Briefing: State of the Food Delivery Industry

Convenience on Demand

Food delivery has become a ubiquitous part of our modern existence. It’s convenient, fast, tasty, and affordable. As our daily lives have become more hectic and stressful, people have grown to cherish that lazy evening pizza or lunchtime sushi. The kind of variety on offer in an average urban city today would have been unavailable to even a king 100 years ago.

While food delivery has existed in some form for more than 100 years, the rise of various modern technologies supercharged it. The union between the automobile and landline phones created modern food delivery services. Phones enabled customers to quickly and simply exchange information, whilst the automobile allowed restaurants to act on that information.

In the late 2000s and early 2010s smartphones, fast cellular internet, mobile payments, and Google Maps converged, enabling the founding of food delivery platforms!

Food delivery requires a restaurant to process an incoming order and dispatch a delivery driver. Before delivery platforms restaurants were forced to handle this themselves.

Plenty of restaurants didn’t have the means or the size to justify such an investment, so they stayed out of food delivery. For a cut of the ticket, delivery platforms handle this tedious process. As delivering food no longer requires a huge upfront investment, apps are able to drastically increase the supply of restaurants. As strong network effects kicked in, more restaurants offering delivery led to more orders, and more orders led to more delivery drivers. This created a highly competitive environment where apps compete for drivers and restaurants. Restaurants compete with each other. Customers benefit by having a better user experience, cheaper food, and faster delivery.

However, not everything is perfect. It seems that in the last few years, we have started to see that maybe this industry is not what was once promised. Restaurants are complaining about high fees, while at the same time, leaving the platforms is inconceivable, as that is where the customers are. Drivers are in uproar and demand higher pay and benefits. Customers say the service is not as affordable as it used to be. Politicians point fingers at “evil, overpaid CEOs” who exploit restaurants, drivers, and customers. Lastly, investors have lost appetite for cash-burning companies, sending delivery stocks to the toilet.

Market Size

While the shine has come off from the industry somewhat. The business itself has never been stronger.

Mordor Intelligence estimates that this year the global online food delivery market will generate $680B in sales. Furthermore, sales are projected to grow with a 15% CAGR, reaching an estimated $1.37T in 2029. APAC is the largest and fastest-growing region.

Meanwhile, the US online food delivery market is estimated to generate $46 in sales this year. Grand View Research forecast a 10.5% CAGR till 2030, reaching around $85.

Main Trends

Ghost Kitchens

Ghost kitchens have been compared to the cloud computing industry. In the same way that AWS builds expensive data servers and allows access for a fee, ghost kitchens build commercial kitchens where multiple restaurants can share equipment and space. Restaurants benefit by needing much smaller upfront investments to begin operating. If one desires to open a restaurant, all one has to do is come up with a concept, find a ghost kitchen, sign a lease, and sign up for one of the delivery platforms.

The promise of delivery-only ghost kitchens is increased choice and variety for customers, enabled small businesses to start up faster and cheaper, and lower prices for customers through increased competition. This trend is here to stay, and some platforms have even started their own ghost kitchens.

Synergies with Ride-hailing

There is an argument to be made that food delivery apps and ride-hailing services go hand in hand, Uber Eats being the most known example. Inherently the service provided is similar, one moves people from A to B, the other food. Depending on the region and vehicle, some drivers can easily do both services.

Furthermore, combining the two allows for lower overheads, increased tech synergies, and improved brand awareness. I believe it is likely that consolidation will lead to more companies combining ride-hailing and food delivery under one umbrella.

Super-Application

A super app is an app that offers multiple services on one platform. WeChat is China’s most well-known super app, allowing users to text, call, read news, post photos, order food, transfer money, etc.

Food delivery apps have started to offer such services as groceries, package delivery, ride-hailing, financial services, E-commerce integrations, and others. Most people don’t order food every day, but they might want a ride, pay a friend, or send a package. By offering these services under one roof, apps hope to increase the monetization of their active client base. Furthermore, by cross-selling these services they achieve various operational synergies, lower customer acquisition costs, and increase retention.

Subscriptions

Anecdotally I regularly cross-check apps to see if there are some interesting promotions available. Understandably, a platform would prefer I stay in their ecosystem. Thus, increasingly food delivery apps are adding subscriptions to improve customer loyalty and decrease churn.

For example, DashPass is a $ 9.99-a-month subscription from DoorDash that comes with free delivery and other perks. According to DoorDash, compared to non-members, the average ticket is 10% higher, they also order from 55% more unique restaurants, and 43% of holders order from the same restaurant at least 2 times a month. Subscriptions are key to driving customers towards creating habits and entrenching them in one’s platform.

Thank you for reading Global Equity Briefing!

If you are wondering what I do outside of Substack, join 1,384 curious wonderers and follow me on X(Twitter) @TheRayMyers

Key Players

Uber Eats

Uber, the $146B juggernaut is most well-known for its ride-hailing business. Although the stock price is up 66% from 1 year ago, it is still down 14% since the peak. The company started offering food delivery in 2014

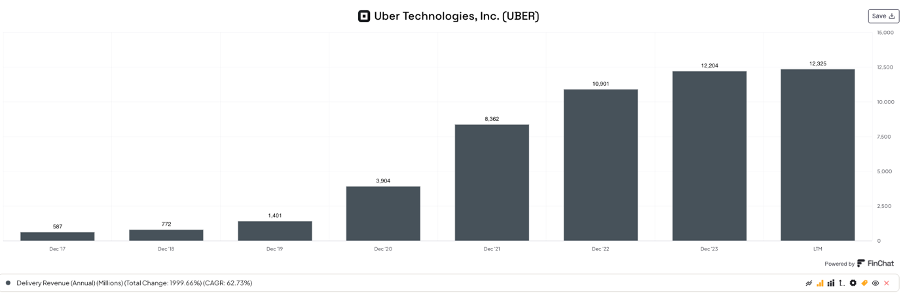

Since then, Uber has become a huge global player in this industry. In 2023 gross delivery bookings reached $64B. The graph above shows that this business has exploded from just $8B in 2018, growing 8X in just 5 years.

As of Q1 of 2024, this business generated TTM revenues of $12.3B. CAGR of 62.7% since 2017. Food delivery exploded during the pandemic and while the growth has slowed, Eats hasn’t returned any of the pandemic gains.

Uber Eats is a massive player internationally, operating in 6,000 cities in 45 countries. However, with an estimated market share of 23%, Eats is the second-largest food delivery operation in the US.

Uber has recently become fully profitable, and its platform is showing strong synergies with the ride-hailing business. Around 34% of their monthly customers use more than 1 service per month. 31% of first-time Eats customers come from rides, whilst 22% of transportation customers originate from Eats. With 149 million monthly active platform customers, Uber is in a strong position to continue cross-selling their services, thus reducing operational, marketing, and customer retention costs. As of Q4 2023, Uber had 19M subscribers to its Uber One membership.

Overall, Uber has come a long way from losing many $10s of billions, in 2022, Uber had a negative net income of $9.1B, an astonishing figure. Q1 2024 TTM sales reached $38.6B, while net income was positive $1.4B, and the company generated over $4B in free cash flow.

DoorDash

DoorDash doesn’t have a ride-hailing business, however, they are the biggest delivery player in the US, with an estimated food delivery market share of 67%. DoorDash market cap is $45.8B, and the stock is down 20% from its peak.

The key to their success was their strategy of expanding to smaller cities and suburbs. While other players were chasing that big city pie, DoorDash saw the potential in areas with less competition. Fewer competitors meant that the company could expand quicker, as they could divert funds that would have otherwise been needed for marketing and promotion.

The company had limited sales internationally, till its acquisition of Finish delivery app Wolt for $8.1B.

TTM Gross order volume reached $70B in Q1 2024. As I mentioned in the subscriptions section, DashPass plays an important role in growing GOV. Subscribers order higher-value items at an increased frequency. Keeping frequent users on the platform is imperative if the company is to reach its long-term profitability goals. 2023 closed with 18 million members in the company’s subscription program, an increase of 3 million Y/Y.

Q1 2024 TTM revenues were $9.1B, the majority of which comes from its dominant position in the US. However, the company is rapidly gaining traction abroad, with Wolt’s acquisition certainly being the catalyst. Since 2022, international business has grown by 188%, while domestic sales increased by 30%.

While losses historically have not been as massive as Uber’s, DoorDash is still to reach profitability. Net loss was almost 3 times higher last year than in 2018. Granted the revenue has grown significantly, from $291M to $8.6B in 2023, an increase of 2,867%. However, the company is on a path of becoming a quite profitable enterprise. According to earnings estimates, 2026 net income should be $2.4B. Q1 2024 was a strong quarter for the company with sales increasing to $2.5B +23% Y/Y, net income of -$23M +86%, and free cash flow of $536M +50%.

Just Eat Takeaway

Just Eat Takeaway is an Amsterdam-based company that formed in 2020 through the merger of Just Eat and Takeaway. The company has a strong presence in Europe, Australia, Canada, and the US. Grubhub, which was acquired in 2021, holds an 8% market share in the US.

The group closed 2023 with EUR 26.4B ($28.3B) in platform sales. Since the end of the pandemic, they have struggled more than Uber Eats and DoorDash. North American platform sales decreased by 14% in 2023, active customers decreased by 13% from 30 million to 26 and restaurant partners decreased by 2% to 408K. Similar disastrous results are in other regions as well. Understandably, the stock has collapsed 90% from its peak, and the company is valued at just EUR 2.4B.

To revive growth and interest in Grubhub’s platform, in 2022 the company announced a partnership deal with Amazon, Prime members now have access to the benefits of Grubhub+, their membership program. With over 100 million members, Amazon Prime is basically used by all US households. Grubhub hopes to drive these customers to use its services.

While revenues have grown significantly, the company is massively unprofitable, losing EUR 1.8B in 2023. A slight improvement over the disastrous loss of EUR 5.7B in 2022. A significant cause of these losses is their catastrophic acquisition of Grubhub. During 2022-2023, Just Eat has had to book a combined EUR 5.7B impairment loss related to this acquisition. Grubhub was acquired for $7.3B in 2021 and barely a year later in 2022 as sales collapsed the company realized this acquisition was an unfortunate mistake.

Even though 2026 estimates project sales to start growing again, reaching EUR 5.8B and profits of EUR 32M, I will be surprised if Just Eat Takeaway remains an independent company for long.

Delivery Hero

Delivery Hero is a Berlin-based delivery company, with a huge presence in Asia, the Middle East, and Europe. The company is trading for a market cap of EUR 7.8B and the stock is down 38% from its peak.

Global platform sales were EUR 45.3B ($48.5B) in 2023, almost double that of Just Eat Takeaway. 56% of platform sales were from Asia, 22% from the Middle East, 17% from Europe and 5% from the Americas.

In stark contrast to its European brother, Delivery Hero is growing the size of its platform. In Q1 2024 platform sales increased, by 18% in Europe, 22% in the Middle East, and 4% in the Americas, while Asia was down 5%.

Delivery Hero consists of various different brands acquired over time, however, the company hasn’t made large and disastrous acquisitions that would cause massive impairments.

2023 revenue was EUR 9.9B, up 16% Y/Y, while net loss decreased 24% to EUR 2.3B, and negative free cash flow decreased by 80% to EUR 167M. According to estimates revenue should grow to EUR 14.6B in 2026 and the company should reach a positive net income of EUR 633M.

Grab

Grab is a US-listed Singaporean technology company that in a similar fashion to Uber offers a comprehensive set of services. Grab operates in Southeast Asian countries such as Singapore, Malaysia, Vietnam, Thailand, and others. The market cap is $14.2B and the stock is down 79% since the peak.

Total gross platform sales were around $21B, an increase of 71% since 2019. However, the growth has slowed down significantly since the pandemic.

Grab is quite focused on the whole Super App aspect, the company not only offers rides and food delivery, it also offers various financial services. Grab is reporting significant synergies, 79% of 2-wheeled drivers in Indonesia, Thailand, and Vietnam are involved in both deliveries and rides. This is the kind of synergies one would like to see from a Super App.

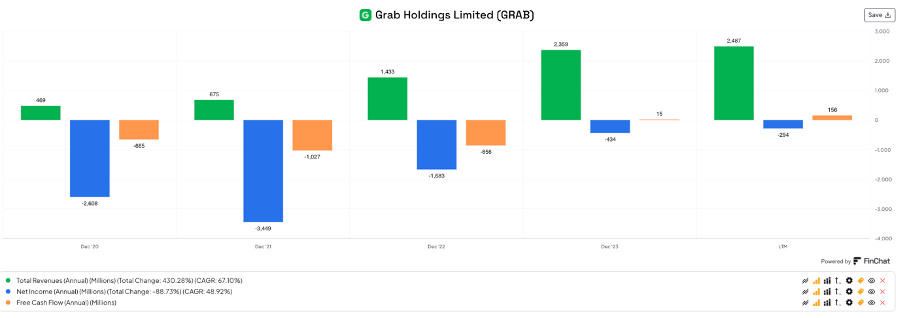

Last year Grab had revenues of $2.5B, an increase of 430% since 2020, net loss has fallen by 88% to $294M, while FCF is now positive $156M. Earnings estimates forecast that Grab’s losses will stop in 2025 and in 2026 net income should be around $463M, whilst revenue will grow to $3.7B.

Other Players

Zomato is a highly popular delivery app in the world’s most populous country, India. Furthermore, China is a market that is perfect for large-scale food delivery. Lots of high-density cities with tech-savvy people and above-average disposable incomes. Thus, it’s not a surprise that lots of different services are available.

This industry has plenty of large global companies, niche local apps, and large restaurant chains with their own in-house delivery drivers.

The global food delivery market is truly massive and a full analysis of all the companies is not in the scope of this article.

Conclusion

In one of my earlier briefings about the state of the streaming wars, I talked about how narratives are often incorrect.

“Disney with its collection of IP and billions of dollars will crush Netflix and quickly take the streaming crown.” WallStreet 2019-2021

“Netflix subscription is too expensive, and the content is not good enough, that’s why subscriber numbers are falling.” WallStreet 2022

Both of these narratives were prevalent and strong, and both were proven incorrect. Disney streaming service has struggled, whilst Netflix keeps growing subscribers.

I see a resemblance in the current narrative regarding food delivery companies.

“Food delivery is a huge market with massive TAM, these services will continue growing fast and will be highly profitable.” WallStreet 2020-2021

The reality was that Covid rather than being a massive, permanent trend accelerator pulled a lot of growth forward. As the industry slowed down and profits weren’t as close as many expected, the stocks collapsed. Now the narrative has shifted to another extreme.

“Food delivery will never be a hugely profitable business for these apps, the growth was not sustainable and was just driven by VC subsidies” WallStreet 2022-2023

Today we see that the growth has reaccelerated again, and many of the delivery apps are on the path to profitability, Uber is already profitable. Food delivery is not going anywhere and with increased automation in processing, assembly, and delivery, the convenience is only going to increase.

And one thing I know about people, is they sure love convenience!

Thank you for reading, Follow me on:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.