Grab Q2 Earnings Update!

Accelerating GMV growth and Exploding Loan Portfolio!

Grab is not just “Uber of Southeast Asia”, it is much more!

The company is on a path to achieving something that Uber failed at, and that is becoming a Super App.

Combining financial services with a thriving ecosystem of services such as mobility, delivery, and travel is a great recipe for sustained long-term growth.

Q2 2025 demonstrated why Grab has become one of the favorite stocks of the retail investing community.

GMV, revenue, and net income growth accelerated.

The loan book explosion continues, +78%!

And they gained 1.7M new users!

Those looking for a comprehensive Grab analysis, my Deep Dive is below.

Overall, Q2 2025 was a great quarter for the company, sending the stock up 0.6%.

Let’s take a ride into Grab’s Q2 earnings to find out more!

1. GMV

2. Deliveries and Mobility

3. Financial Services

4. Incentives

5. Financials

6. Cash Raise

7. Valuation

8. Conclusion

1. GMV

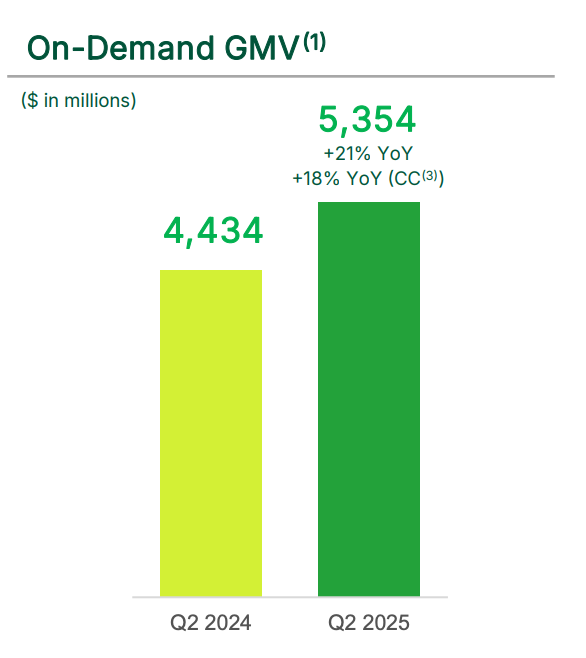

Gross Merchandise Volume of the Grab ecosystem grew 21% Y/Y to $5.3B!

Growth accelerated compared to 16.3% in Q1 2025 and 12.6% in Q2 2024!