10 Serial Acquirers to invest in!

Investing Basics. #5

Serial acquirers have been popular for decades, but in the last 10 years, they have become especially popular, as the benefits of their business model have become visible in their EPS.

Serial acquirers are businesses for which acquiring companies is not an occasional occurrence, but their core business model!

So we are not talking of Google, Meta, or Microsoft, who have done some of the most financially successful acquisitions of all time. We are talking of companies that follow a diligent and consistent acquisition strategy that focuses more on capital appreciation and shareholder returns rather than product or market share goals.

In general, serial acquirers tend to do a large volume of deals, sometimes in a specific niche, sometimes they just buy unrelated companies for an affordable price. Their business model is based on:

Decentralized management

Buying resilient businesses

Stable cash flows

Strong capital allocation discipline

High reinvestment rate

Operational synergies

Great purchase price

The key thesis is that there are many private companies that are extremely cheap, despite being very profitable!

This is because these companies are usually quite small and have low organic growth. An industrial equipment company making unique bolts could generate $10M in EBITDA, have a 20% EBITDA margin, and a stable demand. Yet, in some instances, such a company could be acquired for 4-6x EBITDA, for $40-60M. This is because, while the demand is stable, the organic revenue growth is very weak, sometimes -2% to 2% per year, and is very owner-operator driven.

There are few buyers for such a company, thus the multiple is so low. However, this could be an attractive opportunity for a serial acquirer, who could integrate it into their network and mimic many of the qualities that the owner-operator had. Additionally, quite often a serial acquirer is not looking to benefit from the organic growth of the acquired company, instead, it aims to reinvest the income generated into acquiring other companies.

This can be an extremely profitable business model, as in the example above, the acquired company would return the cost of acquisition in just 4-6 years. After which, the stable and consistent $10M EBITDA could be reinvested in other deals.

This creates a powerful compounding effect!

However, the ability to consistently execute accretive acquisitions while maintaining or improving the operational health of the base portfolio is not a universal trait among these companies.

For this reason, I thought it could be interesting to look at some of the best companies in this niche.

Here are 10 serial acquirers to consider.

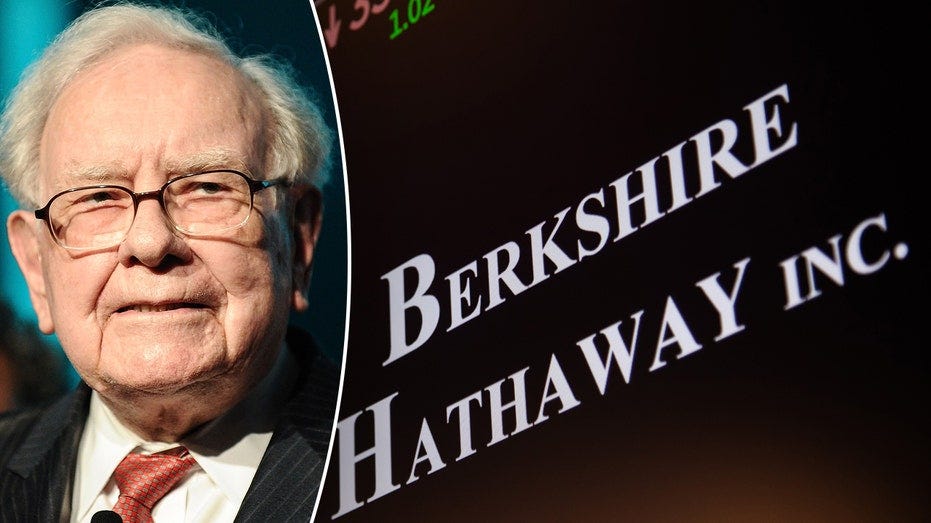

1. Berkshire Hathaway

Market cap: $1T.

P/E: 16

Warren Buffett’s Berkshire Hathaway is possibly the most famous and original serial acquirer. The company is mostly known in public as an investing holding company, with Buffett managing the $257B equity portfolio.

However, Berkshire has done hundreds of large and small acquisitions, which enabled it to accumulate $1.2T in assets!

Rather than competing in just one industry, Berkshire is the key holding company that powers the American economy through companies like GEICO, BNSF Railway, Dairy Queen, and scores of others.

In the last 12 months, Berkshire’s manufacturing segment had revenues of $77.6B, retail had $41B, and Berkshire Energy $26.4B.

These segments were entirely built by acquiring dozens of companies.

Its model is simple but powerful, acquire high-quality businesses, let them operate with autonomy, and redeploy the resulting cash flows into more acquisitions. While Buffett will retire this year, his chosen successor, Greg Abel, who has worked under Buffett for more than 20 years, will likely follow the same strategy.

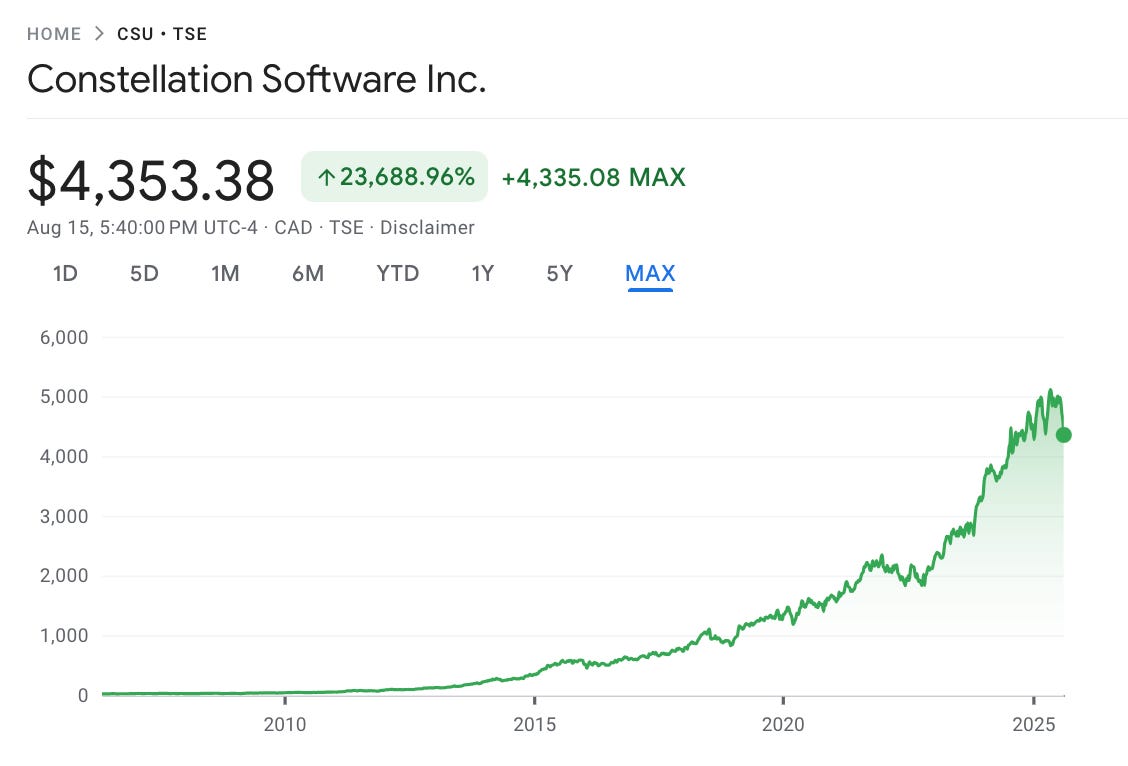

2. Constellation Software

Market Cap: CA$92B, $67B

P/E: 104

While Berkshire is the largest serial acquirer, it is often not considered as such. Meanwhile, Constellation Software is possibly the most serial acquirer that is mentioned as the gold standard of this niche.

Mark Leonard’s company is the most successful serial acquirer in the world. Since its founding in 1995, CSU has completed hundreds of acquisitions, buying small and mid-sized vertical market software businesses around the globe.

Vertical software companies build industry-specific software tailored to the unique needs of a particular sector. They have limited competition and are hard to replace. One famous example is a chicken coop software that counts how many chickens and eggs are in the coop.

In the last 12 months, Constellation generated $10.7B in revenues, and all of it comes from acquisitions that were stitched together over decades.

This relentless deal-making has compounded into a business worth over CA$92B, with more than 1,000 subsidiaries under its umbrella!

3. Topicus

Market Cap: CA$14B, $10B

P/E: 68

Topicus is the European cousin of Constellation Software, born out of CSU’s acquisition and spin-off of its Dutch operations.

While it is far smaller, with a market cap of around CA$14B, it is built on the exact same serial acquirer philosophy!

The company focuses on vertical market software in Europe, acquiring small niche providers that serve mission-critical needs in healthcare, education, finance, and public services. Over time, these dozens of bolt-on deals have created a diverse ecosystem of recurring-revenue businesses.

Rather than chasing a single global product, Topicus acts as a decentralized holding company, giving its acquisitions autonomy while using their cash flows to fuel the next round of purchases.

In the last 12 months, Topicus generated over €1.4B in revenue, while the stock is up 169% since the split.

4. Amphenol

Market cap: $133B

P/E: 44

Amphenol is one of the giants of industrial technology, a global leader in connectors and sensors with a market cap of $133B.

What makes it remarkable is not just its position in electronics but its relentless serial acquisition model. Amphenol has completed hundreds of bolt-on acquisitions over decades, steadily compounding by buying niche component makers across aerospace, automotive, industrial, and communications.

This model has enabled the company to grow by 77,907% since going public in the 1990s!

The company runs a highly decentralized structure, each acquired business keeps its entrepreneurial spirit and customer focus, while Amphenol uses their cash flows to reinvest in the next wave of deals. This small bites strategy has made Amphenol one of the most consistent compounders in industrials, with a long track record of double-digit growth.

In the last 12 months, Amphenol generated over US$18.8B in revenue, demonstrating that a disciplined, acquisition-driven model can scale to extraordinary size without losing focus.

5. HEICO

Market cap: $37B

P/E: 72

HEICO is the aerospace company that’s been steadily compounding for decades through disciplined acquisitions.

Much like Constellation in software or Amphenol in electronics, HEICO thrives on a serial acquirer model, but in industrials. It buys dozens of small, family-owned aerospace and defense parts makers, often niche providers of FAA-approved replacement parts or mission-critical components.

Aviation and military parts are extremely regulated, thus, having been certified by a government agency essentially guarantees a steady demand!

Each deal is modest in size, but over time, they add up to a significant, high-margin portfolio.

The company’s decentralized structure lets acquired businesses keep their entrepreneurial culture, while HEICO provides capital, scale, and access to global customers. By reinvesting strong free cash flows into more bolt-on deals, it has compounded earnings for 30+ years at one of the best rates in industrials.

In the last 12 months, HEICO generated US$4.1B in revenue, while its stock has returned over 100,000% since going public.

A truly insane 1000-bagger returns!

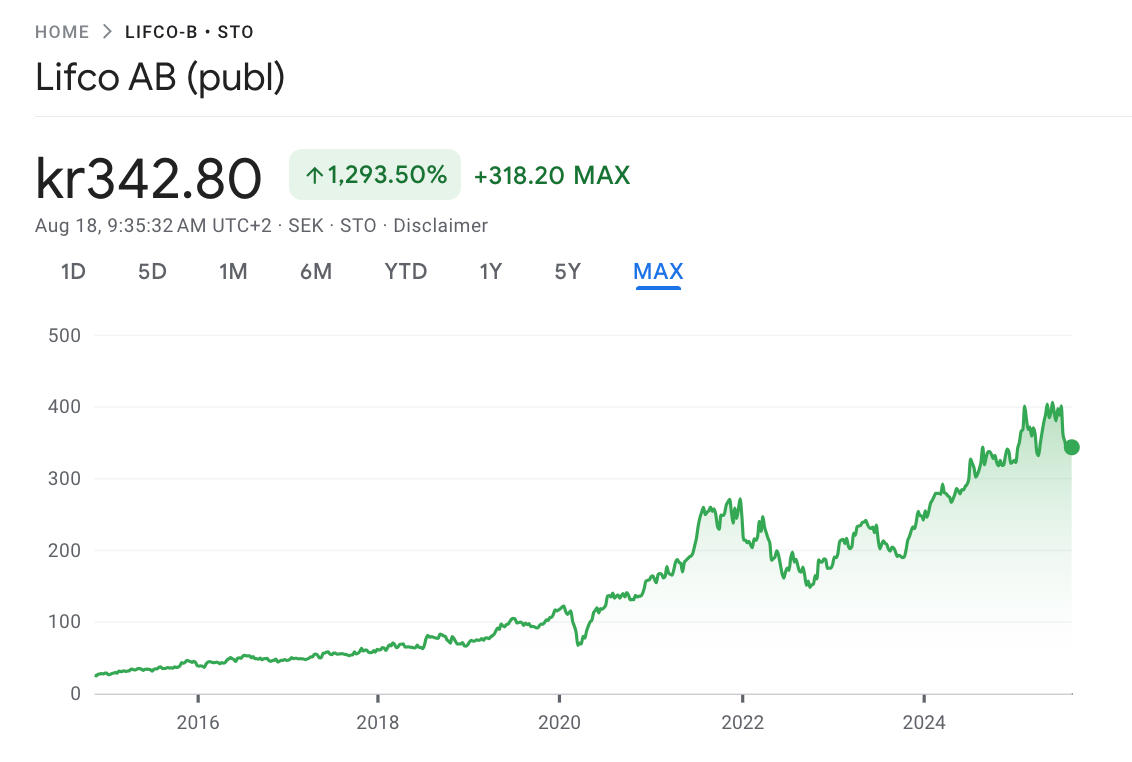

6. Lifco

Market cap: SEK 156B, $16B

P/E: 46

Lifco is Sweden’s serial acquirer compounding machine, generating $2.9B in sales in the last 12 months. A $16B market cap holding company that has become one of Europe’s most consistent serial acquirers.

Just like Constellation Software and Heico, Lifco acquires small and medium-sized businesses, often in highly specialized industrial niches, dental equipment, demolition tools, and construction. These companies usually dominate their narrow markets, generate strong cash flows, and are allowed to stay entrepreneurial under Lifco’s decentralized structure. Meaning they decide capex needs and sometimes make acquisitions themselves.

Rather than chasing scale in one industry, Lifco spreads its bets across hundreds of acquisitions, each one a small bolt-on that adds stability and diversity to the group. With cash flows recycled into the next round of deals, the flywheel spins faster every year.

Since going public in 2014, Lifco’s stock is up 1,293%!

7. Teqnion

Market cap: SEK 2.5B, $260M

P/E: 22

Sweden is somewhat famous for having many serial acquirers, with Teqnion often seen as the little cousin of the other acquirers.

The company focuses on acquiring small, profitable niche businesses across industrials, technology, and services, mostly in Sweden. Like its larger peers, Teqnion runs a decentralized model, and founders keep autonomy, while Teqnion provides stability and reinvests the cash flows into the next wave of acquisitions.

What sets Teqnion apart is its size and pace. It’s still small enough that each bolt-on deal moves the needle, giving investors the classic early-stage compounder profile. In just over a decade, it has built a diverse network of subsidiaries, each contributing to resilient recurring earnings.

In the last 12 months, Teqnion generated more than $175M in revenue, while the stock has delivered 284% returns since its IPO!

8. TransDigm

Market cap: $78B.

P/E: 46

TransDigm is often called the private equity of aerospace, a $78B juggernaut built on a never-ending series of acquisitions.

The company specializes in highly engineered, proprietary aircraft components, where it can command monopoly-like economics. It’s a classical serial acquirer model, buy niche aerospace suppliers, keep them decentralized, and persistently focus on pricing power, margins, and cash flow.

Over the decades, TransDigm has executed hundreds of acquisitions, rolling up everything from actuators to cockpit switches. Each deal expands its portfolio of mission-critical, FAA-certified parts, a business model that basically guarantees recurring aftermarket servicing revenue for decades.

The result is a compounding machine with EBITDA margins of 51%, fueled by acquisitions and reinvestment discipline.

In the last 12 months, TransDigm generated $8.66B in revenues, while as a public company stock has returned over 5,449%!

9. Roper Technologies

Market cap: $57B

P/E: 37

Roper Technologies is a giant of the US industrial software space that has reinvented itself through serial acquisitions become a $57B company.

Originally an industrial conglomerate, Roper has steadily shifted toward asset-light, high-margin businesses by acquiring niche software and tech-enabled companies. Its targets are sticky, mission-critical providers in verticals like healthcare, education, and finance, businesses with recurring revenues and strong cash flow profiles.

I think you might have grown tired of hearing it at this point in the article, but Roper also runs a decentralized model. Acquired companies get to keep their entrepreneurial independence, while Roper uses their profits to fund the next round of deals. Over the years, this disciplined reinvestment has transformed it into one of the most consistent compounders.

In the last 12 months, Roper generated over US$7.5B in revenue, showing that a patient, acquisition-driven strategy can scale into a diversified, large-scale enterprise. This is what makes these serial acquirers so attractive.

They don’t deliver explosive Y/Y growth, but companies such as Roper can steadily compound to grow over 240X in 3 decades!

10. Vitec Software Group

Market cap: SEK 15B, $1.6B

P/E: 38

Vitec is the smaller Swedish cousin of Constellation Software and Topicus, operating in the vertical market software space.

The company focuses on buying niche, mission-critical software providers across the Nordics and beyond, often targeting businesses with high recurring revenues in industries like real estate, healthcare, and utilities. Each deal is small and focused, but over time, they accumulate into a resilient group of sticky software businesses.

Vitec runs a buy-and-hold model where acquired companies retain operational independence, while Vitec provides capital and stability. Again, we are seeing that decentralization is a key strategy here. It is the only way to scale small few-million-dollar deals into a $1B+ company.

Vitec uses the strong earnings to fund further acquisitions, spinning the flywheel faster with each passing year.

In the last 12 months, Vitec had sales of $370M a true Nordic champion of the serial acquirer playbook.

Since going public in 2004, Vitec has delivered decades of steady compounding to its long-term shareholders, growing over 184x!

11. Conclusion

It is clear that serial acquirers have identified a working model. Acquire profitable companies for a reasonable amount of money. Integrate them into the conglomerate by providing operational support to save costs, but then get out of their way.

Decentralization is a key theme behind the success of these companies!

This is because, fundamentally, serial acquiring is a volume business. You can’t acquire tens or even hundreds of companies with a centralized model. Centralization slows down decision-making and interferes with the execution.

Hiring competent managers and insisting on a great company culture is a must for a company to steadily compound over decades!

Failed serial acquirers such as General Electric, Valeant Pharmaceuticals, and many private equity copycats didn’t understand the importance of culture. They just bought companies without caring about culture, centralized too much, and made bets that were too large. The larger the acquisition, the bigger the integration risk.

Furthermore, being an investor in a serial compounder requires a certain mindset. These are not flashy companies with high Y/Y growth, stellar margins, and easily identifiable catalysts. Serial acquirers are slow burners that compound over decades. Thus, they tend to underperform sometimes if one looks at a few-year chart.

So, serial acquirer investors must have patience.

Moreover, looking at the future, to me it seems that the serial acquisition field remains exciting. While competition for deals is intensifying, there are still many unique companies that could be acquired. Especially, as the boomer generation retires en masse.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Great article! How about Röko?

The former CEO of Lifco started Röko in 2019. Therefore, the management is highly experienced. Instead of focussing only on a few sectors like Lifco, Röko is "sector agnostic", which enables them to pick companies from a larger pool.