Monster US growth, high profits, and strong FCF!

Update: Palantir Unclassified FY 2024!

Palantir is, without a doubt, one of the most exciting tech companies of today. It grew from a small software vendor struggling to raise funding into a $234B company!

On 31. March 2024, I released my Palantir Deep Dive, and while I was optimistic regarding its future, I couldn’t have predicted how quickly this future would arrive.

Palantir was trading at $22.86 a share on 31. March, today, 5. February 2025, after releasing a monster Q4 earnings report, it stands at $103.77, up 355%!

In this Palantir Update, I am going to take a look at what happened during the year!

For a full analysis of Palantir’s business, I highly recommend reading my original deep dive. The report gives a very detailed analysis of all their products.

Palantir Unclassified! Equity Research!

To say that Palantir is controversial would be an understatement. The company has created some of the most sophisticated data analysis tools. However, it’s not the tools but how they’ve been used and by whom, that’s generated the controversy. Palantir works with militaries and law enforcement agencies, helping them analyze and make sense of vast amounts…

As a result of strong earnings, Palantir jumped 24% after hours.

Let’s take a look at what Palantir achieved in 2024!

1. AI

2. Foundry

3. Customer Count

4. Financials

5. Valuation

6. Conclusion

1. AI

I think it is safe to say that we are seeing a repeat of the internet bubble of 2000. During the Dot-com bubble, people were completely mesmerized by this new thing called the Internet. During this era, internet start-ups raised hundreds of billions of dollars. While they were right about the massive potential of the internet, they didn’t correctly predict which companies will be the ones to reap the rewards.

Similarly, today, companies with AI in their name are raising an ungodly amount of money. I see many of these companies having the same fate as Pets.com.

However, Palantir is not such a company!

While their stock price is clearly benefiting from this excitement, Palantir is selling real AI products that are having a real impact.

Palantir’s Artificial Intelligence Platform (AIP) empowers businesses to analyze their internal data to find quick solutions to issues. The need for lots of emails to get simple answers is reduced drastically. (Read more about it, in my Deep Dive)

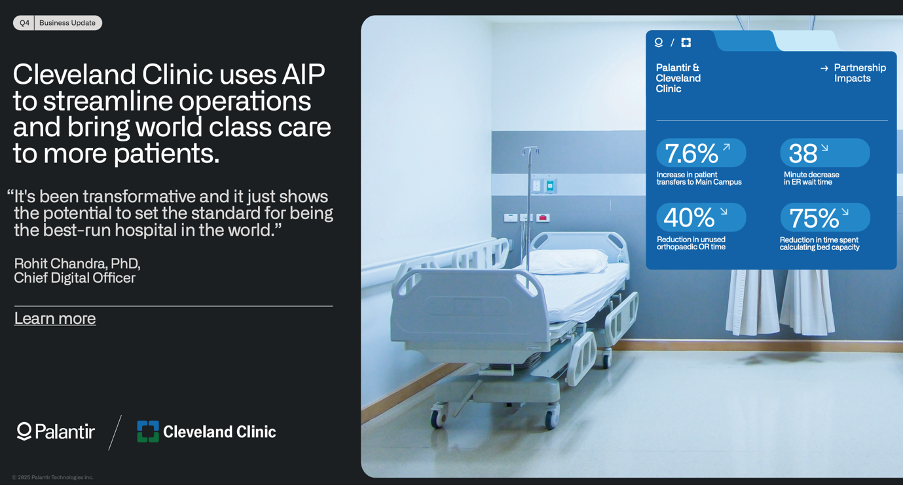

Cleveland Clinic is one of the largest hospitals in Ohio and one of the first clients of AIP.

AIP has enabled the Cleveland Clinic to increase patient transfers to the main campus by 7.6%, reduce the ER wait time by 38 minutes, have a 40% reduction in unused operation room time, and reduce the time spent on calculating bed capacity by 75%.

AIP has saved the hospital many millions of dollars, that it now can spend to deliver better care to its patients!

The TAM for AIP is absolutely massive, and Palantir is set to capture a large share of the global demand for AI applications.

2. Foundry

Palantir’s Foundry is a data analytics, visualization, and integration platform. Companies use Foundry to analyze vast amounts of data quickly and efficiently, leading to better decision-making. (Read about this service in the Foundry section of my Deep Dive)

Rio Tinto is a British/Australian mining company with large-scale operations all over the globe. Using Foundry Rio Tinto is optimizing its railway operations, scheduling maintenance, improving routes, and reducing costs.

Palantir is signing so many deals that I could make this report just about Foundry!

One of the most interesting applications of Foundry is industry operating systems.

Skywise is an operating system for the skies, developed by Palantir with Airbus.

In 2022, there were 10k planes, 17k users, and 100 airlines connected to Skywise. As of the beginning of 2025, there are 11.7k planes, 44k users, and 140+ airlines using the system.

It is clear that Palantir is working to create something similar in health care. The US healthcare system is simultaneously the worst and the most expensive in the OECD. Palantir is cognizant of the opportunity and is actively working with multiple hospitals.

Expect more healthcare deals this year.

3. Customers

Palantir closed the year with 711 customers, up 43% from the prior year. Additionally, its net dollar retention rate of 120% means the company is able to quickly and efficiently upsell additional services.

The success of the US commercial business continues to be the key driver of Palantir’s growth. US commercial customers grew by 73% in Q4 2024 and 19% Q/Q to reach 382 customers.

In the above slide from their Q4 presentation, we see how they do it. After an AIP bootcamp with a bottled water manufacturer, where the client was shown what results AIP could deliver, they signed a 7-figure deal in just 50 days. In other organizations, such a sales deal might take many months or even a year to negotiate.

The results of Palantir’s services are impressive and immediate, thus lowering barriers to customer decision-making!

4. Financials

Palantir had a great 2024, their revenues grew 29% to $2.86B, operating income increased by 159% to $310M, FCF jumped 64% to $1.1B net profits exploded 123% to $468M!

US Growth

In Q4 2024 Palantir had especially strong growth domestically. US commercial revenue increased 64%, while government revenue grew 45%.

There is significant potential for Palantir to continue growing in the world’s most important market!

Accelerating Revenue Growth

Investors love accelerating revenue growth, and Palantir delivered!

In the above graph, we see that Palantir delivered its best growth in 3 years!

2024 revenue growth of 29% was much higher than 16.7% in 2023 and 23.6% in 2022. This acceleration was driven by the continued strength of their commercial business.

In the above graph, we see that the commercial segment is growing rapidly and for 3 straight years has been growing faster than the government segment.

If Palantir keeps its net dollar retention at 120% and grows the number of customers by 40%, revenue growth will continue accelerating. 120% retention means that Palantir could grow revenue by 20% without any new customers. It’s not difficult to see revenue growth exceeding 30% in 2025 if Palantir adds anywhere near as many customers as it did in 2024.

Lower Expenses

Many Palantir critics believed that their business fundamentally is not scalable. Long sales cycles, large implementation costs, and a big sales force mean that there are no synergies.

They were wrong!

In the graph above, we see that SGA as a % of revenue has fallen dramatically. In 2020, Palantir spent 124% just to generate revenue, by 2023, that had fallen to 57%. Furthermore, Palantir is still working to become more efficient, as SGA fell again to 52% in 2025. The company will reduce it even more in the next decade!

Meanwhile, Palantir continues investing in R&D, spending close to 20% of revenue. I don’t foresee Palantir cutting this, keeping their technology edge is paramount for the company.

High Profits and FCF

Strong revenue growth and lower expenses lead to exploding profits!

Operating margin went from -107% in 2020 to 10.8% in 2024. Meanwhile, net income margin jumped from -107% to 16.3%.

Palantir is in a position where, thanks to rapidly increasing economies of scale, the company can acquire new customers and service existing ones cheaper and cheaper!

Large mature software companies operate with 30% operating and 20% net margins. If the company continues its elite execution, I don’t see why it can’t achieve similar margins.

While Palantir’s profits are impressive, their ability to generate cash is absolutely stunning!

FCF grew 64% in 2024 to $1.14B, delivering an FCF margin of 40%! This is an elite FCF margin that is only comparable to the world’s best companies. High FCF has enabled Palantir to have $2.1B of cash on its balance sheet, up from $850M in 2023.

Significant SBC

While it is common for technology companies to heavily reward their employees with stock, Palantir unfortunately takes this not another level.

In 2024, it gave $691.6M of stock to its employees, an increase of 45% from the prior year. SBC expense grew in relative and absolute terms, as SBC as a % of revenue increased from 21% to 24%!

Overall, Palantir shares outstanding increased 4.7% in 2024. I am sure investors don’t mind such a dilution, considering how the stock has performed this year, but it would be nice to see it fall.

2025 Outlook

In its 2025 guidance, Palantir indicated it expects strong growth to continue.

Total revenue $3.74B to $3.76B, so growth around 30-31%. Driven by a 54% growth in the US commercial segment.

Adjusted operating income of between $1.55B to $1.57B, an increase of around 37-39%.

Adjusted FCF could increase between 20-36% to reach $1.5 to $1.7B.

Overall, Palantir gave strong guidance.

5. Valuation

This is, however, where the fairy tale ends. Those who can do math quickly might have already realized that something is off. A net income of $467M for a $234B company is ridiculously small!

With a P/E of 500, Palantir is not expensive, the most appropriate phrase to use is a BUBBLE!

I have said it before, I love Palantir the company, but hate Palantir the stock.

I did a simple valuation model so we can visualize how ridiculously overvalued the company is!

Let’s say Palantir grows its customer count till 2030 with a 35% CAGR. This would result in 4,667 customers.

With a net dollar retention of 120%, we get a 20% yearly revenue gain from existing customers. Next, I used 2024 revenue and deducted 2023 revenue*120% to get how much Palantir earned from new customers during 2024. 274 new customers and $195.5M in revenues from them means Palantir earned $0.71M per customer. Let’s assume that revenue earned from a new customer in the same year the customer was onboarded doesn’t change.

This results in revenue growing by 336% by 2030 to $12.5B, a CAGR of 28%!

I model SGA falling from 52% of revenue to 29%, and R&D, and cost of revenue remaining the same.

In this scenario, operating margins grew from 11% to 34%, leading to an operating income of $4.25B!

In the last few years, Palantir’s net income margin has been higher than operating due to relatively high interest income and low taxes due to a history of large losses. By 2030, however, this should normalize, resulting in Palantir likely having a lower net income than the operating income. Thus, I model tax and other costs as 20% of operating income.

After taking into account these assumptions, we get to a 2030 net income of $3.4B!

With a 3.5% yearly dilution and a P/E of 50, Palantir’s market cap would be $169B, around $54.7 per share.

So, this model has identified a 47% downside for Palantir!

I believe my assumptions have been quite reasonable, and many would argue rather optimistic. However, I acknowledge that Palantir bulls will dispute this assertion, so let’s improve the model.

Let’s increase the customer CAGR to 40%, dollar retention to 135%, revenue per new customer to $1M, reduce dilution to 2%, SGA to 24%, cost of revenue to 17%, and R&D to 16%.

In this scenario, revenue increases from $12.5B to $26.5B, while operating profit from $4.2B to $11.4B, and net income from $3.4B to $ 9.1B.

Even with such aggressive assumptions, I see only a 55% upside, a CAGR of 7.6%!

I don’t find it likely that Palantir will achieve such strong results, and even if they do, the upside is quite limited. Of course, there is a chance that Palantir will trade at a P/E of 100 or 150, in such case, the upside would be significantly larger. But I can’t base my investment decisions on hopes of P/E remaining sky-high.

In the long term, multiples always reverse to the mean!

6. Conclusion

In conclusion, while Palantir is a high-quality company with innovative products and sound finances, the valuation is just too high.

Palantir is in a bubble!

The bubble is caused by investor excitement about AI. While it is entirely within the realm of possibility that Palantir’s stock price will continue rising despite its valuation, in the long term, valuations tend to revert back to the mean.

Bubbles always pop, and I am all but certain that Palantir will see a massive decline in the next few years.

Thus, I can’t in good conscience invest in Palantir, I find the risk and reward ratio unfavorable.

I will continue following the company and will reassess.

I am open to changing my mind if I see growth reaccelerating again in 2025.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Ferrari, Palantir, Robinhood, Celsius, Mercado Libre and Hello Fresh!

Additionally, i have written Investment Cases on Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write 1 article a week!

Subscribe to get all my articles as soon as they are released!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Thanks for the post. You provide excellent information for investors.