Palantir Unclassified! Equity Research!

War-as-a-service and Data Mining or Data-as-a-service and AI?

To say that Palantir is controversial would be an understatement. The company has created some of the most sophisticated data analysis tools. However, it’s not the tools but how they’ve been used and by whom, that’s generated the controversy. Palantir works with militaries and law enforcement agencies, helping them analyze and make sense of vast amounts of data. However, Palantir’s software can also be used by corporations to streamline operations, improve decision-making, and save costs.

In the age of accelerated global tensions and the rise of AI, many have dubbed Palantir the world’s most important company.

Is Palantir a War-as-a-service and Data Mining company, or Data-as-a-service and AI company?

Table of Contents

1. The Story of Palantir

2. Business Model

3. Misconceptions

4. Opportunities

5. Financial Analysis

6. Valuation

7. Conclusion

1. The Story of Palantir

Palantir is a software company that empowers its customers to analyze large quantities of data, enabling users to make smarter decisions and operate more effectively on a large scale.

To understand the story of Palantir we should start by explaining the name, as it has quite a significance. Unlike me, those who are big fans of the fantasy Lord of The Rings books and movies, probably don’t need the explanation. In the J.R.R. Tolkien books, Palantiri are magical ancient stones, that allow the ability to see and communicate over larger distances. In the books, these stones play an important part in intelligence gathering. According to the lore, “Palantiri” in one of the books languages means “far-seeing” or “watch over”.

The founding of Palantir goes back to the early 2000s, the company began by offering software services to various government agencies. Their software was used by the US intelligence community in investigations and data-gathering operations to combat terrorism in the post-9/11 era. CIA was even one of their first investors.

This is at the crux of the “War as a Service” label. The company provides various services to the CIA, the US military, and other militaries. Depending on one’s opinion of these organizations, Palantir is either an “evil CIA-funded war and spy company”. Or a SaaS company providing necessary services to “Western and Western-allied” governments, helping us stay ahead of our adversaries and protecting democracy.

A lot of attention in the media is spent talking about the government services. However, Palantir’s services are used by corporates as well. In fact, Palantir is rapidly growing this segment.

Let us look into Palantir’s services.

Gotham

Gotham is a government-focused software solution that allows its users to analyze large data sets. One of Gotham’s goals is to find those hard-to-find “needles in the haystack”.

Per Palantir, Gotham is “The Operating System for Global Decision Making”. Organizations use Gotham to analyze patterns, find solutions to complicated problems, and share information quickly and efficiently. Decision-making in large organizations is very slow. Data needs to be gathered, analyzed, and presented to the decision-makers. Often employees and middle managers don’t understand the decisions of the management.

This is because, frequently management makes shortsighted decisions based on an incorrect analysis of data. Furthermore, large organizations often suffer from “analysis paralysis”. Organizations generate too much data to analyze, leading to delays in decision-making.

In simple terms, Gotham helps organizations connect information from different sources within the organization, in order to make better decisions.

For example, the CIA has a vast network of intelligence operations worldwide. Satellites that capture enemy movements, bank transfer information, confidential informants relaying information, and spies infiltrating enemy organizations, etc. It might be that an operative working on a case received information that was relevant to another case. A satellite trying to follow one organization could capture the movement of weapons by another.

CIA employees don’t know all the cases, as there are 1000s of active cases. This leads to relevant information being discarded. Gotham helps CIA analysts put together seemingly unconnected pieces of information, gathered by different parts of the agency. The data is presented in a single view enabling users to make quick, confident decisions.

The New York City Police Department is also a client of Palantir. They use Gotham to analyze police reports, surveillance feeds, arrest information, witness statements, and even parking ticket information.

Let us imagine a scenario where a witness saw a blue BMW leave a crime scene. Gotham can help police quickly analyze CCTV footage and find a blue BMW, much faster than if an officer would have to watch hours of footage. After finding let’s say 6 blue BMWs in the area, Gotham checks the license plates and analyzes the NYC databases. Information such as the car owners, their spouses, relatives, and known associates. Quickly flagging anything suspicious that might link them to the case. Gotham finds a known associate and sends a police team to investigate, finding the criminal.

This is just an example, to give you an idea of how Gotham can help its users make better decisions, saving time and resources.

Foundry

Foundry is Palantir’s commercial software solution targeting large and complex companies. The company refers to Foundry as the operating system of the business. While the services are similar to Gotham, the goals are different.

The goal of government institutions is to provide great services to its citizens, private companies want to make a profit. When the US Military uses Gotham, its goal is to find the best solution to a particular problem. Commercial enterprises also want to find the best solutions to a problem, Foundry helps them define what that means.

Large complex organizations generate a lot of data. Analyzing it takes time and costs money. Foundry lets its users integrate, visualize, and analyze data.

“The Ontology-Powered Operating System for a Modern Enterprise”

I know that is a mouthful, so let’s analyze what Palantir means with it. Ontology is a scientific term from philosophy. Ontology tries to understand what exists and how the things that exist are connected. How and why entities are grouped in categories? What are the essential concepts that define them on the fundamental level? In short, Ontology explores the very fabric of existence!

Foundry is an operating system where the very essence of one’s business is explored.

Every single step of the value chain is analyzed. How the product or service is created, what are the steps, and how they connect.

Businesses are large dynamic multilayered entities, where independent processes are linked to create a result. Procurement, finance, marketing, operations, supply chain, and logistics are all connected. Decisions made by employees across these departments have consequences for the business. Operators depend on having raw inputs to operate, and logistics crews need procurement to procure the goods. Marketers create demand for the final product and finance pays for it all. There are bottlenecks in each of these processes.

Organizations often struggle to connect the information flow between the departments. Foundry creates a multilayered view of the business, empowering all foundry users to make better decisions.

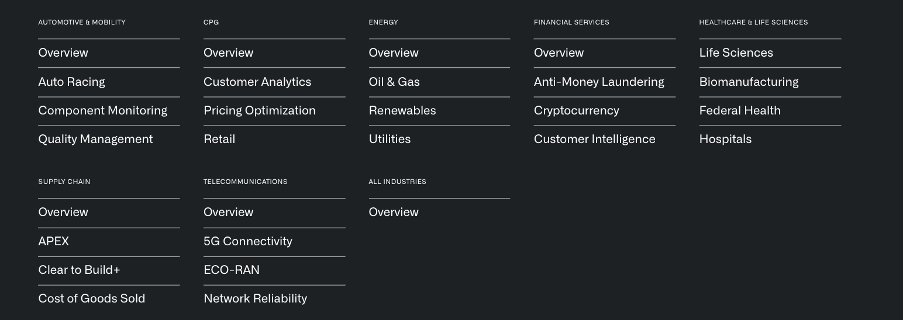

Palantir’s Foundry is available across many industries and the company creates general and custom solutions for its clients.

Airbus Example

Airbus is the world’s largest commercial airplane manufacturer. In 2015, the European giant was facing issues in the manufacturing process of its A350 jetliner. A350 is an engineering marvel, with a price tag of $300+ million, capable of flying 300+ passengers for 10,000+ KM. To the surprise of no one, the manufacturing process is extremely complex. Hundreds of teams from 4 countries in eight manufacturing sites are responsible for putting together 5 million parts.

With the help of Foundry, Airbus was able to integrate data from procurement, manufacturing, logistics, quality control, and other departments, to create a comprehensive view of all the steps involved in creating an A350.

Safety is the most important requirement in aircraft manufacturing. Thus, all planes undergo extensive quality controls. Foundry helped Airbus identify the most frequent causes of defects and tackle them head-on. Quality control generated real-time feedback that engineers in the design labs were able to use to find design and engineering solutions to recurring problems. Managers were able to use the data to better plan shifts, adding employees to production lines who needed them and removing them from others. Procurement was able to order new parts quicker. Logistics used the data from procurement and manufacturing to better plan deliveries.

Better collaboration across teams allowed Airbus to accelerate deliveries by 33%.

Airbus and Palantir both realized that the solutions developed during this project could allow airlines to improve their operations. They created the Skywise platform. The platform allows the airline and Airbus to share data. Airbus can use the data from the airlines to design better planes. The airline can use the data from Airbus to improve its operations, saving costs and generating more revenue.

Today over 49% of the Airbus fleet, 10,000+ planes are connected to the Skywise platform. Generating millions of data points for Foundry to analyze.

Apollo

Technology is changing faster than ever, customers want fast apps, intuitive user interfaces, and quick-to-install solutions. Corporate employees want to automate repetitive and boring tasks. All companies must quickly adapt to this new tech-driven world, and slow companies are going out of business. The problem is that developing software is difficult, especially for companies whose core competency is not software. Let’s not forget that once software is built, it needs to be deployed, maintained, and updated. Having a great app means nothing if half the time it’s buggy. This is where Apollo comes to the rescue.

Apollo is Palantir’s platform for continuous software deployment across all environments.

The goal is to enable secure and seamless delivery of software, wherever the client desires. Gotham and Foundry are designed to be used by people across the organization, with and without technical know-how.

Whilst Apollo was created with software engineers in mind. Empowering them to deploy software across all software stacks.

With Apollo common interface, software engineers can release updates at scale, and rapidly resolve any problems as they arise. Moreover, all software is not created equal. Different environments have different risk tolerances. The margin of error is larger for a university library than for a government updating its emergency communication system. Apollo facilitates customized release planning and scheduling, increasing security and software stability.

Palantir has contracts with various government agencies, processing highly classified and sensitive information. Apollo enables software engineers to deliver secure and fast software solutions, across classified networks, on-premise solutions, satellite networks, and military vehicles. Powering seamless integrations across highly regulated business environments.

When Palantir was founded cloud services were just starting to appear. Nowadays, cloud solutions are everywhere, and the demand is growing. The US cloud computing market brought in $135 billion in 2021 and is estimated to grow with a CAGR of 13.1% till 2030.

The popularity of cloud software enabled multinational companies to have complex computing systems. Some have single-cloud, multi-cloud, and on-premises servers, or most likely a combination of all. Apollo is designed to work together with most large cloud service providers, allowing Palantir customers to deploy software in a manner that best suits their operations.

AIP

Palantir’s Artificial Intelligence Platform (AIP) is the company’s latest AI offering. It allows customized deployment of LLMs (Large Language Models), similar to Open AI’s ChatGPT or Google’s Gemini.

ChatGPT is trained with billions of data points and is designed to give generalized answers. While easy to use and quick to answer simple questions, it has its flaws. The answers are sometimes incorrect, lack detail and reasoning, and suffer from “hallucinations”, cases where the AI makes up information.

AIP empowers organizations to create their own AI tools.

Data security is paramount for large organizations, especially as bad actors are constantly trying to steal valuable data. Government agencies process the private data of millions of citizens. Corporations process data sensitive to their business. Both private data and business secrets must be protected. Organizations need to know that the AI is secure, thus Palantir designed AIP with security in mind.

Organizations can give AIP access to their servers and real-time information feeds, in a secure environment. Once trained and implemented, AIP enables users to get answers to very specific, company-related questions, quickly, accurately, and with great detail. Furthermore, AIP is customizable, creating special permissions for AIP, and its users. Allowing for segregation of duties, safeguarding of employee and customer privacy, and complying with regulations.

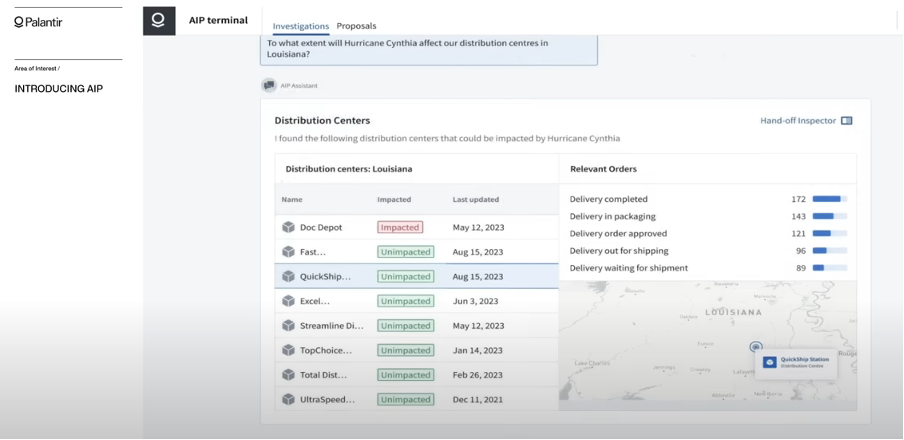

Let’s look at the example from Palantir’s AIP demo. A US-based manufacturing company, with warehouses across the country, learns that a hurricane is about to hit Louisiana.

The company is worried as it has a distribution center there. AIP receives live feed from the company, it sees the number of deliveries planned in the area, the order book for the next weeks, employee shifts, etc. An employee types in a question “What would happen if we shut down the affected distribution center?”

AIP responds, estimating the costs of delayed orders and lost sales. AIP, can also help to create an action plan to divert deliveries to other distribution centers and propose alternative delivery schedules. AIP can propose accelerating certain deliveries while postponing others, calculate the cost of various scenarios, and propose the optimal solution.

It would take an experienced and large logistics team many hours and lots of overtime to come up with a similar plan, and likely would not be as cost-effective as the AIP plan. Smaller organizations don’t have the resources to hire large teams, thus they make incorrect decisions, based on a poor understanding of how different variables affect their business. AIP can identify patterns and suggest better solutions to problems.

AIP has the potential to revolutionize decision-making and save organizations many billions of $.

The usefulness of an LLM model depends on how good the training data is and how well the user understands the model. Consequently, the usefulness of AIP depends on how much and what kind of data the organization gives it, and how the company plans to use AIP.

2. Business Model

Palantir is a Software as a Service (SaaS) company. It offers a suite of products to customers and helps customize them. Once fully implemented customers pay Palantir for using said software. Depending on the service and the contract details, customers either pay per month, per user, per license, or per contract. Ultimately, Palantir is the owner of said software and companies pay a licensing fee for using it. SaaS model differs from other software sales models as the customers are not the owners of the software or the license in perpetuity. Customers always own their data, but if the contract with Palantir expires, companies cannot use Gotham, Foundry, Apollo, and AIP. As of December 31, 2023, Palantir had 497 customers. The company has two operating segments, government and commercial.

Government Sales

While Gotham is Palantir’s primary government-focused product, all other products are available for governments as well. In 2023 55% of Palantir’s revenue was government-related.

Palantir provides vital services to government institutions in an ever-changing global environment.

The company recognized the importance of the critical functions provided by the government and felt that there was a gap in the market. Many Silicon Valley founders and executives don’t want to develop solutions for the government as private markets seem more exciting and promise larger growth. Furthermore, governments are often bureaucratic, resource-constrained, inefficient, and slow to adapt to new technologies. These factors increase the complexity of selling software to governments.

However, Palantir thrives in high-complexity environments as they increase Palantir’s moat. The more complex the environment, the fewer competitors.

Providing mission-critical infrastructure to government agencies is a sticky business. Once the software is implemented and is in use, it’s very difficult for governments to switch. The advantages of this approach include:

Long-Term relationships – Government procurements are tedious affairs. But once the contracts are signed, they are long-term and very difficult to change. This could be a negative if a disadvantageous contract was signed, however, well-thought-out long-term contracts can provide predictable revenue streams for many years.

Predictable revenue streams – Commercial companies go bankrupt every year, while government agencies will exist “forever”. Even during the most difficult times of economic hardship, government services must be provided. Selling software critical to providing such services is highly likely to generate meaningful revenue for many decades.

Predictable demand – The demand for products of commercial enterprises fluctuates greatly, whilst demand for government services is more predictable. People need basic services to survive, and the number of people living in an area is relatively easy to estimate. By offering software needed to deliver these basic services, Palantir stands to benefit by having a more predictable business, thus reducing business risk.

Cross-selling – To provide services to institutions various licenses and security checks are required, increasing barriers to entry. This reduces the pool of companies able to compete for a contract. Thus, once Palantir puts its foot in the door, it becomes that much easier for Palantir to acquire new government contracts.

Transparency of information – Commercial enterprises are very protective of their data and are reluctant to talk openly about their problems. This is in stark contrast to governments, all their issues are public. We are well aware of the long wait times to visit various agencies and our crumbling infrastructure. The availability of such information makes it easier for Palantir to predict which services will be needed and where, then designing and marketing software to help deliver these services.

Commercial Sales

Solving hard mission-critical issues for governments is a great business, but why limit oneself? Large and complex multinational corporations with 10s and 100s of thousands of employees deal with complicated issues daily. Much of the software developed for governments has significant overlaps with corporates.

Palantir’s software solutions are used across approximately 80 industries globally, by production line workers and CEOs alike. In 2023 45% of Palantir’s revenue was generated by corporate clients.

Oil companies use Palantir to produce oil cheaper and quicker.

Car manufacturers plan their supply chain using Foundry.

Banks use Apollo to deliver software updates and Foundry to follow anti-money laundering laws.

Logistics companies train AIP to help them with delivery management.

The use cases are truly endless!

Customer Acquisition

Palantir targets large government and corporate organizations with difficult problems to solve. By learning how to solve hard problems first, the company learns quickly and adapts its processes. This approach allows Palantir to develop solutions for various complex scenarios and apply learnings from one project to the next.

Going after the most difficult problems first increases Palantir’s competitive advantage, the more complicated the problem the fewer competitors. Smaller SaaS companies struggle to offer as broad a service as Palantir and would require partners. While Palantir can compete for large contracts individually.

With each solved problem, the next incremental problem becomes easier to solve!

Furthermore, by solving the most difficult problems first, Palantir earns customer trust. High customer trust leads to Palantir being called up when the other problems need solving. In Q4 2023 Net dollar retention was 108%. This means existing satisfied Palantir customers spent 8% more in 2023 than in 2022.

Implementation

Large and complicated projects are difficult to implement and take a long time. Thus, it is not a surprise that high installation costs is one of the biggest reasons companies pass on new software projects.

“Rather than reject projects with risky and resource intensive installation requirements, we actively seek them out.” Palantir 10-K

Palantir is one of those rare SaaS companies that doesn’t charge for installation!

The company realized early on that not charging for installation would incentivize them to become more efficient. Thus, Palantir continuously looks for ways to improve and speed up the installation process.

Moreover, large organizations are generally risk-averse, high installation costs increase the upfront risk. Often organizations spend massive sums of money, and the product never gets delivered. By removing this upfront risk, organizations are more willing to give Palantir products a chance.

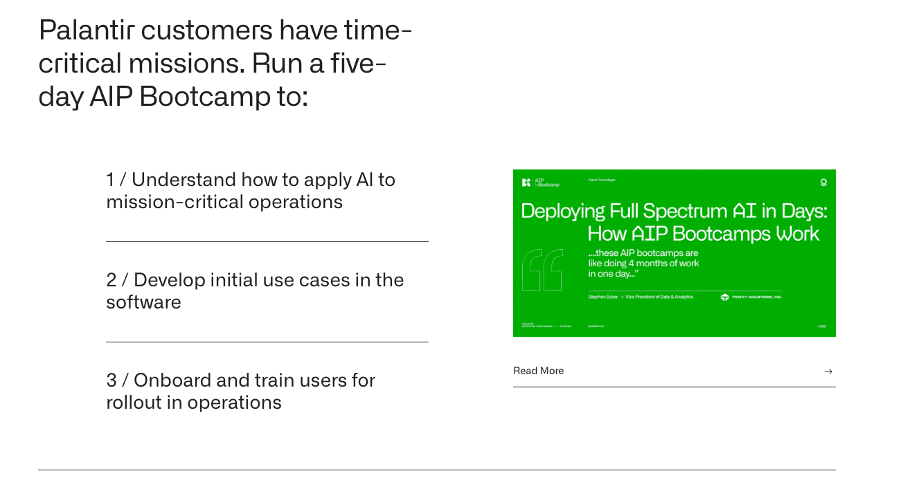

Recently Palantir has started organizing bootcamps for rapid training on its AIP offering. The goal of a bootcamp is to quickly integrate organizations data in the AIP model and train the employees to use it.

“Palantir Artificial Intelligence Platform (AIP) enables new and existing customers to dramatically accelerate high-value AI use cases. To meet the intense requirements of the moment, we have introduced AIP Bootcamps. In these immersive, hands-on-keyboard sessions, participants can expect to go from zero to use case in just one to five days.” How AIP Bootcams Work, Palantir Medium Blog

The company claims that it can go from 0 to use cases in just 5 days!

That is an unbelievable speed. Normally, when installing software, it can take up to many months or even years for organizations to use it. Through constant improvements and iteration, Palantir has been able to reduce installation time immensely. 465 organizations have participated in bootcamps so far.

Palantir compares bootcamps to teaching a person to fish rather than giving them a fish. It is certainly easier to not have to fish, but then one is dependent on someone else. Palantir wants its customers to learn to fish so they can catch better fish quicker. It’s difficult for Palantir to understand customer problems as well as the customers themselves. Only when customers are taught how to properly use AIP to find the best solutions (fish), they can benefit from the full capability of AIP.

AIP bootcamps teaches customers how to tackle real issues with unique solutions!

3. Misconceptions

On the surface, Palantir is a complicated company to understand. They sell difficult-to-implement sophisticated software that is used behind the scenes to tackle complex problems. The benefits of their products are quite “abstract” and difficult to grasp. The ability to make smarter decisions is hard to visualize. Furthermore, Palantir’s close partnership with various governments and their militaries has caused significant negative media attention. This has caused many misconceptions to fester.

Let’s tackle them!

Consulting

Consultants are experts in a particular industry, with years of theoretical and on-the-field experience. The job of a consultant is to analyze a problem and offer solutions. Phrased in such a way, it sounds awfully similar to what Palantir does, so I am not surprised that one would mistake Palantir services for consulting.

However, it’s not that simple. Yes, Palantir analyzes problems and offers solutions, but with software. The value-add of a consulting firm is the decision made by a client based on a consultant’s expert opinion.

Meanwhile, the value-add of Palantir comes from better decisions made by the client’s own employees!

Palantir doesn’t recommend taking a certain action. Palantir’s software supports its clients in making the best decisions, using all the available data at their disposal.

Palantir is not a consulting company. Consulting companies are services-driven businesses with lower gross margins of around 30%. Palantir is a software-driven business, with adj gross margin of 84% in Q4 2023.

Security

The accusation of Palantir not being a safe place to manage data is quite baffling to me. The company has contracts with the CIA, FBI, and the US military.

There are possibly no institutions in the world with stricter requirements for data security!

Palantir employs an industry-leading information security team that constantly monitors exposure and looks for threats. The company uses sophisticated tools to avoid possible hazards from US adversaries. Moreover, Palantir is prepared whether hackers use modern or antiquated methods.

Additionally, Palantir complies with various international security standards such as FedRAMP in the US, ENS in Spain, NCSC in the UK, various ISO’s, and other standards.

Thus, Palantir takes the security of its software solutions extremely seriously and is spending significant resources safeguarding the data of its clients. The data of Palantir’s clients is extremely safe and clients can be assured of the reliability of Palantir’s systems.

Use of Data and Data Mining

Palantir software is used to analyze a lot of sensitive data. It is logical that, after many scandals of companies using scraped or stolen data for malicious intent, people are quite worried. People don’t like when their personal data is used to manipulate them, they feel violated and creeped out. Well, people don’t have to worry.

“Unlike many tech companies, our business model is not based on the monetisation of personal data. We do not collect, store, or sell personal data. We don’t use personal data to train proprietary AI or machine learning models to share or resell to other customers. We never facilitate the movement of data between clients, except where those specific clients have entered into an agreement with each other.” Palantir

The goal of Palantir is not for organizations to acquire hidden third-party data, it’s to enable organizations that already have access to data, to make more effective decisions with it.

Palantir is not a Data Mining company!

Data mining companies “mine” large data sets in order to extract valuable information that is then analyzed using statistical analysis. The mined data is sometimes sold to the highest bidder. Meanwhile, Palantir handles, the generation, flows, integration, analytics, and security of data.

Palantir doesn’t sell user data!

Palantir is fanatical about privacy. Poorly designed technologies present false tradeoffs, privacy or utility? Palantir rejects the idea that to deliver good services to citizens, their privacy must be violated. Thus, all Palantir’s products are built with the principle of “privacy by design”. Meaning the company designs them in such a way as to eliminate any possible breaches of privacy, without ruining the utility of the service.

Right-Wing Company

One of Palantir’s founders is Peter Thiel, a German-American billionaire entrepreneur. Thiel is a somewhat controversial figure, as he has been very outspoken about his conservative beliefs and has donated to many “right-wing” organizations and causes. At the same time, Palantir does significant business with various institutions part of the US security apparatus.

These 2 details of Palantir’s story have caused many left-leaning liberal activists, politicians, and media personalities to label Palantir as a “right-wing” company.

The truth is that Palantir supports “Western” values.

The company aims to provide exemplary software to all government agencies and businesses that are part of “The West” or allied with it. While most technology companies actively work in China, Palantir refuses to do business there because of the Chinese Communist Party. Palantir actively supports the USA, Japan, and Korean governments to counter growing CCP influence.

Left-leaning activists might disagree with certain government policies, but Palantir has nothing to do with said policies. The company simply provides software to agencies that need it. Palantir doesn’t create immigration policies, politicians do. One might reason that deporting illegal migrants to crime-infested poor countries is not a noble thing to do. Certainly, an opinion one can argue about.

However, Palantir provides software to immigration departments of various countries, helping them enforce immigration policies implemented by the country’s politicians. I believe a necessary service that saves countries money and improves efficiency.

Suppose politicians implement a more “Left-leaning” liberal immigration policy. Palantir will be there, helping immigration departments build more temporary housing, and educate, feed, clothe, and integrate migrants.

Data has no politics and Palantir provides some of the best software to analyze it!

Evil CIA-funded company

This misconception is driven by the lack of trust in government institutions. So, as Palantir provides crucial services to these institutions Palantir directly benefits from the dysfunctions and inefficiencies of corrupt government agencies? I disagree with this assessment.

Palantir provides crucial services that improve the world!

While various government institutions have their faults, they provide important services to society. We need strong governments to provide vital services such as policing, immigration, antiterror activities, water, sewage, tax collection, and many others. Countries whose governments don’t provide these services turn into anarchy!

We live in a world where government budgets are more stretched than ever, birthrates are collapsing, and people have longer lifespans. We must find a way to get more out of each $ spent. That is what Palantir’s software is for.

Palantir is not an evil company!

Furthermore, Palantir’s services to the private sector help companies develop better products faster and cheaper. By helping extract oil cheaper, oil companies can sell it for a lower price. If Airbus delivers planes quicker, airlines can provide more flights. Solar companies use Palantir to optimize their operations, generating more green energy, with fewer inputs.

4. Opportunities

Palantir is a very promising software company, with amazing products. Let’s look at some of the biggest opportunities that have the potential to generate many billions of $ in revenue for Palantir.

Digital Twins

Digital twins are exact replicas of something in a digital environment.

They are digital representations of actual real-world items mirroring the entity's physical characteristics, performance, processes, and uses.

Product Twins are digital copies of products. In the previously mentioned Airbus example, I believe the company built a digital twin of its A350 jet. All 5 million individual parts of the plane were logged, and their characteristics were copied into the digital environment. Using this digital twin Airbus jet engineers were able to test various ideas and find the best solutions to problems.

Process Twins are digital copies of a process. Continuing with the Airbus example, Foundry was used to build a digital production line of A350. Once the plane was designed production engineers were able to reshape the assembly lines to manufacture the plane quicker and with less personnel.

Digital twins are used for the following main reasons:

Integration – Data from various sensors is fed to the digital twin, and added together to create a coherent picture. In complicated projects, it can be quite difficult to understand why something is not working. If data from multiple sources is integrated and presented in a single view, it can be easily monitored.

Monitoring – Once digital twins are provided with integrated real-time data, the process can be better understood and monitored. Performance can be observed, and consequences of actions can be simulated.

Simulation – Products and processes can be complicated, consisting of 1000s of steps. Using simulations millions and billions of possible alternative scenarios can be analyzed and the the actions with the highest probabilities of achieving the desired outcome can be discovered. Thus, eliminating the cost of futile actions.

Maintenance – Once all the data is analyzed, monitored, and simulated, real-life actions can be taken. Products can be maintained using the discovered highest probability of success actions. Processes changes can be implemented.

In simple terms, digital twin allows for a cost-effective way of analyzing a complex product or process to find improvements!

Digital twins certainly seem useful, but why is it a great opportunity, are companies willing to pay for it?

The answer is a resounding YES. According to Fortune Business Insights, the global digital twin market earned around $13 billion in 2023 and is forecast to grow with a massive 39% CAGR till 2032. Researchers estimate the digital twin revenues to reach around $259 billion in 2032.

With Foundry Palantir is well-positioned to benefit significantly from the growth in demand for digital twins!

AI

Experts believe artificial intelligence is the next step in the industrial revolution. In the same way that the steam engine created unparalleled opportunities for human advancement, AI will revolutionize the way people live their lives.

AI will benefit companies in many ways. A large share of people’s daily activities consists of repetitive tasks that people seldom do. Such, monotonous activities as data entry and processing can be automated, allowing people to focus on more creative and value-added tasks. Furthermore, AI systems can do tasks much faster and more accurately than humans.

AI will significantly improve the quality and delivery speed of various services!

One of the best aspects of AI is its predictive abilities. Our brains are pattern recognition machines. We noticed weather patterns and learned to adapt our behavior to grow more food, catch fish, and sail the oceans. Our observations and curiosity led us to try new things, innovate, and improve our lives. However, we reached the point where we generate so much data, that it is unfathomable for humans to analyze it.

Analysis paralysis slows down decision-making!

AI can notice patterns in large sets of data much faster than any human can. Using these discovered patterns AI can predict future outcomes and tackle problems before they manifest. If a certain piece of equipment breaks when a scenario manifests. AI can help avoid that scenario or have a replacement part ready when it sees that scenario coming.

A human doctor might have seen thousands of MRI scans in their practice, but an AI can analyze 10s or 100s of thousands of MRI scans. Compare a new scan against them and find patterns that a human might take hours to discover or might even never see.

According to Statista research, by 2030 the global AI market will reach $1.84 trillion, a CAGR of 39%. Palantir AIP platform is a standalone product that allows companies to build custom AI models. Gotham, Foundry, and Apollo use AI as well.

With Palantir’s suite of products, the company is primed to reap the benefits of the AI revolution!

Industry Operating Systems

Microsoft is the pioneer of computer software. With yearly sales of over $20 billion, its Windows operating system has become the operating system of the computer age.

Operating system is like the foundation of a house. Walls, pipes, wiring, paint, and furniture all stand on top of the foundation. OS manages all hardware and software built on top of this foundation. While Windows is a very broad OS offering, in the next few decades more narrow operating systems are likely to grow significantly.

An industry operating system is software that is designed to cater to the unique needs of a specific industry. It contains a comprehensive set of tools that help coordinate various functions, share information, and enhance efficiency.

Once implemented, industry operating systems are very sticky!

Microsoft Windows has been the industry leader for 40 years. New market entrants deal with massive start-up costs and often lack industry expertise. Moreover, incumbent operating systems are constantly improving, making it highly unlikely a competitor can disrupt them. With massive scale come economic advantages that deliver high margins, giving the incumbent incredible pricing power. It can be extremely difficult for a customer to switch products and often they don’t see the benefit of doing so. People are creatures of habit, especially corporate decision-makers.

Skywise is Palantir’s operating system for the skies!

As mentioned in the Airbus example, Skywise empowers Airbus and Airlines to share data to find solutions to common problems. Today over 26,000 users analyse data from 10,000 planes. 49% of Airbus fleet is connected to Skywise, a number that is likely to grow to 100%. Independent forecasts promoted by Palantir, estimate Skywise has the potential to save the airlines around $1.7B per year, depending on Palantir’s cut, the revenue potential could be as high as $850 million per year.

The global industry operating system opportunity is massive. For instance, the size of the global healthcare industry reached $8.45 trillion in 2020 and is projected to grow with a CAGR of 8.6% till 2027, reaching $12 trillion. Software solutions that could create even single-digit % increases in efficiency could generate savings of 100s of billions.

Healthcare operating systems could potentially generate 10s of billions in revenue!

Palantir recently signed a £330 million 7-year deal with the UK National Health Service to develop a federated data platform. The company has signed many other healthcare deals, signaling it is making significant strides in this difficult-to-enter industry, and is determined to be the market leader in delivering healthcare operating systems.

Apart from the airline and healthcare industries, Palantir is working with various partners to develop industry operating systems for the automotive, insurance, banking, security, risk management, and government services industries.

Commercial and International Growth

Palantir has come a long way from just being a government services-focused enterprise. In 2023 45% of Palantir’s revenue came from the commercial sector. According to the World Bank 2022 estimate, only 16.27% of global GDP is government spending. The size of the commercial sector is much larger than that of the government, creating a significant opportunity for Palantir to grow.

Palantir has expanded its sales force to acquire new commercial customers. This has resulted in the number of commercial customers increasing from 49 in 2020 to 375 in 2023.

“In recent periods, we have increased our focus on commercial customers. In the future, we may increasingly focus on such customers, including in the banking, financial services, healthcare, pharmaceutical, manufacturing, telecommunication, automotive, airlines and aerospace, consumer packaged goods, insurance, retail, transportation, shipping and logistics, energy, mining, and other emerging industries.” Palantir 2023 10k filling

In 2023 Palantir’s commercial revenue crossed the $1B mark and is growing at a faster rate than government revenue. From now on Palantir’s commercial revenue growth is likely to continue to be higher than government revenue.

In 2023, 62% of revenue came from the US, and 38% was generated internationally. Palantir is a US-based company with good relationships with US government procurement teams and corporates. So, it is not a surprise that the majority of the revenue is generated domestically. However, Palantir has clearly indicated its desire to grow internationally. The company is hiring international sales teams and there are significant opportunities for international expansion.

5. Financial Analysis

While Palantir certainly has an innovative business model, ideally I would like to see that lead to a financially healthy enterprise. Many SaaS companies are famous for high recurring revenue and great profitability. Let’s look into Palantir’s financials.

Revenue and Growth

In 2018 Palantir was a relatively small software company with $595M in revenue. Since then, Palantir’s has started to show significant sales growth.

Due to the COVID-19 pandemic, 2020 was a tough year for the global economy. That didn’t stop Palantir from crossing $1B in revenue, growing 47% Y/Y. While it took Palantir 17 years to earn the first billion, it only took 3 years to earn the second. 2023 revenue was $2.2B + 16.7% Y/Y.

Since 2018 Palantir’s revenue has grown by 274%, a CAGR of 30%!

Palantir’s strong growth is a sign of the resilience of its business model and the quality of its products.

Looking at revenue composition, in 2023 government revenue of $1.2B constituted 55% of total sales, growing 19.4% Y/Y. Commercial revenue passed the $1B mark, growing 20.2%.

In the above graph, it can be seen that from 2019 to 2021 government revenue grew much faster than commercial revenue, growing by 160%, from $345M to $897M. Meanwhile, commercial revenue grew from $397M to $644M, an increase of 62%.

This large disparity is partly explained by the Covid pandemic disrupting normal commercial procurement cycles, while simultaneously creating extra demand from governments. Government revenues grew by an impressive 76% and 47% in 2020 and 2021 respectively.

However, an important trend started in 2022, the growth of the commercial business was faster than that of the government business!

Since 2021, government business has grown by 36%, while commercial business grew by 56%.

Profitability

As a growing software company, Palantir for many years operated with significantly elevated capex, R&D, and operating expenses. However, after almost 20 years, Palantir had its first full year of profitability in 2023.

Palantir closed 2023 with $209.8M in Net Profit +156% Y/Y, a margin of 9.4%. In just 3 years Palantir went from a negative net income margin of -107% and losing $1.1B to profitability.

This is a clear sign that Palantir has reached scale!

As a result of economies of scale, Palantir has been able to grow revenue faster than its expenses. Last year Palantir’s SGA expenses were $1.26B, reducing these expenses by 2.3% Y/Y. Meanwhile, R&D expenditures were $404.6M, an increase of 12.5% Y/Y below the revenue growth of 16%.

In the above chart, we can see a clear downward trend for both categories of costs as a % of revenue. In 5 years Palantir reduced SGA as a % of revenue from 125% to 57%, whereas R&D from 48% to 18%.

Palantir’s increasing operating efficiencies can be easily observed in its operating income. In 2018 Palantir had an operating income of -$599M, a negative operating margin of 101%. By 2023 operating income had grown to $120M, 5.4% operating margin.

If we separate these periods, from 2018 to 2020 operating income decreased by $574M while revenue increased by $497M, meaning that for each extra 1$ in revenue, Palantir lost $1.15. Whereas, from 2020-2023 operating income increased by $1.29B against a $1.13B increase in sales. Thus, a 1$ increase in revenue led to a $1.14 increase in operating income.

The degree of operating leverage went from – 1.15 to + 1.14 in just 3 years!

Palantir is seeing operating leverage kick in, as high investments of previous years are bearing fruits to Palantir’s bottom line.

Cash Flow

With FCF of $697M in 2023, Palantir is quickly transforming into a massive cash generator.

From the above graph, a clear trend of increasing FCF and FCF margins can be observed. In 2018 Palantir had a negative FCF of $54M, FCF margin of -9.1%.

By 2023 the FCF margin reached 31.3%. FCF grew by 1381% during this period, a CAGR of 67%.

In the above table, we see the Operating Cash Flow, CAPEX, and Free Cash Flow from 2018-2023. Similarly to FCF, OCF experienced substantial growth from -$39M to +$712M, a CAGR of 79%.

Palantir grew cash flow significantly while CAPEX was flat!

There are truly few companies that can grow revenues by 274%, and FCF by 1381%, without growing CAPEX. This is a clear signal that Palantir’s business model is working and we are in the early stages of seeing what the company can achieve.

Balance Sheet

What makes Palantir’s growth even more impressive is how little leverage is used in the business.

Palantir’s total liabilities are only slightly higher than in 2018, whilst its cash and equivalents position has grown more than 3-fold. Palantir has enough cash to not only pay all its debt, but all liabilities as well, with almost $3B left over.

$2.8B of that $3.6B cash and equivalents position is invested in short-duration securities, earning Palantir interest income of $132M in 2023, 4.7% yield. Prudent management of working capital is on display here. The $132M interest income is the cause of Palantir’s net income margin being higher than the operating margin.

Analyzing the relationship between Total Liabilities and OCF, we see a downward trend. It is getting easier for Palantir to pay its liabilities using operating cash flow. In 2021, the first year Palantir was OCF positive, total liabilities/OCF ratio was 2.86. Meaning it would have taken Palantir 2.86 years to pay all its liabilities using operating cash flow. By 2023 the ratio was 1.35, so today Palantir is be able to pay all its liabilities with just above 1-year OCF.

Dilution

One of the biggest criticisms of Palantir is high stock-based compensation. It is a valid concern, nowadays, I feel that many companies exist to reward its executives, not shareholders. Moreover, high stock compensation is used by some companies to inflate cash flow and create fake adjusted earnings. Palantir is not one of these companies.

2020 was the year Palantir went public, thus there were massive one-time employee stock grants. Since then, stock-based compensation has been on a steady downward trend. In 2023 Palantir paid $476M in stock-comp, 21% of revenue, a massive decrease from $1.2B and 116% of revenue in 2020.

Palantir is decreasing stock-based compensation in absolute and relative terms!

Palantir operates in a very competitive industry and if it wants to attract talented employees it must pay competitive stock compensation, otherwise big tech giants like Microsoft, Apple, Tesla, Meta and others will poach all their best people.

Ratios

Below is a table of select Palantir’s financial ratios. Comparing how these ratios have changed in the last 5 years, we can see that across the board, the company has significantly improved in all ratios.

Gross profit improved by 8.4% points, and Net and Operating margins improved by 100+% points. Return on capital ratios are strong, and Palantir has ample liquidity to pay down its liabilities.

6. Valuation

Looking at the current valuation, there is no way to sugarcoat it, Palantir is a very expensive company. Trading for a trailing P/E of 252, market cap of $51B, $PLTR is up 150% since its IPO in late 2020. Palantir is an incredibly promising company, but even great companies can be terrible investments. To analyze Palantir’s prospects, I have built 2 discounted cash flow models: a Base Case and a Bull Case scenario.

Base Case

Revenue growth rate is 22.5%.

Operating margin of 40% by year 10.

Net reinvestment of 2% of revenue.

Terminal growth rate of 5%.

Effective tax rate increases by year 10 to 22%.

WACC is 10%.

Let’s digest the base case. 10-year revenue CAGR of 22.5% would lead to $17.7B in revenue by 2034. Operating margin improves to 40%. Free cash flow to the firm of $5.2B.

For Palantir to reach these figures, the company must successfully execute the opportunities identified in this report. There is significant demand by governments for Gotham. Furthermore, Foundry and AIP to continue to expand in the private sector. Digital twins and industry operating systems go mainstream and Palantir takes significant market share. The company’s AI products generate significant demand from its customers.

Palantir only spent $15.1M in Capex last year. Thus, I believe that it’s safe to say Palantir’s business model is capex-light. Therefore, higher than 2% net reinvestment of revenue is not necessary, and even leaves room for capex increases from current levels.

In my opinion, Palantir deserves a terminal growth rate of 5% as with the growing demand for AI and Data-as-a-service products, there is ample room for revenue growth for many decades and the company will likely grow faster than the global GDP.

Under these assumptions, Palantir’s fair value per share is $23.93, 92 cents above its current share price of $23.01.

Thus, it seems that currently Palantir’s is fairly valued.

Bull Case

Revenue growth rate is 30%.

Operating margin increases to 45% by year 10.

Net reinvestment of 2% of revenue.

Terminal growth rate of 5%.

Effective tax rate increases by year 10 to 22%.

WACC is 10%.

The Bull Case is less likely to happen than the base case.

However, I believe that Palantir products are so unique that there is a significant upside potential to the Base Case!

In this scenario, the 10-year revenue CAGR is 30%. The demand for Palantir’s products is so strong that Palantir becomes one of the fastest-growing tech companies in history.

Operating margin increases to 45% by year 10. An incredibly high operating margin, similar to that of some of the most profitable tech companies of today like Microsoft, Nvidia, Broadcom, and TSMC.

Net reinvestment, WAAC, effective tax rate, and terminal growth rate remain the same as in the Base Case.

In the following scenario, 2034 revenue would be $32.2B and FCFF of $10.6B.

The net present value of all cashflows per share would be $46.10, 100% above the current share price of $23.01.

DCF Analysis

Most would agree that in both cases I selected very generous growth and future profitability assumptions. For a company of this scale, it would be an incredible achievement to grow by around 25% per year for a decade. Only some of the best companies in history have done it.

Palantir investment thesis is that Palantir is one of the best tech companies today!

Mr. Market clearly agrees that Palantir has incredible potential, thus the high multiple. However, Mr. Market is often wrong, so it is fundamental to understand what trends are driving the story. In short, here is the future of Palantir in 4 sentences!

Gotham becomes the backbone of the most important government services!

Foundry is used to build industry operating systems for health care, banking, airlines, energy, and others!

AIP is used by most Fortune 500 companies, embedding AI in the core processes of their business!

Palantir’s proprietary software solutions make them indispensable for complex decision-making processes!

7. Conclusion

In the title of this report, I asked a question, is Palantir a War-as-a-service and Data Mining or a Data-as-a-service and AI company?

In my opinion, the answer is clear, Palantir is a Data-as-a-service and AI company!

Thanks to Palantir’s employees, especially the CEO Alex Karp, the company has created some of the most innovative software products in the world. Gotham is an amazing piece of software that helps NATO militaries operate more efficiently and make better on-the-ground decisions. Russia, China, Iran, and North Korea have formed a new axis of evil. I am glad we have Palantir’s products helping our governments to stand against them!

Foundry is delivering incredible capability for corporates to redesign and rethink their entire business. The potential to tackle some of the most difficult problems with improved decision-making is immense.

Palantir’s AI efforts, with AIP and other products, have the potential to completely revolutionize the way governments and corporations operate.

The company has transitioned from a money-losing start-up into a mature and profitable giant. Palantir’s finances are great, however, the company is very expensive. The valuation is quite demanding and for the company to fulfill its potential supreme execution is mandatory!

The demand for AI and data analytics products is very high. Palantir has the opportunity to become one of the best success stories of the next 20 years!

Post scriptum

On 31. March 2024, I released this Palantir Deep Dive, and while I was optimistic regarding the future, I couldn’t have predicted how quickly this future would arrive.

Palantir was trading at $22.86 a share on 31. March, today, 5. February 2025, after releasing a monster Q4 earnings report, it stands at $103.77, up 355%!

Full update on Palantir’s 2024 performance is available below!

Thank you for reading, Follow me on:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Good insight thanks 👍. Can i translate part of this article into Spanish with links to you and a description of your newsletter?

Hi Ray, great insights, very well written.