Can Oscar 10x by 2030?

Oscar Q3 2025 Update!

Oscar has been on an absolute rollercoaster this year, fluctuating between $11.60 all the way up to $21.40 and down to $13.

Strong execution and profitability drove the stock higher.

The election of Trump drove it down.

Trump’s Big Beautiful Bill adds further chaos to the health insurance industry.

High inflation and increased patient utilization led to higher medical loss ratios across the industry.

Now the expiration of the enhanced ACA subsidies looms large on the stock, as patients could cancel insurance en masse due to premiums skyrocketing.

However, recent developments have led me to believe that the worst could be over and the company could be poised for a strong 2026 and beyond.

The US healthcare industry is worth many trillions of dollars, and Oscar is bringing much-needed innovation. The size of the industry and Oscar’s small market cap mean that the stock could deliver extreme returns even if they capture just a small share of it.

In my Oscar Investment Case, I explained how the company plans to do it. Today, we will create an updated Valuation Model and look at the latest developments affecting the company.

1. Q3 2025 Results

2. ACA Situation

3. Valuation

4. Valuation Model

1. Q3 2025 Results

I don’t think it makes sense to overanalyze Q3 results because they largely don’t matter. 2025 and 2026 are transitory years, with Oscar having to deal with meaningful changes in the industry.

However, there are 3 KPIs that we need to pay attention to:

Medical Loss Ratio

SG&A Ratio

Member Growth

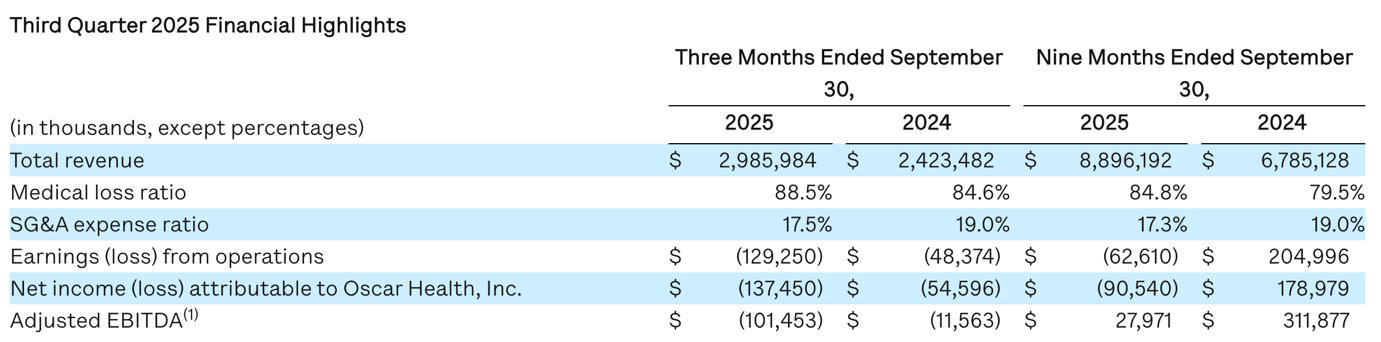

As expected, and per their guidance, the medical loss ratio increased from 84.6% to 88.5%.

This means that in Q3 2025, the company spent 3.9 percentage points more of its revenues on covering patient medical costs than in the prior year. For a health insurance company with razor-thin margins, this is a huge difference that led to operating losses increasing by 167%.

As already discussed in the Q2 analysis, this was caused by increased patient utilization and higher medical cost inflation.

The company will increase prices in 2026 by 10-20% depending on the plan and the region. Higher prices in combination with expectations for lower utilization will enable a lower medical loss ratio.

What we need to pay attention though, is the lower SG&A ratio!

Administrative costs were 17.5% of revenues, down from 19% in the prior year.

This means that Oscar is more efficient at processing customer claims and other administrative tasks. SG&A expense grew only 13.3% Y/Y while revenue grew 23.6%. Let’s remember that revenue per customer is lower than it will be next year, as the company is increasing prices, this means that SG&A will continue falling further next year.

A core bull thesis of Oscar is their potential to have the best SG&A ratio in the industry, and this quarter showed that they are racing towards that goal!

The company guided for a return to profitability in 2026.

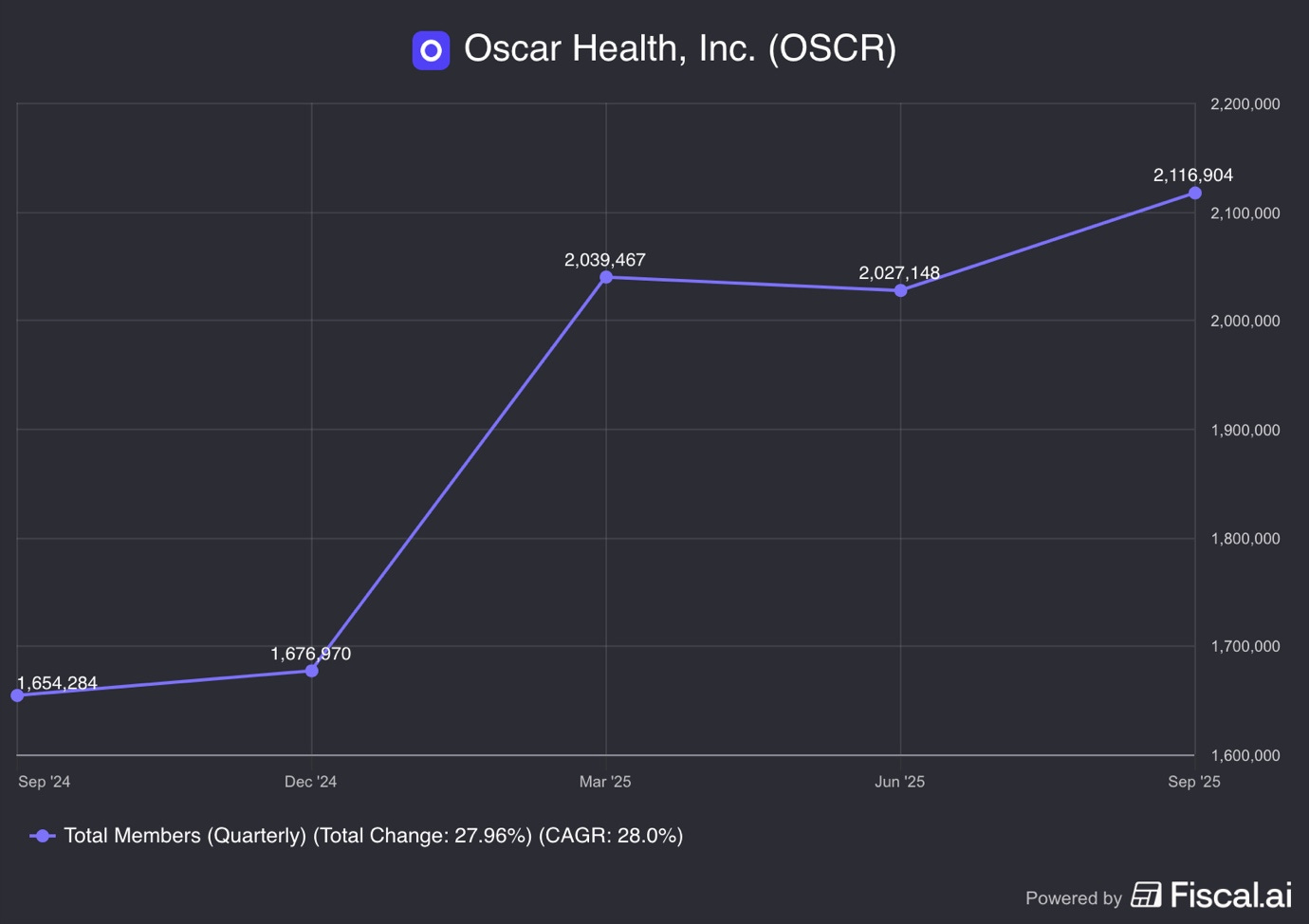

Lastly, as we see in the graph above, Oscar has 2.1M members!

The company added 463 thousand members in this quarter, growing 28% Y/Y and 4.4% Q/Q.

While this is significantly lower than in the prior year, it is still impressive considering the mess that the US health insurance industry is in this year, after Trump’s reforms. There is a lot of uncertainty regarding final pricing, government subsidies, and administrative burdens for the ACA (Obamacare) in 2026. Understandably, a lot of potential Oscar customers are delaying health insurance decisions till there is more clarity.

2. ACA Situation

In 2021, Biden implemented additional healthcare subsidies that enabled millions of middle-class people to qualify for cheaper ACA plans. These enhanced subsidies are set to expire in 2025, and millions of people are expected to see healthcare premiums increase by 114%!

This has created a battle in the US Congress where the Democratic Party has shut down the government unless Republicans and Trump agree to extend these subsidies!

Trump and Republicans don’t want to extend these subsidies for ideological reasons.

However, public opinion is firmly in support of extending these ACA subsidies, especially in the Republican heartland rural states, which depend on the ACA the most. A few days ago, there were a few elections in the US, and Democrats won huge victories, largely campaigning on an anti-Trump and pro-subsidies platform.

Essentially, all polling shows that the people blame Trump and Republicans for the shutdown!

It is my opinion that Republicans and Trump will cave to Democrat demands and extend these subsidies. They are clearly losing this battle, and soon it will become obvious that extending these subsidies and fighting on other issues later is a better strategy in the long term.

The extension of enhanced subsidies positions Oscar incredibly well for the future!

It will deliver pricing clarity that will enable them to onboard new members more effectively, leading to acceleration in the member growth rate.

3. Valuation

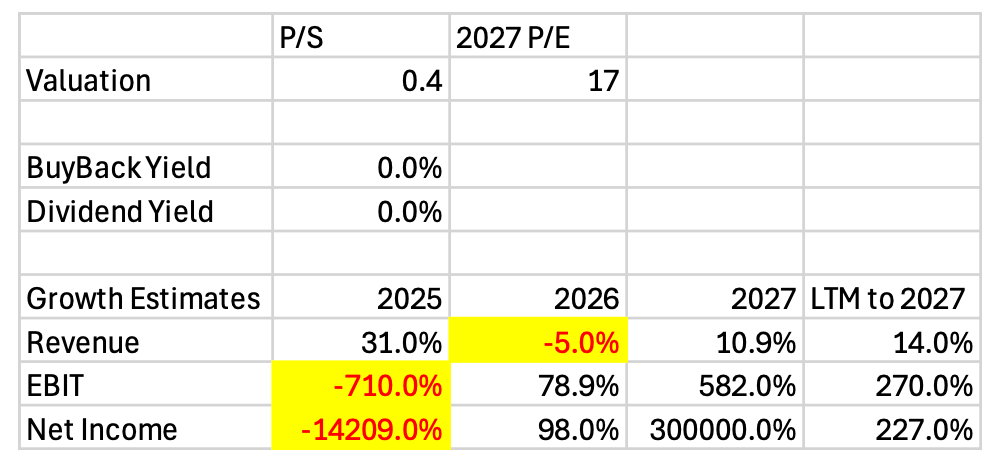

After rising 23% YTD, Oscar has a market cap of $4.28B and it trades for a P/S of 0.4. That might sound cheap, but health insurance companies have very small margins, so they will always trade for a low P/S.

Furthermore, Oscar is unprofitable, so we can’t value it on a P/E basis, we have to look at future growth estimates to assess whether this could be a great investment.

In the table below, I have placed analyst growth expectations for Oscar.

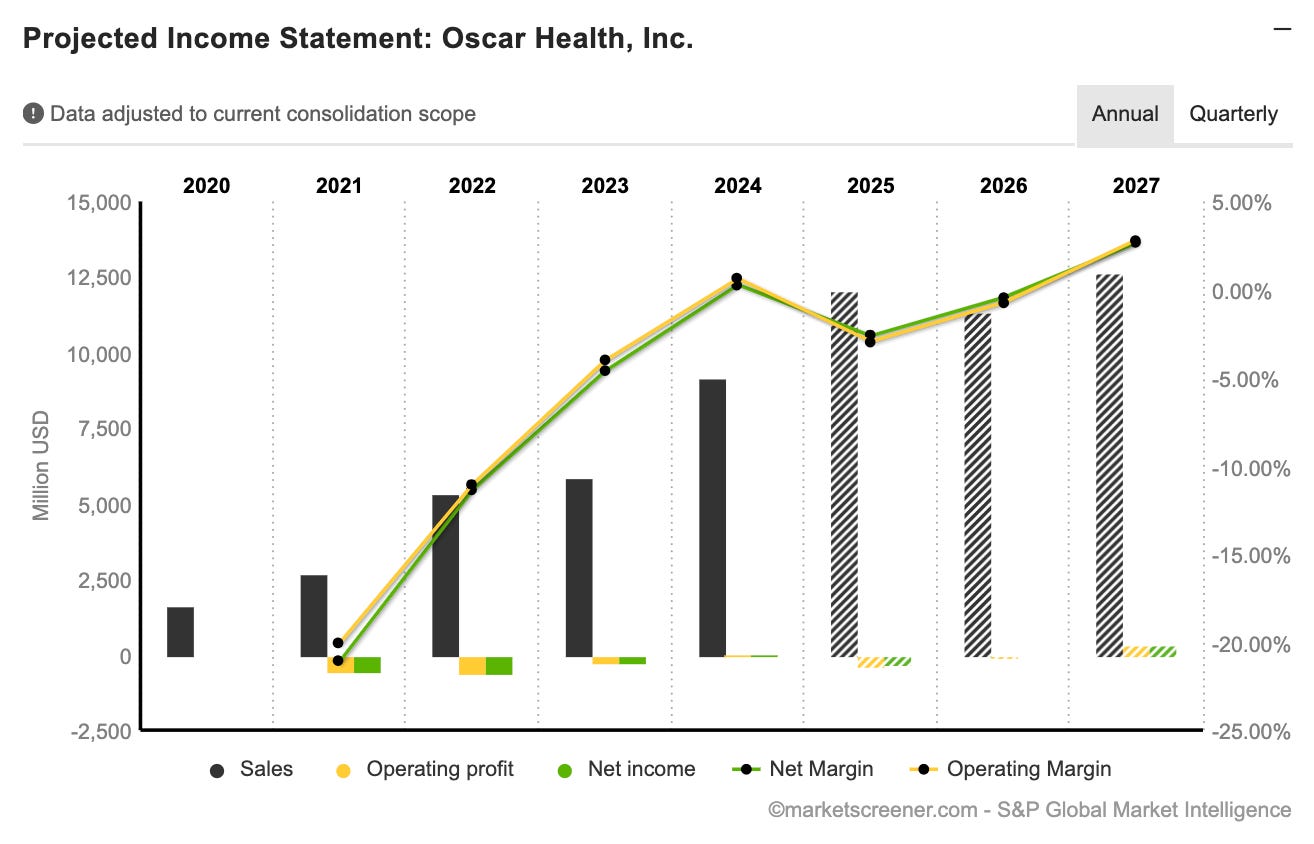

Immediately, we notice why 2025 and 2026 are transition years for Oscar. Earnings have plummeted this year, whilst analysts expect revenue to decline 5% in 2026.

Furthermore, Oscar is forecast to grow revenues by just 10.9% in 2027, whilst earnings are expected to grow just 227% by 2027 from the incredibly low base of today.

The 2027 revenue estimate of $12.6B and 2026 earnings of -$51M are extremely weak, indicating that analysts don’t believe Oscar’s 2026 profitability guidance.

This is a key reason why the company is such a strong opportunity. Most large institutional investors base their investment decisions on analyst estimates. We don’t have those limitations and thus can invest when we disagree with the Wall Street analysts.

Beating analysts’ expectations is the best path to outsize returns!

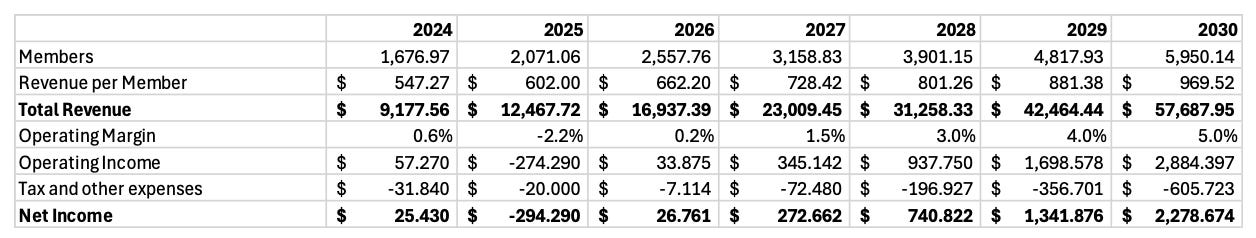

Let’s model what needs to happen for Oscar to 10x by 2030.

4. Valuation Model

Members 6M, 24% CAGR.

$970 revenue per member, 10% CAGR.

We get revenues of $57.7B!

Previously, they guided for 5% operating margin in 2027, so I will model them achieving that a few years later in 2030.

Taxes and other expenses of 21%.

The result is net income of $2.28B!

Since 2021, they have grown shares outstanding by 6.3% per year, but I model that decreasing to 5% dilution per year.

With an exit multiple of 25, we get a share price of $169.9, an upside of 917% from today!

Now let’s discuss how plausible these assumptions are.

Achieving 6M members by 2030 is difficult but not impossible!

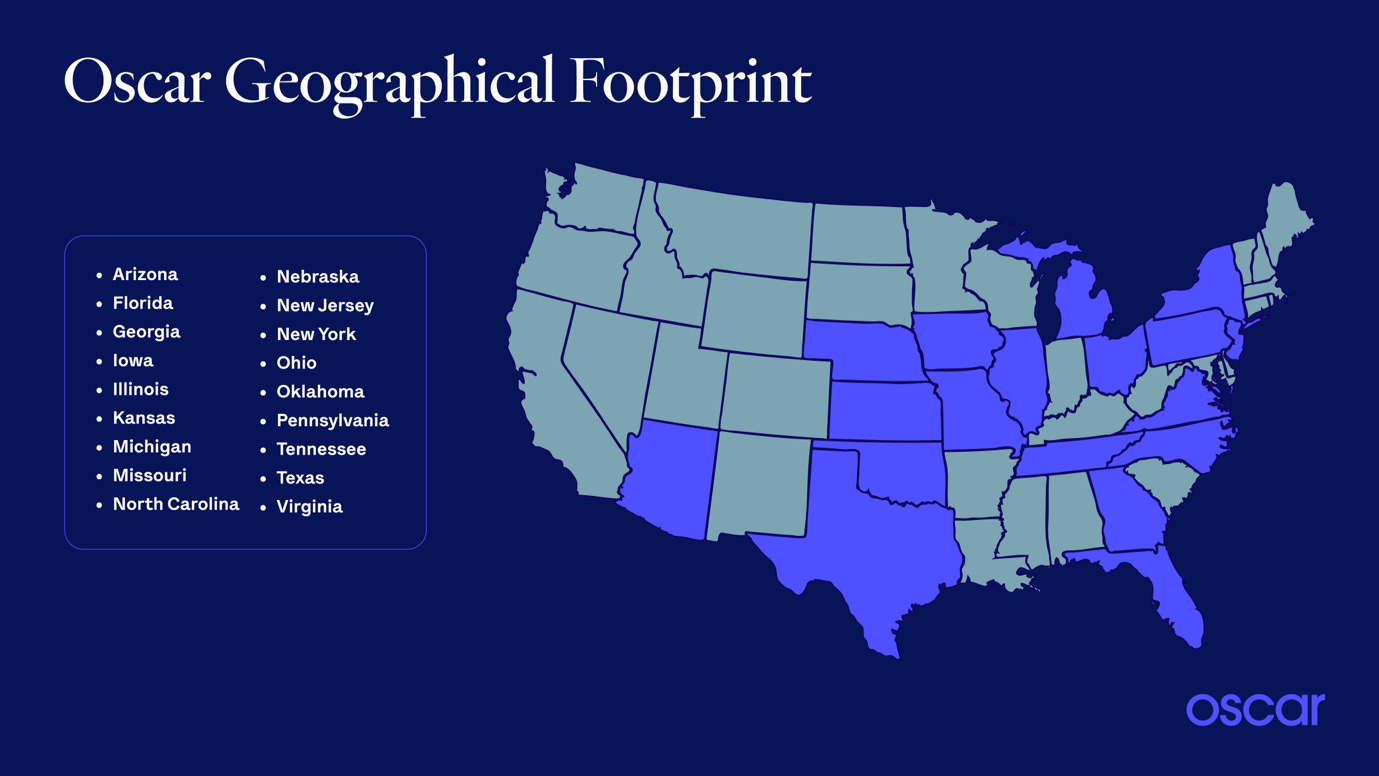

Let’s remember that Oscar operates only in 18 out of the 50 US states.

Next year, they plan to enter Alabama and Mississippi and expand to more counties in existing states. They could double their customer base simply by achieving the same market share in new states. However, with the growth of the individual health insurance market, they are well-positioned to increase their market share. Let’s remember that historically, health insurance in the US has been linked to a person’s employer. However, ICHRA is a new law that enables employers to subsidies an employee’s individual healthcare plan without creating a group plan.

Oscar believes that ICHRA will significant growth driver for them, especially as millions of people who lose healthcare coverage because of Trump’s cuts seek alternatives.

Next, revenue per member growing with a 10% CAGR also seems realistic, as we are seeing now, persistent inflation is causing pain in the industry.

5% operating margin in 2030 also seems doable and not an extreme outcome.

Lastly, depending on the market’s growth expectation for Oscar, a 2030 P/E of 25 is plausible.

In short, I see Oscar being a 10x stock by 2030 as a realistic scenario!

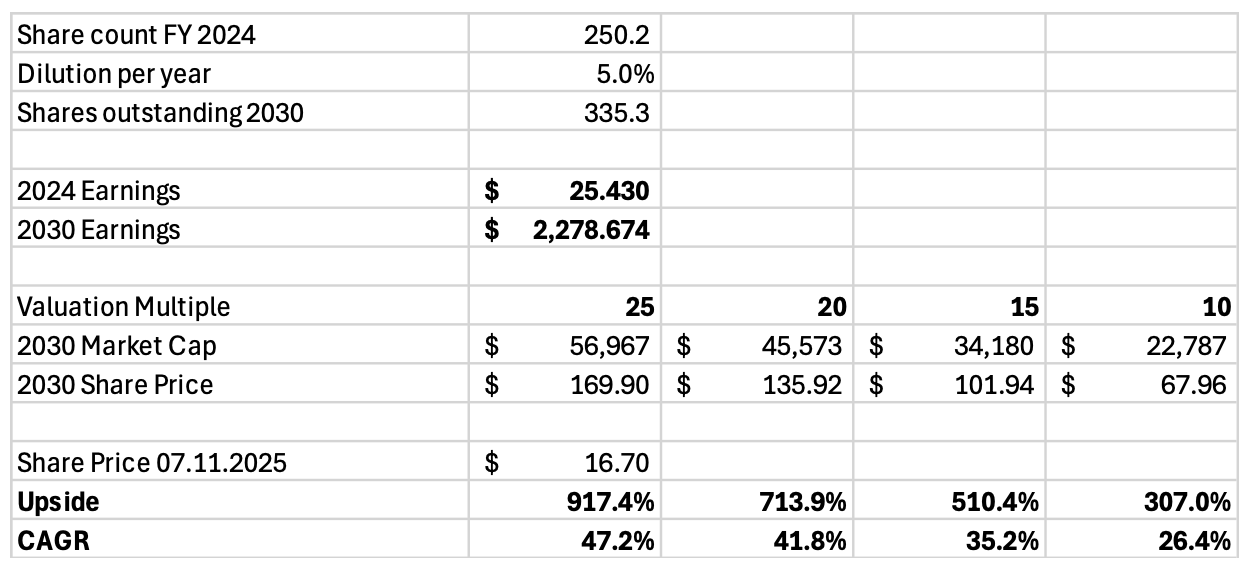

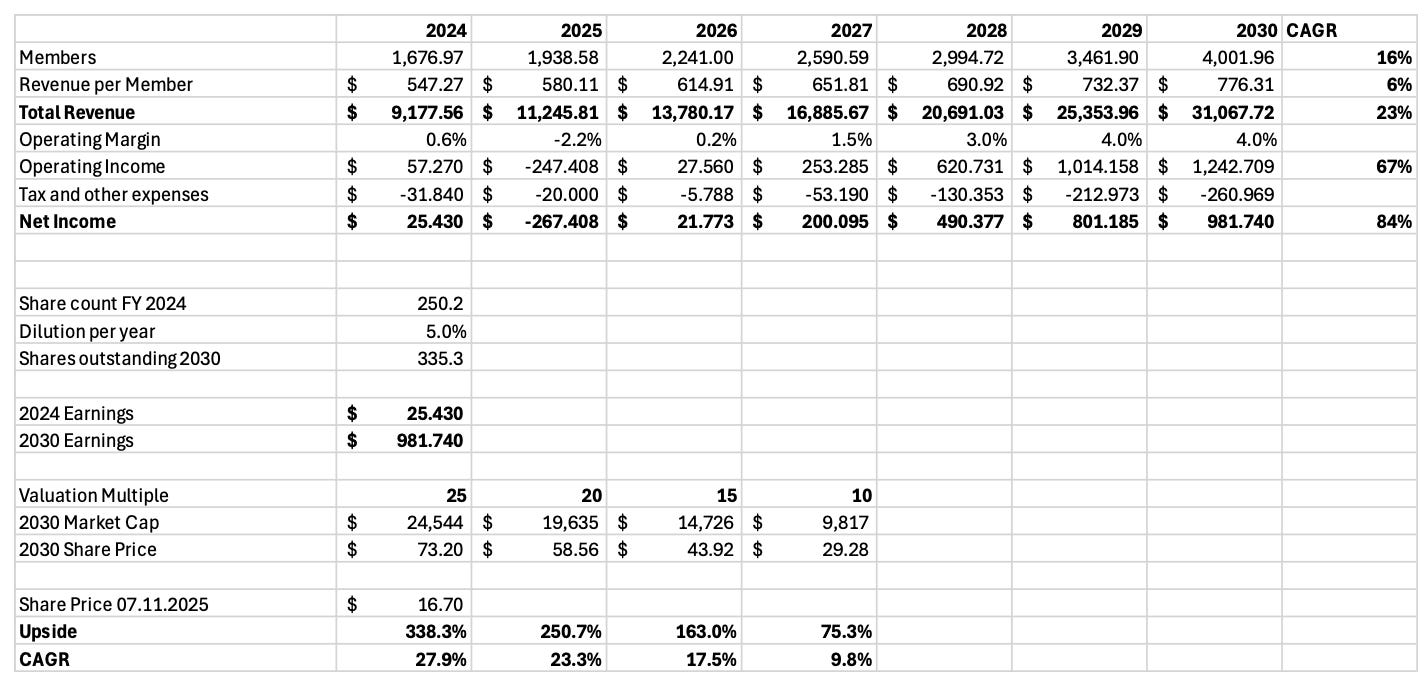

However, even in a case where they are unable to onboard new members as quickly as I have modeled, Oscar still looks attractive!

As we can see in the table above, I built a valuation model with more modest assumptions.

With 4M members, 6% revenue CAGR per member, and a 4% operating margin, we are still looking at a company that could generate $1B in earnings.

With a 15-20 P/E, Oscar could have an upside of 163-251%!

5. Conclusion

While the 2025 results are not what most expected just a few months ago, earnings are set to return in 2026. The company is handling industry-wide medical loss overruns due to increased patient utilization and persistent medical cost inflation well.

Next, I find it likely that enhanced ACA subsidies will be extended!

Furthermore, SG&A is decreasing, despite the insurance industry turmoil.

Lastly, as millions of people lose benefits due to Trump’s Big Beautiful Bill, they will seek alternatives, and Oscar could benefit from being that lower-cost alternative.

As the valuation model showed, there is a realistic path for the company to 10x by 2030. For that to happen, they need to reach 6M members and a 5% operating margin.

In conclusion, I like the setup that Oscar is offering today!

Oscar is well-positioned to beat analyst expectations and deliver great shareholder returns for patient long-term investors.

Here is what my Premium Members can expect:

Top Monthly Picks - Each month, I will select a few stocks that I find likely to outperform.

These picks will focus more on short-term pricing movements and swift through market narratives.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on semi-monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Pricing Structure

I strive to build a long-term relationship with my Premium subscribers, so I have chosen a pricing structure that emphasizes annual subscriptions.

The standard practice is to give 2 months free for annual plans, but I have decided to give 6!

Small note, please go to the website to purchase the subscription, as if you do it on the iOS app, you have to pay the 30% Apple Tax. (The plan cost more there)

Thank you for being a reader. I look forward to seeing you on Global Equity Briefing!

Equity Research Report List

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

The SG&A ratio improvement is really what caught my atention here. If they can maintain that trajectory while scaling to 6M members, the operting leverage becomes huge. The ACA subsidy extension feels likly given the political pressure, and that removes a major overhang. The path to 5% margins seems doable with their tech platform advantage over legacy insurers.