Is Palantir a Buy? A look into Q2 2025.

Massive FCF Growth, and a Monster Revenue Guidance.

Before Palantir’s Q2 2025 earnings, the stock was up 112% YTD, and many skeptics thought that this stock couldn’t go up any higher.

Well, they were hugely mistaken, as Palantir delivered an absolutely stunning earnings report, sending the stock up 4% in after-hours trading!

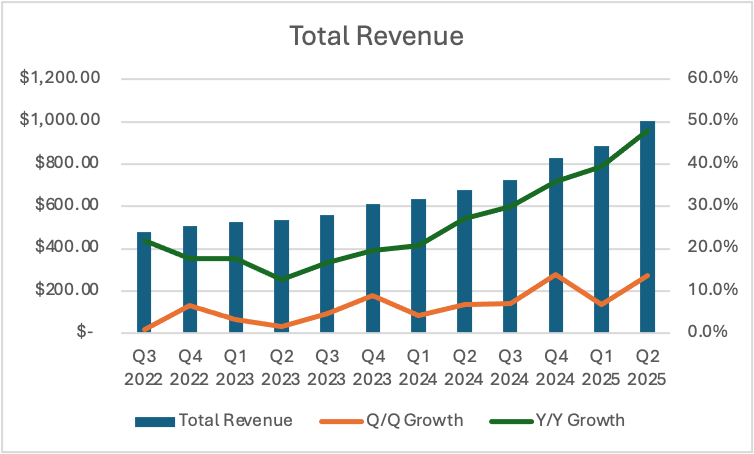

Revenue growth accelerated to 48% Y/Y.

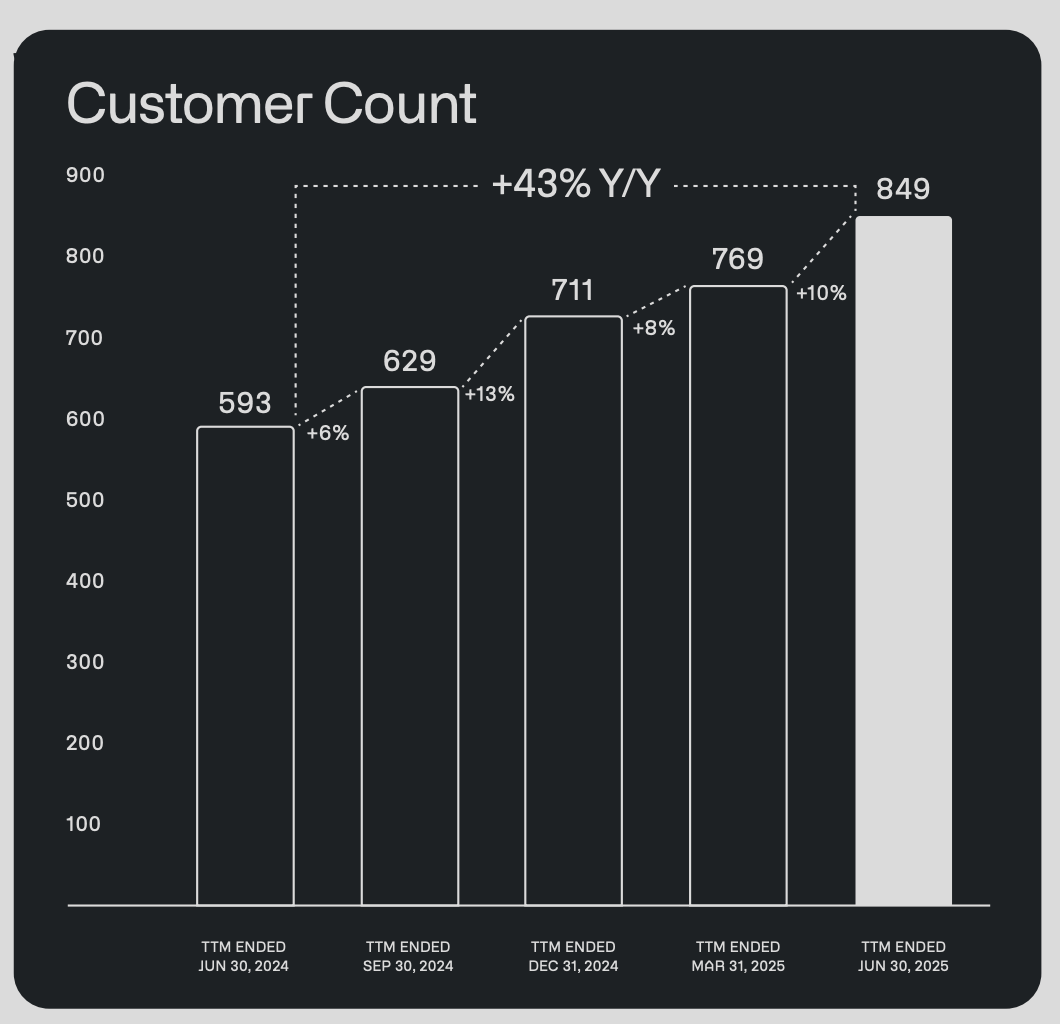

Total customer count increased by 43.2% Y/Y.

Most importantly, Free Cash Flow exploded 276%, delivering a mind-boggling FCF margin of 53%!

In this article, I will analyze Palantir’s Q2 2025 earnings and tell you if I am a buyer of the stock at these levels.

If you want to learn more about the business, I have written a full Deep Dive into the company!

Let’s look at the quarter in more detail!

1. US Commercial

2. US Government

3. US Revenue

4. International

5. Finances

6. Valuation

7. Conclusion

1. US Commercial

In this segment, Palantir reports revenue from US-based corporations.

For years, Palantir bulls claimed that the commercial opportunity for Palantir is many times larger than the governmental one. For investors to buy into this thesis, Palantir had to show faster growth, and they certainly did.

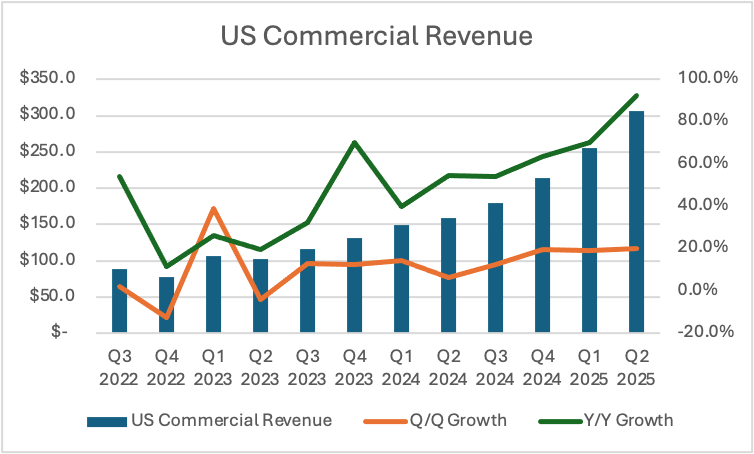

In Q2 2025, US Commercial revenue grew 93% Y/Y to 306M!

This is a significant acceleration from 54.6% growth in Q2 2024 and 70.3% in Q1 2025. Palantir also demonstrated an incredible 20% Q/Q. This is the type of growth that most companies would dream of on a Y/Y basis, not quarterly.

The orange line in the above graph indicates this was the best result in 10 quarters!

Additionally, as indicated by the green line in the graph, Palantir recorded its highest-ever Y/Y US commercial growth rate.

Another impressive stat is that the total contract value of this segment grew a shocking 222% Y/Y to $843M, driven by a 5x jump in deals over $5M.

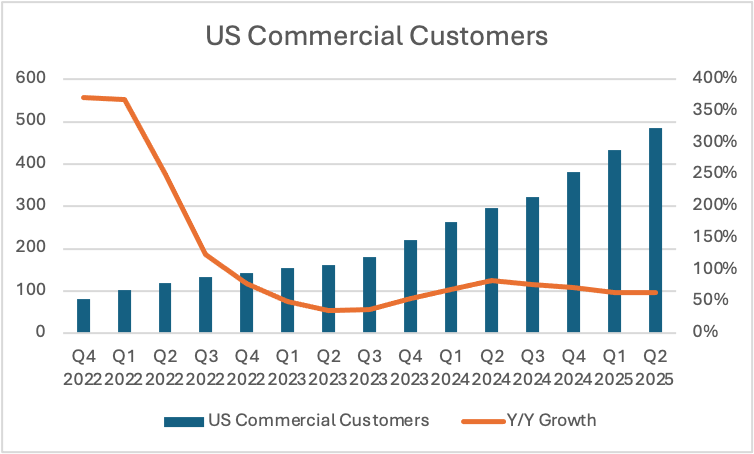

It’s no surprise this growth comes alongside rapid expansion of their customer base, Palantir gained 187 new customers Y/Y and 53 Q/Q, totaling 485.

In the graph above, we see that Palantir has consistently grown its customer base by around 50% per year since Q4 2023!

Key points from the call:

“The impact our software is delivering for our customers as they cross the chasm is ever widening their advantage over the AI have-nots.

Citibank shared that the customer onboarding process and relevant KYC and security checks that once took them nine days now take seconds.

Fannie Mae recently announced they're working with Palantir, decreasing the time to uncover mortgage fraud from two months down to seconds, saving The U. S. Housing market millions in future fraud losses.

Nebraska Medicine President and COO noted they saw a 2100% increase in discharge lounge utilization, which is the equivalent of adding another unit to their hospital” Palantir Q2 2025 Earnings Call

Palantir’s AI-driven software is delivering real and actionable insights that are saving its customers billions.

2. US Government

Palantir’s software is used by many US government agencies such as the FBI, CIA, DoD, and more. Revenue from these government agencies is reported in this segment.

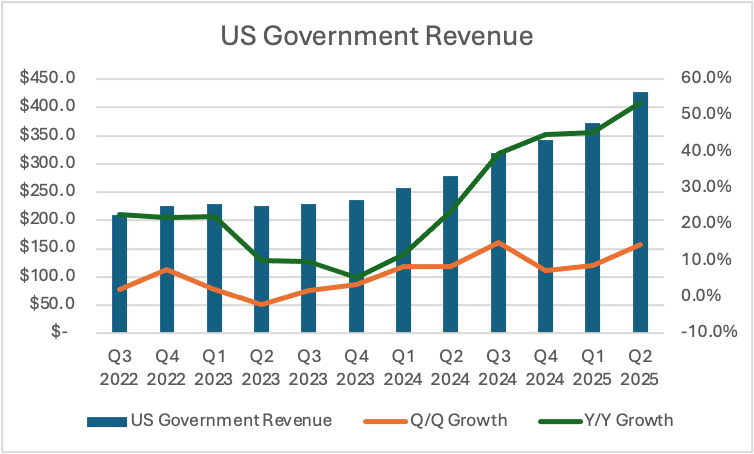

Despite persistent claims that Palantir’s government growth is unsustainable, this quarter’s results decisively refuted that argument.

The US government revenue grew 53.2% Y/Y to $426M!

Far from reaching a ceiling, Palantir’s US government revenue growth accelerated!

If we look at the green line in the above graph, we see that in Q2 2025, this segment delivered the best Y/Y growth in 12 quarters. Growth significantly reaccelerated from 23.6% in Q2 2024 and 45.3% in Q1 2025.

Key points from the call:

“Last week, Palantir was awarded a ten-year enterprise agreement with the Army totaling up to $10,000,000,000 consolidating 75 contracts into a single contract.” Palantir Q2 2025 Earnings Call

$1B a year just from a single US government department. Now this contract replaces existing ones, so it is hard to say how much of this is new business, but in any case, this is a large and major contract.

It seems that the TAM for the US government business is much larger than many analysts believed!

3. US Revenue

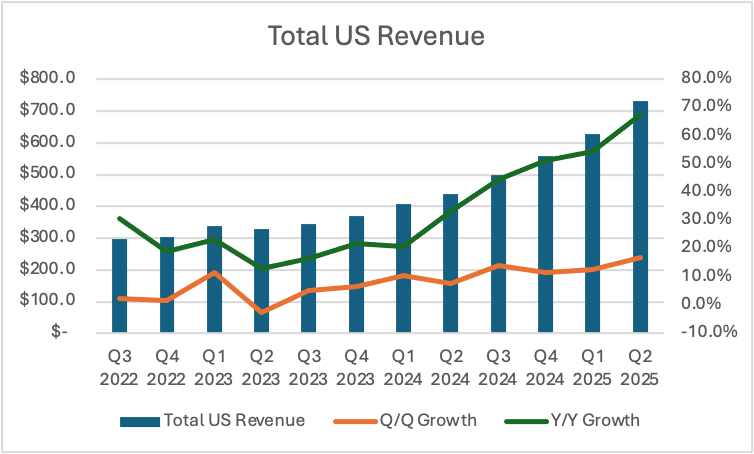

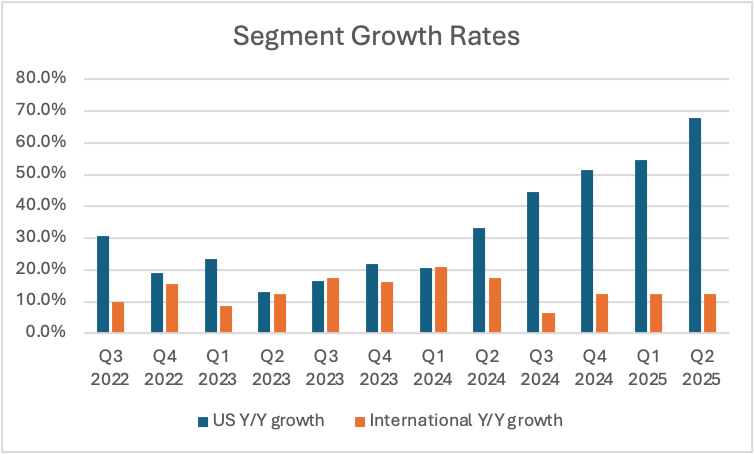

Total US revenue grew 67.7% Y/Y to $733M!

Growth accelerated from 33.3% in Q2 2024 and 54.5% in Q1 2025.

Key points from the call:

“AI is giving the American worker superpowers.

At the all in winning the AI race summit in DC, an ICU nurse, a factory worker, a hospital administrator, an electric vehicle battery maintenance technician shared how AI is making them better, faster, and more productive, giving them more time with patients, more time solving problems, and enabling more workers to access the job market.

Our investments in AIFD are accelerating the already eye watering time to value for our customers and providing customers with capabilities to solve bigger and more complex problems independently.” Palantir Q2 2025 Earnings Call

This is what is driving the stellar performance in the US. Once companies hear real stories, from real people, they rush to Palantir to help them become more competitive.

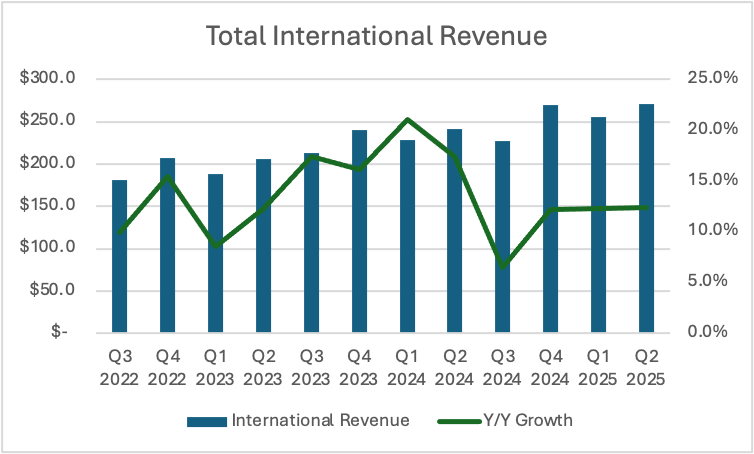

4. International

In a stark contrast to Palantir’s US business, its international segment continues to lag.

International revenue grew just 12% Y/Y to $271M!

In the graph above, we see that the Q2 2025 growth of 12% was in line with Q1 2025, but lower than 17.4% in Q2 2024.

If we compare US and International quarterly Y/Y growth rates, we see that the international segment has been heavily underperforming. The underperformance has been especially glaring since Q2 2024 and has increased every quarter since.

Key points from the call:

“And and then this is yet another advantage America has that we underestimate. It's so plastic. If you compare America to, say, Germany, the the way in which they build industry, they purchase software, they judge software, they there's a there's a pattern that is etched in stone there. But in America, people are very open to value creation, and they're under more pressure.” Palantir Q2 2025 Earnings Call

Similarly, as in the previous quarter, Alex Karp said that he believes that Europe is sleeping on AI, but they will get it eventually. Once that happens, international growth will accelerate. The culture in the US is just more open to innovation than in Europe.

In the next few years, we will see if he is right.

5. Finances

Overall, Palantir delivered simply extraordinary results.

Revenue grew 48% Y/Y to $1B, operating income grew 156% to $269M, net income grew 144% to $327M, whilst FCF grew 276% to $532M!

Reaching 48%, revenue growth showed strong momentum, up sharply from 27.2% in Q2 2024 and 39.3% in Q1 2025.

Looking at the graph, it’s clear revenue has grown steadily, with every quarter showing positive Q/Q growth. The green line tells the story of Y/Y growth accelerating each quarter since Q2 2023.

This performance is the result of Palantir gaining high-value customers, who keep signing ever larger deals.

Customers sign a deal with Palantir in one vertical, and after being very satisfied with the result, they sign more and more deals in other verticals.

This is a potent formula that delivers accelerating revenue growth!

5.1. Total Customers

In Q2 2025, Palantir gained 80 new customers, an increase of 10.4% Q/Q and 43% Y/Y!

AIP continues to be a huge driver for Palantir.

A reminder that AIP is their AI platform product that enables organizations to essentially build a proprietary ChatGPT-like app. This local LLM is trained with an organization’s internal data, which is used to answer employee questions, saving time and resources.

Key Points from the call.

“Our primary sales force now and I think likely in the future are going to be current customers telling other customers, if you want this to work, bring them in and listen to how they orchestrate their culture inside your culture with their products.” Palantir Q2 2025 Earnings Call

Nothing is better marketing for your product than happy customers. Palantir has built a great product that makes customers happy, enabling them to acquire new customers without expensive sales teams.

Whilst other enterprise software companies see sales, customer service and implementation as separate, Palanti sees it as a whole. This approach enables them to build better and more unique solutions to customer problems.

5.2. Deals and Net Dollar Retention

Palantir doesn’t charge customers for implementation, which is rather unique in the enterprise software space. In Palantir’s eyes, by not charging for implementation, they are incentivized to build more efficient customer acquisition and onboarding procedures.

This approach is delivering supreme results, as in Q1 2025, they signed 157 deals of $1M+, 66 of which were for $5M+, and 42 for $10M+.

Compare this to Q2 2024, when 96 $1M+, 33 $5M+, and 27 $10M+ deals were signed.

This means that $1M+ deals grew by 63.5%, $5M+ by 100% and $10M+ by 55.6%!

Especially huge growth in large deals is a good sign, as these are the lower churn, higher profitability customers. I think it is quite likely that in the future, Palantir will stop disclosing $1M deals as they are increasingly irrelevant and begin disclosing $20M and $50M deals.

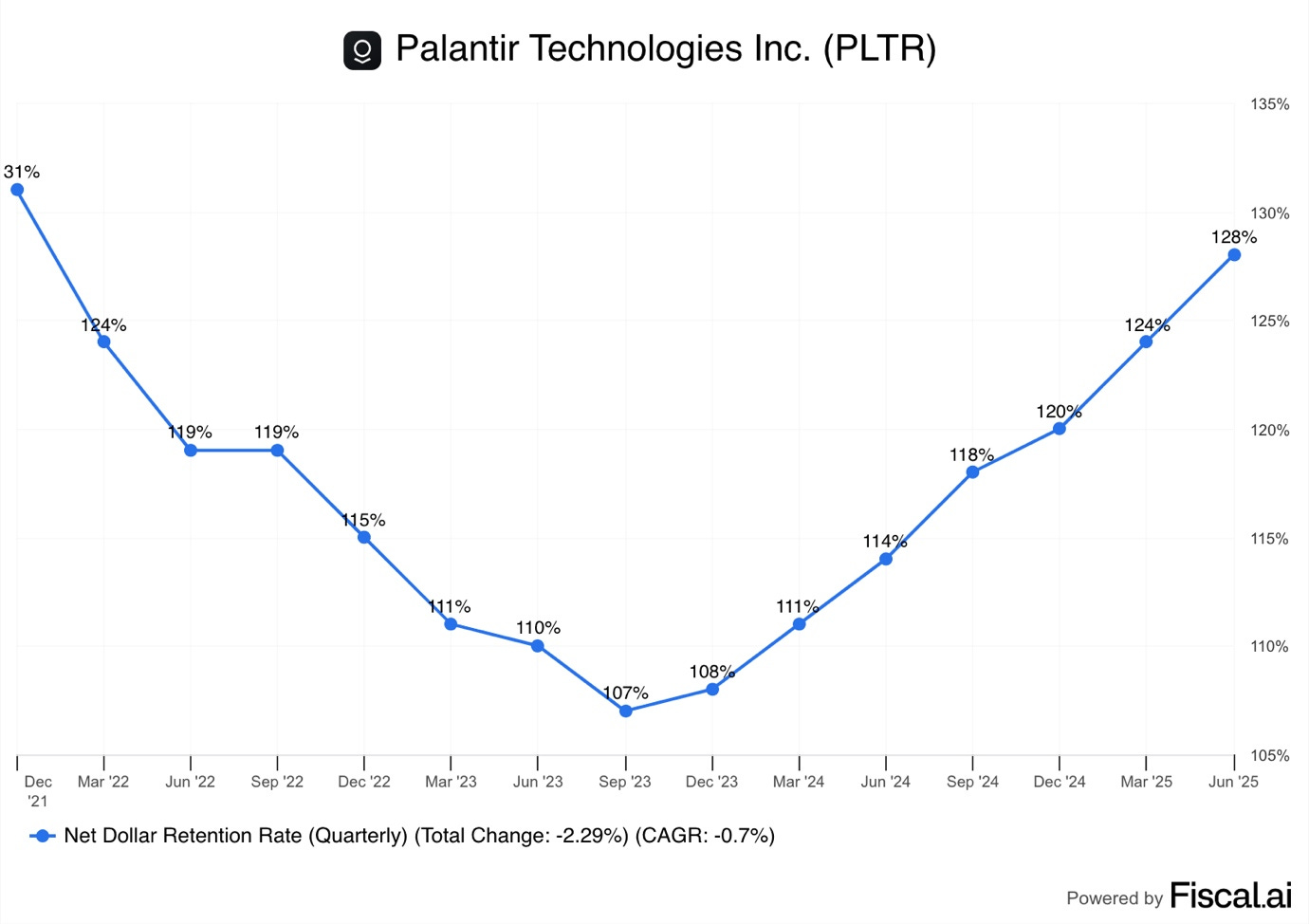

Net dollar retention measures how much existing customers spend with Palantir. In Q2 2025, NDR reached a multi-year record of 128%.

Put simply, even if Palantir didn’t add any new customers, its Q2 2025 revenue would still be up 28% thanks to increased usage by existing clients.

This means that from the 48% Y/Y revenue growth, 20% came from new customers.

“We're seeing new starts with higher ambition, and existing customers expand their work at a faster rate.

A healthcare company completed a bootcamp in April, then signed an $88,000,000 TCV deal a month later to coordinate and automate patient care across facilities.

An American telecom company started working with us in 2022 and has increased their contract 10x since then and is now projecting hundreds of millions in cost savings.”

These numbers tell us that not only are Palantir incredible at keeping existing customers, but they are also incredible at acquiring new ones.

5.3. Stock-Based Compensation

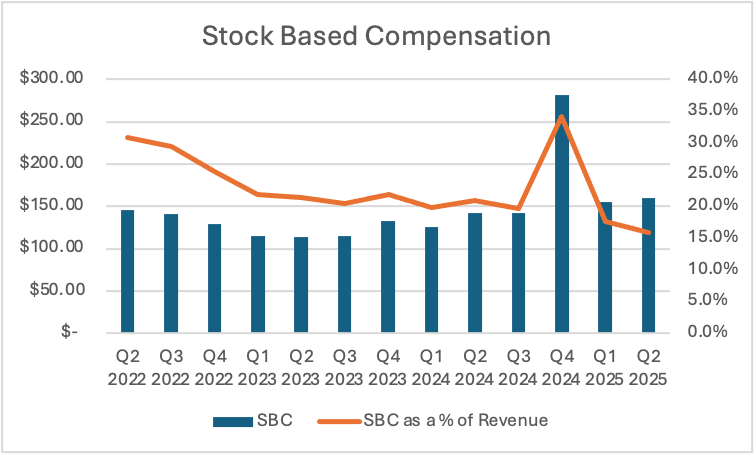

Many analysts have lambasted Palantir for its very high and aggressive share-based compensation. However, I don’t believe that this claim is warranted anymore, as SBC has gone down considerably.

This quarter, Palantir spent $160M on SBC, up just 13% Y/Y!

SBC growth of 13%, considerably below the 48% revenue growth, means that SBC as a share of total revenue decreased substantially.

SBC is now 15.9% of total revenue, down from 20.9% in Q2 2024 and 17.6% in Q1 2025.

In the graph above, we see that, barring the vesting of special employee stock awards in Q4 when Palantir’s stock reached certain goals, SBC has been going down as a share of revenue, and that is expected to continue.

5.4. Profitability

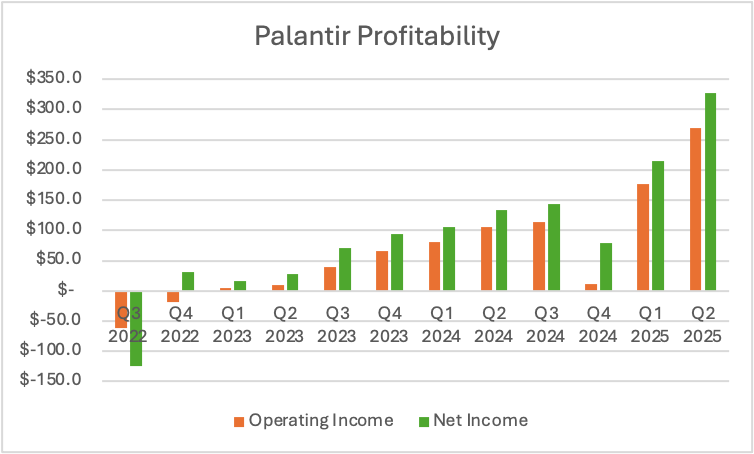

Operating income grew a whopping 155.7% Y/Y to $269M, reaching a new record for the company. Operating margin increased from 15.5% to 26.8%. All of this was possible due to stronger cost efficiency and leaner overhead.

Net income jumped an impressive 143.6% to $327M, bringing the margin to 32.7%. Interestingly, Palantir’s net income is higher than its operating income, as it’s boosted by $56M in interest earnings from its $6B cash mountain.

5.5. FCF

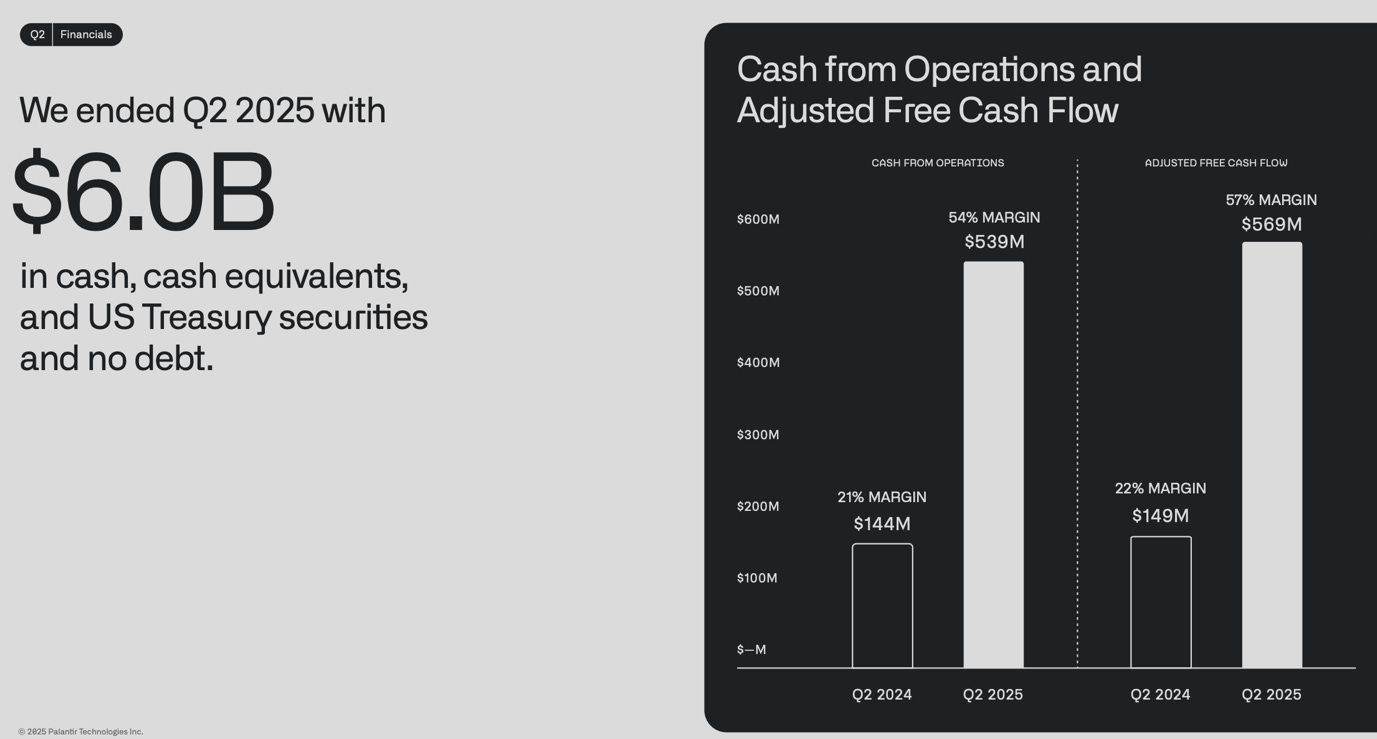

Palantir is quickly turning into a paper-hungry cash flow printer, delivering $569M in ADJ FCF, a margin of 57%.

This is an unbelievable improvement from the 22% margin in Q2 2024!

Let’s remember that Palantir’s software model is a very scalable business, as it costs almost zero to sell an additional license, once the software is already developed.

Last quarter, I said that if Palantir continues to execute, they could reach a 50% FCF margin “in a few years”.

I am just floored that Palantir was able to achieve it in a single quarter.

Many analysts, your truly included, were skeptical of Palantir’s ability to continue this impressive growth run.

Yet, the company delivered another absolutely monster growth quarter. Now they are generating over $500M in FCF a quarter and have a $6B in cash. They have essentially 0 debt and $0 capex needs.

It is quite exciting to think what this company will be able to do with so much cash it generates!

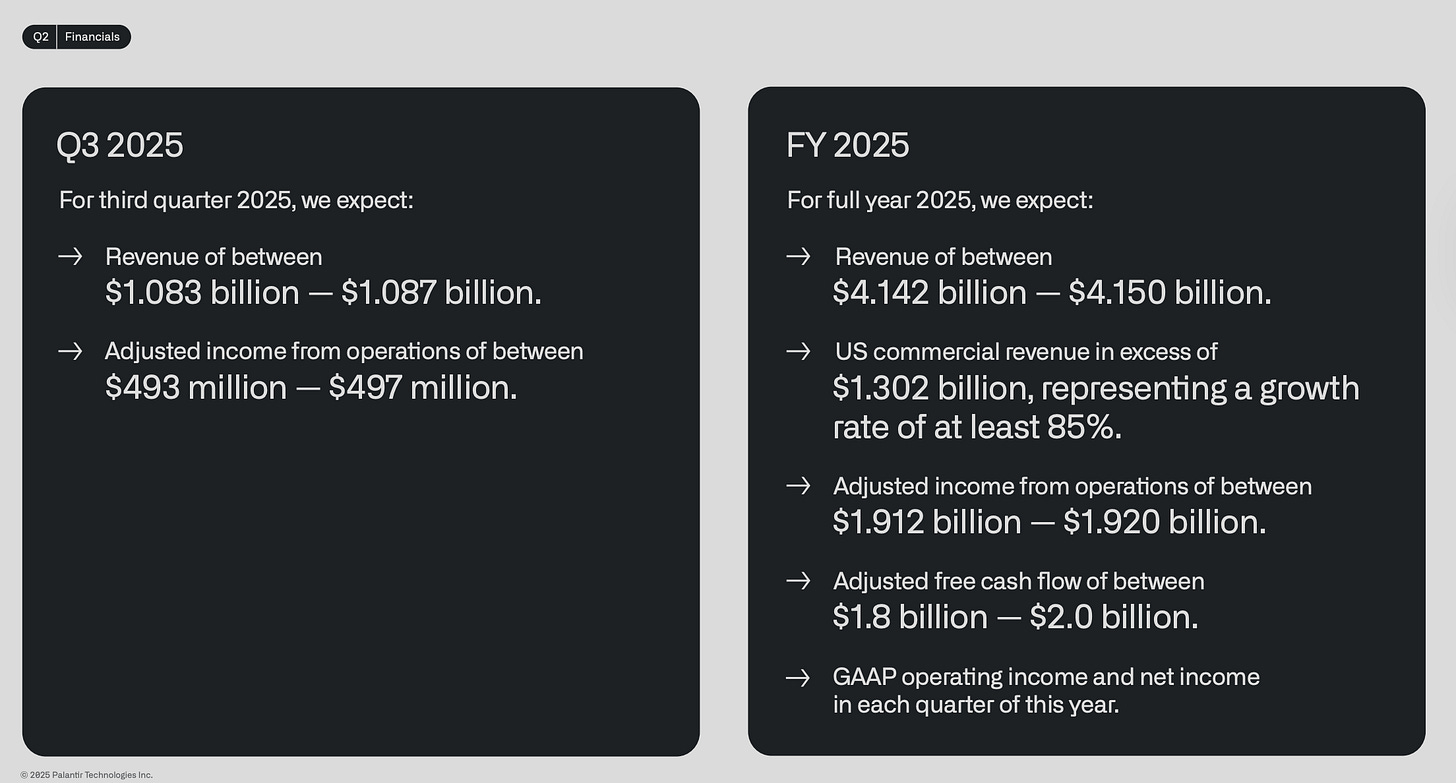

5.6. Guidance

In the next quarter, Palantir expects revenues of around $1.083B, which would be an increase of 50% over Q3 2024!

This is a major growth acceleration from all quarters this year, exactly what the bulls have been saying will happen, incredible.

For the full 2025 year, the company expects to grow revenues by around 44.5% to $4.142B, a huge increase from the 31% growth it guided for in Q4 2024.

Palantir’s full-year guidance implies that the company expects to sustain the accelerated growth rate.

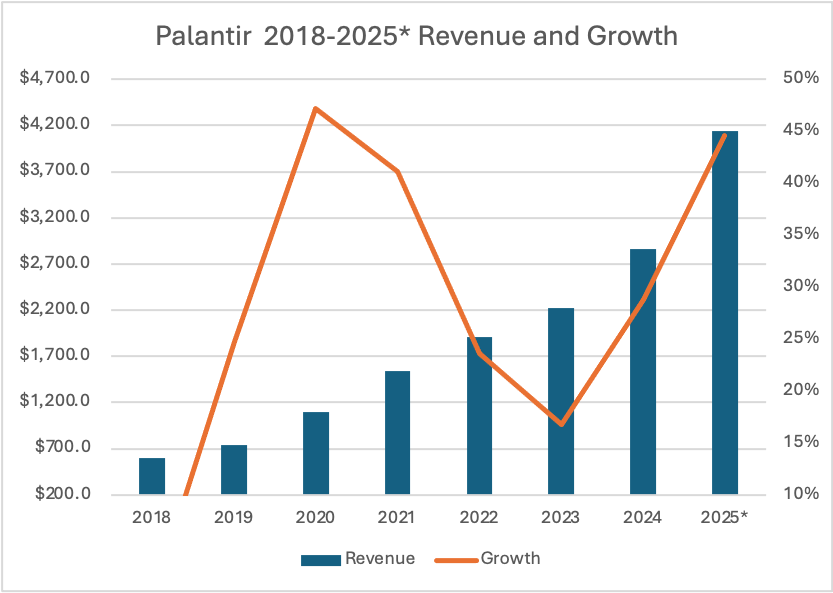

Investors were hoping that Palantir would raise its guidance significantly, and they got it. In the graph above, we see that that would be a huge acceleration from 2024, 2023, and 2022.

This is likely why the stock jumped over 4% in after-hours!

The US commercial revenue growth guidance was raised from 68% to 85%, which is a massive increase. This again demonstrates that the international segment is the weakest part of the business.

The question is whether the international segment is structurally different than the US, or only a few years behind.

If due to aversion to AI or advanced technology adoption, the growth is pushed out a few years, Palantir could see further growth acceleration as international growth picks up.

However, it might be that growth internationally will remain weak due to structural issues and higher competition from local players. Trump has not made himself popular in Europe, and it might be politically difficult for EU governments and corporations to use Palantir’s services. Organizations in the EU might prefer local software, even in cases where it is inferior to Palantir.

We need to wait and see if growth accelerates there, especially as Palantir will likely invest more resources in a European sales team.

6. Valuation

Since I published my Palantir Deep Dive on March 31, 2024, the stock has increased by 628% and reached a market cap of $364B.

Furthermore, it has jumped 34% since the last quarterly review.

There are few who, with a straight face, still downplay the incredible execution this company has delivered in the last 2 years. What gives them ammunition for this is the absolutely absurd valuation that Palantir trades at.

Palantir is most certainly a high-class company, and it has proven to be a very good investment for some, but I am just not that certain this can continue.

Currently, the company trades for a TTM P/E of 536 and P/S of 110, which can only be described as insanity.

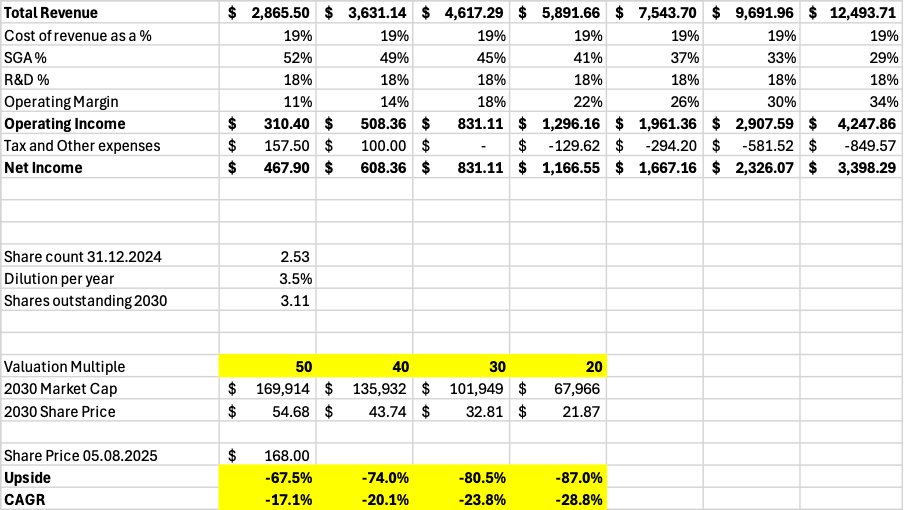

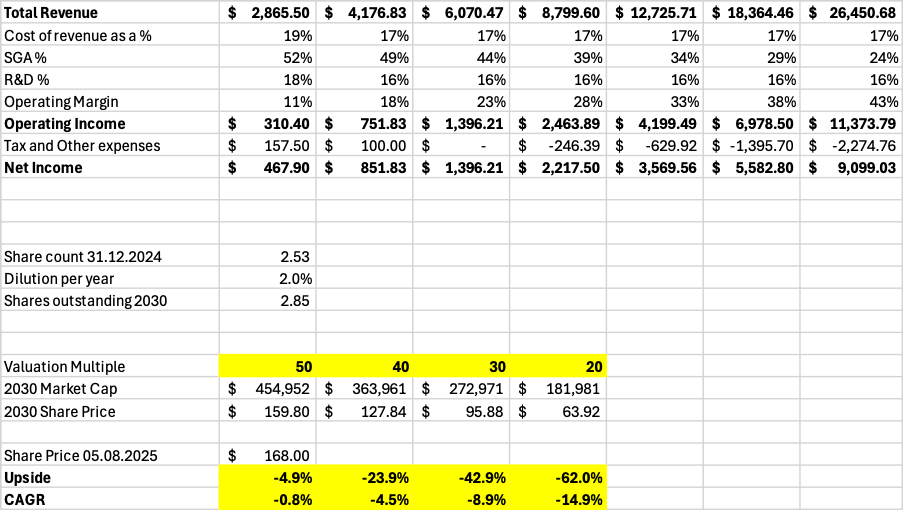

In my Palantir FY 2024 update, I created a Palantir valuation model. I am going to use the same model, but updated the current share price.

A full explanation of the model is available in that report!

Base Case:

In my Base Case scenario, I find a 67.5% to 87% downside to the Palantir stock!

Bull Case:

In my Bull Case scenario, I find a 62% to 4.9% downside!

As you can see in the tables, both cases imply huge revenue growth and improved profitability.

The valuation leaves very little upside, even in the most optimistic scenario, and a lot of downside if things don’t go perfectly!

The increased guidance is a signal that things are accelerating.

Q3 2025 revenue guidance implies a growth of 50%, which is a huge acceleration. If Palantir guides for 50% growth in 2026, the stock could explode.

The problem I have is that I just don’t see how the company could sustain such a growth rate for many years, given the valuation demands.

If Palantir grows earnings 20 times in the next decade, P/E would still be 27!

Firstly, to 20x earnings, Palantir needs to deliver a 35% CAGR over the decade. That is exceptionally difficult to achieve at such a scale, with only a few incredible companies having done so, such as Microsoft, Amazon, and Google.

Secondly, this is a higher multiple than most companies trade at on a TTM basis, not 10 years out. Even if Palantir delivers such growth, the stock price in 2035 could be flat or even down.

Thirdly, this valuation means that even small misses or underperformance could cause the stock to fall 10,20, and even 30% in a short span of time.

If revenue growth decelerates to 20%, the stock could fall 90%, as even after falling 90% the P/E would still be 50+.

For this reason, I just can’t get myself to invest in this company.

It might do well this year as we are in a huge AI gold rush. Additionally, a guide for 50% growth in 2026 could drive the stock up, but I am not willing to make that bet myself.

7. Conclusion

I would like to conclude this analysis with a 2 quotes from Palantir’s earnings call.

“As AI continues to relentlessly advance, the market has become increasingly aware of the most important and fundamental technical reality. LLMs, on their own, are at best a jagged intelligence divorced from even basic understanding.

In one moment, they may appear to outperform humans in some problem-solving task, but in the next, they make catastrophic errors no human would ever make. By contrast, our ontology is pure understanding, concretized in software. This is reality, not rhetoric, and enterprises are experiencing this reality keenly.

LLMs simply don't work in the real world without Palantir. This is the reality fueling our growth.” Palantir Q2 2025 Earnings Call

AI is here, and all companies are looking at how to integrate it into their business. LLM can be extremely useful, but only if properly implemented. Palantir’s software is key to that implementation.

They are one of the leading companies delivering real and actionable AI products. Hospitals can serve more patients, banks reduce fraud, manufacturing companies improve efficiency, and retailers can adjust their supply chains to manage tariffs and other disruptions.

This is why Palantir is delivering incredible financial results.

In the next quarter, Palantir expects revenues of around $1.083B, which would be an increase of 50%!

For the full 2025 year, the company expects to grow revenues by around 44.5% to $4.142B, a huge increase from the 31% growth it guided for in Q4 2024.

“So our in the near future, the 10x revenue we are going to get in the US. Over the next, in my view, next five years.” Palantir Q2 2025 Earnings Call

Alex Karp believes Palantir can 10x their US commercial business in the next 5 years.

Despite this incredible execution, I just can’t get past the valuation.

Currently, the company trades for a TTM P/E of 536 and P/S of 110.

Bulls argue that Palantir, as once in a once-in-a-generation company, deserves once in a once-in-a-generation valuation. Time might prove them right, but I am going to be watching from the sidelines.

Thank you for reading Global Equity Briefing!

Global Equity Briefing is an investing newsletter with a focus on analysing global companies. I have written highly detailed Deep Dives on Nu Bank, Ferrari, Palantir, Grab, Celsius, Mercado Libre and Hello Fresh!

Additionally, I have written Investment Cases on Meta, Amazon and Google! and comparisons of Visa vs Mastercard and Eli Lilly vs Novo Nordisk!

My goal for 2025 is to write around 4-6 articles per month!

Subscribe to get all my articles as soon as they are released!

Support my work by becoming a paid subscriber!

You can follow me on Social Media below:

X(Twitter): TheRayMyers

Threads: @global_equity_briefing

LinkedIn: TheRayMyers

Disclaimer: Global Equity Briefing by Ray Myers

The information provided in the "Global Equity Briefing" newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Ray Myers, as the author, is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented in this newsletter is based on publicly available information and sources believed to be reliable. However, Ray Myers does not guarantee the accuracy, completeness, or timeliness of the information provided. The author assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned in the "Global Equity Briefing" report. Any investment decisions made based on the information in this newsletter are at the sole discretion of the reader, and they assume full responsibility for their own investment activities.

Great write up. I agree, valuation is nuts. Pure FOMO. But ........ sometimes you just have to get on the gravy train. Just need to get off before it derails!

the US Army $1B/year contract is insane, and given no customer makes up more than 10% of total revenue, it seems the market might still be underestimating Palantir revenue growth for 2026.