How Adyen 20X'ed revenues in less than a decade!

Adyen. Equity Research! Part 1/3

It has never been easier, safer, and faster to pay for goods and services online.

Not only do all e-commerce stores, streaming services, and apps accept credit cards, but they also accept a wide range of other payment methods. Mobile wallets, direct debits, local and regional payment methods, and more.

But rarely do people appreciate it or think about how it works!

Well, there is a whole ecosystem of companies that enable our modern digital financial system to function.

And one of the key players in this ecosystem is Adyen.

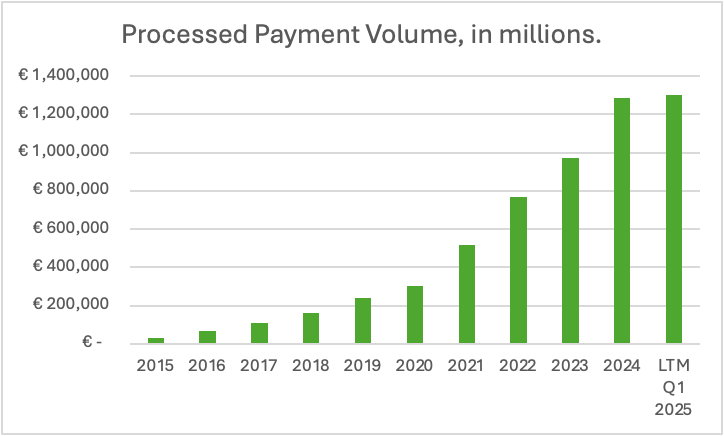

Adyen is a payment processing juggernaut, handling €1.3T in payments!

This makes Adyen one of the largest and most important financial services companies in the world.

Furthermore, thanks to the quality of their offering and massive scale, Adyen grew its revenues 20X in less than a decade!

In this 3-Part Deep Dive, I will explore what made them such a success and what lies in their future.

In Part 1, we will explore how Adyen came to be and its business model.

Next, we will look at competitors and business risks in Part 2.

The Deep Dive will conclude with a look at opportunities, valuation, and finances in Part 3.

1. The Story of Adyen

2. Business Model

3. Competitive Advantages

4. Management

5. Parts 2 and 3

1. The Story of Adyen

Adyen was founded in 2006 in Amsterdam, the Netherlands, by Pieter van der Does and Arnout Schuijff. The founders saw the opportunity that online payments could become and decided to tackle it with innovative technology solutions.

Funnily, this was actually their second attempt at founding a payments company!

During the 1990s, they formed a payments company called Bibit, which was successfully sold to the Royal Bank of Scotland in 2004. After the sale, the founders worked for a bit for the bank, but decided to quit and start again.

They saw the inefficiencies and fragmentation in the existing payment infrastructure and didn’t believe a bank could solve these.

The duo envisioned creating a new, unified payment platform that could simplify global transactions and meet the demands of the digital age.

They were right, and as of today, Adyen is a € 50B market cap company, processing trillions of euros in payments.

2. Business Model

Adyen is a payment processing financial technology company with revenues of €2B and net income of €925M.

Their approach to payments has been a huge success, enabling the company to process €1.3T in transactions!