Hello Readers!

Today I bring the second part of my Hello Fresh Deep Dive!

This digital-native food subscription company has increased its business 10X since 2016. However, today, its business is undergoing some changes. In this report, we will discuss what methods Hello Fresh uses to acquire and keep customers. How massive economies of scale drive them forward! Are competitors doing something about it? And what risks is the company facing?

Before getting to it, to understand the full picture, I recommend you start with Part 1!

Hello Fresh. Hungry for More! Equity Research! Part 1/3

Hello Fresh is a €1.5B subscriptions-based, direct-to-consumer food delivery business attempting a turnaround. In this 3 part Equity Research Deep Dive, we will look at what happened to Hello Fresh and how is the company moving forward.

1. Marketing Strategy

2. Scale

3. Reviews

4. Churn

5. Competition

6. Part 3

1. Marketing Strategy

As a direct-to-consumer company operating in a highly competitive food industry Hello Fresh must successfully acquire and keep customers.

Thus, marketing is their core competency!

It is essential to identify what customers value the most, their pain points, desires, and wishes. Understanding the customer hierarchy of preferences is crucial for Hello Fresh to successfully market their products. Throwing money at the wall is not necessarily the most effective marketing strategy, smart and targeted marketing builds long-lasting profitable customer relationships.

Customer Hierarchy of Preferences

Food is high on the customer hierarchy of preferences, so it is relatively simple to acquire customers.

In this industry acquiring new customers is the easy part, servicing and keeping them is the hard part!

Price is the first level of the hierarchy. Food is a necessity for survival, so customers will always spend money on it. However, their ability to pay is the first factor determining what kind of food they consume. Thus, large introductory discounts are one of the main strategies that Hello Fresh uses. New customers receive a 50% discount for their first order, which is a great way to get someone to try your product. The goal is to convert beginner customers into long-term subscribers.

Taste is next hierarchy. People generally tend to choose food based on its flavor. They might claim to love mangoes due to their health benefits, but I doubt that 20 million tons of mangoes would be consumed worldwide if they weren’t as delicious as they are. Hello Fresh uses bright pictures and loud epithets such as “Chef-Curated” and “Chef-Inspired” in their marketing to target this hierarchy.

Food Quality and Nutrition are crucial factors in customer decision-making. People worry about food poisoning and thus carefully choose the foods they consume regularly. The name of the company, “Hello Fresh” is meant to convey this sense of quality. Additionally, the company regularly promotes the freshness of its ingredients in promotional materials.

Convenience is the key hierarchy promoted by the company. One of the biggest value propositions of Hello Fresh’s products is that they save time. On Factor’s website, the company emphasizes “Clean eating, without the hassle.”

Our ancestors learned which foods were safe and kept consuming them frequently. Since then we have kept this tendency as Consistency is a big factor in customers choosing established and known brands over new entrants. Snickers might not be the tastiest chocolate in the world, but when a person purchases it, they know what they are getting. Hello Fresh’s messaging emphasizes consistent quality, delivered consistently.

Sustainability and Social Aspects do drive decisions, but generally not as strongly as other hierarchies. Hello Fresh still strives to please these preferences by offering “responsibly raised” and “100% American” meats with their Good Chop butcher brand.

Marketing Effectiveness

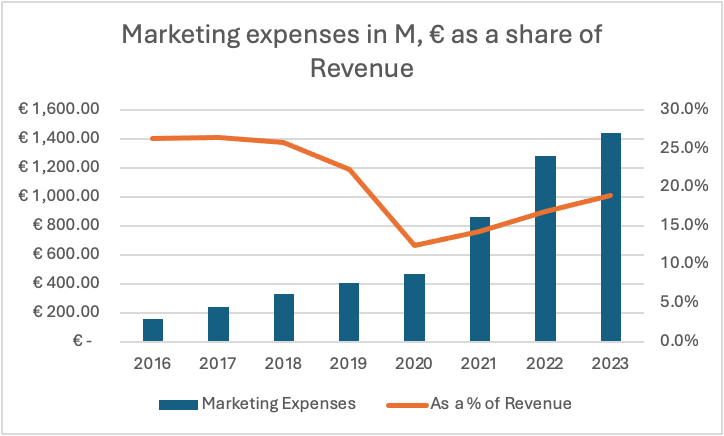

During the heavy business ramp-up phase of 2016 through 2019, the company spent over a quarter of its sales on marketing. The pandemic was a huge accelerator in demand thus, in 2020 and 2021, marketing spending as a share of revenue was temporarily low at 12.5% and 14.4%, respectively.

In 2023, the company spent €1.4B on marketing, 19% of its revenue!

In the first half of 2024, Hello Fresh’s marketing spending was €818M, 20.3% of revenue. In the long term, marketing spending is likely to remain at 20% of revenue.

Large marketing campaigns have delivered strong results for the company!

Their market share in the US has been increasing steadily every year. Hello Fresh holds a strong 74% market-leading share in US meal kits.

Additionally, Factor’s market share gains in the US have been nothing but extraordinary. In just a few years, the company went from a 10% market share to 60%! In a 2020 earnings call, CEO Dominik Richter said that in 2017, it took the company 9 months to break even on their marketing investment. The next year, they were able to lower it to 7 months, while before the pandemic in 2019, they were approaching the 6-month level. It is likely that due to recent changes in the business dynamics, the current marketing payback period has increased.

Hello Fresh assesses the effectiveness of their marketing spending by dividing the estimated long-term value of the customer (LTV) by the customer acquisition costs (CAC). LTV is calculated by multiplying the average order value (AOV), variable contribution margin, and average orders per customer. In the first half of 2024, AOV was €65.8, the variable contribution margin was 24.7%. The company didn’t disclose the average orders per customer in H1, but for Q4 of 2023, it was 4.29. If we use that figure and double it for the first 2 quarters of 2024, the LTV is €139.45.

This means if Hello Fresh spends €100 to acquire a customer, it will have €39.45 left to cover any general administrative expenses and taxes!

The goal is to significantly improve this metric! The lower the break-even point, the more profitable each customer becomes. To discover the best marketing methods and improve the marketing payback, Hello Fresh uses a very diverse and broad marketing strategy. Whilst most direct-to-consumer businesses heavily rely on Meta and Google for advertising, Hello Fresh doesn’t.

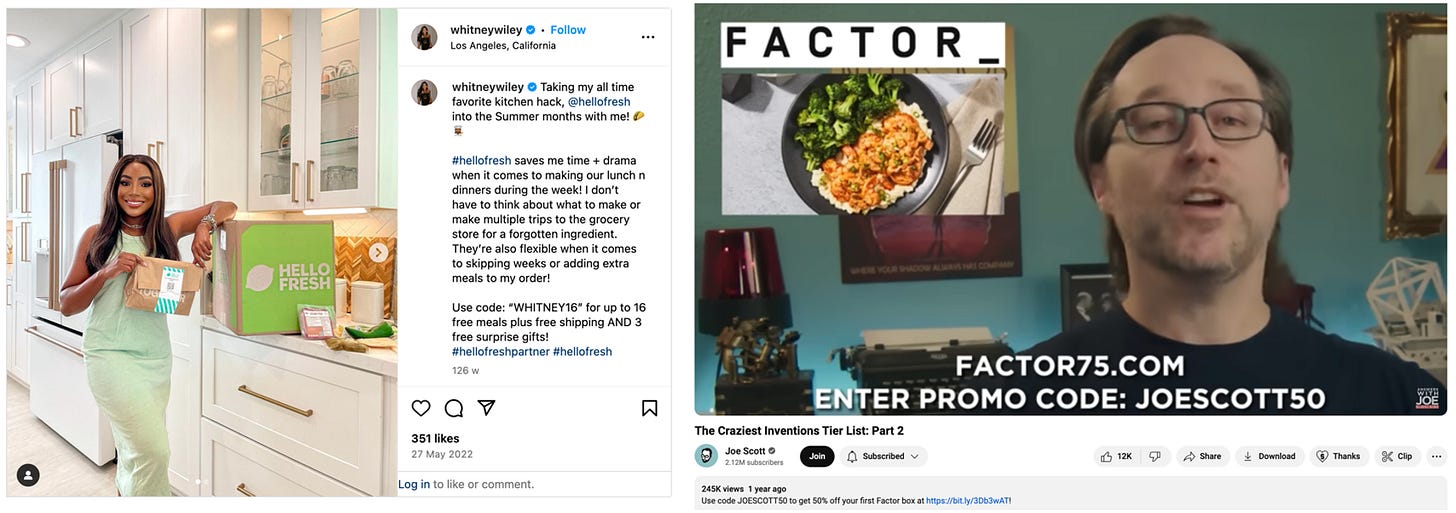

Hello Fresh is known to heavily use influencer marketing. The nature of their product makes it very easy to quickly understand what they are selling, making it perfect for Instagram and YouTube promotions.

Influencer campaigns are not only great and cost-effective ways of reaching a very targeted audience, but they also help grow Hello Fresh’s own social media accounts. Hello Fresh’s US Instagram account has over 620K followers, its YouTube account has 36K subscribers and over 15M lifetime views. Additionally, Factor has 528K Instagram followers. Social media is great for reacquiring churned customers.

2. Scale

As mentioned in the competition section, many meal kit delivery companies are struggling. The post-pandemic industry sales slowdown has increased customer acquisition costs and put pressure on margins. In a high fixed-cost industry, even small slowdowns can cause large losses. I suspect that this negative sentiment caused Hello Fresh to get looped together with other companies. However, the company operates on a much larger scale, which gives them more room to maneuver.

Scale is Hello Fresh strongest competitive advantage!

Huge scale enables better unit economics, which leaves more funds for marketing to acquire new customers. This is the key to Hello Fresh’s success. The company was able to reach scale faster than competitors, creating a self-reinforcing cycle of growth, where each additional customer increases scale, improving contribution margin and LTV. Higher LTV enables Hello Fresh to spend more on marketing, continuing the cycle of customer and LTV growth.

Additionally, since 2020, Hello Fresh has spent over €1B on capital expenditures, building large high-tech processing plants, automated kitchens, and dedicated delivery networks. None of their direct competitors operate at a scale that would allow them to invest anywhere close as much. These investments are what enabled Factor to grow 50% in H1 2024. Hello Fresh claims their current meal-kit capacity is sufficient for €10B in revenue, 60% above their current run rate. As very limited capex will be necessary to grow the meal-kit segment, more funds will be available to invest in RTE and other segments.

In 2023, Hello Fresh delivered over 1 billion meals to customers, a CAGR of 35% since 2016!

In 2016, the company delivered 91 million meals to customers, which means that Hello Fresh grew meals delivered 10 times in just 5 years. Since the post-pandemic peak of 2022, the growth has plateaued.

The pandemic caused massive disruptions to the global order, accelerating many digital trends. Experts thought that customers had permanently changed their behaviors. However, we have seen many digital companies underperform in 2023, indicating that rather than accelerating trends, the pandemic pulled future growth forward.

3. Churn

Hello Fresh operates in a high-churn industry. Novelty is a significant factor for people when deciding on a meal. Most Hello Fresh customers subscribe for a few months and cancel. That is the experience I had as a client. I signed up for their service with a 50% discount, and after paying the full price for one box, I canceled.

I was fully satisfied with the meals but didn’t think paying the full price for the kit made sense to me. I imagine there are lots of customers who made a similar decision. In such circumstances, Hello Fresh must gather enough long-term subscribers to make up for the marketing spent on acquiring unprofitable short-term customers.

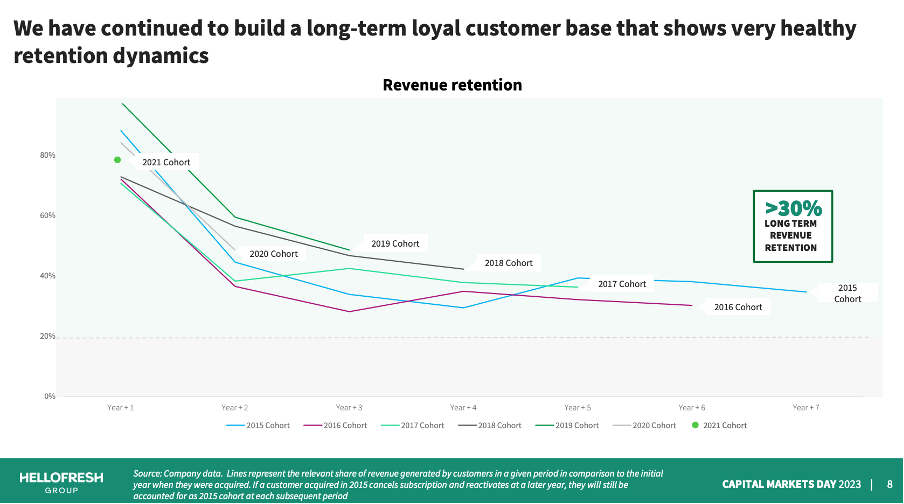

Per Hello Fresh’s 2023 Capital Markets presentation, the company has achieved an estimated 30% long-term revenue retention rate. This means that 70% of customers cancel their subscriptions. In the graph above, we see that, on average, one year after signing up, more than 50% of customers have canceled.

While some customers who cancel end up resubscribing, such high churn is atrocious.

Reducing churn is imperative for the company to create a sustainable long-term business!

Additionally, reducing churn is one of the biggest opportunities. Lower churn enables cheaper customer acquisition and thus improves margins.

4. Reviews

Hello Fresh is a customer-facing company that, as we established in the marketing section, must constantly acquire new and regain old customers. For such a business, bad reviews could possibly have long-lasting consequences.

Hello Fresh US has a Trustpilot score of 3.8, which I would classify as acceptable, while the reviews in the UK are an atrocious 3.3. In its home country of Germany, the Trustpilot's score is 3.5.

After reading through some negative reviews, I have noticed a pattern and found areas where Hello Fresh should improve.

Price – A lot of reviews complain about the price. This is a consequence of Hello Fresh’s aggressive discounting discussed in the marketing section. A lot of customers get quite unhappy once they get charged the full price. I don’t think there is much to be done about this. What is an acceptable price for the same product varies between households. $10 per meal might be prohibitively expensive for one person and cheap for another.

Don’t like the food – Another common complaint of reviewers is the food itself. Some people don’t find it tasty, others want more choice. Hello Fresh is tackling this complaint by increasing their menu options by 71% since 2019.

Delivery – There are many bad reviews where customers complain about late deliveries, spoiled food, and incorrect orders. The company is confronting this issue by taking some deliveries in-house and increasing automation in their warehouses.

Customer service – Terrible customer service or lack thereof is the most popular complaint. Nothing enrages people more than being unable to speak to a real person once an issue arises. Hello Fresh heavily utilizes various chatbots and automated replies to save costs on customer service.

It is understandable to experience some growing pains when your business quadruples in a few years from an already large base. It would be wise to use the current slowdown to work on all the various issues mentioned by customers.

Negative reviews getting out of control could potentially irrevocably damage Hello Fresh brand!

Moreover, Hello Fresh, churn is already quite high, bad reviews could cause it to increase even more.

5. Competition

Although food is one of the largest and most important industries in the world, it is also one of the most competitive. Hello Fresh has many competitors, let’s look at them.

Grocery stores – The most popular way of acquiring food in the urban areas where Hello Fresh operates. Increasingly, supermarkets are betting big on meal kits, food bites, and RTE meals. If one walks through a large supermarket, they are likely to find soup and salad kits, sliced cooked meats, and various quick-bite options like sandwiches, croissants, and RTE meals.

These stores have economies of scale, significant foot traffic, and a stable customer base. Availability and speed are their main advantages over Hello Fresh, customers get it instantly in the store. Prices are often lower as well. However, Hello Fresh trumps them in selection as, due to not being limited by shelf space, they can offer a larger selection on their website. This advantage, however, disappears online as after the pandemic, grocery stores have significantly grown their delivery business. In theory, they could offer a similar selection if enough investments would be made.

Driven by the change in consumer preferences influenced by the pandemic, the delivery of groceries has become more popular. Statista Market Insights estimates that the US grocery delivery market will grow with a 12% CAGR, reaching $455B in 2029. While in Europe, the market is to grow with a slightly slower 10% CAGR, reaching $151B in 2029. As the demand grows, supermarket chains will continue investing in various service differentiation efforts to attract and keep customers. More and better food options are likely to become key areas for investment.

There are synergies between grocery stores and meal-kit companies in the supply chain, marketing, delivery, and operations. Thus, it’s not a surprise that there have been some notable acquisitions of meal-kit companies by supermarket chains.

Home Chef with a 10% US meal-kit market share is the second largest player in this space. Kroger, one of the largest supermarket chains in the US purchased the company in 2018. Since the acquisition Home Chef’s market share has fallen by 3% points.

Waitrose, a supermarket chain in the UK, acquired meal-kit company Dishpatch.

Additionally, the leading German grocery store chain Lidl acquired a local meal-kit company Kochzauber.

Furthermore, the US supermarket chain Albertsons acquired Plated in 2017, a US-based meal-kit service. However, the service was stopped just two years later in 2019.

Food delivery Apps – Uber Eats is the most well-known delivery app, but there are dozens of other ones. If a restaurant meal can be delivered for a price similar to a Factor meal, why would one order? Of course, this is hardly possible, as Uber Eats meals are rarely $12, often $20 or more. Additionally, there are other factors to consider, such as calorie count, taste, nutrition, and value.

Apart from dedicated grocery delivery apps such as Instacart in the US and Flink in Europe, restaurant delivery apps have increased their focus on grocery delivery. It is not inconceivable for any of these apps to add meal kits or RTE meals to their offerings, most likely through a partnership.

I wouldn’t be surprised if Factor partners with any of these apps for extra distribution.

Marley Spoon – As you can see in the picture above, Marley Spoon commands a small and shrinking market share in the US. Overall, their active subscribers declined 17% in Q2 of 2024, while revenues were up 1% to €86.8M. Their US business grew, while their European and Australian businesses are collapsing.

Blue Apron – The most serious Hello Fresh competitor. Blue Apron started struggling significantly in 2018 and, in stark contrast to Hello Fresh, didn’t see any meaningful increase in business during the pandemic. The company’s sales as of LTM Q3 2023 were $425M, down 52% from the peak of $881M in 2017. Despite having a better Trustpilot score of 4.1, Blue Apron struggled to compete with Hello Fresh. Blue Apron’s market share has been steadily decreasing, and in 2023 it was acquired for $103M, less than the $300M raised during its lifetime.

Simply put, Hello Fresh is in a league of its own!

The company is a market leader in both the meal kit and RTE segments. Most of their competitors are struggling, selling off assets, outsourcing manufacturing, and getting acquired. None of them operate on a scale anywhere near Hello Fresh, and I find it likely that many will go bankrupt in the next few years.

6. Part 3

We will conclude this Deep Dive with a look at Hello Fresh opportunities (RTE?)

Additionally, a full financial analysis will be conducted together with a valuation model.

Subscribe to Global Equity Briefing for more quality reports!

Hello Fresh. Hungry for More! Equity Research! Part 3/3

The pandemic caused a surge in demand for this DtC subscription food company’s products. Such supercharged demand enabled Hello Fresh to increase sales by 107% and achieve record profits. However, the hyper-growth is over, flat sales and unprofitability are here. Is Hello Fresh doomed as its stock price would suggest, or was Mr. Market a bit too pessimistic? That’s the question I am hoping to answer in the final part of this deep dive!

Thank you for reading, Follow me on:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.