Welcome to the Part 3 of Nu Deep Dive!

This is the final part of my Nu report!

In Part 1 we explored how Nu came to be and how this fast-growing Brazilian fintech makes money! (Read Below)

Whilst in Part 2 we looked at Competition and Risks! (Read Below)

Today I will explain how Nu plans to continue growing in Latin America and beyond. Additionally, we will look at how the company will use AI to benefit its customers!

Lastly, I will show my valuation model and explain why I see a potential 300%+ upside for patient Nu investors!

Let’s go!

1. Opportunities

2. Three Act Strategy

3. Financial Analysis

4. Valuation

5. Trump’s Trade War

6. Conclusion

1. Opportunities

Stock investors don’t buy the past, they buy the future! So let’s look at Nu’s most exciting opportunities!

Geographic Expansion

Nu’s CEO, David Velez, many times has emphasized their aspirations of becoming a global technology company. To achieve this goal, in 2019 and 2021, Nu expanded to Mexico and Colombia. As mentioned in the business model section, the company has 10M customers in Mexico and 2M in Colombia.

Nu hopes to replicate the success it had in Brazil and, so far, the results have been unbelievable!

In February 2025, Jorg Friedemann, Nu’s Director of Investor Relations, said that this year, the company will announce the next country they plan to expand to.

Brazil, Mexico, and Colombia are the three largest Latin American countries by population, so one would think that expansion to Argentina, the fourth-largest, is the logical step.

However, the Argentinian economy is in shambles, the inflation is sky-high, and Javier Milei’s cuts to government spending have caused a recession. Nu has said that they are monitoring the situation, and if the reforms bring economic growth and stabilization, the company will enter the market. It is unlikely to happen in the next few years.

Thus, my best guess is that Nu’s next destination will be Peru. With 34M people, Peru is the 5th most populous country in the region. The country is one of the youngest in Latin America and, internet and mobile adoptions are growing. Most importantly, 50% of the country doesn’t have access to banking services. This makes Peru, a great potential country for expansion.

I find it quite likely that Nu will eventually expand to other Latin American countries such as Chile, Ecuador, Panama, and more.

Recently, it was reported that Nu is considering moving its legal HQ to the UK. The company has said that they have no interest in entering the European banking sector. There are many fintech players and the competition is fierce.

The UK office could be responsible for managing its global expansion plans in other emerging markets, such as North Africa, the Middle East, and Central and Southeast Asia.

There is potential to gain hundreds of millions of new customers!

Nu has demonstrated its ability to manage difficult economic, regulatory, and political environments in Latin America. It could use the same approach to expand globally.

Emerging markets could be attractive for expansion not only because of the size of the market but also because of less competition. Less competition is what allowed Nu to grow so quickly while remaining profitable. People living in these areas are starved for great services and will quickly flock to them. This means Nu will need to spend less on marketing to acquire customers.

I could see Nu having upwards of 300M customers in 10 to 15 years!

Loans

There are so many loan categories that the company hasn’t expanded to that have huge potential, but let’s look at the 3 most promising ones.

Car Loans – Latin America is a very car-centric region, as mountains, deserts, and jungles make public transportation development very expensive. GDP growth will likely lead to millions of vehicles purchased by the middle class. Around 6M new and 20M used vehicles are sold every year. With around 40% of that in Brazil alone. Car loans have been quite profitable for banks in other regions and I don’t see why that wouldn’t be the case for Nu.

Mortgages – Housing loans are some of the most profitable for banks because they are asset-backed loans with fewer defaults and lower loan losses. Most of these loans are of very long duration, 20 to 30 years, making them highly attractive for banks.

BNPL – This new financial instrument has exploded in popularity. Buy-now-pay-later loans usually offer interest-free installment payments to customers. BNPL providers can afford to not charge interest, as they charge a 5-7% fee to the merchant, who pays it to increase average order sizes. This could be extremely synergistic with NuPay, as Nu could offer both products together to the merchant.

Business Banking

Small and medium-sized businesses are vital to the Latin American economy. It is estimated that up to 90% of all businesses are micro, small, and medium-sized. These companies are responsible for creating up to 60% of all jobs.

Small entrepreneurs have historically lacked proper banking services. Well, not anymore!

In December of 2024, Nu said that they have 4.5M business accounts on the platform!

In the same December press release, Nu announced a new working capital loan scheme for businesses. The potential to service them is immense. Inventory loans, invoice factoring, mortgages, car loans, payroll funding, and more.

Additionally, this could be an incredible way to attract new and sticky retail customers. If Nu enables many businesses to grow and formalize their operations, it is quite possible that these businesses will onboard their employees on Nu.

For many young people and former informal economy workers, this could be their first introduction to modern financial services. Anecdotally, my mother still uses the bank account she opened decades ago, only because her first job used that bank.

2. Three Act Strategy

In its review of 2024, Nu’s CEO David Velez outlined their “Three Act Strategy”.

Act 1. Latin America

The first goal is to become a regional banking champion of Latin America. Nu is building a simple and disruptive market share-taking banking product. With it, Nu is solving real customer pain points.

Low access, high fees, poor customer service, and low trust!

“When with your technology you are able to provide a product that is of a higher quality, at a lower cost, you win!” David Velez Nu Videocast | 2025 priorities | Prioridades para 2025

In the picture above we see Mastercard’s comprehensive approach to financial inclusion.

Nu is still early in its growth story. They are focused on helping people move up the ladder from Unbanked to Underserved to Financially included!

While they have onboarded 10s of millions of Unbanked cash-only consumers, Nu still has 91M people left in Latin America to onboard.

Once a customer has a bank account, Nu aims to deliver full financial inclusion with advanced financial products, such as credit cards, personal loans, insurance, savings accounts, and investment products!

Act 2. Beyond Banking

Act 2 is to move away from being a simple financial technology company into a new-age technology company. The primary goals are to make their products more sticky and increase customer wallet share.

“We want to fight complexity to empower people.” David Velez Nu Videocast | 2025 priorities | Prioridades para 2025

NuCell is their mobile phone offering aiming to extend Nu Bank’s customer-centric, digital-first, approach to telecommunications services. NuCell is a virtual private network that rents access to telecommunications infrastructure. As of now, it is only available in Brazil, but I don’t see why Nu wouldn’t eventually take this model to other regional countries.

NuCell is an innovative way to monetize its customer base with fee income. The next step is likely to partner with a retailer to offer loans for phone purchases.

Nu Marketplace is Nu’s integrated shopping product that through partnerships with various retailers enables customers to purchase products without leaving Nu’s app. Apart from driving volumes for NuPay and lending, there is potential to generate fee income from participating merchants. In 2023, there were 255M visits to the Nubank Shopping marketplace.

Established global financial giants such as American Express, JPMorgan Chase, and others have long used travel perks to drive the use of their products, but Nu is taking that a step further. It offers a full travel booking service directly in the app, enabling customers to book flights and hotels, financed with Nu’s loan and credit card.

There is a lot of complexity in emerging markets and Nu is determined to fight it!

There is huge potential for billions in profits in fighting that complexity with innovative digital products and partnerships!

Act 3. Global Expansion/AI Private Banker

I have high confidence that Nu will expand to other emerging markets outside Latin America.

I am paraphrasing and simplifying, but this is what David Velez said:

“There is complexity all over the globe in financial services. When you look at emerging markets, in some emerging markets 5-10% of people have access to credit and that is the ultimate complexity. When 90% of the population is dependent on loan sharks for credit their lives are much harder. Financial services is the largest profit pool in the world, something like $7T in profits and only 3% of that profit belongs to digitally native companies. 2025 will become the year in which we start making the first steps for Nu to go beyond Latin America and become a multi-country, multi-region, multi-continental technology company” David Velez Nu Videocast | 2025 priorities | Prioridades para 2025

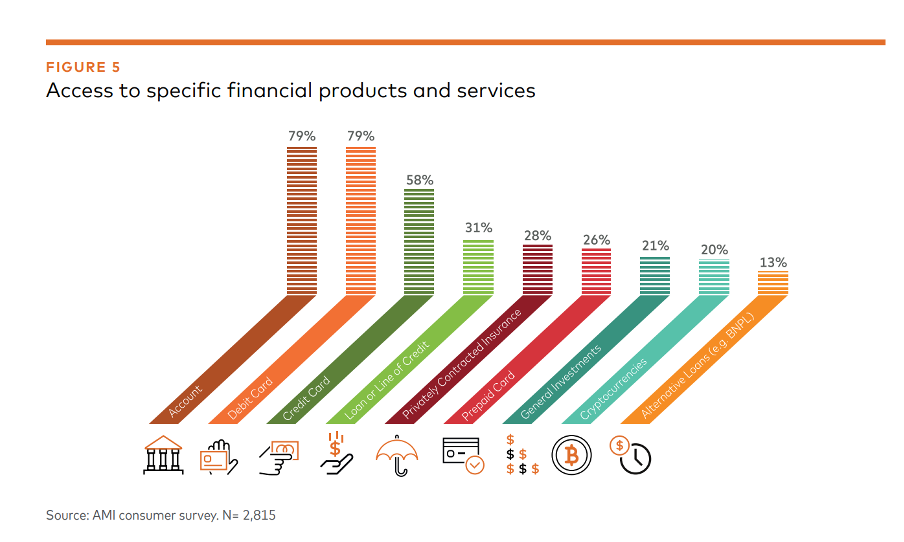

In the above picture, we see the access to various financial products in Latin America, in other emerging markets the situation is even worse. There is a fallacy that companies cannot make a profit from serving low-income people, but that is not the case.

If Nu is successful at taking its business model and expertise to other emerging markets, they could make huge profits!

The other aspect of Act 3 is the AI private banker.

Unfortunately, a large share of the lower-income underbanked people in emerging economies lack financial education. People are scared and don’t trust banks.

Simply put, people don’t know what they don’t know!

Nu wants to change that by using AI to help customers make smarter financial decisions.

AI will analyze various financial products, recommend the most affordable and appropriate options, and answer customer questions. Ultimately, the goal is to help move people up the financial inclusion ladder.

It just so happens, conveniently, that Nu’s AI product will probably recommend customers use Nu products!

AI private banker tools have the potential to increase the adoption of various Nu services, driving higher transaction volumes, and thus increasing fee and interest income.

3. Financial Analysis

Nu finished 2024 with net revenues of $5.5B, an increase of 49% Y/Y. Meanwhile, earnings before taxes grew 82% to $2.8B, whilst net income grew by 91% to $1.97B.

Let’s investigate Nu’s finances in more detail.

Revenue

As I mentioned in the business model section, a bank’s revenue consists of net interest income (NII), fee income, and a provision for bad loans.

In the graph above, I have placed the three so we can visualize these components. In 2024, Nu had NII of $6.8B, an increase of 54.4% Y/Y. Since 2018, NII has grown with an impressive CAGR of 97%.

At the same time, 2024 fee income of $1.9B increased 18.7% Y/Y. It has grown with a CAGR of 72.9%.

NII is growing faster than fee income, displaying Nu’s strategy of being the low-cost provider at play!

The company is prioritizing acquiring customers and issuing loans, rather than earning fee income.

Lastly, Nu posted a $3.17B provision for loan losses in 2024, an increase of 38.7% Y/Y and a CAGR of 73%.

In 2018, Nu’s loan losses provision of $118.6M was higher than the $116.1M in NII.

However, in 2024, NII Y/Y growth of 54.4% and the long-term CAGR of 97% are both above the loan losses provision growth rates of 38.7% and CAGR of 73%!

This clearly illustrates improving business dynamics. Nu is originating higher-quality loans that are more likely to be repaid.

If we put the three together, we get the 2024 total revenue of $5.5B, up 48.7% Y/Y.

Since 2018, revenue has grown with a CAGR of 81.4%!

In the above graphs, we see Nu’s revenue composition before interest costs and the provision for loan losses.

With interest income of $3.8B, Credit Card is Nu’s largest segment, taking up 33% of gross revenue. Credit card income grew 51% in 2024 and has grown with a 76% CAGR since 2018.

$3B was generated by conventional Lending products, an increase of 84% Y/Y. This segment is 27% of the gross revenue and has grown with a 223% CAGR.

Next, Nu earned $1.6B from Other Interest income, up 28% Y/Y. This segment is 14% of the gross revenue and has grown with a 120% CAGR.

As the fee income we already discussed above, the last is Income from Financial Instruments. This segment earned $1.2B for Nu, up 16.6% Y/Y and a CAGR of 51%.

These splits do not take the interest cost and provision for loan losses into consideration. This is because Nu raises cash centrally and then funds the loans, and calculates loan losses for the whole portfolio together.

Deposits

For a bank, its ability to raise deposits is crucial for the long-term health and stability of its balance sheet. Additionally, let’s not forget that customer deposits tend to be some of the cheapest ways of raising capital, fueling profitability.

As of 2024, Nu holds $28.9B in customer deposits, an increase of 21.9% Y/Y. During the year Nu gained $5.2B in net deposits.

Since 2018, deposits have grown 47X, a CAGR of 91%!

Profitability

Nu finished 2024, with an operating income of $2.8B, margin of 50.7%, whilst net income reached $2B, a margin of 36%.

Operating income grew by 81.6% in 2024, meanwhile, net income grew by 91.4%!

In the graph, above we can see that Nu only became profitable in 2023, so it is still early in their profit story.

In the table above, I have placed the Y/Y growth rates for operating income and net income. In it, we see how great was Nu’s profit growth last year.

An important metrics to measure how effective a bank is at generating profit is the return on equity (ROE) and return on assets (ROA).

ROE measures the return a company generates from its shareholder equity. In 2024 Nu, ROE was 28.1%, a great result. Banks closely track ROE because it directly reflects profitability and capital efficiency.

Meanwhile, ROA measures the return generated from a company's assets. It is possibly, the most important metric for a bank as the whole business of a bank is essentially managing assets for its clients and generating income from them. Nu’s ROA in 2024 was 4.2%, an exceptional result. Just for comparison, the world’s largest bank by market cap, JP Morgan Chase had a ROA of 1.5% last year.

4. Valuation

Nu has a market cap of around $45B and currently trades below its IPO valuation, despite being a significantly larger and more profitable company.

In the table above I have placed some valuation metrics.

If we look at Nu’s valuation, it trades for a significantly depressed P/E ratio of 24. Considering, the quality of their offering and opportunities for global expansion, I find this extremely affordable.

Analyst estimates tell us that Nu is forecast to grow sales by 25.5% in 2025 and 128% in the next 3 years!

Furthermore, net income is forecast to grow by 32.3% in 2025 and 176% by 2027, indicating that analysts expect the margin improvements to continue.

Taking analyst estimates into account, 2027 P/E is only 9!

This is extremely affordable.

Let’s what kind of returns Nu investors could experience.

Valuation Model

While Nu’s user growth has been extraordinary, there is still a lot of room left. With Nu set to announce their next country this year.

I model Nu reaching nearly 190M customers by 2030, 75M more than in 2024, a CAGR of 8.8%!

Furthermore, as the company moves people up the financial inclusion ladder, ARPU is set to grow significantly and at a faster rate than the number of customers.

I estimate ARPU could reach $108.5, an increase of 125% from today, a CAGR of 14.4%!

This ARPU is entirely achievable as it would still be below what legacy Brazilian banks earn today, with Itau Unibanco earning around $330 per customer today.

These assumptions would lead the revenue to grow with a 24.5% CAGR to reach $20.5B by 2030!

Assuming some improvements in margins, we get to a 2030 net income of $8.2B an increase of 317%, CAGR of 26.8%.

Last year Nu’s shares outstanding grew by 1.1%, so I think it is likely that dilution won’t be more than 1.5% per year.

If Nu trades for a reasonable P/E of 20 to 30, its share price could reach $31 to $47 by 2030!

This model shows, that there is between 212-368% upside to the current stock price!

5. Trump’s Trade War

As I am finishing this report Trump is rolling out his Trade War with the whole globe.

Now, I don’t believe that it is based on sound economic theory, and I doubt that it will achieve any of his goals.

The long-term consequences of the Trade War would be so brutal and painful for the world, that it is impossible to model. I can only provide my opinion.

I believe that the most likely outcome is that a lot of countries retaliate, China has already done so and the EU is having meetings this week to agree on a retaliation strategy.

This will create a lot of pain for the average US consumer, as all everyday items will get significantly more expensive and hundreds of thousands of people are set to lose their jobs. Pressure from the business community is growing and some Republicans have already come out strongly against the tariffs. There were huge protests all over the US this weekend and Republicans fear getting destroyed in the midterms in 2026.

For these reasons, I find it likely that Trump’s measures will not last, he will back down. Trump will sign some deals with some countries and say that he won.

I am just not sure when that will be, so we have a few tough weeks and months ahead of us.

During this market panic, there will be huge opportunities in the stock market. As the valuation model shows, Nu is clearly one of them!

6. Conclusion

Through his execution and product innovation, David Velez has demonstrated to be a competent CEO with a clear vision for the future.

His company has built a powerful suite of products that address real pain points for the people of Brazil, Mexico, and Colombia. Affordable bank accounts, low usage fees, great customer service, and an unparalleled customer experience.

Nu has clear and executable opportunities for expansion:

User growth in existing markets of Brazil, Mexico and Colombia.

Expansion to other markets in Latin America, such as Peru, Chile, Argentina, and more.

Introduction of new loan types, such as car loans, mortgages, and BNPL.

Expansion of NuPay across the entire e-commerce and digital ecosystem.

Moving customers up the financial inclusion ladder.

Expand small and medium-sized business banking solutions.

With their 3 Act strategy Nu is well situated to not only become the fintech champion of Latin America but of other emerging markets as well!

With a market cap of $45B Nu trades for a P/E of 24. Considering their explosive growth, and future opportunities, I find the valuation extremely affordable.

As the valuation model shows, patient investors could be looking at between 212-368% upside to the current stock price!

Overall, I find Nu to be one of the best long-term opportunities in the market!

Q1 Earnings 2025 Update:

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write 1 article a week!

Subscribe to get all my articles as soon as they are released!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

How much they pay you to write this? It is not very well balanced extremely one sided. Certain things shown in last earnings that need to watched moving forward not mentioned

Thanks for the 3 part write up. Very good reading. Do you feel that $DLO will be a competitor? I see them running up against Mercado as well.