10 Fallen Angels to invest in!

Investing Basics. #6

A Fallen Angel is a once-strong company that has seen its stock price collapse.

Usually, the fall from the heavens was justified.

Market conditions changed

Demand disappeared

Growth slowed down

Expenses skyrocketed

Unfortunately, most of the time, these Angels never return to heaven!

However, in rare cases, Mr. Market is proven wrong, as sales growth returns, costs get in line, and profits increase, leading to a stratospheric rise back to heaven!

After falling 75% in 2022, Netflix is up over 500% in just 3 years!

Meta collapsed 70%, after which it jumped over 700%!

Meanwhile, AppLovin fell by 50%, before rising over 170%!

These cases fascinate investors, as they promise strong returns in a relatively short amount of time. Thus, many investors are always on the lookout for the next Angel that is ready to fly back to heaven.

In this report, I will look at 10 companies whose stocks have fallen over 40% since their highs and present the case why they could return to previous levels within a few years.

Let’s dig in!

1. Diageo

Market Cap: $53B

P/E: 22

Diageo is a global beverage company based in London, UK, that sells alcoholic beverages, such as spirits, beer, and wine, through brands like Johnnie Walker, Guinness, and Smirnoff.

So far, the stock is down 26% YTD and 57% from the 2021 all-time high. This is largely because of:

Slower growth and disappointing earnings

Rising competition

Trump’s tariffs

Leadership changes

Investor concerns about the execution

There is no doubt that these are serious challenges, but Diageo is actively responding in ways to manage these headwinds.

Against slower growth, Diageo is leaning into restructuring!

They are stepping up cost-cutting efforts (raising the target to ~$625M) and reallocating resources toward higher-growth premium and no/low alcohol segments.

While in the face of competition or shifts in consumer tastes (moderation trends, alternative drinks), Diageo is innovating with smaller pack sizes, canned/pre-mixed cocktails, and more.

To counter tariff and trade pressures, Diageo is optimizing its supply chain by relocating bottling, managing inventory, shifting investments, and has said it expects to mitigate about half of the tariff impact on operating profit.

Regarding market or geopolitical uncertainty, Diageo has also been adjusting its portfolio, selling or exchanging underperforming brands like Ciroc in North America for Tequila/Mezcal brands and emphasizing leadership transitions to restore confidence in execution.

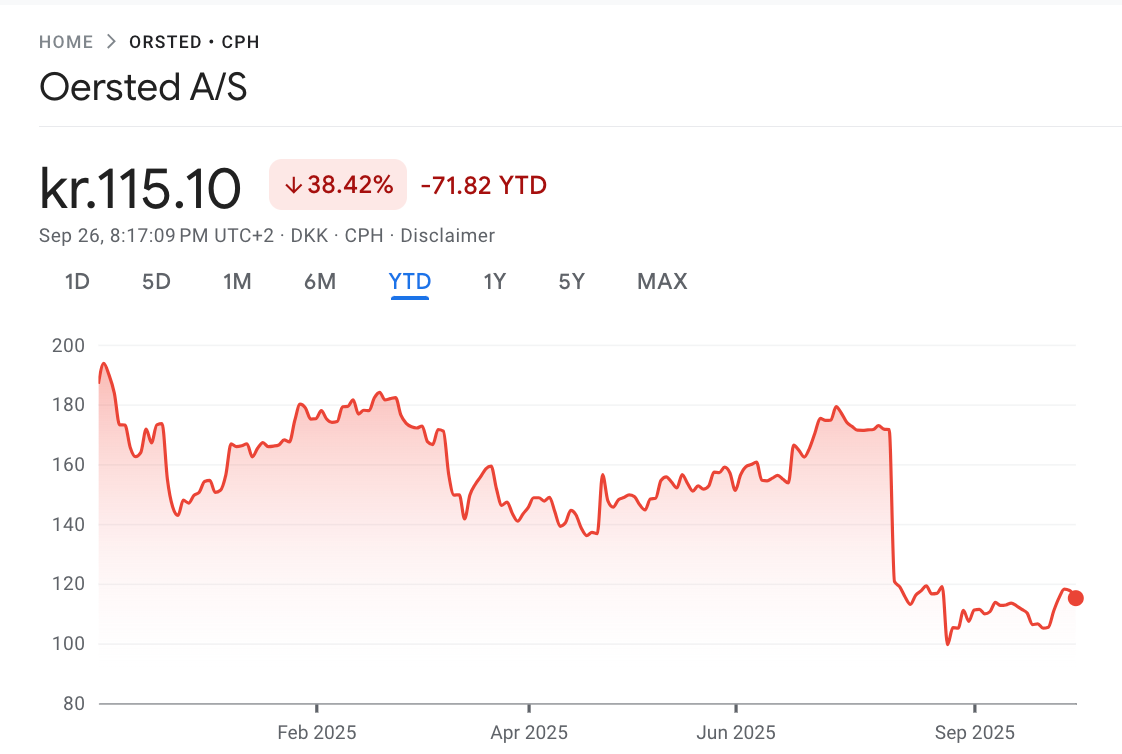

2. Orsted

Market Cap: $24B

P/E: 8

Orsted is a Danish renewable energy company that develops, constructs, and operates offshore and onshore wind farms, solar farms, and energy storage facilities.

So far, the stock is down 36% YTD and 92% from the 2021 all-time high. Such a catastrophic collapse was caused by:

Project delays and cost overruns

Increased scrutiny of renewable energy projects

Trump’s Trade War

Trump’s attacks on Denmark

Regulatory headwinds in the US (paused project in New Jersey)

While these have been a few challenging years for Orsted, the price might be too low to ignore anymore, as Orsted is actively responding to these challenges.

First, Orsted is tightening project management controls, renegotiating supplier contracts, and deploying new risk assessment tools to reduce exposure to material cost spikes. At the same time, it is optimizing its project pipeline, prioritizing assets with the strongest economics and pushing for modular construction approaches to accelerate timelines.

In the face of increased scrutiny of renewable energy projects, they are strengthening their community engagement strategy. This includes working closely with regulators, local communities, and investors to improve transparency around environmental impacts and permitting timelines.

To counter trade war disruptions and tariff volatility, Orsted is exploring diversified supply chains, considering onshore manufacturing for key components, and partnering with multiple logistics providers to limit bottlenecks. The company has signaled that these steps could mitigate a significant portion of potential cost escalation tied to trade policy uncertainty.

Unfortunately, Trump’s bizarre attacks on Denmark to annex Greenland have gotten Orsted in the crossfire, as he recently paused a windfarm project with no valid reason. However, Orsted recently successfully sued the US government, with the judge ruling that construction of the wind farm must continue.

Furthermore, Orsted is leaning on its global portfolio, especially growth in Asia and other European markets, which could help diversify its geographic risk profile.

Overall, despite Trump’s ridiculous grievances regarding wind and solar, this industry is going forward, and Orsted is well-positioned to grow in Europe and other regions!

3. United Health

Market Cap: $312B

P/E: 15

UnitedHealth Group is a diversified healthcare conglomerate that provides health insurance through and healthcare services, pharmacy care, and care delivery, through its Optum division.

So far, the stock is down 32% YTD and 45% from the 2024 all-time high. This terrible performance was driven by:

Scrutiny after the high-profile assassination of its executive

Higher medical costs

Lower profitability

DOJ investigation

Trump’s Big Beautiful Bill

While these challenges are certainly serious, UNH is actively responding, potentially positioning the stock for a quick rebound.

Following the high-profile assassination of its executive, the murderer was celebrated and the company was vilified. However, people’s memories are short, and this hasn’t led to a healthcare reform to help people, in fact, Trump’s new bill made it way worse.

Amid rising medical costs, UNH is increasing prices to tackle higher medical utilization rates. These trends should normalize in the coming years, leading to stabilization of the medical loss ratio.

Warren Buffett’s investment in the company is a clear indication that it is highly likely that UNH will fix its margins!

Finally, in response to the DOJ investigation, UNH is fully cooperating with authorities, and it will probably receive a slap on the wrist and a small fine.

4. PayPal

Market Cap: $64B

P/E: 14

PayPal is a financial technology company that provides online payment solutions, enabling individuals and businesses to send, receive, and manage money securely over the internet through brands such as PayPal, Venmo, Xoom, and Braintree.

So far, the stock is down 21% YTD and 78% from the 2021 all-time high. Such a catastrophic fall from grace was caused by:

Slowing revenue growth

Bad acquisitions

Unclear strategy

Slow user growth

Falling take rate

Clearly, PayPal lost its way, but we could be standing before a turning point.

Slowing revenue growth has been in part driven by a change in strategy of shifting from a growth at all costs model to a more balanced approach that also focuses on unit economics and profitability.

PayPal is expanding its high-margin services, such as Braintree, Venmo, and cross-border commerce, while deepening merchant relationships through enhanced checkout experiences and value-added services like fraud prevention and BNPL.

In response to criticism over its M&A history, PayPal is tightening its capital allocation strategy, emphasizing buybacks instead of large acquisitions.

With PayPal potentially buying back 9% of shares outstanding per year!

To address concerns about an unclear strategy, PayPal new CEO has articulated a sharper focus on core payments, scaling its digital wallet ecosystem, and driving adoption in everyday commerce rather than pursuing confusing initiatives.

Facing slower user growth, PayPal is investing in international expansion, partnerships with major retailers, and seamless integrations with leading e-commerce platforms to capture new users.

Finally, to counter falling take rates, PayPal is introducing new monetization levers, including merchant-funded incentives, advanced analytics for enterprise clients, and premium financial services, aiming to offset pricing pressures with higher-value offerings and differentiated solutions.

While I personally wouldn’t invest in the company, because as a user, they have clearly lost me, and I don’t live in the US, so I can’t try Venmo, but I see the logic in the strategy.

5. LVMH

Market Cap: $301B

P/E: 23

LVMH is a French multinational luxury house that owns and manages a portfolio of prestigious brands across fashion, jewelry, cosmetics, wines, and spirits. In addition to the company name, brands of Louis Vuitton, Moet and Hennessy, it owns Dior, Fendi, Givenchy, Tiffany’s, Sephora, Marc Jabos and dozens more.

So far, the stock is down 19% YTD and 43% from the 2023 all-time high. This unluxirous performance was largely the result of:

Unsustainable sales growth during and post COVID

Issues in the spirits division

Higher costs

Slowing growth in China

Questions regarding succession planning.

There is no doubt that these are serious challenges, but LVMH is actively responding in ways that could reactivate its stock price.

During and after COVID, there was a lot of demand for luxury goods and experiences, leading to strong growth, which is now fading.

In the face of issues in the spirits division, the company changed the management of this division, which is implementing a new strategy.

They are rationalizing inventory, adjusting production levels to reflect demand trends, and closing unprofitable D2C stores!

To counter slowing growth in China, LVMH is broadening its geographic reach by deepening its presence in Southeast Asia, the Middle East, and the US, while enhancing local engagement strategies in China to capture evolving consumer tastes and shifting luxury shopping behaviors.

Lastly, regarding succession planning, LVMH has been gradually elevating next-generation leaders within the Arnault family and professional management ranks, with all of his children holding key positions in the company.

This aims to signal a deliberate and phased approach to leadership continuity that aims to reassure investors and employees about long-term strategic stability.

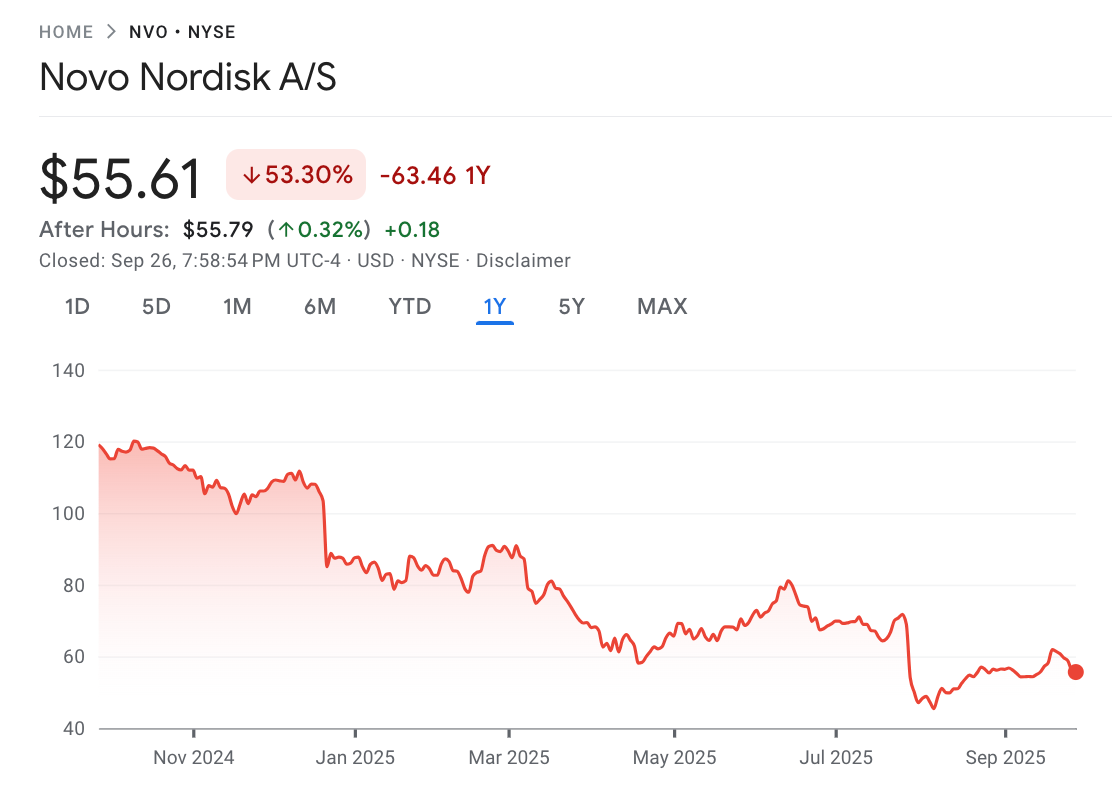

6. Novo Nordisk

Market Cap: $191B

P/E: 14

Novo Nordisk is a Danish pharmaceutical company, known for its diabetes and GLP-1 weight loss drugs like Ozempic and Wegovy.

The stock is down 66% in the past year and 53% in 2025, largely because of the following reasons.

Slower growth than expected.

Threats from fake and compounded GLP1s.

Trump’s Trade War.

Trump’s attacks on Denmark.

In short, while these are serious challenges, I think the effect they will have on Novo Nordisk in the long term is exaggerated.

The FDA, the US Congress, and Novo Nordisk itself have taken a tougher stance against fake and compounded GLP1s. Novo has filed over 100 lawsuits against companies selling fake and compounded GLP1s and has already won some of them.

Additionally, the company is in the process of expanding its presence in the US and will create 1000 new jobs in North Carolina.

Furthermore, the EU just signed a new trade deal with Trump.

In aggregate, all these factors lead me to believe that these challenges are temporary!

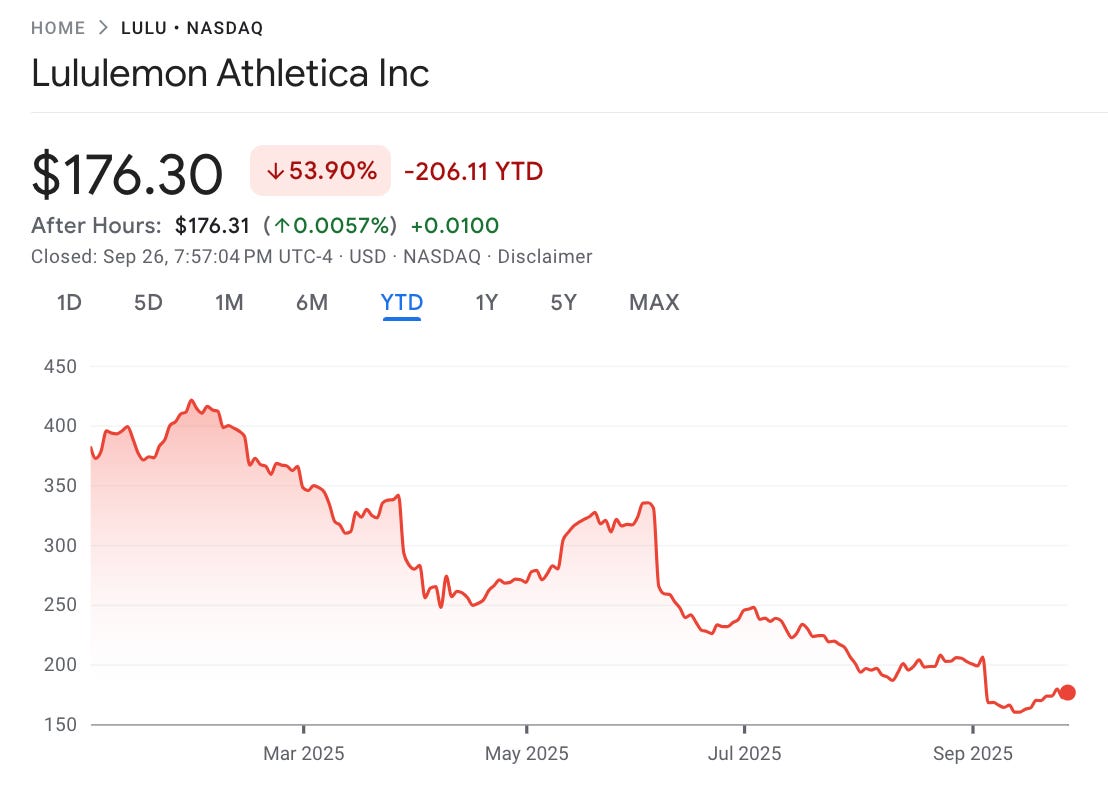

7. Lululemon

Market Cap: $21B

P/E: 12

Lululemon is a Canadian athletic apparel company best known for its expensive yoga pants, activewear, and accessories, focusing on performance and style.

So far, the stock is down 54% YTD and 66% from the 2024 all-time high. Such a catastrophic collapse was caused by:

Slowing growth in the US

Increased competition

Inventory challenges

Tariffs

Lululemon is actively responding, trying to stem the bleed and reignite growth.

While growth in the US is weak, Lululemon is accelerating its international expansion, particularly in Asia and Europe, where the company’s presence is still low!

In the face of increased competition, the company continues to invest in product innovation with proprietary fabrics, limited-edition collections, and new retail concepts, all while leveraging its loyal community and digital ecosystem to deepen customer engagement and differentiation. Results have yet to be seen.

To address inventory challenges, Lululemon is upgrading its supply chain strategy, aiming to improve demand forecasting and shift toward a more agile inventory model to reduce markdown risk and improve margins.

Finally, to mitigate the impact of tariffs, the company is diversifying its sourcing locations, negotiating with suppliers, and selectively adjusting pricing strategies to protect profitability.

Overall, while international growth is good, the company must strengthen its domestic business and fight off new competition!

8. Edenred

Market Cap: $5.6B

P/E: 10

Edenred is a French company that specializes in payment solutions for the working world, offering services like employee benefit vouchers, government benefits, fleet and mobility solutions, and corporate payment systems to improve efficiency and reduce costs.

So far, the stock is down 36% YTD and 68% from the 2023 all-time high. This fall was largely caused by:

Fee caps in certain markets

Regulatory risk

Slowing growth in Europe

Uncertain growth outlook

Edenred operates one of these businesses that users and stakeholders dislike, despite the obvious benefits of it. Nobody likes a middleman, and Edenred’s high margins are easy targets for politicians, implying that Edenred is siphoning money that is meant for the people.

Against proposed and implemented fee caps in Brazil, Spain, Italy, Turkey, and others, Edenred is accelerating the rollout of value-added services, such as data analytics, loyalty programs, and digital engagement tools, to diversify revenue streams and reduce reliance on transaction fees alone.

To counter slowing growth in Europe, Edenred is expanding aggressively into high-potential emerging markets in Latin America and Asia!

Edenred hopes to launch innovative digital payment solutions to drive user adoption and deepen customer relationships in existing markets.

Finally, with an uncertain growth outlook, Edenred is focusing on operational efficiency, cost discipline, and strategic partnerships to maintain financial resilience while investing in scalable technology platforms to support long-term growth.

The company is aggresivly buying back 5% of its stock, and analysts expect earnings to increase by 50% by 2027.

9. Global-E

Market Cap: $6.2B

P/E: negative earnings, P/S of 7.

Global-E is an e-commerce platform that enables businesses to sell internationally by providing cross-border solutions such as localized pricing, currency conversion, duties and tax calculation, shipping logistics, and payment options tailored to each market.

So far, the stock is down 33% YTD and 55% from the 2021 all-time high. This fall was largely caused by:

Slowing growth

Operating losses

Dependence on Shopify

Trump’s Trade policies

Clearly, these are serious challenges, but Global-E is actively responding, possibly positioning the stock for a rebound.

While growth indeed has slowed down from 80% in 2021 to 28% in Q2 2025, Global-E is expanding its merchant base beyond core geographies, launching tailored solutions for mid-market and enterprise retailers, and investing in AI-driven localization tools to boost conversion rates and accelerate international e-commerce adoption.

Facing operating losses, the company is prioritizing operational efficiency, leveraging automation to reduce fulfillment costs, and focusing on high-margin services like cross-border tax compliance and currency management to improve profitability as scale grows.

It earned $10M in Q2 2025, positioning them towards profitability in the future!

To address its dependence on Shopify, Global-E is diversifying platform partnerships, integrating with additional e-commerce ecosystems, and developing direct APIs so merchants can adopt its services independently of any single partner relationship.

Most crucially, to mitigate risks from Trump’s trade policies, the company is implementing flexible routing options, building relationships with multiple logistics providers, and offering merchants real-time duty and tax calculation tools to help navigate potential tariff impacts seamlessly.

As cross-border selling becomes more complex, Global-E could actually benefit as a provider of tools that help solve that complexity!

10. Intel

Market Cap: $166B

P/E: negative earnings, P/S of 3.

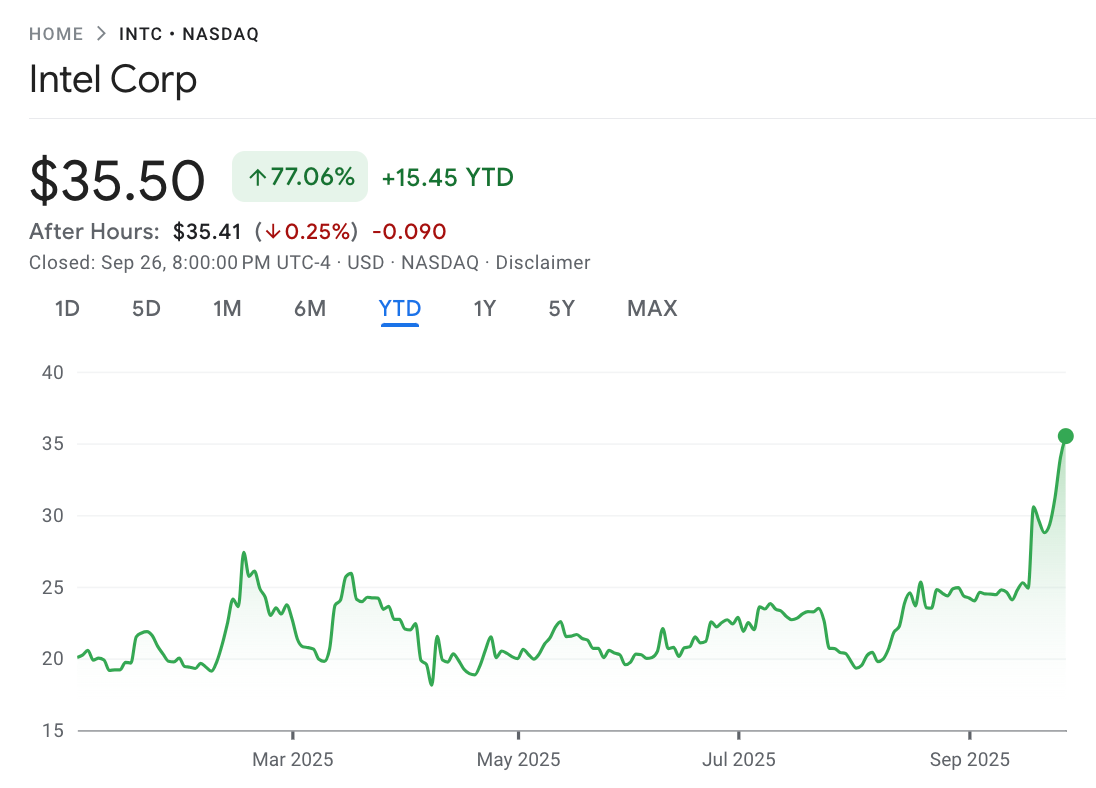

While the stock is up 77% YTD, I still consider them a fallen angel as they are down 48% from 2020 highs.

There are many reasons why Intel lost its way, the key ones are:

Missed the smartphone

AMD

Missed AI

Can’t compete with TSMC

And honestly, all these reasons are still more valid than ever today, and there is nothing that I see that could change this. There is only one reason and one reason only why someone could consider investing in Intel, and that is Trump.

Recently, a tech YouTuber that I watch, Tech Altar, released a video where he used a perfect phrase to describe what Intel is to Trump and the US.

Intel is the Boeing of semiconductors!

The analogy is quite clear. Just as Boeing, Intel is an advanced manufacturing company creating products that are extremely important for the US military industrial complex. Also, just as Boeing, Intel has lost its leadership to a competitor with better products.

But most importantly, just as Boeing, the US government will do everything it can to make sure this company survives and continues manufacturing in the US!

Trump recently forced Intel to give the US government a 10% stake in it, after which he said that he would help it succeed.

He sent a clear message to all US tech giants: “Help Intel, or I will crush you with tariffs”.

Nvidia was the first to listen, and quickly invested $5B in Intel!

Now, the latest news is that Trump is demanding that all chip companies manufacture the same amount of chips in the US as they import. If they import more than what is produced in the US, they will pay a 300% percent tariff. Clearly, that is a negotiating strategy.

The other day, it was reported that Intel has “begun conversations” with Apple about a potential investment. Tim Cook is smart, he sees where the winds are shifting, so he will surely agree to this “investment” (more like a shakedown).

I suspect that other big tech companies will follow.

In such a scenario, Intel could guarantee demand for its products and finish the construction of its new manufacturing plants. If in, let’s say, 5 years, they go back to previous margins, the stock will skyrocket.

While I could see this happen, I am staying on the sidelines, as Intel lost its dominance for valid reasons, and in my eyes, these reasons are still relevant today, despite Trump’s support.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

I would say the problem for most of these is either their market is shrinking dramatically (Lulu LVMH diageo) or they have absolutely no moat (PayPal etc)

Love the way this is articulated. Your post covers most of the co's that have a strong chance of turning around. What are your thoughts on $SNAP?