Is Microsoft a buy?

Microsoft Investment Case!

MSFT 0.00%↑ began in the 70s as a small software vendor to the niche computer industry, but today it has evolved into a diversified technology giant.

While Microsoft has been at the forefront of technology for decades, today it is enjoying especially strong growth as a result of the world’s economies going through a digital transformation.

Companies, governments, and citizens are increasingly not satisfied with slow, burdensome paper-based processes. Digital cloud-based software solutions are becoming the norm, and Microsoft, as the lead provider, is benefiting!

At the same time, AI has exploded on the scene, promising to completely revolutionize the world as we know it!

Demand for Microsoft’s services is growing rapidly, enabling them to overtake Apple to become the largest company in the world!

Despite the $3.3T market cap, Microsoft is well-positioned to significantly reward its investors in the next decade!

In this Microsoft Investment Case article, I will explore Microsoft’s strong position in Video Games, Cloud, Enterprise Software, and AI!

Let’s start!

1. Video Games

2. Cloud

3. Cloud

4. AI

5. M&A

6. Valuation

7. Conclusion

1. Video Games

While video games have historically been looked down on as something “only kids do”, that is no longer the case. Technological advances have made video games better, more advanced, and easier to play than ever before. Today, video games are popular with adults and kids alike and are a fast-growing $300B industry poised for rapid changes.

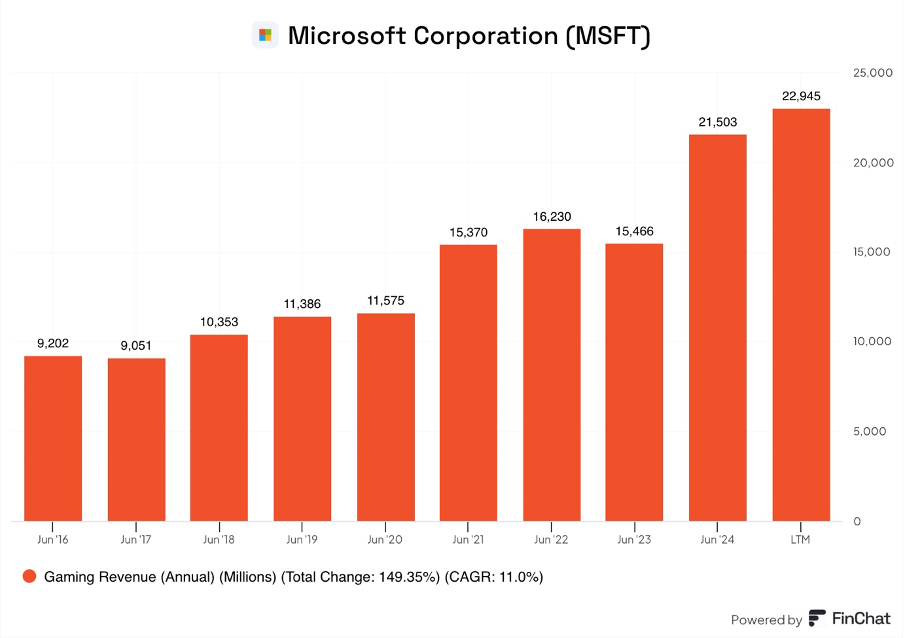

With $21.5B in gaming revenue, Microsoft was the 3rd largest video game company in the world in 2024!

The most important thing investors must understand is that the video game industry is in the early stages of transitioning from one-time purchases to cloud streaming subscriptions!

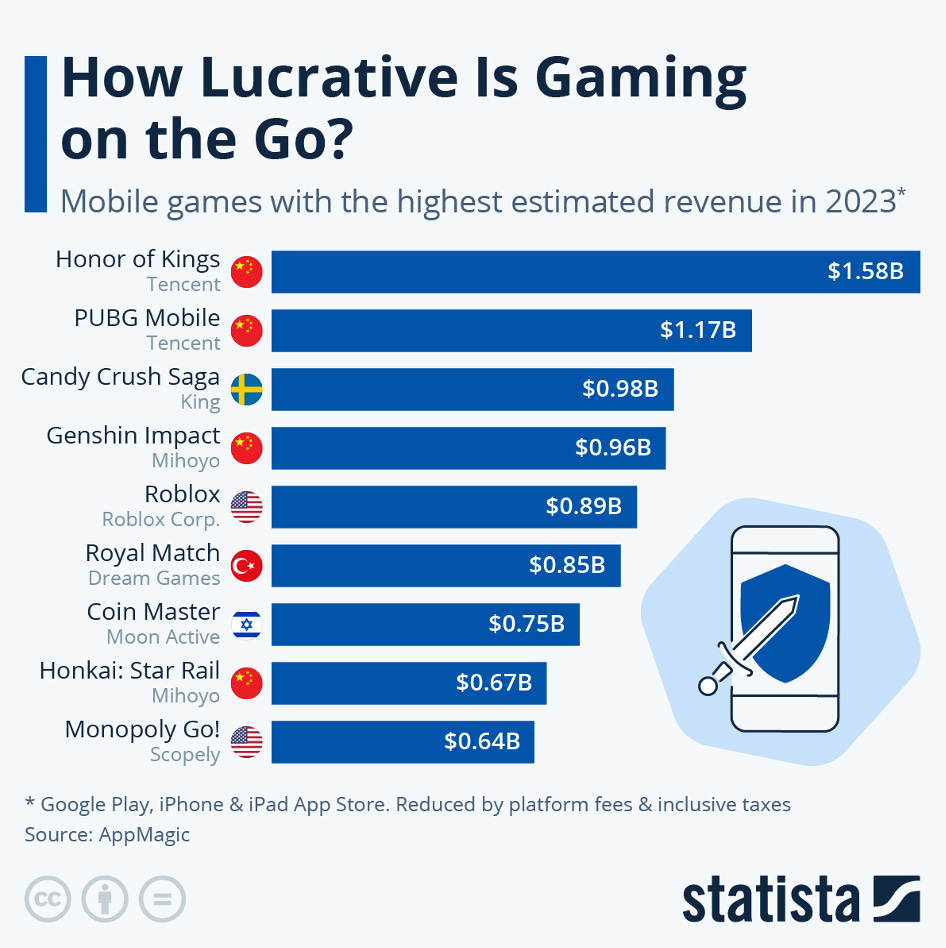

Statista estimates that the total global mobile gaming market made $92.6B in 2023. Tencent’s Honor of Kings was the most popular game that year, generating $1.58B, around 1.7% of the entire industry. Furthermore, the top 10 most popular mobile games generated $8.5B, or around 9.2% of the total mobile gaming industry.

This is the problem with investing in video game companies.

Video games are fundamentally hit-driven businesses, as the majority of the sales and profits are generated by just a few blockbuster games!

Cloud gaming could change that!

Instead of developing a number of games individually and trying to forecast (more like guess) which video game will be a success, companies will look at their games as part of a portfolio.

Gamers will sign up for a subscription that, for a simple monthly price, will give them access to a portfolio of games, similar to video streaming services such as Netflix, Disney+, and Prime Video.

Instead of buying a single game for $80, gamers will pay $20 a month to get access to hundreds or even thousands of games! This will increase customer long-term value (LTV).

The transition to cloud-based video game streaming could significantly increase the total addressable market (TAM) for video games. The most advanced video games require powerful PCs or consoles. Millions of people who would like to play some games once in a while are not willing to spend hundreds or even thousands of dollars on such a device. Moreover, some games are just too demanding for mobile phones.

With cloud gaming, instead of running the game on one’s device, the game is run on Microsoft’s large and powerful servers, which then stream the video of the game to the device.

In theory, if internet speeds are fast enough, even the most basic devices should be able to run even the most powerful games.

The transition to cloud-based video streaming made Netflix a more predictable and profitable business than old Hollywood studios ever were, video game streaming will do the same to the video game industry!

This is why Microsoft paid $7.5B in 2020 to acquire Bethesda and $68.7B in 2022 for Activision Blizzard. They are building a portfolio of games for their cloud gaming subscription offering.

Gaming revenues have grown with an 11% CAGR to reach $22.9B as of LTM Q1 2025!

I think it is entirely possible for gaming revenues to double or triple in the next decade. Most importantly, the transition to a subscription-based model could double gaming margins.

Furthermore, Microsoft is uniquely situated to embed AI in its games. LLM models can make games more engaging and personalised, creating new venues for expanded monetization. AI development tools could drastically cut development times and budgets.

Microsoft doesn’t report the subscription figures for its cloud gaming unit, it is included in the Xbox Game Pass, which had 34M subscribers in February of 2024.

Industry experts predict that the company will pass the 50M subscriber mark in 2025. Additionally, The Information reported that Microsoft had an internal target to reach 100M subscribers by 2030.

While there are many challenges ahead, with Xbox, its portfolio of video game studios, and Azure cloud infrastructure, Microsoft is well-positioned to capture a large slice of the evolving video game streaming market.

2. Cloud

It is estimated that around 85% of global IT budgets go to on-premises spend. As the world continues the digital transformation of our economies, many experts predict that in the next 10 to 20 years, this ratio will flip.

This means that trillions of dollars of global IT spending will shift to the cloud!

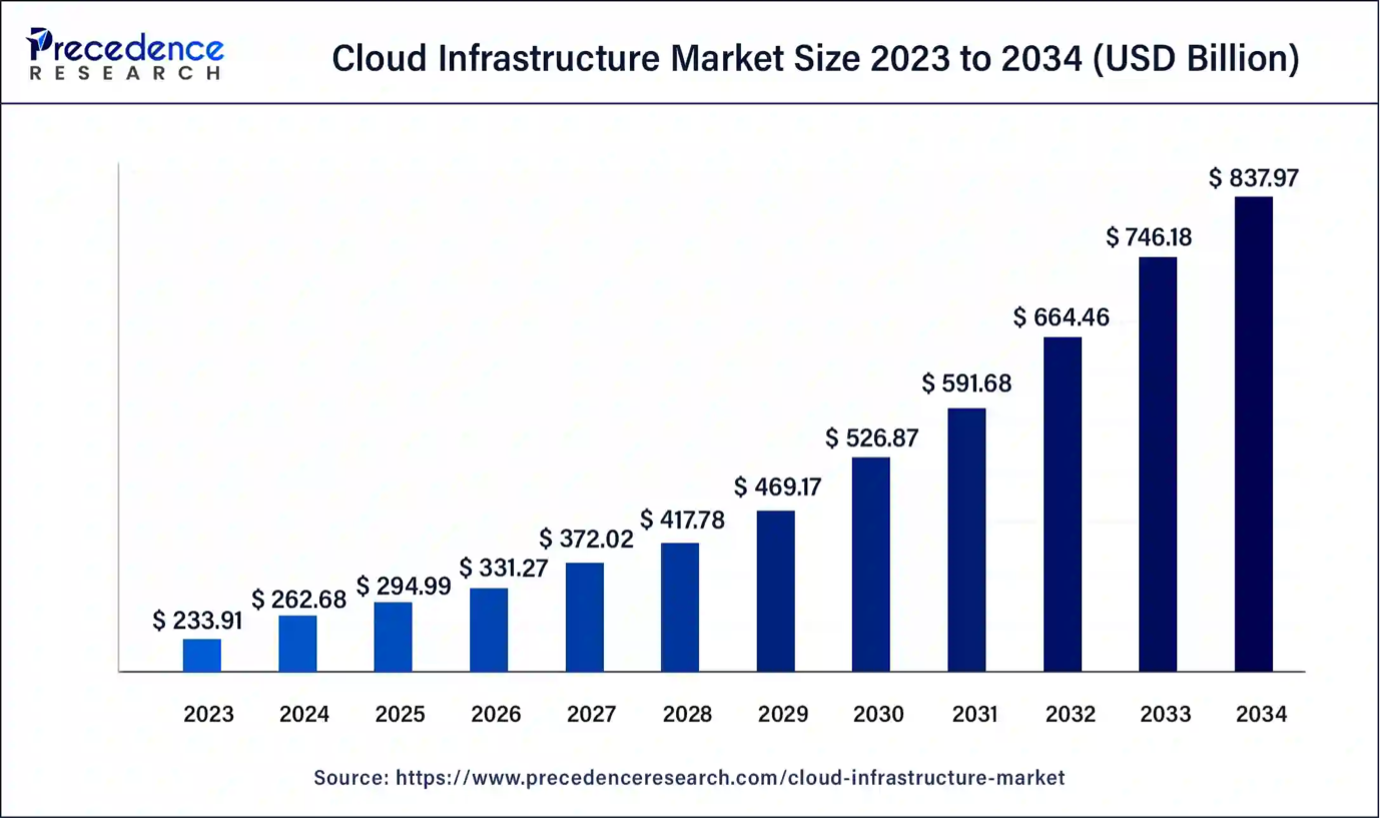

Precedence Research believes that the global Cloud Infrastructure market will grow with a 12.3% CAGR to reach $838B by 2034!

Microsoft services this market with its Azure cloud Infrastructure-as-a-Service (IaaS) product.

Instead of buying expensive servers to place in the basement of their office, businesses can keep all their data on Microsoft’s secure servers. Customers pay based on how much data they use, enabling them to quickly scale up their computing needs.

Additionally, this significantly lowers start-up costs for new businesses! New ventures no longer need to incur thousands and possibly millions of dollars in start-up server costs early in their life.

If the idea is a success, great, just buy additional compute from Azure. If it is not a success, at least they didn’t waste funds on expensive servers.

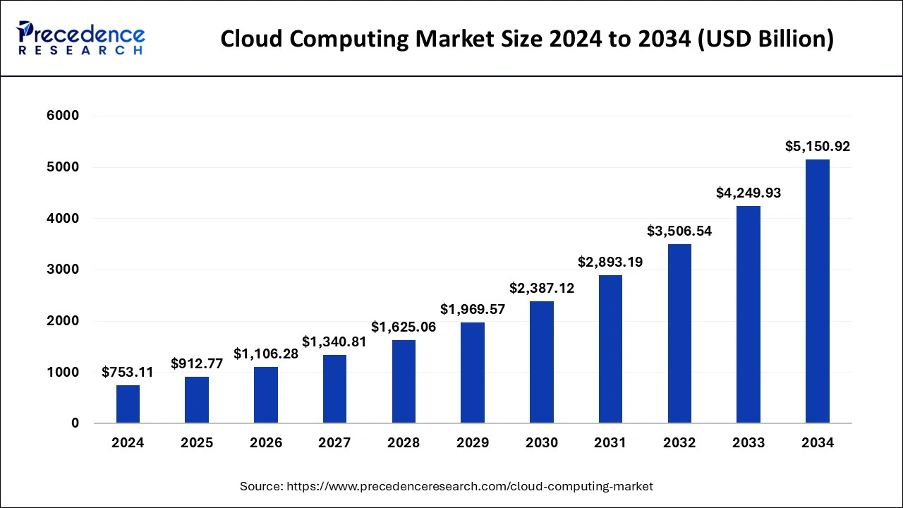

However, infrastructure is just one part of the total cloud market.

Precedence Research estimates that the total Cloud Computing market will grow with a 21.2% CAGR to reach $5.15T by 2034!

This means that running software platforms on cloud infrastructure is a five times larger business than cloud infrastructure itself.

Microsoft, of course, realizes this, thus, they are building new offerings to capture a bigger share of the broader cloud computing market.

Additionally, they are transitioning all on-premises, license-based software into on-cloud, subscription-based offerings!

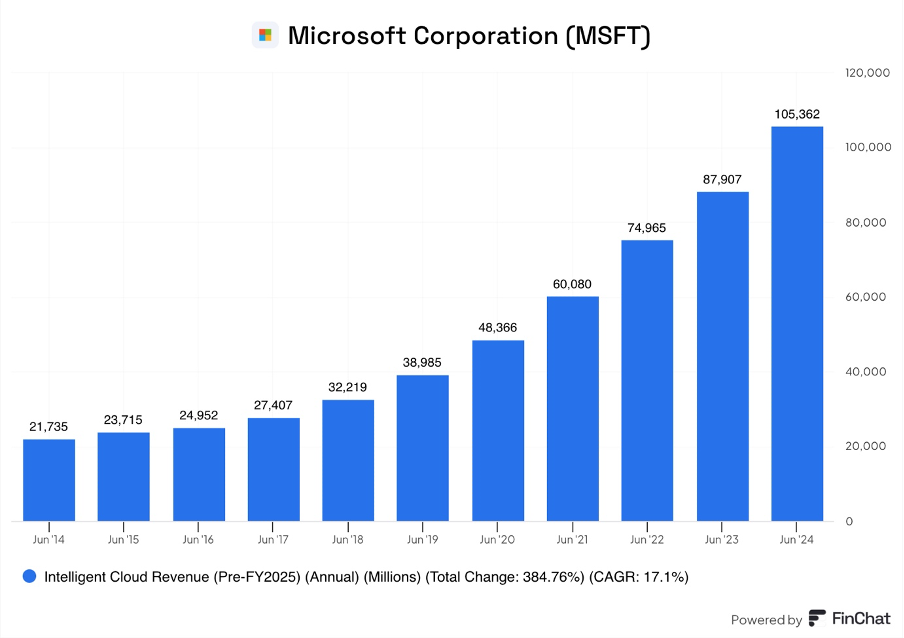

Microsoft Intelligent Cloud segment contains all its cloud offerings.

Since 2014, this segment has grown by 385% to reach $105.4B!

As I said earlier, only 15% of global IT spending goes to cloud services, Microsoft is well-positioned to grow for decades to come.

3. Enterprise Software

Becoming a vendor to a multi-billion-dollar corporation is a long and tedious process that involves working with different departments, such as procurement, legal, tech, finance, and compliance. After the signing of a contract comes software implementation, which takes months or even years.

While large enterprises are difficult customers to sign on, they are very profitable and easy to serve!

While there are some requirements for maintenance and updates, once the software is installed and fully implemented, enterprise customers require relatively little effort to serve.

Additionally, Microsoft enterprise customers are extremely sticky and remain customers for years and in some instances for decades! Anyone who has worked in a corporate setting will confirm that it is extremely difficult to convince management and employees to change habits and implement new software.

Most importantly, enterprise customers are not price sensitive, enabling Microsoft to significantly increase prices at regular intervals with limited churn.

Microsoft’s strength with enterprises is one of its biggest competitive advantages!

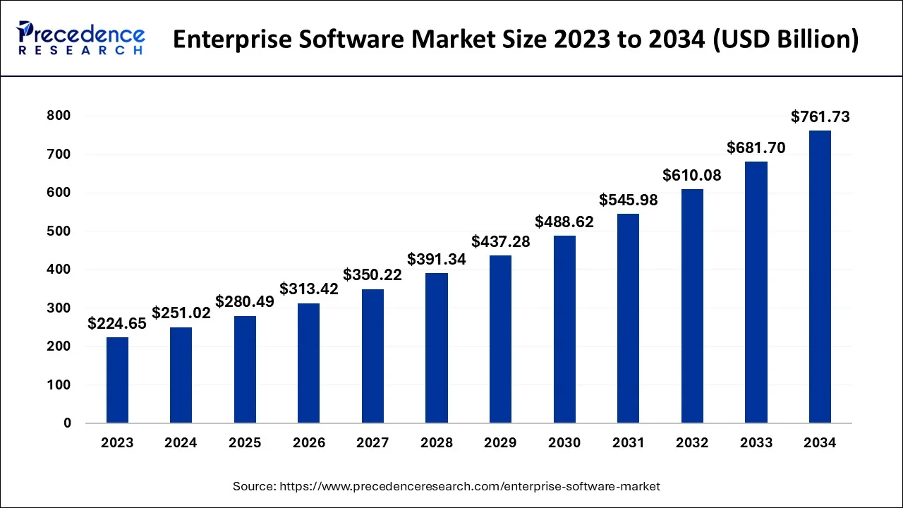

Precedence Research believes that the global Enterprise Software market will grow with an 11.74% CAGR to reach $761.7B by 2034!

Microsoft offers a vast suite of services that caters to virtually every need of a large organization, creating huge upsell opportunities and further reducing churn.

Their software is the backbone that enables the digital transformation of large enterprises.

In addition to its legacy flagship services, such as Windows and Office, Microsoft is enabling unparalleled digital cooperation with its Teams and SharePoint offerings.

At my previous job, I was working in an international company with dozens of offices around the world. One of my responsibilities was creating reports based on data generated and shared by my colleagues in Morocco, the Philippines, the USA, Canada, Kenya, China, and more. We had a shared SharePoint folder and regularly had Teams calls with people from multiple continents.

This kind of deep and efficient collaboration was unimaginable just a decade ago!

Another core offering is Dynamics. It is Microsoft’s advanced and comprehensive enterprise software offering designed to collect, integrate, and utilize data across core business functions such as sales, marketing, finance, procurement, supply chain, and more.

For instance, the finance package of the Dynamics Enterprise Resource Planning (ERP) module enables companies to digitize and automate tedious accounting and financial reporting tasks. It streamlines invoice processing and creation, budgeting, forecasting, bank statement processing, and cash flow management.

Meanwhile, the Dynamics Customer Relationship Management (CRM) module helps sales and marketing teams track leads, automate sales processes, manage customer service, and track marketing progress.

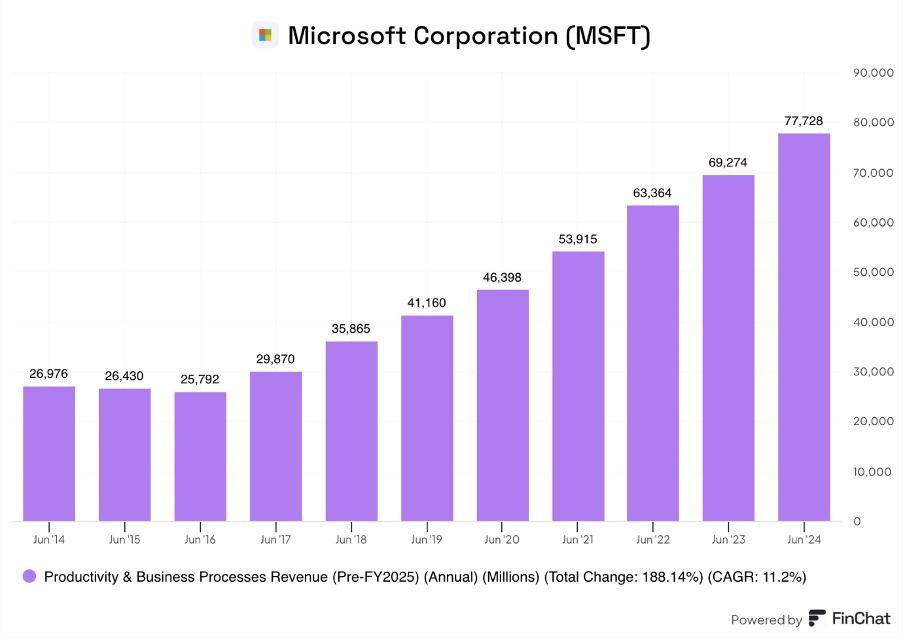

The Productivity and Business Processes segment, which includes Dynamics, Office, Teams, and other enterprise offerings, has grown by 188% since 2014 to $77.7B!

Thanks to Microsoft’s strong position in enterprise services and focus on shifting them to the cloud, they are likely to see significant growth in the next decade!

4. AI

AI is rapidly taking the world by storm, and in the next decades, it will get embedded in all of the most important functions of our economies.

Microsoft is one of the businesses that stands to benefit disproportionately, as they are both the supplier and the user of AI!

On the supplier side, they have Azure, Office, Dynamics, GitHub, and more!

Microsoft Azure cloud infrastructure service is seeing strong demand from companies training and running AI models (inference). A single AI query uses 10 to even 100 times more computing power than a normal internet search. For this reason, the majority of computing is still used on training. However, once AI models are sufficiently developed, they will get embedded in more areas of the economy, requiring more inference.

Jevons paradox dictates that as technological progress increases the efficiency of something, its use significantly increases, leading to the overall consumption increasing rather than decreasing.

For instance, a more efficient diesel engine won’t reduce the total diesel consumption. This is because as the price per mile falls, people drive more often, and people with lower incomes can now afford to drive.

Rapid advancements will enable AI to be used more frequently, increasing demand for Azure cloud computing!

This feeds right into the Office, Dynamics, and GitHub.

AI CoPilot embedded into Office apps such as Excel, Word, and PowerPoint will enable people to be more productive. Word reports will be written faster and with greater detail and accuracy. Analysts will create and analyze Excel spreadsheets with ease. Word and Excel documents will be simply uploaded into PowerPoint, creating presentations within seconds.

AI tools will support increased automation in the Dynamics ERP and CRM systems, driving better insights and decision-making.

New AI coding tools on GitHub will accelerate software development by suggesting code and automating common programming tasks.

And we haven’t even touched one element that is often forgotten, the internal use of AI.

By leveraging its own AI tools across its vast enterprise operations, Microsoft establishes a powerful feedback loop that enhances its product strategy.

Usage data directly feeds back to the development teams, helping identify bugs and areas for improvement, and accelerating the development.

Moreover, as the developer of AI tools, Microsoft will use them before anyone else. This gives them a competitive advantage over other companies.

Microsoft is its own best customer!

5. M&A

In 2024, Microsoft generated an incredibly healthy $74B in FCF. Historically, the company hasn’t shied away from deploying cash to acquire companies to enter new segments or expand its capabilities in existing ones.

While some of these acquisitions have been huge disasters, most famously Nokia, others have just slowly died, like Skype. Overall, Microsoft’s record is quite incredible.

Let’s look at the acquisitions of LinkedIn and GitHub.

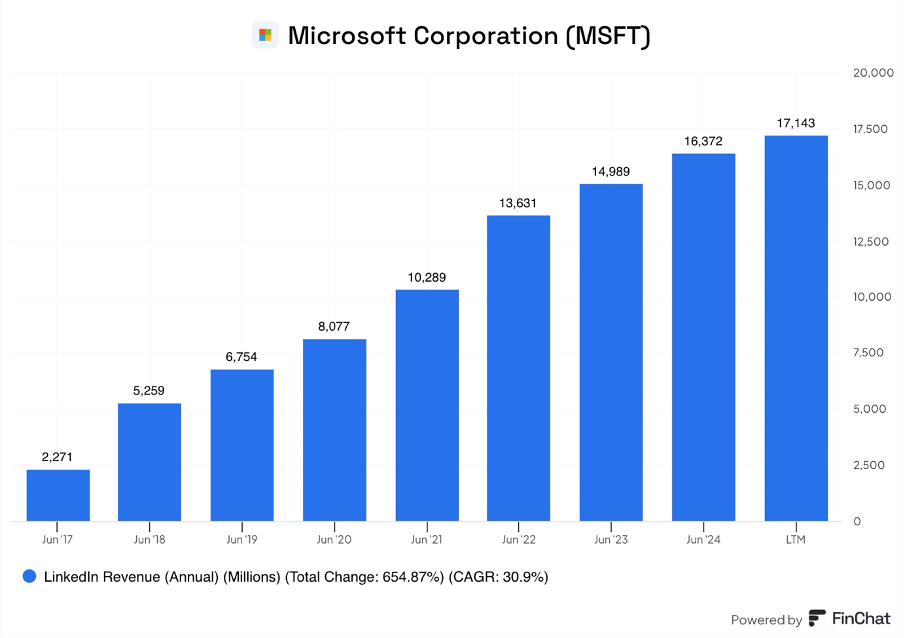

Microsoft acquired LinkedIn in 2016 for $26.2B, entering the social media space. While originally, many analysts were skeptical of the acquisition, largely due to the price tag and concerns regarding the user growth.

Since then, however, LinkedIn has become an explosive success for Microsoft!

LinkedIn revenues have grown more than sevenfold to $17.1B. At the same time, registered users have grown from 450M to 1.04B. With 320M monthly active users, LinkedIn is the 12th most popular social media app in the world!

A leading position in the professional social media space makes LinkedIn an instrumental part of the global employee recruitment industry.

Another successful acquisition is GitHub. In 2018, Microsoft acquired this code-hosting platform for $7.5B and has since significantly grown it.

GitHub was an important part of the open-source software development community, so when Microsoft acquired it, many feared that this would end. However, not only has Microsoft kept all the open-source functionalities, but they have expanded them.

Additionally, GitHub has been instrumental in supporting Azure cloud growth with software developers. By tightly integrating GitHub with Azure, Microsoft has created a seamless pipeline from code to cloud. This gives developers compelling reasons to stay within the Microsoft ecosystem.

Under Microsoft’s stewardship, GitHub has grown to over 100M developers and 14M DAUs, generating around $2B in ARR for Microsoft!

Great financial performance has been driven by a strong adoption of GitHub CoPilot, their AI-powered software coding tool.

Overall, Microsoft has demonstrated that they are great acquirer of promising businesses. I find it likely that the company will continue to grow sales and earnings not only by further integrating previous acquisitions but also by conducting new accretive acquisitions.

6. Valuation

With a market cap of $3.3T, Microsoft is the world’s most valuable company! It is absolutely mind-boggling that Microsoft has been able to sustain market-beating growth rates for such a long time!

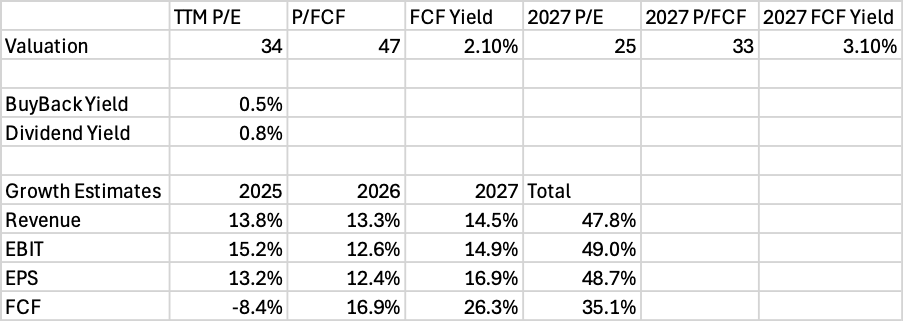

In the table above, I have placed some key valuation metrics.

Microsoft trades for a P/E of 34, which is significantly higher than the S&P 500 average of 27. However, considering the quality of their business, I think a 26% premium to the average S&P 500 company is more than fair.

Microsoft looks considerably more expensive if one looks at the cash flow metrics. P/FCF is 49, but this is because FCF is currently temporarily lower due to elevated capex. Microsoft plans to spend $80B on AI capex in 2025. A reminder that capex spending doesn’t appear in the income statement until assets are depreciated or written off.

Wall Street analyst estimates tell us that Microsoft is forecast to grow sales by 13.8% in 2025 and 47.8% by 2027!

Moreover, analysts expect a slight increase in profit margins by 2027, as EBIT and EPS are both expected to grow at a higher rate than revenue, 49% and 48.7% respectively.

However, FCF will decrease this year, due to AI capex investments I mentioned. These investment levels are projected to stay somewhat elevated, with 3-year FCF growth of 35.1% being significantly lower than revenue and profitability growth.

Forward growth estimates lead to a 2027 P/E being 25, whilst P/FCF is 33. These metrics are still somewhat high, implying strong growth expectations past 2027.

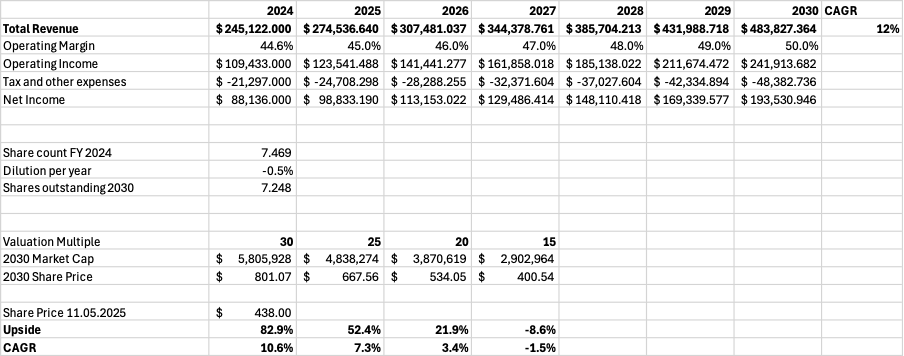

Valuation Model

Let’s see what kind of returns Microsoft investors could see in the next few years.

I model revenues growing with a 12% CAGR till 2030 to reach $483.8B, up 97% over 6 years.

Additionally, considering the opportunities mentioned in this report, I model the operating margin increasing from 44.6% in 2024 to 50% in 2030.

Assuming a 20% effective tax rate, we get to a net income of $193.5B, and an increase of 120%!

If Microsoft reduces the number of shares outstanding by 0.5% per year and trades at a P/E of 30, slightly below the 34 P/E it trades at today, it would have a market cap of $5.8T and trade for $801 a share.

This model shows that there is around 83% upside to the current share price, a CAGR of 10.6%!

This is not what most investors would deem stellar growth. However, considering the moat, the quality of the business, and the opportunities in the next decades, I find Microsoft to be a great addition to a balanced, long-term-minded portfolio for investors with a low-risk appetite.

7. Conclusion

Microsoft is a high-quality business that holds an almost monopoly-like position in enterprise productivity software. Products such as Windows, Office, Teams, and SharePoint have become the default operating systems of the corporate world.

Microsoft’s enterprise software offerings are high-margin, sticky, recurring, cash cows!

In addition to being an enterprise software giant, Microsoft is a video game behemoth. Thanks to its acquisitions of Minecraft, Bethesda, and Activision Blizzard, Microsoft owns some of the most valuable video game IP. This IP will be instrumental in Microsoft’s quest to become a video game streaming leader!

What Netflix did to movies and TV shows, Microsoft wants to do to video games!

Of course, Microsoft couldn’t be a video game streaming leader without a strong position in cloud computing services.

Through its Azure cloud offerings, Microsoft stands to benefit significantly as the world continues the path of digital transformation.

Only 15% of global IT spending is on the cloud. Microsoft’s cloud business is set to continue growing at a healthy rate, as in the next decades, the share doubles, triples, and quadruples!

Most importantly, AI is set to revolutionize the world as we know it, and Microsoft is working hard to embed it in all of its offerings.

While Microsoft stock is not cheap, trading at 34 times earnings, the company is uniquely situated to benefit from multiple long-term technology trends.

With a 12% revenue CAGR and a slight improvement in margins, investors could see around an 83% return by 2030!

This makes an investment in Microsoft a low-risk, stable choice for patient long-term investors.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.