Is Google a Buy after this monster Q3?

Q3 2025 Earnings Analysis.

In the second half of 2025, we have seen a sharp reversal in the narrative that Google is an AI loser, with the stock rising over 80% from the April lows.

The roll-out of AI overviews and AI mode is going great.

Google Cloud business signed a $10B deal with its Mag7 rival Meta.

Gemini usage is reaching new highs.

Search growth accelerated.

YouTube demonstrates incredible strength.

Google just again reported strong results, putting all the doubters to rest, sending the stock up 7%!

In this article, I will look at Google’s Q3 2025 results, if you want a more detailed analysis of the business, read my Google Investment Case!

Let’s dig in!

1. Financial Results

2. Search

3. YouTube

4. Cloud

5. Subscriptions, Platforms, and Devices

6. Advertising Network

7. Waymo

8. Is Google a Buy?

1. Consolidated Finances

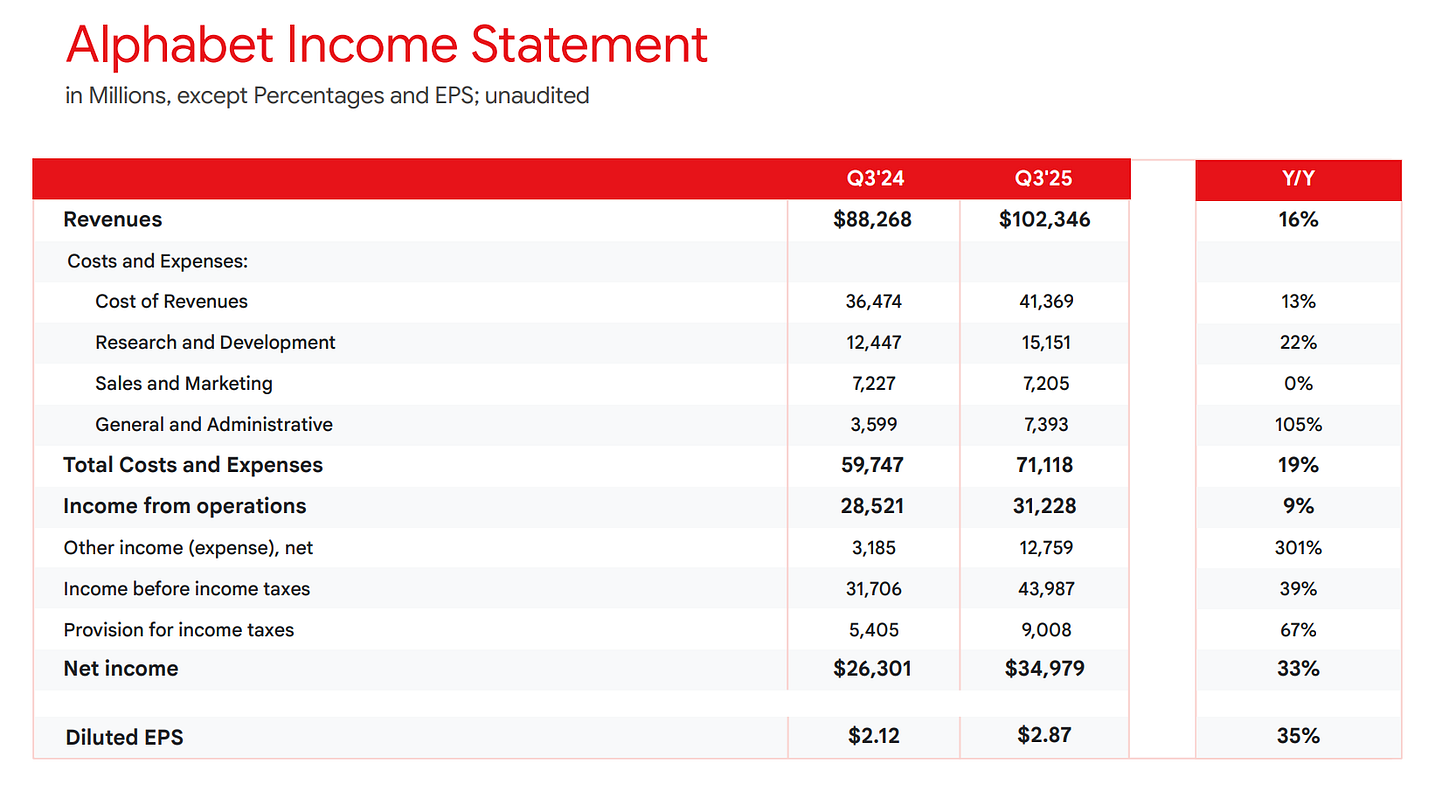

Overall, the Alphabet group demonstrated incredible strength with Q3 revenues growing 15.9% to $102.3B!

This is an acceleration from 13.8% growth in the prior quarter and beats the analyst estimate of $99.7B by 2.6%

As we can see in the picture above, income from operations grew by 9% to $31.3B, whilst net income grew by an incredible 33%.

This means that the operating margin decreased from 32.4% to 30.5%, whilst the net margin improved significantly to 34.2%.

Operating results benefited from Google improving operating leverage as the cost of revenues increased by 13%, whilst sales and marketing expenses were flat, both below the revenue growth rate of 16%.

However, operating income would have been much higher if not for the 105% increase in the general and administrative expenses, largely because of a $3.5B fine from the EU. The European regulator fined Google about $3.5B for violating antitrust laws by abusing its dominant position in the digital advertising technology market. Specifically, Google was found to have favored its own ad exchange, AdX, in a way that disadvantaged competitors, advertisers, and publishers.

Excluding this fine, operating income would have been $34.7B, 21.8% higher than in Q2 2024, a margin of 33.9%!

This is a clear indication that the company continues to increase operating leverage as it scales its best-in-the-world high-margin businesses.

Operating income also suffered from an increase in depreciation of 40.8% Y/Y from $4B to $5.6B. My understanding from the Q1 and Q2 2025 earnings calls is that higher depreciation is caused by the accelerated retirement of some cloud infrastructure. Last quarter, they mentioned that this was coming. Google is investing heavily in capex to build infrastructure to handle growing AI workloads.

The problem is that AI workloads use much more processing power, thus, they are significantly more damaging to the infrastructure than regular cloud computing. Previously, cloud servers had a useful life of 5-7 years, but it seems that current AI servers have a much lower useful life, around 2-4 years.

Furthermore, net income benefited from $12B in other income, driven by unrealized gains in Google’s equity holdings. The company has stakes in Anthropic and SpaceX, and their valuations have grown considerably this year.

Next, EPS grew by 35% to $2.87, faster than the 33% net income growth. This EPS increase was supported by Google spending $11.5B on share repurchases during Q3. EPS is set to continue growing faster than net income, as at the beginning of the year, the company revealed an increased repurchase program of $70B, up from $62B it spent in 2024.

Moving on to FCF, it grew 39% Y/Y to $24.5B!

This is a significant beat on the analyst average estimate of $17.6B, which forecasted that FCF would remain flat this quarter.

In the above table, we see how massive this improvement was compared to the prior quarter. On a TTM basis, FCF is up 32%, compared to the 58% increase in Q3 OCF. This large 20% gap can be explained by Google’s huge capex investments.

In light of the accelerated AI spending boom, we can expect FCF to be quite lumpy for the foreseeable future!

Capex grew by a mindboggling 83% Y/Y to $24B!

Nvidia shareholders might be quite happy about the AI boom, as we are currently in a massive GPU investment cycle. Google can’t afford to be behind in this AI race, so they are set to spend hundreds of billions of dollars on AI infrastructure in the next few years.

Just as in Q1 and Q2, Google has again increased its full-year 2025 capex guidance, this time from $85B to $91-93B. With $65.7B already spent this year, Q4 capex should be around $25-27B.

This increased guidance indicates that capex will grow by 75-88% in Q4 2025!

With such high spending, depreciation expense is set to increase significantly in the next few years. If this AI capex is unprofitable, earnings and EPS will fall.

2. Search

The Search segment earned the company $56.5B, up 14.5% Y/Y!

Let me repeat it again:

The narrative that Google’s Search business is dead is dead!

As we can see in the chart above, search revenues of $56.26 were 14.5% above Q2 2024.

This is a large acceleration from 11.7% in Q2 2025 and 12.2% growth in Q3 2024!

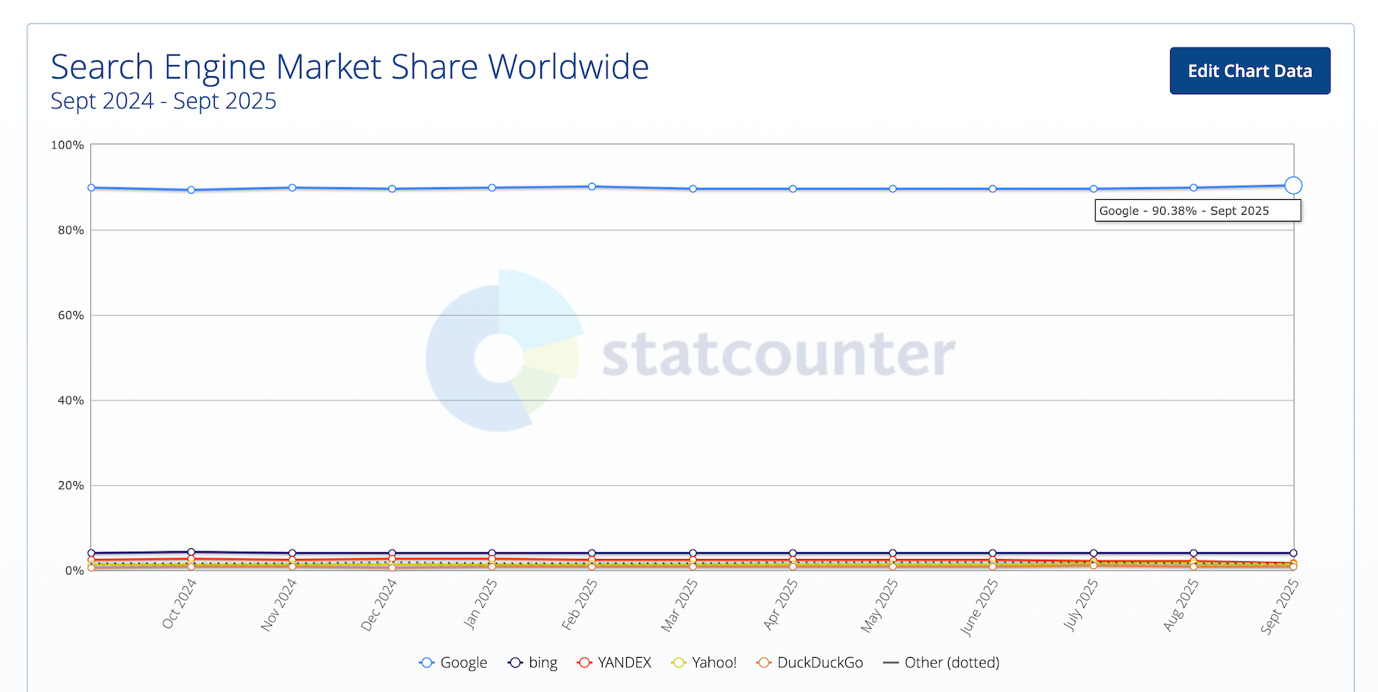

ChatGPT was released in 2022, but you can’t see that on this graph. After it partnered with Microsoft to integrate OpenAI’s models into Bing, it was supposed to take Google’s lunch.

For many quarters, bears have been suggesting that a growth slowdown followed by declining revenues is imminent, yet again and again, that hasn’t materialized.

I believe that many investors underestimate the technological prowess of Google and customer lock-in!

There is a reason that Googling something has become a verb, the company has been dominating this niche for 2 decades. I suspect that people will continue using this term in the future, even when using Google’s Gemini or other AI apps.

At the same time, anecdotes that “my nephew only uses ChatGPT” are simply biased and not true for the general population. Google has an incredible lock-in with billions of people, and it will be very hard to convince them to switch, especially with Google constantly improving the search user experience with AI mode and AI summaries.

We can see this narrative disrupted in the graph above. Last quarter, there were a lot of reports spreading doomerisms about Google’s search engine market share falling below 90% for the first time, but this quarter it grew to 90.38%.

AI is changing the way search is used, as reportedly the length of AI sessions seems to be increasing from 5 minutes on conventional search to 14 minutes. This supports the argument that AI will significantly increase the search market size.

Furthermore, Google revealed that the Gemini app now has 650M monthly active users!

This is still significantly less than Demand sages’ reported ChatGPT’s 800M weekly active users, but nevertheless a strong growth.

Key Points from the call:

“Rolled out globally in September, AI Max in Search is already used by hundreds of thousands of advertisers, currently making it the fastest-growing AI-powered Search Ads product. In Q3 alone, AI Max unlocked billions of net new queries. By delivering the most relevant ad across surfaces and matching advertisers against additional queries they weren’t reaching before, AI Max helps advertisers discover new customers at the exact moment they need their product or service. Kayak, for example, looked to grow conversions while staying within their ROAS goals. After turning on AI Max in Search, they grew the conversion value by 12% in early tests.”

A key concern from bears was Google’s ability to monetize AI search queries. The theory is that if AI chatbots help users receive answers faster, these users will spend less time in search, making fewer queries, thus leading to fewer ads displayed.

However, what we are seeing is completely the opposite!

Conversational search actually leads to more time spent on search and creates opportunities for relevant advertising, because of more data to gauge intent.

AI mode conversation about a trip to Bali enables Google to create a highly targeted ad from Kayak.

This is something that ChatGPT hasn’t even started yet, whilst Google is already quite successful at.

3. YouTube

In my opinion, YouTube is the most important media company in the world!

With over 2.7B monthly active users, YouTube is the largest video streaming platform in the world, which dominates user-created media, and it has now set its sights on the world of sports!

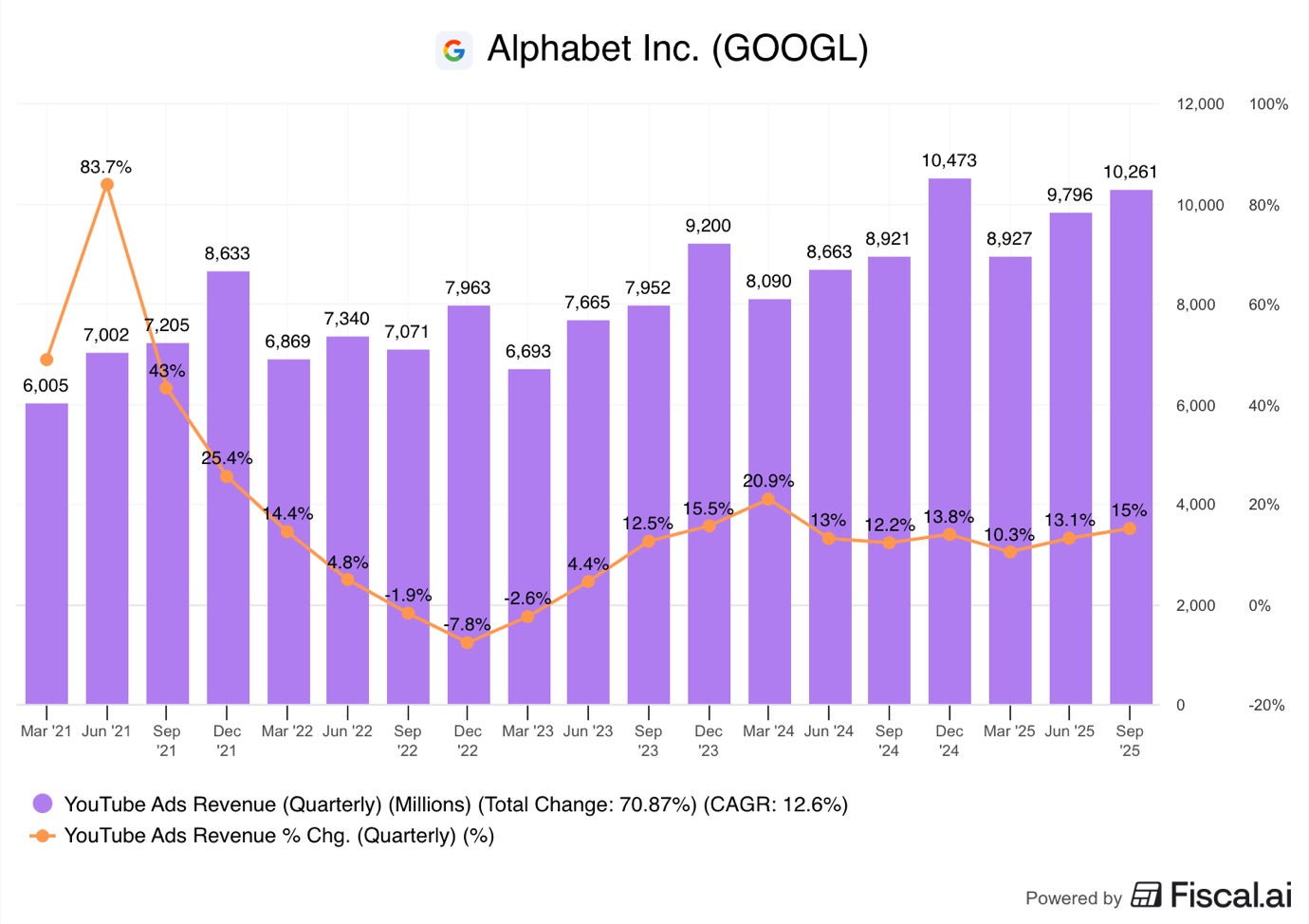

Advertising revenue increased by 15% Y/Y to $10.26B!

This quarter, the growth accelerated from 12.2% in Q3 2024 and 13.1% in Q2 2025.

While it might seem that YouTube is overrun with ads, the reality is that the ad load is significantly below traditional TV, giving the company ample opportunities to increase it, especially in emerging markets where it is adding users the fastest.

Some claim that “YouTube could soon overtake Netflix”, without realizing that YouTube has already done so!

This is because the above chart doesn’t include YouTube Premium subscription revenue. The company doesn’t report it separately, as it’s included in the “Subscriptions, Platforms, and Devices” segment.

The last available information is that YouTube Premium has 125M subscribers. If we assume that the average monthly price is $8, then Premium generates an additional $4B each quarter.

That would bring YouTube’s total revenue for Q3 2025 to $14.3B, above $11.5B, Netflix posted.

There were a few key product announcements this quarter:

The company changed its terms of service, making repetitious mass-produced, inauthentic content “ineligible for monetization. This move is clearly aimed at reducing AI slop on the platform and improving content quality.

YouTube is expanding its partnership with Southeast Asian e-commerce leader Shopee, enabling product integrations in the videos to support the live shopping trend. Influencers can add Shopee links to the life streams.

YouTube is enhancing the Adobe editing software integration for Shorts, enabling faster and simpler video editing using Adobe’s suite of AI editing tools.

Key Points from the call:

“In the living room, YouTube has remained number one in streaming watch time in the U.S. for more than two years, according to Nielsen.

Last month marked YouTube’s first time as a live NFL broadcaster. This exclusive global broadcast, live from Brazil, drew more than 19 million fans and set a new record for most concurrent viewers of a live stream on YouTube. YouTube Shorts also continues to perform well. In the U.S., Shorts now earn more revenue per watch hour than traditional in-stream on YouTube”

YouTube is the biggest winner from cord-cutting as it offers the best of both worlds.

Simple and easy ad-supported viewing for casuals.

Ad-free premium viewing for regulars.

A whole generation of kids grew up on YouTube, and now they are becoming adults and are ditching traditional TV. Expansion into sports is the obvious next venture. The company has an ecosystem of commentators and sports analysts already. Adding live sports will strengthen their lock-in with users even more.

Meanwhile, Shorts is making Reels and TikTok work for their money. The reason why shorts earn more per watch hour is that YouTube is able to place more ad time in 1 hour of content. Short-form viewers are more accepting of ads, especially when they are custom-made for the format.

4. Cloud

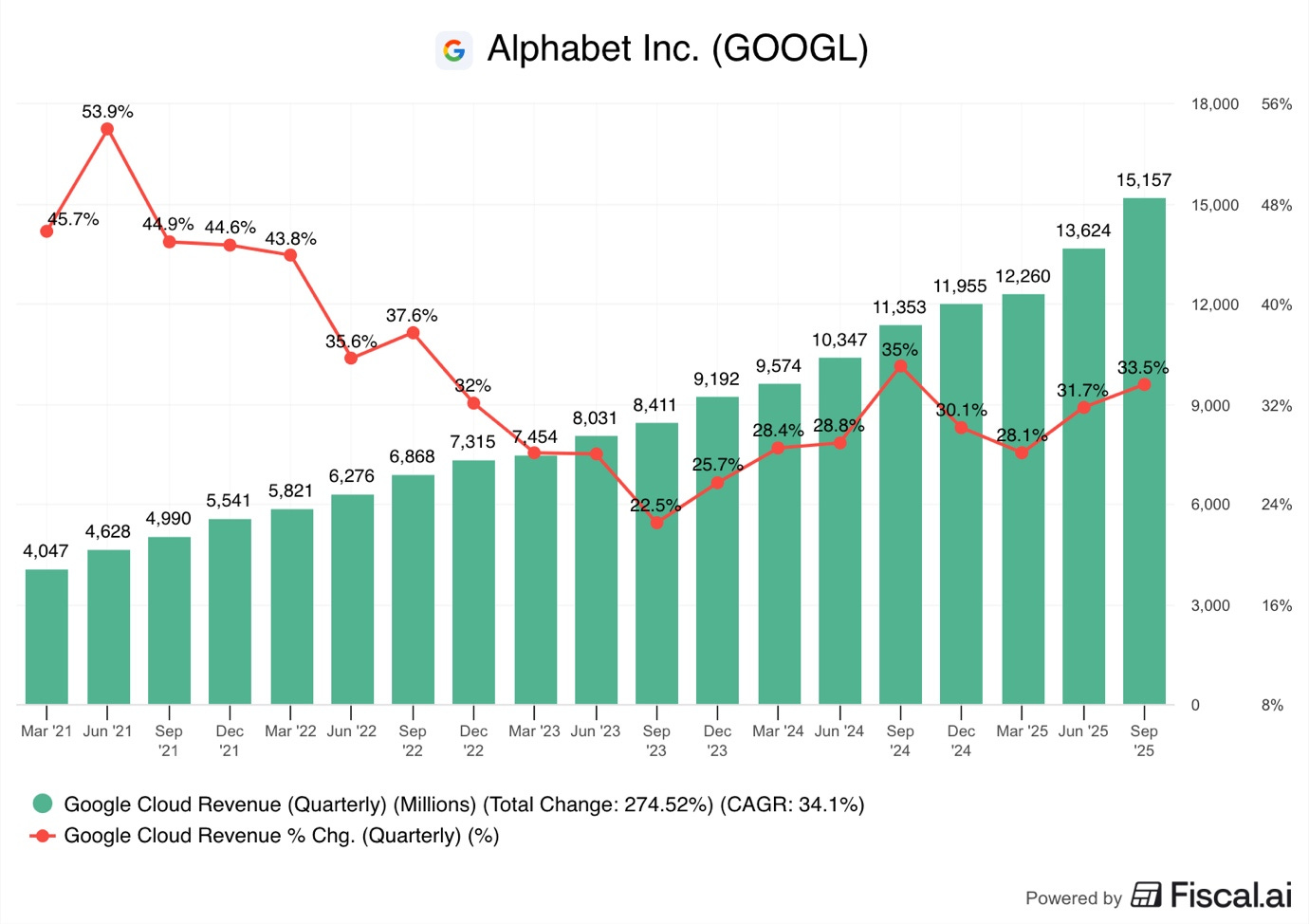

The big news this quarter was the Meta $10B deal with Google Cloud!

This 6-year deal with their Mag7 rival demonstrates the quality of their offering and boosts their positioning against key rivals such as AWS and Microsoft Azure. The demand for AI infrastructure is so strong that Meta was forced to seek outside capacity, and this in itself is a strong signal for the potential of Google’s AI cloud infrastructure business.

Deals such as this show that investors and analysts continue to severely underestimate TAM for Cloud services!

It is estimated that up to 80% of global IT spending still goes to on-premises solutions, with only 20% going to the Cloud. Many experts believe that in the next two decades, this ratio will flip.

This and other deals enabled Cloud to post an incredibly strong quarter, with revenue growing by 33.5% to $15.1B!

As we can see in the graph above, the growth accelerated from an already strong 31.7% in the prior quarter. The company added $1.6B in revenues from Q2, 21% higher than the $1.3B increase from Q1 to Q2.

On a Q/Q basis, revenues grew 11.4%!

Such Q/Q growth is stronger than most companies grow Y/Y, truly incredible!

In addition to stellar top-line growth, Cloud showed strong profitability.

The segment posted operating income of $3.6B, an increase of 84.6% Y/Y, whilst Q/Q operating income increased 27.1%.

Cloud operating margin now sits at 23.7%, a noticeable improvement from 20.7% in Q2 2025 and 17.1% in Q3 2024. While there is still room for margins to grow, as the deceleration from 141% Y/Y growth to 84.6% shows, it won’t be as easy to increase them anymore, and growth will be more gradual.

A key factor in Google’s Cloud success is its custom-designed data center chip!

The company uses specifically designed chips for maximum performance for specific workloads in its data centers.

Argos is a custom-built chip for YouTube video processing to get maximum efficiency.

TPUs for AI workloads.

The TPUs, especially, are extremely successful, demonstrating incredible electricity efficiency, usage versatility (training and inference), and scalability.

Recently, it was reported that the AI start-up Anthropic signed a 1M TPU chip deal with Google Cloud!

Contracts such as these drove Cloud backlog to a record high of $155B, a 46% increase Y/Y.

Key Points from the call:

“Our complete enterprise AI product portfolio is accelerating growth in revenue, operating margins, and backlog. In Q3, customer demand strengthened in three ways.

One, we are signing new customers faster. The number of new GCP customers increased by nearly 34% year over year.

Two, we are signing larger deals. We have signed more deals over $1 billion through Q3 this year than we did in the previous two years combined.

Third, we are deepening our relationships. Over 70% of existing Google Cloud customers use our AI products, including Banco BV, Best Buy, and Fairprice Group. As we scale, we are diversifying revenue.

Today, 13 product lines are each at an annual run rate over $1 billion.”

“Nine of the top 10 AI labs choose Google Cloud.”

More customers, larger deals, and deeper relationships with existing customers.

This is a potent combo that drives incredibly strong growth!

Google’s prowess in custom chips, cloud, and AI is not only enabling the company to create compelling AI products but also making it an attractive partner. This is why Meta and 9 of the top 10 labs use Google’s services.

5. Subscriptions, Platforms, and Devices

I would like to reiterate that I really don’t like this segment reporting, as it is a rather confusing mess.

This segment includes YouTube Premium, Android, Google One, Google Workspace, Android, Pixel and other devices.

There are just so many unrelated offerings included here that it is difficult to assess what is driving this segment, which I suspect could be intentional.

If Google doesn’t disclose its subscription revenue, then investors can’t apply a higher multiple to that, more steady and predictable part of the business!

In Q3 2025, the company earned $12.9B from this segment, an increase of 20.8% Y/Y!

In the graph above, we see that while growth accelerated slightly from 20.3% in Q2, it was noticeably below 27.8% in Q3 2024.

The growth of this segment was driven by strong growth in its subscription business, with YouTube Premium and Google One passing a combined 300M paid subscribers. Personally, I am addicted to YouTube and pay EUR 19 a month, just to avoid being bombarded with advertising. It is expensive, but still a no-brainer subscription that saves me literally hours every month.

Key Points from the call:

“YouTube with our subscriptions products, we’re also seeing momentum with strong growth in offerings such as YouTube Music and Premium and YouTube TV.”

“Revolut, the global financial services company, leverages Google Cloud’s Vertex AI platform and Gemini models to help power its advanced customer service chatbot, develop new hyper-personalized financial products, and offer predictive insights. Revolut is also increasing its presence on YouTube, adopting VO3 for personalized creatives, making Google a key ads partner for delivering growth and launching new markets”

Within this segment, Google also reports earnings from its AI subscriptions. We are starting to see some synergies between Google’s products. Advertisers are using Google’s cloud to run their business, Gemini AI models for customer services, and AI images and videos for advertising run on YouTube.

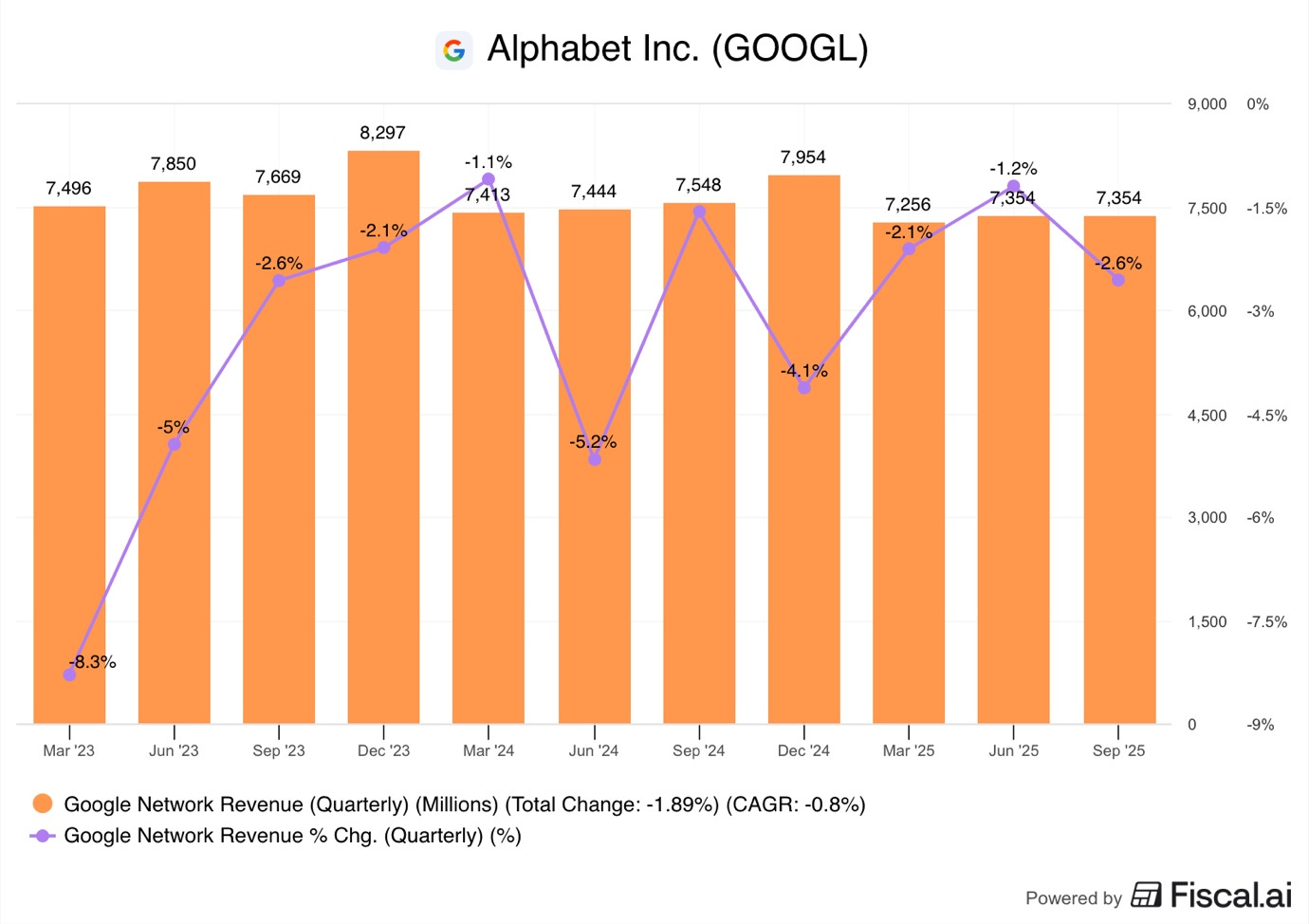

6. Advertising Network

Within this segment, Google reports revenue from its third-party advertising businesses, such as AdSense, Ad Exchange, and Ad Manager.

Google made $7.35B from this segment, down 2.6% Y/Y!

In the above graph, we see that this segment has been performing poorly for quite some time, with declining sales for 13 quarters in a row.

This segment has been a headache for the company for quite some time now.

The worst performing segment.

Courts in the US have labeled it a monopoly.

$3.5B fine in the EU.

It is likely that the US court will order remedies that will further weaken this segment. But in the grand scheme of things, it doesn’t matter, as YouTube, Cloud, Waymo, Search, and AI are much more promising verticals.

I honestly wouldn’t be surprised if Google simply splits out or sells this segment. With $7.3B in revenues, the ad network generates just 7.2% of total revenues, and juice doesn’t seem to be worth the squeeze, especially considering all the headaches with fines and lawsuits.

7. Waymo

The big Waymo announcement this quarter was their partnership with Lyft!

Waymo plans to begin robotaxi services in Nashville in 2026 through a partnership with Lyft. This is clearly an intentional action to spread its bets and not be too dependent on Uber.

Additionally, Waymo has announced plans to begin operations in Miami, Washington DC, Dallas, Seattle, and Denver in 2026. Also, the company intends to begin operations internationally by expanding to London and Tokyo.

It so happens that yesterday I released an article on the current state of Robotaxi Wars, where I explore how Waymo competes with other industry players.

“Notice that so far, Waymo has been operating in areas with stable weather. This is because rain, wind, clouds, and snow are significant obstacles that interfere with sensors on which robotaxis depend. In Denver, Waymo will have to deal with strong snow, whilst in Miami and Seattle, with rain. Data from such environments is crucial to increasing the reliability of AI driving models.

In my eyes, the company enjoys a few competitive advantages:

First mover advantage

Unlimited resources

Cloud and AI integrations with Google

Lower advertising costs”

Overall, Waymo is in a strong position to be one of the key leaders of the quickly developing trillion-dollar robotaxi industry.

8. Is Google a Buy?

My answer to this question, together with a new valuation model that takes into account the current progress, will be provided to Global Equity Briefing Premium members tomorrow!

Here is what my Premium Members can expect:

Top Monthly Picks - Each month, I will select a few stocks that I find likely to outperform.

These picks will focus more on short-term pricing movements and swift through market narratives.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on semi-monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Pricing Structure

I strive to build a long-term relationship with my Premium subscribers, so I have chosen a pricing structure that emphasizes annual subscriptions.

The standard practice is to give 2 months free for annual plans, but I have decided to give 6!

Small note, please go to the website to purchase the subscription, as if you do it on the iOS app, you have to pay the 30% Apple Tax. (The plan cost more there)

Thank you for being a reader. I look forward to seeing you on Global Equity Briefing!

Equity Research Report List

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Try Brave browser or extenstions instead of paying for youtube. I love Google but they not just steal your personality to generalize algorithms for the whole world but then you also pay for it.

Brilliant. What if AI growth slows next quarter?