Stock Battle: Airbus vs Boeing!

Dance of the Duopoly!

For many decades the advancements in the aviation industry have come from Boeing and Airbus. Yes, many smaller operators that have come and gone made heaps of innovations. Nevertheless, the scale and continued drive of these two giants have led us to this golden age of travel!

Over 100 years ago the first commercial flight in the world flew 23 minutes from St. Peterburg, Florida to Tampa, a distance of 17 miles. Since then, the commercial aircraft industry has come a long way, growing step by step, and becoming cheaper and cheaper. A direct flight from Singapore to Newark is currently the longest commercial flight in the world and takes 18 hours and 45 minutes to fly 8,285 miles. At the same time, a ticket for a 2-hour flight between Amsterdam and Barcelona can be purchased for a mere EUR 80.

However, the last few years have been very volatile. The Covid pandemic disrupted supply chains and destroyed the demand for global air travel. The war in Ukraine led to the effective closure of Russian and Ukrainian airspace. Boeing 737 Max scandal caused the plane to be grounded for many years.

Just at the moment when it seemed that things were finally calming down and settling, the door of a Boeing plane fell out of the sky. Since then, it seems that every other day there is another news story regarding Boeing’s safety troubles.

Airbus has possibly a once-in-a-generation opportunity to solidify itself as the senior manufacturer in this duopoly.

Let’s compare Airbus and Boeing!

Basics

Airbus is a European Aerospace and Defense company with a $144B market cap. The company was formed in 2000 by officially merging a consortium of various European companies, that united in the 70s to compete in the commercial airliner space. Heavily supported by various European governments, German and French states still own around 11% each, Spain 4%. Since becoming a public company, Airbus stock has grown with a CAGR of 9.82%.

Airbus has grown significantly, expanding its operations to other continents, and becoming a major player in the defense industry. The company manufactures various military planes, helicopters, drones, satellites, fighter jets, and more.

Boeing is an American Aerospace and Defense company with a $108B market cap. The company is older than Airbus, founded in 1916 by William Boeing. Boeing played a significant role in manufacturing aircraft for the US military during both World Wars. Since becoming a public company, Boeing’s stock has grown with a CAGR of 6.42%.

However, the Boeing of today is the result of decades of growth, mergers, and division splits. In 1997 they acquired McDonnell Douglas, while in 2005 Boeing divested a division that became Spirit Aerosystems. Today Boeing manufactures commercial and military airplanes, satellites, drones, helicopters, military systems, and more.

Defense and Space Business

Both companies have significant Defense businesses, however, their strategies are different.

Boeing is heavily focused on the domestic US market, where with large military contracts it has a very strong presence. Boeing products include large bombers and F-15 fighter jets.

Airbus’s defense business is more limited, focusing on using their existing platforms, and adapting them for military use, whilst Boeing offers a more customized approach.

In the above picture, we see that there is a significant overlap in the products of both companies. However, Boeing only manufactures military helicopters, which allows the company to heavily customize them for the desired mission capabilities. Meanwhile, Airbus doesn’t manufacture missiles of its own, but it holds a stake in a European missile manufacturer. Another difference between the two is that Airbus doesn’t manufacture airborne early warning (AEW) aircrafts, a flying surveillance radar system.

Both companies have made the unmanned aircraft category a priority. The nature of war is changing, cheaply and quickly manufactured drones have become a necessity. During the war in Ukraine, we have observed how relatively inexpensive drones can penetrate classic defenses and render tanks and military vehicles obsolete. Furthermore, their importance in surveillance gathering will only increase.

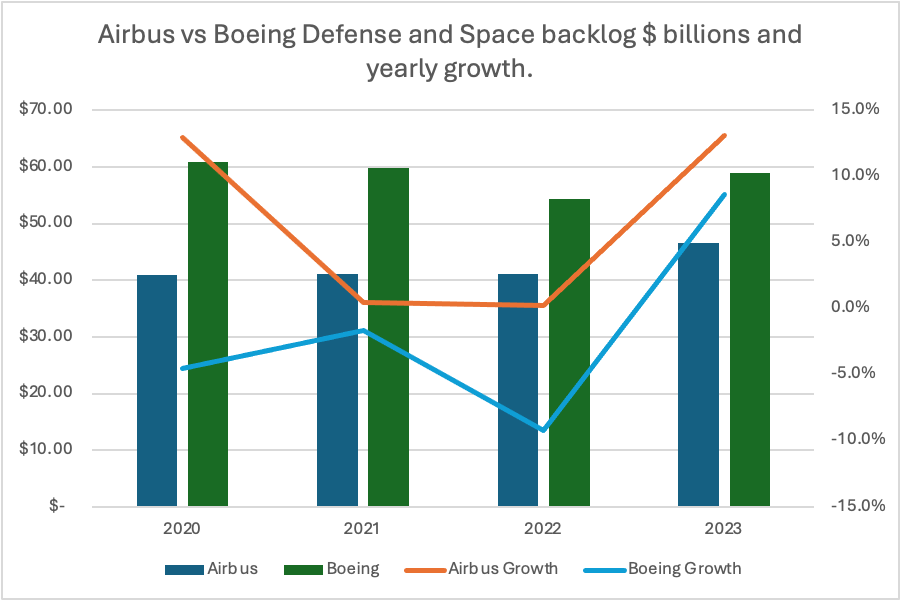

Looking at the backlog, it stands at $46.6B for Airbus and $59B for Boeing. While Boeing is the larger player, the difference has been shrinking steadily. In 2019 the delta in backlogs was $27.5B, today it’s just $12.4B. Since 2020, Airbus’s backlog has grown each year, increasing by 28.7% in total, whilst Boeing’s backlog fell 7.4%.

Looking at the backlog can give the impression that Airbus is quickly catching up to Boeing, but that is not the case. Airbus’s backlog is increasing due to its inability to increase production. Its sales of $12.7B have only grown 4% in 4 years. While Boeing’s revenues of $24.9B are down 4.2% during the period.

Whilst Boeing’s backlog is 27% larger, their revenues are 96% larger.

Boeing is the clear winner in the defense category, for Airbus to catch up it needs to meaningfully ramp up production.

As a result of the Ukraine war, European countries such as Germany, Poland, Finland, and Sweden have announced significant investments in their military infrastructure. Airbus as the largest European manufacturer is projected to significantly benefit from this increased spending.

Commercial Aircraft Business

For decades Boeing was the largest commercial jet manufacturer, but between 2003-2011 Airbus delivered more jets, Boeing regained the position for a few years, but since 2019 Airbus has been the leader, with the gap growing.

In 2023 Airbus delivered 735 planes, an increase of 74 units or 11.2% Y/Y, and received new orders for 2094. Meanwhile, Boeing delivered 528 planes, 48 units more than the prior year, +7.7%. The gap between Airbus and Boeing increased to 207 planes, up from 171 in 2022.

Since 2019 Airbus has delivered a stunning 1541 more jets than Boeing!

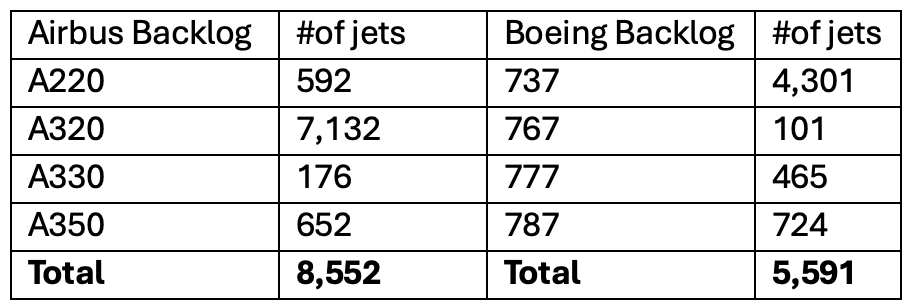

As of 2023 close, Airbus had a backlog of 8,552 planes worth $541.8 billion, whilst Boeing’s backlog was 5,591 planes for $440.5 billion. At the current rate of production, it would take both companies more than 10 years to go through the backlog.

However, due to the recent accident involving a Boeing 737 Max, Boeing’s quality control measures have come under question. Regulators are putting in place measures to guarantee the safety of Boeing’s planes. This means that the backlog and the yearly manufacturing rate are going to continue lagging behind Airbus.

Finances

Last year Airbus revenues were $72.2B, up 11.4% Y/Y. Driven by higher deliveries in its main commercial jet segment, $52.7B in revenue +18.8% Y/Y. Helicopter and Defense sales were a drag on overall growth, growing 7.3% and 5.26% respectively. However, net profit of $4.1B and free cashflow of $3.5B were down 8% and 13% respectively.

High inflation and production increases have had a huge impact on Airbus’ margins, with gross margin falling from 17.3% to 15.3%, operating from 8.3% to 6.5%, net from 7.2% to 5.8%, and FCF margin from 6.5% to 4.9%.

Boeing’s revenue increased 16.8% Y/Y to $77.8B. Alike to Airbus, the increase was driven by its flagship commercial jet business, which grew 30% Y/Y to $33.9B. Defense business grew to $24.9B +7.6% Y/Y, while its global services business of $19.1B grew by 8.6%.

Boeing has been unable to regain wings since the 737 Max scandal and the COVID-19 pandemic. Thus, for the past 5 years, Boeing has been a money-losing company, with cumulative losses of $23.8B. Last year Boeing improved its net income by 55% to negative $2.2B. However, unlike Airbus, Boeing’s margins improved significantly in 2023. Gross margin increased from 7.9% to 11.9%, operating from -1.2% to 1.7%, net from -7.4% to -2.9%, and FCF margin from 3.4% to 5.7%. To be fair to Airbus, Boeing comps were easier, due to its recent financial slump.

Looking at the indebtedness of both companies Airbus Net Debt decreased slightly but is still negative $5.4B, meaning the cash position is larger than debt. A stark contrast to Boeing, whose Net Debt is +$38.1B. The high leverage in Boeing can be easily seen in its EBIT to Interest ratio of 0.5, which means all of its EBIT is only enough to pay 50% of interest expense, whilst Airbus has a healthy ratio of 5.7.

What I find most stunning, is the Capex to Revenue ratio disparity. I don’t believe that in this industry lower capex expenses are an advantage. It’s a sign of problems to come. Boeing spends less than half as a percentage of revenue on capex, compared to Airbus, 1.9% to 4.7%.

Boeing doesn’t pay any dividends but does limited buybacks, whereas Airbus pays a 1.1% dividend and has a small buyback scheme. Both companies are trading for a similar 2026 multiple. I would like to remind those looking at Boeing’s 2026 growth prospects that Boeing is coming from a much lower base than Airbus. Furthermore, considering that Boeing is currently in shambles, the gap between them and Airbus is likely to increase. Consensus Wallstreet estimates have been coming down so far this year, however I believe it is likely they are to come down further.

Conversely, Airbus is currently undergoing the expansion of its production lines to meet the high demand for its products. This explains the 39% growth in top-line sales. Moreover, once this expansion period is passed, Airbus’s profitability will increase by 100% and FCF by 62%. The company plans to be done with the A320 production line expansion project by 2026-2027.

Future

With the growth of global demand for air travel, both companies are poised to significantly benefit. Let’s look at a few trends prevalent in this industry.

Cloud Services

Skywise is the result of Palantir’s cooperation with Airbus, creating an operating system for the skies.

Skywise allows Airbus and Airlines to share data to find solutions to common problems. Today over 36,500 users analyse data from 11,000 planes. 52% of Airbus fleet is connected to Skywise, a number that is likely to grow to 100%. Airbus uses the data from airlines to design better planes. In return airlines use the data from Airbus to improve its operations, saving costs and generating more revenue. This is the future of global air travel, and Airbus is leading it with Palantir.

Boeing has a partnership with Microsoft to deliver similar capabilities. As much as I could find, it seems it doesn’t have the scale and capabilities of Skywise.

India

With over 1.5 billion people India has become the most populus nation on earth. However, the nation is underdeveloped, lacking infrastructure to serve its citizens. India hopes to change that with the kind of aggressive infrastructure buildout that China has done over the last 20 years. Airbus and Boeing planes will play a crucial role in enabling Indian citizens to traverse their large country.

In 2023 there were an estimated 150 million domestic and 68 million international passengers in India. Airbus estimates that Indian travel demand will grow with a 6.2% CAGR for the next 20 years, which would mean around 700 million passengers by 2044. For such a massive increase in passengers, India will require around 2,200 new jets.

To meet this anticipated demand IndiGo recently ordered an unbelievable 500 Airbus A320 jets. This is the largest single purchase agreement in commercial aviation history. The low-cost airline plans to take the deliveries between 2030-2035. To not be outdone by IndiGo, Air India ordered 470 jets, 220 from Boeing, and 250 from Airbus.

China

Just like India, China is a huge growth market for the aviation industry. Boeing estimates that by 2042 Chinese airlines will order 8,560 new aircraft. By 2030 Chinese domestic market could surpass Europe’s and by 2040, North America’s.

However, the Chinese government is determined to not be dependent on foreign manufacturers. In 2008 state-owned Commercial Aircraft Corporation of China (COMAC) was formed. Since then, the Chinese Communist Party has spent many $billions to develop their own plane. On May 28. 2023 C919 made its first commercial flight in China. While the company is still small today and the quality is questionable, China will likely become a significant player in this sector.

Conclusion

Airbus is without a doubt the superior company, its finances are better than Boeing’s in all aspects. Even though, according to Wall Street estimates, Boeing should return to profitability, I am still worried about the continued losses, high debt, and low capex.

We still don’t know the full extent of the problems at Boeing. Furthermore, Boeing’s CEO was recently fired, and there are a lot of questions about the engineering problems at Boeing. Moreover, the recent safety scandal indicates a more serious structural and cultural problem at Boeing.

Fundamentally, Boeing is a turnaround play, and turnaround plays are inherently risky, as most fail. The company is USA’s biggest exporter and there is a belief that Washington will not let such an important company fail. However, I am not convinced that support from Washington is enough to solve all their problems. Lastly, for a turnaround play, I find the risk and reward ratio unfavorable. Considering all the problems and risks, the valuation of Boeing is too high for my liking.

Airbus is a play on continued Boeing troubles. The company is projected to grow significantly in the next 3 years and with a commercial jet backlog of 10 years, Airbus is set for a foreseeable future. However, if Boeing recovers, Airbus’s pricing power and ability to get new orders will diminish. Airbus must use the time while Boeing is down to kick them in the nuts. I am not entirely sure Airbus is capable of ramping production quickly enough to do that.

Thank you for reading, Follow me on:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.