Are Bulls right? A look into Palantir's incredible Q3!

Revenue Acceleration, High Margins, and a Strong Guidance.

Palantir just delivered another extraordinary quarter, once again demonstrating why they are one of the best-performing stocks of the last 5 years.

Revenue growth accelerated to 68.2% Y/Y

The international segment is finally improving

Large customer count is growing fast

Record high retention

Net margin surpassed Microsoft and Google

Increased guidance

Yet, this wasn’t enough for the market, as the stock is now down 8% after earnings.

I believe we could be reaching a ceiling for the stock, as despite incredible execution, Palantir trades for an extremely demanding valuation.

In such cases, even incredible execution is not enough, as the company has a market cap of $452B.

Let’s look at Q3 in more detail.

1. Financials

2. US Commercial

3. US Government

4. US Revenue

5. International Segment

6. Valuation

7. Conclusion

1. Financials

Simply put, Palantir absolutely killed this quarter!

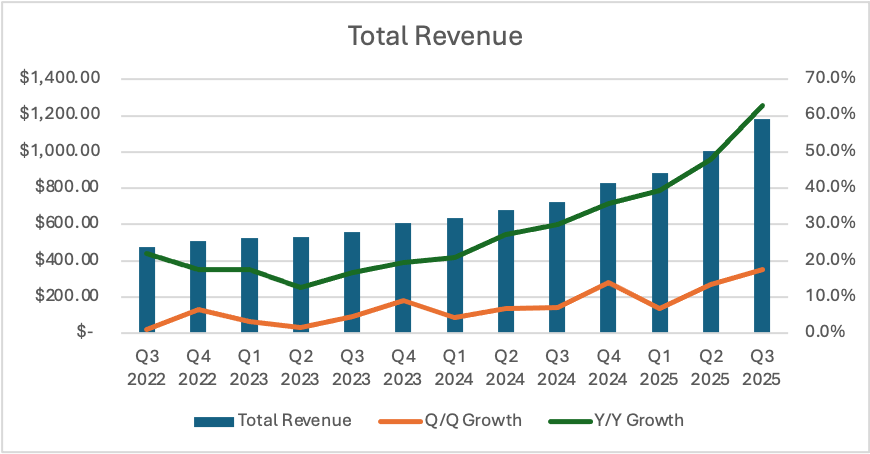

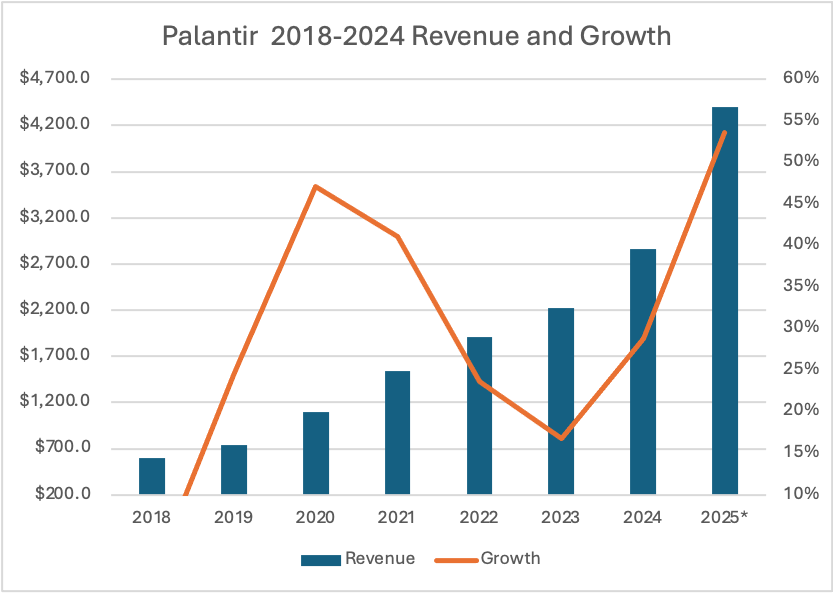

Revenue grew 68.2% Y/Y to $1.2B, whilst operating income and net income exploded by 247.6% and 231.6% to $393.3M and $475.6M.

Revenue growth showed strong acceleration from 30% in Q3 2024 and 48% in Q2 2025.

In the graph above, it’s clear revenue continues growing at a steady and rapid pace, with each quarter showing positive Q/Q growth. The green line tells the story of Y/Y growth accelerating each quarter for 9 quarters in a row.

This performance is the result of Palantir gaining high-value customers, who keep signing ever larger deals.

Customers sign a deal with Palantir in one vertical, and after being very satisfied with the result, they sign more and more deals in other verticals.

This is a potent formula that delivers exponential revenue growth!

1.1. Total Customers

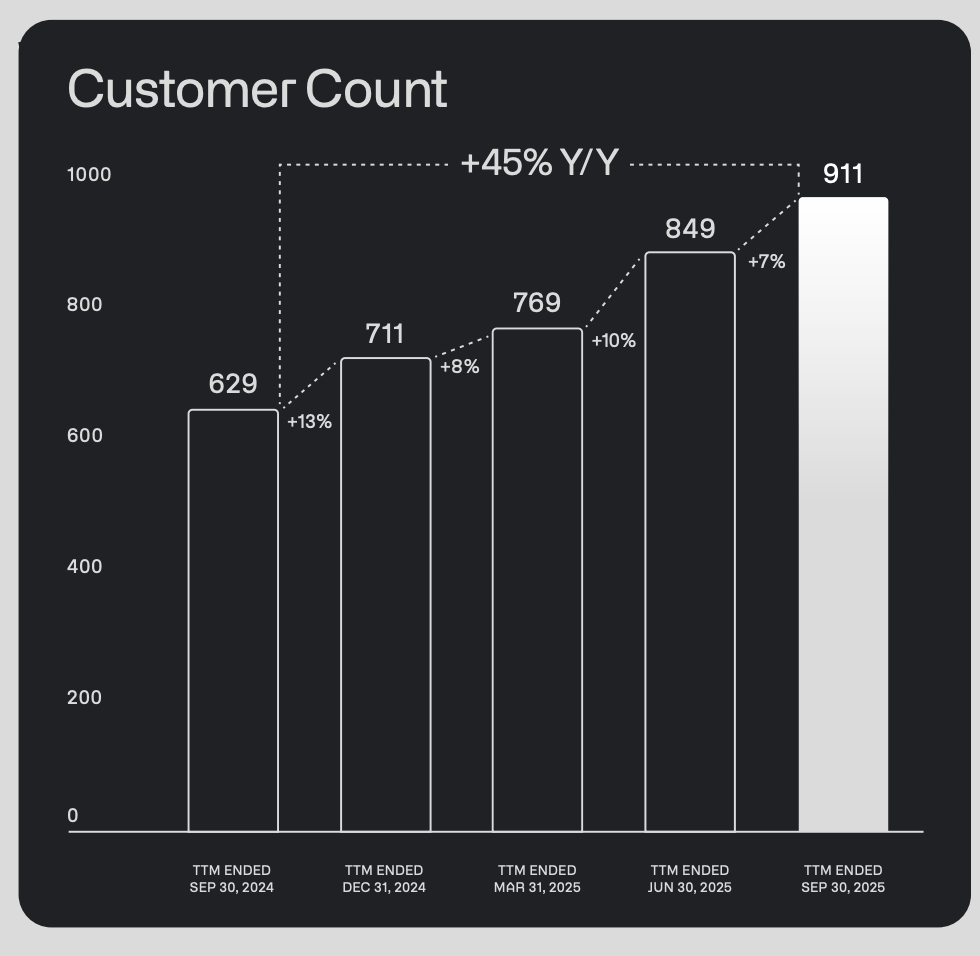

In Q3 2025, Palantir gained 62 new customers, an increase of 7.3% Q/Q and 44.8% Y/Y!

AIP continues to be a huge driver for Palantir.

A reminder that AIP is their AI platform product that enables organizations to essentially build a proprietary ChatGPT-like app. This local LLM is trained with an organization’s internal data, which is used to answer employee questions, saving time and resources.

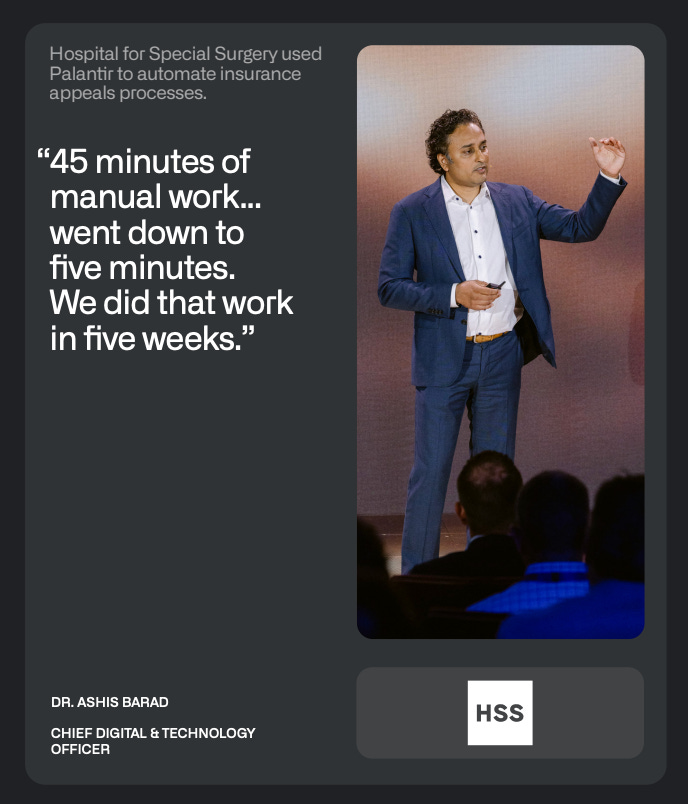

The Hospital for Special Surgery in New York City was able to reduce a 45-minute task of reviewing insurance appeal processes down to 5 minutes.

1.2. Deals and Net Dollar Retention

Acquiring customers is difficult and expensive, especially in the enterprise software space with long lead times and very specific requirements. Thus, for any aspiring SaaS businesses, it is extremely important to 1) retain existing customers and 2) upsell them more services.

Realizing this, Palantir has taken a rather unique approach in the enterprise software space, not charging customers for implementation. In their eyes, by not charging for implementation, Palantir is incentivized to build more efficient customer acquisition and onboarding procedures.

This approach is delivering supreme results, as in Q3 2025, they signed 204 deals of $1M+, 91 of which were for $5M+, and 53 for $10M+.

This is an incredible increase from a year ago, when 104 $1M+, 36 $5M+, and 16 $10M+ deals were signed.

This means that $1M+ deals grew by 96.2%, $5M+ by 141% and $10M+ by 231%!

An especially strong increase in large deals signals that Palantir is gaining customer trust and they are choosing to use Palantir’s services in more use cases.

I think it is quite likely that in the future, Palantir will stop disclosing $1M deals as they are increasingly irrelevant and begin disclosing $20M and $50M deals.

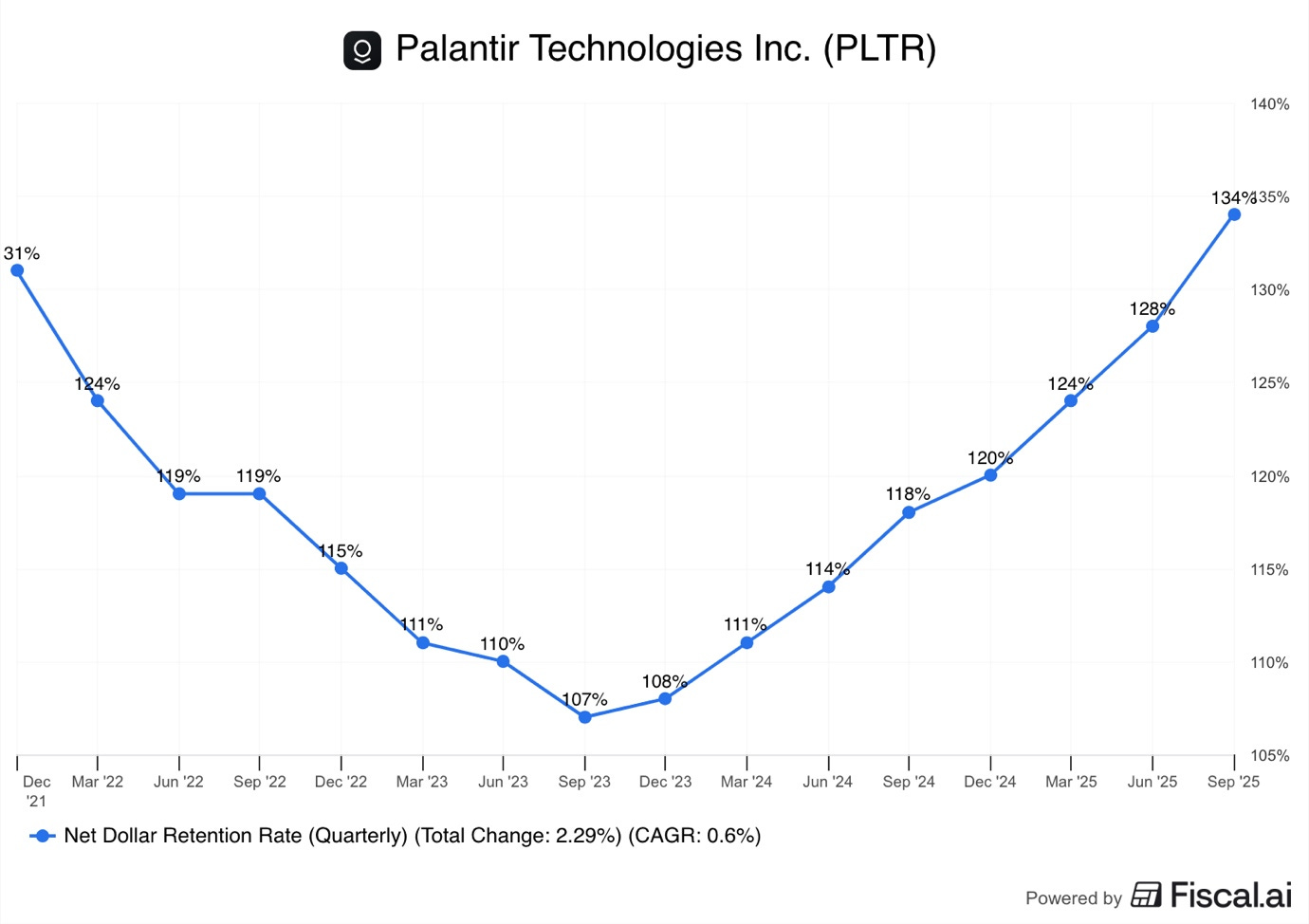

Net dollar retention measures how much existing customers spend with Palantir. In Q3 2025, NDR reached an all-time high of 134%.

Put simply, even if Palantir didn’t add any new customers, its Q3 2025 revenue would still be up 34% thanks to existing customers.

This means that from the 68% Y/Y revenue growth, 34% came from new customers.

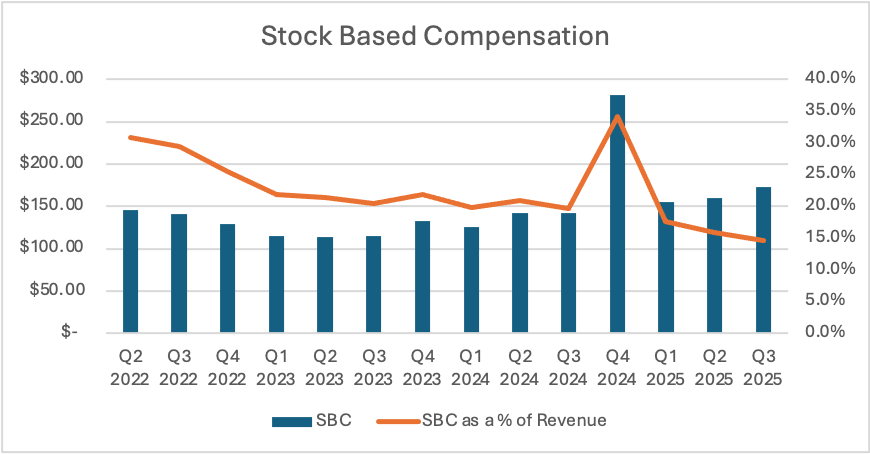

1.3. Stock-Based Compensation

Many analysts have lambasted Palantir for its generous and excessive share-based employee compensation. However, I don’t believe that this claim is warranted anymore, as the company has shown a consistent pattern of flatlining share-based compensation despite incredible revenue growth.

This quarter, Palantir spent $172M on SBC, just 21% higher than in Q3 last year.

SBC growth of 21% is considerably below the 62.8% revenue growth, which means that SBC as a share of total revenue decreased substantially.

SBC is now 14.6% of total revenue, down from 19.6% in Q3 2024 and 15.9% in Q2 2025!

In the graph above, we see that, barring the vesting of special employee stock awards in Q4 when Palantir’s stock reached certain goals, SBC has been going down as a share of revenue, and that is expected to continue.

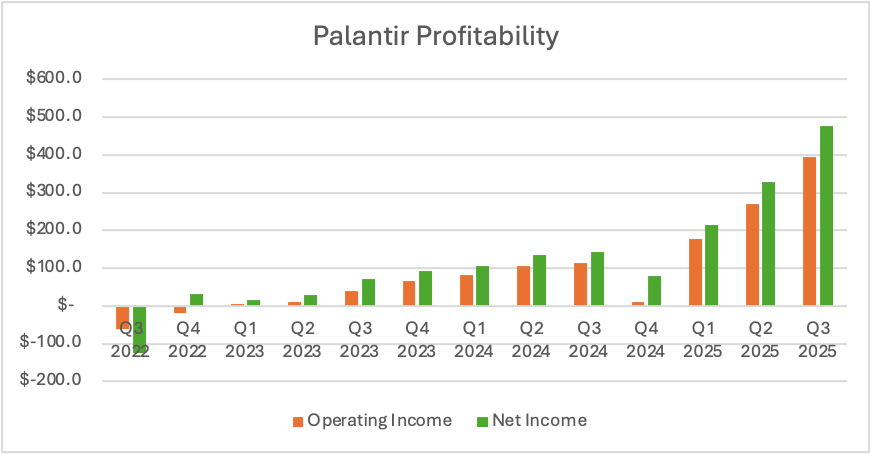

1.4. Profitability

Operating income jumped 247.6% Y/Y to $269M, enabling the operating margin to increase from 15.6% to 33.3 %.

Palantir provides a highly scalable digital service that requires a relatively low amount of incremental costs. This means that as the company scales, its margins are increasing rapidly.

Net income jumped an impressive 231.4% to $475.6M, bringing the margin to 40.4%!

This means that this quarter, Palantir delivered a higher net income margin than Microsoft and Google!

This is an incredible achievement that even the strongest of Palantir supporters didn’t believe would happen so quickly.

Palantir’s net income is higher than its operating income, as it’s boosted by $60M in interest earnings from its $6.4B cash mountain.

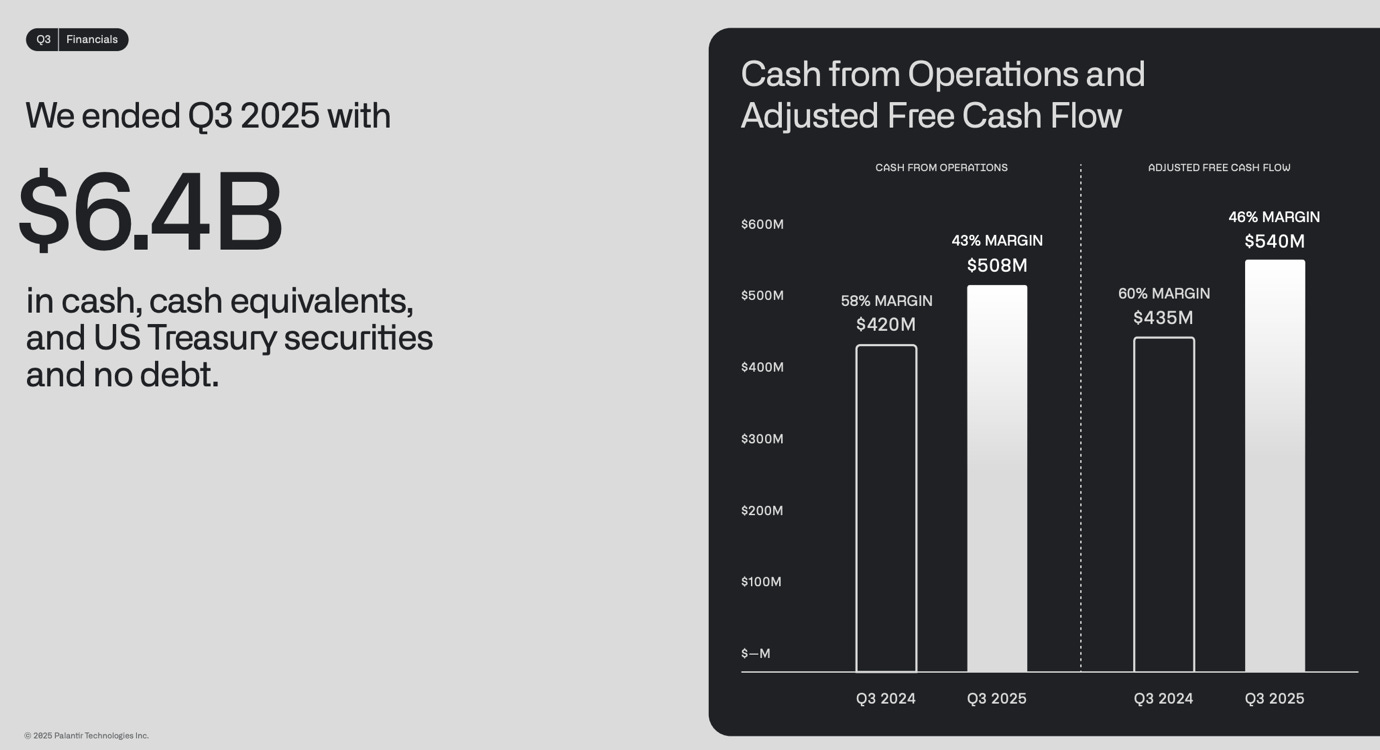

1.5. FCF

Palantir is quickly turning into a paper-hungry cash flow printer, delivering $540M in ADJ FCF, a margin of 46%.

While this is a strong figure in absolute terms, FCF grew by 20.5% Y/Y, but decreased 5.8% Q/Q!

This is not a cause for concern and simply reflects standard operating dynamics for Palantir. The company experiences swings in FCF due to the timing mismatch between cash outflows to suppliers and cash inflows from customers. They often receive large bulk payments for various contract implementation stages.

We saw similar dynamics play out in Q2 2023, Q1 2024, and Q1 2025, when FCF declined 52.8%, 52.7% and 33.5% Q/Q.

This quarter, accounts receivable reached $1B, growing by around $260M, 34.5% Q/Q, indicating that Palantir did a lot of work for customers for which they still need to be paid. Assuming standard 60–90 day corporate payment terms, a lot of this should be collected in Q4.

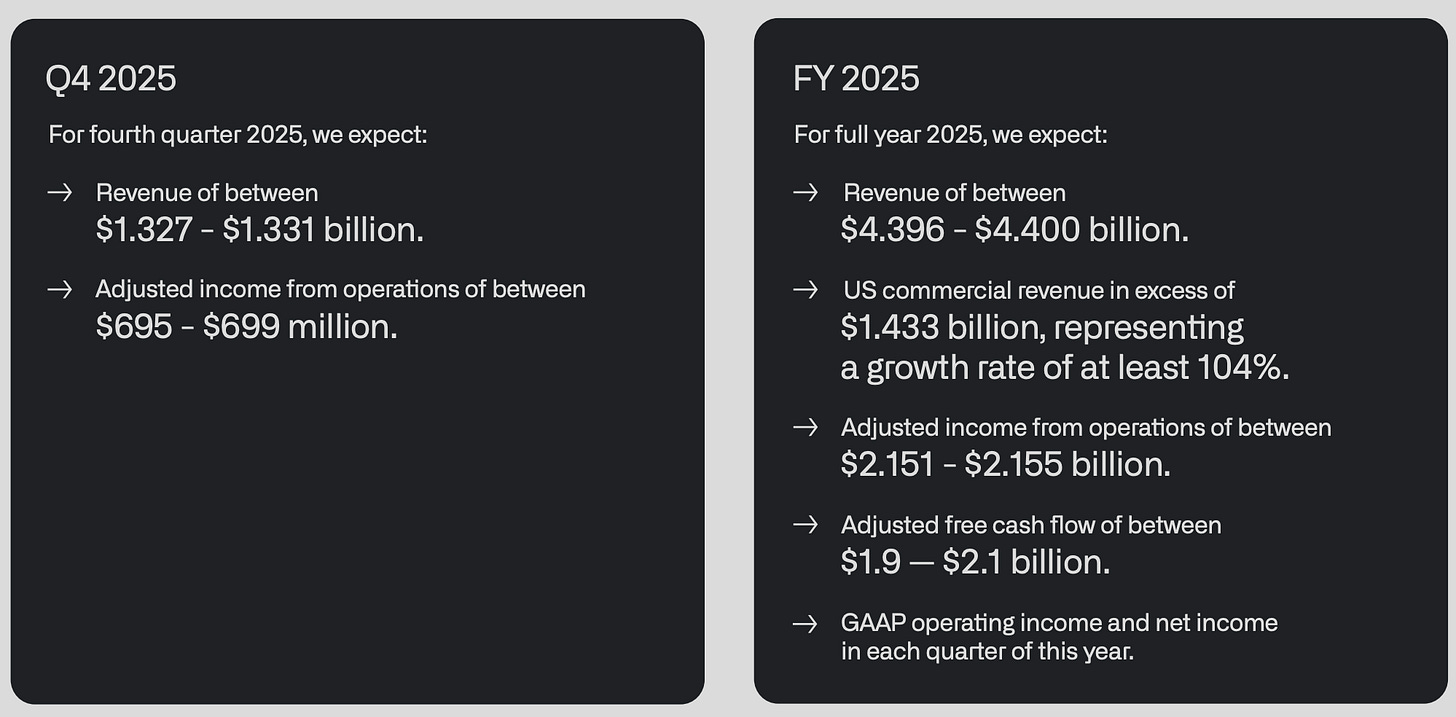

1.6. Guidance

In the next quarter, Palantir expects revenues of around $1.33B, which would be an increase of 60% over Q4 2024!

This is a major growth acceleration from all quarters this year, exactly what the bulls have been saying will happen, incredible.

For the full 2025 year, the company expects to grow revenues by around 53.6% to $4.4B, a huge increase from the 31% growth it guided for 2025 in Q4 2024!

Palantir’s full-year guidance implies that the company expects to sustain the accelerated growth rate.

Investors were hoping that Palantir would raise its guidance significantly, and they got it. In the graph above, we see that that would be a huge acceleration from 2024, 2023, and 2022.

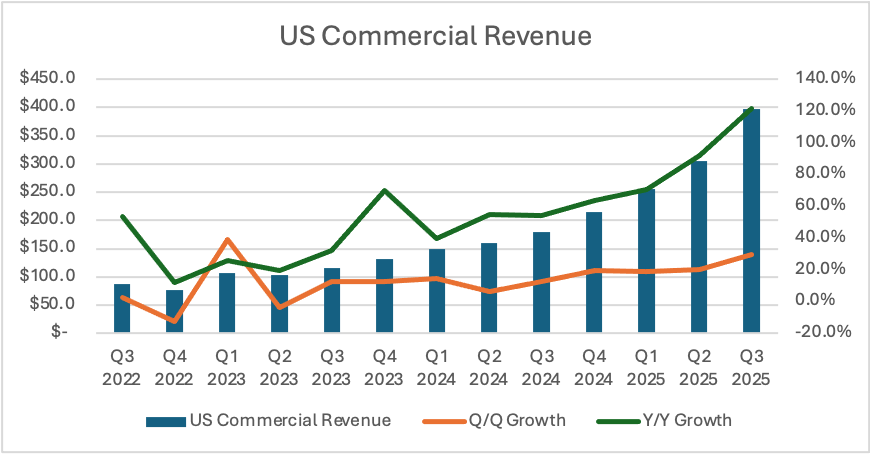

The US commercial revenue growth guidance was raised from 85% to 104%!

2. US Commercial

In this segment, Palantir reports revenue from US-based corporations.

For years, Palantir bulls claimed that the commercial opportunity for Palantir is many times larger than the governmental one. For investors to buy into this thesis, Palantir had to show faster growth.

In Q3 2025, US Commercial revenue grew 121.4% Y/Y to $397M!

This is a significant acceleration from 54.1% growth in Q3 2024 and 92.2% in Q2 2025. Palantir also demonstrated an incredible 29.6% Q/Q growth. This is the type of growth that most companies would dream of on a Y/Y basis, not quarterly.

The orange line in the above graph indicates this was the best result in 11 quarters!

Additionally, as indicated by the green line in the graph, Palantir recorded its highest-ever Y/Y US commercial growth rate.

Another impressive stat is that the total contract value of this segment grew a shocking 342% Y/Y and 54% Q/Q to $1.3B, driven by a 5x jump in deals over $5M!

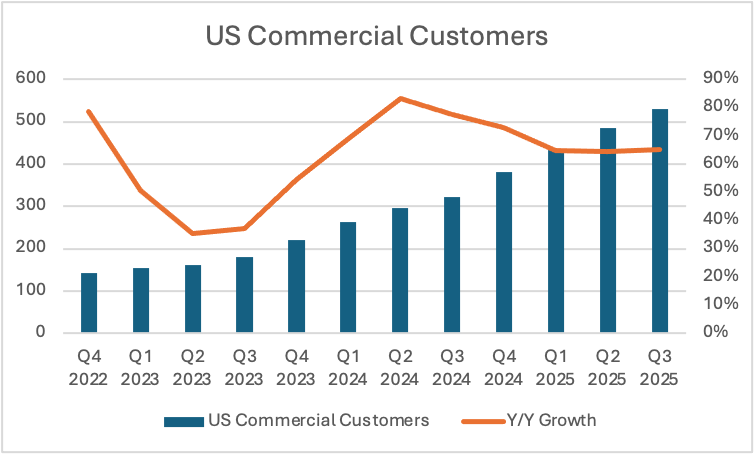

It’s no surprise this growth comes alongside rapid expansion of their customer base, Palantir gained 209 new customers Y/Y and 45 Q/Q, totaling 530.

In the graph above, we see that Palantir has consistently grown its US commercial customer base by around 50% per year since Q4 2023!

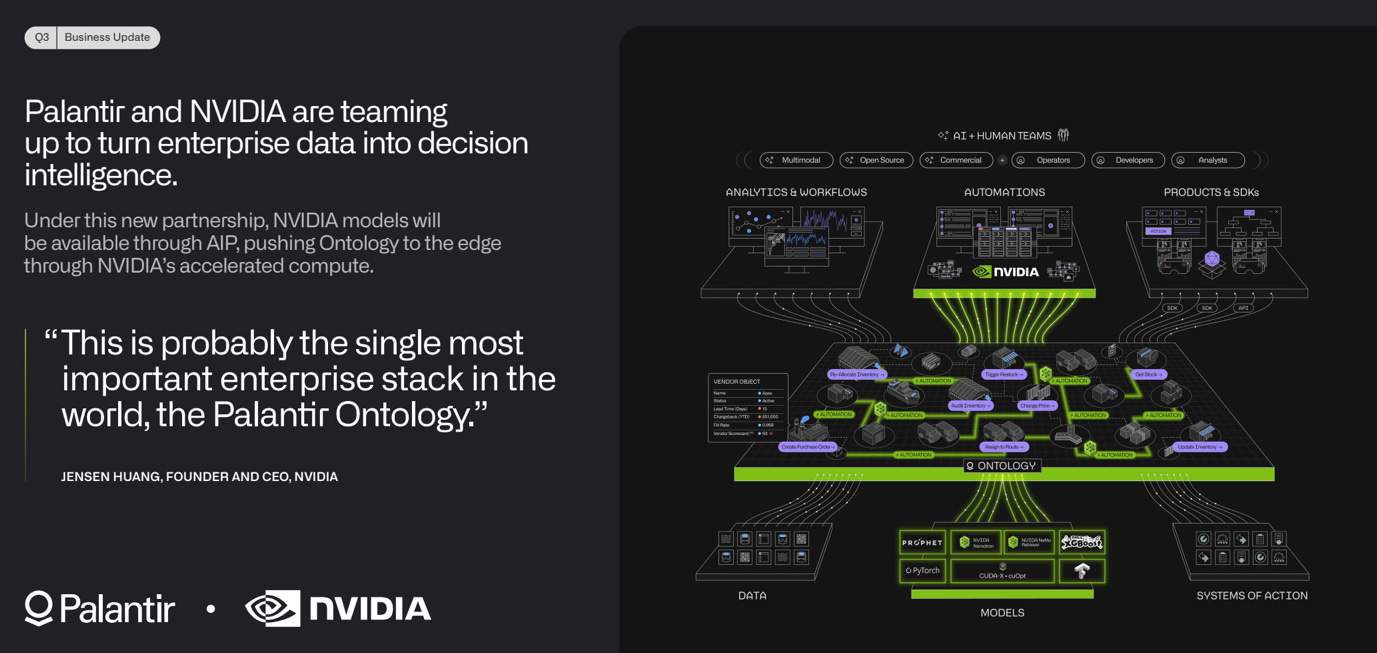

The big news of this quarter was Palantir’s partnership with the AI chip-making giant Nvidia.

Both companies will work together to integrate Palantir’s Ontology systems and Nvidia’s AI hardware, AI models, and software to deliver an improved and optimized user experience.

Previously, Palantir simply used Nvidia GPUs and CPUs through general cloud computing services from its cloud providers like AWS and Azure. This partnership means that both companies will develop software together to get better performance from Nvidia’s GPUs for the exact workloads that Palantir customers are using them for.

Nvidia signs dozens of partnerships every month, as the company is the world’s largest company and AI queen, and everyone wants to dance with the queen of the ball.

Most of these announcements are nothing burgers that are just used as marketing for the partner company and are not worth looking into. Many of these deals have little substance and just mean that the partner company simply uses Nvidia chips for something.

The Palantir deal is not one of those PR deals!

This is a deep technical and operational integration that involves the AI model layer, AI inference layer, application layer, and, most importantly, joint sales activities.

If I understood correctly, both companies plan to engage in a sort of co-selling activities of an integrated product. Palantir will tell its customers something sorts of “Hey, use AIP together with Nvidia chips for the best result”. Meanwhile, Nvidia will say, “Hey, for best use of our chips, use AIP”.

In the announcement, they specifically talk of “reference workflows”. In this context, they mean a pre-built, validated, and optimized blueprint for an end-to-end, high-value AI process that customers can deploy quickly on the integrated Palantir/Nvidia stack.

Nvidia is seen as the golden standard in AI, and Palantir’s sales teams will certainly use this partnership as a talking point in negotiations.

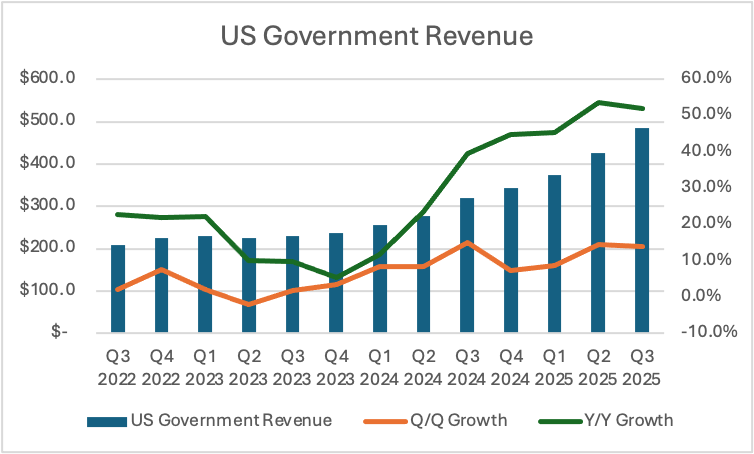

3. US Government

Palantir’s software is used by many US government agencies such as the FBI, CIA, DoD, and more. Revenue from these government agencies is reported in this segment.

Despite persistent claims that Palantir’s government growth is unsustainable, this quarter’s results decisively refuted that argument.

The US government revenue grew 51.9% Y/Y to $486M!

Far from reaching a ceiling, Palantir’s US government business continues to demonstrate that the TAM is significantly larger than many analysts believed.

If we look at the green line in the above graph, we see that while the Q3 2025 growth rate was slightly slower than the prior quarter, the company still delivered one of the best results in its history and a major improvement from 39.5% growth in Q3 2024.

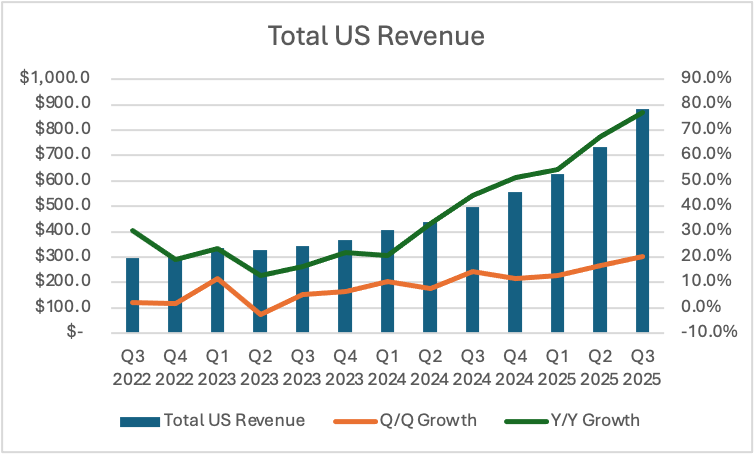

4. US Revenue

Total US revenue grew 76.9% Y/Y to $883M!

Growth accelerated from 44.4% in Q3 2024 and 67.7% in Q2 2025.

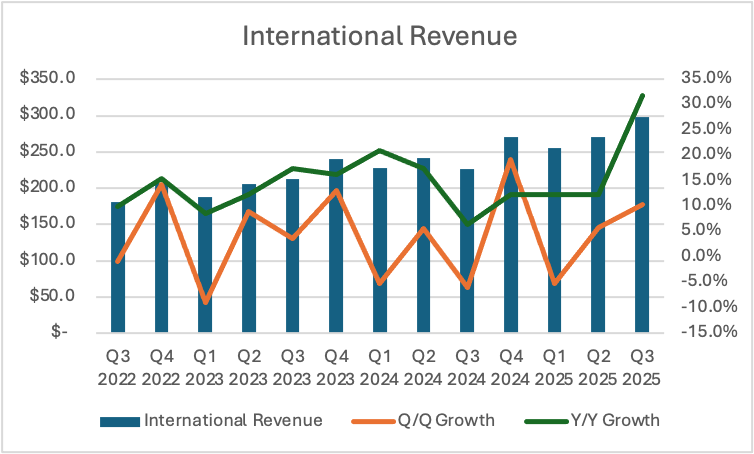

5. International

For some time already, the international segment has significantly underperformed the US. Alex Karp has consistently expressed his belief that Europe is sleeping on the AI opportunity and is too stupid to realize the value Palantir services bring (I am paraphrasing), but soon they will realize this, and revenue growth will accelerate.

Many analysts questioned this assertion and thought that rather than being a few years behind the US, the international segment is structurally different than the US!

If, due to aversion to AI or advanced technology adoption, the growth is pushed out a few years, Palantir could see further growth acceleration as international growth picks up.

However, it might be that growth internationally will remain weak due to structural issues and higher competition from local players. Trump has not made himself popular in Europe, and it might be politically difficult for EU governments and corporations to use Palantir’s services. Organizations in the EU might prefer local software, even in cases where it is inferior to Palantir.

However, this quarter we saw the first signs that Alex Karp might be right!

The international segment reported revenues of $299M, an increase of 31.8% Y/Y.

This was a meaningful acceleration from 6.5% growth in Q3 2024 and 12.3% in Q2 2025!

If international growth is a little bit behind the US, then this segment could be poised to deliver really strong growth in the next few years. Palantir needs this to keep the current growth cadence intact.

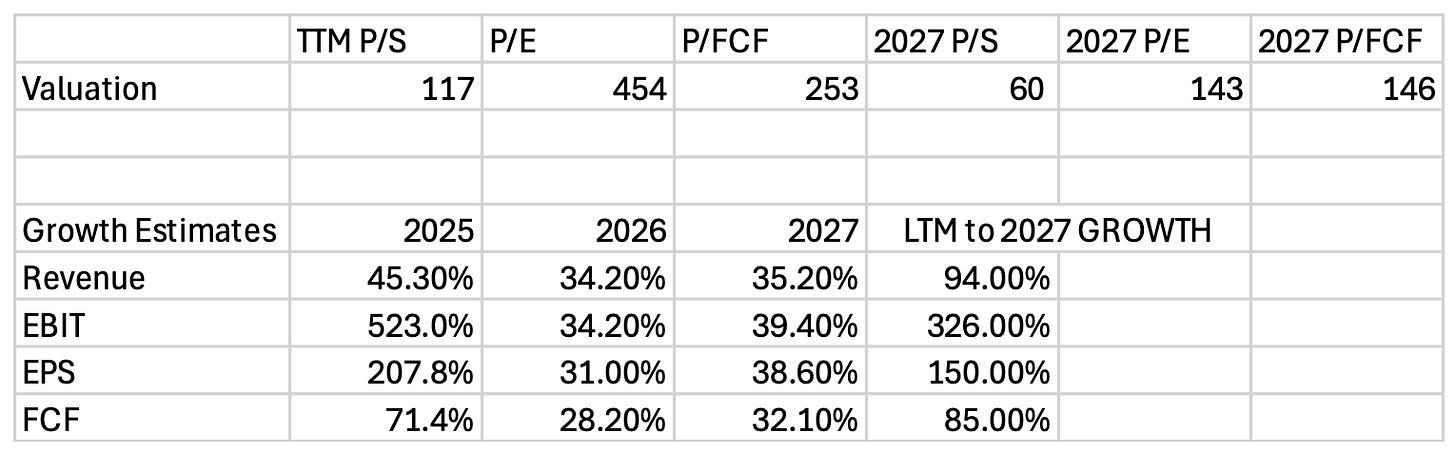

6. Valuation

After an incredible year in which Palantir has risen over 150%, the company has a market cap of $452B, making it the 21st largest company in the world!

Despite undeniably amazing execution, it is extremely hard to justify such a market cap.

As we can see in the table above, the company trades for a truly insane P/S of 117 and P/E of 454!

Looking at growth expectations, we see that the company is forecast to double its revenues by 2027, with EBIT and EPS expected to grow by 326% and 150%.

While this is strong growth, it is not strong enough to justify the valuation, as the company’s 2027 valuation metrics of 60 P/S, 143 P/E, and 146 P/FCF are still extremely high.

This clearly implies Palantir’s shareholder base expects the company to significantly outperform analyst expectations!

So far, they have been right, but will that remain the case in the long term as well?

Let’s build a valuation model to see what kind of growth Palantir’s shareholders are expecting.

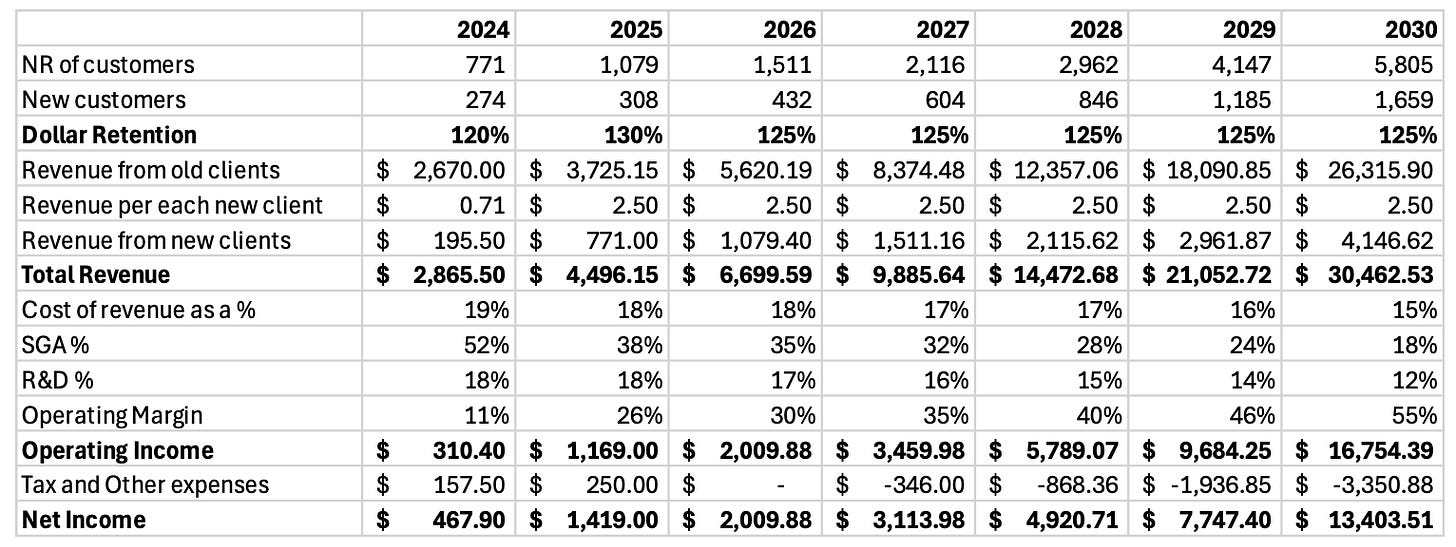

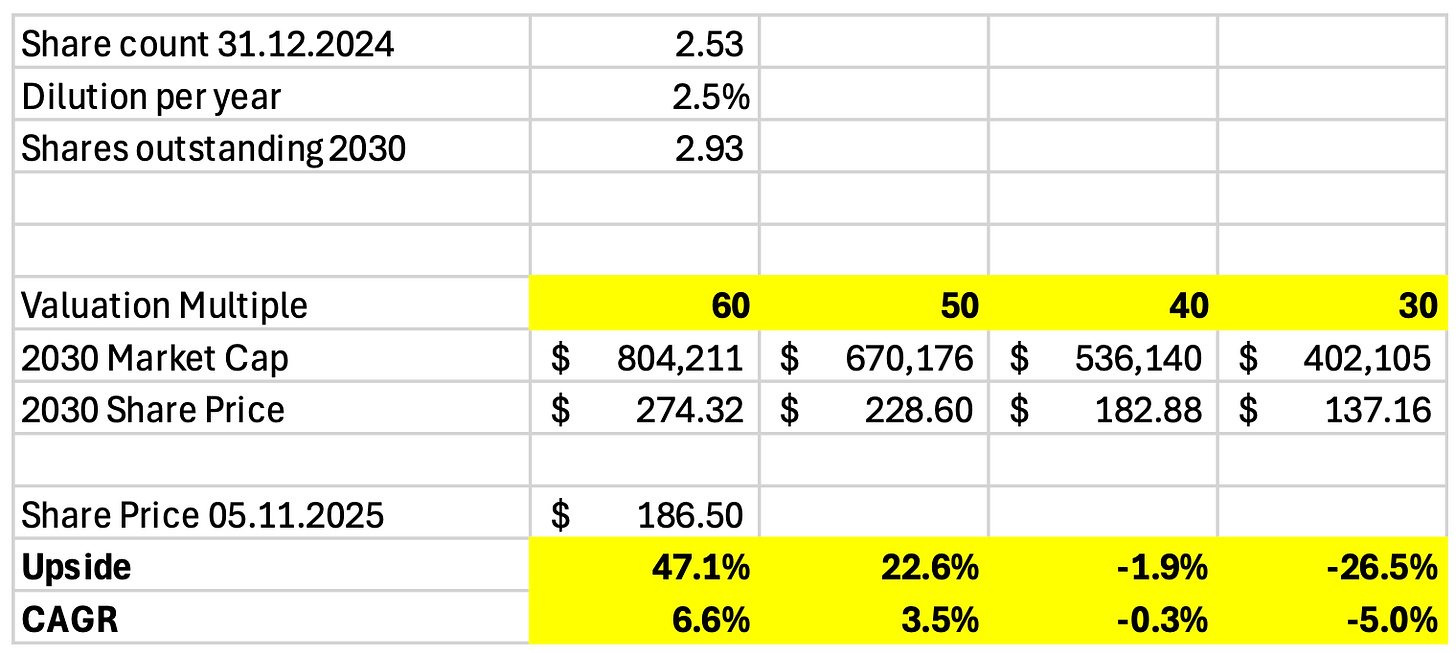

6.1. Valuation Model

Customer CAGR: 40%

Net Dollar Retention: 125%

Revenue per each new customer: $2.5M

Cost of revenue: 15%

SGA as a % of revenue: 18%

R&D: 12%

Operating margin: 55%

Tax, others, and net of interest: 20%

We get to revenues of $30.5B, operating income of $16.8B and net income of $13.4B!

Next, I model a modest dilution of 2.5% per year.

Assuming a generous exit multiple of 60, we get a $274.32 stock in 2030.

This would be an upside of 47.1%, a CAGR of 6.6%!

So Palantir could 6x revenues and 9x earnings in 5 years, and the stock could still barely move. This is the danger of investing in something with an absolutely insane valuation.

The only way for Palantir’s shareholders to make any gains from now till 2030 is for the company to either 1) retain their multiple, or 2) retain the current growth trajectory.

If Palantir still trades for a very high P/E of 100-200, the stock could have an upside of 145-390%. This would be a very healthy return, but basing one’s investment decisions on hopes of this insane valuation remaining is not a prudent long-term investing strategy.

Next, if I change the revenue CAGR to 60% and leave the 50-60 multiple, the potential upside increases to 106-147%.

I am a firm believer that AI is one of the most important technologies that humanity has ever created, however, I am extremely skeptical that Palantir could sustain a 60% CAGR for the next 5 years.

There are just too many things that need to happen for investors to make a healthy return from now on!

I will continue to analyse this company from the sidelines.

7. Conclusion

Bulls argue that Palantir, as once in a once-in-a-generation company, deserves once in a once-in-a-generation valuation. So far, Palantir has performed spectacularly, proving the bulls right.

The revenue acceleration to over 60% is simply incredible!

Palantir is rapidly embedding itself across core government and business functions, becoming an AI-driven operating system. The partnership with the world’s largest company, Nvidia, is a strong testament to the quality of their offering.

“This is probably the single most important enterprise stack in the world, the Palantir Ontology.” NVIDIA CEO Jensen Huang

However, there is no denying that the valuation is simply insane!

Never in the history of the stock market has there been a company trading for a P/S of 117 and a P/E of 454 at this scale. This means that investors are pricing in the company becoming a huge AI winner in a rapidly evolving global industry.

That certainly is a possibility, however, as the valuation model showed, even a 45% revenue CAGR, improving margins, and a high exit multiple of 60, would only lead to a CAGR of 6.6% by 2030.

So, for investors to have meaningful gains from now on, the valuation needs to remain elevated, or growth needs to accelerate further. I have a hard time believing that Palantir could sustain a 60% revenue growth rate for the next 5 years.

Here is what my Premium Members can expect:

Top Monthly Picks - Each month, I will select a few stocks that I find likely to outperform.

These picks will focus more on short-term pricing movements and swift through market narratives.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on semi-monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Pricing Structure

I strive to build a long-term relationship with my Premium subscribers, so I have chosen a pricing structure that emphasizes annual subscriptions.

The standard practice is to give 2 months free for annual plans, but I have decided to give 6!

Small note, please go to the website to purchase the subscription, as if you do it on the iOS app, you have to pay the 30% Apple Tax. (The plan cost more there)

Thank you for being a reader. I look forward to seeing you on Global Equity Briefing!

Equity Research Report List

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.