E-commerce giants & the rise of Agentic Commerce: Amazon & Shopify

Equity analysis together with Ozeco's Crack The Market

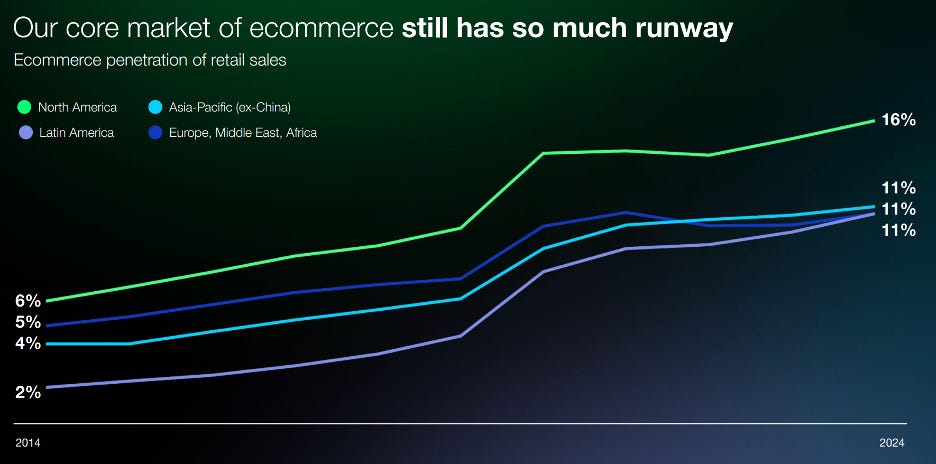

E-commerce is rapidly gaining share in retail spending. E-commerce represents 16% of all US retail sales ($1.2tn) and should grow to 18% in 2028 ($1.4tn), up from 1% in 2000 and 10% pre covid. Globally, e-commerce is a $6tn market in 2024, growing to $8tn by 2028.

E-commerce is continuing to rapidly take share by capturing incremental retail spending. This trend should continue, supporting the sector’s growth. At the same time, consumer sentiment, which bottomed out in 2022, has improved for two consecutive years, though remains below pre-pandemic levels.

And with Agentic AI in e-commerce is in its early days, this could accelerate the sector’s growth while disrupting the traditional order.

We see two winners from this megatrend:

Amazon: The global e-commerce, logistics, media, and technology $2.5tn giant is at the heart of every consumer’s life with a growing cloud business and at the forefront of Agentic commerce but has underperformed other tech giants and is now seriously undervalued and could be at an inflection point!

Shopify: Every retailer’s favorite platform sits at the center of global e-commerce and its partnership with OpenAI makes it the future of e-commerce. The company is also a payments juggernaut with incredible growth, making it a must own as we enter the Age of Agentic commerce.

Bullish. Amazon

Amazon is THE global e-commerce, logistics, media, and technology company that has become an indispensable part of daily lives for millions of consumers. After establishing their e-commerce dominance in North America, they have expanded to over 20 countries.

However, recently, there has been a lot of negative sentiment regarding Amazon. This has been driven by its stock underperforming its mega-cap technology peers, being up only 43% in the last 5 years, compared to Google rising 257%, Apple 138%, and Microsoft 125%.

A key cause of this negative sentiment also comes from Amazon largely not previously participating in the circular OpenAI AI ecosystem. This has caused their AWS growth rate to be below peers. It is my firm belief that this view is shortsighted and will be debunked with time and great execution.

Although with a $2.5T market cap, Amazon is one of the largest companies in the world, I believe it is significantly undervalued!

Here are a few reasons why!

Logistics Moat

Logistics is an important moat that protects Amazon from competitors!

In its mature markets of the US, Canada, and Western Europe, Amazon can deliver packages at speeds and quality consistently exceeding what other competitors can offer. For instance, last year, an item I wanted to purchase was slightly cheaper at some small, obscure e-commerce shop that I had never heard of. As there was no urgency, I decided to purchase it there and save €20. I was aware that it wouldn’t be delivered the next day, however, I didn’t expect it would take 2 weeks.

Convenience and speed are very important factors for customer decision-making, even when purchasing items that are not urgently needed. For this reason, Amazon has spent heavily on establishing the best logistics and delivery network.

Excluding AWS, since 2019, Amazon has spent close to $200B on capex!

Amazon now manages 705M sq ft of warehouse and logistics space. The company is expanding every year, and I don’t see any competitors being able to challenge them in the US, Canada, and Europe.

E-commerce 3P Sales

Apart from selling items directly to customers, Amazon lets businesses sell on its platform and charges various fees for using it. As Amazon continues to grow, the company adds additional services available to its merchants.

First, Amazon started collecting a % fee to access the platform. Then it began offering logistics services and now charges merchants fees for storing and delivering packages. I have no doubt that in a few years, the company will be offering additional services to merchants.

Additionally, as global e-commerce penetration grows, Amazon expands to new geographies, and its media business flourishes, platforms attractiveness to merchants and companies increases.

Thus, 3P sales are likely to continue growing at a healthy cadence!

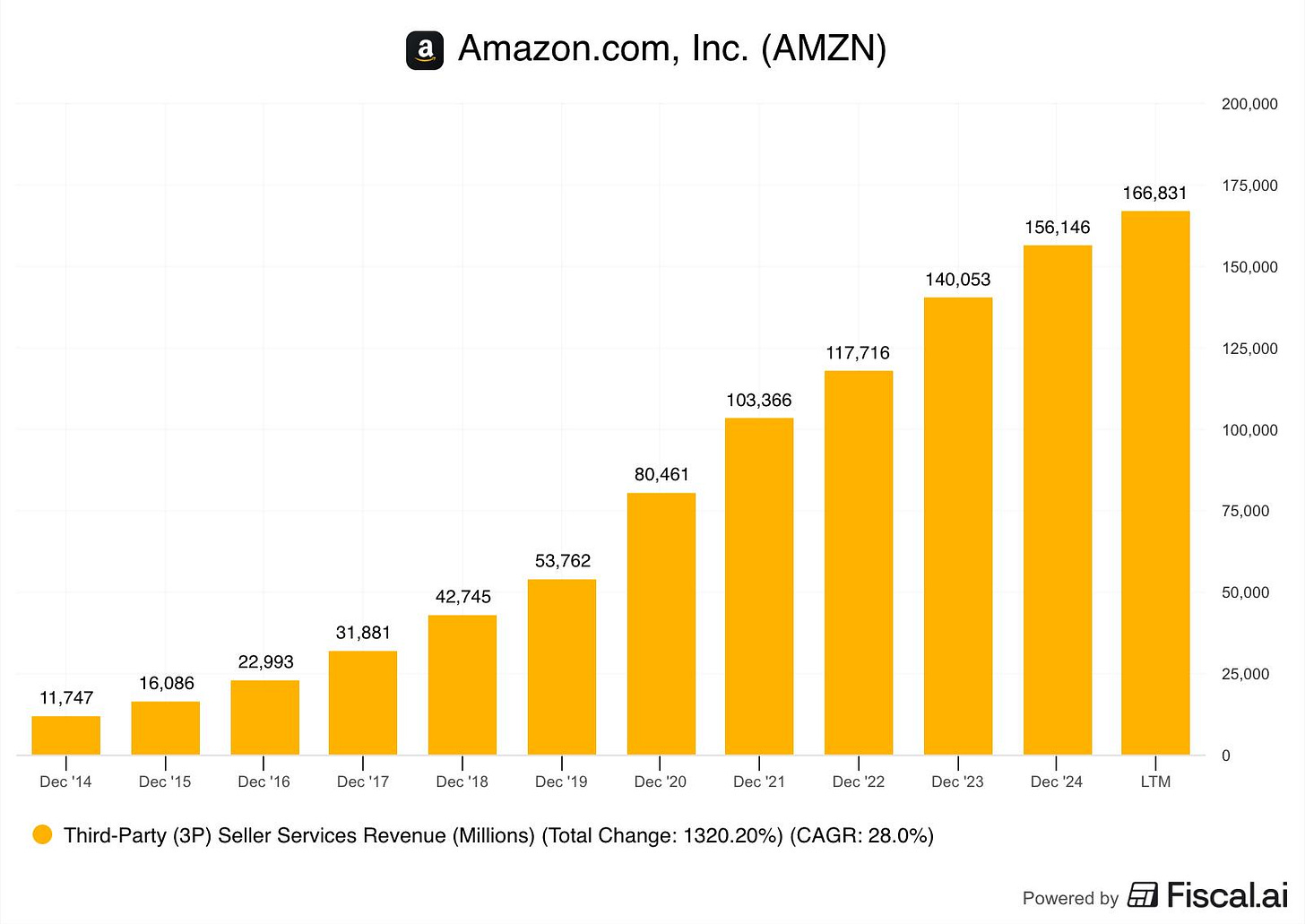

As we can see in the graph above, 3P sales have grown with a 28% CAGR for a decade to reach $166.8B in the last 12 months.

The value from this segment stems not from explosive growth, but from stability and durability. As Amazon is well positioned to grow 3P sales with a 8-10% CAGR for over a decade.

Advertising

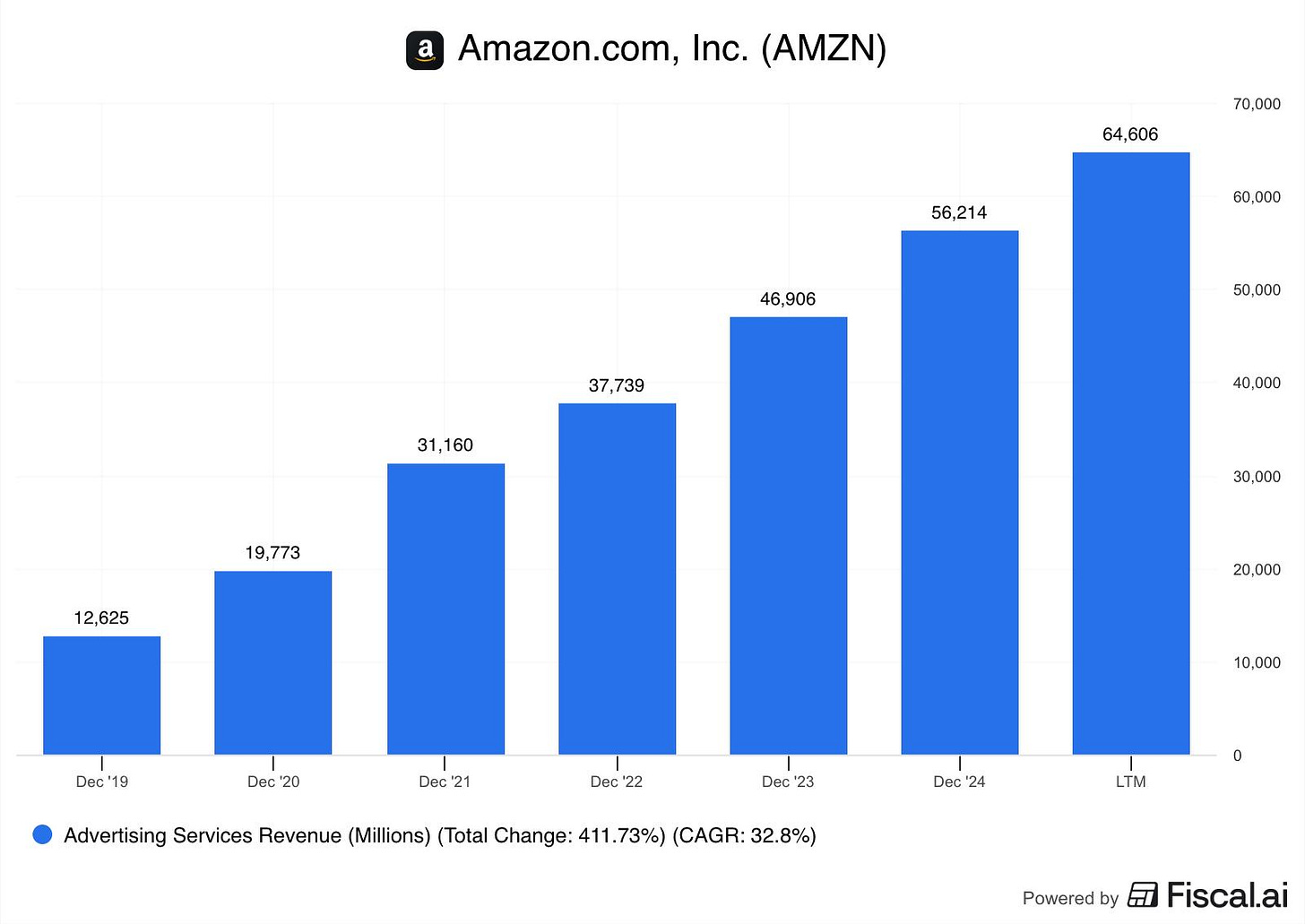

In LTM of Q3 2025, Amazon earned $64.6B from selling advertising. Yes, you read that correctly, this is an extremely huge business!

Since 2019, Amazon has grown its advertising business by 412%, more than 5x in just 6 years!

Whenever a customer searches on Amazon, a sponsored product is usually the first item.

These are very high-intent queries!

A person searching “perfume” is more likely to purchase a perfume than a person walking past a perfume poster at the bus stop. The price a business is willing to pay for advertising depends on the expected revenue generated from said advertising. Dior would be willing to pay a pretty penny to be the first prominently displayed perfume on Amazon, as that would generate significant exposure and sales.

Furthermore, Prime Video, Amazon’s highly popular streaming service, has recently started showing advertising. With its recent NFL, NBA, and NASCAR deals, the company has become a large bidder on live sports events. Live sports bring millions of viewers that Amazon will gladly service with lots of advertising.

I find it quite likely Amazon will earn $100B from advertising in just a few years!

As Amazon’s e-commerce platform grows and Prime Video becomes more popular, the company’s advertising sales are likely to continue growing for many years!

AWS

AWS provides Cloud computing infrastructure services and is the backbone of the modern digital economy.

Large and small businesses used to have their own physical servers in the basement of their offices. Nowadays, that is increasingly becoming a relic of the past. Amazon builds large data centers and rents out its computing capacity.

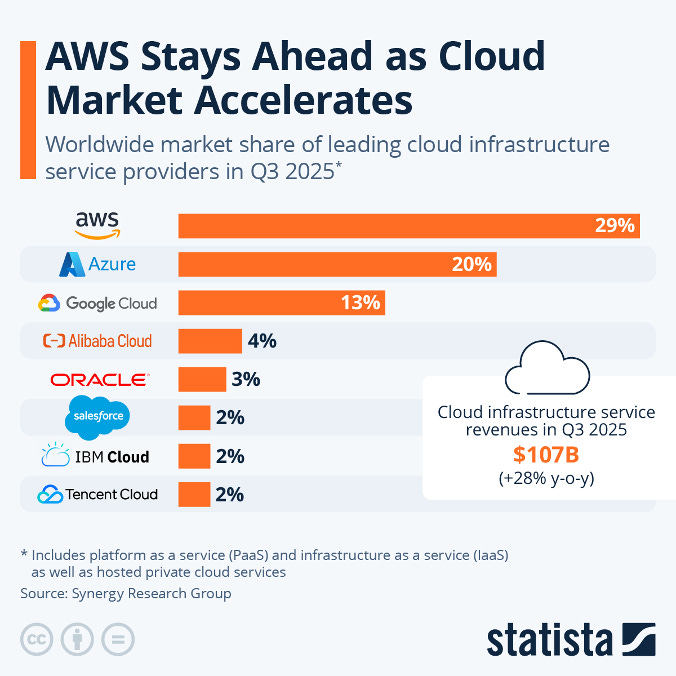

With a 29% market share, AWS is the largest player! Additionally, this scale enables the company to have the lowest operating costs, enabling the highest EBIT margin of near 40%.

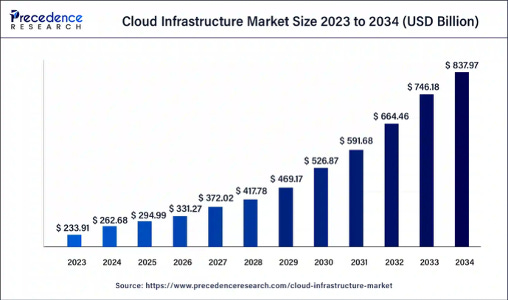

Precedence Research estimates that the cloud infrastructure market will reach $838B by 2034, growing with a CAGR of 12.3%!

Amazon is in a strong market position to remain an industry leader. If their market share decreases to 25%, the revenue would be $210B, compared to $122B in the last 12 months. A 35% EBIT margin would mean an EBIT of $74B. And this assumes Amazon doesn’t grow its cloud services revenues (which they will).

At 20 times EBIT, this segment alone could be worth $1.47T in 2034!

Furthermore, there is an additional opportunity for AWS that comes from AI. The company is aggressively investing in building new data centers to serve the AI computing demands of itself and the AI industry. One of the biggest reasons why AWS has underperformed Azure and Google is that AWS is largely not participating in the OpenAI ecosystem.

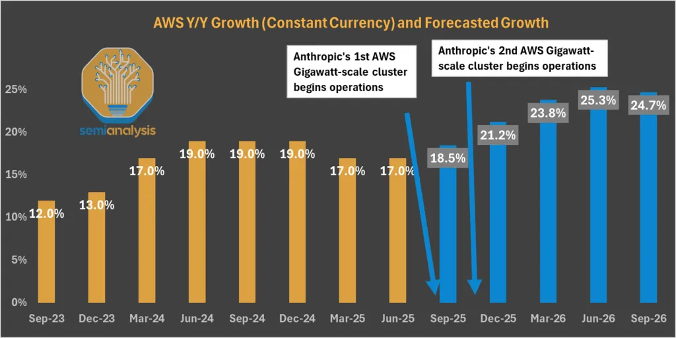

Instead, it has established a deep, long-term partnership with OpenAI’s key rival, Anthropic. AWS will provide Anthropic with purpose-built AI training clusters that will go online soon.

As we can see in the picture above, analysts at the semiconductor research company SemiAnalysis forecast a meaningful acceleration in the AWS growth rate, driven by these Anthropic AI clusters. We saw the beginning of it, with AWS revenue growth accelerating to 20.2% in Q3 2025 from 16.9% in Q1 2025.

In my opinion, the recent bearishness on the future of AWS is not warranted.

Especially, considering that AWS did recently sign a $38B 7-year deal with OpenAI. And while this is not on a scale of OpenAI’s $100B+ deals with other providers, it does signal that the narrative that AWS is losing all these AI deals because their AI services are “subpar” is simply incorrect.

Not only do I find it extremely likely Amazon will reach my 2034 back-of-the-napkin estimates, I also see the company exceeding them. AWS is an innovator in the field, just last year, Amazon spent $53B on AWS capex.

Apart from just providing cloud infrastructure, AWS will undoubtedly expand its cloud computing offerings, with more services for analytics, SaaS, security, and more.

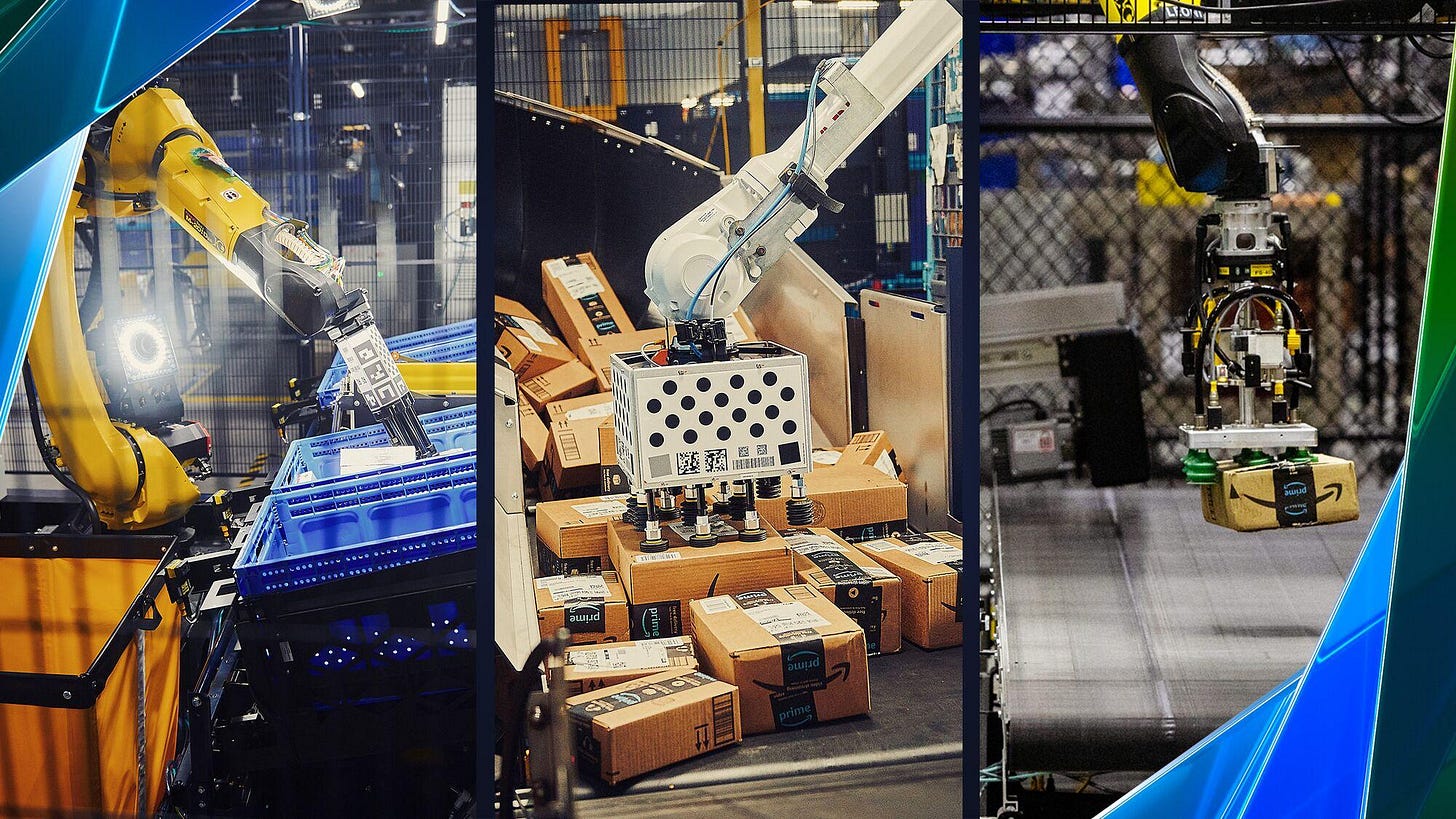

Robotics

There is possibly no company in the world better positioned to benefit from the rise of robotics and AI-driven automation.

Amazon has over 1.2M non-corporate employees worldwide, working as delivery drivers, warehouse packers, customer service officers, and more. Just in the last five years, the company added 400K non-corporate employees, leading to fulfillment expenses reaching $106B.

Now, Amazon is heavily focused on making each of these 1.2M employees more productive, providing them with robotic and software tools to process more packages.

In July, Amazon announced that they deployed its 1 millionth warehouse robot.

As we discussed in the logistics moat section, Amazon is already able to process and deliver packages at superior speeds. As the company deploys millions of robots in its warehouses, its advantage will only increase.

Using the same number of people and warehouse square footage, Amazon will be able to process more packages.

This will result in a lower average cost per package, directly leading to higher margins.

Furthermore, Amazon, through its autonomous driving division Zoox, is working to completely revolutionize driving.

Currently, this division is working on launching a robotaxi for city transport. However, I don’t see why Amazon couldn’t use the same technology in its logistics network. Autonomous driving would enable the company to further drive down costs.

Amazon operates over 70K vehicles in its logistics network.

However, humans need to eat, sleep, and take a break. Machines don’t, so by automating its vehicle fleet, the company could get more out of each vehicle, further increasing its scale and automation advantage.

Conclusion

Amazon is trading for a P/E of 32, which I find to be very affordable, considering their growth prospects.

WS estimates that Amazon’s net income will surpass $102B in 2027, an increase of 73% from 2024! That means that Amazon trades for 2027 P/E of 24!

Amazon is currently at a profitability inflection point!

Their logistics business is allowing the company to service customers with a broad selection of products at an unprecedented speed.

As a result, Amazon’s 3P sales are exploding, enabling higher economies of scale to increase margins.

The advertising business is delivering extremely high margin growth, as Prime Video continues delivering strong numbers and more customers use Amazon’s e-commerce platform.

Furthermore, AWS is set to continue to benefit from the world’s economies digitizing!

But most importantly, the company is uniquely positioned to benefit from automation and the rise of robotics.

For these reasons, I believe Amazon is significantly undervalued and presents an attractive investment opportunity for long-term investors.

Bullish. Shopify

Shopify is THE global e-commerce giant and every retailer’s favorite platform, relentlessly expanding its offering and reach. The company has also become an investor favorite thanks to its 12% (and growing) market share of e-commerce and incredible topline and profit growth.

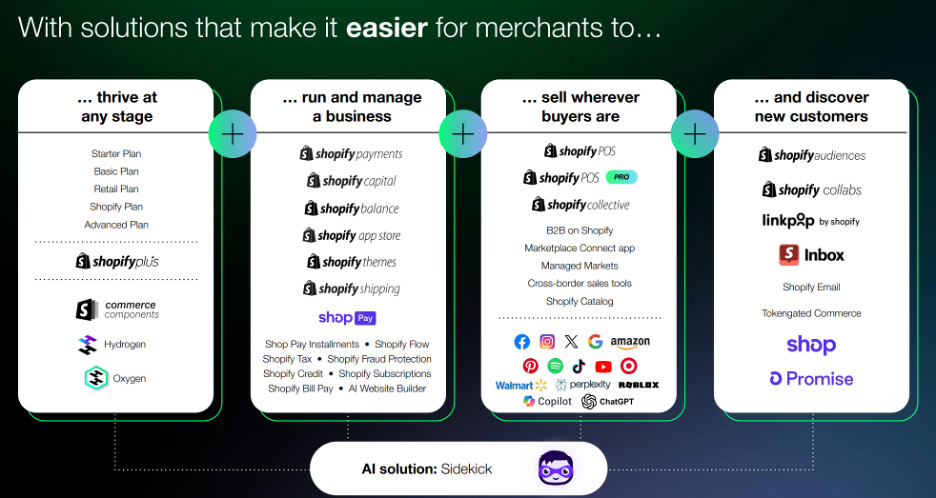

The company generates revenue through two primary streams:

- Subscription Solutions (26% of sales, $2.2bn): Platform subscription, POS Pro, themes, Apps, registration of domain names.

- Merchant Solutions (74% of sales, $6.6bn): Shopify Payments, transaction fees, referral fees from partners, advertising revenue on the Shopify App Store, Shopify Capital, Shop Pay Installments, Shopify Balance, Shopify Shipping, the sale of POS hardware, Shopify Email and Shopify Markets.

Year after year, Shopify has delivered consistent growth through strategic focus on:

- Expanding its e-commerce solution to better serve large and enterprise merchants.

- Adding offline and B2B solutions.

- Adding more merchant services through continued product development

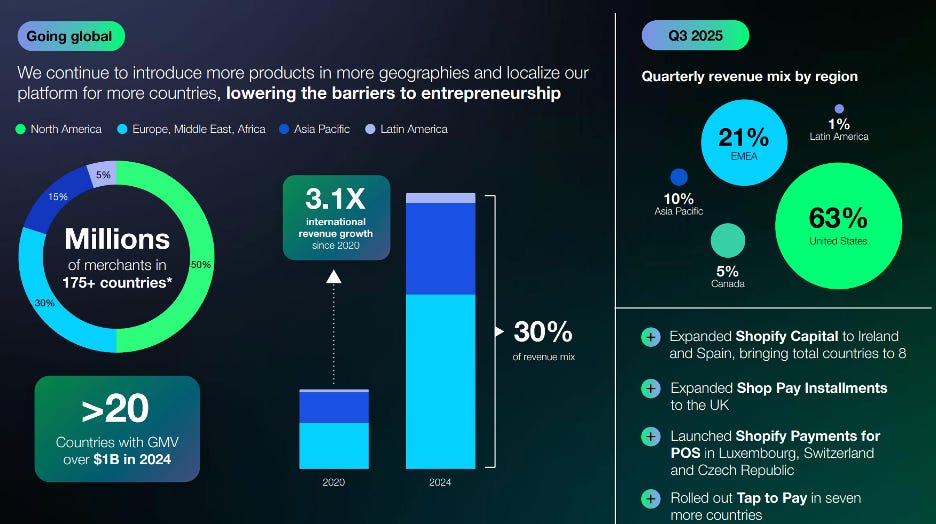

- International expansion.

See Shopify’s dominance live: Just look at its live dashboard during Black Friday weekend ( https://bfcm.shopify.com/ ), its merchants are doing $2m sales and 20k orders per minute with 50m unique shoppers. Shopify is modern e-commerce!

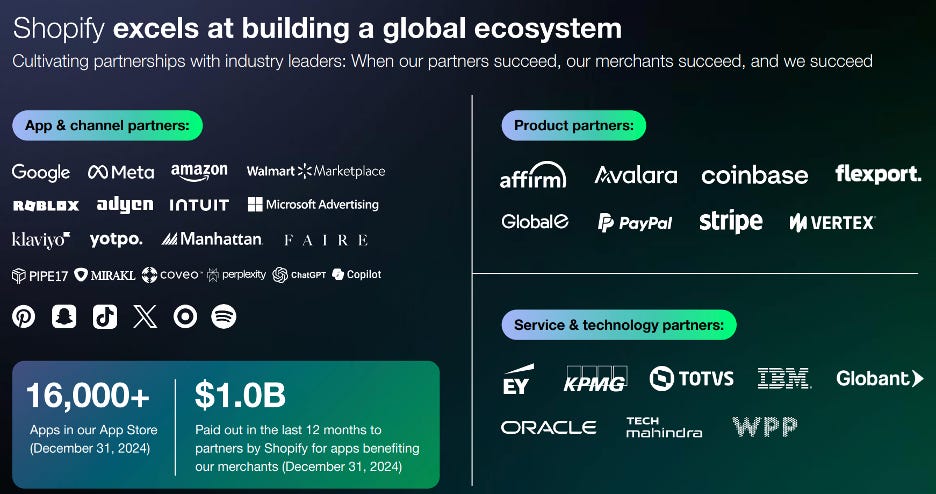

It has also become a leading player in the emerging Agentic commerce space with a structural partnership with OpenAI, helping connect millions of products to ChatGPT.

Shopify is effectively the e-commerce operating system. Investments across agentic commerce, social, enterprise, international, in-store, and B2B have paid off for Shopify and has deepened the moat of the platform. It now boasts >16,000 apps on its App Store, millions of merchants and amongst the most famous brands as its customers. It has quietly become one of the biggest payment services providers.

A rising star with a huge market that it is just starting to penetrate. At the highest level, it is an SMB commerce aggregator. Shopify’s GMV (around $400bn) is 14% of US retail (and 20-25% ex-Amazon), >50% of highly lucrative SMB eCommerce payments, and 5% of merchant acquiring revenue pool (up from <2% in 2019). Shopify is also not only the SMB e-commerce king, it is now conquering enterprise clients, with around 50% of revenues from mid/larger merchants (Shopify Plus), which is growing 2x faster than standard. Shopify Plus merchants now account for the majority of Shopify’s GMV.

Sentiment has significantly improved on the stock throughout the year (post Liberation-day and the tariff announcements) thanks to an accelerating topline quarter after quarter, clearly displaying the company’s impressive ecosystem and execution. This supports a very high EPS growth going forward. The question is now around valuation and what multiple are you willing to put on the company. Its market is still largely underpenetrated, giving the company a tremendous growth ramp for years to come.

Learn why this $200bn e-commerce champion is just getting starting and is one of the best compounders to own for the next decade.

The future of e-commerce

The retail e-commerce operating system.

Why Shopify (vs Amazon for example)?

- User experience:

- Merchant has own website, online business built around it

- Control over own product / sales data

- Brand:

- Control over branding and business outcome

- Directly manage relationship with customers

Shopify’s large and growing opportunity in the largely untapped e-commerce space: Shopify’s global serviceable e-commerce GMV opportunity ex China, Amazon, Apple and Walmart is huge at $1.9tn, which translates into a nearly $60bn serviceable revenue opportunity (growing high-single digits), suggesting Shopify is just 11% penetrated within its serviceable market. Every point of market share is likely worth $600m in annualized revenue. Not bad for a company currently doing $12bn in annual revenue. And we can’t forget the offline retail opportunity that could bring an incremental $60-90bn.

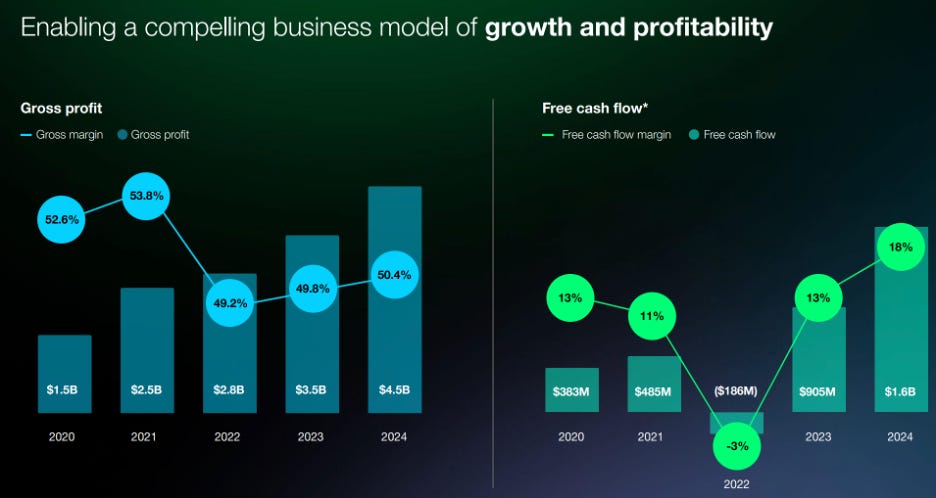

An incredibly broad offering that assures a right to win: Shopify’s R&D investment dwarfs peers’, culminating in an unrivaled array of features and capabilities that keep the company on the cutting edge. There is a clear opportunity to price for value, especially for enterprise clients, and to give a sense of the upside, every $100 increase in monthly fees for existing Shopify Plus merchants could be worth $30m in annualized revenue and profit. Shopify should also narrow its margin gap to similarly sized SaaS businesses (a $300m annual EBITDA opportunity) by leveraging AI (and other efficiencies) while preserving its unique culture and ecosystem. The company’s rising FCF margin (now at 18%) is a testament to the operating leverage built into its model.

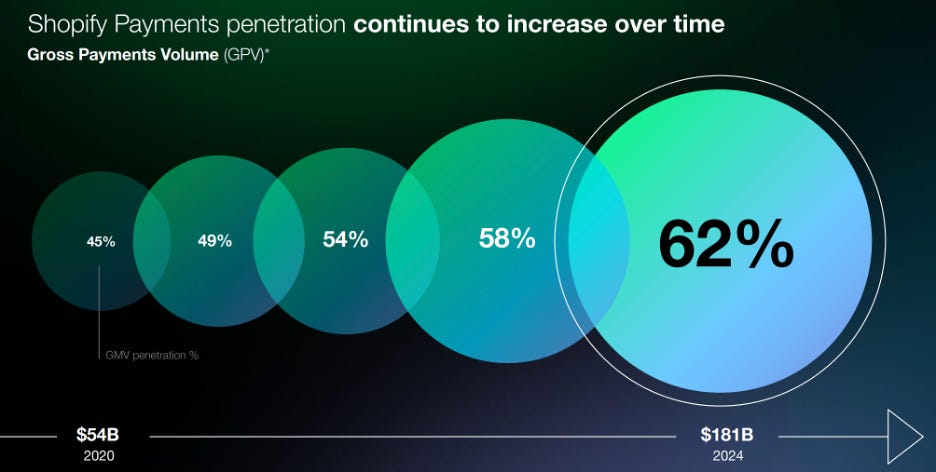

A payments juggernaut

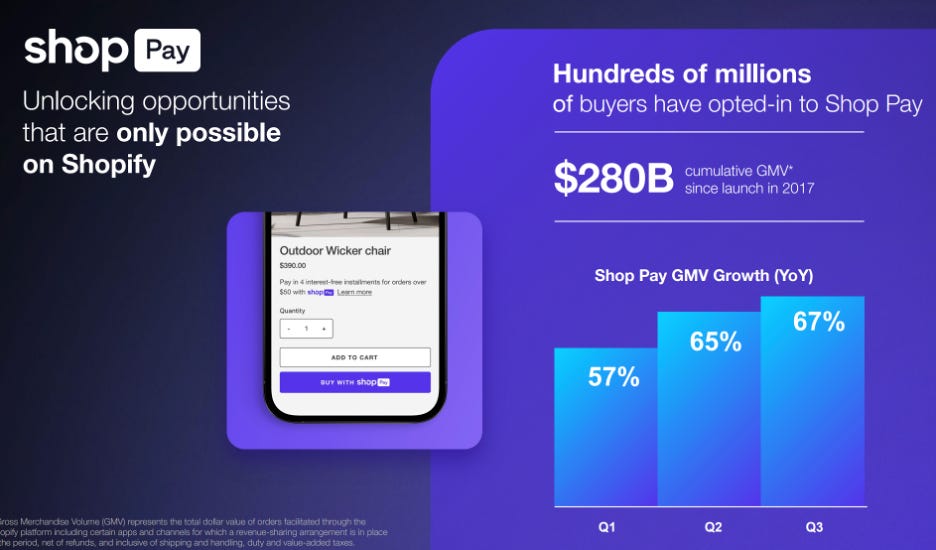

A rising payments giant: top 10 payment services provider growing very fast

Shopify has emerged as a top 10 payments services provider in North America. 74% of its revenues and 57% of gross profits comes from its payments/merchant businesses, up from 41% of gross profits in 2019. >2/3 of Shopify’s GMV goes through Shopify Payments, up from 42% in 2019. The company has expanded payments worldwide with 39 countries now vs 14 six years ago. In its most mature markets payments penetration is >90%. It has also developed a comprehensive suite of products in embedded finance like Shopify Capital, Installments, Markets, Banking, Taxes, Cards. Shopify has also been one of the earliest adopters of Stablecoins.

A Paypal killer with the best converting checkout on the internet: Challenging Paypal by aggregating SMB commerce but also with its Shop Pay button (likely to cannibalize share from Paypal’s share). Shopify is not only an important distribution partner for Paypal for its SMB business and a client for its unbranded processing, but it is capturing more of the transaction’s economics than Paypal thanks to its branded Shop Pay. Shop Pay is now $75bn in volumes (in 2024, nearly half of Shopify powered transactions), up 48% CAGR vs. 2021, small compared to $500bn for PayPal branded in 2024 but growing an order of magnitude faster (57% vs. MSD).

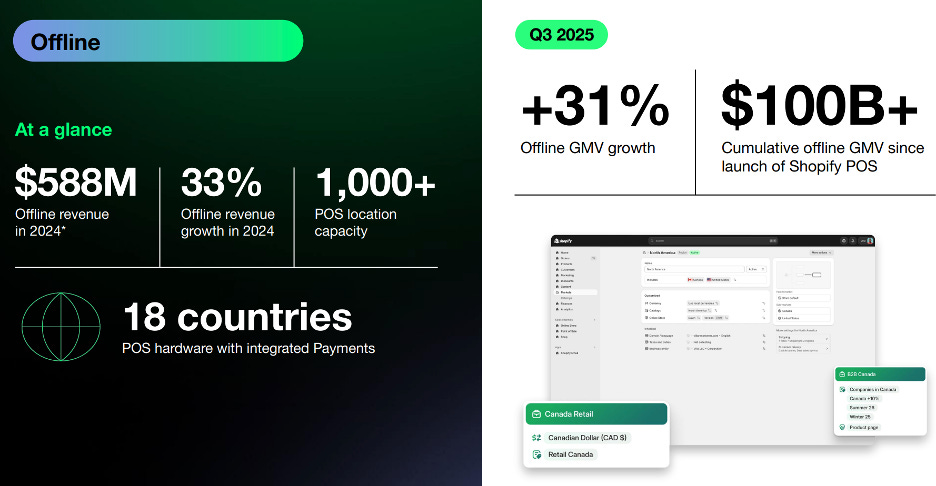

Making inroads in-store: It also has a strong in-store business ($20bn, 12% of the business, half of the size of Clover and Square) growing >25% CAGR (vs MSD-DD% for its peers).

A growth machine

Growth is only accelerating and margins are stellar, reflecting the company’s incredible moat.

Growth Strategy:

- GMV growth: grow merchant base + grow merchants’ revenue.

- Take rate expansion: innovation and expansion of platform + grow ecosystem + cross-sell.

A unique compounder: The company should continue to grow >25% over the next 5 years and around 20% for the next 15 years. Very few companies have this growth runway in front of them.

Quarter after quarter, Shopify is delivering consistent and durable growth. Throughout 2025, revenue growth accelerated from 27% in Q1 to 31% in Q2 to 32% in Q3, while FCF margin continued to expand from 15% in Q1 to 16% in Q2 to 18% in Q3 each quarter.

This steadily strong performance is a testimony of how well the company executes and how strong Shopify’s moat is. Management cited that every 26 seconds, a new entrepreneur makes their first sales on Shopify, simply mind blowing.

The Agentic AI play

Shopify is perfectly positioned for the emerging Agentic commerce.

Shopify’s partnership with OpenAI further underscores its central role in the upcoming age of Agentic commerce. They are seeing overall Al driven traffic to Shopify increased 7x, and they are optimistic the partnership with OpenAl opens up new service areas.

Agentic Al in e-commerce is coming and coming fast: Traffic from GenAl sources increased >1,200% yoy (off a very small base) and consumers were 16% more likely to convert on retail sites vs. non-Al sources (paid and organic search, email, social media).

Companies like ChatGPT, Perplexity, Google, and Copilot, are integrating Al to streamline shopping experiences. These platforms could potentially disrupt traditional e-commerce models, including Amazon, by offering more efficient and consumer-friendly shopping experiences & he also discussed the potential implications for advertising and the future of individual websites.

Al monetization without heavy Al capex, driving significant increase in revenues: Shopify’s exclusive (alongside Etsy) partnership with OpenAl’s ChatGPT creates a new Al-native sales channel with the potential to annualize at multi $10bn in sales and possibly >$100bn in sales. Unlike the Magnificent 7, which are committing hundreds of billions to Al capex, Shopify can monetize this channel without material investment, making incremental Al-driven revenue highly accretive to free cash flow.

E-commerce acceleration and Shopify share gains: With >800 million weekly active users, ChatGPT has the potential to help accelerate the migration of functional and lifestyle categories further online, where Al acts as a virtual advisor. Shopity’s early access positions it to capture incremental small merchants and strengthen enterprise adoption. This could add an incremental >$30-50bn in Shopify volumes by 2027. It is very difficult to estimate the potential of Agentic commerce for Shopify, but its rising importance in e-commerce and breadth of merchants (from entrepreneurs to the largest retailers in the world) coupled with its breadth of services, make it a big winner in this new way of shopping that is emerging.

Conclusion

Shopify is a massive AI winner but commands a large premium due to its unique growth profile, recurring nature of its revenue and consistent execution.

Shopify is starting to become expensive at around 85-90x NTM PE (vs high of 105x in 2025), up from 45-50x during the trough in March/April 2025 post tariff scare. This is explained by the company being in a hypergrowth phase (significantly outpacing retail and e-commerce growth) delivering >30-35% growth over the next years, having incredible visibility thanks to its very large SAM (still largely unpenetrated) and extending its e-commerce dominance through unparalleled innovation. It is a truly unique company. Shopify doubled its NTM EPS in 3 years from $0.9 end of 2023 to $1.8 today

Look for pullback for this unique compounder: However, investors should look for pullback in the shares (usually linked to fears around weakening consumer spending/sentiment) to find more attractive entry points.

What could drive further upside for Shopify?

- Further share gains (from low teens to mid teens/20% towards end of decade): Shopify could continue to outperform in B2B commerce, international expansion, and platforming large omnichannel enterprise merchants. This would drive higher topline growth. Shopify could reach mid teens in global e-commerce share (and 20% in the US) by 2027-28 up from low teens today. The company has recently been gaining share in Europe and the large enterprise migration to Shopify is a big tailwind that will last for many years, this is still early days.

- Strong operating leverage (operating margins from mid teens toward 20% by end of decade): With robust topline growth, investors will likely start focusing more on Shopify’s ability to drive operating leverage. Given the company’s scale, improving attach rates on higher-margin services and continued cost discipline should lead to margins a few hundreds bps higher (vs 16.7% operating margin in 2024). In the next few years, there is additional margin expansion potential from automation, infrastructure optimization, and deeper monetization of Shopify Payments, positioning the company for steady operating income growth.

Here is what my Premium Members can expect:

Portfolio Review - Each month, I will present the portfolio performance and discuss my stock watchlist and my best ideas.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on semi-monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Equity Research Report List

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Great post, gentlemen. Congratulations on the work!!!

I couldn't choose so I own both in my long/term account 😇