Google Q2 Earnings Update!

Growth accelerates, and Search is alive and kicking!

Google has just released a stellar Q2 2025 earnings report, again demonstrating that the bear narratives are not based in reality.

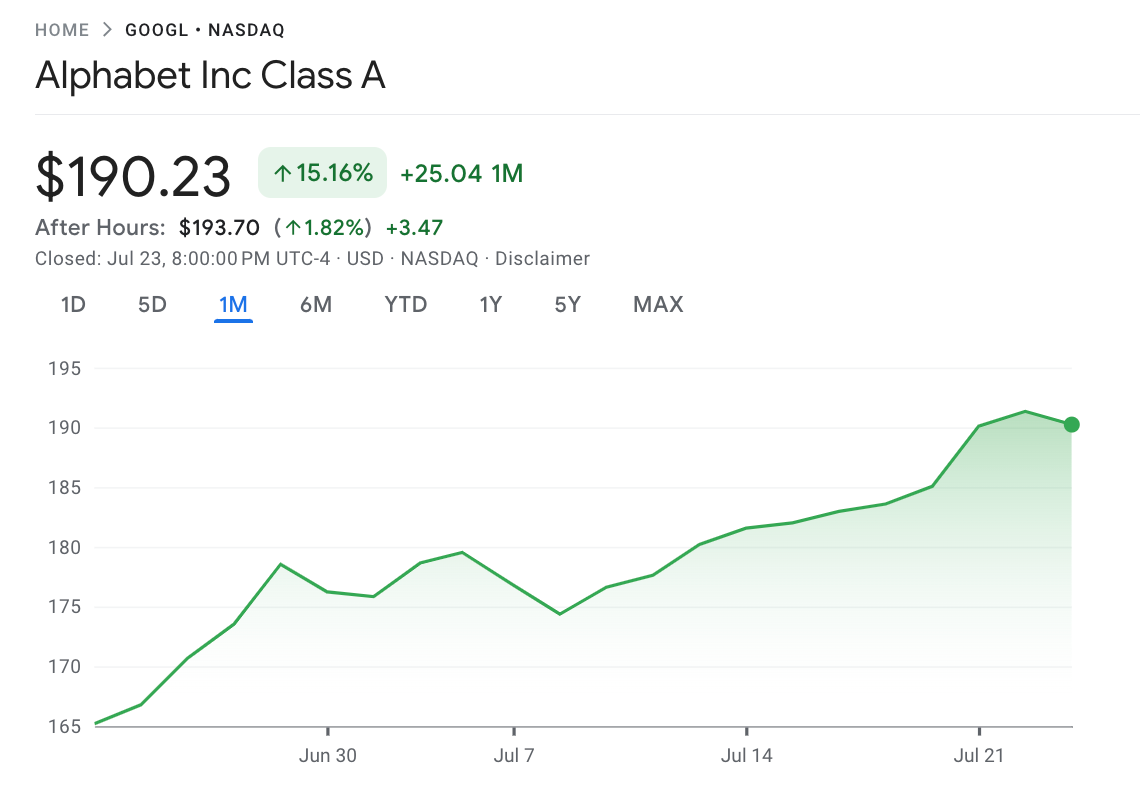

The stock is up 2% in after-hours and 18% over the past month!

Basically, all of the bear narratives were proven wrong.

Search is not dying, as the growth accelerated to 11.7% Y/Y.

Gemini App reached 450M MAUs, despite ChatGPT.

Waymo continues to expand at breakneck speed, despite the launch of Tesla's Robotaxi.

Cloud segment growth reaccelerated to 31.7% Y/Y, showing they are not just some “3rd rate” cloud provider!

Despite a tough macroeconomic environment, trade wars, court battles, and increased competition, Sundar and the company continue demonstrating why they are one of the world’s best technology companies.

In this article, I will look at Google’s Q2 2025 results, if you want a more detailed analysis of the business, read my Google Investment Case!

Let’s dig in!

1. Search

2. YouTube

3. Cloud

4. Subscriptions, Platforms, and Devices

5. Advertising Network

6. AI and Waymo

7. Consolidated Finances

8. Valuation

9. Conclusion

1. Search

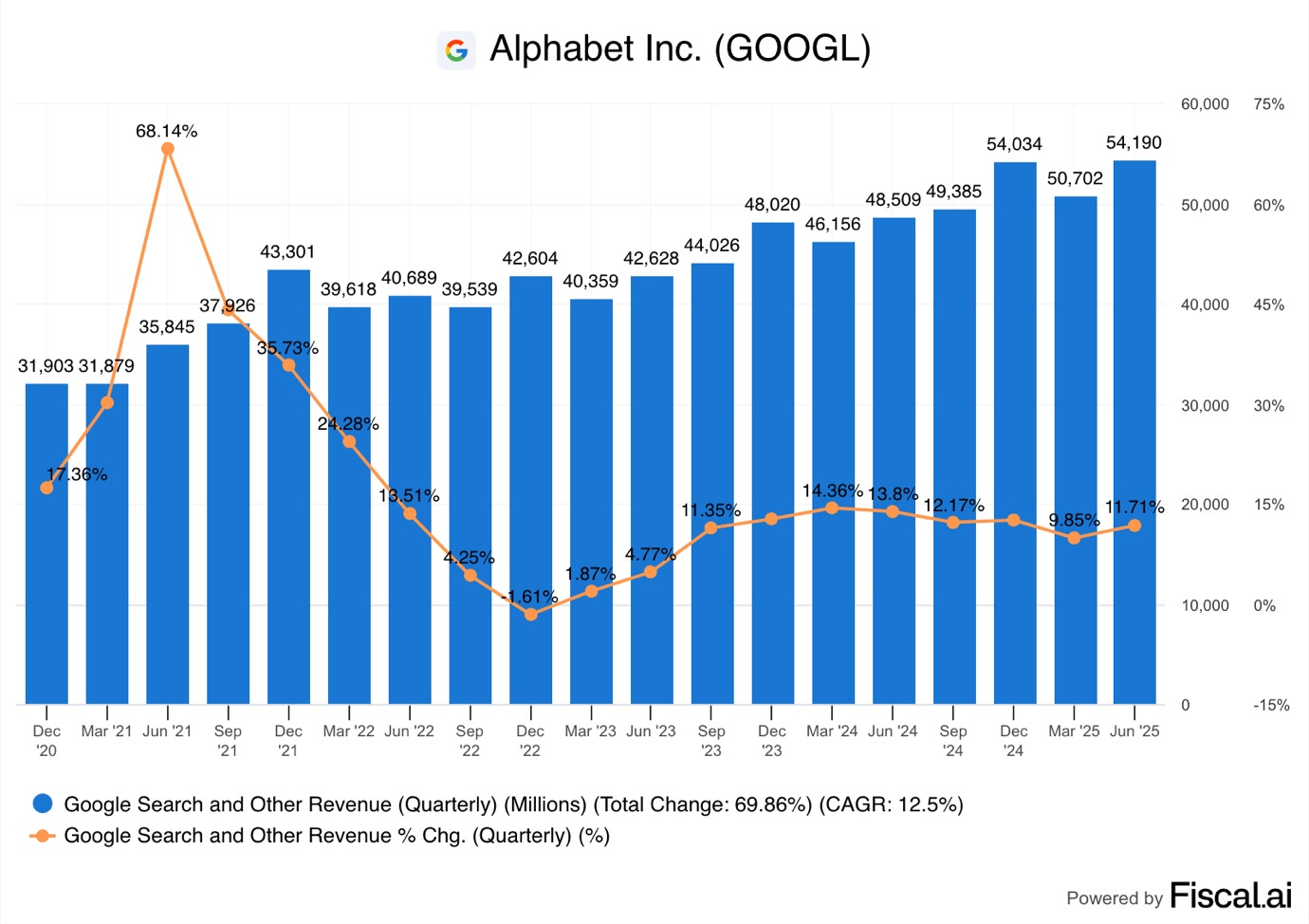

The Search segment earned the company $54.2B, up 11.7% Y/Y!

Simply put, the narrative that Google’s Search business is dead is dead!

As we can see in the chart above, the Search segment earned $54.2B in revenues in Q2 2025, an increase of 11.7% Y/Y.

This is a noticeable acceleration from 9.85% in Q1 2025, and only a bit slower than the 13.8% growth in Q2 2024.

ChatGPT was released in 2022, but you can’t see that on this graph. After it partnered with Microsoft to integrate OpenAI’s models into Bing, it was supposed to take Google’s lunch.

For many quarters, bears have been suggesting that a growth slowdown followed by declining revenues is imminent, yet again and again, that hasn’t materialized.

I believe that many investors underestimate the brand power of Google and customer lock-in!

There is a reason that Googling something has become a verb, the company has been dominating this niche for 2 decades. I suspect that people will continue using this term in the future, even when using Google’s Gemini or other AI apps.

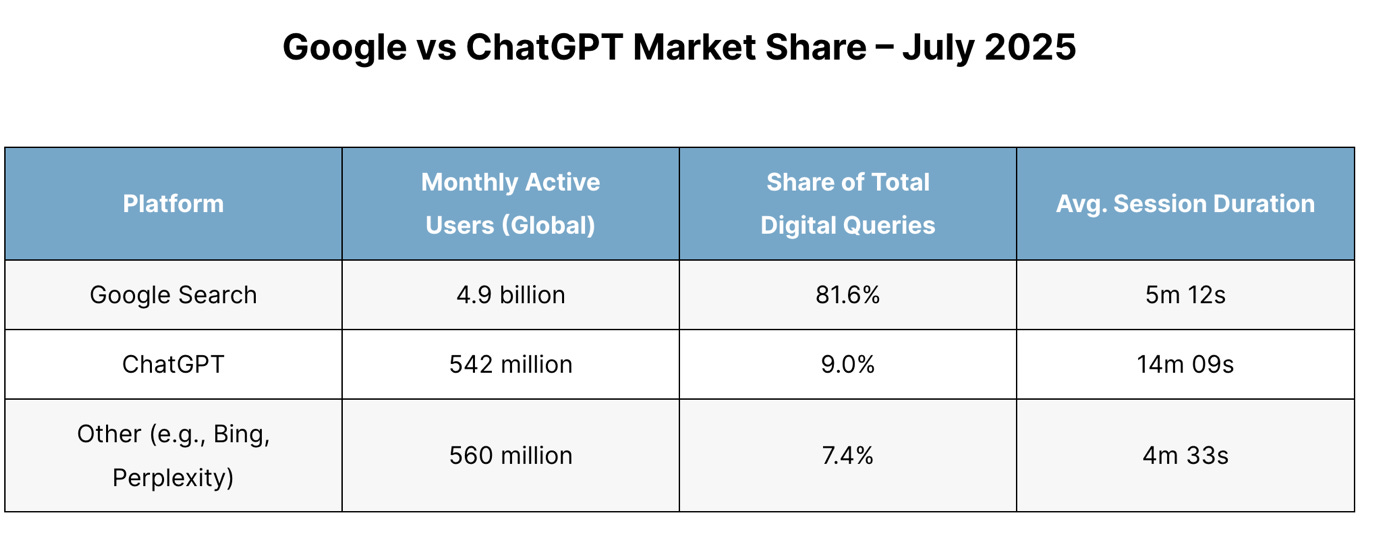

At the same time, anecdotes that “my nephew only uses ChatGPT” are simply biased and not true for the general population. Google has an incredible lock-in with billions of people, and it will be very hard to convince them to switch, especially with Google constantly improving the search user experience with AI mode and AI summaries.

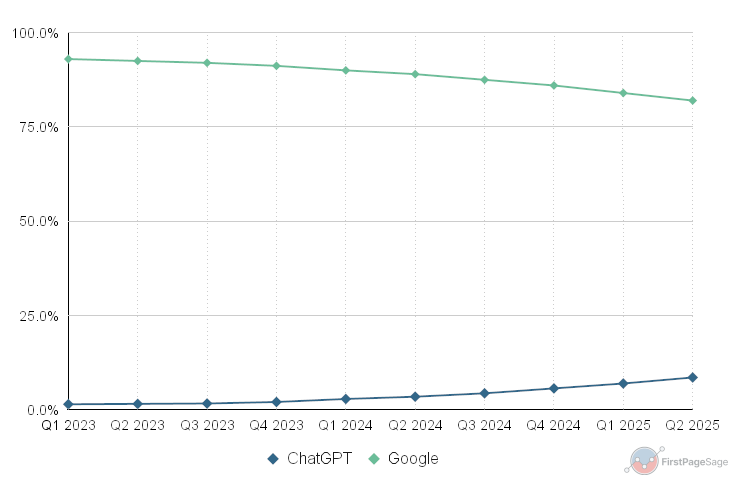

As we can see in the share of total digital queries graph above, Google is much larger than ChatGPT, but it seems to be losing market share. That is inevitable when one controls 90% of the market and a new technology form factor emerges.

However, extrapolating this too far into the future is a huge mistake, and I find it likely that ChatGPT market share gains will slow down in the future.

Another interesting point from this data is that the length of AI sessions seems to be longer than Google Search (14 min vs 5 min), which supports my suspicion that AI will significantly increase the search market size.

Thus, market share gains won’t necessarily lead to declining revenues, as the whole search market expands as people engage in longer and more frequent conversations.

Key Points from the call:

“Our new search features continue to perform well. AI mode has launched in The US and India and is going well. While AI overviews now has over 2,000,000 monthly users across more than 200 countries and territories and 40 languages.” Sundar Pichai

2. YouTube

As I mentioned last quarter, YouTube is now 20 years old. Little did Jawed Karim, the founder of YouTube, know that he would create the world’s most important media company.

With 2.7B monthly active users, YouTube is the largest video streaming platform in the world, that dominates user-created media, and it has now set its sights on the world of sports!

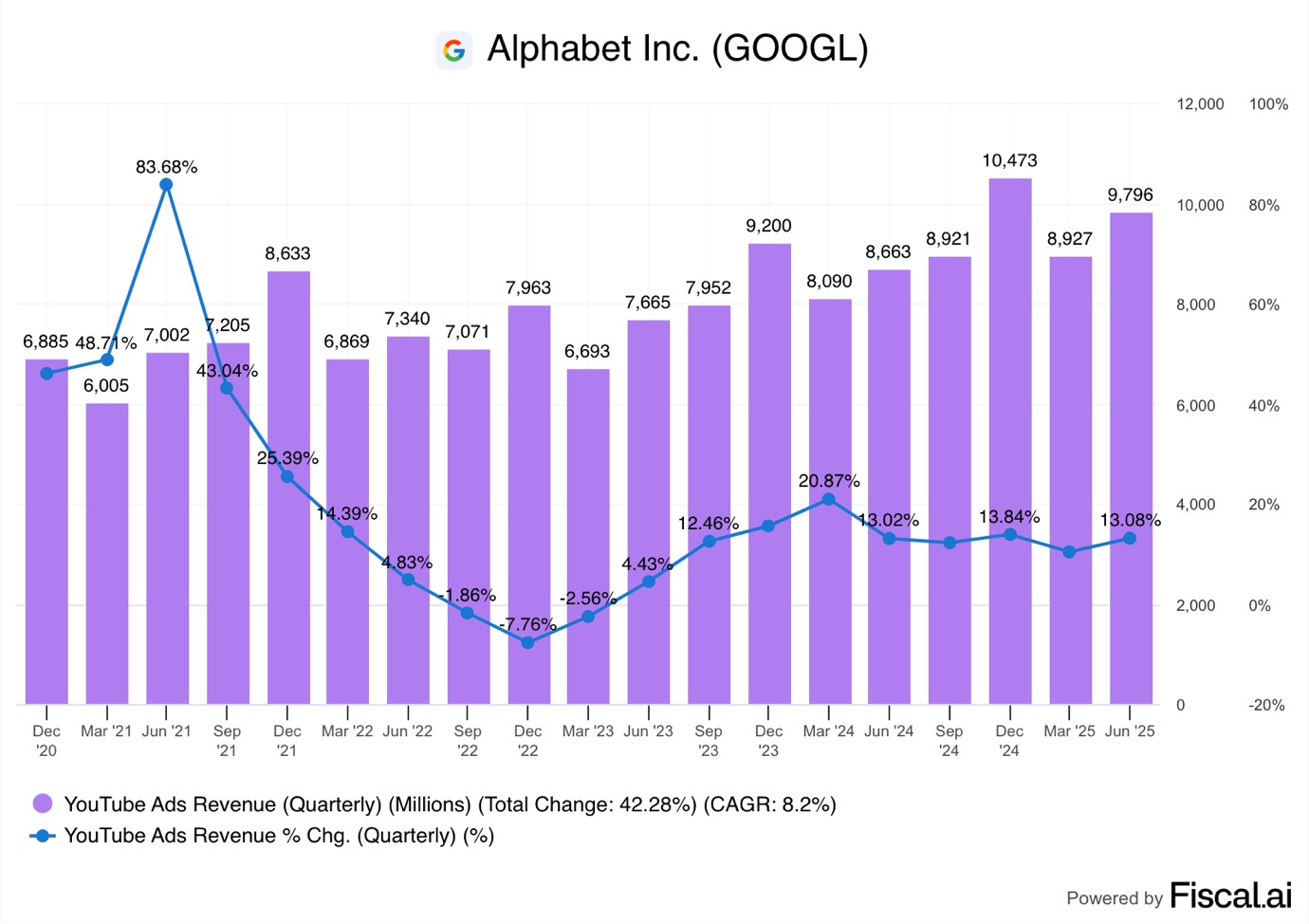

Advertising revenue grew 13.1% Y/Y to $9.8B!

In Q2 2025, growth accelerated from 10.4% in Q1 to 13.1% and is on par with the 13% growth in Q2 2024.

It is incredible that YouTube can continue to demonstrate such high growth despite its already massive scale.

Many often say that “YouTube could soon overtake Netflix”, without realizing that YouTube already is the larger company!

This is because the above chart doesn’t include YouTube Premium subscription revenue. The company doesn’t report it separately, as it’s included in the “Subscriptions, Platforms, and Devices” segment.

The last available information is that YouTube Premium has 125M subscribers. If we assume that the average monthly price is $8, then Premium generates an additional $4B each quarter.

That would bring YouTube’s total revenue for Q2 2025 to $13.8B, above $11.1B, Netflix posted.

Key Points from the call:

“A generation that grew up with YouTube on their devices is now increasingly watching their favorite creators and content on their televisions. That includes millions of sports fans too. Globally, they consume more than forty million hours of sports content on YouTube annually. And in September, we'll stream the NFL's first Friday game of the season live from Brazil. From sports to shorts, we now average over 200,000,000 daily views on YouTube shorts.” Sundar Pichai

3. Cloud

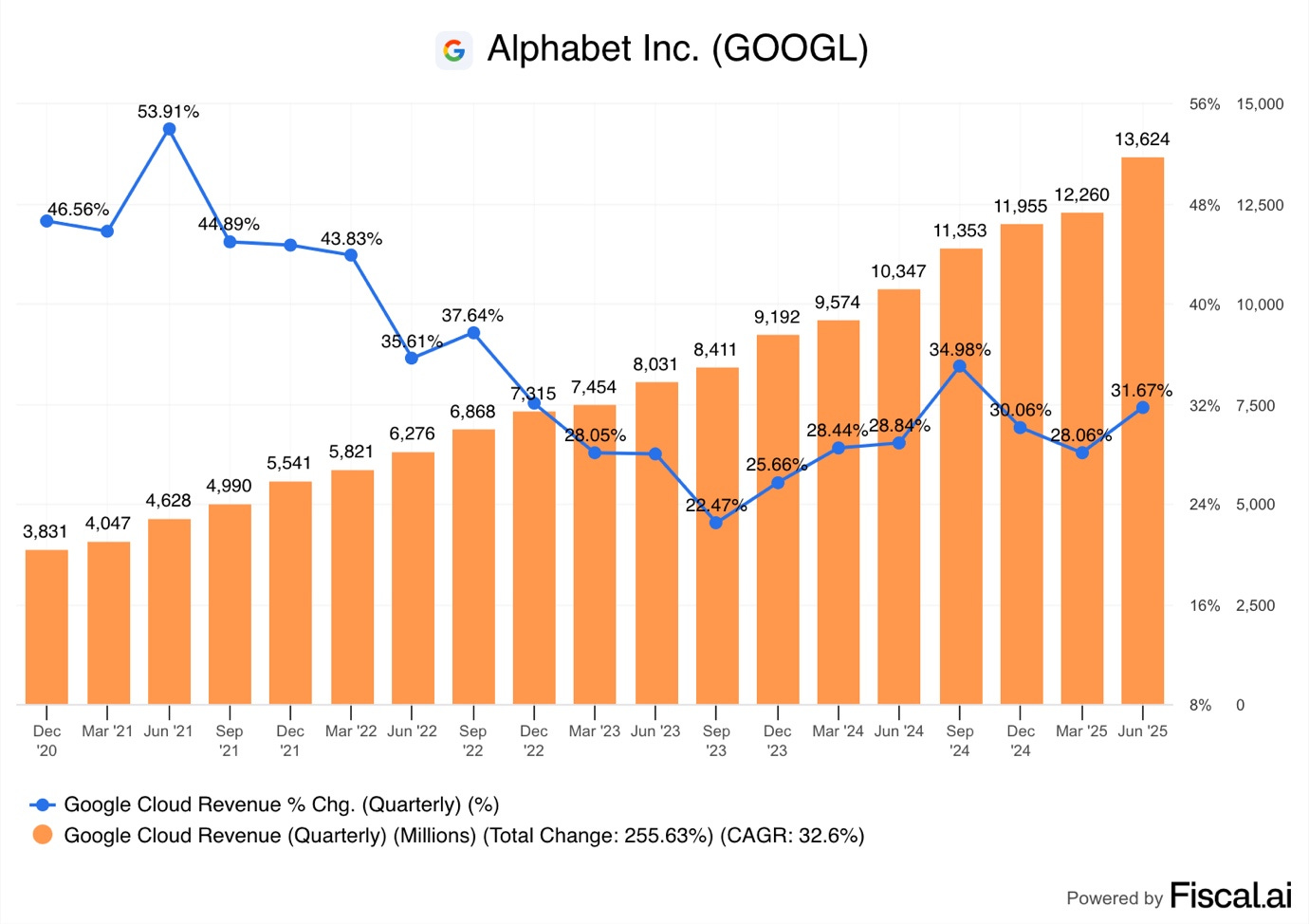

The Cloud segment continues to prove again and again that investors and analysts severely underestimate its TAM.

It is estimated that around 80% of global IT spending goes to on-premises solutions and only 20% to the Cloud. Many experts believe that in the next two decades, this ratio will flip.

This means that Trillions of dollars of global IT spending will move to the cloud!

So I am not surprised that Cloud growth accelerated from 28% in Q1 2025 to 31.7% Y/Y.

As we can see in the graph above, the jump in Q2 was very strong, up over $1B from the previous quarter, growing an amazing 11.1% Q/Q.

Such Q/Q growth is stronger than most companies grow Y/Y, truly incredible!

This was the second fastest growth in 10 quarters.

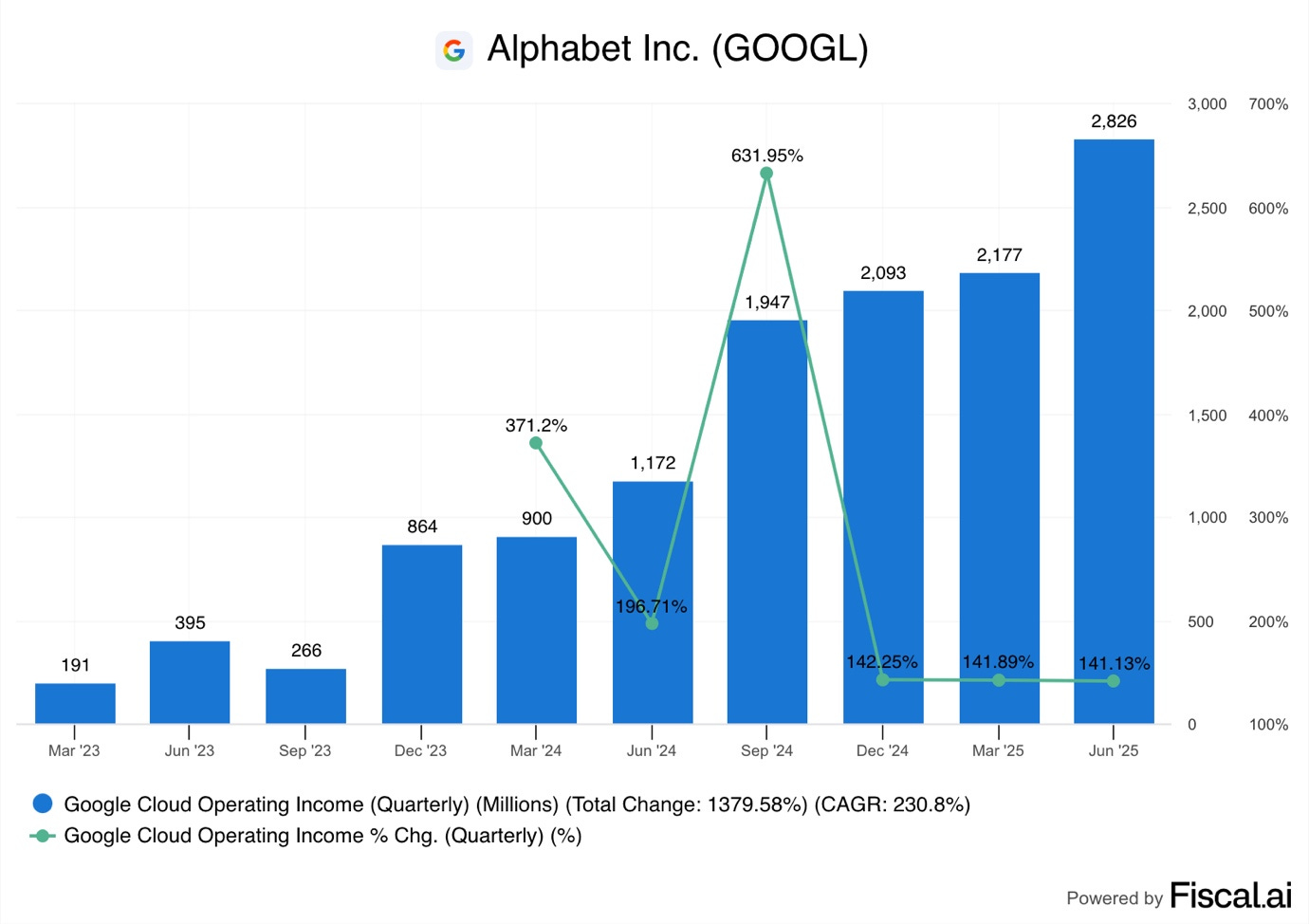

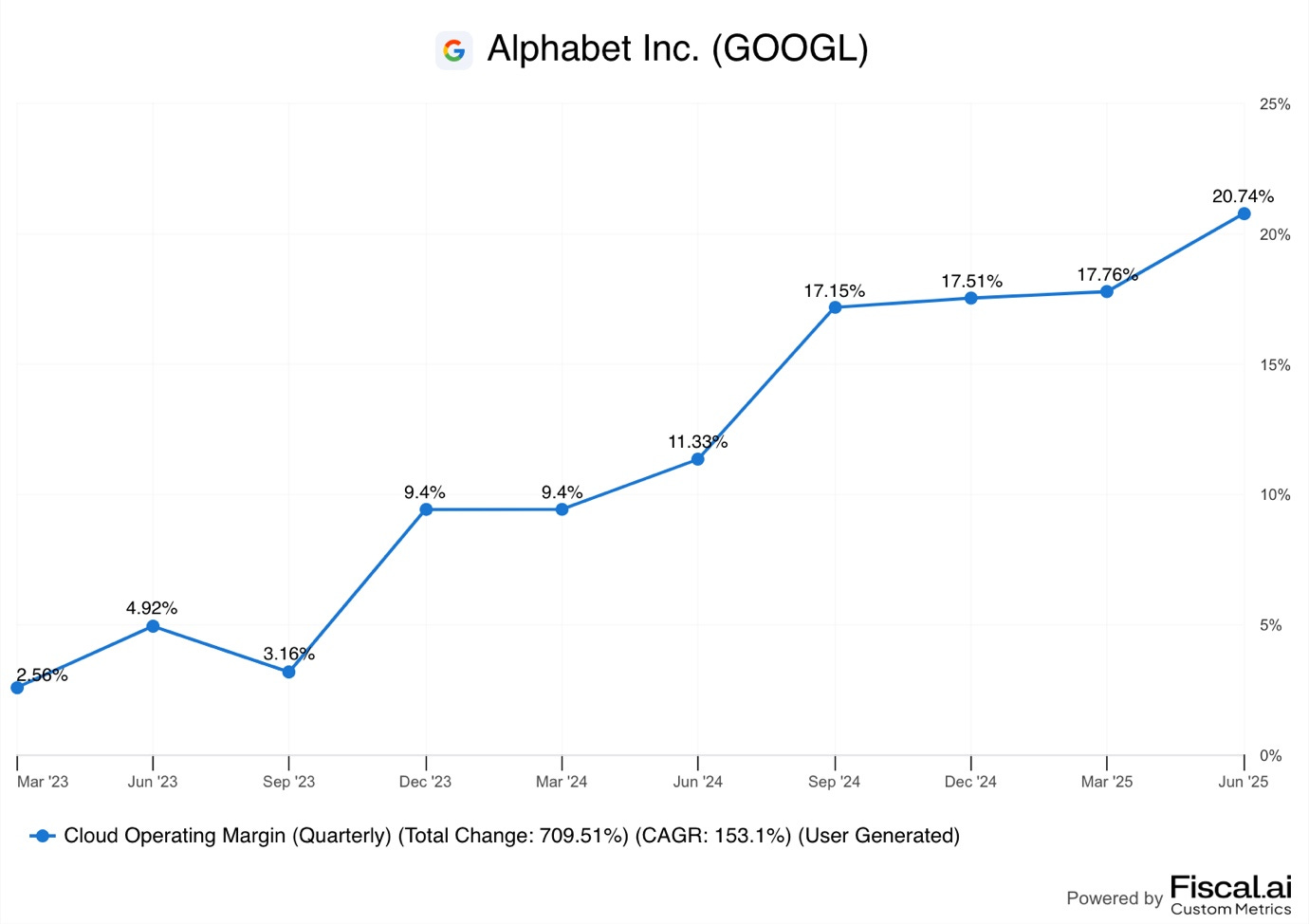

In addition to stellar top-line growth, Cloud also delivered significant profitability improvements.

The segment posted operating income of $2.8B, an increase of 141% Y/Y, on par with the growth in the two prior quarters. Looking at quarter-on-quarter growth, operating income jumped 29.8%.

Cloud operating margin now sits at 20.7%, a noticeable improvement from 17.8% in Q1 2025 and 11.3% in Q2 2024.

AWS’ operating margin is nearly 40%, indicating that there is a lot of room for Google to improve margins. While I doubt that Google can reach AWS levels anytime soon, I don’t see why the company couldn’t reach 30% in a few years.

Key Points from the call:

“One, the number of deals over $250,000,000 doubling year over year. Two, in the first half of twenty twenty five, we signed the same number of deals over $1,000,000 that we did in all of 2024. Three, the number of new GCP customers increased by nearly 28% quarter over quarter, or more than 85,000 enterprises, including LVMH, Salesforce, and Singapore's DBS Bank now built with Gemini, driving a 35 x growth in Gemini usage year over year.” Sundar Pichai

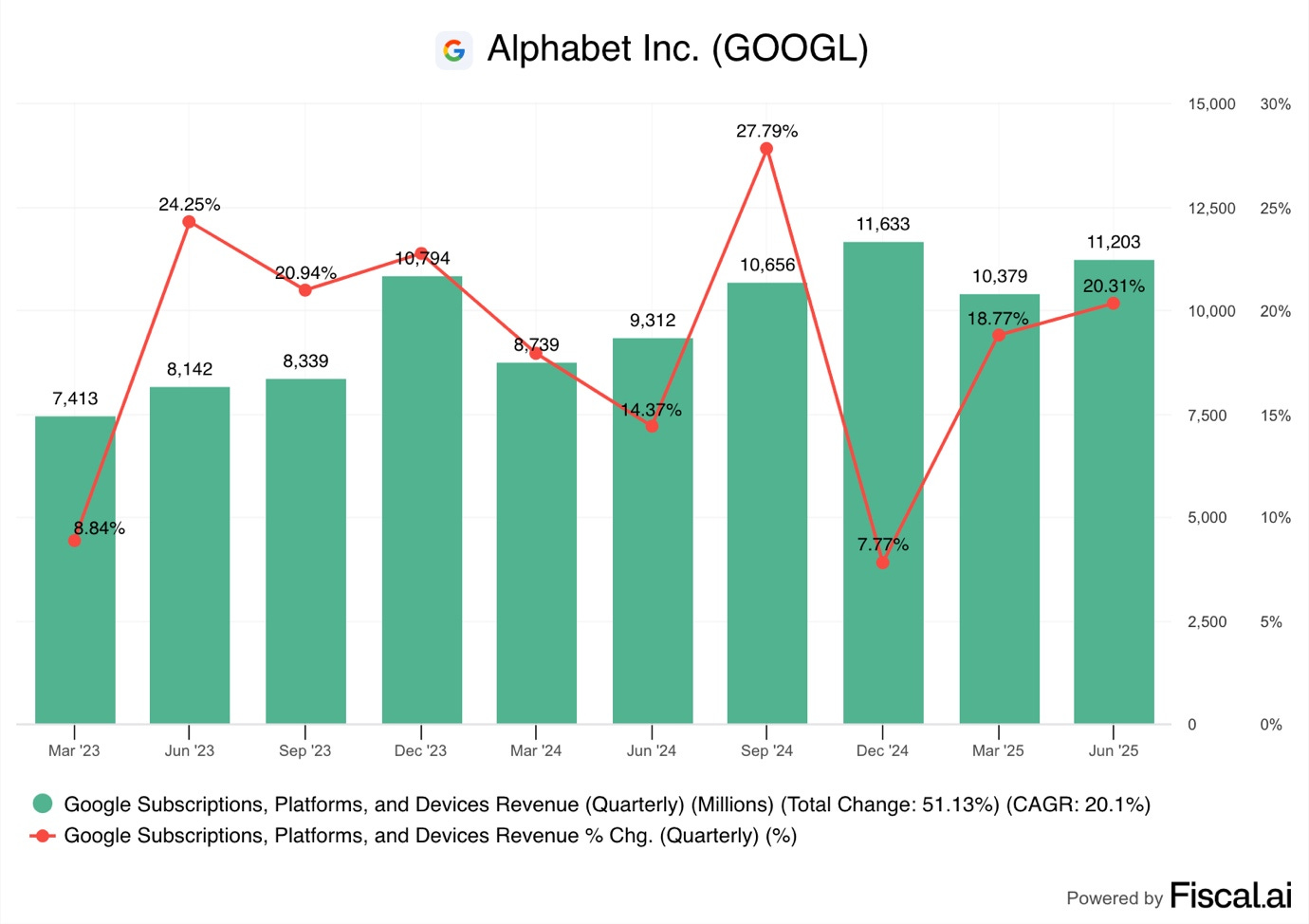

4. Subscriptions, Platforms, and Devices

I would like to reiterate that I really don’t like this segment reporting, as it is a rather confusing mess.

This segment includes YouTube Premium, Android, Google One, Google Workspace, Android, Pixel and other devices.

There are just so many unrelated offerings included here that it is difficult to assess what is driving this segment, which I suspect could be intentional.

If Google doesn’t disclose its subscription revenue, then investors can’t apply a higher multiple to that, more steady and predictable part of the business!

In Q2 2025, the company earned $11.2B from this segment, an increase of 20.3% Y/Y!

In the graph above, we see that growth accelerated from 18.8% in Q1 and 14.4% in Q2 2024.

Google did release the new Pixel 9a in April to somewhat great reviews, however, it is unlikely that it drove this segment.

The company said that the performance of this segment was driven by YouTube Premium and Google One.

Key Points from the call:

“And we are really pleased with the growth in subscriptions, which got a boost from our Google AI Pro and Ultra plans.” Sundar Pichai

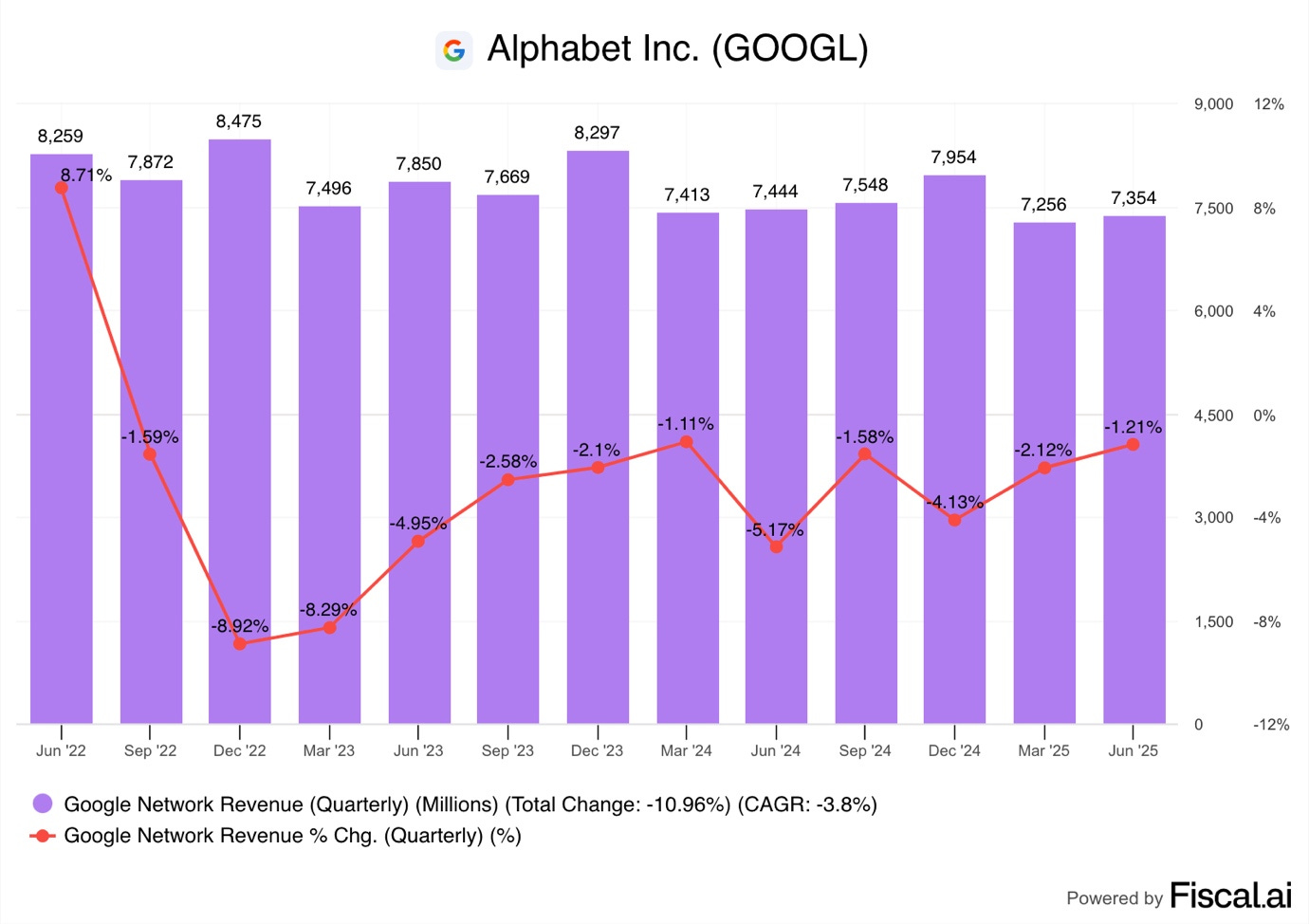

5. Advertising Network

Within this segment, Google reports revenue from its third-party advertising businesses, such as AdSense, Ad Exchange, and Ad Manager.

Google made $7.35B from this segment, down 1.2% Y/Y!

In the above graph, we see that this segment has been performing poorly for quite some time, with declining sales for 12 quarters in a row.

Considering this poor performance, it seems quite bizarre to me that regulators are going after this segment. It seems they are a bit late to the party, however, the courts disagree with me, as this segment was deemed a “web advertisement monopoly”.

Overall, I think this court case is a nothing burger for the group!

Firstly, this segment is relatively small and was the poorest performing anyway, as increased competition and changing advertising market put pressure on growth.

Secondly, it is my understanding that the court’s decision only applies to certain sections of the unit, not all of it.

Thirdly, Google is appealing the decision, so it will take years before any concrete steps need to be taken!

The government is pushing for divestiture of a part of this unit, and a remedies trial is set for September.

In any case, the remedies that the Judge might decide on will have an immaterial impact on the whole company. Worst case scenario, Google pays a few billion-dollar fine and sells off a portion of this segment.

6. AI and Waymo

On May 20, 2025, Google held its developer event, where it presented a lot of new current and future AI features, such as:

Gemini 2.5 Pro – New and extremely powerful Large Language Model that beats ChatGPT in many benchmarks.

AI Mode Search – powered by Gemini 2.5 Pro, it brings conversational style search experiences directly to the Google Search bar.

Project Astra – A prototype AI assistant capable of doing many tasks.

AI Agents – Agents capable of scheduling appointments and accepting calls.

Creative AI Tools – Video, picture, and audio generation for creatives.

Language translation – Live conversational language translation embedded in Google Meet.

And many more!

Furthermore, the company announced many premium AI subscriptions designed to compete with ChatGPT.

Google AI Pro is a $19.99 a month subscription, offering Gemini 2.5 Pro access, Deep Research reports, 1,000 AI credits for pictures and video generation, and 2 TB of storage on Google Drive.

Meanwhile, those with more needs can use Google AI Ultra for $249.99 a month. Ultra comes with 12,500 AI credits, prototype AI agents, unlimited most advanced Deep Research reports, and a whopping 30 TB of storage.

However, most importantly, Google showed how all of their AI tools are getting embedded in tools across their vast ecosystem of services!

Google can easily add Gemini results to all Search queries, decreasing the need for alternative LLM tools such as ChatGPT, Perplexity, and Grok.

Google Chrome will add the Gemine toolbar, simplifying the usage.

YouTube could offer automatic dubbing and subtitles on videos.

Gmail will offer Gemini smart features to analyze received emails and write responses.

Google will enable its Workspace apps to draft documents, create charts, auto-complete data tables, and more.

Various tools within Google Drive help search and analyse a vast depository of documents.

Apart from maybe Microsoft, no company has an ecosystem better suited for the rollout of AI products.

We can see that in Gemini’s growth, as the service recently passed 450M MAUs, an increase from 350M in the prior quarter.

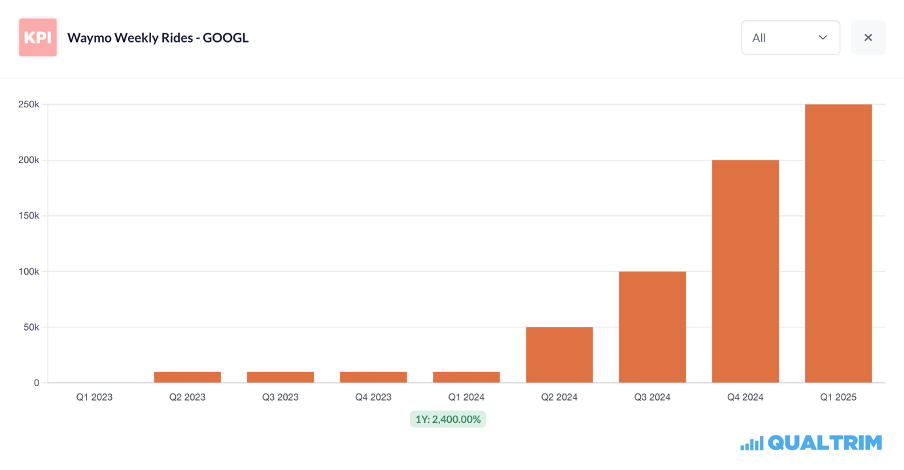

In addition to the rollout of Gemini across their services, the company is investing heavily in Waymo, the world’s largest Robotaxi network.

Unfortunately, Google didn’t report Waymo’s weekly rides in Q2.

However, in Q1, Waymo taxis drove an average of 250 thousand autonomous miles a week, an increase of 25,000% Y/Y and 25% Q/Q!

While this growth is impressive, the real challenge hasn’t yet begun.

After years of delays and failed promises, Elon Musk’s Tesla finally launched their robotaxi service on 22. June 2025 in Austin, Texas.

So far, the results have been mixed, with a few crashes and sudden braking issues. Also, Tesla’s offering is limited only to certain parts of the city, despite Elon and Tesla bulls criticizing Waymo for doing the same. Regulators have begun an investigation into these incidents, with a focus on whether Tesla’s camera-only approach can deliver satisfying safety results.

Overall, I am extremely skeptical of Tesla’s ability to rapidly grow its coverage network to overtake Waymo.

In Q2 2025, Waymo launched a robotaxi service in Atlanta, doubled its coverage radius in Austin, and expanded it by 50% in Los Angeles and San Francisco!

Moreover, they launched Waymo for Teens for children aged 14-17. Previously, only adults were allowed to use the service. Now parents can order a robotaxi for their teens without worrying about the driver, and monitor the journey easily.

Key Points from the call:

“The Waymo Driver has now autonomously driven over 100,000,000 miles on public routes, and the team is testing across more than 10 cities this year, including New York and Philadelphia. We hope to serve riders in all 10 in the future.” Sundar Pichai

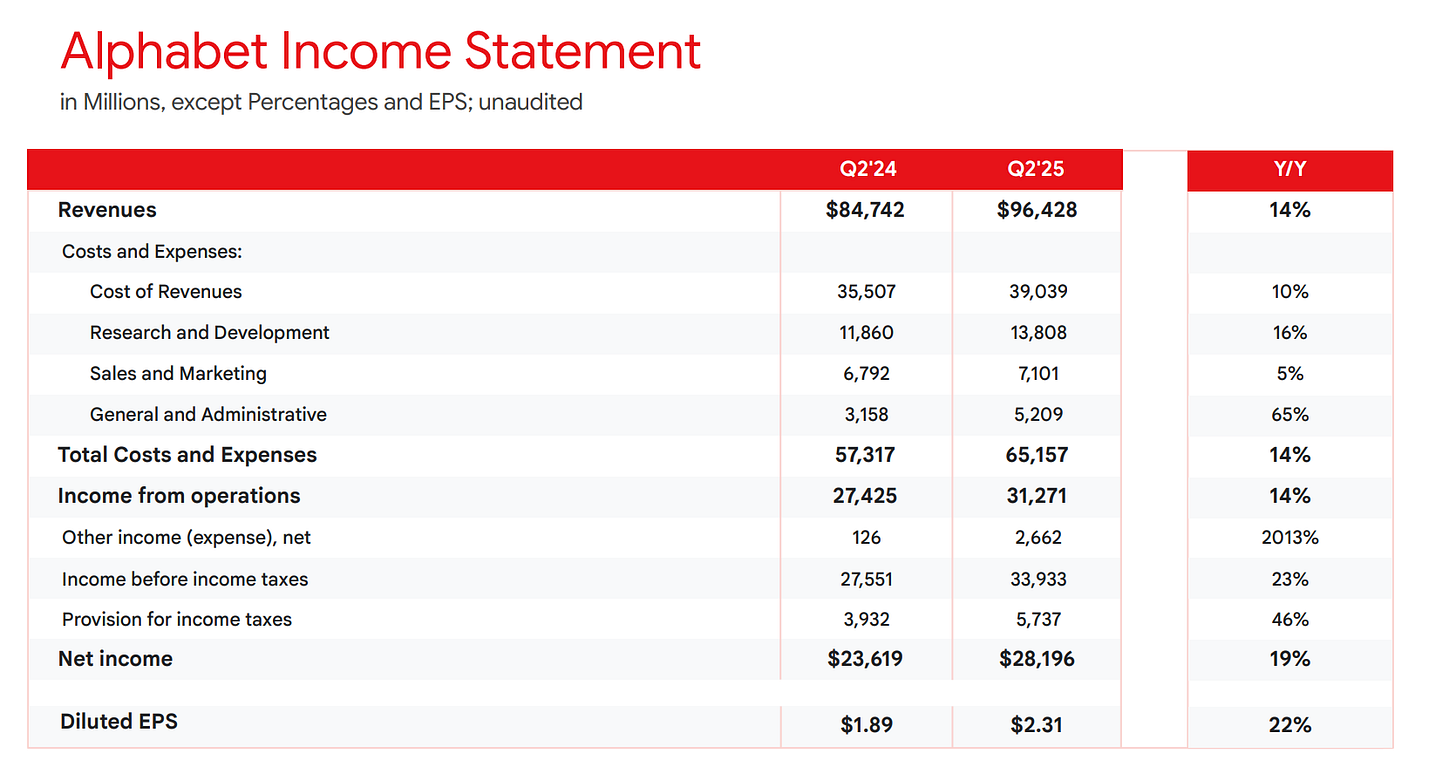

7. Consolidated Finances

Overall, the consolidated group posted a stellar financial performance, with Q2 revenues growing 14% to $96.4B!

This is an acceleration from 12% growth in the prior quarter.

As we can see in the picture above, income from operations grew by 14% to $31.3B, whilst net income jumped a decent 19%.

This means that the operating margin remained flat at 32.4%, whilst the net margin improved slightly to 29.2%.

Operating results improved on the account of Google growing cost of revenues by just 10%, whilst sales and marketing expenses only grew by 5%, both below the revenue growth rate of 14%.

However, the results would have been much better if not for the 65% increase in the general and administrative expenses, largely because of a $1.4B legal settlement. $500M relates to a shareholder lawsuit that the company settled in May, with the remaining $900M relating to other cases, possibly the DOJ advertising antitrust case.

Companies often make provisions for legal penalties before a final court decision, as US GAAP requires them to do so if penalties are probable and the amount can be reasonably estimated.

Largely, these results show that Google is maintaining cost discipline, despite massive AI investments, lawsuits, and macroeconomic uncertainty.

Operating income also suffered from an increase in depreciation of 34.7% Y/Y to $5B. My understanding from the Q1 and Q2 2025 earnings calls is that higher depreciation is caused by the accelerated retirement of some cloud infrastructure. Google is investing heavily in capex to build infrastructure to handle growing AI workloads.

The problem is that AI workloads use much more processing power, thus, they are significantly more damaging to the infrastructure than regular cloud computing. Previously, cloud servers had a useful life of 5-7 years, but it seems that current AI servers have a much lower useful life, around 2-4 years.

Google expects depreciation growth to accelerate in Q3!

Furthermore, net income benefited from $2B in other income, driven by unrealized gains in Google’s equity holdings.

Next, EPS grew by 22% to $2.31, faster than the 19% net income growth. This EPS increase was supported by Google spending $13.6B on share repurchases during Q2. EPS is set to continue growing faster than net income, as last quarter Google revealed an increased repurchase program of $70B, up from $62B it spent in 2024.

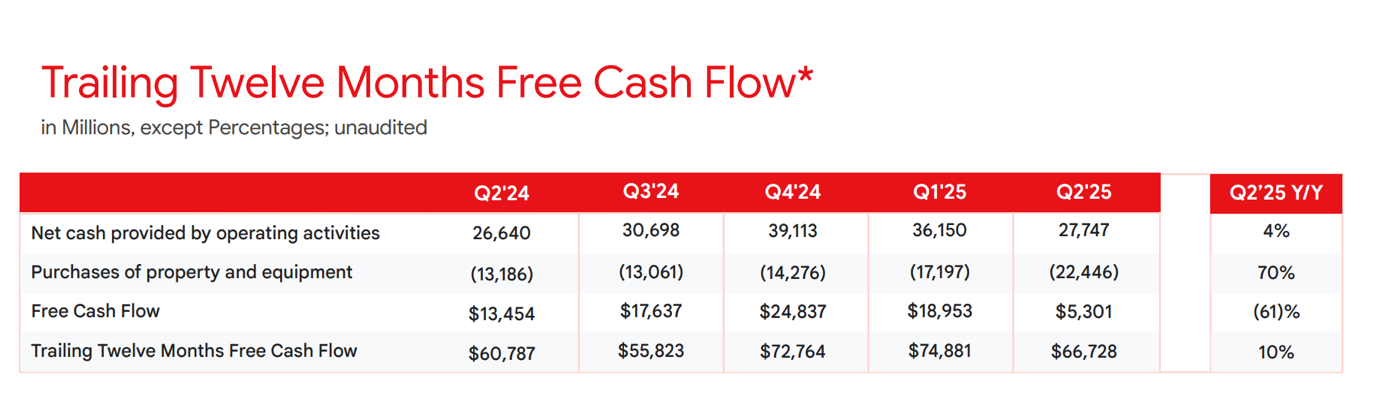

Moving on to FCF, it declined 61% Y/Y to $5.3B!

While on a quarter basis, such a decline seems drastic, on a TTM FCF still grew 10% to $66.7B. In light of their massive AI-related capex investments, we can expect FCF to be a bit lumpy for quite some time.

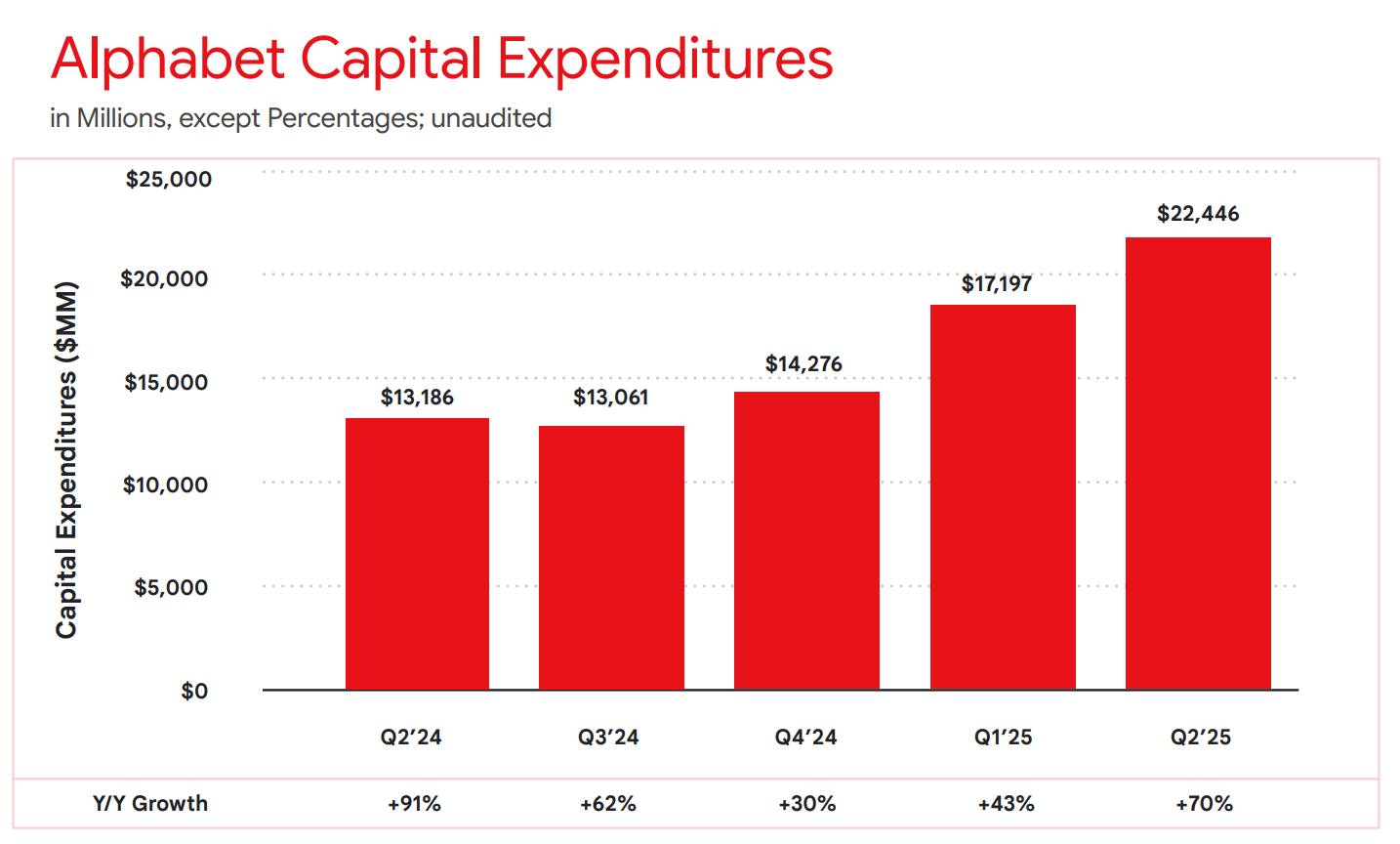

Capex grew by a huge 70% Y/Y and 30.5% Q/Q to $22.4B!

Nvidia shareholders are probably quite happy, as we are currently in a massive AI capex investment cycle. Google can’t afford to be behind in this AI race, so they are set to spend hundreds of billions of dollars on AI infrastructure in the next few years.

Google has increased its full year 2025 capex guidance from $75B to $85B. This means that Google has around $45B left to spend.

This increased guidance indicates that capex will grow by 70%+ as well in Q3 and Q4 of 2025!

8. Valuation

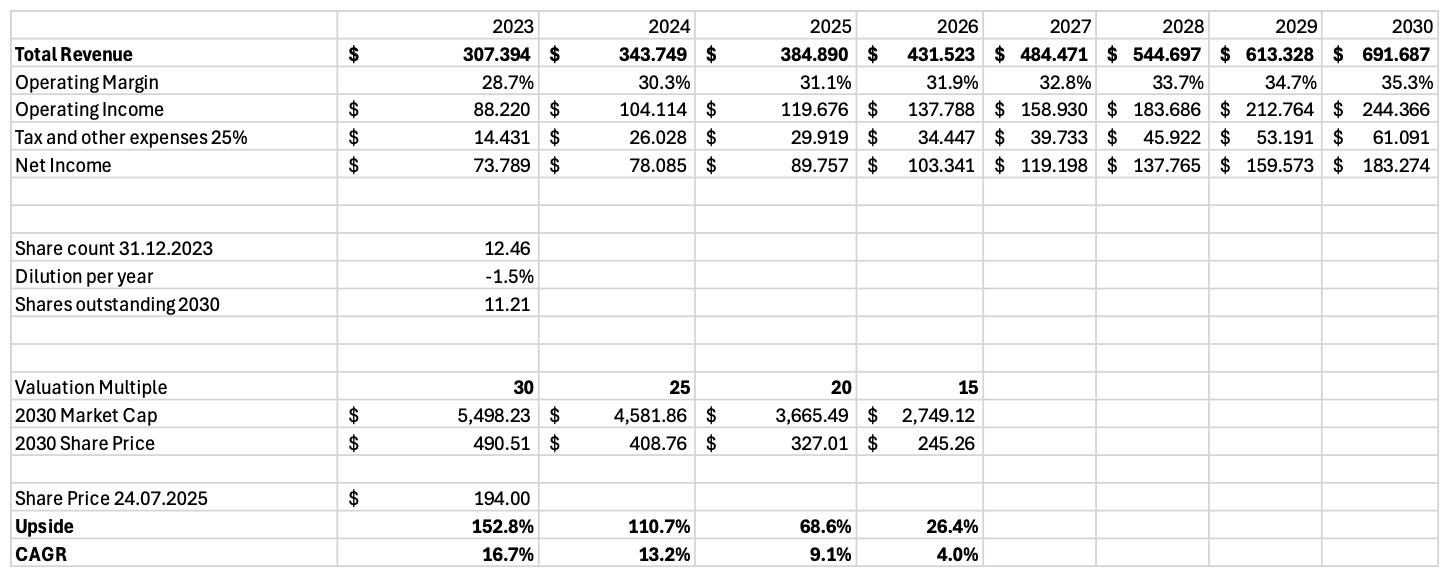

The same as in my Q1 earnings review, I don’t see a need to update the assumptions from the valuation model I made for my Google Investment Case article a few months back.

However, if Trump’s Trade War accelerates, then there could be some short-term downside, from a weaker consumer causing ad rates to fall.

Overall, in the long term, I believe Google’s fundamentals to be strong and the company to be attractively priced!

Despite rising around 16% in the past month, Google trades for an attractive multiple of 20.

I see an estimated 69% to 153% upside in Google’s stock by 2030, a CAGR of 9.1% to 16.7%!

I believe my growth assumptions to be reasonable and even somewhat conservative. You can read more about the assumptions driving this valuation model in my Google Investment Case!

9. Conclusion

I think Google trades for an attractive valuation, with enough room to outperform my expectations.

Growth accelerated in most of Google’s segments, showing again that investor doomerism was not warranted!

As this quarter clearly demonstrated, Search is far from dead. While it will grow at a slower pace than before, it will still grow and won’t disappear. While ChatGPT is a real threat, Google has enough resources and talent to successfully compete.

Meanwhile, the Cloud segment continues to be the crown jewel, with huge growth and improving margins.

Furthermore, let’s not forget YouTube is the most important media company in the world, generating over $34B a year in ad revenue and growing premium subscribers.

While Waymo is growing rapidly and could potentially become a large revenue contributor in 2030, however, I doubt it will be profitable by then.

The lawsuits are unlikely to cause a material slowdown in the next few years, but they are still important to look at. Considering how erratic the current administration is, there is potential for unforeseen negative consequences.

Additionally, a prolonged Trade War that causes a recession could negatively damage advertising revenue, so it is something to look at!

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Great analysis. Strong quarter from Google, all segments shows acceleration in revenue growth. 👍

https://open.substack.com/pub/techitalt/p/alphabets-q2-building-ai-while-the?r=5jmutn&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true