Emerging Markets Fintech, growing payment volume by 45% per year!

DLocal Investment Case!

DLocal is a Uruguayan financial technology company specializing in facilitating a seamless payment experience in emerging markets. DLO 0.00%↑

Emerging markets refer to countries that are experiencing rapid industrialization and digitization, transitioning from low to middle-income. While these markets represent a smaller share of the global GDP than developed countries, they represent an outsized share of the global population and GDP growth.

Rapid economic growth, fast digitization, and a large population make emerging markets highly attractive for digital internet companies.

For Instance, it is estimated that Netflix has around 12M subscribers in India, 17M in Brazil, and 4M in Turkey.

Meanwhile, Spotify has around 83M monthly active users in India, 39M in Brazil, and 2.6M in Turkey.

While emerging markets show huge potential, of course, there are massive challenges.

Regulatory complexity, frequent policy changes, currency volatility, FX controls, low banking access, high fraud risk, and economic instability, just to name a few.

These challenges make it difficult to process and manage payments, causing significant headaches even for the largest of companies.

This is where DLocal comes into the picture!

With its technology platform, DLocal streamlines the payment process in over 40 emerging markets in Latin America, Africa, Asia, and the Middle East.

In just 5 years, DLocal has gone from processing $1B in transactions to $25B!

The fact that large technology companies such as Uber, Temu, Spotify, Netflix, Meta, Microsoft, Amazon, Shein, and others have picked DLocal is a testament to the quality of their offering.

In this article, I will present the DLocal Investment Case, which is largely driven by:

The development of new products

Acquiring new merchants

Growing market share with existing merchants

Let’s take a look!

1. Business Model

2. The Opportunity

3. Financials

4. Valuation

5. Conclusion

1. Business Model

DLocal offers a full suite of best-in-class payment processing products that help global merchants simplify their business, save money, increase revenue, and improve customer experience.

Currently, the company is led by one Pedro Arnt. Before becoming the CEO of DLocal in 2023, he worked at Mercado Libre, the “Amazon of Latin America,” for 20 years. For 12 of those 20+ years, he was the CFO of the company.

During his tenure, Mercado Libre transitioned from a small e-commerce company with revenues of $20M into an e-commerce, logistics, and fintech behemoth with revenues of $20B and payment volume of $120B.

There is possibly no one better in the world DLocal could have picked as their leader to scale them into a similar-sized payments company!

This article is on DLocal, but for those interested, I wrote a Deep Dive on Mercado Libre.

Let’s look at DLocal business model in more detail:

Pay-in – Dlocal processes all the traditional payment methods, such as bank transfers, credit cards, and debit cards. In the US, it is extremely easy for Netflix to collect payments, as more than 90% of people have a debit or a credit card. Unfortunately, in the Philippines, only 15% of adults have a credit card. However, millions of people use mobile wallets such as GCash and PayMaya. Dlocal enables merchants such as Netflix to accept GCash in the Philippines and hundreds of other local payment methods in 40+ countries. Offering local payment methods is crucial to increase conversions, reduce costs, and improve customer experience.

Pay-outs – Receiving payments is only part of the equation, as for companies such as Uber, Amazon, and Expedia, paying out the money is as important as receiving it. DLocal enables Uber to seamlessly pay its drivers, Amazon to pay local merchants, and Expedia to pay hotels.

What makes DLocal special is that it offers all these services through a single unified platform!

Previously, large companies operating in emerging markets were using dozens or even hundreds of local or regional payment processors. In some markets, they even needed more than one, as these processors had different capabilities, handling distinct payment methods.

DLocal enables clients to manage their business in over 40 countries from a single dashboard, using hundreds of payment methods.

It’s DLocal for Platforms offering is especially designed to handle the complex needs of large merchants such as e-commerce platforms, ridesharing and delivery apps, and SaaS platforms!

DLocal offers a simplified interface to issue, collect, and pay invoices.

Additionally, they have built-in features that aid clients in the user onboarding process, verifying identities, and ensuring compliance with anti-money laundering and know-your-customer regulations.

Furthermore, DLocal’s platform offers tax support, helping calculate VAT, sales tax, customs tariffs, and more. This is especially important in e-commerce, where cross-border commerce is common.

Another key capability of the platform is FX management.

Managing currencies in emerging markets is notoriously problematic, time-consuming, and expensive. High fees, FX regulations, and strict asset controls are just some of the problems.

dLocal simplifies the process for its customers by handling the moving of funds across borders, converting them to the preferred currency, and depositing them into a client’s bank account. This includes handling local banking networks and compliance with FX control regulations.

Furthermore, dLocal assists clients in hedging currency volatility, especially in high-volatility regions such as Egypt and Turkey.

Thanks to the quality of their offering, DLocal’s total payment volume (TPV) has exploded.

As of LTM Q1 2025, TPV was $28.4B, a 21X increase in just 5 years!

2. The Opportunity

DLocal presents a compelling growth opportunity as emerging markets are quickly catching up to developed markets.

Internet penetration is growing, and access to financial services is improving. As a result, young urban populations are craving digital services, driving huge interest in emerging markets from local, regional, and global internet giants.

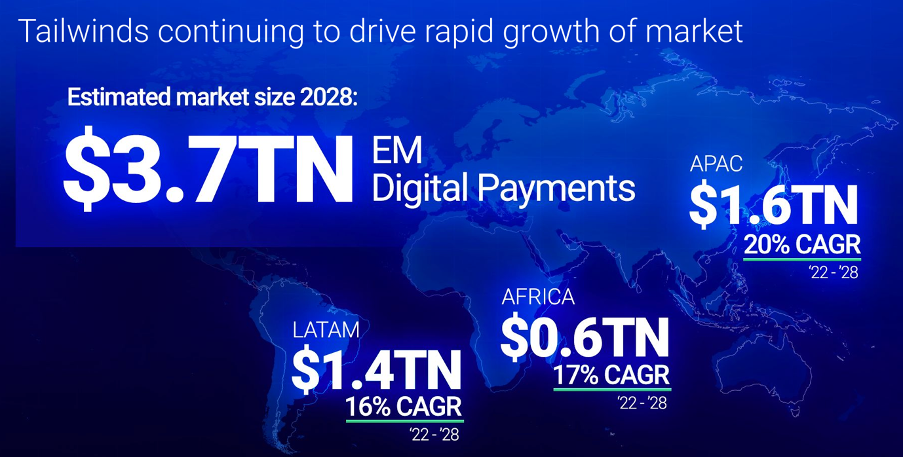

Based on a report commissioned by DLocal, researchers at Americas Market Intelligence forecast digital payment volumes in emerging markets to reach $3.7T by 2028!

Latin America is forecast to grow with a 16% CAGR from 2022 to reach payment volumes of $1.4T by 2028.

Africa is growing slightly faster at 17% per year, but it is estimated to be much smaller at $0.6T by 2028.

Meanwhile, Asia-Pacific is simultaneously the largest and the fastest-growing emerging market. Growing with a 20% CAGR, it is estimated to reach $1.6T by 2028.

Let’s remember that the DLocal processes just $28.4B in payments today, a tiny fraction of the total payment volume in the markets it operates in.

Even if they keep the same market share, DLocal would grow significantly, however, they are uniquely positioned to not only keep the market share but also to significantly expand it.

Let’s take a look at DLocal’s 3-fold growth strategy.

2.1. Product Development

By building a sophisticated and broad best-in-class product offering, DLocal aims to improve its value proposition. A better value proposition makes it easier to upsell new products and geographies.

DLocal started in 2016 in one country with one product, but has since developed many innovative products to solve the complexity of collecting payments in emerging markets.

The company combines on-the-ground local expertise with regional and global technology experts to fully grasp merchant needs and how to better serve them.

While their offering is already broad, there is still potential to develop it, and I am sure they are working diligently to release new products.

Now that they have an invoice management offering, what stops DLocal from creating a platform where DLocal clients can quickly and easily settle invoices between themselves?

This is just one example. There is a significant opportunity to add additional software products that don’t charge transaction fees, but are monetized in other ways, such as subscriptions or usage fees.

2.2. New Merchants

TPV of $28.4B is certainly impressive, but it is insignificant if one looks at the overall market.

In its 2023 Investor Presentation, DLocal estimated the total digital payments volume of the countries it operates in at $1.4T!

This means that they have only a 1.9% market share!

And that assumes that the market today is not larger than it was in 2022, but as we discussed earlier, the market is growing extremely quickly. So there is a massive opportunity to capture more transaction volumes by onboarding new merchants to the platform.

Let’s look at the example of a “Leaning Global Satellite Internet Provider”.

Most likely, this is Elon Musk’s Starlink.

By 2022, SpaceX had launched thousands of satellites in preparation to scale its satellite internet service.

In 2022, Starlink was operational in only a few countries, and as ambitious as Elon is, he wanted to launch in 11 countries simultaneously in Africa, Asia, and Latin America, so they were considering working with more than 11 local payment processors.

Luckily for Starlink, they discovered DLocal, who, with their single platform, enabled Starlink to start the service in 11 countries!

No need to deal with 11 different companies, 11 different contracts, and 11 sales teams trying to upsell.

After the initial launch, “the client” is planning on using DLocal in more than 20 countries.

Using DLocal Starlink can manage their business in 40 countries, dealing with just 1 company, 1 master contract, and 1 sales team.

Word spreads quickly in business circles, positioning DLocal well to sign new merchant deals.

DLocal is the payments processor of choice for many companies aiming to expand in emerging markets!

2.3. Gaining Market Share with Existing Merchants

DLocal works with some of the most well-known companies in the world, such as Netflix, Spotify, Meta, Amazon, Google, and many more.

The companies in the picture above literally make hundreds of billions of dollars in emerging markets!

Meta in 2024 made over $50B in revenues from South America, Africa, and Asia. Meanwhile, Google earned close to $80B in South America and Asia.

Let’s remember that DLocal’s entire TPV is just $28B, around 40% of Meta’s business in its target markets. And this is just one of their customers.

The opportunity to capture a larger slice of their business is immense!

Many of these customers don’t use all the features that DLocal offers and don’t use the company in all the markets it operates in.

Companies sign deals with DLocal to process payments in a few countries to test the quality of their service. After DLocal delivers superb results, customers give more of their business to the company.

We can see in the above graph from their investor presentation that merchants are consistently using DLocal in more countries and adding new payment methods!

The average merchant that DLocal signed in 2018 now uses their services in 5 countries for 48 payment methods.

This explains their explosive TPV growth.

As DLocal expands to new regions and adds new capabilities, their value proposition increases even more, enabling them to capture a larger share of transaction volumes from their existing customers.

Let’s look at how Spotify reduced costs and gained subscribers by using DLocal.

In March 2022, the Nigerian government implemented new FX controls to keep more USD in the country. This was a problem for Spotify, which only collected payments in USD.

Through its on-the-ground expertise and relationships with local banks, DLocal enabled Spotify to start accepting Nigerian Naira in record time. This allowed Spotify to quickly continue growing.

This story is a clear example of the challenges of operating in emerging markets. Solving this complexity is a straightforward way to capture a larger share of transaction volumes.

3. Financials

In short, DLocal runs a scalable, high-margin, low-capex, fast-growing business!

Let’s look at FY 2024 and Q1 2025 results:

Revenue: $746M +14.7% Y/Y. $217M +17.5% Y/Y

Gross Profit: $295M +6.4% Y/Y. $85M +34.8% Y/Y

Operating Income: $141M -21.7% Y/Y. $46M +70.4% Y/Y

Net Income: $120M -19.1% Y/Y. $47M +163% Y/Y

FCF: -$34M -112% Y/Y. $94M +141% Y/Y

2024 was a weak year, but the results in Q1 2025 show a strong improvement, both in profitability and revenue growth.

Talking about the swing in FCF, it is a bad metric to assess DLocal’s operating performance, because FCF is heavily affected by the flow of funds DLocal processes for merchants. Often, there are timing mismatches causing swings in FCF. Additionally, the funds are not true operating cash, as it belongs to the merchants.

Operating income and net income are better metrics to track.

Overall, DLocal has experienced impeccable growth.

In the last 5 years, revenue has grown by 1,307%, whilst profits have grown by more than 800%!

Profits growing slower than revenue means that margins have decreased.

Whilst normally that would be a cause for concern, in this case, there is a valid and logical reason.

3.1. Take Rate

DLocal makes money by charging a fee of a few percent from the transaction to the merchant. Simply put, the higher the total payment volume, the more money the company makes.

In 2022, DLocal’s take rate of TPV was 3.96%, generating $419M in revenues from $10.6B in TPV.

Since then, however, the take rate has fallen precipitously to 2.92% in 2024, down 26% in just 2 years.

This is the direct result of DLocal’s stronger position in large key markets, such as Mexico and Brazil, increased payout share in the TPV mix, and its strategy to target large global merchants.

Firstly, the general principle in payment processing is that the larger the market, the smaller the take rates. This is because larger markets enable companies to reach a bigger scale, activating higher operating efficiencies. Whilst at the same time, large markets have more payment processors, causing increased competition between the players, putting pressure on take rates.

Secondly, payouts have lower take-rates as these are often simple bank transfers that incur lower fees. In Q1 2025, payouts were 33% of the TPV vs 22% in Q1 2022.

Thirdly, clients such as Amazon, Google, Netflix, and Meta have a very strong negotiating position. As DLocal captures a larger share of their business, these companies demand steep volume discounts.

For instance, in Q3 2024, DLocal revenue in Brazil declined 26% Y/Y, largely due to significantly lower take rates.

“If you consider all those assumptions, we should expect a net take rate compression while delivering high TPV growth even at the scale we’ve already attained. Over the midterm, we will work diligently to maintain that strong TPV growth while recognizing that given the extremely strong levels of retention that we’re able to deliver, our larger merchants will continue to attain lower pricing tiers and contracts. We will focus on offsetting this take rate compression through growth in higher take rate new verticals that we’re pursuing, natural mix shift towards higher take rate frontier markets away from Brazil and Mexico despite still growing well in those large markets and new revenue streams through new product launches and constant innovation.” DLocal CEO, Pedro Arnt. Q4 2024 Earnings Call

DLocal has emphasized that they prioritize TPV growth over take rates. So, in the next few years take rate will continue to fall. However, DLocal plans to mitigate some of the decline by releasing new products and growing in smaller markets with structurally higher take rates.

3.2. Margins

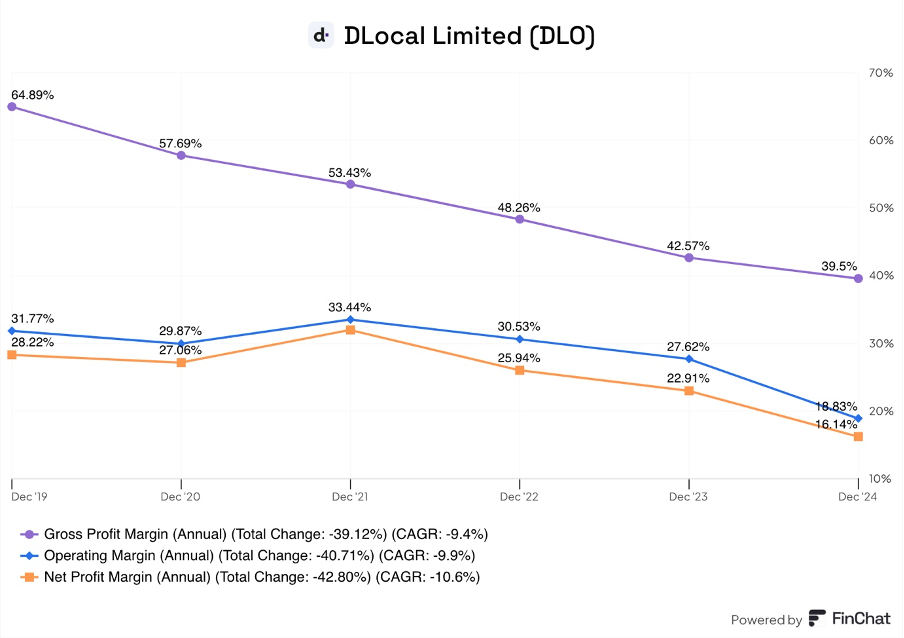

If we look at the margins, we see a clear trend of worsening unit economics leading to falling margins!

This is largely due to falling take rates.

Gross margin has fallen from 64.9% to 39.5% as DLocal collects less revenue from each $1 it processes, but the costs to process that transaction remain similar as before. Visa and Mastercard still get their cut, and so do DLocal’s local banking and merchant acquiring partners.

Operating margin has fallen from 31.77% to 18.8% as DLocal invests heavily to build new product teams and expand to new geographies.

In 2024, their technology and development costs doubled, sales and marketing costs increased by 26%, whilst general administrative costs increased by 43%.

Net profit margin has fallen from 28.2% to 16.1% largely on account of the previously mentioned factors.

The company has acknowledged this shift and said that they are taking steps to address the issue:

New products could enable higher take rates or earn fee income.

Growth in smaller markets with structurally higher take rates should lower the downward pressure on the overall take rate.

Technology investments could help cut out some of the middlemen, improving gross margin.

Higher scale and increased automation will lower relative operating costs, supporting the operating margin.

We have already started to see the results of some of these actions, as Q1 2025 margins improved significantly Y/Y.

Gross margin went from 34.1% to 39.2%

Operating margin jumped from 15.6% to 21.2%

Net income margin soared from 9.6% to 21.5%

Overall, I think it is likely we have reached a bottom for margins and they will improve in the next few years!

However, I think it is unlikely that they can ever get back to 2019 levels.

But that is not necessary for investors to come out on top. Because it seems Wall Street doesn’t believe in DLocal execution, letting it trade at an attractive valuation!

4. Valuation

DLocal has a market cap of $3.3B, and its stock is up 4% YTD.

Looking at the valuation metrics, we see that DLocal trades for a P/E of 24 and has a buyback yield of 3%.

Additionally, recently the company announced its intention to pay 30% of its FCF of own funds as dividends. FCF of own funds was $90M in 2024, so that would mean a dividend of around $30M, at the current valuation, the yield would be 0.89%.

Furthermore, Wall Street analysts expect DLocal to grow revenues by 29.7% this year and 102.4% over the next 3 years.

At the same time, EBIT and EPS are expected to grow by 142% and 132%.

This means that DLocal trades at an attractive 2027 P/E of 12!

I find this valuation highly compelling for such a high-margin, fast-growing business.

Let’s build a valuation model with reasonable assumptions.

4.1. Valuation Model

If we model TPV growing by a 27% CAGR till 2030, it would reach $108B.

Assuming a gradual reduction in the take rate from 2.92% to 2.00%, 2030 revenue would reach $2.2B!

Revenues of $2.2B would be an increase of 191% from 2024 levels, a CAGR of 19%!

As discussed earlier, new products and investments in technology could improve margins. So, I model the operating margin improving from 18.8% in 2024 to 26% by 2030.

With a 21% tax rate, we get to a net income of $445M.

That would be an increase of 270% from 2024, a CAGR of 24%!

If dilution is a modest 0.5% per year, and DLocal trades for the same 24 P/E as it does today, the company would reach a $10.7B market cap by 2030.

That would result in a share price of $36.33, a 213% upside from $11.60 it trades at today!

5. Conclusion

DLocal is uniquely positioned to benefit from the digitization of emerging markets, driving massive adoption of digital services.

E-commerce, streaming services, ride-hailing, food delivery, SaaS, travel, and financial services are undergoing a once-in-a-generation shift!

With its comprehensive and improving platform, DLocal is taking an increasing slice of the emerging markets digital payments pie.

Thanks to the quality of their services, DLocal has built strong relationships with some of the world’s largest and fastest-growing digital companies. Just by servicing the likes of Amazon, Meta, and Google well and upselling new products, DLocal can grow immensely.

They have built a capital-light, high-margin business that trades for a reasonable valuation.

As the valuation model shows, with reasonable assumptions, investors could see 213% upside by 2030!

In conclusion, DLocal is a high-quality, emerging market growth play offering attractive returns for patient long-term investors.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Very interesting post! As an investor I like being exposed to emerging markets high growth, but I don't know whether $GRAB may provide better returns in the next 5 years. What's your view on this?

Great write up. I understand dLocal's business better now. Thanks!