Is AppLovin the next $1T AI Winner?

AppLovin Investment Case!

When ChatGPT started the AI boom era, many analysts were unsure where the AI profits would accumulate. It quickly became clear that to power AI, we need extremely powerful computer chips, and a boatload of them.

In just a span of 2 years, this AI-driven demand enabled Nvidia to become the world’s most valuable company with a $4.5T market cap.

Now, AppLovin is demonstrating that AI-powered advertising is next in line for those juicy AI profits!

The company operates an advertising platform that enables its clients to use AI to better build, target, manage, and analyze advertising campaigns across mobile apps and connected TVs.

This approach has turbocharged their business, with sales growing by 89% from 2022, whilst FCF jumped 613%!

Stellar financial performance has enabled their stock to jump a whopping 485% in the past year!

Recently, AppLovin reported an amazing Q2 earnings report, and this ignited my interest in the company, thus, in today’s report, I will be looking at their business!

1. Business Model

2. The Opportunity

3. Valuation

4. Short Seller Report

5. Conclusion

1. Business Model

As their name would suggest, AppLovin’s focuses on mobile applications. Originally, the company was building a mobile-based video game business in parallel to its advertising efforts.

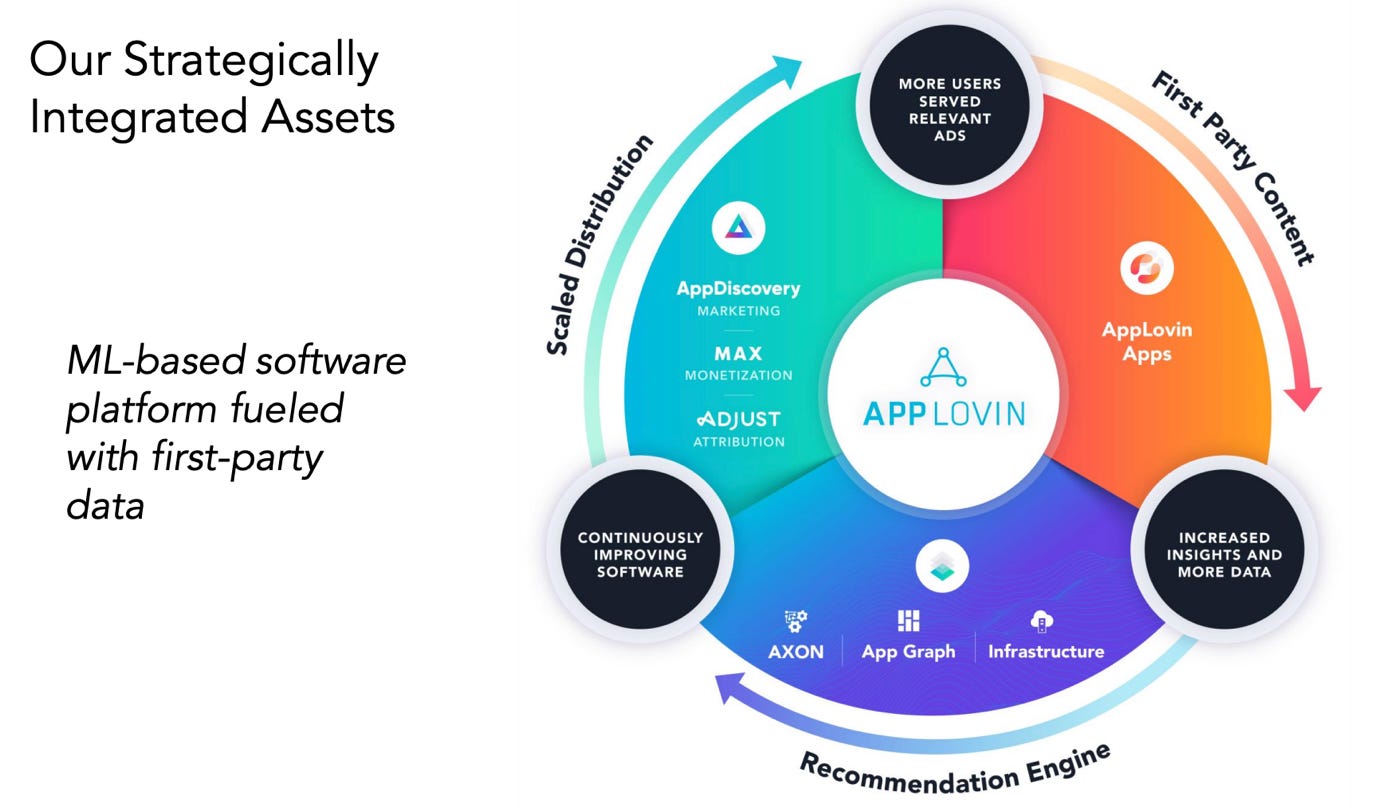

In the above picture from their December 2021 Investor Presentation, we see the three pillars of their business model.

AppLovin Apps – Mobile video games that generated first-party data for their algorithms to analyze and were a venue to test advertising and analytics software.

Analytics – Mobile marketing analytics platform that fueled their recommendation engine. Tracks user activity and ad performance across apps.

AppDiscovery – Their marketing distribution platform that was used to run, test, and optimize advertisement campaigns and monetize mobile applications.

Back then, AI was still called machine learning (ML), so AppLovin is a pioneer in this space.

However, in the last few years, the company has undergone a pivot and strategic realignment to focus on more profitable and faster-growing areas of its business.

Recently, they sold the mobile video game business for $900M to focus exclusively on advertising!

Let’s look at the remaining business and how AppLovin makes money.

AppDiscovery

Since businesses have existed, they have always wanted to have more customers. It is simply not enough to have a great product or service, as if nobody knows about it, there won’t be any sales.

For this reason, businesses spend significant sums paying to get attention for their business. However, it is not as easy as simply throwing money at advertising and hoping customers will just come.

An advertising saying that “Half the money I spend on advertising is wasted, the trouble is, I don’t know which half” has been popular since the 1900s!

While the advertising market has completely transformed in the last 100 years, this truth hasn’t changed.

Well, AppLovin is using AI and advanced algorithms to maybe finally change that!

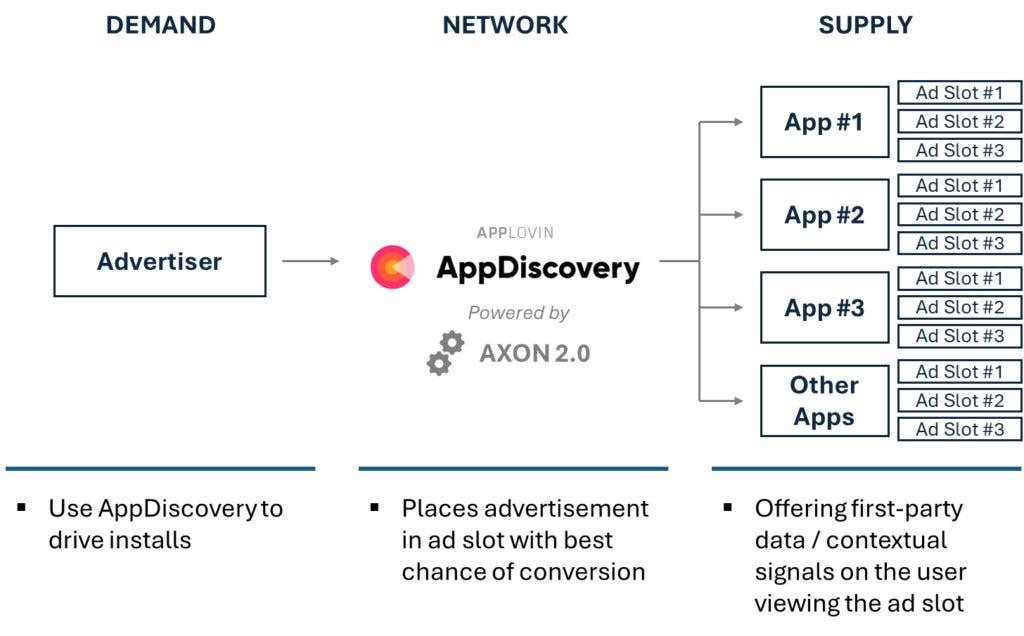

AppDiscovery is their AI-based advertising engine that is central to AppLovin's growth strategy. The company has built a suite of features that help advertisers make a higher return from their mobile app advertisements.

Here is how it works:

Their AXON AI engine uses machine learning models trained on billions of anonymized device interactions to find the right place for clients’ ads to maximise conversions. This service carefully analyses the advertised app and then uses AXON's predictive algorithms to help advertisers find users who are most likely to download that app.

They use AI models to analyse user behaviour and predict what type of apps or services the user would like. This enables AppLovin to estimate user lifetime value and better assess potential retention. This information is extremely valuable as it helps to find the answer to that crucial advertising dilemma of not knowing “which half of my advertising is wasted”.

This is directly reflected in how customers pay for AppLovin’s services. Instead of paying a fixed price per view, click, or conversion, advertisers are charged dynamically based on the revenue they receive from the users they acquire.

The system enables advertisers to set return on ad-spend (ROAS) or cost per install (CPI) targets and automatically adjusts bids, targeting strategies, and ad types to reach these targets.

Most importantly, AppLovin’s platform is extremely scalable, enabling advertisers to access over 1.6B daily active users who are connected to the MAX supply side platform. This allows the company to serve advertisers of all sizes, helping them rapidly scale their business globally.

How effective are their services?

For example, following Apple’s infamous 2022 privacy rule changes, many apps saw significant revenue declines. One of those apps, Daily Yoga, sought AppLovin’s help to reignite growth, and the results were incredible and instantaneous.

100% month-over-month growth in US app installs

62% growth in day zero ROAS

24% growth in overall ROAS

Reached 16th place in the US Apple App Store health and fitness rankings

MAX

Similarly, as with businesses looking to increase sales by paying for attention, there are those who capture a lot of attention and are looking to earn income by selling access to that attention.

Connecting these two parties has always been a challenge!

Finding reliable and stable advertisers has always been a bottleneck for publishers. Often, advertising slots were not filled, leaving money on the table. Other times, the advertiser that a publisher could find didn’t resonate with the publisher’s audience.

Most importantly, publishers spent a considerable amount of time and resources finding advertisers. This is not their core competency, creating engaging and interesting content for their viewers is.

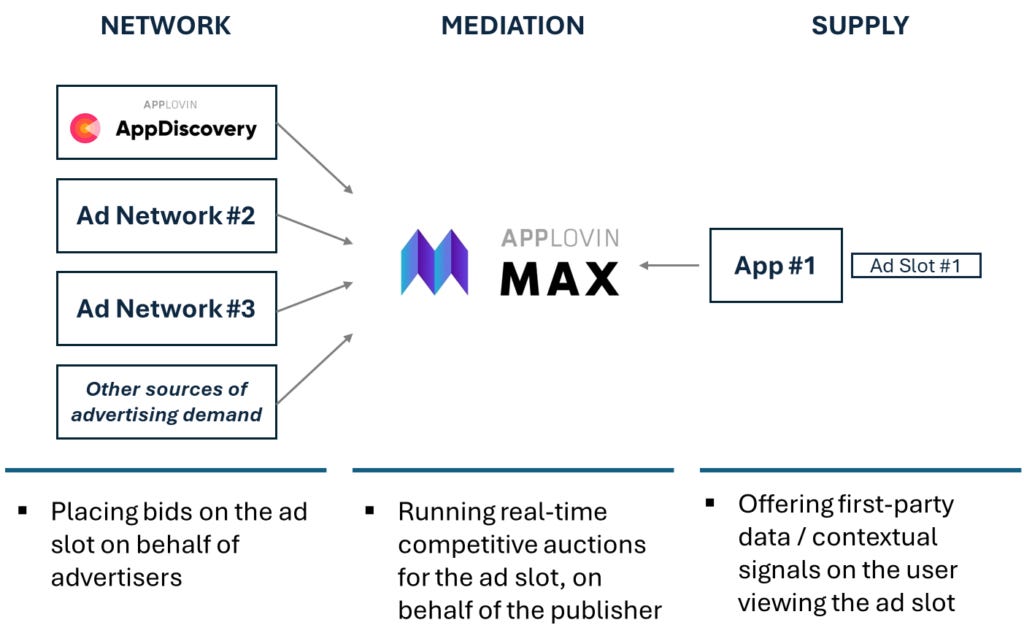

AppLovin aims to solve this issue with its advertising supply side platform, MAX!

App publishers can join the platform to monetize their apps by maximizing advertising revenue.

Here is how it works:

In a stark contrast to closed advertising supply-side platforms such as Meta and Google, MAX is an open and competitive advertising bidding platform.

App publishers submit their apps to MAX, and the company runs an advanced, AI-driven, automatic, split-second bidding process to get the highest available price for their clients’ advertising inventory.

Simply put, Meta and Google mostly run auctions for ads on their own inventory. These companies do not typically allow competing ad networks to bid directly alongside their own demand.

Meanwhile, AppLovin’s own AppDiscovery demand-side advertising network bids alongside other advertising networks for MAX inventory. AppLovin doesn’t disadvantage other ad networks over its own to guarantee the highest available price for its clients. Whoever offers the highest price wins.

AppLovin facilitates competitive auctions for ad inventory, supporting a wide array of ad formats such as banner, native, video, and others, with the goal of maximizing in-app advertising revenue.

Furthermore, for an open platform, full transparency and trust are crucial to attract publishers and demand-side participants. If other advertising demand providers believe the platform is not fair, they will not bring their advertising demand to it.

To foster this trust, AppLovin provides detailed visibility into bidding data and performance metrics, showing how different demand sources compete for inventory and which ads perform best.

The transparency and open bidding process principles are also reflected in how MAX is monetized. The company doesn’t charge a subscription fee or any other upfront payment. Instead, the company charges a percentage of the revenue generated.

AppLovin hasn’t disclosed how much they charge, but publicly available information suggests that the fee ranges from 5-15%.

The more demand MAX can bring and the higher the bids, the more both AppLovin and the publisher earn!

For example, the mobile video game studio N3TWORK saw a 75% increase in revenue per daily active user once it joined the MAX platform on Android. On Apple’s iOS, the results were even more impressive, increasing 85%.

Video game publishers are AppLovin’s core clients on both suply and demand sides, as they are consistently the largest advertisers, while simultaneously providing a lot of advertising inventory.

Adjust

As I mentioned before, figuring out which advertising actually works is more than a 100-year-old problem in advertising. For hundreds of years, advertisers were just throwing money at publishers and hoping that their sales would increase. Often, when sales did increase, it was unclear which of the ad slots worked the best.

While it might seem that the attribution problem was causing headaches just for advertisers, it actually was a major headache for publishers as well. This is because without knowing how much revenue their clients made from advertising, they couldn’t effectively charge for their services.

Adjust is an AppLovin’s medicine that fixes this headache for both the publisher and the advertiser!

Adjust is AppLovin’s mobile marketing analytics and attribution platform, open to all advertising platforms. This means that Adjust is not just used by AppLovin’s own AppDicovery and MAX clients, but also those using Unity, Trade Desk, Meta, Google, TikTok, or any other advertising platform.

In marketing, attribution refers to identifying the action that generated the desired outcome for the advertiser and attributing credit to it. For publishers, attribution is crucial to increase prices for their ad inventory. Whilst for advertisers, attribution helps to identify profitable advertising methods and double down on them, and cut budget from the failing methods.

Here is how Adjust works:

The service tracks which campaigns, channels, and ad formats drive app installs, in-app purchases, or other key events. Additionally, it provides a single source of data to analyze marketing performance across networks, like the mentioned AppDiscovery, Google, Meta, TikTok, and others.

Adjust delivers real-time dashboards with granular performance data by user segment, geography, or campaign. This data is crucial to have reliable analytics and reporting for developers and decision makers to make better data-based decisions.

Clients receive insights into ROAS and customer lifetime value that can be used to change strategy.

Using Adjust, marketing executives can identify which advertising works the best, leading to smarter budget allocations. Game developers can see which missions generate more in-game purchases, driving game development decisions. E-commerce platforms see which ad formats generate higher sales for which product categories.

Simply put, for advertisers, Adjust provides clarity on which marketing efforts produce real, valuable users. Meanwhile, publishers benefit from deep insights into how ad campaigns are performing for their apps.

Most importantly, Adjust strengthens the AppLovin ecosystem by feeding high-quality performance data back into AppDiscovery and MAX for smarter targeting!

One of AppLovin’s clients, the video game developer 2K Games, famous for its NBA 2K series, was able to achieve a ROAS of 300-500%, thanks to Adjust.

SparkLabs

The game doesn’t end even once the advertiser and the publisher are connected, and a great ad targeting strategy has been designed. The next step is to create a memorable, brand-safe, and engaging advertisement.

Even the best match between advertiser and the publisher won’t create great results if the advertisement itself is trash. For this reason, AppLovin created SparkLabs.

SparkLabs is AppLovin’s in-house creative studio that specializes in building and optimizing ads for mobile and connected TVs. It’s designed to help advertisers improve performance by constantly testing, refining, and iterating on ad concepts.

Essentially, when a video game developer wants to use Adjust or AppDiscovery services to monetize their game, the company can offer them SparkLabs services to create the ad itself.

Using data from Adjust, MAX, and AppDiscovery, AppLovin can analyze which ad formats work the best for a certain type of game. Whether that is a video ad, banner ad, free coin offering, in-game items, or anything else. Then SparkLabs can use that information to create an ad that achieves high conversion rates.

SparkLabs core purpose is to make it easier for advertisers to create effective and engaging ads that convert, thus increasing the usage of AppLovin’s advertising services!

For this reason, SparkLabs is offered as a value-added service to AppLovin customers, with many services available for free.

Wurl

Historically, AppLovin was solely focused on the mobile application ecosystem. But in the last few years, the company has made serious efforts to expand beyond mobile apps. One of the largest of such efforts is their 2022 $430M acquisition of Wurl.

Wurl is a comprehensive connected TV (CTV) distribution and monetization platform!

CTV is essentially a smart TV or a TV that uses a Roku, Amazon Fire, Google Chromecast, or other “smart box” to manage TV apps. The Wurl platform helps video publishers distribute content across smart TVs (CTVs) and advertisers find where to effectively place their ads.

Essentially, Wurl combines the capabilities of the AppDiscovery and MAX services, but just for CTVs, not mobile apps!

In the same way as MAX, Wurl helps publishers (streaming platforms) monetize their inventory by letting multiple demand sources (advertisers, ad exchanges) bid in real time.

Moreover, just as AppDiscovery, Wurl provides advertisers with the tools to target, bid, and place ads in streaming content across many platforms.

However, in addition to that, though it’s Global FAST Pass offering, Wurl helps rights holders monetize their content by distributing it on FAST CTV channels!

FAST stands for Free ad-supported streaming TV. These are streaming platforms, or internet streaming-based TV channels that offer ad-supported video content. Some of the most popular ones include Pluto TV, The Roku Channel, and Freeve.

Using Wurl’s Global FAST Pass, one can quickly launch a new FAST channel and distribute it across some of the largest CTV platforms, such as LG, Samsung, Roku, Amazon Fire, and dozens of others.

Using Wurl, these channels can be easily monetized through advertising on day 1!

Furthermore, AppLovin enables these channels to grow their audience by utilizing effective targeted advertising not only across Wurl’s CTV inventory, but also across MAX 1.6B daily active mobile application users.

For instance, the video streaming company, Cineverse, migrated a lot of its FAST channels to Wurl’s distribution technology and saw reduced distribution costs. Moreover, Wurl delivered ad fill rates increases of 15-20%, directly contributing to higher revenues.

2. The Opportunity

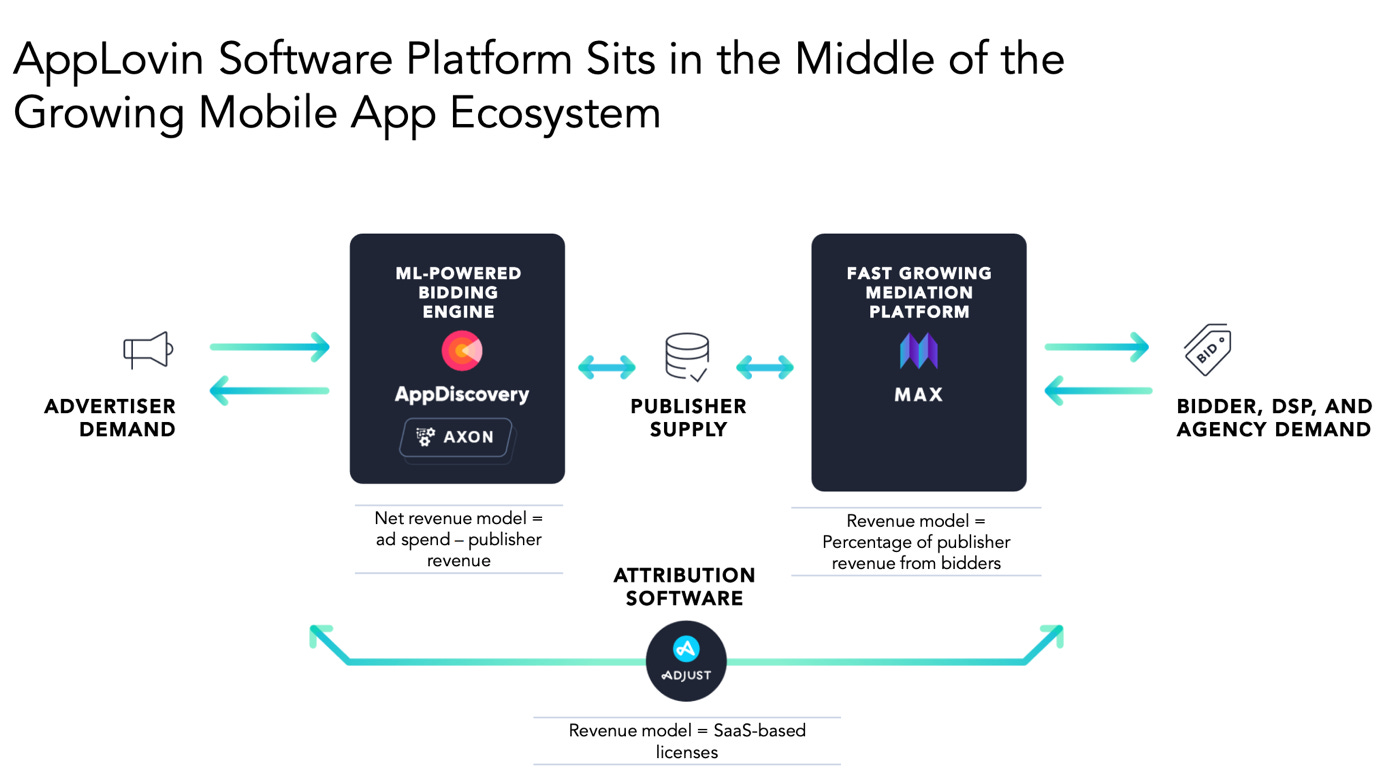

As we see in the picture below from AppLovin’s 2021 Investor Presentation, AppLovin functions as a powerful middleman, an aggregator of demand and supply.

In a sense, AppLovin is building a modern-day tollbooth for the global advertising highway!

In the same way as Visa and Mastercard are toll booths to the global financial highway, AppLovin is positioning itself to be an integral piece in the advertising ecosystem.

Mobile Advertising

The combination of MAX, AppDiscovery, Adjust, SparkLoob, and Wurl creates a powerful, integrated ecosystem that extends beyond a mere collection of tools.

Together, AppLovin’s services establish a synergistic feedback loop essential for modern, effective, and AI-powered performance marketing!

MAX empowers publishers to maximize revenue from their ad inventory, generating data to train AI models. These AI models are used in AppDiscovery to acquire high-quality customers for MAX.

Meanwhile, Adjust provides additional data and analytics necessary to further measure and enhance advertising campaigns, ensuring that advertisers achieve profitable ad spend.

This closed-loop system, where SparkLoop creates an advertisement, MAX offers ad inventory from 1.6B users, AppDiscovery finds the most profitable place for it, and Adjust measures and refines it all, is an extremely effective and profitable business model.

This business model gives AppLovin a significant competitive advantage that positions them well to capture a meaningful share of the fast-growing mobile advertising market!

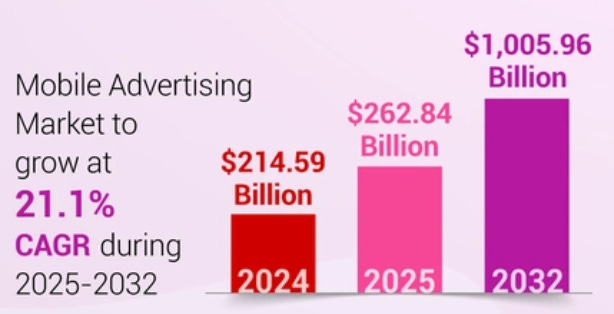

Analysts at Fortune Business Insights forecast that the global mobile advertising market will grow with a stunning 21.1% CAGR till 2032, reaching $1T!

Thanks to the combination of their highly synergetic AI-powered services, AppDiscovery, MAX, and Adjust, AppLovin is in a great position to take meaningful market share in this fast-growing market.

Streaming Advertising

Thanks to the acquisition of Wurl, AppLovin is positioned to grow in the video streaming market.

While it might seem to many that video streaming has fully penetrated the world, that simply isn’t the case. In June of 2025, around 41% of US TV time was spent on watching linear TV channels.

This means that there is still significant growth left for the video streaming industry!

Wurl’s key market, FAST streaming, is expected to significantly expand in the next few years, as premium streaming fatigue and higher prices push people towards more affordable, ad-supported entertainment options.

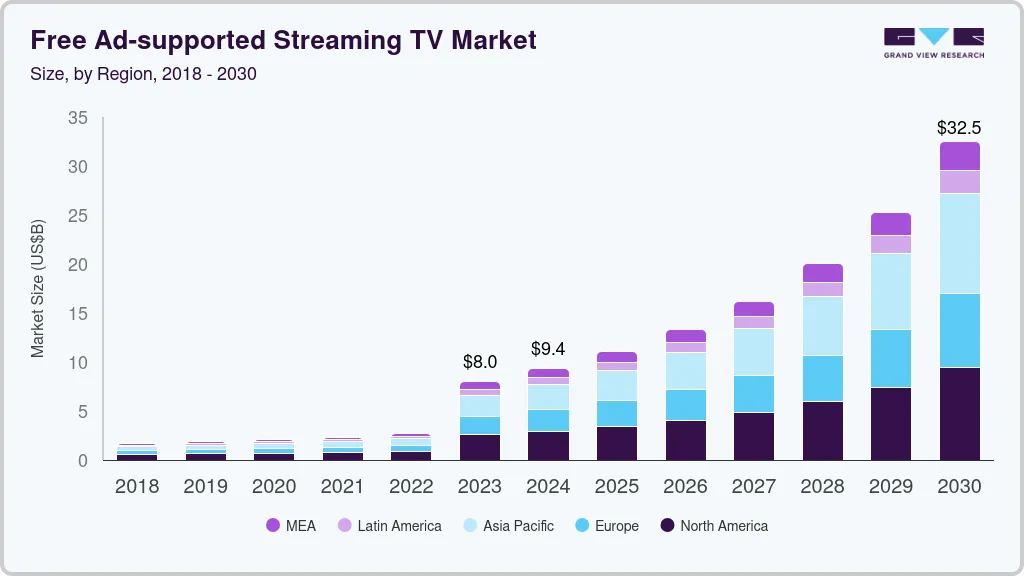

Researchers at Grand View Research estimate that the FAST market will grow with a 22.1% CAGR to reach $32.5B by 2030!

New Verticals

Historically, AppLovin has been focused mostly on mobile apps and, especially, video games. Recently, the company has been taking steps to expand beyond this market.

AppLovin is launching a new self-service advertising offering called AXON Ads Manager. Often in advertising, a lot of the deals happen through sales teams that involve a lot of negotiations and lengthy invoicing procedures.

AXON Ads Manager will enable advertisers to use a simple portal to purchase advertising!

This will enable smaller businesses across more verticals to use AppLovin AI targeting systems to increase sales.

AXON Ads Manager will launch on a referral basis on October 1, 2025, before a full launch in 2026.

Furthermore, in the Q2 2025 earnings call, this is what the CEO said.

“The ongoing improvement in our models drive sustainable growth rates beyond the market growth rates, while we continue to expand our dominant leadership position. Based on all the opportunity in front of us in our core market, we are confident we can sustain 20% to 30% year-over-year growth driven by just gaming. However, what gets us more excited now than ever in our history before is the opportunity to really expand outside our core market.” AppLovin Q2 2025 Earnings Call

AppLovin is expanding beyond mobile apps and video games, with a strong focus on growing across the web, CTVs, and e-commerce.

Recently, AppLovin released a dedicated Shopify App, which will enable thousands of e-commerce stores to launch, scale, track, and adjust marketing campaigns using AppLovin’s AI technology across their 1.6B daily active users.

In the last 12 months, Shopify stores had sales of $327B. If we assume that the average store spends around 15% of revenues on marketing, the total marketing expenses of Shopify stores could be around $49B. A 10% take rate would mean that Shopify alone is a $4.9B opportunity. Of course, AppLovin won’t service 100% of the marketing budget of all Shopify stores, but even a 10% market share could generate $490M in revenues for the company. And this is just a single e-commerce platform.

E-commerce is a massive opportunity for AppLovin!

3. Valuation

After multiple stellar quarters, AppLovin’s stock has jumped 485% in the past year to reach a market cap of $158B.

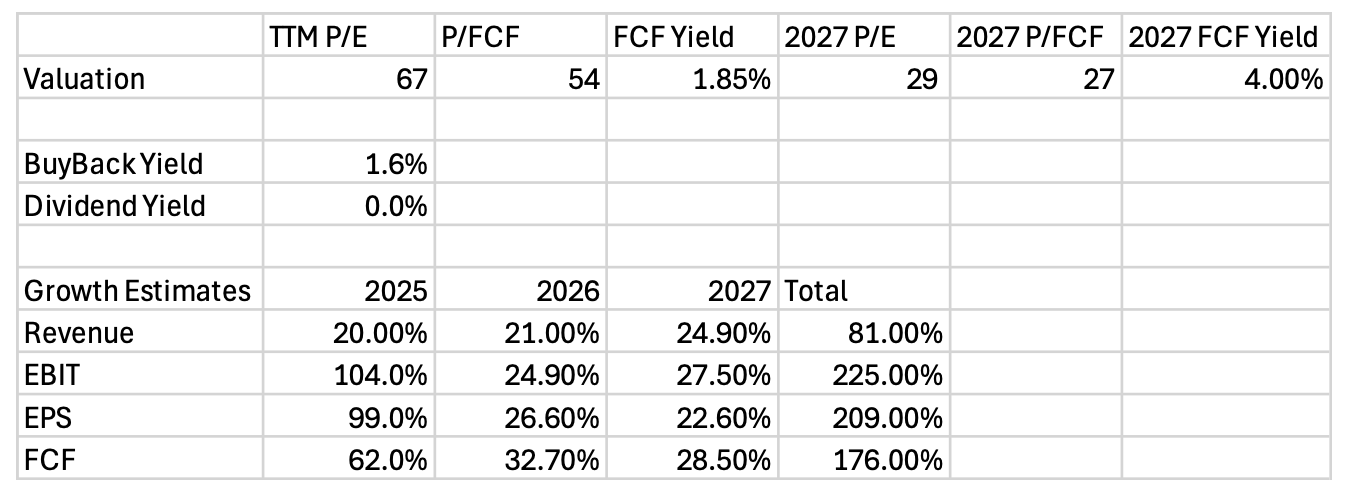

Currently, it trades for a TTM P/E of 67 and has a buyback yield of 1.6%.

In the above table, I have placed some key estimates of AppLovin.

Please note that, as I said, AppLovin disposed of the gaming business, which has a negative effect on the revenue growth rates. In Q2 2025, AppLovin’s revenues grew by 77%, but because from Q3 2025, gaming revenues are excluded, total 2025 revenues will be only 20% higher than in 2024.

If we exclude $1.49B the gaming business generated in 2024, AppLovin’s 2025 revenue growth rate would be 64%, not 20%!

In any case, even including the gaming business, analysts expect 2027 revenues to be 81% higher than in 2024. This really demonstrates the strong growth that the advertising platforms are experiencing!

Furthermore, analysts expect that margins will improve, enabling EBIT and EPS to grow by over 200% by 2027.

Taking this growth into account, the 2027 P/E is 29, whilst P/FCF is 27. While this is a premium valuation, AppLovin AI-powered advertising models are proving extremely successful, bringing astonishing growth for the company and its clients.

Analyst growth estimates could prove to be conservative.

Valuation Model

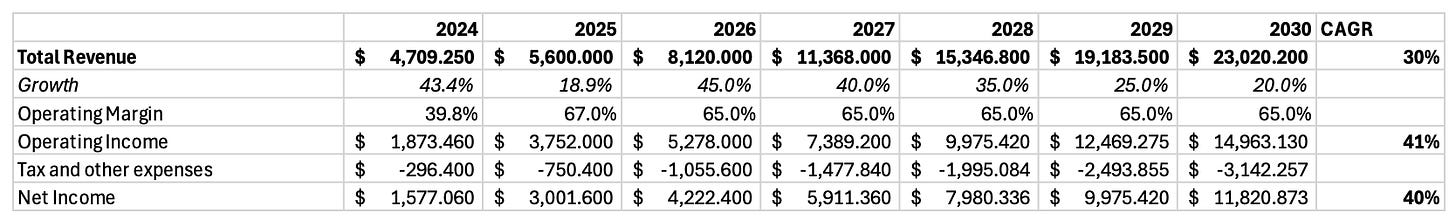

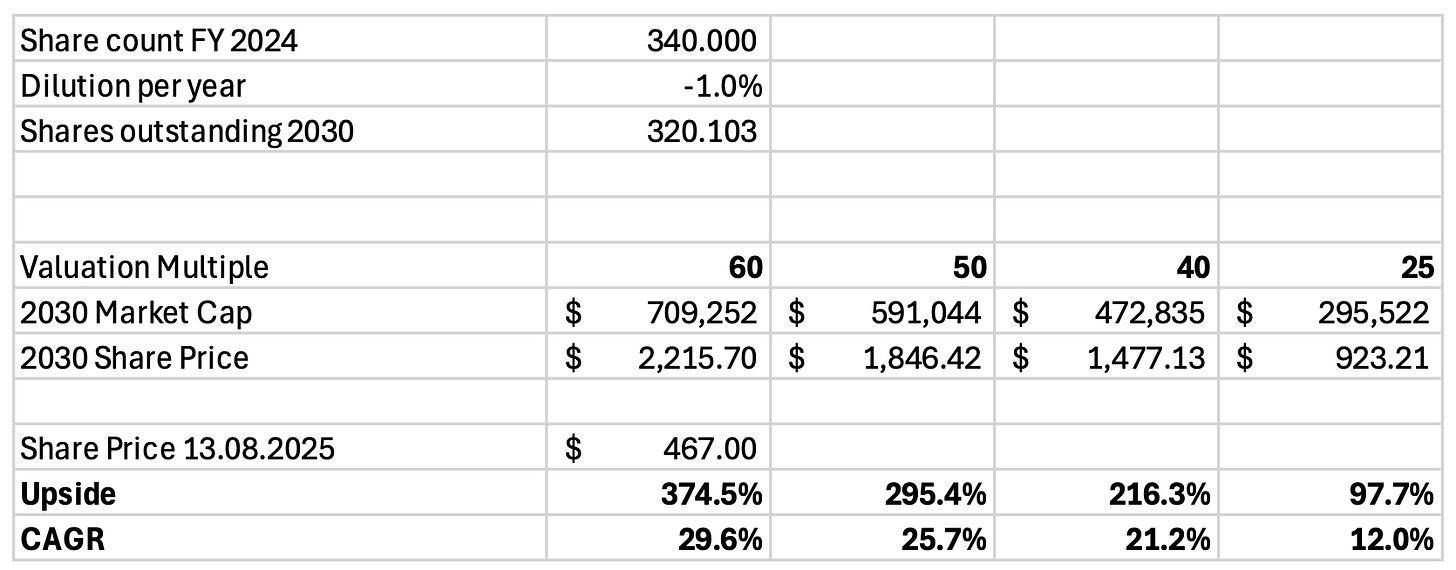

To see how much upside could still be left in the stock, I built a valuation model.

Firstly, the bullish commentary of the management during the Q2 2025 earnings call led me to believe that analyst estimates could be too conservative. With the launch of AXON Ads Manager and the continued expansion in streaming and web-based advertising, the company could take their AI targeting model to the next level.

Thus, I model a 30% revenue CAGR till 2030.

This would result in revenues of $23B, an increase of 389% from 2024!

Secondly, in Q2 2025, they had an absolutely insane operating margin of 76%!

I don’t believe that this is sustainable, and I think they may need some more expenses to sustain the 30% revenue CAGR, so I model an operating margin of 65%.

Taxes of 21%.

And we get to the net income of $11.8B, a margin of 51.4%!

Furthermore, as an extremely profitable company, I expect them to continue repurchasing shares, thus, I model a negative 1% dilution per year.

With a P/E of 40, we are looking at a $1,477 stock, an upside of 216% from today!

However, with such a performance, I think it is quite likely that the market would assign a higher multiple.

A P/E of 50-60 would mean a share price of $1,846-$2,215, and upside of 295-374%!

But let’s speculate a bit.

As we discussed in the analyst estimate section, they expect the advertising business to grow 64% in 2025, yet it grew 71% in Q1 and 77% in Q2. So basically, they expect the growth to slow down in the second half of the year. Yet, I don’t see any reason for this to happen.

In fact, during the Q2 2025 earnings call, the management seemed extremely bullish regarding the future!

I think there is a decent chance that not only will they sustain the momentum, but also that the growth accelerates.

If that happens, this could be a 2-3X stock in just a year. Because as earnings beat estimates and analysts update their 2026 and 2027 estimates, more investors could pile in, causing multiple expansion.

Especially in this AI bull market, I could see the multiple expanding to 80 and even 100+!

But this is pure speculation.

4. Short Seller Report

Before concluding this analysis, I would like to mention that AppLovin has been a target of many short seller reports.

Muddy Waters released a short seller report on March 27, 2025, whilst Culper Research released a report on June 12, 2025.

These reports allege that AppLovin:

Downplayed their Chinese business

Has significant Chinese shareholders

Have secret agreements with Chinese ad-tech companies

Committed advertising fraud

Lied about AI returns

Violated SEC rules

Stole technology from Meta

Violated Apple and Google App Store rules

Also, these reports are skeptical of the supposed AI technology App Lovin has and believe the company to be a fraudulent enterprise.

The company has denied these accusations.

In short, I doubt these accusations have a lot of merit, and I doubt that the company is a fraud, as short sellers claim. The fraud, especially, seems unlikely. If AppLovin were faking the ROAS or downloads or installs, as the report claims, advertisers would have noticed that.

While I believe short sellers do important work, from my observations, their claims are more often than not exaggerations and misunderstandings.

5. Conclusion

AI is here, and it is increasingly looking as if AppLovin is positioning itself to be the next big winner of this technology boom.

AI-driven advertising has the potential to help advertisers answer that old dilemma:

“Half the money I spend on advertising is wasted, the trouble is, I don’t know which half”.

Together, AppDiscovery, MAX, SparkLoop, Adjust, and Vurl create a synergistic feedback loop essential for AI-powered performance marketing!

MAX empowers publishers to maximize revenue from their ad inventory, generating data to train AI models. These AI models are used in AppDiscovery to acquire high-quality customers for MAX.

Meanwhile, Adjust provides additional data and analytics necessary to further measure and enhance advertising campaigns, ensuring that advertisers achieve profitable ad spend.

This closed-loop system, where SparkLoop creates an advertisement, MAX offers ad inventory from 1.6B users, AppDiscovery finds the most profitable place for it, and Adjust measures and refines it all, is an extremely effective and profitable business model.

Becoming a Visa-like tool booth of the AI-powered digital advertising industry is enabling AppLovin to achieve a Visa-like 50%+ net income margins.

If current trends continue, AppLovin could become the next trillion-dollar AI winner!

I certainly will be following the company closely to see how far they can take their AI technology.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Tough business to understand if you don't have a little background in advertising sales. Great piece, thank you spending the time explaining!

Great piece! Shifting deeper into advertising while differentiating from traditional platforms is a smart move. The potential in that space is huge. Let's see if there's any merit to short-seller reports, but either way, the growth path is there. Thanks for the insights in the business, and solid work on the valuation! Will keep watching.