are not maximizing the power of compounding!

The point of investing is to generate meaningful returns that will make your life easier in the future.

Some people settle on a percentage of their income, whether that be 5%, 10%, or 20% and never reassess it.

People tend to underestimate their future needs and overestimate their income.

If you can easily invest 40% of your income, why wouldn’t you? You might not have that ability in the future, because of kids, mortgage, etc.

I have a few friends who earn significantly above the median wage, and don’t have kids, yet they invest very little.

Instead, they “overspend” on what I would describe as “unnecessary material things”.

Also, often young people say, “I will invest later when my income is higher”. It might seem immaterial now, but even just $100 today could be worth thousands in the future.

It is important to build the habit of investing as early as possible.

People shouldn’t set investing targets, they should set spending targets!

Instead of investing 15% of your income, set yourself a spending budget and then invest the rest.

As your income grows, increase the spending budget for less than the raise and invest the rest.

3. Buying Hype Stocks

Many investors, instead of buying a stock when it’s down 50%, buy it when it’s up 100%.

For instance, Palantir is up 385% in the past 12 months.

I guarantee you that there are investors who right now are looking at the above Google Finance chart and are buying only because of these strong results.

Buying hype stocks is not a viable long-term strategy!

Here is why:

You are probably buying near the top

Hype ignores fundamentals

FOMO overrides logic

Hype can fade quickly

Palantir trades for obscene multiples, P/E of 600 and P/S of 100. People who justify this valuation use phrases such as “AI”, “no competition”, “ontology”, “generational company”, and more.

These phrases are meant to create the fear of missing out (FOMO), leading people to turn off logical thinking!

All these phrases might be true, but that doesn’t matter as sooner or later, a stock always goes back to fundamentals.

Hype and the narrative always fade, and investors go back to looking at growth and valuation.

Hype stocks such as Palantir are very exposed to huge drops when, eventually, financial reality doesn’t live up to the hype.

In the 2000s, the hype was about the internet stocks, in 2020, it was the EV and battery stocks, today, it is quantum computing and AI stocks. Each of those times, people said, “This is not a bubble, this time is different”, yet it never is.

4. Selling Early

It is strange, but often people are more scared of sitting on large gains than from large losses.

Of course, I am guilty of this mistake myself, as I sold Nvidia at around a 100% gain. Since then, Nvidia has risen 500%+ to become the world’s largest company.

"Selling your winners and holding your losers is like cutting the flowers and watering the weeds." Peter Lynch

Peter Lynch is a famous fund manager whose AUM grew from $18M to $14B in 13 years. His point is that instead of selling your winners to invest in the losers, investors should sell the losers and invest in the winners.

Identify your best ideas and double down on them, rather than selling them.

Of course, there are exceptions, and each situation is different.

But in general, don’t sell out of great stocks just because they have gone up a lot.

Just because a stock is up 200% doesn’t mean it can’t continue growing!

Analyze the business fundamentals, such as business model, sales growth, and valuation. If growth prospects are strong and valuation is still reasonable, don’t be afraid to invest more.

5. Not Doing Enough Research

Recently, there was a new paper called “The Research Behavior of Individual Investors” by Toomas Laarits and Jeffrey Wurgler.

The paper revealed shocking data.

The median investor spends just 6 minutes of research before each trade!

Meanwhile, the average investor spends 30 minutes per trade.

This means that most investors don’t spend even one hour of research before investing their money. Most just look at a few charts and read a few snippets of some analysts’ reports, and that’s it.

That is shockingly little research, which explains the terrible returns of the average investor.

"Know what you own, and know why you own it." Peter Lynch

For all their holdings, investors should be able to answer these questions:

What does the company actually do?

What is the business model?

What are the unit economics?

Is the company profitable?

How much cash do they generate?

Is the balance sheet healthy?

Who are the competitors?

How does the long-term outlook look like?

Is it attractively priced?

Investors shouldn’t even consider investing in a company before fully understanding not only the answers, but what they imply.

6. Being a Trader, Not an Investor

I don’t believe in trading, I believe in investing!

Some investors conflate the two, but there are huge differences:

Trading is short-term focused, minutes, hours, or days. Investors are long-term focused, years or decades.

Traders aim to capture short-term swings, whilst investors generate long-term wealth.

Traders rely on “technical analysis and charts” (stock astrology), meanwhile investors analyze business fundamentals.

Traders are neurotic and impatient. Investors are calm and patient.

Traders have a short-term mindset focused on price action. Investors see themselves as business owners.

99% of traders lose money.

Don’t be a trader, be an investor!

7. Unrealistic Goals

Many novice investors join the stock market hoping to generate 10X returns in 2 years and buy a Lambo.

Unfortunately, that doesn’t happen!

Having unrealistic goals leads to disappointment. Expecting 50% annual returns or to “retire rich in 5 years” with $100 investment isn’t grounded in reality.

When reality doesn’t match expectations, many investors get discouraged and quit.

Furthermore, you can’t generate outsized returns without taking outsized risks. So, people with unrealistic goals, who chase the next 10X stock, tend to make riskier investments.

The truth is that it is much harder to identify a 10X stock than most would like to admit!

However, identifying steady compounders with great long-term prospects that are likely to return 10-20% per year is possible.

There are no shortcuts in life.

Having realistic goals is important to stay consistent, don’t get discouraged, and make smart long-term decisions.

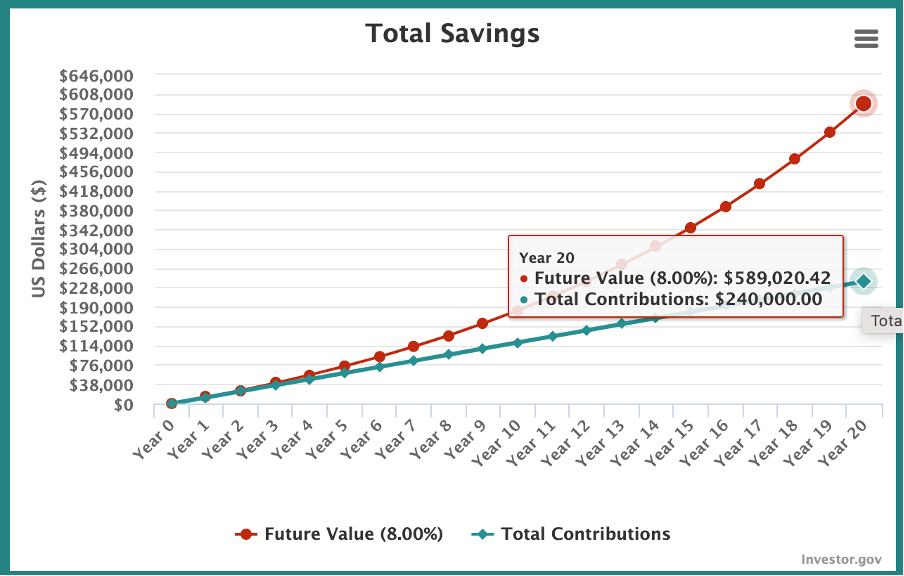

8. Lack of Consistency

People underestimate the effect of compound interest.

If one invests $1,000 a month for 20 years, their total contributions would be $240K. At 8% average interest rate, the total portfolio balance would reach $589K.

If one can achieve a 10% return, the total portfolio balance would be $759K.

For the portfolio to be valued at $1M, a return needs to be 12.1%.

The S&P 500 index has an average return rate of 10%.

Stellar returns are not necessary to have a portfolio of millions of dollars, the only thing that is necessary is patience and consistency!

While $1,000 might seem like a lot of money to some, it is very doable for the average American.

The median household income in the US is around $80K, which is around $60K after taxes, depending on the region. $12K a year is 20% of the after-tax income of the median household.

Investing consistently for decades is the highest probability method to become a millionaire.

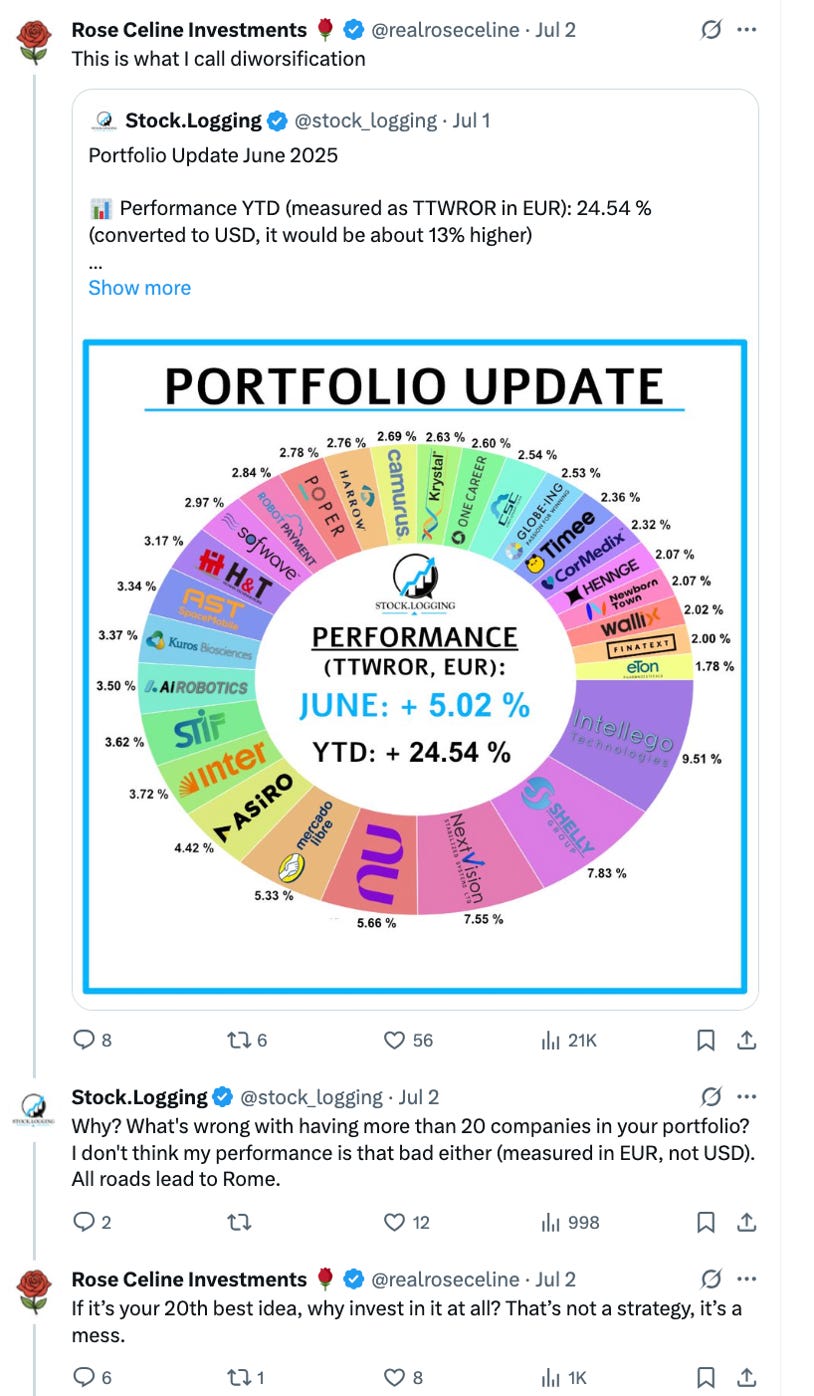

9. Diworsification

Many professional investors often talk about how diversification is very important to protect your portfolio and reduce risk.

While it is not entirely inaccurate, it is very misleading and doesn’t apply to retail investors!

Professional fund managers raise capital for investments from rich people and organizations. For their services, these professionals charge obscene fees. Diversification doesn’t make returns larger, and it doesn’t lower overall risk, what it does, however, is lower volatility.

Sometimes, even the best stocks fall 40-80%, because of various reasons (Netflix, Meta, Amazon, Microsoft, Apple, Nvidia, Tesla, Spotify all have had such downturns). If you have done your research and understand the company, these are buying opportunities.

The problem with professional investors is that they manage money for people who don’t know how to invest and lack understanding of the market.

So, when a fund is down 50%, investors ask for their money back, and the fund needs to liquidate even more at low prices. By avoiding volatility, the fund protects itself from these withdrawal requests.

For funds, capital preservation is of more importance than the growth of capital!

This is why they always preach about diversification. But individual investors don’t have such limitations, so they are not forced to sell a stock during a downturn.

So why would you limit your returns by diversifying into oblivion?

My opinion is that diworsification is a bigger issue than the lack of diversification!

Let’s look at this conversation I saw on X/Twitter the other day.

The confusion of the person sharing the portfolio is striking. “What’s wrong with having more than 20 companies?”

This is what listening to wrong advice does to an investor.

Rose’s response says it all. “Why invest in your 20th best idea?”

What is the point?

If one of your 2-3% holding returns 80%, that barely even registers on the total balance.

"Diversification is protection against ignorance. It makes very little sense for those who know what they’re doing." Warren Buffet

If you don’t know what you are doing, just buy the S&P 500 index.

However, if you do know what you are doing, make large investments in great companies that trade at great valuations.

Don’t invest in 30 companies like the person in the tweet above.

10. Timing the Market

Timing the market refers to the idea of selling now and buying in later when the prices are more affordable.

The problem is that timing the market is basically impossible for the average investor.

You have fund managers who have spent decades investing and studying the markets, yet they can’t even time the market.

The probability that you are correct in your analysis is very slim!

Let’s just look at the pandemic years. As the world was shut down due to lockdowns, many investors sold out, expecting further declines. Instead, we experienced a huge stock market rally.

Time in the market beats timing the market!

Buying stocks at regular intervals and not selling them for years is the best long-term strategy.

11. Conclusion

In conclusion, it is important to have a long-term mindset when investing, as having a short-term mindset leads to a lot of mistakes.

Be smart and mindful about your investing, don’t just buy a few stocks here and there, do real analysis, and have a thoughtful strategy.

Don’t invest more money than you can afford, build a decent savings account first!

At the same time, don’t be afraid to invest a significant share of your income. If you have no debts and limited expenses, use this opportunity to invest in your future.

Be consistent!

Be an investor, not a trader!

Don’t buy hype stocks!

Water your flowers, don’t water your weeds!

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.