Could This Insurance Disruptor 5X?

Oscar Health Investment Case!

Oscar is bringing a technology-first approach to the US health insurance system, aiming to reduce costs, improve patient outcomes, and elevate user experience.

This approach enabled Oscar to 9X members and 20X revenue in just 5 years!

It’s not a secret that the US healthcare system is gigantic and extremely complex.

In 2023, the US spent a mindboggling $4.9T on healthcare!

This is around 17.6% of the GDP, making the US healthcare system, by a large margin, the most expensive in the world.

One would think that, with such high spending, American citizens would be extremely happy with their healthcare services.

Well, unfortunately, they are not, and US healthcare satisfaction ranks among the worst in the developed world, and by several criteria, even worse than some countries of the developing world.

There are many causes for this underperformance, but a badly designed health insurance system is one of them.

This is where Oscar Health comes into the picture.

“Make a healthier life accessible and affordable for all,” Oscar Health Mission Statement.

In this Oscar Investment Case article, I will examine how Oscar could make people healthier and investors richer.

1. Business Model

2. Technology

3. Oscar Medical Group

4. Financials

5. Opportunities

6. Obamacare Risk

7. Valuation

8. Conclusion

1. Business Model

Oscar is a digital-first health insurance company, focusing on serving individuals and small businesses.

The basic principles of health insurance are the same as for other forms of insurance.

A policyholder pays monthly premiums that the insurance company accumulates and then uses to pay the costs covered by the insurance policy. The goal is to collect enough premiums so the insurer has adequate reserves to pay all the claims, cover operating expenses, and generate a profit.

Moreover, most insurance companies invest the accumulated capital (float) in bonds and other securities, generating an additional investment income, which ideally is a bonus, not the main profit driver.

However, the health insurance industry operates under very stringent regulations, with fewer options to maneuver. Understandably, as healthcare is often a matter of life or death.

In the US, medical insurance is mostly provided by the employer.

The Affordable Care Act (ACA), nicknamed Obamacare, makes it mandatory for large businesses with more than 50 full-time employees to provide health insurance.

But what about the smaller businesses, freelancers, and solo entrepreneurs?

That is Oscar’s bread and butter.

Since 2019, Oscar has grown members by 780%, to reach over 2M people!

This is unbelievable growth, which was enabled by a particular quirk of the US health care system.

Oscar primarily serves this cohort through the ACA marketplace!

The ACA marketplace enables individuals and small businesses to purchase government-subsidized health insurance plans. Depending on one’s monthly income and household size, they could be eligible for various government benefits.

ACA rules dictate the bare minimum that a plan must cover, which directly influences how much an insurer will charge in premiums. However, the government wants these plans to be more affordable, so it subsidizes them.

Additionally, one problem with the US health insurance system is the extremely high co-pays and deductibles. This discourages people from seeking medical care, so the ACA also subsidizes these out-of-pocket expenses.

This means that at the moment, Oscar’s business is entirely dependent on government subsidies!

Without these subsidies, Oscar’s customers wouldn’t be able to afford the insurance, and Oscar wouldn’t have grown so quickly.

This exposes Oscar to the risk of Trump repealing Obamacare, which will be discussed later in the report.

2. Technology

Earlier, I stated that Oscar is bringing a technology-first approach to health insurance. Let’s explore what I mean by that.

Oscar uses proprietary, in-house designed, and cloud-based software to service their clients!

Meanwhile, many of the large and established insurance companies use generic, off-the-shelf, and on-premises-based software.

Oscar’s vertically integrated approach allows them to:

Automate tedious tasks

Onboard new members faster

Process claims quicker and with higher accuracy

Manage more from the Oscar mobile App

Integrate some virtual care visits (TeleHealth)

Provide data-based healthcare insights

Constantly update the App and deploy new features

For instance, 98% of insurance claims are processed automatically, without needing a manual review, compared to 80% for other insurance companies.

This means that Oscar reviews 2 out of 100 insurance claims, compared to the industry average of 20 out of 100!

This is an incredible achievement that lowers administrative costs, improves user retention, and improves health care outcomes.

At the core of Oscar’s technology-driven customer strategy is what the company calls the “Member Engagement Engine”. Oscar uses all the information at their disposal to engage and nudge customers into better behaviour.

App pop-ups that remind to take medicine

Calls to invite to check-ups

Offers of preventive care

Emails that remind to submit a claim

Tracks everything and flags issues

Oscar’s strategy that prioritizes technology is enabling them to deliver a much better user experience and ultimately lower costs for the company.

Simply put, sicker patients cost an insurance company more. By reminding them to follow a treatment plan or seek preventive care, Oscar decreases the probability that a patient gets sicker.

Oscar had an NPS score of 66 in Q1 2024, while the Spanish language offering had an NPS score of 87, significantly above industry averages of 30.

Meanwhile, 90% of provider visits were ranked positively by Oscar’s members.

Lastly, Oscar has an incredibly strong Apple App Store rating of 4.9/5, which clearly shows the quality of their mobile-centered experience.

3. Oscar Medical Group

Traditional insurers largely act as claims processors. They set up clinical networks, negotiate rates with hospitals, and then pay providers for services rendered.

They have very little direct control or influence over how care is delivered or whether it's truly necessary!

Oscar, on the other hand, works directly with the patient and the doctors to improve outcomes and reduce costs.

Oscar Health achieves that through a deep integration with Oscar Medical Group.

Oscar Medical Group provides medical services exclusively to Oscar Health members.

But it is crucial to note, Oscar Health doesn’t own Oscar Medical Group, as the law in many US states prohibits corporations from directly owning or employing physicians.

Rather, Oscar Medical Group is a collection of independent doctors who have agreements to serve Oscar’s insurance members.

This gives Oscar Health more direct control and influence over how care is delivered and how much it costs!

Let’s explore how it differs from the traditional health insurance model.

Oscar Health is an operational partner for Oscar Medical Group doctors, providing technology, administrative, and customer support. Other insurance companies don’t do any of that, they just pay the bill.

Whilst other health insurance companies receive claims after the visit, and sometimes even weeks or months later, Oscar gets real-time data from Oscar Medical Group. This allows for better patient monitoring, generates real insights, and drives Oscar’s member engagement engine.

This integration elevates patient experience by combining the previously separate insurance and health care functions. Oscar’s customers get various free or low-cost digital telehealth services such as primary care, mental health, virtual urgent care, and others. Some of these services are delivered directly inside the Oscar Health app.

A major goal of this system is to create cost savings for Oscar Health and its customers!

Key savings include fewer unwarranted emergency care visits, lower medical costs through increasing proactive care, avoiding expensive out-of-network care, and reducing the number of unnecessary medical tests.

4. Financials

Oscar’s financial growth has been simply extraordinary.

In 5 years, revenue has grown by 2,020% to reach $10.1B in LTM Q1 2025!

In the graph above, we see that this performance was largely driven by the growth in premiums, however, in the last 3 year’s Oscar has also started earning noticeable investment and services income.

$189M in investment income and $20M in service revenue might seem small compared to $9.9B in premiums, but they have much higher margins and are crucial to improve profitability.

In Q1 2025, Oscar grew revenues by 42.2% to $3B, showing that they have no intentions of slowing down.

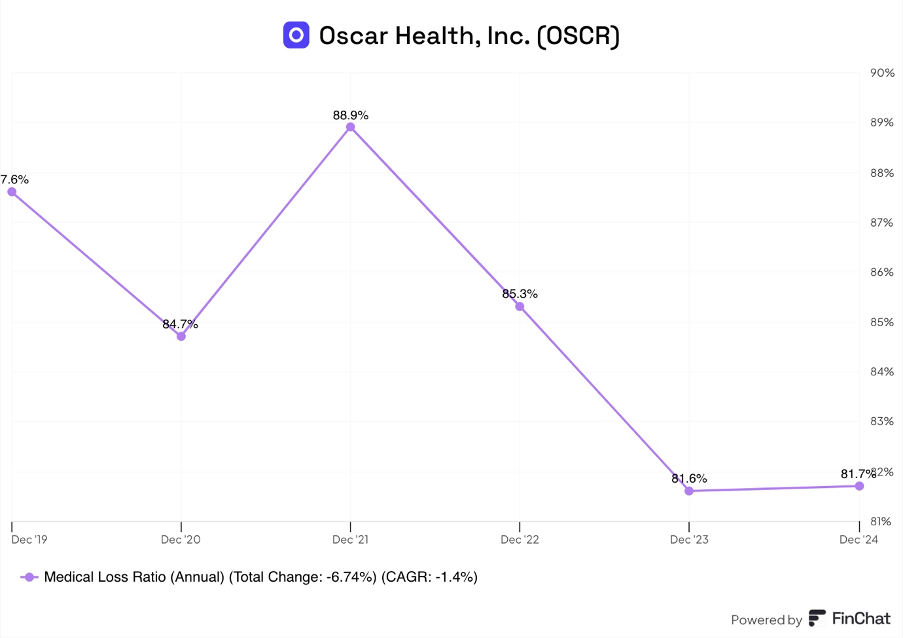

Medical Loss Ratio

As one would imagine, medical expenses are the biggest cost category for a health insurance company.

In the industry, medical loss ratio is used to measure the share of collected premiums that is spent on medical expenses.

In 2024, Oscar reported a medical loss ratio of 81.7%, a tiny increase Y/Y, but still way below 89% in 2021.

There is essentially no room for improvement here because, per regulations, 80% is the minimum allowed medical loss ratio. A lower medical expense ratio means that customers need to pay more of their expenses themselves.

Theoretically, Oscar could lower the ratio by 1.7 percentage points by changing some insurance policies to have less coverage, but that would probably lead to lower customer satisfaction and possible churn.

The medical loss ratio will always be above 80%, which means that health insurance is not a high-margin business but a high-volume business!

Health insurance companies largely grow profits not by improving margins, but by serving more customers.

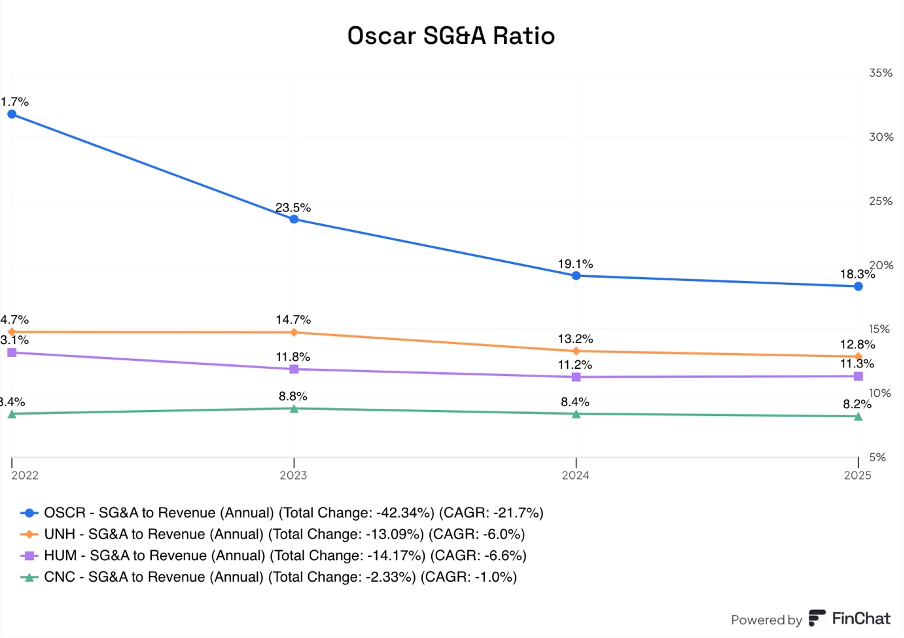

SG&A Ratio

After medical costs, sales, general, and administrative costs are the second-largest expense category. Operating in the health insurance space comes with significant administrative, legal, regulatory, and customer service burdens.

Their technology-first approach has driven significant cost efficiency improvements, but there is still a lot of work to be done.

As we can see in the graph above, in 2024, 19.1% of their revenue went to administrative costs. While this is a noticeable improvement from 31.7% 2 years ago, it is still above scaled insurance peers.

UnitedHealthcare has an SG&A ratio of 12.8%, Humana 11.3%, and Centene 8.2%.

This should be viewed as an opportunity!

As Oscar attracts new members, it costs less and less per member to service them as there are more members to split the fixed costs with. So, member growth should continue to drive down the SG&A ratio.

Another factor is the previously mentioned technology-first approach. This could put more downward pressure on SG&A, creating additional savings.

If Oscar continues to execute, in the next decade, they could achieve an SG&A ratio on par with the most well-run insurance companies!

Lastly, Oscar has come up with an ingenious way to improve the SG&A ratio, offering their technology for a fee. This has a separate section below where I expand on this business.

Profitability

After huge losses, Oscar became profitable in 2024 and is set to continue generating significant profits.

There is a major seasonality in health insurance operating margins, with Q1 typically being the strongest and Q4 the weakest as patients seek to get as much health care as possible before their deductible resets in January.

Operating income was $57.3M in 2024, a margin of 0.62%. In their 2024 Investor Presentation, Oscar said their target is a 5% operating margin by 2027.

In Q1 2025, Oscar delivered a strong operating margin of 9.75%, a noticeable improvement from 8.66% in Q1 2024. They seem to be making progress towards their 2027 target.

Growing top-line and expanding margins are a potent combo that could deliver explosive profit growth!

Let’s assume that revenue stays constant, and operating margin reaches 5%. Operating profit could reach $448M, 8X higher than in 2024.

However, if revenue grows by 50% over the next 3 years (much slower than historically), a 5% operating margin would deliver $672M in operating profit, a 12X increase from today.

Such growth would be unprecedented!

However, the net income margin was just 0.28% in 2024, largely because Oscar has a fair bit of debt. The company has around $360M in long-term debt and leases, costing them $24M in interest payments.

However, I don’t think of this as a long-term problem. This liability on the balance sheet was sitting at $370M in 2022. Oscar paid off 10M in 2 years, and now they are profitable, so it is not a concern.

As a final note, FCF is not a relevant metric for Oscar, because of the nuances of the insurance industry, it is very volatile, and not a true representation of the value the company is creating.

5. Opportunities

Member Growth

As of Q1 2025, Oscar has 2M members, a tiny amount if one looks at the broader US health insurance industry.

In their 2024 Investor Presentation, Oscar estimated that there are 10M people eligible for ACA in the geographies they currently operate.

This means that Oscar currently has only a 20% market share, leaving ample room for growth!

Today, Oscar operates in 18 US states and hundreds of counties, but they plan to expand into 150 new markets by 2027. This would increase the TAM by 60% to 16M.

These estimates take into account the fact that certain provisions of the ACA expire this year. However, if they are extended, Oscar estimates that their TAM would increase by an additional 4M people.

Though I find it unlikely that Trump and the Republican controlled legislature will extend these provisions.

+Oscar

As I mentioned in the technology section, Oscar has really put in a lot of effort and focus on developing their technology stack.

The company saw potential in their technology and thought they could earn an additional income from licensing it to others, thus +Oscar was born.

+Oscar is a SaaS offering that helps other health insurance companies offer a better digital experience!

+Oscar gives clients access to Oscar’s “Member Engagement Engine”, who pay a small fee per each member.

I am not sure what the TAM for +Oscar is, and today it generates just $20M. But it is something to pay attention to, as it could grow into a sizable business.

The $20M comes at a very high incremental margin, as the company essentially lets others use the tech they are paying for anyway.

Individual Coverage Health Reimbursement Arrangement (ICHRA)

ICHRA is a new law that allows businesses with more than 50 employees to not create a managed company health insurance plan as required per Obamacare, if they contribute to employees’ individual health insurance plans.

This is great because a lot of employees don’t want to bother with the hassle of managing a group insurance plan.

The number of employees that were offered ICHRA plans grew a mind-boggling 171% in 2023!

This very glaringly demonstrates that the business community likes ICHRA.

Oscar believes that 75M people could move from group-managed plans to individual plans in the next years!

I can imagine it can be annoying to have to change health insurance every time one changes jobs. Especially as nowadays, people rarely remain at the same job for a decade or more, most switch after 2 to 5 years.

Also, the rise of freelancing, working from home, and gig work means that there are more people having to manage their own health insurance.

ICHRA empowers them to pick a health insurance plan and keep it.

This would be a monumental shift in the US health insurance industry and could reorder the power rankings. Oscar, as a leader in the direct-to-consumer and individual health insurance space, could be one of the largest beneficiaries of the ICHRA.

Most crucially, it would reduce their exposure to Obamacare.

6. Big Obamacare Risk

A huge existential risk to Oscar comes from Trump and the Republican controlled legislature.

There is no denying that Obamacare has improved lives for millions of people, but it has come at an extreme cost.

Researchers at Kaiser Family Foundation estimated that in 2024, the ACA cost the taxpayer around $125B in direct marketplace subsidies for 19M people!

Trump and the Republicans have not hidden their disdain for this policy and have tried multiple times to repeal it.

There might be no other policy Trump hates more than Obamacare.

Some of you might remember that iconic moment in his first term when Republicans attempt to repeal it didn’t go through because of a no vote from the late John McCain.

Main criticisms are that the ACA centralizes healthcare too much, limits patient choice, and hurts small businesses by requiring them to offer insurance.

But the most important criticism is that the ACA is an expensive “socialist and communist” policy.

What Democrats call “helping disadvantaged people,” Republicans call “government handouts”.

Republicans often argue against “government handouts” because they encourage laziness and discourage work and personal responsibility. Additionally, they believe it introduces a moral hazard.

I can see some logic in both the progressive and conservative arguments, but that doesn’t matter as it is not the topic of this article.

What does matter is that Oscar is heavily exposed to any changes in the law!

If subsidies are decreased, it is likely that many customers wouldn’t be able to afford insurance anymore, which would reduce revenue and lead to a fall in members.

Depending on how severe the cuts are, Oscar could even go bankrupt!

However, as 19M people depended on the ACA, a full repeal is unlikely. I think partial cuts and reductions in subsidies are more likely.

It is difficult to model, as even small cuts could have a disproportional effect on Oscar and their members.

Also, Trump has staked his legacy on the Trade War and the border with Mexico. These are huge priorities for him, so he is more likely to focus on those. Additionally, we are just 16 months away from the midterms, and I doubt that Trump would want to cut the ACA before the elections, as Red states are the key beneficiaries of this policy.

However, as always, Trump is unpredictable, and he could change his mind at any moment.

7. Valuation

With a market cap of $3.6B, Oscar seems to be quite attractively priced.

It trades for a TTM P/E of 31, but let’s remember that the company has a minuscule net income margin.

Wall Street analysts expect that Oscar will grow revenue by 22.5% this year and 42.3% by 2027.

Higher operating efficiencies are projected to turbocharge profitability. With Net income expected to grow by 2,306% over the next 3 years!

No, this is not a typo. Wall Street expects Oscar to 24X their earnings in the next 3 years.

Taking that into account, 2027 P/E is 7, an extremely low multiple for a growth company with inflecting profits.

Usually in these cases, when numbers seem too good to be true, one needs to take a breather and ask, why is that?

Well, in the picture above, I have highlighted a clue in yellow.

If you recall, earlier in the report, I mentioned that certain provisions of Obamacare are expiring in 2025, and it is unlikely that Trump will extend them. Thus, analysts expect that next year’s revenues will fall by 1.4%.

This goes back to the central issue with Oscar, their huge exposure to Obamacare!

Oscar’s stock is down 23% since Trump got elected, with many investors not wanting to touch it, due to their huge exposure.

But let’s just see what could happen if Obamacare is not repealed.

7.1. Valuation Model

Let’s say that Oscar reaches around 4M members and grows their revenue per member with a reasonable 3% CAGR.

We get to revenues of $25.35B, 176% above the 2024 level!

The company has a goal of reaching a 5% operating margin by 2027, so if we model that for 2030, we get to $1.27B in operating income.

If we model taxes at 21%, we get to net income of $1B.

Assuming a 5% per year dilution and an exit multiple of 25, we get to a market cap of $25B and a share price of $74.65.

That is an upside of 410%, a CAGR of 31.2%

Considering Oscar’s 2027 ACA TAM is 16M, and their expansion into individual corporate plans (ICHRA), getting to 4M members by 2030 seems rather easy.

Furthermore, it is entirely plausible that they have much more than 4M.

8. Conclusion

Oscar has built a unique business that is more technologically savvy and integrated than some of the old dinosaurs of the health insurance industry.

This approach has enabled the company to quickly onboard members, growing revenues 20X in just 5 years.

However, that performance was achieved thanks to generous government subsidies from Obamacare!

Now that Trump is back, there is a real risk of Obamacare getting repealed or significantly scaled back.

That could crush Oscar’s business, and it is unclear if the company would ever recover.

Nevertheless, despite this risk, the opportunity seems compelling.

The health insurance industry is in dire need of innovative tech-based solutions, and Oscar is well-positioned to be one of the key players.

Oscar operates only in 18 states, with huge potential to enter new geographies!

Furthermore, ICHRA individual plans could change the industry and lead to tens of millions of people looking for a new provider in the next decade!

Most importantly, as the valuation model shows, Oscar trades at an extremely attractive valuation.

With reasonable growth assumptions, Oscar could return more than 400% to investors by 2030!

But…

Oscar investors need to be cognisant that Trump could change the whole equation.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Great post!