Historical multiples don’t matter!

Investing Basics. #2

Hello Global Investors!

Today, I want to talk about a pet peeve of mine that drives me crazy sometimes.

I am a frequent user of X/Twitter and follow lots of the popular “finfluencers”. Many of them are smart people who provide interesting insights.

However, there are those who make claims that I find rather annoying. No, I am not talking about wildly bullish posts implying that a stock will 100X.

I am talking about posts that look at historical P/E charts and, based on whether a company trades above or below a 5 or 10-year average P/E, determine that it is overvalued or undervalued.

So today, I will talk about why historical P/E’s don’t matter, as they have nothing to do with how a company will perform in the future!

What matters is future growth expectations.

In short, historical P/Es tell you where a stock has been, but not where it's going!

Historical multiples don’t matter because they don’t tell investors in which business life cycle stage a company is, current growth assumptions, whether a company is in a downturn or in a decline, and whether it might be mispriced.

Let’s expand on each.

1. Business Life Cycle

2. Growth Assumptions

3. Decline vs Downturn

4. Mispricing

5. Conclusion

1. Business Life Cycle

Businesses are not static, they go through various life cycle phases and operate in an environment that is constantly changing.

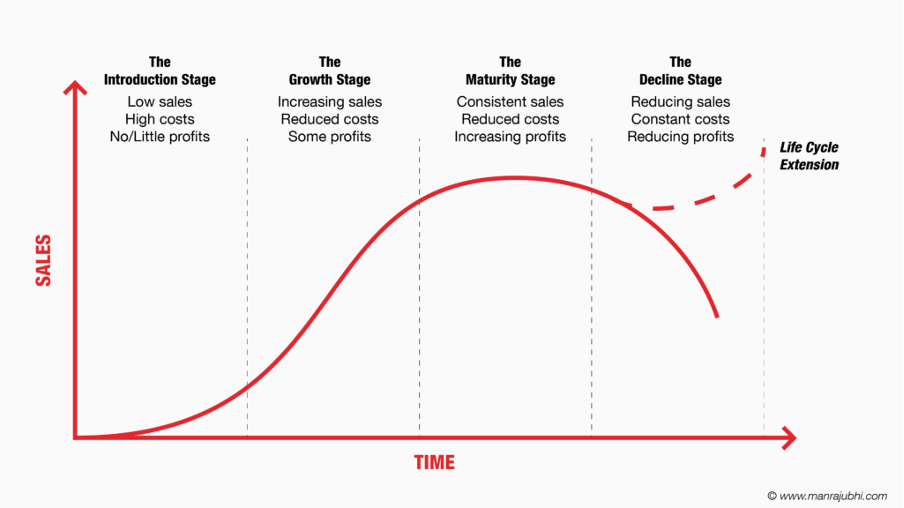

In the above illustration from Manraj Ubhi, we see the Business Life Cycle.

Companies are valued based on which stage they are in their life cycle, and the market's expectations for how long they will remain there and how quickly they will go to the next stage.

Valuing a company based on a growth stage multiple if it has reached maturity is a recipe for disaster!

A 10-year average P/E reflects a mix of potentially outdated business realities, making it a poor benchmark for today.

Let’s look at Pepsi.

In the above X/Twitter post, Dividend Dude is implying that because Pepsi trades for a P/E of 16, significantly below historical averages of 25+, it is a buying opportunity.

This is terrible logic. 10 years ago, Pepsi was living in a different world than we are living in today!

Emerging markets were much less penetrated than they are today. Since 2017, Pepsi’s revenues in Latin America are up 63%, Europe 32%, Africa 69%, and Asia 68%. I find it extremely unlikely that these regions will deliver such strong growth in the future.

Additionally, white label store-brand products are a real threat to Pepsi’s margins. People don’t love brands as much as they used to, and will gladly buy Walmart, Costco, or other store brands for half the cost of Lay’s chips. The popularity of store brand products is exploding and will only continue to rise.

Furthermore, Pepsi has been very dependent on its snack division for growth. As GLP1s and healthiness movements accelerate, I just don’t see Pepsi growing pricing and volumes as much as they have in the past.

Lastly, the 4.4% dividend yield is not sustainable as the company pays out 116% of its FCF in dividends and share-repurchases. This means that Pepsi is funding shareholder returns with debt. Long-term debt is now at $48.5B, up by $7B since 2022.

This is while the company grew sales by 0.4% in 2024, and analysts expect 0% sales growth this year and just 3% in 2026.

Why would an investor pay 25 P/E for this company?

To be honest, I wouldn’t even pay the 16 P/E it trades for today.

Pepsi is no longer in the growth stage of its lifecycle, thus, it shouldn’t be valued as one, it should be valued as a mature and declining company!

I expect Pepsi to continue to underperform shareholder expectations, which refuse to grasp this reality.

2. Growth Assumptions

Often, investors tend to oversimplify things and jump to conclusions. In my previous article on why Net Income Does Matter and shouldn’t be ignored, I talked about how high capex doesn’t always equal bad.

Similarly,

High P/E = Bad

Low P/E = Good

is simplistic and wrong.

A company trading at a high P/E today might actually be undervalued if its earnings are expected to grow rapidly in the future.

However, a stock with a low P/E could be a value trap if growth is expected to decline.

Let’s look at Starbucks and Novo Nordisk.

In the above X/Twitter post, Dimitry implies that Starbucks is undervalued, largely because when he made the post, it traded for a FWD P/E of 20, below the 10-year mean of 28.6.

Today, more than a year later, Starbucks trades for a P/E of 34, the same P/E as in 2015.

Since the post, Starbucks is up a mere 10%, yet the multiple has expanded by 70%. This is because earnings have decreased.

This valuation makes no sense when one really thinks about it.

The prospects the company had back in 2015 were just on another level compared to today.

The concept of a premium chain cafe was relatively new.

Other chains didn’t focus on coffee.

China, Japan, and Europe were open fields for expansion.

Pricing power was not exhausted.

Today, the concept of a premium café is saturated. Entrepreneurs are not dumb, when they see something working in one country, they copy it. Those who like travelling will confirm that there are Starbucks-like local chains in basically every country today. All have great coffee, comfortable seating, wifi, for half the price of a Starbucks.

Additionally, McDonald’s, Dunkin Donuts, KFC, and others have significantly upgraded their coffee game. McDonald’s in particular, with their McCafé concept, has been very successful.

Furthermore, there are around 7,600 Starbucks café’s in China, up 7X since 2015. Overall, the company doubled the restaurant count in the last decade, from 20k to 40K. I find it highly unlikely that Starbucks can double again, going from 40K to 80K restaurants. Yet investors are paying the same P/E today.

Lastly, Starbucks has exhausted its pricing power. There is no consumer surplus left to capture back. Recently, it was reported that Starbucks lowered prices in China for certain items by as much as 33%.

I just don’t see how Starbucks doesn’t significantly underperform investor expectations!

Meanwhile, Novo Nordisk is completely on the opposite side of the spectrum.

Here is a comment I received on X/Twitter from Alex on a post about Novo Nordisk.

Today, Novo Nordisk trades for a P/E of 22, above its P/E from before 2020.

Yet, from 2015 to 2020, Novo Nordisk only grew sales by 32.7%.

In 2023 alone, Novo Nordisk grew sales by 31%!

Business fundamentals have changed. Ozempic and other GLP1 drugs are the first real, safe, and medically effective weight loss drugs in history.

Since 2020, revenue has doubled, and quite likely will double again in the next 5 years.

I would buy Novo Nordisk trading above its historical P/E than Starbucks below it!

3. Decline vs Downturn

Sometimes I hear investors saying, something to this effect, “This company is down 50% and trades just for a P/E of X, because we are in a downturn. Revenue growth will return and multiple will expand”.

Often, that simply isn’t the case.

Investors quite frequently conflate a decline with a downturn!

A downturn is a cyclical, short-term negative phase in a company’s performance, with the business often recovering.

A decline is a structural, long-term erosion in a company’s fundamentals, with the business weakening, often permanently.

Buying a company when it is at the bottom of a downturn could be very profitable as the business recovers.

However, investors who buy a stock that is in decline, thinking it will recover from a downturn, have set themselves up for blood and tears.

And to be honest, it is not always clear and easy to tell the difference. So, investors need to answer these questions to determine if a company is in a downturn or decline.

Is revenue growth slowing due to temporary factors or long-term demand erosion?

Are margins under pressure because of cyclical cost spikes or business model weaknesses?

Is market share stable or shrinking over time?

Is the brand still aspirational and relevant to the next generation?

Is the geographic growth story intact?

Are forward estimates being revised up, or down?

Let’s look at Nike, for example.

Currently, Nike is in a 65% drawdown from its all-time highs!

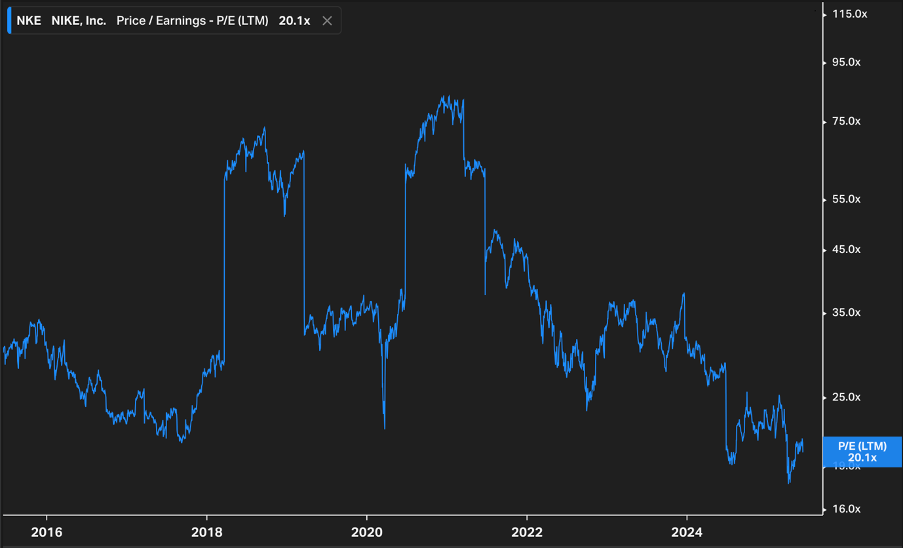

In the above P/E graph, we see that it trades at essentially the lowest P/E it has ever traded at. A P/E of 20 seems to be an attractive valuation for many. Even celebrity hedge fund investors such as Bill Ackman have invested heavily in the company.

Nevertheless, I disagree and believe that Nike is in a decline, not in a downturn, and here is why:

Brand relevance is diminishing

Saturation in North America and Europe

Huge exposure to China

Higher competition

Notice, I didn’t mention tariffs. Nike’s decline started way before Trump became the president.

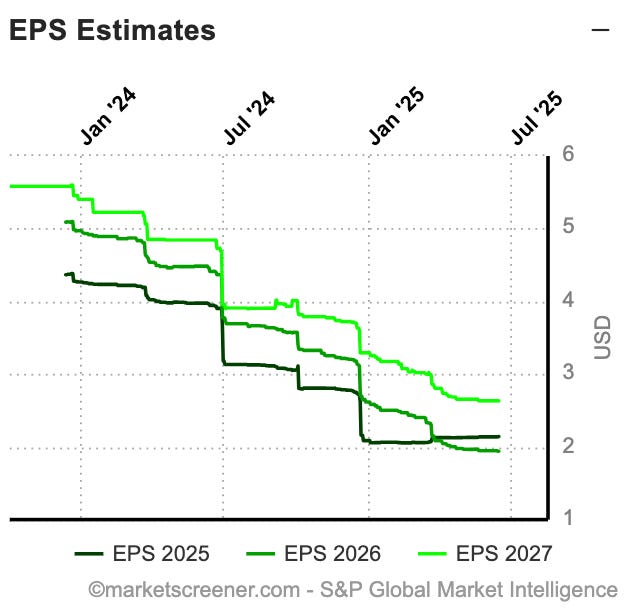

In the above picture, we can see that EPS estimates are going only one way, and that is down!

The brand of Nike is not as strong as it once was, and young people increasingly prefer other brands.

Also, since 2017, sales in North America and Europe have grown by 57% and 32%, there are no easy new cities to open shops in.

Moreover, China, which was seen as a headwind, is now a huge headache for Nike. In Q1 2025, sales fell 17% Y/Y. This is despite many other Chinese consumer brands doing better. There is a structural shift going on in China, pushed by the government to move away from Western and especially US brands. Trump particularly has damaged the Made in the USA brand in China.

The last and most important reason is that competition is higher than ever. Hoka, OnRunning are new entrants that have gained traction, whilst Adidas is recovering from its Kanye West debacle. This means that Nike can’t expect to sell as many $150 shoes as before.

I don’t find Nike to be an attractive investment, despite it trading below its historical P/E!

4. Mispricing

Historical P/Es sometimes reflect times when the stock was mispriced due to market euphoria or downturn. Using those averages as a guide can skew analysis and lead to poor decision-making.

One can find many quality companies that traded for crazy multiples during the 2020 bubble. But it is easy to find cases of past mispricing. Instead, I want to talk about current mispricing and how to avoid it.

Market values are not perfect, they often lag reality. Companies can be undervalued because of low expectations or overvalued because of high expectations.

So, let’s talk about Apple.

I think Apple is one of those companies that could be perfectly situated to fall 50% in the next few years. I can already see X/Twitter posts in 2028 claiming that because Apple trades for a P/E of 20, below the 2025 P/E of 31, it is a great buy.

Here is why I believe Apple to be terribly mispriced:

Peak iPhone

Vision Pro Flopped

AI laggard

0% App Store tax is going away

Low revenue growth

Slowing services growth

Exposure to China

High P/E

I could write an article on this topic alone, and maybe I will, but my overall point is that investors are paying for past greatness when they are paying a P/E of 31 for Apple.

Apple won’t grow nearly as fast as other companies trading for a similar multiple!

In the next few years, we will likely see noticeable iPhone revenue declines, and unfortunately, Apple has nothing that could replace that revenue.

Services growth has already slowed down significantly, from 27% in 2021 to 13% in 2024. Now that the 30% Apple tax on the internet seems to be on its way to its death, Apple TV+ is underperforming, and Google’s $20B search fee might be banned by the court, I expect the segment to underperform.

Overall revenues fell 2.8% in 2023 and only increased by 2% in 2024.

How is this a 30 P/E company?

5. Conclusion

In conclusion, I believe that historical multiples don’t matter and are completely useless.

Business fundamentals change, and investors need to analyze business fundamentals to determine whether a company is a great investment!

A company trading significantly above its historical multiples can be an excellent purchase if business fundamentals have changed and growth is likely to accelerate.

Meanwhile, a company trading significantly below its historical multiples can be an absolutely terrible investment if business fundamentals have deteriorated.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Totally digging this series, keep it coming. I also like how you include actual tweets/examples.

First off, hats off to you—your write-ups are always a masterclass in cutting through the hype, and this one’s no exception.

Here’s my take on Apple. Sure, the bear case highlights real headwinds—maturing iPhone sales, antitrust heat on the App Store, a late start in generative-AI. All valid. Yet those clouds don’t block the bigger picture: Apple is the gatekeeper to a billion-plus devices, and that position is already monetised at software-level economics. Services contribute roughly 42 % of gross profit, and the cash-cow mechanics are hard to disrupt. Google’s $20 billion TAC payment proves that a mere default slot can mint high-margin dollars; extending that toll-booth model to “AI prompts” via Apple Intelligence could add a fresh, royalty-like stream without the cap-ex burden of training frontier models.

Add the $1.3 trillion in annual App Store-facilitated commerce (20 % CAGR since 2019) and the platform’s gravitational pull is obvious: developers go where the wallets are. Even if regulators shave Apple’s take rate, volume plus near-zero incremental cost keep the profit mix attractive. Meanwhile, a $100 billion free-cash-flow engine funds R&D, buybacks and strategic pivots on demand. In other words, every bearish dart can land and the model still works: high-margin services keep compounding, new AI revenue tolls slot on top, and the hardware base quietly refreshes itself. That asymmetry is why the long case still resonates.