Net Income Does Matter. Don’t just look at FCF.

Investing Basics. #1

Hello Global Investors.

Today, I am starting a new article series on Investing Basics.

The other day, I read an interesting article on Jimmy’s Journal Substack titled: “Net Income Doesn't Matter. Look for Free Cash Flow (FCF).”

In his article, Jimmy stated that Net Income doesn’t matter and investors should look only at FCF. I recommend that people give the article a read.

However, I disagree, Net Income Does Matter

so I decided to write this article and explain why Net Income Does Matter and shouldn’t be ignored!

First, let’s understand the difference between these two metrics.

Net income is an accrual accounting-based metric that measures a company’s profitability in a given period, whilst FCF measures how much actual cash is generated after investing in capital expenditure projects.

Generally accepted accounting principles dictate that revenue and expenses follow each other. Meaning that when a company sells a product, it must book that sale as revenue and all direct expenses associated with the sale as costs of goods sold. This is irrespective of when cash actually changes hands.

“But in reality, net income is often a poor proxy for how much value a business is truly generating.” Jimmy’s Journal

I disagree 100% with this statement. I think more often than not, FCF is a poor proxy of the value a business is truly creating!

Here is why:

FCF ignores Stock-Based Compensation

Depreciation is a real expense

FCF is more volatile

FCF can be manipulated

Negative FCF is not always bad

FCF is useless for financial services companies

Let’s expand on each.

1. FCF ignores Stock-Based Compensation

The biggest problem with FCF is that it ignores Stock-Based Compensation (SBC).

SBC refers to companies issuing new shares to employees. Often, employees hold them for a few years before selling them. This is a real expense as it dilutes shareholders’ ownership in the company.

If a $10B market cap company issues $200M in SBC, that means that shareholders now own 2% less of the company.

This is a REAL EXPENSE!

However, as this doesn’t involve cash leaving the company, FCF ignores it.

THIS IS MADNESS!

Meanwhile, US GAAP requires SBC to be recognized and expensed when vested, so in the $200M example, net income would be reduced by $200M, while the FCF wouldn’t.

This has created a situation where this aspect of FCF is manipulated by many CEO’s to make their company seem much better than it actually is.

They plaster FCF all over their earnings presentations and talk about how they are “generating real cash flow” and that we should ignore the negative EPS and net income metrics.

Nowadays, it has become commonplace for companies to release “Adjusted Earnings” and remove SBC, and sometimes even other “one-time” expenses.

This makes my blood boil.

One of the most egregious examples is Snowflake.

Above is a slide from their Q4 2024 earnings presentation. Notice that they have no shame adjusting everything, gross margin, operating margin, and FCF.

Is it really a “one-time” expense if every quarter you find something to adjust?

But, ok, that is not the topic of today’s article.

If you look at the right side of the slide, you see a graph of FCF margin. 29% does seem great, and it is up from 12% just 2 years ago.

If someone were to look at this slide of the presentation, they would think that not only is Snowflake a highly profitable company, but its profits are growing.

Well, that is not the case!

If you look at the chart above, we see that not only is Snowflake hugely money-losing,

LOSSES HAVE BEEN INCREASING EVERY YEAR!

The only reason why their FCF is positive $758M is that they pay a mindboggling $1.5B in SBC.

Now, I don’t know and don’t care about Snowflake’s business fundamentals, but this is an incredibly dishonest way of presenting the financial health of a company.

Their earnings presentation certainly doesn’t contain a graph like above showing how their losses are increasing and increasing, and SBC is increasing and increasing.

This is a clear example where Net Income does matter and FCF doesn’t!

Snowflake is not “creating real value for shareholders” with their FCF, just diluting them out of existence.

2. Depreciation isn’t just “noise”

When people say that “depreciation is not a cash expense,” it is partially false and overly simplistic.

This signals a fundamental misunderstanding of what depreciation measures.

When a company purchases machinery that has a useful life of 10 years, instead of booking all that expense in year 1, it divides it over 10 years, each year recording a depreciation expense of 10% from the original purchase.

This recognizes and matches the cost of purchasing that machinery with the value created by it.

FCF doesn’t include depreciation because it is not a “real cash expense”, but it is cash that a company has already spent, or is still being spent, if the purchase was on credit.

Depreciation measures real economic cost!

Think about it, how can your machinery and assets aging and becoming less valuable not be a real “expense”?

It is.

Ignoring depreciation is like saying your car doesn’t cost you anything, because you paid for it last year already.

FCF might look great, but how long will it remain so if a business doesn’t spend it prudently?

Depreciation shows us that!

If a company purchased unproductive assets, depreciation expense could be larger than the revenue generated by those assets.

However, if you just look at the FCF, it might seem that the business is generating a lot of cash.

But is it truly so if you ignore the biggest expense category needed to generate that cash?

3. FCF is more volatile than Net Income

FCF is more volatile than Net Income, because it measures how much cash is actually collected.

Customers often pay invoices in bulk, whilst companies regularly go through capex cycles.

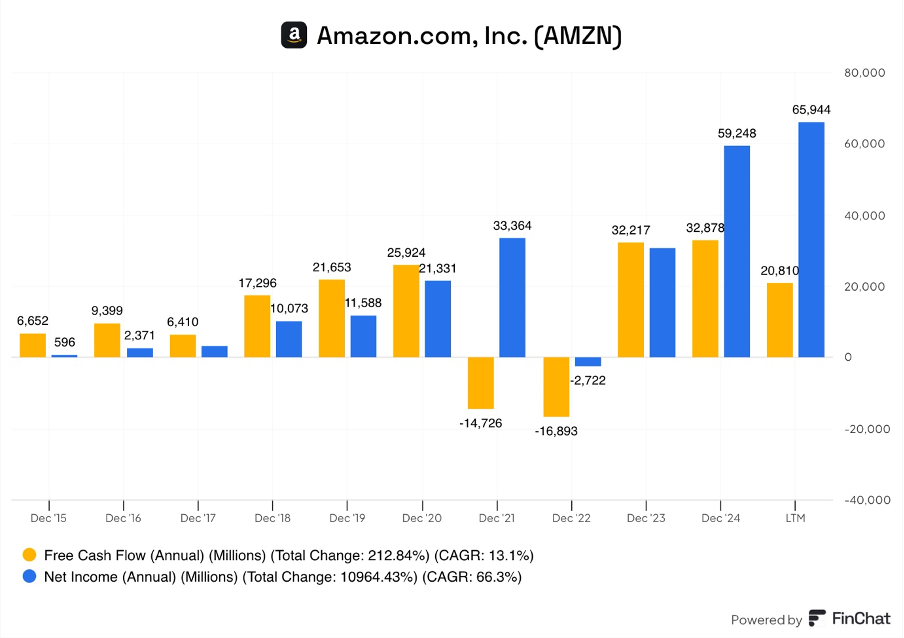

Let’s just look at Amazon.

The blue line (net income) is certainly less jumpy than the yellow one(FCF). From 2015 to 2020, Amazon generated more cash than net income, as they were reaping the benefits of earlier investments, whilst the assets were depreciated, making the net income smaller.

Today, the situation is in reverse as Amazon is investing tens of billions in AI capex, so net income is much higher than FCF.

I don’t believe it makes sense to already punish the company for its heavy capex.

Amazon trades for a P/E of 35, whilst P/FCF is 109.

Essentially, the market has already decided that these capex investments will not generate enough returns.

I believe a fair P/E for Amazon is around 50 to 60.

4. FCF can be manipulated

“Net income can be manipulated. FCF is hard to fake.”Jimmy’s Journal

I believe this is false.

FCF can be manipulated by:

Collecting payments early

Delaying capex projects

Postponing supplier payments

In my previous job, I worked at a large multibillion-dollar company, and one of my tasks was to track cash flow and make sure we had enough cash to meet the company's objectives. So, I know that FCF can be manipulated. Every quarter, we had suppliers calling us and essentially begging us to pay some invoices early.

One person from the procurement team literally told me that they got a call from one of our suppliers who said that if we don’t pay a $10M+ invoice before the quarter end, they will miss their FCF estimates, and their stock price could fall, even though the invoice wasn’t due for like a week after the quarter closed.

Moreover, we had the same story with some customers, who often paid overdue invoices in the first week of a new quarter.

Yes, this will be visible in financial statements, but let’s be honest, most investors only look at the headline numbers and whether it was a beat or not.

Furthermore, companies can easily postpone capital expenditures to increase FCF.

In this case, Apple comes to mind. In 2025, Microsoft, Amazon, Google, and Meta are investing close to $100B each, just in AI capex, whilst Apple's total capex will only be around $10B.

Apple’s FCF certainly looks the best today, but how long will it remain so with them underinvesting in the most important technology revolution of the 21st century?

Regarding net income, it can be manipulated by:

Recognizing revenue early

Shifting costs to other projects

Changing depreciation schedules

However, anyone who has ever had to deal with an audit from the Deloitte, KPMG or other accounting firms knows that they are a pain in the ass!

It is not as simple as one thinks, and you can’t change depreciation schedules on a dime. Any changes that would increase net income are instantly suspicious and would warrant extra scrutiny.

Also, this is literally fraud, while postponing capex, collecting invoices early, and delaying supplier payments is perfectly legal and common.

5. Negative FCF doesn’t mean a company is “bleeding cash”

I see investors repeatedly make this claim, yet quite often, that simply isn’t the case.

I agree that negative operating cash flow could be perceived as bleeding cash, but if a company has extremely healthy operating cash flow, but negative FCF because of high capex, they are not bleeding cash!

Why would you call investing in the future and buying assets “bleeding cash”?

Are you bleeding cash when you purchase a house, a car, or a new roof?

People often invest in assets that cost more than their yearly operating cash flow, but when a company does it, that suddenly means they are bleeding cash?

Was Amazon bleeding cash in 2021 and 2022 when they had negative FCF of $14.7B and $16.9B?

No. Amazon doubled its logistics footprint by opening hundreds of new warehouses!

This is directly reflected in the net income of today, which is at record highs. Net income demonstrates that Amazon made prudent investments in 2021 and 2022. If you just look at FCF today, you don’t see that. Huge AI investments are hiding that.

“What’s the point of generating millions in revenue, reporting 20% margins, and never actually seeing any of that money? Your company only exists in a fantasy world...”Jimmy’s Journal

This scenario is a fantasy world, it doesn’t happen!

A company that generates paper profits but doesn’t collect cash is a fraud, and auditors will catch up to that very fast. Both US GAAP and IFRS require companies to evaluate receivables, and if they can’t be collected, they must be written off, thus reducing net income.

The above example from Jimmy’s article says that company A is bleeding cash, whilst company B is generating real value for shareholders.

Here, Jimmy instantly assumes that Company A is making unproductive capex investments and proclaims Company B the winner.

Well, maybe Company B is underinvesting in the future?

Of course, we need to analyze each case individually, but saying that

High Capex = Bad

Low Capex=Good

is simplistic and wrong.

Analysts have always said that Amazon is overinvesting in capex, and this spending will not generate returns large enough to justify it. They continue to make the same mistake today, despite Amazon proving them wrong again and again.

6. FCF is useless for Financial Companies

Banks, payment processors, and other financial services businesses have huge cash flow swings that make cash flow analysis completely useless.

These financial services companies manage the flow of billions of dollars of cash on behalf of their clients. This causes huge jumps in cash flow, without any fundamental changes in the business.

For instance, Sofi had a negative FCF of $1.3B in 2024, despite generating $500M in net income, this is because they issued a lot of loans, which will generate a lot of interest income later.

Meanwhile, Adyen had a positive FCF of $2B in 2021, a FCF margin of, wait for it….

177%

Sounds great, right? They generated more cash than revenue.

But if you look a bit deeper, it becomes clear that this is not really their money. It’s just what Adyen holds on to for a bit before they transfer it back to their clients.

In 2024, Adyen’s FCF was $1.7B, a decrease from 2021 levels.

Is that bad?

Well, no!

Their revenues and net income almost doubled during this period.

Going on to capex, these companies are not capex-heavy businesses as they don’t need investments in machinery or factories.

This makes capex largely irrelevant.

So, if operating cash flow doesn’t matter and capex doesn’t matter, why would you look at FCF?

7. Conclusion

FCF is an important metric, but only if it is applied correctly.

It must be analyzed together with Net Income, Capex, Depreciation, and SBC.

Depreciation is a real expense that shows the decay of value producing assets.

Capex is not instantly bad. One needs to analyze where this investment goes before determining whether it is value-creating or value-destructive.

SBC is a real expense that reduces shareholders’ ownership and shouldn’t be ignored.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Re' your point on SBC getting added back to net income and working capital adjustments to arrive at Operating Cashflow, what I do is just subtract SBC back out along with capex to arrive at FCF.

Further, the argument can be made, as Aswath Damodoran advocates, that you should also deduct acquisitions before arriving at FCF--his argument is that why should companies have to count internal capex, but not external capex? If you don't deduct acquisitions, you are effectively allowing companies to show the growth in future years from those acquisitions--but without showing the cost of such investments in the past.

Thanks, Ray, for the incredibly educational article. I also really enjoy Jimmy’s articles—for example, I gained a much deeper understanding of ratios like ROIC, ROIIC, and ROE from one of his pieces. His articles on FCF are excellent too, but it was phenomenal to read about these topics from a different perspective. I learned a lot from this as well. I think that’s why I love Substack so much. :)