Is Stripe a threat?

Adyen. Equity Research! Part 2/3

Welcome to Part 2 of this Adyen Deep Dive.

In Part 1, we explored Adyen’s business model and competitive advantages.

In today’s Part 2, we will look at Adyen’s competitors such as Stripe, Block, PayPal, and Dlocal.

Additionally, cybersecurity, regulatory, customer concentration, and take-rate compression risks are analysed.

Let’s jump in.

1. Competitors

2. Risks

3. Part 3

1. Competitors

Stripe

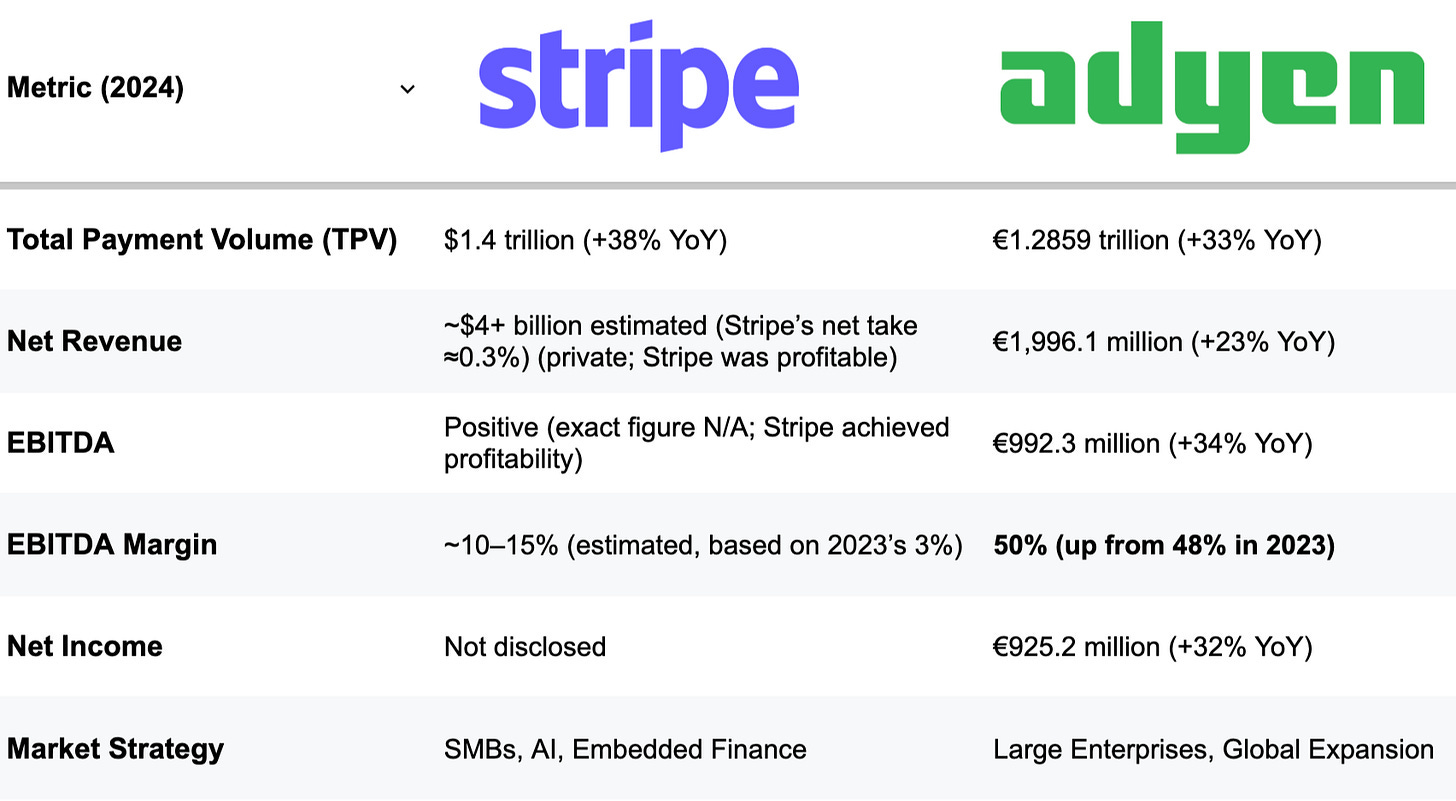

Stripe is Adyen’s largest and most formidable direct opponent.

Unfortunately, Stripe is not a publicly traded company, so we don’t have as much data to compare, but we have some key KPI’s

In 2024, Stripe processed $1.4T while Adyen processed €1.3T.