One of the best small-cap opportunities in the market!

$HITI is up 113%, here is why!

A few months ago, on February 20, 2025, I published my investment case on Canada’s “Costco of Cannabis”, High Tide.

At that time, the company was trading for a P/S of 0.6, as the market was skeptical of this name. Many investors were burned by the Canadian cannabis bubble of 2018-2020 and saw the industry as uninvestable.

My great friend and colleague, Mr. Heavy Moat, raised a good point.

Why bother?

As I said in my reply, all sin companies are quite profitable, and I don’t see a reason for cannabis to be any different. Additionally, because of the prevailing negative market narrative, the stock is very cheap, positioning investors to not only benefit from earnings growth but also from multiple expansion.

As I explained in my report, I believe skeptics were missing the bigger story, which was a maturing market and an easing competitive and regulatory environment, positioning the industry for a rebound. And I find High Tide the best investment to seize these changing industry dynamics.

After my report, there were a few patchy months, but as High Tide reported stellar earnings and announced a large acquisition to enter the German medical cannabis industry, the stock flew!

As of September 23, 2025, High Tide is up 113% from the lows and 41% from my report!

Despite the rise, the fundamentals haven’t changed, as, in my opinion, High Tide remains one of the most compelling small-cap opportunities on the market!

Let me elaborate.

1. Canadian Business

2. E-commerce Business

3. Germany

4. US Legalisation

5. Finances

6. Valuation

7. Conclusion

1. Update on the Canadian Business

As I said in the February report, when cannabis was first legalized in Canada in 2018, the market was flooded with entrants, with high supply leading to low prices, whilst stringent government regulations and high taxes meant high costs. However, today, as a result of a wave of bankruptcies and some provinces reducing regulations, the industry is stabilizing, leading to the demand consolidating with the best players.

And High Tide is certainly one of the best players, thus their Canadian business has been performing exceptionally well.

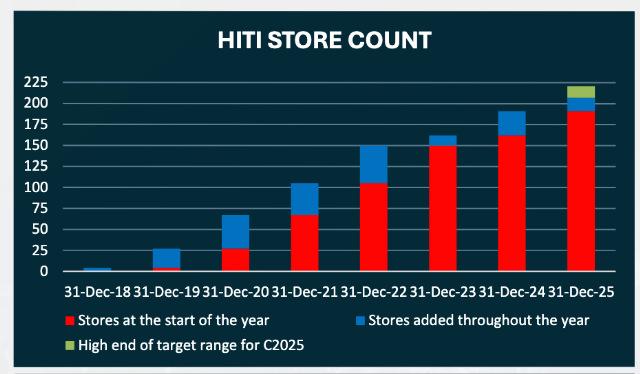

First, so far in 2025, High Tide has opened 16 new locations, reaching 206, and is well on its way to reach its 20-30 new location target for this year. The long-term target is to have over 300 locations in Canada.

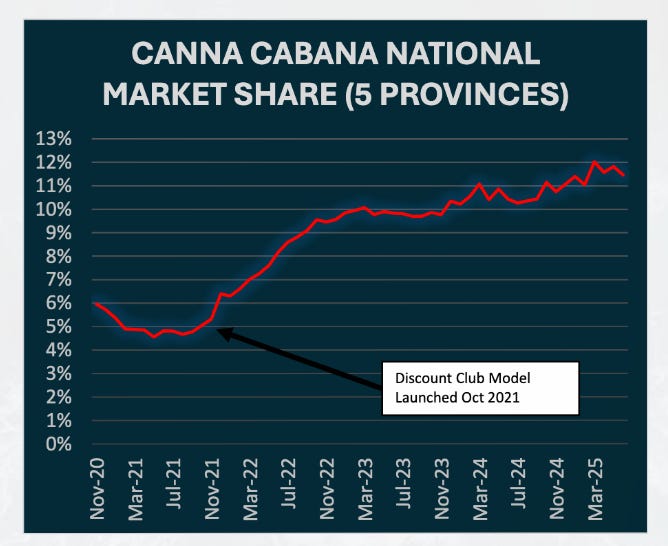

The company has a 12% market share in the provinces in which it operates, an increase from 11% last year. High Tide continues to demonstrate steady market share gains, as it grows faster than the industry.

This is what I wrote in the February report:

“I find it likely that the growth will reaccelerate in the next few years!

High Tide has been an unprofitable and cash flow-burning company for many years, and changing market conditions in 2023 forced it to shift focus from top-line growth to improving margins. Now that the company has improved its business economics, it can shift its focus back to growing sales. “

So far, this is exactly how it has played out.

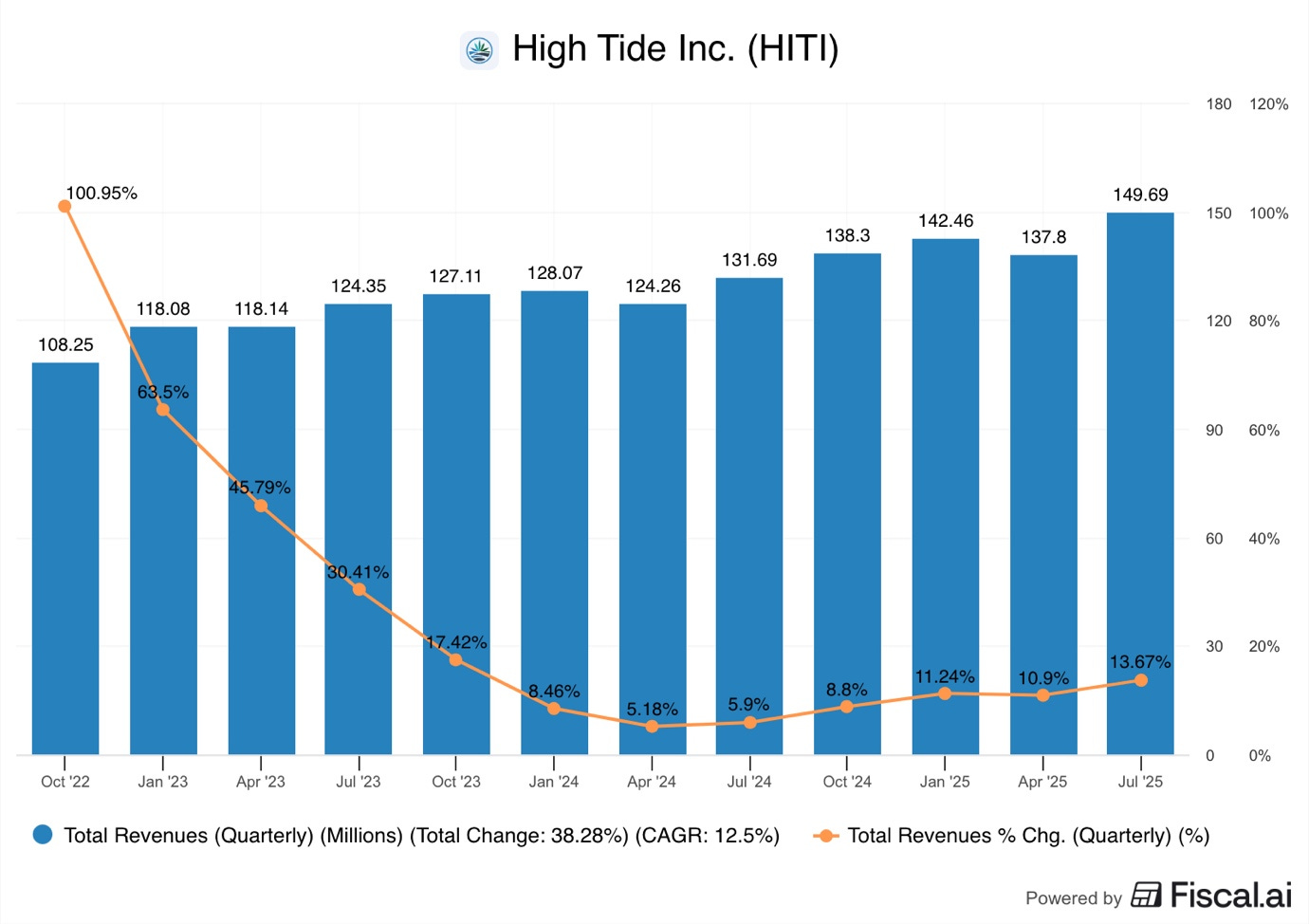

As we can see in the graph above, revenue growth has increased from a mere 5.9% in Q3 2024 to 13.7% in Q3 2025, reaching CA$149.7M.

Revenue growth rates show a clear accelerating trend, despite a challenging macroeconomic environment in Canada. The company achieved this result not only because of new stores, but also because existing stores continue to perform better.

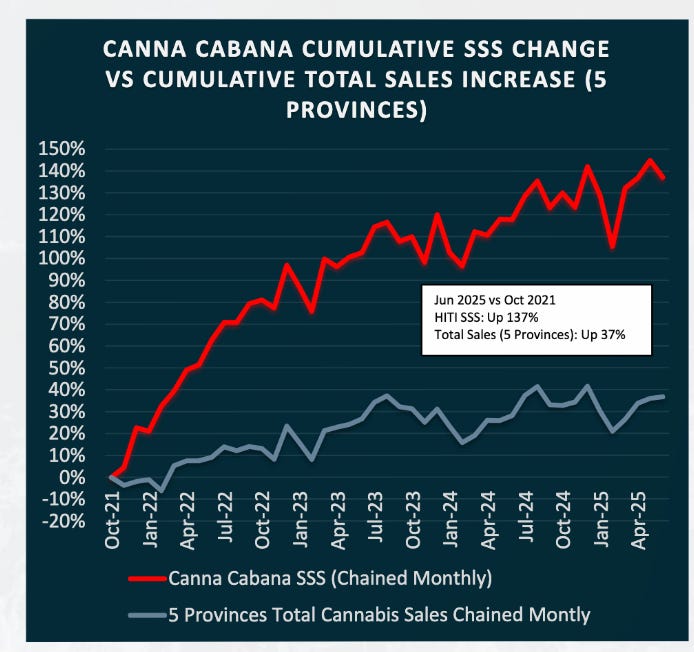

Same-store sales were up 7.4% in Q3 2025, and 137% since June 2021, which compares extremely favorably to the industry average, which saw a 37% same-store growth since 2021. In fact, the 7.4% same-store sales growth in Q3 2025 was High Tide’s fastest SSS growth rate in over 2 years.

On a LTM basis, Canna Cabana dispensary sales grew 15% Y/Y, compared to 5% growth of the industry!

It is clear that High Tide is a significant market share taker, largely thanks to its innovative Costco-like subscription model.

For a full explanation, read my previous report.

But essentially, High Tide’s Cabana Club loathly program offers special perks and discounts to its members.

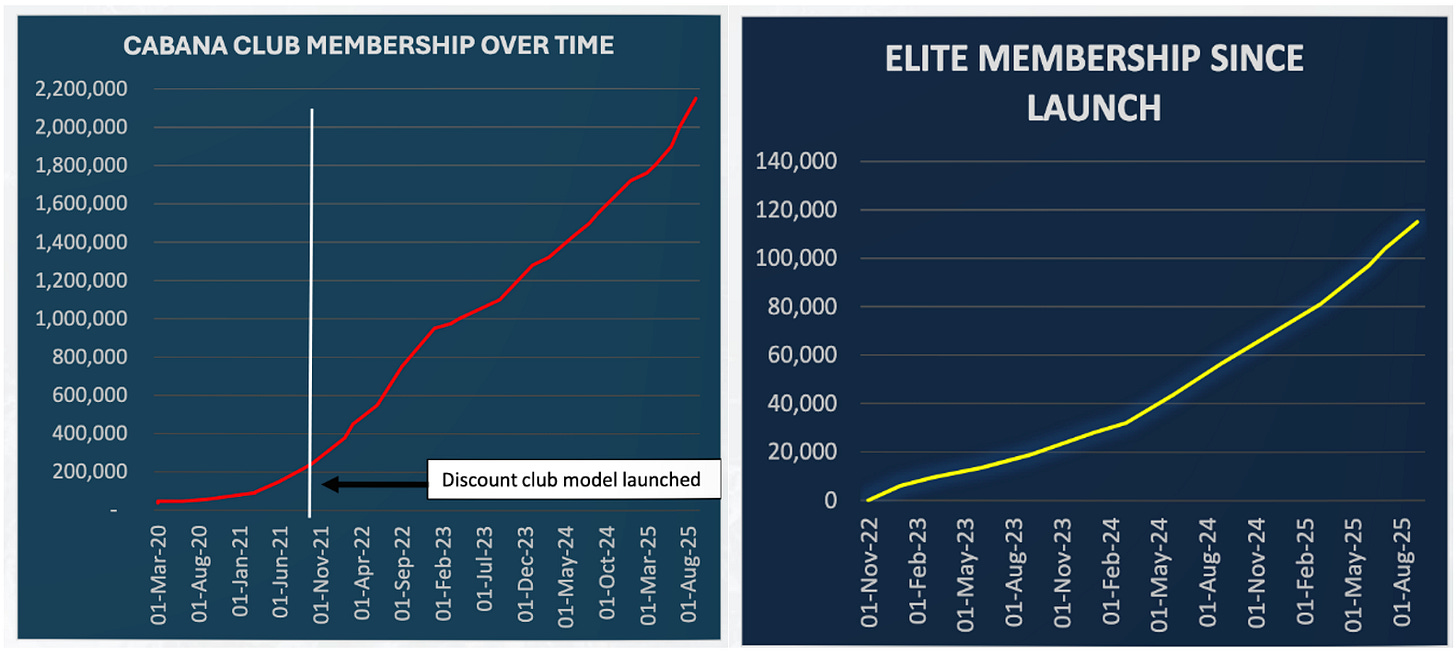

As of Q3 2025, Cabana Club has 2.15M members in Canada, an increase of 39% Y/Y, while Elite members grew by 102% Y/Y to 115K!

Members of the loyalty program are crucial to drive recurring purchases and increase same-store sales growth.

2. Struggling E-commerce Business

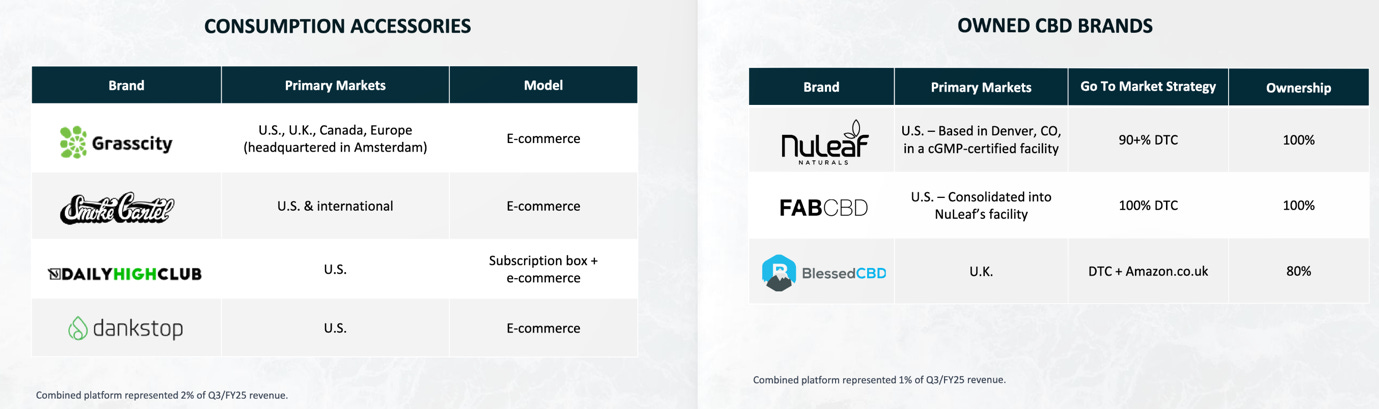

However, not everything is as rosy, as unfortunately, High Tides’ e-commerce business is struggling. The company owns a few e-commerce stores in the US that sell cannabis accessories and some hemp-derived products, such as CBD oil.

However, the good news is that this business is small and largely insignificant!

In Q3 2025, the e-commerce segment revenue fell by 54.6% Y/Y to CA$3.9M, whilst operating income turned into an operating loss of CA$2.9M!

After such a drop, this segment now generates only 3% of High Tides’ overall revenue, down from 7% a year ago.

High Tide CEO, Raj Grover, has said that he believes that this segment can be turned around, thus, they recently hired a new VP of e-commerce. I am extremely skeptical and think that they should just sell or close these websites. There is a belief that in the case of a US federal legalization, these e-commerce stores will be valuable, but I disagree.

Nobody is loyal to a generic weed-themed e-commerce store they bought a bong from once. Furthermore, in my opinion, cannabis consumption accessories are very synergistic with cannabis itself. I just don’t see the benefit of simply selling cannabis accessories, as users can easily purchase a bong, pipe, or rolling papers from the same store they bought the cannabis from.

As a Canadian company, High Tide is not allowed to sell cannabis till legislation is changed federally, until that happens, they will be at a disadvantage to the local operators in states where retail cannabis sales are allowed.

In my opinion, this segment is a distraction!

3. Expansion to Germany

Earlier in the year, High Tide announced its intention to purchase a majority stake in the German medicinal cannabis distributor Purecan for €5.8M.

However, during the due diligence process, High Tide decided to exit the deal. A key strategic reason for High Tides’ acquisition of Purecan was their intent to develop and launch a telemedicine portal, where patients could get medicinal cannabis prescriptions remotely and digitally.

However, the newly elected German government has said that allowing telemedicine portals to prescribe cannabis would be open to abuse, so they are reviewing the law. Due to such circumstances, High Tide found the risk of legislative changes too great, so they pulled out of the deal.

This might turn out to be a blessing, as after this deal was cancelled, the company decided to enter into an even larger deal, by acquiring a 51% stake in a German cannabis distributor, Remexian, for €26.4M.

This deal is almost 5 times larger than the proposed deal with Purecan!

Remexian operates at an annualised sales rate of €70M and ADJ EBITDA of €15M, resulting in an acquisition multiple of 3.64x ADJ EBITDA. High Tide holds the right to acquire the remaining stake for the same multiple for 5 years after 2 years from the deal closure, so from September 1, 2027, till September 1, 2032.

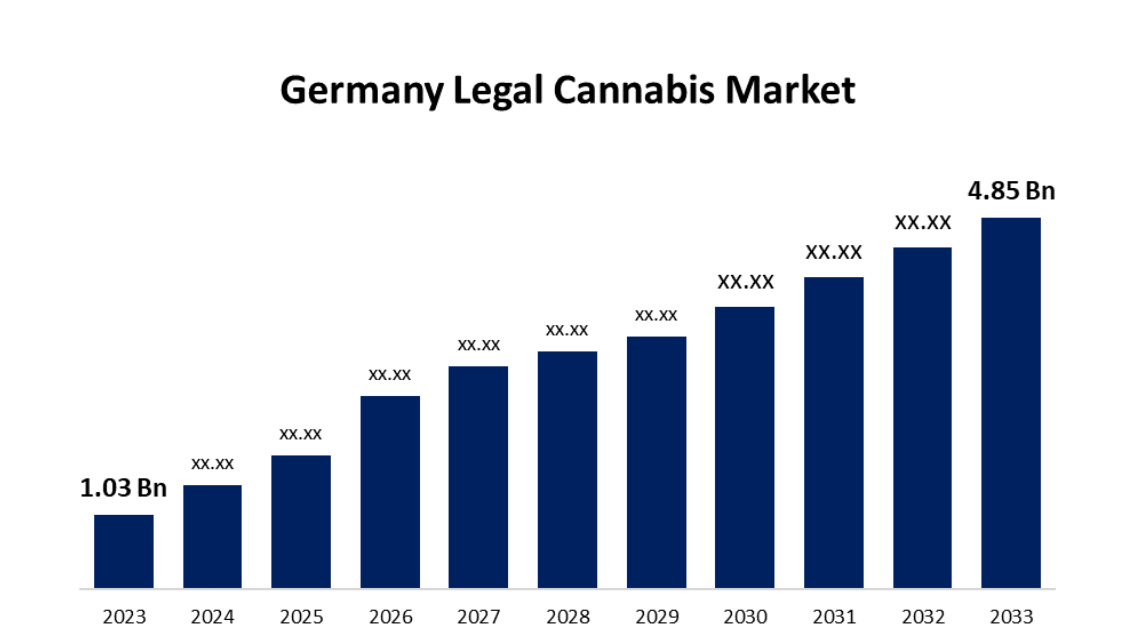

This is a very reasonable valuation considering the growth potential of the German medicinal cannabis market.

Researchers at Spherical Insights forecast that the legal German cannabis market will grow with a 16.76% CAGR to US$4.85B!

Let me explain how the German export business will work:

High Tide negotiates a price with Canadian growers, let’s say CA$3 per gram.

It then adds its markup, let’s say 40% and sells that cannabis to Remexian for CA$4.2 per gram.

Remexian adds its mark-up, let’s say also 40%, and sells cannabis wholesale to pharmacies, for CA$5.6 per gram.

Pharmacies add their markup, 19% VAT, and sell retail for likely around CA$15 or €9 per gram.

High Tide makes money at two steps of the process.

First, as a wholesale exporter to Germany, it keeps 100% of the markup that it adds to the purchase price. It recognizes the entire CA$4.2 as revenue, and $CA1.2 as gross profit.

High Tide operates as a middleman, taking a fee for its services, without incurring large operating expenses. This is why the export business could be so profitable for High Tide. In the above example, they will recognize a 28.6% gross profit margin, of which a large portion will just go down to the bottom line, as the costs of actually shipping the product to Germany are much lower than the distribution costs of running a retail brick-and-mortar business in Canada.

This segment could have a 20% EBIT margin, compared to the 3.6% Q3 2025 EBIT margin!

Second, as a 51% owner of Remexian, High Tide has rights to 51% of the profits that their medical cannabis wholesale distribution business generates in Germany. So, after Remexian adds its mark-up and incurs all its distribution expenses.

While the idea is simple, the actual accounting will get a bit murky. As the majority owner, High Tide will have to consolidate all revenues and expenses of Remexian into High Tide, but then recognize 49% of Remexian’s net income as non-controlling interest.

This deal is beneficial to High Tide in many aspects.

Firstly, and most obviously, it enables High Tide to enter a new region, expanding to the fast-growing German medicinal cannabis market.

Secondly, it positions them well to enter the German recreational retail cannabis market. Currently, recreational cannabis sales are not legal, and it is unclear when that might change. However, I find it likely that full legalization will happen. Medicinal cannabis legalization is always the first step, and often the second follows, as it was in Canada and many US states.

Third, it strengthens its negotiating power with growers. High Tide will be able to get better prices from suppliers because the quantity of cannabis purchased will increase. Higher volume discounts will make the company more competitive domestically, enabling lower prices for consumers and higher margins for High Tide.

Fourth, High Tide now has a foothold in Europe that it can use to expand to other medicinal cannabis markets such as the UK, Poland, Denmark, Italy, and others.

4. US Legalization

While Cannabis is legal in some US states, it is illegal on a federal level. All cannabis must be sold in the state where it is grown, as export to other states is classified as drug trafficking and punishable by decades in prison.

While Trump has said that he is open to cannabis reform, he has no intention to legalize it on a federal level. At best, he would reclassify it and give more power to the states in regulating it. This would make it easier for local cannabis companies to operate, but it would have no impact on High Tide.

In my opinion, it is highly unlikely that High Tide will be able to begin a retail cannabis business in the US in the foreseeable future!

5. Finances, Valuation, and Conclusion

The rest of this report is for Global Equity Briefing Premium members.

Here is what my Premium Members can expect:

Top Monthly Picks - Each month, I will select a few stocks that I find likely to outperform.

These picks will focus more on short-term pricing movements and swift through market narratives.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on a monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

The standard practice is to give 2 months free for annual plans, but I have decided to give 6!

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.