Eli Lilly vs Novo Nordisk!

Part 2 of this Stock Battle.

Last November, I wrote a report for my Stock Battles series where I compared Eli Lilly and Novo Nordisk. At that time, both companies were some of the hottest stocks on the market thanks to the explosion of GLP1s. (I highly recommend this report, which I think really concisely explains the businesses of both companies.)

$LLY was up 559% in 5 years at the time of the report.

$NVO was up 255%.

Since then, their fates have diverged dramatically!

Novo’s stock has collapsed in a spectacular fashion, falling 56%. Their CEO was fired, and the company keeps issuing lower and lower guidance and dealing with setback after setback.

Meanwhile, Lilly is going from strength to strength, rising 44%, and briefly becoming the first non-tech $1T company.

So, what happened?

I concluded that Lilly vs Novo report with the following assessment:

“Novo Nordisk trades for a cheaper valuation, however, Lilly is growing quicker and is set to become a larger and more profitable company than Novo.

Investors need to choose between a premium valuation, higher growth, and more diversification of Eli Lilly and a more concentrated GLP1 business with less debt, higher dividends, and buybacks, trading at a more reasonable valuation. “

Novo is a concentrated GLP1 business, and while that worked well from 2019 to 2024, it experienced severe issues in 2025, and this was the primary cause of this spectacular collapse.

In this report, I will look at what happened to Novo’s GLP1 business and where it is going in the future.

Can Novo Nordisk challenge Eli Lilly, or are they doomed?

Additionally, I will compare the valuation of both companies.

1. Novo Nordisk’s Issues

2. Eli Lilly

3. Effectiveness Race

4. Valuation

5. Conclusion

1. Novo Nordisk’s Issues

Novo Nordisk is largely a GLP1 company. At the time of writing the previous report 93% of their total revenues were generated by the Diabetes and Obesity segment.

The rare disease segment, which was responsible for the remaining 7% has been performing poorly for years, despite lots of efforts and significant investment to turn it around.

This means that GLP1s were the only growth area of the company, and thus, as revenue growth collapsed, so did the stock price.

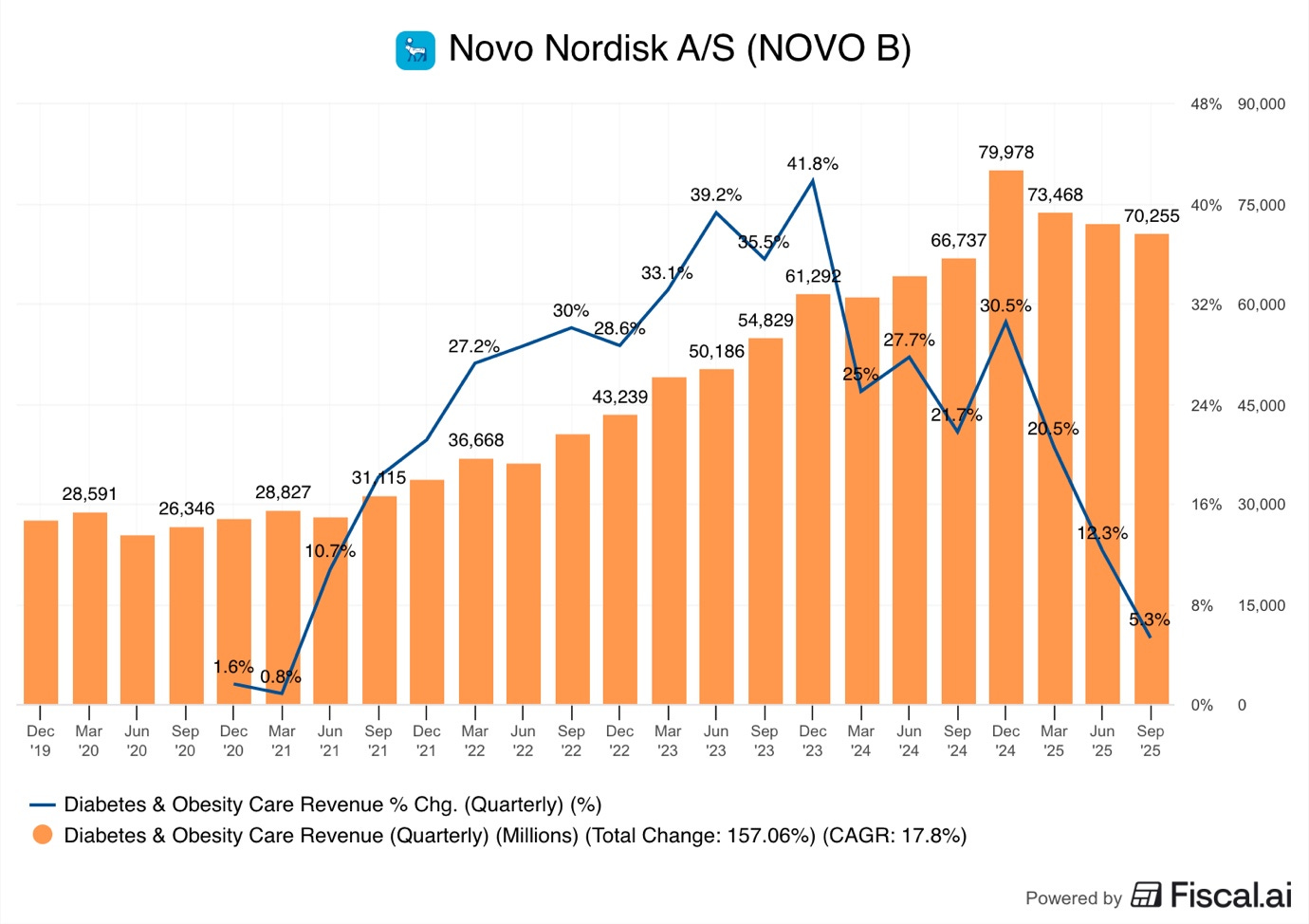

As we see in the graph above, Diabetes and Obesity revenues peaked in Q4 2024 at DKK 80B and showed 30.5% Y/Y growth. This was driven by the continued 12.6% sales growth of Ozempic and the production ramp-up of Wegovy, which reached sales of DKK 20B, growing by 107%.

By Q3 2025, Y/Y growth had plummeted to a mere 5.3%, and sales actually declined by 12.2% from Q4 2024.

This was caused by Wegovy sales growth collapsing to just 17.6% in Q3 2025.

In addition to competition with Eli Lilly, Novo is underperforming largely because of these factors:

Operational failures

Semaglutide shortage

Compounding competition

Regulatory pressure

Potential tariffs

Novo Nordisk’s operational failures didn’t allow it to capitalize on its strong first-mover advantage in the GLP1industry. When Ozempic became a media sensation, the demand for this highly effective medicine exploded. But the company was too slow to ramp up manufacturing. The active ingredients were never the issue, as Novo was able to easily procure the necessary chemicals. The bottlenecks were the drug delivery mechanism.

Both Ozempic and Wegovy use specialized, single-use injectable pens you can see in the picture above. These require sterile assembly and regulatory sign-off, making scaling pen output difficult, needing years, not months.

Simply put, Novo underestimated just how fast obesity demand would explode!

This weakened their negotiating hand with insurance companies, governments, and distributors, as they were not willing to commit to a drug that the company couldn’t guarantee would be delivered in the desired quantities. Most importantly, it left space for Eli Lilly to come in, but we will expand on them later.

Not only did Novo’s inability to meet the demand led to them losing billions of dollars in potential sales, but it also directly pushed the US government to declare a Semaglutide shortage, creating a compounding boom.

The US Food and Drug Administration (FDA) has the power to declare a certain drug in shortage. The FDA did so for Semaglutide in mid-2022, and this designation pauses patent exclusivity of a drug, enabling compounding pharmacies to create and sell copies of it.

A compounding pharmacy is like a small niche drug manufacturer. Under normal circumstances, it focuses on manufacturing relatively small quantities of drugs for specialized cases where a patient can’t take a mass-produced drug due to some medical condition. Ordinarily, such a designation would lead to a few compounding pharmacies manufacturing a relatively small number of doses.

Yet, this time, because of the extreme demand for Novo’s Semaglutide GLP-1s, the designation created a frenzy, leading to millions of compounded doses, creating a multi-billion-dollar opportunity for compounders.

The largest and most well-known opportunist was the telehealth company Hims and Hers. They used the shortage as a huge marketing and customer acquisition opportunity, earning $225M from GLP1s in 2024, with a goal for that to increase to $725M in 2025.

The exact figure is impossible to quantify, but the total losses to Novo Nordisk from the shortage are likely many billions of dollars!

Furthermore, one of the largest issues for Novo coming out of this shortage is that compounding has completely reset the pricing expectations for the industry, directly driving regulatory pressure to reduce prices. You see, because these compounding pharmacies didn’t need to spend years and billions of dollars to develop and market the drug, they could sell it for significantly cheaper than Novo Nordisk.

Furthermore, companies such as Hims and Hers ran multimillion-dollar marketing campaigns, emphasizing the “safety of compounded semaglutide” and significantly lower $150-200 p/m price compared to around $1,000 that Novo was charging at the time.

Novo’s price was always going to come down, but as patients’ and doctors’ expectations were lowered down to $200, Novo couldn’t reduce the price more gradually over the years, to $800, $600, $500, and then to $300.

These reset lower price expectations created immense pressure from the public and the regulators to do something, culminating in an agreement with the Trump administration.

Novo will provide discounted GLP1s to the US government programs, Medicaid (low income), and Medicare (elderly), from as low as $149 p/m in some cases, to $300 p/m. This is a significant discount to the $500-1000 p/m currently. Some analysts expect that this deal alone will decrease Novo’s 2026 revenue growth rate by 1-3 percentage points.

Lastly, another factor affecting the stock was the risk of Trump’s tariffs as a result of his trade war with the world. Novo Nordisk largely manufactures outside the US, so it would be heavily exposed to any tariffs that Trump would implement. As always, Trump is unpredictable and inconsistent in his rhetoric. The latest trade deal with the EU has set the tariff at 15%, but again in September, Trump threatened to put a 100% tariff on all pharma imports. So it seems that the tariff uncertainty cloud will continue affecting the company.

There are two smaller factors that I believe created additional pessimism and also pushed the stock down: 1) Trump’s attacks on Denmark, and 2) Novo’s idiotic Canada patent mistake.

Most people have probably heard in the news that Trump wants Greenland, which is a part of the country of Denmark. This has created fears that Trump will try to exert pressure on Denmark by attacking Danish companies operating in the US. These fears were proven right when, for a made-up nonsense reason, the Trump administration revoked a license of an offshore wind farm project in New Jersey, developed by the Danish company Orsted. Trump ended up losing a lawsuit, and the project continued, but fears remain.

The second point that clearly shows the incompetence that could have been a key factor in the Novo CEO’s firing is the lost Canadian patent. Under Canadian law, maintaining a patent requires a small annual maintenance fee of a few hundred dollars.

Novo Nordisk forgot about it, missed all deadlines, grace periods, and reminders, thus losing Canadian patent protections for Semaglutide.

This mistake will cost the company billions of dollars in lost sales in Canada.

Such a mistake should not be possible at a multi-hundred-billion-dollar company, and has significantly damaged institutional investor trust.

2. Eli Lilly

Meanwhile, Eli Lilly has executed spectacularly, enabling it to briefly reach a $1T market cap.

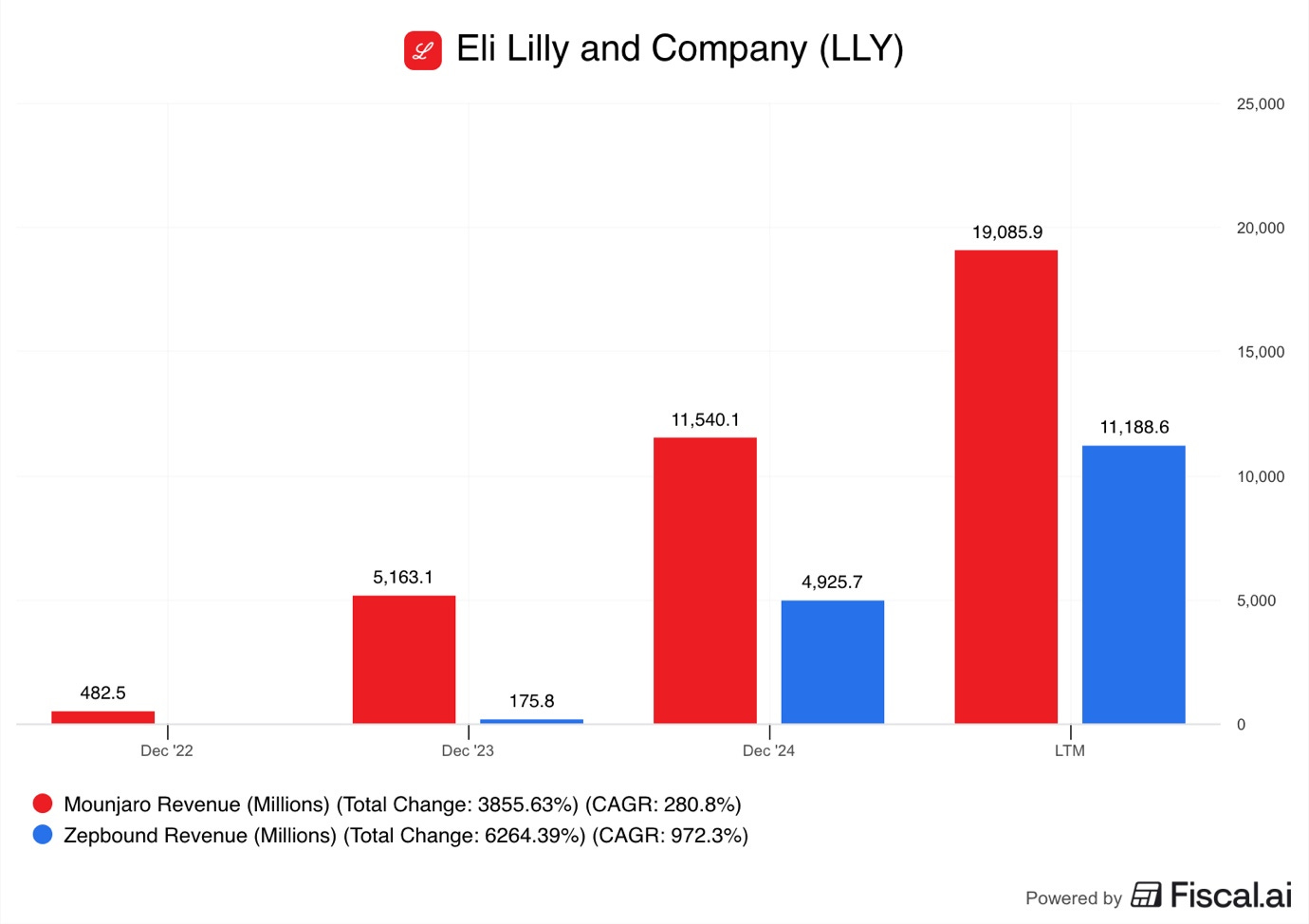

This performance has been driven by the spectacular growth of its GLP1 obesity drugs,

Mounjaro LTM sales reached $19.1B in Q3 2025, while Zepbound passed $11B!

However, Lilly’s GLP1 medicines don’t use Semaglutide, rather, they are built on Tirzepatide. This means the consequences of the FDA declaring a Semaglutide shortage had no direct effect on Lilly.

While the FDA also declared a Tirzepatide shortage, the effects on this designation were not as dire for Lilly as they were for Novo Nordisk.

Key reasons were:

Lilly lacked brand familiarity

Operational readiness

Duration of the shortage

Being a US company

Not always being the first on the scene comes with first-mover advantages.

When Ozempic went viral in the media because of celebrities such as Kim Kardashian allegedly using it for weight loss, the demand exploded. While that drove sales and enabled Novo to demand a high price, it also pushed the government to increase the supply and reduce prices, thus, the FDA declared a shortage.

When compounding began, the demand for Semaglutide was significantly greater than for Tirzepatide, because the latter lacked brand familiarity. Everyone knew Ozempic and wanted to get their hands on it.

Companies such as Hims and Hers actively marketed that they were using the same ingredient as Ozempic, directly aiming to monetise the brand that Novo Nordisk had built. Nobody was advertising a compounded Tirzepatide as “the same ingredient as in Mounjaro”, as the brand familiarity of it was nowhere on the same scale as Ozempic.

It also cheapened the Ozempic and Wegovy brands. Why would someone pay full price if there are compounded products for less than half the price?

Lilly could position Mounjaro and Zepbound as the premium product.

Furthermore, another advantage that Lilly perfectly capitalized on was that sometimes, companies that launched their products later learned from competitor mistakes.

Thus, Lilly planned to scale their manufacturing from day one.

The company saw Novo struggle with injection pen manufacturing, so they invested early to increase capacity. Lilly entered into production partnerships with contract manufacturers to increase capacity, while Novo began building a new site in North Carolina for $4.1B. This is a slow process, and Novo plans to start production in 2027 and finish the site in 2029.

Lilly realized that their core competency is drug discovery, marketing, and distribution, not manufacturing.

By outsourcing that task, Lilly might give up some margin, but it enables them to scale up and down production significantly faster. Moreover, using contract manufacturers also allowed Lilly to expand geographically, thus implementing regional redundancy. This means that the company is better suited to handle supply chain issues or trade tensions.

Lilly’s overall approach to manufacturing enabled it to scale much faster, giving the FDA the confidence to end the Tirzepatide shortage earlier. The Semaglutide shortage lasted for 3 years, from early 2022 to early 2025, while Tirzepatide lasted for just less than 2 years, from December 2022 to October 2024.

This might seem trivial, but it isn’t. The longer a drug is in shortage, the more compounders begin creating it. So, each additional year in shortage leads to more lost sales than the previous. Additionally, many compounders continue selling the drug after the shortage is over, requiring the patent holder to seek the help of the courts to stop it. Novo Nordisk has filed hundreds of lawsuits to stop compounders, whilst Lilly has filed a fraction of that.

Lastly, as a US company, Lilly enjoys significant advantages in this economy where Trump actively attacks foreign companies to benefit US businesses. The US is by far the largest Obesity treatment market, and Lilly is better positioned to serve it than Novo Nordisk, both through a larger US manufacturing network and a better relationship with the current US administration.

While Eli Lilly also participated in the Trump agreement, agreeing to lower the price for Zepbound to $299 p/m for Medicaid and Medicare and $399 for cash patients. The consequences of it will be lower, because the company’s supply chain and manufacturing system are better suited for high-volume manufacturing than Novo’s.

3. Effectiveness Race

There is another factor at play that I thought would be better discussed on its own, and that is the effectiveness of the GLP1 treatments of both companies.

Both companies are engaged in an effectiveness arms race!

It could be that the industry is past the beginning stages, where all GLP1s had strong demand as patients and doctors were happy that, finally, there was an effective obesity treatment. We could be entering a cyclical stage, where a one player releases an updated drug that has the highest effectiveness, leading the other to underperform for a year or two, until it releases a more effective drug.

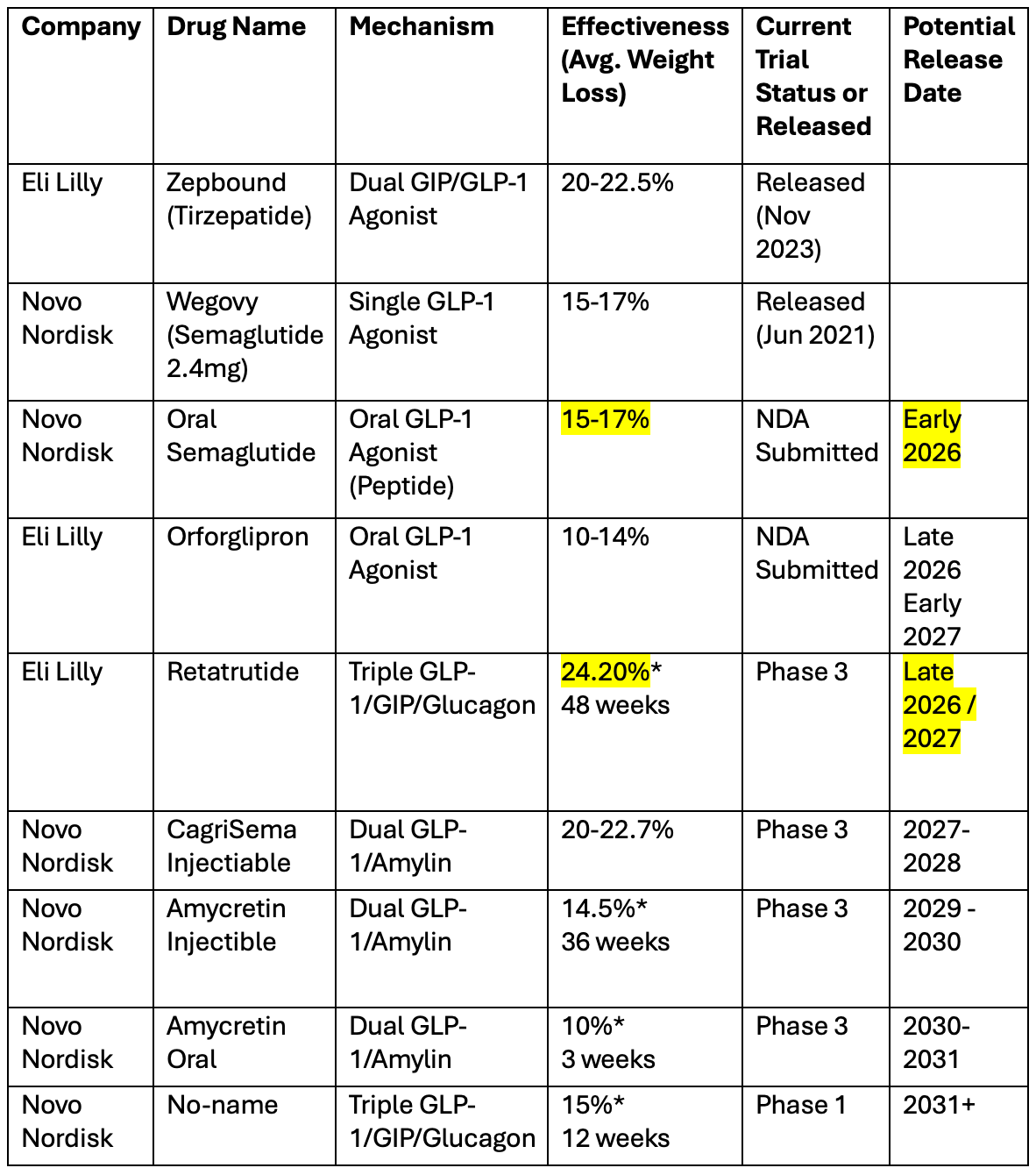

It seems that Lilly is in the lead now!

The chemistry of its drugs is a bit different from Novo’s. Tirzepatide utilizes a dual mechanism that combines GLP-1s with GIPs. To not get too technical, GIP is another hormone that helps regulate insulin and glucose. Simply put, combining GLP1 with GIP enables Lilly to use the complementary effects of each to improve the effectiveness of a drug.

Clinical trials have demonstrated that Mounjaro and Zepbound are superior to Ozempic and Wegovy.

In a head-to-head Surmount-5 trial, researchers enrolled 751 adults with a BMI index of over 30, or excess weight of at least 27kg. These participants were randomly split into groups, with one group being given Zepbound and the other Wegovy. After 72 weeks, the results were compared.

Wegovy patients lost 13.7% of their body weight, an average of 15kg.

Zepbound patients lost 20.2% of their body weight, an average of 22.8kg.

This trial demonstrated that Zepbound is 47% more effective on average than Wegovy. Furthermore, the drug was more effective on the extremes, with 31.6% of patients losing more than 25% of their body weight, almost double as much as 16.1% on Wegovy.

These are undoubtedly superior results.

However, Novo Nordisk already has a response ready in CagriSema.

This is the next-generation injectable that, similar to Zepbound, uses a dual mechanism combining GLP1 with another agent. Novo will use Amylin, a satiety-regulating agent that is meant to be appetite-suppressing. Initial phase 2 trials showed results of around 20% weight loss, matching or potentially improving on Zepbound. Novo Nordisk is currently doing head-to-head trials to compare the efficacy against Zepbound.

CagriSema could be released in the next 1-2 years.

After CagriSema, Novo plans to release an even better drug called Amycretin.

Amycretin is an injectable that will also use a dual mechanism that combines GLP1 with Amylin to have an increased appetite-suppressing effect. However, it will use a different chemical composition that delivers the two hormones, GLP1 and Amylin, through a single molecule, while CagriSema uses two molecules. This new chemical method could make the drug easier for the body to absorb, thus making it more effective.

Early trials showed a 14.5% weight loss after just 36 weeks, indicating that after 72 weeks, the results could potentially be significantly better than Zepbound’s result of 20%.

Amycretin could be released in the next 3-4 years.

Novo is also working on the next-generation triple mechanism drug that combines GLP1, GIP, and Glucagon. The third element has increased energy expenditure qualities, which would cause the patient to also burn more calories. The first trial showed a 15% weight loss in just 12 weeks. However, this was a very small trial of just 36 people. So there is still a lot of work before the drug can be released, making this a 2030s story.

Obviously, Lilly is not standing still, and they have a pipeline of next-generation drugs as well. The company wants to keep the efficacy lead Zepbound has, thus, they are also working on a triple mechanism drug called Retatrutide.

Just as Novo’s triple mechanism drug, Retatrutide, combines GLP and GIP with the calorie-burning Glucagon. The latest research showed patients losing an incredible 24.2% of weight after just 48 weeks.

While the effectiveness of Retatrutide seems similar to Novo’s 3 mechanisms drug, the fact that I keep referring to it as a 3 mechanisms drug because it doesn’t even have a name, is a clear indication that Lilly has a huge lead.

Retatrutide is currently in phase 3 trials, which means that it could be available to patients in late 2026 or 2027. Likely giving Lilly a 3–4-year advantage before Novo would be able to counter them.

What we have discussed so far are just the injectables. Both companies are preparing to start the oral pill race.

It is expected that GLP1 pill treatments will become bestsellers.

This is as while oral pills are less effective, and have comparable side effects, they are easier and more convenient to take, and are a more acceptable form of treatment for patients who prefer pills over injections. A core problem for all medical treatments is adherence to the prescribed schedule. Patients often forget to take the medicine or stop taking it due to discomfort or side effects. Pills have significantly higher adherence than injectables, thus making them better suited to have a sustained long-term result.

Novo Nordisk is planning to release an oral Semaglutide pill nicknamed oral Wegovy.

A trial showed that a 25mg oral Wegovy led to a 13.6-16.6% weight loss after 64 weeks, while a 50mg dose led to a 15.1-17.4% weight loss.

At such a dose, the results are comparable to the injectable Wegovy, positioning it for great sales.

After oral Wegovy, Novo plans to release an oral version of Amycretin, which, in a recent trial, delivered a 10% weight loss in 36 weeks in patients with type 2 diabetes. This is a really strong result so early in the trial. Furthermore, it indicates that a dedicated higher dose for obesity treatment could achieve an even better result.

To compete with Novo’s oral treatments, Lilly is planning to release Orforglipron. This is not an oral version of Lilly’s highly successful Zepbound, rather, it is a single mechanism GLP1 drug, not a dual mechanism. An oral Zepbound is still in development, thus many years away from a potential release.

The trial results show that Orforglipron efficacy is below oral Wegovy, delivering 10.5-12% weight loss in 72 weeks. However, the advantage is that it uses a simpler chemical structure, and thus has a less strict dosing regimen and usage instructions. Making the intake slightly more convenient.

Oral Wegovy could be released next year, whilst Orforglipron 6-12 months later.

This would give Novo Nordisk a slight first-mover advantage, but as we are observing currently, the company has a history of failing to fully capitalize on it. Novo Nordisk investors hope that the company has learned from their mistakes and is better prepared this time around.

In the table below, I have summarized the current situation.

In short, Novo has a slight advantage in oral, with a slightly more effective drug that will come on the market a bit sooner.

Lilly has a strong advantage in injectables today, with Zepbound being 47% more effective. And the worrying thing for Novo is that by the time they release CagriSema, which is of similar effectiveness to Zepbound, Lilly could have already released the next-gen triple mechanisms Retatrutide that is already more effective than CagriSema.

It doesn’t seem plausible that Novo’s Amycretin, which is released after CagriSema, will be more effective than Lilly’s Retatrutide, and Novo’s response to it will only come out in the 2030s.

It doesn’t seem likely that Novo has a realistic shot of challenging Lilly in the injectable effectiveness, as it is one generation behind.

However, more data is needed to conclude that 100%. As always in pharma, there are unforeseen consequences, and either company might underperform expectations.

4. Valuation

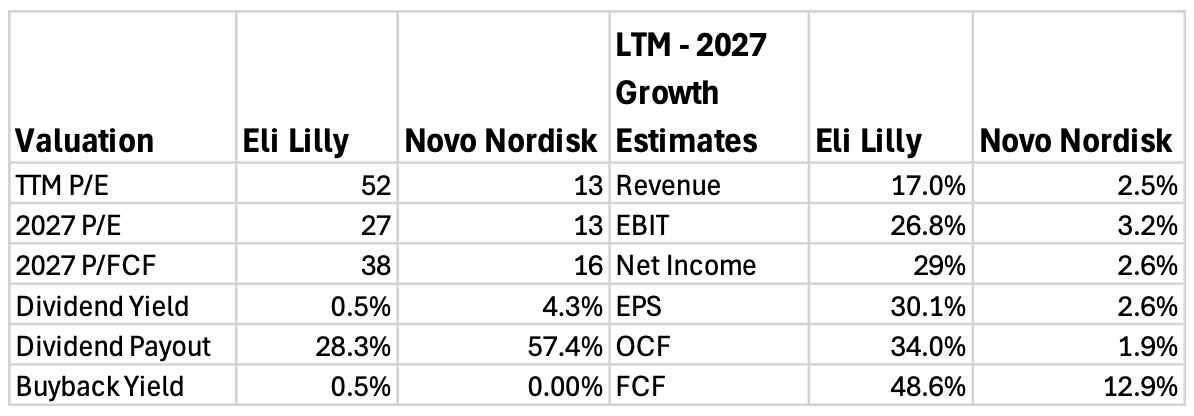

As a result of all the factors mentioned in the report, Novo Nordisk’s stock has collapsed by 56%, while Eli Lilly has risen 44%. And this divergence is clearly visible in the table below.

Novo Nordisk trades for a quite affordable TTM P/E of 13, largely because analyst growth expectations have collapsed.

Last year, analysts were expecting that Novo’s 2026 revenues would be around DKK 404.5B, but now the expectation is DKK 310.1B, a decrease of 23.3%.

Looking at forward revenue growth estimates, the current P/E of 13 seems perfectly fair, as analysts expect the company to only grow revenue, earnings, and OCF by about 2.5% per year. While FCF is set to grow by a stronger 12.9% CAGR, simply because Novo will cut back on capex.

These are extremely weak expectations.

And this is the core of the current Novo Nordisk bull thesis. Analyst expectations tend to swing widely and be a year late. This means that when optimism comes because of a new product, they often overestimate potential revenue growth, and miss when changing business reality leads to lower sales, as just now with Novo Nordisk. At the other extreme, analysts often overcorrect their mistakes and project lower sales, expecting underperformance to continue.

If Novo Nordisk delivers even a modest improvement, delivering a 5% CAGR, the stock could increase 50% simply by multiple increasing a bit.

For that to happen, there must be a good adoption of the Oral Wegovy, and the rest of the core business must not deteriorate further. If growth increases even to 8-10%, then the stock could very likely double or triple in a relatively short amount of time.

Meanwhile, Lilly trades for a premium TTM P/E of 52, due to strong growth expectations.

Analysts expect Lilly to grow revenue with a 17% CAGR in the next 2 years, and unlike Novo, whose margins will be flat, Lilly’s margins are expected to increase. Earnings are forecasted to grow with a 30% CAGR, while OCF and FCF will grow even faster.

This means that Lilly trades for a 2027 P/E of 27.

Another thing that I hate to see is the lack of share repurchases done by Novo Nordisk.

European companies tend to prefer dividends over buybacks, which is less tax efficient and doesn’t increase EPS. A US company in such a situation, trading for an incredible low multiple that Novo trades for, would aggressively ramp up share repurchases.

Instead, Novo has completely paused their share repurchase program and has increased their dividend by 50% in 2025.

And for the life of me, I don’t understand why they would do something like this.

The company is very profitable and FCF positive, generating $10B in FCF, with cash reaching $6.6B on the balance sheet. Furthermore, the debt ratio is only 20%, giving the company ample room to raise debt.

They should have kept the dividend flat and borrowed $5B to repurchase $10B of shares, around 5-7% of the company.

5. Conclusion

Novo Nordisk’s underperformance is the result of operational mistakes and strategic errors, encapsulated by the embarrassing mistake with the Canadian patent. While it is true that nobody could have foreseen how popular Ozempic and Wegovy would be, the company should have acted more swiftly to ramp up production.

Their focus on vertical integration over contract manufacturing likely cost them their lead.

At the same time, we have to give credit to Eli Lilly, who executed perfectly, ramped up production early, and thus were able to end the Tirzepatide shortage much earlier. Furthermore, Zepbound is a great product that is 47% more effective than Wegovy. This advantage is clearly helping the company sustain sales momentum.

Furthermore, looking at their GLP1 pipeline, Lilly is in a great position to increase the sales gap with Novo Nordisk.

By the time Novo releases CagriSem, their answer to Zepbound, Lilly will have already released their next-generation triple mechanism treatment, Retatrutide, which is superior. Novo’s next possible answer to Retatrutide, Amycretin, will be released 2 years later, giving Lilly a large lead.

In conclusion, an investment in Novo Nordisk is a bet on the company turning around its business and returning to strong growth.

Meanwhile, an investment in Eli Lilly is a bet on them keeping their efficacy leadership and continuing to grow much faster than Novo Nordisk.

In the report below, I made 2030 Valuation models for each company and then compared them to determine which is the better buy at today’s valuation.

Here is what my Premium Members can expect:

Portfolio Review - Each month, I will present the portfolio performance and discuss my stock watchlist and my best ideas.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on semi-monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Equity Research Report List

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Will the first approved oral wegovy give Novo Nordisk an edge vs. Lily? Will Lily come up with oral version in 2026?