Is AppLovin a Buy?

2030 Valuation Model!

AppLovin has been a relentless target of short seller attacks for almost 2 years now, as its impressive stock performance, rising over 1,000% in 2 years, and AI winner narrative have attracted many skeptics.

There are two strategies that companies commonly use to fight short sellers, but only one really works.

Deny allegations and threaten legal action.

Continued great financial execution.

AppLovin has chosen the second option, and their Q3 results demonstrate that!

As I mentioned in my AppLovin Investment Case, analyst expectations were way lower than the current trajectory would imply.

So, AppLovin handily beat analyst expectations, sending the stock up 7% in the after-market.

AppLovin’s share price is now up 48% since I published my first report on the company back in August!

Execution has been exemplary in the past 2 years, but as investors, we don’t care about the past, we care about the future.

Thus, I have built a new updated 2030 valuation model that takes into account the new developments.

Let’s dig in.

1. Q3 Results

2. Key Points from the Call

3. Valuation

4. Valuation Model

1. Q3 2025 Results

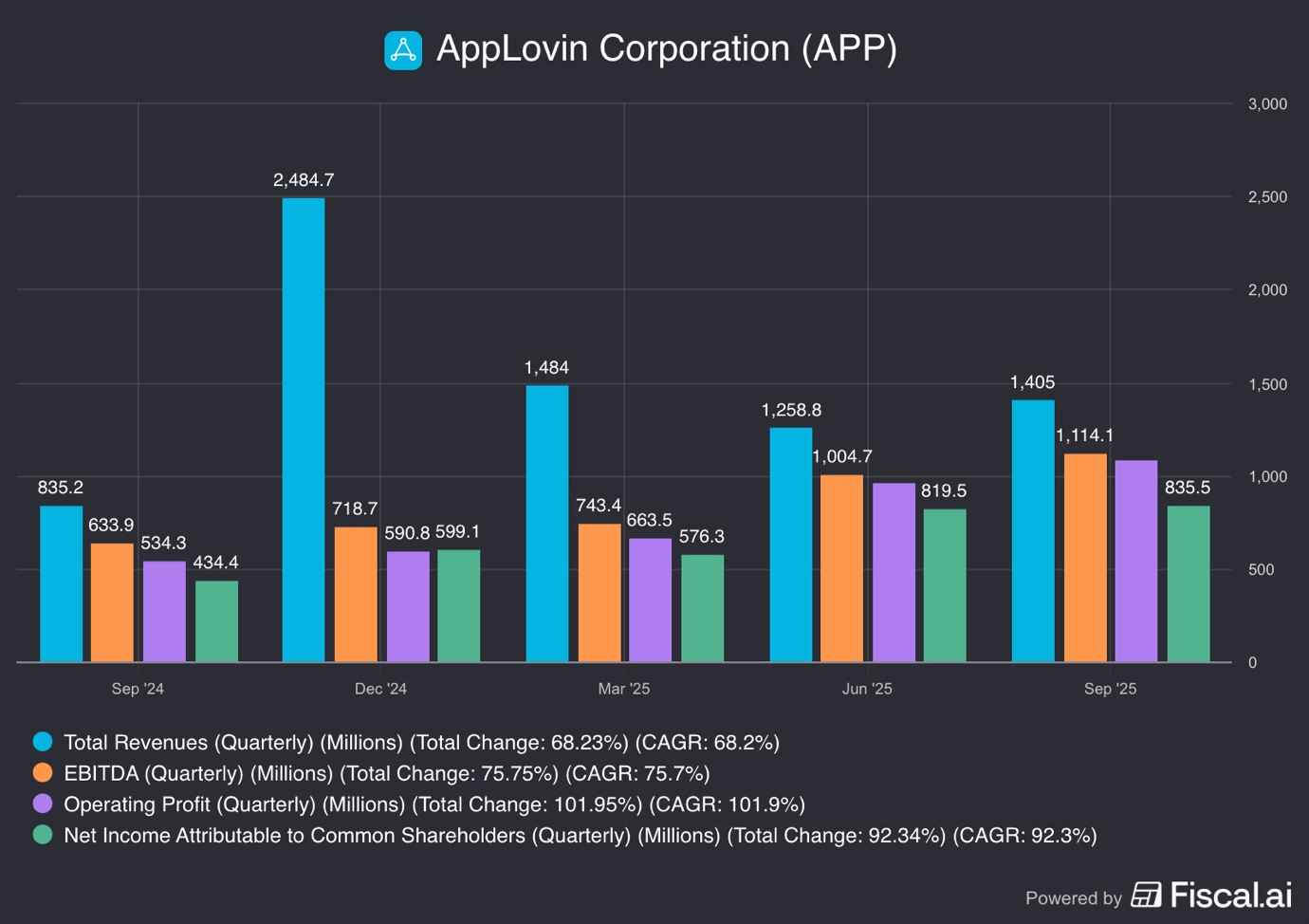

Revenue: $1.4B +68.2% Y/Y, +11.6% Q/Q

EBITDA: $1.1B +75.8% Y/Y, +11% Q/Q

Operating profit: $1.08B, +102%, +12.6% Q/Q

Net Income: $835.5M, +92.3% Y/Y, 2% Q/Q

EPS: $2.45+ 91.5% Y/Y, +2% Q/Q

FCF: $1.05B +91.3% Y/Y, +36.4% Q/Q

Overall, it was an exceptionally strong quarter that continues to demonstrate why the stock has risen so sharply.

They beat the revenue estimate of $1.34B by 4.9%, EPS estimate of $2.4 by 2%, EBITDA estimate of $1.09B by 6.3% whilst FCF slightly missed estimates.

AppLovin now has an insane 77% operating margin and a 59.5% net income margin!

This makes them one of the most profitable companies in the world.

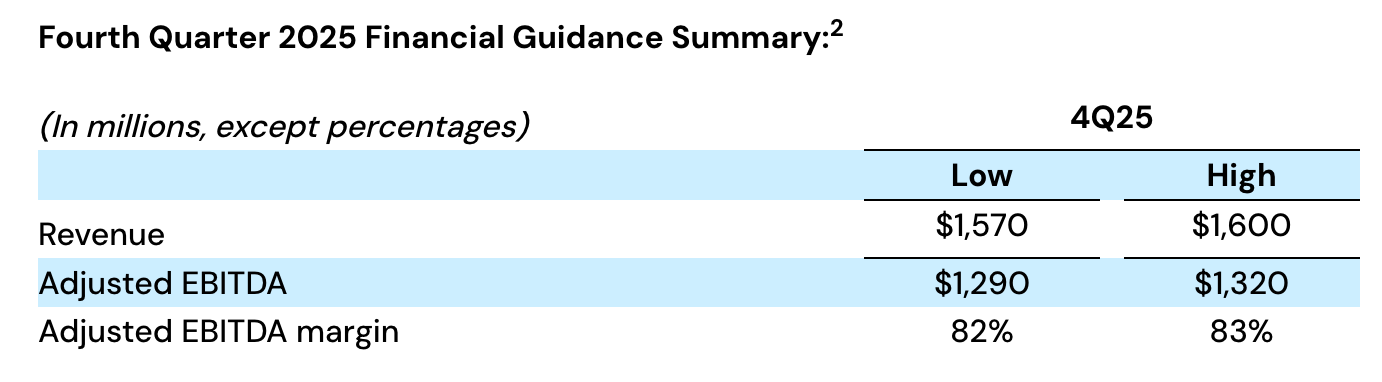

Additionally, the company guided for Q4 revenues of $1.6B and ADJ EBITDA of $1.3B. Currently, analysts expect revenues of $1.55B, which is 3.3% below the guidance.

The guidance implies 60% Y/Y revenue growth and 53% ADJ EBITDA growth!

In addition to increasing its guidance, the company announced a new share repurchase plan, with $3.3B authorized to be used for repurchases, around 1.6% of the current market cap.

2. Key Points from the Call

“I’m particularly proud of our team because even while executing a strong quarter, we also delivered our major October 1 launch of our self-service platform and referral form. We did so without any significant hiccups, no major bugs, and effective filtering out of low-quality ad accounts, something I was personally monitoring closely.

While it takes a while for new customers to get going, to integrate, to learn how to use our system, and to ramp spend, we’re already seeing spend from these self-service advertisers grow around roughly 50% week-over-week.” Q3 2025 Earnings Call

The company is launching its self-service app. Previously, advertisers negotiated with AppLovin’s sales teams the details. This increased complexity and limited their services to only large advertisers.

The goal is to make it easier for existing advertisers to ramp up spending and enable small “dumb” businesses to use its services. By “dumb,” I mean advertisers that have a very limited understanding of how performance advertising works and need help driving higher return on ad spend. AppLovin’s platform will help them with just that.

“We are in the very, very beginnings of understanding how to work with neural nets and these AI technologies. I mean, if you think about this industry and the core AI industry, it’s only a few years old of engineers really being able to extract this kind of value out of these tools and technologies across a broad range of industries.

As this goes forward, we’re going to have consistent incremental improvements and sometimes large, sometimes small, but additive to high impact on driving up conversion rate from technology lifts.“ Q3 2025 Earnings Call

I titled my AppLovin investment case back in August, “Is AppLovin the next $1T AI Winner?”. I got some flak for it, as it is hard to imagine today, but the TAM is truly massive. As Adam said in the quote above, AI is really just a few years old, and we have only scratched the surface of what could be achieved. Advertising today is still relatively ineffective, and there is a lot of room for driving consistent incremental improvements in conversion rates.

“You’re also going to get advertiser density expanding, paired with our recommendation system, giving the model a chance to personalize the advertising to the user better. If we have fewer advertisers and fewer categories, we just have less to show.” Q3 2025 Earnings Call

Diversification in the ad types will increase ad inventory. This is because some gaming companies previously limited the supply out of fear of promoting competing video games. Now that AppLovin is attracting e-commerce advertisers, it will show ads for shoes, clothes, electronics, and other products that video game companies would gladly promote, as they don’t directly lead to the customer leaving the game for a competitor.

“They’re playing games, but they’re not going to convert. Our conversion rates are really low. There are moments when the model knows a user is going to be in the game. When those moments happen, the CPM for a game advertiser is phenomenal. It’s really, really high. Our average conversion rate is that 1% …….We’re driving 10 game installs over 1,000 impressions, but we’re probably wasting 80%-90% of those impressions because the model knows in a tight percentage of impressions, games are going to convert, this user is ready for something new, and the CPM there will beat anything else that comes along. You go and bring in demand density. What happens? Now the model can better use all that excess impression.” Q3 2025 Earnings Call

This is a great quote that simply explains the problem with the current advertising landscape. 90% of ads inside video games are wasted, because the user is simply playing the game and has no intention of leaving to another game. Users get desensitized as they learn to simply ignore ads. But if the ad is not for another video game, but for a product or a service, they are more likely to engage with it.

So by expanding into ads for e-commerce and other verticals, AppLovin will increase both 1) the ad supply and 2) ad conversions!

This is a potent combo to drive strong growth for many years as the company goes through this transition.

“You take it to the next level, which is now all of a sudden we’re getting data from way more types of customers. We now know, let’s say tomorrow, someone buys a $5,000 handbag on a website. That’s the data point we didn’t have a year ago. That data point, my simple mind can probably tell you that’s a good user for Candy Crush if they haven’t played Candy Crush.

The neural net’s going to tell you a lot more than that based on its correlations. You are building up a data set that does not just limit itself to the shopping category or the website advertising category. It helps enable better advertising for the gaming customers as well. You put all those pieces together, and I am really confident that we are not going to squeeze anyone in our platform. We are probably going to have expansion across the board as we add more demand density and get more data into the system.”Q3 2025 Earnings Call

Data is king, and now that AppLovin is incorporating e-commerce advertising in its platform, it will have data on successful transactions. As Adam says in the quote, someone who made a large purchase obviously has a lot of money to spend. The AI will use that information to route ads to this person to drive maximum spending. The more money AppLovin customers make, the more AppLovin makes.

Previously, they might have had data on whether someone made a lot of in-game purchases, but that is not enough to drive higher advertising conversions.