Here is why IREN is down 50%.

Q4 2025 Review!

The past week has been painful for the entire AI trade, but Iren has suffered more than most, falling 31% before even reporting Q4 2025 earnings. Shareholders hoping that earnings would bring back optimism were greatly disappointed, as Iren fell as much as 20% in the after-hours.

This means that Iren is down close to 50% in just a few days!

I believe there are 3 key reasons why the stock reacted so negatively to the earnings:

No Hyperscaler Deals

Revenue Miss

Earnings Miss

In my opinion, the market wildly overreacted to these developments. Furthermore, investors are completely ignoring the positives that Iren announced:

Secured $3.6B GPU Financing

New Massive Data Center

Strong ARR Guidance

Let’s dig deeper.

1. No Hyperscaler Deals

There were some reports that Iren was originally supposed to release its financial results next, but moved the release up.

This created immense speculation in the Iren investor community that a new major Hyperscaler deal is imminent!

When the earnings release came out and no new deal was announced, there was a lot of disappointment, which contributed to the sell-off.

Multiple narratives emerged as to why the company didn’t announce a new deal. But the key concern was that IREN might be facing stiff competition from other AI data center developers. I disagree with this narrative.

Iren has already signed a major $9.7B contract with Microsoft, so the company is focused on finishing construction of its Childress, Texas data center to service it.

There is no need to rush into an agreement, as there is plenty of time before additional capacity is set to come online!

Furthermore, the company revealed that they are currently in multiple advanced negotiations with both hyperscale and non-hyperscale enterprises.

Iren is taking the time to negotiate the most favourable contractual terms. They could sign a colocation deal tomorrow, but they don’t want that. The company wants to get the best deal possible, and that simply takes more time.

Moreover, a little insight from the earnings call was the disclosure that IREN is negotiating at least one multi-billion-dollar contract that specifically requires a comprehensive software solution.

“we do have an internal software capability. I think we probably downplay it a bit, partly in response to the market seeming to overplay it, but we’ve got that capability. To give you additional comfort, one of the contracts we are negotiating at the moment is a multi-billion-dollar contract where we need to bring a software solution. So it is not holding us back. It will not hold us back. The reality is exactly as what Kent said, you are dealing with the largest technology companies in the world. To pretend that you can be better at software and jam something down their throat when that is their competitive moat and that is their expertise, it’s just not congruent with reality.” Daniel Roberts Iren Q4 2025 Earnings Call

To date, most of IREN’s customers have utilized bare metal services, where they layer their own orchestration over IREN’s raw GPU compute. Moving up the stack to provide software-managed services would represent an evolution in the company’s service offering, potentially increasing the margins a bit.

But the big opportunity lies with Hyperscalers and they have the best software in the world, so it’s unrealistic that Iren can compete with that. However, they could offer some cloud services to some smaller customers and get a little bit better margin.

In their cash flow statement, we see that last quarter, the company spent $107.6M on intangible assets. This is a major cash outflow that likely went to software development.

2. Revenue Miss

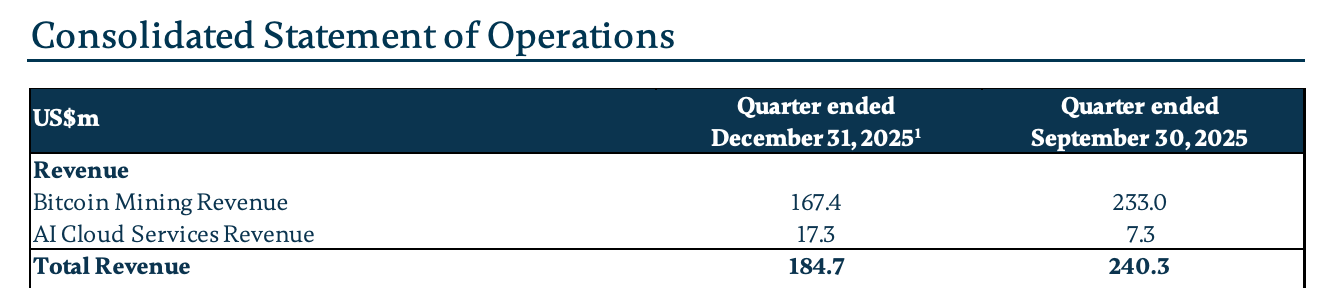

Analysts expected that Iren would have revenues of $227M, but instead reported just $185M, 19% below expectations!

Understandably, at first glance, missing revenue estimates by 19% seems like a major disappointment. However, if one takes a few minutes to understand the causes, this doesn’t look as tragic.

As you can see in the picture above, Iren today is not yet an AI cloud business from a financial perspective.

The company reported $17.3M in AI revenues, an increase of 137% Q/Q and 550% Y/Y!

While this is strong growth, the AI revenues represent only 9.4% of total company revenues, with Bitcoin mining generating the remaining 90.6%.

As you can see in the picture, Bitcoin revenues declined by 39% Q/Q, from $233M to $167.4M!

So the revenue miss was entirely driven by their legacy bitcoin business, which has nothing to do with their fast-growing, high-potential AI data center business.

The revenue decline is the result of the change of focus from bitcoin to high-performance computing. To prepare sites for incoming GPU clusters, IREN reduced its operating Bitcoin mining capacity, which, when coupled with a period of lower Bitcoin prices and an increasing Bitcoin global network mining capacity, led to a material reduction in income.

This doesn’t concern me at all!

What would concern me would be if the company were missing its AI ARR targets.

3. Earnings Miss

Similarly, as with revenue, analysts expected that Iren would have a net loss of $44M, but instead reported a net loss of $155M, 3.5x larger than expected!

While some of the fault lies with the higher expenses related to scaling the AI business, the majority was due to unique one-time charges, such as:

$31.8M impairment of assets

$107M unrealized loss on financial instruments

$112M debt conversion inducement expense

$22.3M in accelerated SBC expense

Iren is retrofitting its bitcoin mining sites because the company can generate higher revenues and earnings by putting AI GPUs in place of Bitcoin mining equipment.

Thus, the company took a $31.8M impairment on the value of this equipment. Simply speaking, they likely sold this equipment to another bitcoin miner, but the money they got for it was $31.8M less than what the equipment was worth as per their balance sheet.

Next, the company took a $107M accounting charge on the value of the derivatives it holds related to its convertible debt notes. Iren purchased prepaid forwards and capped calls to hedge against dilution from these offerings. Last quarter, these positions generated massive unrealized gains due to the stock’s rapid appreciation. However, this quarter there was a pullback of the share price, resulting in a reversal of those gains, creating a GAAP-level loss that does not reflect actual cash outflow.

Furthermore, the company recorded a $112M one-time expense to incentivize the conversion of existing debt into equity. This is a strategic move to lower interest burden and extend maturity, though it creates a sharp, one-time negative impact on reported earnings. Essentially, the company gave the holders of its debt $112M worth of equity now, so they don’t have to pay interest, and convert later when Iren’s share price is much higher.

Lastly, Iren reported a $22.3M increase in share-based compensation because of its Q4 2025 share price exceeding internal performance thresholds, effectively pulling forward expenses that would have otherwise been recognized in future quarters.

Overall, Iren’s earnings demonstrate how complicated and confusing GAAP accounting can be.

An investor who just looks at the headline figure could have the impression that their expenses ballooned. Yet, as we discussed, it was entirely driven by unique one-time circumstances.

Such a huge earnings miss would be disastrous if it were caused by deteriorating business fundamentals. Yet that wasn’t the case.

4. $3.6B GPU Financing

The first major announcement was that Iren has secured $3.6B of 6% interest GPU financing to service the Microsoft contract!

The implications of this financing are profound for IREN’s capital structure. By securing an interest rate of less than 6%, IREN has achieved a cost of capital significantly lower than many of its peers in the AI infrastructure sector. For instance, CoreWeave has GPU leases that cost 10%.

This low rate is a direct reflection of the high-quality credit profile of the Microsoft contract!

The loan repayment profile is perfectly matched to the cash flows from the five-year Microsoft contract. Combined with the $1.9B in prepayment already received from Microsoft, this facility ensures that the first phases of the Childress campus are essentially fully funded without further reliance on public equity markets for this specific project.

This answers an important question of many Iren bears, who were skeptical that the company could secure the financing required to service the Microsoft contract at favorable terms.

Many were claiming that Iren will have to issue more convertible notes to deliver on the Microsoft contract. While in reality, the funds from these note offerings are primarily intended for future data center development, not the current Microsoft contract.

This GPU financing step provides investors with a clear roadmap for Iren’s future.

1. Develop the beginning stages of a new data center.

2. Secure a major contract with a large pre-payment.

3. Get vendor financing from Dell for some data center equipment.

4. Get GPU financing from leading banks.

5. Complete the project.

6. Use cashflows to repay debt.

7. Repeat.

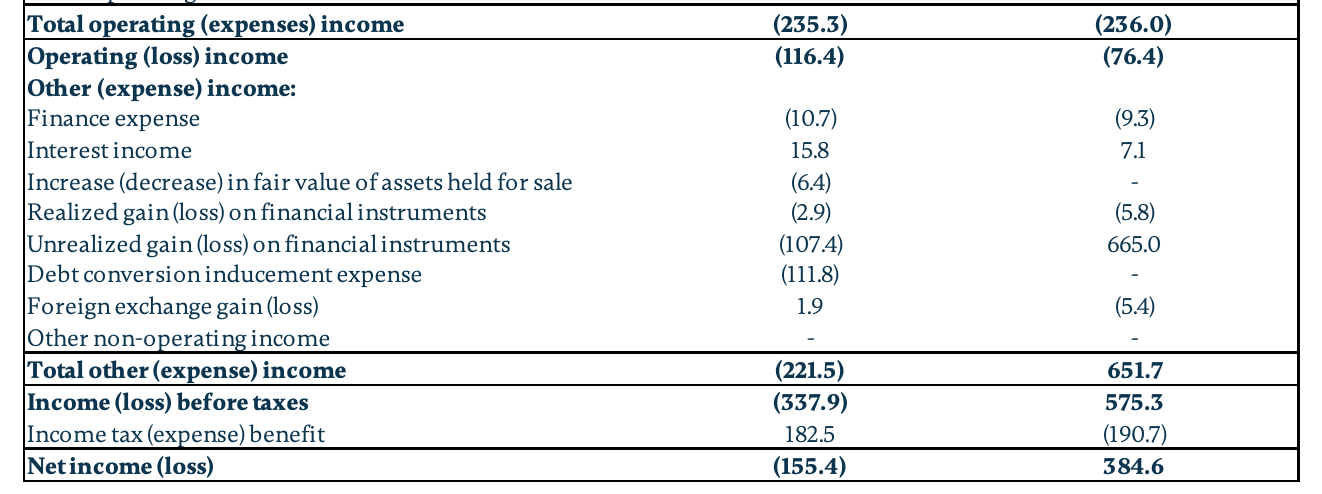

5. New Oklahoma Data Center

The second major announcement was the development of a new 1.6GW AI Data Center in Oklahoma!

At $10M ARR, this facility has the potential to generate $12-14B in annual revenues, depending on PUE. And Iren plans to begin energizing it in 2028, with first revenues likely coming in 2029-30.

This certainly means that Iren will issue more convertible notes to finance the development of this data center. However, as the company has shown, it can turn limited dilution into high-quality assets.

6. Guidance

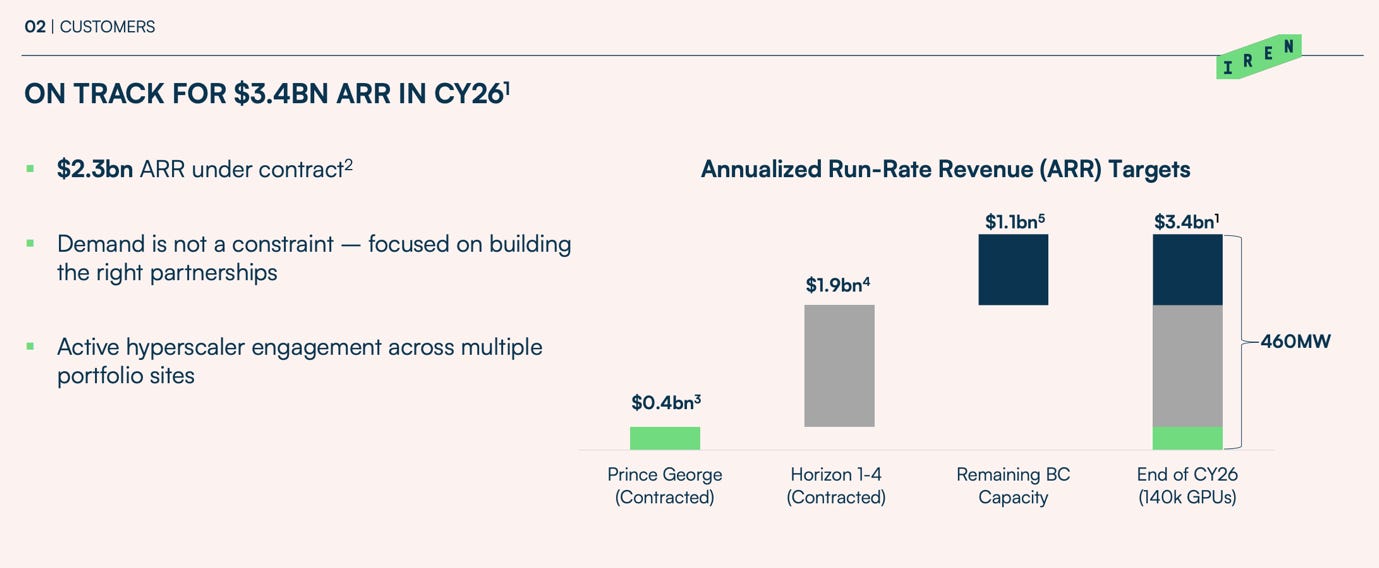

Lastly, the company said that they plan to reach $3.4B ARR by the end of 2026!

A market cap of around $12B means that Iren trades just 3-4x its 2026 ARR, which I find quite attractive, considering their AI business is growing by more than 100% Q/Q.

7. Conclusion

I will conclude this analysis with the picture from Iren’s earnings presentation!

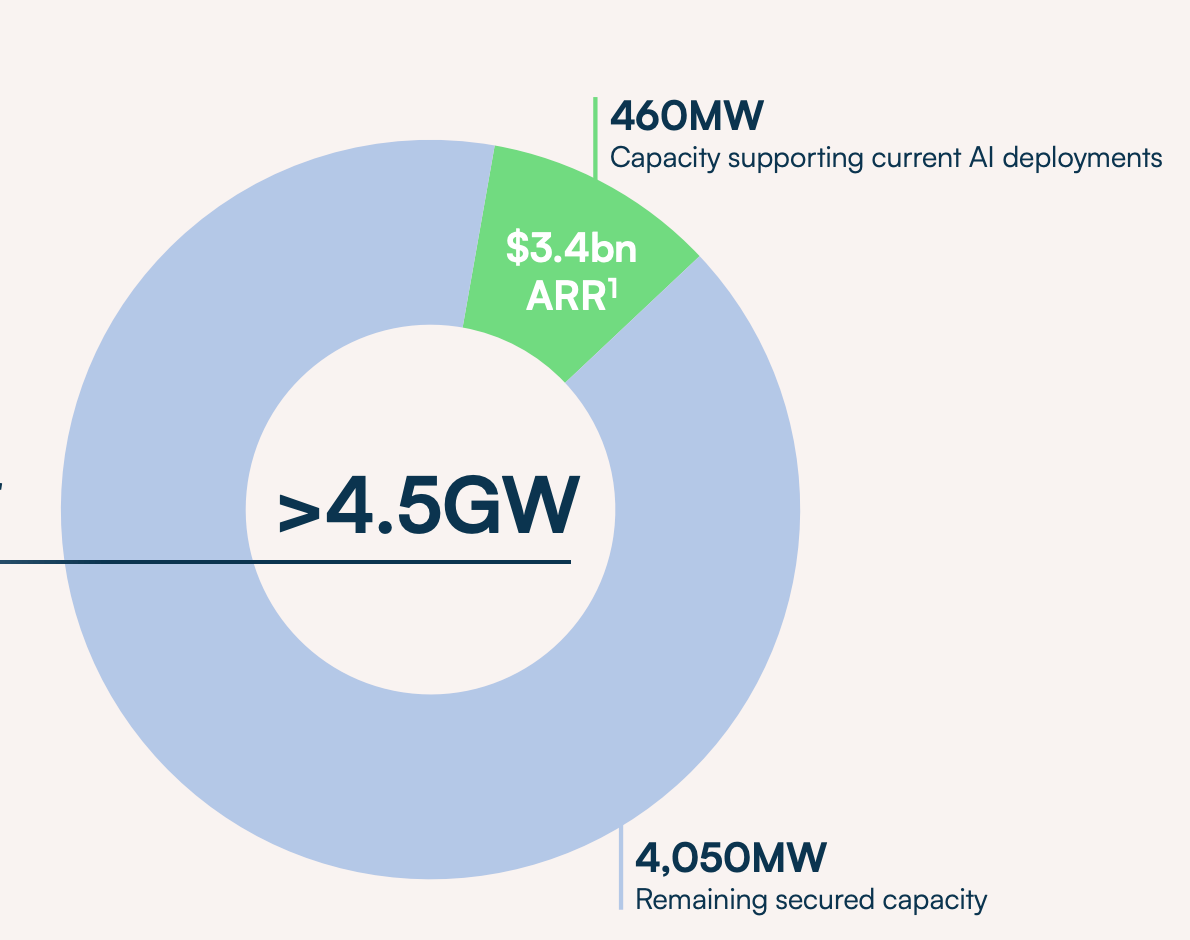

Iren aims to achieve $3.4B ARR by 2026 by developing only 10% of its secured capacity!

This means that with current capacity, Iren could be generating $34B in annual revenues.

We could be looking at a $100-200B market cap company in 6-8 years’ time.

I have made a new valuation model with a forecast for the next 5 years that is available to my premium subscribers.

Here is what my Premium Members can expect:

Portfolio Review - Each month, I will present the portfolio performance and discuss my stock watchlist and my best ideas.

Recent developments.

Unwarranted pullbacks.

Insider activity.

Potential catalysts.

Deep Dives – 8,000+ word detailed analysis of a company, delivered in 3 Parts.

Part 1 – Brief History of the company and its Business Model.

Part 2 – Management, Moats, Competitors, and Risks.

Part 3 – Opportunities, Financial Analysis, and a Valuation Model.

You can expect a comprehensive research report that is educational, interesting, and provides actionable insights!

To see what you can expect, read my Palantir Deep Dive!

Members of the Premium service get access to my library of 11 Deep Dives and to all future Deep Dives, which will be released on semi-monthly basis.

Investment Cases – A short, concise report with actionable insights.

This report is about the size of a single part of a Deep Dive.

Focused Investment Thesis

Main drivers of the Bull Case

Valuation Model

To see what you can expect, read my Oscar Health Investment Case!

Earnings Reviews and Updates – For companies that are of great interest to me and my readers, I will provide regular quarterly or semi-annual updates after earnings reports.

Financial performance

Business Update

New developments

Updated Valuation Model

To see what you can expect, read my Google Q2 2025 Earnings Review!

Equity Research Report List

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the “Global Equity Briefing” newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the “Global Equity Briefing” report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Great analysis as always thank you.

Nice