Stock Battle: Airbnb vs Booking.com

Disruptor vs Goliath!

Traveling has never been easier!

Engineering innovations have empowered aircraft to travel huge distances with less fuel. At the same time, stiff competition between airlines has driven ticket costs down to unprecedented levels.

Lastly, the internet revolution enabled customers to simply and cheaply book accommodations all over the globe!

This is where today’s duo comes into the picture.

Booking and Airbnb are leading travel accommodation companies that are used by millions of people every day.

While their business models are quite different, their origin stories share some parallels.

Booking was a darling of the dot-com bubble of 2000 that saw its stock collapse 99% as the bubble burst!

Meanwhile, Airbnb is a darling of the ZIRP era bubble of 2021. At one point, it saw its valuation surpass Booking.com, peaking at $130B. Subsequently, its stock collapsed 62%!

As both companies recently released their Q4 and FY 2024 earnings reports, I thought that this is a perfect opportunity for a Stock Battle!

Let’s put the companies against one another!

1. The Basics

Airbnb runs a platform that enables people to list apartments or rooms for short-term rent. The company was founded in 2008 during the Great Recession, and the founders thought that many people would be open to having strangers stay at their house for a few days for some extra income.

From this simple idea, Airbnb has expanded to become a globe-spanning travel behemoth, with over $81B in platform sales. The name of the company has even become a verb with people referring to short-term nonhotel accommodations as “getting an Airbnb.”

The company had a very successful IPO during the 2021 stock market mania, and the stock rose further, with the market cap peaking at $130B. Since then, the valuation has come down over 30% and now sits at $87B.

Meanwhile, Booking runs a more traditional and comprehensive multi-brand travel platform that enables people to book hotels, hostels, apartments, flights, cars, restaurants, tours and more. Apart from its flagship, Booking.com brand, the company also owns Priceline, Agoda, Kayak, Rentalcars.com, and OpenTable.

The company has delivered incredible stock market returns, with the stock up 360% and 190% in 10 and 5 years, respectively. With a market cap of $163B and platform sales of over $165B, Booking is the largest travel company in the world.

2. Business Model

While both companies operate in the travel industry, their business models are quite different.

So, let’s take a look!

Airbnb

Originally, the platform only had apartments and rooms, but now it has expanded to experiences. However, the platform still doesn’t have hotels, flights, and restaurants.

I think if you could go back to 2018 to tell Airbnb bulls that in 2025, Airbnb will still be a single brand and a single product platform without airline tickets, they wouldn’t have believed you. The company hasn’t come up with anything apart from a few changes to its app.

While their app is great, in terms of the overall product, I find the innovation at Airbnb disappointing!

Airbnb makes money by charging a 5-14% service fee to the guest and a similar fee to the host. Fees vary by location, daily price, length of stay, and total value of the booking. Additionally, while customers are charged before the stay, hosts are paid after.

This creates an incredibly advantageous working capital dynamics, with Airbnb holding many billions of dollars in cash for weeks or months before having to pay out. Airbnb can use these funds internally or invest them in interest-bearing securities.

In 2024, Airbnb earned $818M in net interest income, a whopping 31% of its total net income!

Booking.com

Booking is the world’s most popular hotel listing website. Additionally, their expansion into car rental and fights has seen impressive adoption.

The platform offers a remarkable end-to-end travel experience. A person can book a flight, hotel, airport taxi, and a tour, all on the same website!

The product offering of Booking is fundamentally superior to Airbnb!

In addition to its flagship platform, all its other brands are popular in their respective niches. Priceline is a dominant value-oriented US platform, whilst Agoda is a popular platform in Asia Pacific. Furthermore, OpenTable and Rentalcars.com are popular restaurant reservation and car rental platforms.

The company makes money in 3 primary ways.

Booking buys hotel rooms or airline tickets from merchants at a wholesale discount and then lists them on their website with a mark-up. This segment generated $14.1B for the company, around 59.6% of the overall business!

Additionally, it allows hotels and other partners to list on its platform, with the company taking a 10-30% cut of each transaction. Booking made $8.5B from these agency fees, 36% of the total revenue.

Lastly, merchants who want to increase their visibility on the platform can advertise. $1.4B, around 4.6% of the group's revenue comes from advertising.

Booking doesn’t have as favorable working capital dynamics as Airbnb because the company, most of the time, doesn’t charge the customer before the booking. Additionally, often, the hotels themselves handle payments.

Gross Platform Bookings

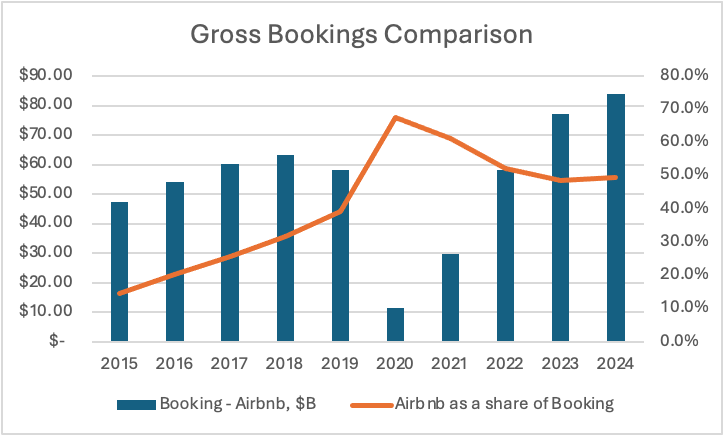

Airbnb finished 2024 with platform bookings of $81.8B, an increase of 11.7% Y/Y. Meanwhile, Booking grew its platform bookings by 10% Y/Y to $165.6B.

Since 2015, Airbnb has grown bookings by an impressive 915%, a CAGR of 29%. This is much faster than 198%, 13% CAGR of Booking!

Airbnb’s growth has been stratospheric, however, it has slowed down much faster than many investors anticipated.

The dollar difference of gross bookings has never been larger!

In 2015, Booking’s platform was $47.4B larger. The difference has been growing Y/Y every year except for the pandemic years of 2019 and 2020. (Later in this report, I will explain why Airbnb suffered less from the pandemic than Booking.) In 2024, the difference reached an all-time high of $83.8B.

Looking at gross bookings in relative terms, from 2015 to 2019, Airbnb grew steadily. Their gross bookings as a share of Booking gross bookings jumped from 14.6% to 39.4%. (I will ignore the pandemic years.) However, in the last 3 years, Airbnb has plateaued at around 49%.

This is a stunning reduction in growth!

Nights Booked

In 2024, people booked 491.5M nights and experiences on Airbnb’s platform, up 9.7% Y/Y. Meanwhile, Booking’s customers booked 1.14B room nights, a 9% improvement Y/Y.

Unfortunately, Airbnb doesn’t disclose these KPIs separately. Nevertheless, I still think we can compare them, as it is likely that experiences are just a tiny portion of that. Brian Chesky, Airbnb CEO, has acknowledged that experiences have underperformed expectations.

With this metric, the picture is similar to gross bookings. Airbnb’s 23.7% CAGR is much higher than the 11.4% Booking’s!

However, in absolute terms, the difference has never been higher, with Booking having 653M more nights booked on its platforms. In relative terms, Airbnb stands at 43% of Booking’s nights booked.

Significant drivers of the ever-increasing gross booking difference are the airline ticket and rental car segments. While the car unit has taken more time to recover from the pandemic, the airline segment has exploded. Booking sold 49M flight tickets in 2024, an increase of 36% from 2023 and 227% from 2021.

This is the biggest no-brainer service Airbnb should add to its platform.

It puzzles me that the company still hasn’t done so. Airbnb should have done this 10 years ago!

3. Covid-19

The pandemic caused the travel economies to completely shut down. For 2 years, there was essentially zero recreational travel. Both companies were significantly affected, but Airbnb was less so.

As we discussed, the majority of Booking’s business is hotels, car rentals, and flights. As lockdowns killed travel, the company saw its business hit from all sides.

Airbnb only provides apartments and experiences. You can’t lose what you don’t have, so their business didn’t suffer from a reduction in demand for hotels and transportation.

Additionally, Airbnb pivoted towards longer stays and domestic travel. During the pandemic, most offices went fully remote, allowing people to leave expensive high-density areas. This drove demand for multi-month bookings outside the large cities, with 24% of the nights booked in 2021 being for more than 28 days.

Furthermore, the demand that still existed shifted to domestic travel, with Germans staying in Germany and Americans in America. Hotels come with many amenities, such as housekeeping, pool, sauna, gym, restaurants, and more. During the pandemic, many customers wanted to avoid shared spaces and didn’t need these amenities, thus preferring the privacy of a home.

As their businesses cratered, both companies raised billions in financing and fired thousands of employees.

4. Finances

Airbnb finished 2024 with revenues of $11.1B, EBIT of $2.56B, net income of $2.65B and FCF of $4.5B.

Meanwhile, Booking posted revenues of $23.7B, EBIT of $7.6B, net income of $5.9B, and FC of $7.9B.

Let’s look at their finances in more detail.

Revenue

Booking 2024 revenues of $23.7B are up 87% from 2017, a 9.4% CAGR. This is a third of the growth that Airbnb posted in the same period, as it grew by 333%, a 23.3% CAGR!

However, this is largely due to the growth before the pandemic, since 2020, Booking has grown faster than Airbnb.

In 2024, Booking grew sales by 11.1% compared to 12% for Airbnb.

Wall Street analysts believe that Airbnb will grow sales by 9.8% and 10.7% in the next 2 years. Meanwhile, Booking is expected to grow by 6.6% and 8.8%.

Analysts expect Booking to significantly decelerate, whilst Airbnb is to remain flat and accelerate in 2026!

Expenses

Airbnb is still a relatively young company, whilst Booking is a mature one, thus, their expense structures are different.

As Airbnb is actively working to improve its app and release new offerings, it spent $2.1B on R&D, 18.5% of its revenues. Booking doesn’t disclose its R&D expenditure, however it is probably much lower as a % of revenue, but likely similar in dollar terms.

Booking spent 30.7% of revenue on marketing, about double the 15.8% of Airbnb.

This is because more people book directly on Airbnb than on Booking.com!

In the above picture, we can see the comparison of Google Search statistics for Airbnb and Booking.com. Airbnb searches are many times more frequent than Booking.com. This discrepancy is despite Booking’s platform processing $84B more in transactions.

Booking has to actively spend more on marketing to acquire customers, because the competition for hotel bookings is fierce, with many hotel platforms and hotels themselves advertising to get customers.

Profits and FCF

As platform businesses, both companies have very high gross margins of more than 80%. However, if we go a bit lower in the income statement, we see that despite higher marketing expenses, Booking’s operating margin is higher, 32% vs 23% for Airbnb.

Nevertheless, the net income margins are very similar at 24.8% for Booking and 23.9% for Airbnb. This is because, as we discussed earlier, Airbnb makes $818M in net interest income, driven by cash held for hosts. Booking doesn’t have net interest income, rather they have a net interest expense of $181M, as they have more debt.

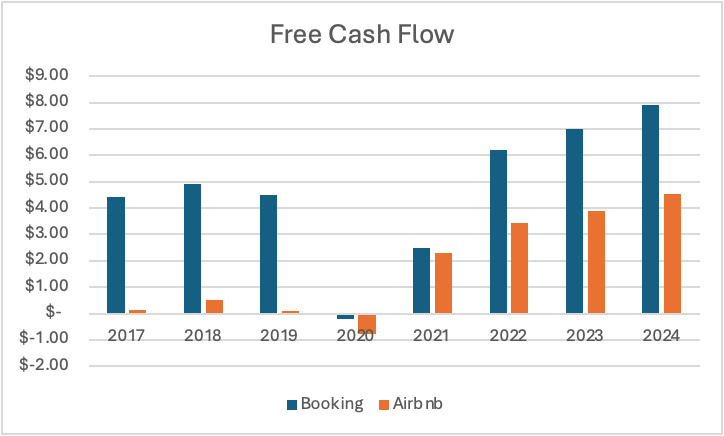

Booking has been consistently profitable for years, with net income growing with a 14.1% CAGR since 2017. Meanwhile, Airbnb has only started posting significant profits recently.

Airbnb FCF margin is 40.7%, higher than 33.3% of Booking, largely due to the more advantageous working capital dynamics and higher stock compensation. However, in the graph, we see that for Airbnb, high FCF is a recent phenomenon, whilst Booking has been generating extremely high FCF for many years.

Both companies have superb cash flow generation abilities!

Debt

Airbnb has very little debt, as the company has historically resorted to using equity to finance its expansion.

In the graph above, we see that Booking holds $17.2B in Debt, 6 times more than Airbnb. Booking has used this debt to finance various acquisitions and share repurchases. But, investors don’t need to worry about the leverage, since Booking has over $16B in cash, and ample profits to manage the debt.

Lastly, now that Airbnb is profitable, I think they will use more debt, rather than equity, to fund its future growth. If there even is a need to raise capital, as the business generates a lot of cash.

Dilution

Airbnb is a significantly more dilutive company than Booking.

In the graph above, we see that since 2020, Airbnb has consistently issued many times more shares in dollar terms to employees than Booking. In 2024, Airbnb spent $1.4B on SBC, more than double the $0.6B of Booking. For Airbnb that was 12.7% of revenue, whilst Booking only paid 2.5%.

This means that despite a buyback yield of 4.5%, Airbnb’s shares outstanding only decreased by 2.4%!

Meanwhile, Booking’s buyback yield of 4%, reduced their shares outstanding by 4.2%!

In fact, Booking is a well-known share cannibal, with total shares outstanding falling 34% from 2015!

Airbnb shares outstanding are up 144% since 2017!

5. Valuation

Airbnb with a market cap of $87B trades for a P/E of 34, whilst with a market cap of $163B, Booking trades for a P/E of 29.

In the above table, I have placed some forward valuation metrics. Overall, while the cash flow valuation metrics are basically the same, Booking is much cheaper on the earnings basis.

Airbnb’s TTM P/E is 15% higher, FWD P/E is 28% higher and 2027 P/E is 26% higher!

This is because, investors generally tend to assign a premium to better top-line and bottom-line growth.

In the table above, I have placed analyst consensus growth estimates. Whilst Airbnb is expected to grow its sales faster, the difference is just a few % points. Both companies are projected to expand profitability, except for 2025, Airbnb will grow its EPS slightly faster than Booking.

Looking at these metrics, I don’t believe Airbnb premium to Booking valuation is justified!

Investors are paying a 26% higher 2027 P/E for 15% higher relative total revenue growth, but actually smaller EPS growth. This can be explained by investors, believing that Airbnb has a higher terminal value, implying it will sustain faster growth than Booking well into the future.

6. Future

Both companies are likely to remain significant travel industry players, but each has different opportunities and problems.

Airbnb operates a single product platform and hasn’t made any meaningful acquisitions. Recently, the CEO said that the company is working on new offerings that have multi-billion-dollar potential, and they plan to roll them out in the next few years. This has significant execution risk.

Booking has historically focused on acquisitions, but that is over. In the current regulatory climate, it is unlikely that competition authorities will allow them to make any more, in fact, their last EUR 1.6B attempt was denied in 2023. Airbnb has an advantage in this regard, but I doubt they will do any large ones.

In terms of regulation, Airbnb faces an onslaught of investigations and new regulations. New York City recently essentially banned the platform completely. Barcelona, Amsterdam, Paris, and dozens of other cities are planning to issue new regulations that will make Airbnbs less convenient and more expensive.

Booking, however, faces antitrust issues. Governments and hotels don’t like the power the platform has. No meaningful M&A can take place, and various regions are working on laws that would limit Booking fees.

For instance, Booking has been criticized by its parity clause, which bans hotels from having lower prices on their website. Germany has banned the practice, and other countries are looking into doing the same.

7. Conclusion

Both companies are fundamentally different investments.

Investment in Airbnb is a bet that successful releases of new offerings will increase gross bookings, and higher scale will drive margin improvements!

Whilst investment in Booking.com is a bet that the company will use its highly dominant position to steadily take a bigger share of the growing global travel industry!

So essentially, Airbnb is the high risk, potentially higher reward strategy, but Booking.com is the low risk, steady growth, high margin, high ROIC strategy.

Currently, taking into account the valuation, their offerings and future growth estimates, I find Booking to be a better buy!

My opinion could change, if Airbnb releases new products that get significant customer adoption. At the moment, I am skeptical, as the company hasn’t released anything that I could describe as substantial in years.

Additionally, I think that Booking is more likely to overdeliver on Wall Street analyst estimates than Airbnb.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, i have written Investment Cases on Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write 1 article a week!

Subscribe to get all my articles as soon as they are released!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

TY